Us Bagged Equine Feed Market

Marktgröße in Milliarden USD

CAGR :

%

USD

8.46 Billion

USD

12.93 Billion

2024

2032

USD

8.46 Billion

USD

12.93 Billion

2024

2032

| 2025 –2032 | |

| USD 8.46 Billion | |

| USD 12.93 Billion | |

|

|

|

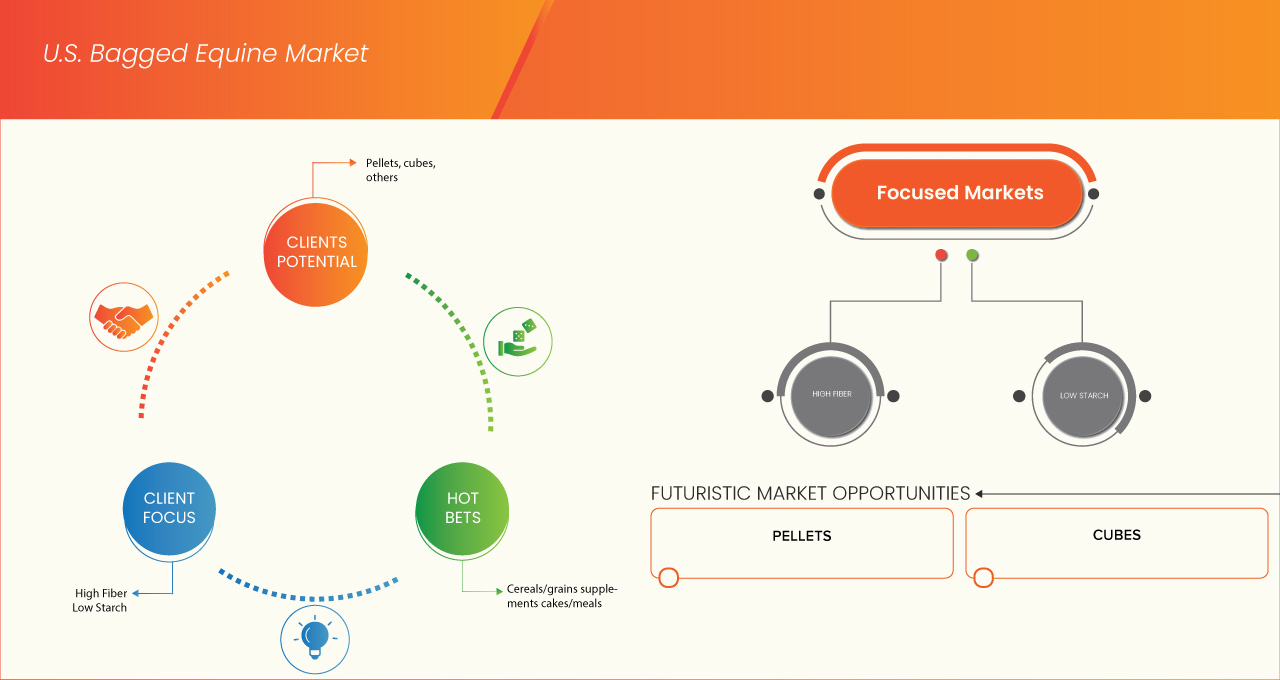

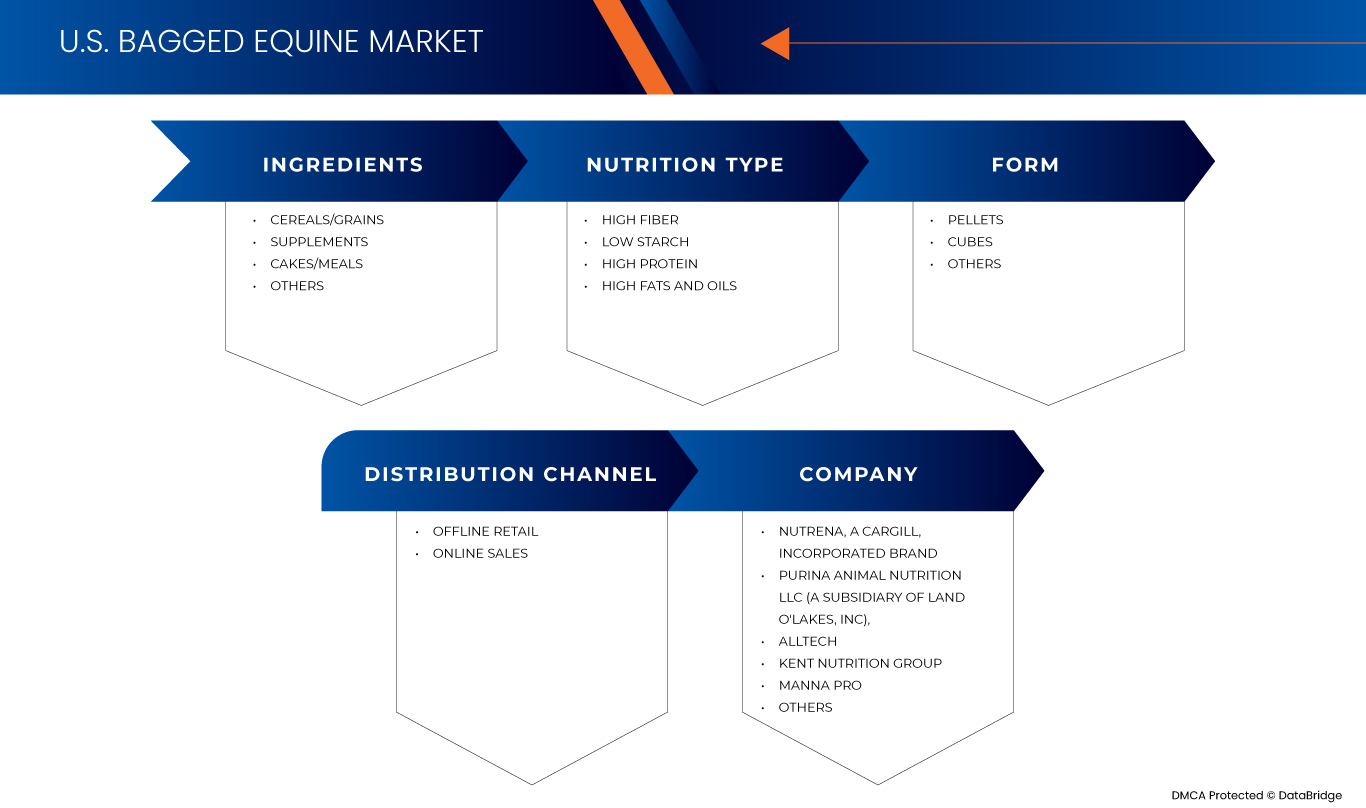

U.S. Bagged Equine Feed Market Segmentation, By Product (By Ingredients (Cereals/Grains, Supplements, Cakes/Meals, and Others), Nutrition Type (High Fiber, Low Starch, High Protein, and High Fats And Oils), Form (Pellets, Cubes, and Others), Distribution Channel (Offline Retail and Online Sales) – Industry Trends and Forecast to 2032

U.S. Bagged Equine Feed Market Analysis

The U.S. bagged equine Feed market serves a significant segment of the broader animal feed industry, catering to horse owners, breeders, and equestrian professionals. Equine feed refers to any nutritional product specifically formulated for horses and other equines to support their dietary needs, health, and performance. Comprising a variety of ingredients, including grains, forage, supplements, vitamins, and minerals, equine feed is designed to provide essential nutrients that may be lacking in a horse's natural diet. It is available in different forms, such as pelleted, textured, and cubed feeds, tailored to meet the requirements of various equine activities, life stages, and health conditions. Horse owners emphasize nutrition for longevity, condition, and performance and demand for organic, GMO-free, and tailored feeds boost the growth of market. Here is a detailed analysis:

U.S. Bagged Equine Feed Market Size

U.S. bagged equine feed market size was valued at USD 8.46 billion in 2024 and is projected to reach USD 12.93 billion by 2032, with a CAGR of 5.5% during the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

U.S. Bagged Equine Feed Market Trends

“Rising Demand For High-Quality, Specialized Feeds For Different Equine Life Stages And Activities”

Die steigende Nachfrage nach hochwertigem, speziellem Pferdefutter spiegelt bedeutende Veränderungen in der Pferdepflege und -haltung wider, die durch den Fokus der Pferdebesitzer auf optimale Gesundheit, Leistung und Langlebigkeit bedingt sind. Pferde benötigen protein- und kalziumreiches Futter, um das Knochenwachstum und den Muskelaufbau zu unterstützen. Ausgewogene Ernährung mit moderatem Energiegehalt, Ballaststoffen und essentiellen Nährstoffen für die Erhaltung und Arbeitseffizienz. Dieser Trend betont eine Ernährung, die auf die Lebensphasen, Aktivitäten und besonderen Bedürfnisse von Pferden zugeschnitten ist, was Wachstumschancen für die Pferdefutterindustrie signalisiert.

Berichtsumfang und Marktsegmentierung für abgepacktes Pferdefutter in den USA

|

Eigenschaften |

Einblicke in den US- Markt für abgepacktes Pferdefutter |

|

Abgedeckte Segmente |

|

|

Wichtige Marktteilnehmer |

Nutrena, eine Marke von Cargill, Incorporated (USA), Purina Animal Nutrition LLC (eine Tochtergesellschaft von Land O'Lakes, Inc) (USA), Alltech (USA), Kent Nutrition Group (USA), Manna Pro (USA), Wallnut Hill Feeds, Inc. (USA), Seminole Feed (USA), Hi-Pro Feeds (USA), Midway Co-Op (USA), Star Milling CO (USA) und Gain Animal Nutrition (USA) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen. |

Definition des US-amerikanischen Marktes für abgepacktes Pferdefutter

Unter Pferdefutter versteht man alle speziell für Pferde und andere Equiden entwickelten Nahrungsmittel, die deren Ernährungsbedürfnisse, Gesundheit und Leistung unterstützen. Pferdefutter besteht aus einer Vielzahl von Zutaten, darunter Getreide, Raufutter, Nahrungsergänzungsmittel, Vitamine und Mineralien, und soll wichtige Nährstoffe liefern, die in der natürlichen Ernährung eines Pferdes fehlen können. Es ist in verschiedenen Formen erhältlich, z. B. als Pellets, strukturiertes und gewürfeltes Futter, das auf die Anforderungen verschiedener Aktivitäten, Lebensphasen und Gesundheitszustände von Pferden zugeschnitten ist. Richtig ausgewogenes Pferdefutter fördert optimales Wachstum, Energie und allgemeines Wohlbefinden von Pferden und ist daher ein wichtiger Bestandteil der Pferdehaltung und -pflege.

Dynamik des US-amerikanischen Marktes für abgepacktes Pferdefutter

Treiber

- Steigender Trend zur Vermenschlichung von Haustieren

Der zunehmende Trend zur Vermenschlichung von Haustieren treibt den US-Markt für abgepacktes Pferdefutter erheblich an, da Pferdebesitzer ihre Pferde zunehmend wie Familienmitglieder behandeln. Dieser Perspektivwechsel führt zu einer erhöhten Bereitschaft, in hochwertige, nahrhafte Futterformulierungen zu investieren, bei denen die Gesundheit und das Wohlbefinden ihrer Pferde an erster Stelle stehen. Verbraucher achten heute anspruchsvoller auf die in Pferdefutter verwendeten Zutaten und suchen nach Produkten mit natürlichen, biologischen und hochwertigen Zutaten. Infolgedessen besteht eine wachsende Nachfrage nach speziellen Ernährungslösungen, die auf die individuellen Bedürfnisse der Pferde zugeschnitten sind, einschließlich Alter, Rasse und Aktivitätsniveau, und die ein Engagement für ihre allgemeine Gesundheit und Leistung widerspiegeln.

Zum Beispiel,

- Im April 2024 wurde in einem Artikel der US-amerikanischen Zentren für Krankheitskontrolle und -prävention festgestellt, dass fast 2 Millionen US-Haushalte Pferde besitzen. Darüber hinaus wurde festgestellt, dass Reiten und die Arbeit mit Pferden nachweislich das Gleichgewicht, das Selbstvertrauen und das Selbstwertgefühl steigern.

Darüber hinaus beeinflusst der Humanisierungstrend die Kaufentscheidungen der Verbraucher und die Markentreue, indem er starke emotionale Bindungen zwischen Pferdebesitzern und ihren Tieren fördert. Da die Besitzer die Lebensqualität ihrer Pferde immer mehr schätzen, tendieren sie wahrscheinlich zu Marken, die ethische Beschaffung, Nachhaltigkeit und Tierschutz in den Vordergrund stellen. Die Präsenz sozialer Medien und Online-Communitys verstärkt diesen Trend und ermöglicht es Pferdebesitzern, Erkenntnisse und Empfehlungen zur Ernährung auszutauschen, was die Nachfrage nach hochwertigen abgepackten Pferdefutterprodukten weiter ankurbelt. Folglich führt die Betonung hochwertiger Pflege, personalisierter Ernährung und ethischer Praktiken zu einem Wachstum auf dem Markt.

- Zunahme der Pferdepopulation

Der Anstieg der Pferdepopulation in den USA spielt eine bedeutende Rolle, da eine steigende Zahl von Pferden direkt zu einer höheren Nachfrage nach speziellen Futterprodukten führt. Da immer mehr Besitzer die Bedeutung von hochwertigem Futter für die Gesundheit, Leistung und Langlebigkeit ihrer Pferde erkennen, wächst der Markt für abgepacktes Pferdefutter weiter. Hobbys wie Freizeitreiten, Pferdesport und Pferdebesitz werden immer beliebter, und das Bewusstsein für die Ernährungsbedürfnisse von Pferden in verschiedenen Lebensphasen führt zum Konsum vielfältiger und maßgeschneiderter Futterprodukte. Darüber hinaus ermutigt dieser Bevölkerungszuwachs die Hersteller, ihre Angebote zu erneuern und zu diversifizieren, was den Wettbewerb weiter ankurbelt und die Produktverfügbarkeit auf dem Markt erhöht.

Zum Beispiel,

- Laut einem im Januar 2023 im Pharma Innovation Journal veröffentlichten Artikel erhalten Rennpferde das Protein, die Energie, Vitamine und andere Nährstoffe, die für die Entwicklung des Körpers gut trainierter Sportler erforderlich sind. Darüber hinaus benötigen Pferde, die stark trainiert sind, wachsen, trächtig sind oder säugen, mehr Energie und Protein in ihrer Ernährung

Darüber hinaus korreliert das Wachstum der Pferdepopulation mit einem erhöhten Interesse an der Pferdepflege, was zu einem breiteren Markt für entsprechende Produkte und Dienstleistungen führt. Da mehr Pferde gepflegt werden, steigt die Nachfrage nach speziellen Sackfuttermitteln, was Innovationen bei Futterformulierungen fördert, um spezifische Gesundheits- und Leistungsanforderungen zu erfüllen. Einzelhändler und Hersteller erkennen die Chance, diesen wachsenden Markt zu bedienen, indem sie vielfältige Produktlinien entwickeln, die Bio-, gentechnikfreie und leistungsspezifische Futtermittel umfassen. Folglich steigert die steigende Pferdepopulation nicht nur den Umsatz im Sackfuttersektor für Pferde, sondern stimuliert auch Fortschritte in der Produktentwicklung und schafft einen lebendigen und wettbewerbsfähigen Markt, der auf die sich entwickelnden Bedürfnisse von Pferdebesitzern im ganzen Land zugeschnitten ist.

Gelegenheiten

- E-Commerce-Erweiterung

Der Ausbau des E-Commerce bietet dem US-Markt für abgepacktes Pferdefutter eine große Chance, da Hersteller und Einzelhändler dadurch ein breiteres Publikum über ihre geografischen Grenzen hinaus erreichen können. Mit dem zunehmenden Trend zum Online-Shopping können Pferdebesitzer bequem von zu Hause aus nach Pferdefutter suchen und es kaufen. Diese Veränderung des Verbraucherverhaltens verbessert die Zugänglichkeit und eröffnet das Potenzial für Nischenmarken, in den Markt einzudringen, ohne dass eine große physische Einzelhandelspräsenz erforderlich ist. Unternehmen, die in benutzerfreundliche Websites und effektive Online-Marketingstrategien investieren, können eine breitere Kundenbasis ansprechen und so letztendlich das Umsatzwachstum in einem wettbewerbsintensiven Umfeld steigern.

Darüber hinaus ermöglichen E-Commerce-Plattformen Marken, durch gezieltes Marketing und maßgeschneiderte Empfehlungen ein persönlicheres Einkaufserlebnis zu schaffen. Durch die Nutzung von Datenanalysen und Kundeneinblicken können Unternehmen die Verbraucherpräferenzen besser verstehen und maßgeschneiderte Angebote wie Abonnementdienste oder Großeinkaufsoptionen einführen, die auf die besonderen Bedürfnisse von Pferdebesitzern zugeschnitten sind. Darüber hinaus bietet E-Commerce Marken die Möglichkeit, über soziale Medien, Content-Marketing und Bildungsressourcen mit ihren Kunden in Kontakt zu treten und eine Community rund um ihre Produkte aufzubauen. Dieses Engagement stärkt die Markentreue und etabliert die Marke als vertrauenswürdige Autorität in der Pferdeernährung. Dadurch werden langfristige Beziehungen zu Verbrauchern aufgebaut, die sich in Wiederholungskäufen und größeren Marktanteilen niederschlagen können.

- Technologische Forschung im Zusammenhang mit der Produktion und Herstellung von Tierfutter

Die technologische Forschung im Bereich Tierfutter bietet dem US-amerikanischen Markt für abgepacktes Pferdefutter eine attraktive Chance, da sie die Entwicklung innovativer und wissenschaftlich formulierter Produkte ermöglicht, die den spezifischen Ernährungsbedürfnissen von Pferden gerecht werden. Fortschritte in der Ernährungswissenschaft, Biotechnologie und Futterformulierungstechniken ermöglichen es Herstellern, Futtermittel zu entwickeln, die Gesundheit, Leistung und allgemeines Wohlbefinden optimieren. So kann beispielsweise die Erforschung der Verdaulichkeit verschiedener Zutaten zur Formulierung von Futtermitteln führen, die die Nährstoffaufnahme verbessern und so die Leistung und Gesundheit der Pferde steigern. Dieser Fokus auf wissenschaftliche Innovation kann Marken dabei helfen, sich in einem überfüllten Markt durch das Angebot von Premiumprodukten mit nachgewiesenem Nutzen zu differenzieren und so anspruchsvolle Verbraucher anzuziehen, die bereit sind, in hochwertige Ernährung für ihre Pferde zu investieren.

Darüber hinaus ermöglichen technologische Fortschritte eine stärkere Anpassung und Präzision bei der Futterproduktion, was dem wachsenden Trend zur personalisierten Ernährung in der Heimtier- und Tierpflegebranche entspricht. Durch den Einsatz von Datenanalyse, maschinellem Lernen und künstlicher Intelligenz können Unternehmen Einblicke in spezifische Ernährungsbedürfnisse basierend auf individuellen Pferdeprofilen, Alter oder Aktivitätsniveau gewinnen und so maßgeschneiderte Futterlösungen entwickeln. Dieser Grad der Personalisierung verbessert die Wirksamkeit des Futters und fördert auch stärkere Beziehungen zwischen Marken und Verbrauchern, da Pferdebesitzer Produkte schätzen, die speziell für ihre Tiere entwickelt wurden. Darüber hinaus können Investitionen in Forschung und Technologie die Glaubwürdigkeit und Positionierung einer Marke als Branchenführer stärken, der sich der Pferdegesundheit verschrieben hat, und so einen Wettbewerbsvorteil auf dem sich entwickelnden Markt für abgepacktes Pferdefutter schaffen.

Einschränkungen/Herausforderungen

- Anstieg der Rohstoffkosten

Da die Nachfrage nach Pferdepflegeprodukten steigt, haben neue Anbieter mit preisgünstigen Futteroptionen die Aufmerksamkeit kostenbewusster Pferdebesitzer auf sich gezogen. Diese preisgünstigeren Ersatzprodukte stammen oft von Großlieferanten oder sogar internationalen Herstellern, was es für etablierte US-Marken schwierig macht, ihren Marktanteil zu halten. Während Premiummarken Wert auf Qualität, Nährwert und Sicherheit legen, kann der Reiz niedrigerer Preise für Pferdebesitzer mit knappem Budget besonders verlockend sein, insbesondere in Zeiten wirtschaftlicher Unsicherheit.

Darüber hinaus hat die Verbreitung kostengünstiger Alternativen zu einer Änderung des Kaufverhaltens der Verbraucher geführt. Viele Pferdebesitzer entscheiden sich möglicherweise für diese budgetfreundlichen Optionen und geben kurzfristigen Einsparungen den Vorzug vor den langfristigen Vorteilen, die mit qualitativ hochwertigerem Futter verbunden sind. Dieser Trend wirkt sich nicht nur auf den Verkauf von abgepacktem Premiumfutter für Pferde aus, sondern zwingt die Hersteller auch dazu, ihre Preisstrategien und Produktangebote zu überdenken. Im Bestreben, mit kostengünstigeren Optionen zu konkurrieren, müssen etablierte Marken möglicherweise Kompromisse bei der Qualität eingehen oder in Marketingkampagnen investieren, was die Gewinnmargen weiter schmälern und das Wachstum in einem bereits wettbewerbsintensiven Markt behindern kann.

- Ungeeignetheit von Sackware für alle Pferdearten

Die Ungeeignetheit von abgepacktem Pferdefutter für alle Pferdearten stellt eine erhebliche Herausforderung für den US-amerikanischen Markt für abgepacktes Pferdefutter dar, da die Ernährungsbedürfnisse und Nährstoffanforderungen verschiedener Pferderassen, -alter und -aktivitätsstufen unterschiedlich sind. Pferde haben unterschiedliche Stoffwechselraten und spezifische Ernährungsbedürfnisse, die auf ihrem Gesundheitszustand, ihrer Trainingsintensität und ihrer Arbeitsbelastung basieren. Beispielsweise benötigen Leistungspferde, trächtige Stuten und ältere Pferde möglicherweise speziell zusammengestelltes Futter, das sich von den standardmäßigen abgepackten Optionen unterscheidet. Die Unfähigkeit, eine maßgeschneiderte Ernährung bereitzustellen, kann zu suboptimalen Gesundheitsbedingungen, schlechter Leistung und erhöhten Tierarztkosten führen, was letztlich die Kundenzufriedenheit und Markentreue mindert.

Diese Herausforderung behindert das Marktwachstum und schränkt das Vertrauen der Verbraucher in abgepacktes Pferdefutter als geeignete Lösung für alle Pferdebesitzer ein. Darüber hinaus verringert diese Entwicklung den Marktanteil abgepackter Produkte insgesamt und zwingt die Unternehmen dazu, in Forschung und Entwicklung für speziellere Rezepturen zu investieren oder riskieren, Kunden an Wettbewerber zu verlieren, die spezielle Ernährungsbedürfnisse abdecken.

Umfang des US-amerikanischen Marktes für abgepacktes Pferdefutter

Der Markt ist nach Zutaten, Ernährungsart, Form und Vertriebskanal segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Zutaten

- Getreide

- Ergänzungen

- Kuchen/Mahlzeiten

- Sonstiges

Ernährungstyp

- Hoher Ballaststoffgehalt

- Wenig Stärke

- Hoher Proteingehalt

- Hoher Fett- und Ölgehalt

Bilden

- Pellets

- Würfel

- Sonstiges

Vertriebskanal

- Offline-Einzelhandel

- Online-Verkäufe

Marktanteil von abgepacktem Pferdefutter in den USA

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten nach Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im asiatisch-pazifischen Raum, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die auf dem US-Markt tätigen Marktführer für abgepacktes Pferdefutter sind:

- Nutrena, eine Marke von Cargill, Incorporated (USA)

- Purina Animal Nutrition LLC (eine Tochtergesellschaft von Land O'Lakes, Inc) (USA)

- Alltech (USA)

- Kent Nutrition Group (USA)

- Manna Pro (USA)

- Wallnut Hill Feeds, Inc. (USA)

- Seminole-Feed (USA)

- Hi-Pro Feeds (USA)

- Midway Co-Op (USA)

- Star Milling CO (USA)

- Gain Tierernährung (USA)

Neueste Entwicklungen auf dem US-Markt für abgepacktes Pferdefutter

- Im September 2024 gaben Alltech und EnviroEquine eine strategische Lizenzvereinbarung bekannt, um die Technologien von Alltech in die Nahrungsergänzungsmittel von EnviroEquine zu integrieren. Diese Vereinbarung verbesserte die Produktqualität und half dem Unternehmen, seine Markenpräsenz in Nordamerika und Europa auszubauen

- Im August 2024 führte Hubbard Feeds, ein Unternehmen von Alltech, Recharge ein, eine Produktlinie zur Optimierung der Rinderaufnahme, Verbesserung der Leistung und Verbesserung der Rentabilität. Recharge unterstützt das Wohlbefinden der Rinder, insbesondere bei Stress, mit nachweislichen Verbesserungen der Futtereffizienz und des Wachstums

- Im September hat Equine Network eine Partnerschaft mit Absorbine und Sentinel geschlossen, um „My New Horse“ auf den Markt zu bringen, eine Marke, die Ressourcen und eine Community für neue Pferdebesitzer und -reiter bietet. Die Plattform bietet Expertenrat, Anleitungsvideos, Budgettipps und soziale Kontakte, damit sich neue Reiter auf ihrem Weg zum Pferdebesitzer sicher und gerüstet fühlen.

- Im September 2019 führte Purina Omolene Horse Feed ein spannendes Update ein, indem es sein Sortiment um das Outlast Gastric Support Supplement erweiterte. Diese Ergänzung bietet tägliche Magenunterstützung in jeder Mahlzeit und hilft Pferden bei Magenbeschwerden, von denen bis zu 90 % der aktiven Pferde betroffen sind. Die aktualisierten Omolene-Futter, jetzt mit verbesserter Verpackung, bieten eine verbesserte Leistungsernährung für alle Arten von Pferden, vom aktiven Freizeitpferd bis zum Spitzenpferd, und sorgen für optimale Gesundheit und Unterstützung

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. BAGGED EQUINE FEED MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 MULTIVARIATE MODELLING

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 SECONDARY SOURCES

2.9 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 BRAND ANALYSIS

4.3.1 OVERVIEW

4.3.1.1 NUTRENA, A CARGILL, INCORPORATED BRAND

4.3.1.2 PURINA ANIMAL NUTRITION LLC (A SUBSIDIARY OF LAND O'LAKES, INC)

4.3.1.3 ALTECH

4.3.1.4 KENT NUTRITION GROUP

4.3.1.5 MANA PRO

4.3.2 SUMMARY

4.4 FACTORS INFLUENCING BUYING BEHAVIOR IN THE U.S. BAGGED EQUINE FEED MARKET

4.4.1 CONCLUSION

4.5 PRODUCTION CAPACITY OUTLOOK

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7.1 PRECISION NUTRITION AND CUSTOMIZED FORMULATIONS

4.7.2 ENHANCED INGREDIENT PROCESSING TECHNIQUES

4.7.3 ADVANCED QUALITY CONTROL AND SAFETY MONITORING

4.7.4 SUSTAINABLE MANUFACTURING PRACTICES

4.7.5 INCORPORATION OF FUNCTIONAL INGREDIENTS AND ADDITIVES

4.7.6 AUTOMATED PRODUCTION AND PACKAGING PROCESSES

4.7.7 USE OF DIGITAL SOLUTIONS FOR CUSTOMER ENGAGEMENT AND EDUCATION

4.7.8 RESEARCH AND DEVELOPMENT IN FEED INNOVATION

4.7.9 CONCLUSION

4.8 VALUE CHAIN ANALYSIS: U.S. BAGGED EQUINE FEED MARKET

4.8.1 PROCUREMENT:

4.8.2 MANUFACTURING:

4.8.3 MARKETING & DISTRIBUTION:

4.9 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE PET HUMANIZATION TREND

5.1.2 INCREASE IN THE EQUINE POPULATION

5.1.3 CONVENIENCE INVOLVED IN THE USAGE OF BAGGED FEED

5.2 RESTRAINTS

5.2.1 RISE IN RAW MATERIAL COSTS

5.2.2 RISING CONCERNS REGARDING SUSTAINABILITY DURING THE MANUFACTURING OF THE FEED

5.3 OPPORTUNITIES

5.3.1 E-COMMERCE EXPANSION

5.3.2 TECHNOLOGICAL RESEARCH INVOLVED IN PRODUCTION AND THE MANUFACTURING OF ANIMAL FEED

5.4 CHALLENGES

5.4.1 COMPETITION FROM LOW-COST ALTERNATIVES

5.4.2 UNSUITABILITY OF BAGGED EQUINE FOR ALL KINDS OF HORSES

6 U.S. BAGGED EQUINE FEED MARKET, BY FORM

6.1 OVERVIEW

6.2 PELLETS

6.3 CUBES

6.4 OTHERS

7 U.S. BAGGED EQUINE FEED MARKET, BY NUTRITION TYPE

7.1 OVERVIEW

7.2 HIGH FIBER

7.3 LOW STARCH

7.4 HIGH PROTEIN

7.5 HIGH FATS AND OILS

8 U.S. BAGGED EQUINE FEED MARKET, BY INGREDIENTS

8.1 OVERVIEW

8.2 CEREALS/GRAINS

8.3 SUPPLEMENTS

8.4 CAKES/MEALS

8.5 OTHERS

9 U.S. BAGGED EQUINE FEED MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE RETAIL

9.3 ONLINE SALES

10 U.S. BAGGED EQUINE FEED MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: U.S.

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 NUTRENA, A CARGILL, INCORPORATED BRAND

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 PURINA ANIMAL NUTRITION LLC(A SUBSIDIARY OF LAND O’LAKES, INC)

12.2.1 COMPANY SNAPSHOT

12.2.2 PRODUCT PORTFOLIO

12.2.3 RECENT DEVELOPMENT

12.3 ALLTECH

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT DEVELOPMENT

12.4 KENT NUTRITION GROUP

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 MANNA PRO

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT DEVELOPMENT

12.6 GAIN ANIMAL NUTRITION

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 HI-PRO FEEDS

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 MIDWAY CO-OP

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 SEMINOLE FEED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 STAR MILLING CO

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 WALNUT HILL FEEDS, INC.

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Abbildungsverzeichnis

FIGURE 1 U.S. BAGGED EQUINE FEED MARKET: SEGMENTATION

FIGURE 2 U.S. BAGGED EQUINE FEED MARKET: DATA TRIANGULATION

FIGURE 3 U.S. BAGGED EQUINE FEED MARKET: DROC ANALYSIS

FIGURE 4 U.S. BAGGED EQUINE FEED MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. BAGGED EQUINE FEED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. BAGGED EQUINE FEED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. BAGGED EQUINE FEED MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. BAGGED EQUINE FEED MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. BAGGED EQUINE FEED MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 FOUR SEGMENTS COMPRISE U.S. BAGGED EQUINE FEED MARKET, BY INGREDIENTS 2024, (%)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISE IN PET HUMANIZATION TREND IS DRIVING THE GROWTH OF THE U.S. BAGGED EQUINE FEED MARKET FROM 2025 TO 2032

FIGURE 14 THE CEREALS/GRAINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. BAGGED EQUINE FEED MARKET IN 2025 AND 2032

FIGURE 15 ESTIMATED PRODUCTION CAPACITY OUTLOOK, 2018–2032 (KILO TONS)

FIGURE 16 VALUE CHAIN ANALYSIS OF THE U.S. BAGGED EQUINE FEED MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DROC ANALYSIS

FIGURE 19 U.S. BAGGED EQUINE FEED MARKET: BY FORM, 2024

FIGURE 20 U.S. BAGGED EQUINE FEED MARKET: BY NUTRITION TYPE, 2024

FIGURE 21 U.S. BAGGED EQUINE FEED MARKET: BY INGREDIENTS, 2024

FIGURE 22 U.S. BAGGED EQUINE FEED MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 23 U.S. BAGGED EQUINE FEED MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.