Saudi Arabia Warehousing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

| 2023 –2030 | |

| USD 9,314.17 Million | |

| USD 13,214.96 Million | |

|

|

|

Saudi Arabia Warehousing Market, By Component (Hardware/System, Software, and Services), Function (Inventory Control and Management, Asset Tracking, Yard & Dock Management, Order Fulfilment, and Workforce & Task (Process) Management, Shipping, Predictive Maintenance, and Others), Type (Insource Warehousing and Outsource Warehousing), Size (Small, Medium, and Large), Ownership (Public Warehouses, Private Warehouses, Bonded Warehouses, and Consolidated Warehouse), Warehousing Storage Nature (Ambient Warehousing (Around 80°F), Air Conditioned (56°F and 75°F), Refrigerated (33°F and 55°F), and Cold/Frozen (Of or Below 32°F)), WMS Tier Type (Advanced WMS, Basic WMS, and Intermediate WMS), End User (Retail and E-Commerce, Transportation and Logistics, Automotive, Healthcare, Food and Beverages, Electrical and Electronics, Chemical, Agriculture, Energy and Utilities, and Others) - Industry Trends and Forecast to 2030.

Saudi Arabia Warehousing Market Analysis and Insights

Saudi Arabia is becoming a hub for regional trade and a key player in global supply chain networks as the largest economy in the Middle East. The warehousing industry in the kingdom is witnessing rapid development, with a surge in demand for modern, technologically advanced storage facilities that can meet the requirements of diverse industries. The growth of e-commerce, along with the government's focus on economic diversification and investments in infrastructure, is driving the need for efficient and strategically located warehousing solutions. With its strategic geographic location and ambitious Vision 2030 plan, Saudi Arabia warehousing market is poised for continued expansion and innovation to meet the evolving demands of the modern business landscape. The market is experiencing significant growth and transformation in response to the country's expanding logistics and e-commerce sectors.

Data Bridge Market Research analyzes that the Saudi Arabia warehousing market is expected to reach USD 13,214.96 million by 2030 from USD 9,314.17 million in 2022, growing with a substantial CAGR of 4.5% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Komponente (Hardware/System, Software und Dienste), Funktion (Bestandskontrolle und -verwaltung, Anlagenverfolgung, Lager- und Dockverwaltung, Auftragsabwicklung und Personal- und Aufgaben- (Prozess-)Verwaltung, Versand, vorausschauende Wartung und andere), Typ (Insource-Lagerhaltung und Outsource-Lagerhaltung), Größe (klein, mittel und groß), Eigentumsform (öffentliche Lager, private Lager, Zolllager und konsolidiertes Lager), Art der Lagerung (Lagerung bei Umgebungstemperatur (ca. 27 °C), klimatisiert (13 °C und 24 °C), gekühlt (0 °C und 13 °C) und kalt/gefroren (0 °C oder weniger)), WMS-Stufentyp (erweitertes WMS, einfaches WMS und mittleres WMS), Endbenutzer (Einzelhandel und E-Commerce, Transport und Logistik, Automobilindustrie, Gesundheitswesen, Lebensmittel und Getränke, Elektrik und Elektronik, Chemie , Landwirtschaft, Energie und Versorgung und andere) |

|

Abgedecktes Land |

Saudi-Arabien |

|

Abgedeckte Marktteilnehmer |

Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, SA TALKE Ltd., LogiPoint und United Group |

Marktdefinition

Lagerhaltung bezieht sich auf die Branche und Infrastruktur im Zusammenhang mit der Lagerung, Verwaltung und Verteilung von Waren und Produkten im Königreich Saudi-Arabien. Dieser Markt umfasst eine breite Palette von Dienstleistungen und Einrichtungen, die in der Lieferkette und Logistik verschiedener Branchen eine entscheidende Rolle spielen. Die Lagerhaltung umfasst ein Netzwerk von Lagereinrichtungen, Vertriebszentren und Logistikdiensten, die der effizienten und sicheren Lagerung, Handhabung und Bewegung von Waren und Produkten dienen. Diese Einrichtungen können in Größe und Spezialisierung variieren und dienen Branchen wie Fertigung, Einzelhandel, E-Commerce, Landwirtschaft und mehr.

Dynamik des Lagermarktes in Saudi-Arabien

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Wachsender E-Commerce-Sektor in Saudi-Arabien

Der aufstrebende E-Commerce-Sektor in Saudi-Arabien ist ein starker Motor für das Marktwachstum und die Expansion. Aufgrund des rasanten Anstiegs des Online-Shoppings und der sich ändernden Verbraucherpräferenzen besteht eine erhöhte Nachfrage nach effizienten Lager- und Vertriebseinrichtungen zur Unterstützung des E-Commerce-Betriebs. Lager spielen eine entscheidende Rolle bei der Sicherstellung einer pünktlichen Auftragserfüllung, Bestandsverwaltung und reibungslosen Lieferung von Produkten an Online-Käufer und verbessern so das allgemeine Kundenerlebnis.

- Steigende Expansion des verarbeitenden Gewerbes

Das Wachstum der Fertigungsindustrie in Saudi-Arabien spielt eine große Rolle auf dem Lagermarkt. Fabriken und Industrien produzieren Waren und benötigen dafür Lagerplätze. Lager sind wie große Lagerräume, in denen Unternehmen ihre Produkte aufbewahren, bevor sie an Geschäfte oder Kunden verschickt werden. Da die Fertigungsindustrie in Saudi-Arabien wächst, steigt außerdem die Nachfrage nach Lagern, da sie eine sichere und organisierte Möglichkeit bieten, alle hergestellten Produkte zu lagern. Dieser Trend belebt den Lagermarkt in Saudi-Arabien und schafft Möglichkeiten für Unternehmen, die Lagerdienstleistungen anbieten.

Zurückhaltung

- Hohe Grundstücks- und Lagereinrichtungskosten

Hohe Grundstücks- und Lagerkosten stellen eine erhebliche Einschränkung für das Marktwachstum dar. Die Kosten für den Erwerb geeigneter Grundstücke und den Bau von Lagerhallen können für Unternehmen, die ihre Präsenz im Land aufbauen oder ausbauen möchten, eine erhebliche Hürde darstellen. Diese Kosten umfassen Grundstückspreise, Baumaterialien, Arbeitskräfte und die Einhaltung lokaler Vorschriften, die zusammen zur finanziellen Gesamtbelastung beitragen.

Gelegenheit

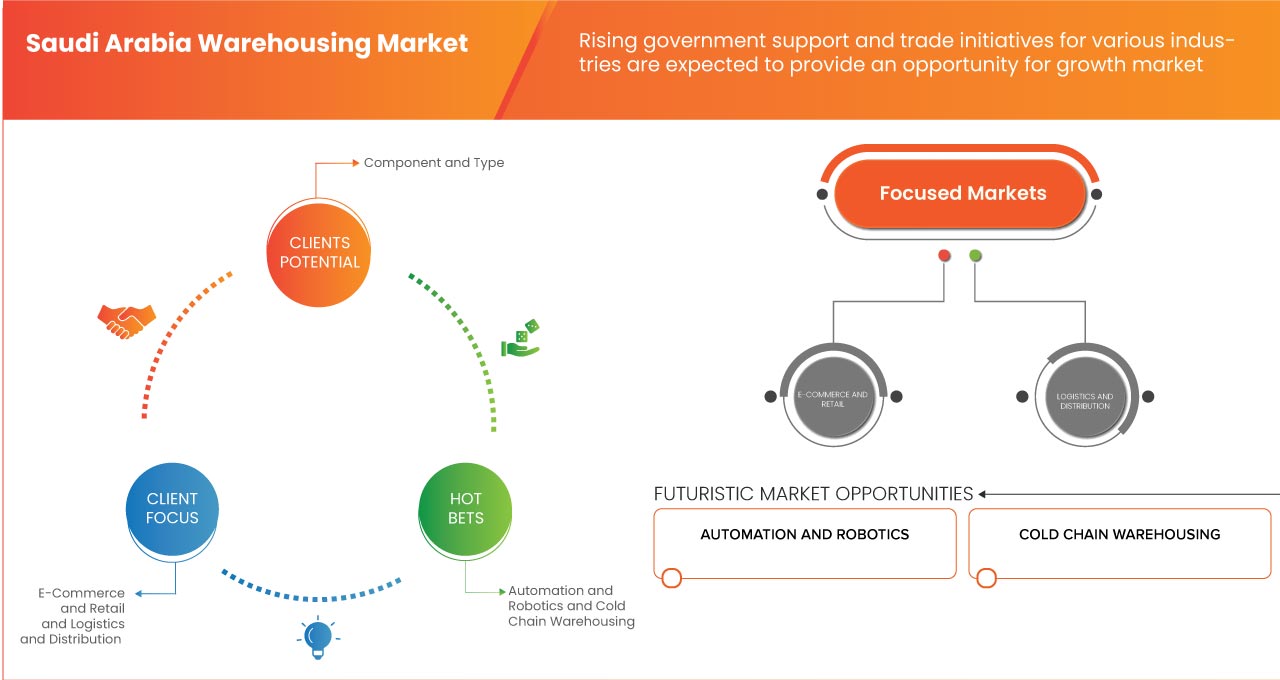

- Steigende staatliche Unterstützung und Handelsinitiativen für verschiedene Branchen

Die zunehmende Unterstützung und die handelsbezogenen Initiativen der Regierung bieten eine große Chance für Marktwachstum. Diese Maßnahmen fördern ein günstigeres Geschäftsumfeld und ziehen eine Vielzahl unterschiedlicher Branchen in die Region. Die Nachfrage nach modernen Lagereinrichtungen dürfte mit der Ausweitung der Geschäftstätigkeit verschiedener Branchen steigen, was vielversprechende Aussichten für die Entwicklung und Expansion der Branche bietet.

Herausforderung

- Fachkräftemangel

Ein wesentlicher Faktor, der das Marktwachstum voraussichtlich bremsen wird, ist der Mangel an Fachkräften. Da die Branche weiter wächst und sich weiterentwickelt, besteht eine steigende Nachfrage nach Arbeitskräften mit Spezialkenntnissen in Bereichen wie Lagerverwaltung, Logistik und dem Betrieb fortschrittlicher Automatisierungs- und Technologiesysteme. Die Verfügbarkeit solcher Fachkräfte auf dem Markt ist jedoch nach wie vor begrenzt, was zu Rekrutierungsschwierigkeiten und höheren Arbeitskosten führt.

Jüngste Entwicklungen

- Im Mai 2023 erreichte Tamer Logistics einen bedeutenden Meilenstein, indem es bei den TLME Inspiration Awards 2023 den Preis als inspirierendstes Logistikunternehmen des Jahres gewann. Diese prestigeträchtige Anerkennung würdigte nicht nur ihre Anpassungsfähigkeit und Innovationsfähigkeit in einer sich schnell verändernden Branche, sondern untermauerte auch ihre Position als echter Marktführer in den Bereichen FMCG, Gesundheitswesen, Kosmetik und Drittanbieterlogistik im Königreich Saudi-Arabien. Diese Auszeichnung war ein Beweis für ihr Engagement für Spitzenleistungen und unterstrich ihre Rolle bei der Neudefinition von Lieferkette und Logistik, was letztendlich zu einem verbesserten Ruf und einer Branchenführerschaft beitrug.

- Im September 2021 sicherte sich MLS die exklusive Rolle als alleiniger Aftermarket-Dienstleister für Hyundai und Nissan in Saudi-Arabien. Diese strategische Partnerschaft hat nicht nur Mosanadas Marktpräsenz gestärkt, sondern es dem Unternehmen auch ermöglicht, einem breiten Kundenkreis umfassende und spezialisierte Dienstleistungen anzubieten, was zum Umsatzwachstum beitrug und seinen Ruf als vertrauenswürdiger Anbieter im Automobilsektor stärkte.

Umfang des Lagermarktes in Saudi-Arabien

Der Lagermarkt in Saudi-Arabien ist in acht wichtige Segmente unterteilt, basierend auf Komponente, Funktion, Typ, Größe, Eigentümerschaft und Lagerhaltungsart, WMS-Tier-Typ und Endbenutzer. Das Wachstum zwischen den Segmenten hilft Ihnen dabei, Nischenwachstumsbereiche und Strategien zur Marktansprache zu analysieren und Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten zu bestimmen.

Komponente

- Hardware/System

- Software

- Dienstleistungen

Auf der Grundlage der Komponenten wird der Markt in Hardware/System, Software und Dienste segmentiert.

Funktion

- Bestandskontrolle und -verwaltung

- Anlagenverfolgung

- Geräte- und Fahrzeugverfolgung

- Hof- und Dockmanagement

- Auftragsabwicklung

- Personal- und Aufgaben-(Prozess-)Management

- Versand

- Vorausschauende Wartung

- Sonstiges

Auf der Grundlage der Funktion ist der Markt in Bestandskontrolle und -verwaltung, Anlagenverfolgung, Hof- und Dockmanagement, Auftragsabwicklung, Personal- und Aufgaben- (Prozess-)Management, Versand, vorausschauende Wartung und andere segmentiert.

Typ

- Insource Warehousing

- Lagerhaltung auslagern

Auf der Grundlage des Typs ist der Markt in Insourcing-Lagerhaltung und Outsourcing-Lagerhaltung segmentiert.

Größe

- Klein

- Medium

- Groß

Auf Grundlage der Größe wird der Markt in klein, mittel und groß segmentiert.

Eigentum

- Öffentliche Lager

- Private Lager

- Zolllager

- Konsolidiertes Lager

Auf der Grundlage des Eigentums ist der Markt in öffentliche Lagerhäuser, private Lagerhäuser, Zolllagerhäuser und konsolidierte Lagerhäuser unterteilt.

Lagerung Lagerung Natur

- Lagerung bei Raumtemperatur (ca. 27 °C)

- Klimatisiert (56°F und 75°F)

- Gekühlt (0°C und 13°C)

- Kalt/Gefroren (von oder unter 0 °C)

Auf Grundlage der Art der Lagerhaltung wird der Markt in Lagerung bei Raumtemperatur (ca. 26 °C), klimatisierte Lagerung (13 °C und 24 °C), gekühlte Lagerung (0 °C und 13 °C) und kalte/gefrorene Lagerung (0 °C oder weniger) segmentiert.

WMS-Stufentyp

- Erweitertes WMS

- Grundlegendes WMS

- Mittleres WMS

Auf der Grundlage des WMS-Stufentyps ist der Markt in erweitertes WMS, grundlegendes WMS und mittleres WMS segmentiert.

Endbenutzer

- Einzelhandel und E-Commerce

- Transport und Logistik

- Automobilindustrie

- Gesundheitspflege

- Essen und Trinken

- Elektrik und Elektronik

- Landwirtschaft

- Energie und Versorgung

- Sonstiges

Auf der Grundlage des Endbenutzers ist der Markt in Einzelhandel und E-Commerce, Transport und Logistik, Automobil, Gesundheitswesen, Lebensmittel und Getränke, Elektrik und Elektronik, Chemie, Landwirtschaft, Energie und Versorgung und Andere segmentiert.

Saudi-Arabien: Lagermarkt – Länderanalyse/Einblicke

Der Lagermarkt in Saudi-Arabien wird analysiert und Informationen zur Marktgröße werden nach Komponente, Funktion, Typ, Größe, Eigentümerschaft und Art der Lagerhaltung, WMS-Stufentyp und Endbenutzer bereitgestellt.

Auf der Grundlage der Städte ist der Markt in Dschidda, Riad, Dammam, Al Khobar und den Rest von Saudi-Arabien unterteilt. Riad, die Hauptstadt Saudi-Arabiens, dominiert den saudi-arabischen Lagermarkt. Diese Dominanz ist auf die zentrale Lage zurückzuführen, die es zu einem strategischen Knotenpunkt für die Verteilung von Waren im ganzen Land macht. Darüber hinaus hat Riads florierendes Geschäftsumfeld im Einklang mit der Vision 2030-Initiative der Regierung erhebliche Investitionen in die Logistik- und Lagerinfrastruktur angezogen und so seine Position als Marktführer im Lagermarkt des Königreichs weiter gestärkt.

Der Städteabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Ländermarken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile für Lagerhaltung in Saudi-Arabien

Die Wettbewerbslandschaft des Lagermarkts in Saudi-Arabien liefert Einzelheiten zu den Wettbewerbern. Die enthaltenen Details umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktzulassungen, Produktbreite und -umfang, Anwendungsdominanz und Produkttyp-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf dem Markt.

Zu den wichtigsten Marktteilnehmern auf dem Lagermarkt in Saudi-Arabien zählen unter anderem Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, SA TALKE Ltd., LogiPoint und United Group.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 COMPANY COMPARATIVE ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 TECHNOLOGICAL TRENDS

4.5 KEY STRATEGIC INITIATIVES

4.6 CASE STUDY 1

4.6.1 PROBLEM STATEMENT

4.6.2 BACKGROUND

4.6.3 SOLUTION

4.7 CASE STUDY 2

4.7.1 PROBLEM STATEMENT

4.7.2 SOLUTION

4.8 LIST OF THE TOP WAREHOUSING COMPANIES AS PER SQM

4.9 PATENT ANALYSIS

4.9.1 IMAGE-BASED INSPECTION AND AUTOMATED INVENTORY AND SUPPLY CHAIN MANAGEMENT OF WELL EQUIPMENT

4.9.2 OPTIMIZED TASK GENERATION AND SCHEDULING OF AUTOMATED GUIDED CARTS USING OVERHEAD SENSOR SYSTEMS

4.9.3 SYSTEM AND METHOD FOR WORKFLOW MANAGEMENT

4.9.4 RETURN ORDERING SYSTEM AND METHOD

4.9.5 RETAIL SHELF SUPPLY MONITORING SYSTEM

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING EXPANSION OF THE MANUFACTURING SECTOR

5.1.2 SURGING GROWTH OF THE LOGISTICS SECTOR

5.1.3 TECHNOLOGICAL ADVANCEMENT IN WAREHOUSING

5.2 RESTRAINTS

5.2.1 HIGH LAND AND WAREHOUSE SETUP COST

5.2.2 COMPLEXITY TO OPERATE A WAREHOUSING BUSINESS IN SAUDI ARABIA

5.3 OPPORTUNITIES

5.3.1 RISING GOVERNMENT SUPPORT AND TRADE INITIATIVES FOR VARIOUS INDUSTRIES

5.3.2 SURGING GROWTH OF SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN SAUDI ARABIA

5.3.3 INCREASING PARTNERSHIP AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 INCREASING GEOPOLITICAL TENSIONS AND GLOBAL ECONOMIC SLOWDOWN

5.4.2 SKILLED LABOR SHORTAGE

5.4.3 CHALLENGING CLIMATIC CONDITIONS

6 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE

6.1 OVERVIEW

6.2 INSOURCE WAREHOUSING

6.3 OUTSOURCE WAREHOUSING

7 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

7.1 OVERVIEW

7.2 PUBLIC WAREHOUSES

7.3 PRIVATE WAREHOUSES

7.4 BONDED WAREHOUSES

7.5 CONSOLIDATED WAREHOUSES

8 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE

8.1 OVERVIEW

8.2 SMALL

8.2.1 SMALL SCALE DISTRIBUTION CENTERS

8.2.2 MICRO WAREHOUSES

8.3 MEDIUM

8.3.1 REGIONAL WAREHOUSES

8.3.2 CROSS DOCKING FACILITIES

8.4 LARGE

8.4.1 NATIONAL DISTRIBUTION CENTERS

8.4.2 MEGA WAREHOUSES

9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE

9.1 OVERVIEW

9.2 AMBIENT WAREHOUSING (AROUND 80°F)

9.2.1 BY PRODUCT TYPE

9.2.1.1 FOOD & BEVERAGES

9.2.1.1.1 BY TYPE

9.2.1.1.1.1 BREADS AND CEREALS

9.2.1.1.1.2 SAUCES AND CONDIMENTS

9.2.1.1.1.3 TEA AND COFFEE

9.2.1.1.1.4 BISCUITS AND CAKES

9.2.1.1.1.5 PASTA AND RICE

9.2.1.1.1.6 OTHERS

9.2.1.2 ELECTRONICS

9.2.1.3 PAPER PRODUCTS

9.2.1.4 PHARMACEUTICALS

9.2.1.5 COSMETICS

9.2.1.6 OTHERS

9.3 AIR CONDITIONED (56°F AND 75°F)

9.3.1 BY PRODUCT TYPE

9.3.1.1 FOOD

9.3.1.1.1 BY TYPE

9.3.1.1.1.1 FRUITS & VEGETABLES

9.3.1.1.1.2 BY TYPE

9.3.1.1.1.3 TOMATOES

9.3.1.1.1.4 WATERMELON

9.3.1.1.1.5 BANANAS

9.3.1.1.1.6 COCONUT

9.3.1.1.1.7 BASILS

9.3.1.1.1.8 CANNED FISH AND MEATS

9.3.1.1.1.9 CANNED FRUIT AND VEGETABLES

9.3.1.1.1.10 CONFECTIONERY PRODUCTS

9.3.1.1.1.11 CHOCOLATE AND CANDIES

9.3.1.2 OIL & PETROLEUM

9.3.1.3 CHEMICALS

9.3.1.4 OTHERS

9.4 REFRIGERATED (33°F AND 55°F)

9.4.1 BY PRODUCT TYPE

9.4.1.1 FOOD AND BEVERAGES

9.4.1.1.1 BY TYPE

9.4.1.1.1.1 FRUITS AND VEGETABLES

9.4.1.1.1.2 BY TYPE

9.4.1.1.1.3 ORANGES

9.4.1.1.1.4 APPLES

9.4.1.1.1.5 CUCUMBER

9.4.1.1.1.6 BEANS

9.4.1.1.1.7 KIWIS

9.4.1.1.1.8 EGGPLANT

9.4.1.1.1.9 GUAVAS

9.4.1.1.1.10 BLUEBERRIES

9.4.1.1.1.11 OTHERS

9.4.1.1.1.12 DAIRY PRODUCTS

9.4.1.1.1.13 MEAT

9.4.1.1.1.14 FISH

9.4.1.1.1.15 EGGS

9.4.1.1.1.16 OTHERS

9.4.1.2 CHEMICALS

9.4.1.3 BIO-PHARMACEUTICALS

9.4.1.3.1 BY TYPE

9.4.1.3.1.1 VACCINE

9.4.1.3.1.2 BLOOD BANKS

9.4.1.3.1.3 OTHERS

9.4.1.4 PLANTS AND FLOWERS

9.4.1.5 OTHERS

9.5 COLD/FROZEN (OF OR BELOW 32°F)

9.5.1 BY PRODUCT TYPE

9.5.1.1 POULTRY AND SEA FOOD

9.5.1.2 FRUITS AND VEGETABLES

9.5.1.2.1 BY TYPE

9.5.1.2.1.1 GRAPES

9.5.1.2.1.2 SWEET CORN

9.5.1.2.1.3 CABBAGE

9.5.1.2.1.4 CHERRIES

9.5.1.2.1.5 STRAWBERRIES

9.5.1.2.1.6 MUSHROOMS

9.5.1.2.1.7 LETTUCE

9.5.1.2.1.8 BROCCOLI

9.5.1.2.1.9 BRUSSELS SPROUTS

9.5.1.2.1.10 OTHERS

9.5.1.3 ARTWORK

9.5.1.4 OTHERS

10 SAUDI ARABIA WAREHOUSING MARKET, WMS TIER TYPE

10.1 OVERVIEW

10.2 BASIC WMS

10.3 INTERMEDIATE WMS

10.4 ADVANCED WMS

11 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 HARDWARE/SYSTEM

11.2.1 PALLETS

11.2.1.1 SELECTIVE

11.2.1.2 DRIVE ION DRIVE

11.2.1.3 DOUBLE DEEP

11.2.1.4 CANTILEVER

11.2.1.5 OTHERS

11.2.2 CONVEYOR SYSTEM

11.2.2.1 ROLLER SYSTEM

11.2.2.2 BELT CONVEYORS

11.2.2.3 SLAT CONVEYORS

11.2.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

11.2.3.1 UNIT LOAD

11.2.3.2 MINILOAD

11.2.3.3 DEEP LANE

11.2.3.4 MAN ON BOARD

11.2.4 TRANSPORT SYSTEM

11.2.4.1 INDUSTRIAL TRUCKS

11.2.4.2 CRANES

11.2.5 AUTOMATED GUIDED VEHICLES (AGVS)

11.2.5.1 MATERIAL HANDLING

11.2.5.2 PICKING

11.2.5.3 SORTING

11.2.6 SORTATION SYSTEM

11.2.6.1 UNIT SORTER

11.2.6.1.1 POP UP WHEEL/ ROLLER/BELT SORTER

11.2.6.1.2 PIVOTING ARM SORTER

11.2.6.1.3 PUSH SORTER

11.2.6.2 CASE SORTER

11.2.6.2.1 TILT-TRAY & CROSS BELT SORTERS

11.2.6.2.2 PUSH TRAY SORTER

11.2.6.2.3 CASE & UNIT SORTERS

11.2.6.2.4 OTHERS

11.2.7 AUTONOMOUS MOBILE ROBOTICS

11.2.7.1 MATERIAL HANDLING

11.2.7.2 ORDER FULFILMENT

11.2.7.3 INVENTORY SCANNING

11.2.8 BARCODE SYSTEM

11.2.9 OTHERS

11.3 SOFTWARE

11.3.1.1 CLOUD

11.3.1.2 ON PREMISES

11.4 SERVICES

11.4.1.1 MANAGED SERVICES

11.4.1.2 PROFESSIONAL SERVICES

11.4.1.2.1 MAINTENANCE

11.4.1.2.2 INTEGRATION

11.4.1.2.3 TRAINING AND CONSULTING

11.4.1.2.4 TESTING

12 SAUDI ARABIA WAREHOUSING MARKET, BY END USER

12.1 OVERVIEW

12.2 FOOD AND BEVERAGES

12.2.1 NON PERISHABLE GOODS

12.2.2 COLD CHAIN LOGISTICS

12.2.2.1 HARDWARE/SYSTEM

12.2.2.1.1 PALLETS

12.2.2.1.2 CONVEYOR SYSTEM

12.2.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.2.2.1.4 TRANSPORT SYSTEM

12.2.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.2.2.1.6 SORTATION SYSTEM

12.2.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.2.2.1.8 BARCODE SYSTEM

12.2.2.1.9 OTHERS

12.2.2.2 SOFTWARE

12.2.2.3 SERVICES

12.3 TRANSPORTATION AND LOGISTICS

12.3.1 LAST MILE DELIVERY PROVIDER

12.3.2 THIRD PARTY LOGISTIC PROVIDER

12.3.2.1 LAND TRANSPORT

12.3.2.2 OCEAN FREIGHT

12.3.2.3 AIR FREIGHT

12.3.2.3.1 B2C

12.3.2.3.2 B2B

12.3.3 FREIGHT FORWARDER

12.3.3.1 HARDWARE/SYSTEM

12.3.3.1.1 PALLETS

12.3.3.1.2 CONVEYOR SYSTEM

12.3.3.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.3.3.1.4 TRANSPORT SYSTEM

12.3.3.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.3.3.1.6 SORTATION SYSTEM

12.3.3.1.7 AUTONOMOUS MOBILE ROBOTICS

12.3.3.1.8 BARCODE SYSTEM

12.3.3.1.9 OTHERS

12.3.3.2 SOFTWARE

12.3.3.3 SERVICES

12.4 RETAIL AND E-COMMERCE

12.4.1 E-COMMERCE

12.4.1.1 ONLINE MARKET PLACES

12.4.1.2 DIRECT TO CONSUMERS BRANDS

12.4.2 BRICK AND MOTOR

12.4.2.1 HARDWARE/SYSTEM

12.4.2.1.1 PALLETS

12.4.2.1.2 CONVEYOR SYSTEM

12.4.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.4.2.1.4 TRANSPORT SYSTEM

12.4.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.4.2.1.6 SORTATION SYSTEM

12.4.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.4.2.1.8 BARCODE SYSTEM

12.4.2.1.9 OTHERS

12.4.2.2 SOFTWARE

12.4.2.3 SERVICES

12.5 ENERGY AND UTILITIES

12.5.1 OIL AND GAS

12.5.2 UTILITIES

12.5.3 RENEWABLE ENERGY

12.5.4 MINING AND RESOURCES

12.5.4.1 HARDWARE/SYSTEM

12.5.4.1.1 PALLETS

12.5.4.1.2 CONVEYOR SYSTEM

12.5.4.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.5.4.1.4 TRANSPORT SYSTEM

12.5.4.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.5.4.1.6 SORTATION SYSTEM

12.5.4.1.7 AUTONOMOUS MOBILE ROBOTICS

12.5.4.1.8 BARCODE SYSTEM

12.5.4.1.9 OTHERS

12.5.4.2 SOFTWARE

12.5.4.3 SERVICES

12.6 CHEMICAL

12.6.1 HARDWARE/SYSTEM

12.6.1.1 PALLETS

12.6.1.2 CONVEYOR SYSTEM

12.6.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.6.1.4 TRANSPORT SYSTEM

12.6.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.6.1.6 SORTATION SYSTEM

12.6.1.7 AUTONOMOUS MOBILE ROBOTICS

12.6.1.8 BARCODE SYSTEM

12.6.1.9 OTHERS

12.6.2 SOFTWARE

12.6.3 SERVICES

12.7 AUTOMOTIVE

12.7.1 HARDWARE/SYSTEM

12.7.1.1 PALLETS

12.7.1.2 CONVEYOR SYSTEM

12.7.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.7.1.4 TRANSPORT SYSTEM

12.7.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.7.1.6 SORTATION SYSTEM

12.7.1.7 AUTONOMOUS MOBILE ROBOTICS

12.7.1.8 BARCODE SYSTEM

12.7.1.9 OTHERS

12.7.2 SOFTWARE

12.7.3 SERVICES

12.8 ELECTRICAL AND ELECTRONICS

12.8.1 HARDWARE/SYSTEM

12.8.1.1 PALLETS

12.8.1.2 CONVEYOR SYSTEM

12.8.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.8.1.4 TRANSPORT SYSTEM

12.8.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.8.1.6 SORTATION SYSTEM

12.8.1.7 AUTONOMOUS MOBILE ROBOTICS

12.8.1.8 BARCODE SYSTEM

12.8.1.9 OTHERS

12.8.2 SOFTWARE

12.8.3 SERVICES

12.9 HEALTHCARE

12.9.1 PHARMACEUTICAL

12.9.2 MEDICAL DEVICE

12.9.3 BIOTECH AND RESEARCH

12.9.4 OTHERS

12.1 COMPONENT

12.10.1 HARDWARE/SYSTEM

12.10.1.1 PALLETS

12.10.1.2 CONVEYOR SYSTEM

12.10.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.10.1.4 TRANSPORT SYSTEM

12.10.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.10.1.6 SORTATION SYSTEM

12.10.1.7 AUTONOMOUS MOBILE ROBOTICS

12.10.1.8 BARCODE SYSTEM

12.10.1.9 OTHERS

12.10.2 SOFTWARE

12.10.3 SERVICES

12.11 AGRICULTURE

12.11.1 HARDWARE/SYSTEM

12.11.1.1 PALLETS

12.11.1.2 CONVEYOR SYSTEM

12.11.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.11.1.4 TRANSPORT SYSTEM

12.11.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.11.1.6 SORTATION SYSTEM

12.11.1.7 AUTONOMOUS MOBILE ROBOTICS

12.11.1.8 BARCODE SYSTEM

12.11.1.9 OTHERS

12.11.2 SOFTWARE

12.11.3 SERVICES

12.12 OTHERS

13 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 INVENTORY CONTROL AND MANAGEMENT

13.2.1 BY TYPE

13.2.1.1 INVENTORY OPTIMIZATION

13.2.1.1.1 BY TYPE

13.2.1.1.1.1 SAFETY STOCK MANAGEMENT

13.2.1.1.1.2 DYNAMIC REORDERING

13.2.1.1.1.3 DEMAND SENSING

13.2.1.2 REAL TIME INVENTORY TRACKING

13.2.1.2.1 BY TYPE

13.2.1.2.1.1 RFID BASED TRACKING

13.2.1.2.1.2 BARCODE SCANNING

13.2.1.2.1.3 GPS BASED TRACKING

13.2.1.2.1.4 FIXED LOCATION

13.2.1.2.1.5 FLOATING (RANDOM) LOCATION

13.3 ORDER FULFILMENT

13.3.1 BY TYPE

13.3.1.1 PICKING AND PACKAGING AUTOMATION

13.3.1.1.1 BY TYPE

13.3.1.1.1.1 COBOTS

13.3.1.1.1.2 ROBOTS PICKERS

13.3.1.1.1.3 GOODS-TO-PERSON PICKING (GTP)

13.3.1.1.2 ORDER ROUTING AND OPTIMIZATION

13.3.1.1.2.1 MULTI CHANNEL ORDER MANAGEMENT

13.3.1.1.2.2 ROUTE PLANNING ALGORITHM

13.3.1.1.2.3 DYNAMIC SLOTTING

13.3.1.1.3 RECEIVING AND PUT AWAY

13.4 ASSET TRACKING

13.4.1 BY TYPE

13.4.1.1 PRODUCT AND PACKAGE TRACKING

13.4.1.1.1 BY TYPE

13.4.1.1.1.1 RFID TAGGING

13.4.1.1.1.2 SMART PACKAGING

13.4.1.1.1.3 BLOCK CHAIN BASED TRACKING

13.4.1.1.2 EQUIPMENT AND VEHICLE TRACKING

13.4.1.1.3 BY TYPE

13.4.1.1.3.1 GPS TRACKING

13.4.1.1.3.2 TELEMATICS

13.4.1.1.3.3 CONDITION MONITORING

13.5 SHIPPING

13.6 WORKFORCE AND TASK( PROCESS) MANAGEMENT

13.7 YARD AND DOCK MANAGEMENT

13.8 PREDICTIVE MAINTENANCE

13.8.1 BY TYPE

13.8.1.1 FAILURE MODE AND EFFECT ANALYSIS

13.8.1.2 SENSOR BASED

13.8.1.3 AI DRIVEN

13.9 OTHER

14 SAUDI ARABIA WAREHOUSING MARKET, BY CITY

14.1 SAUDI ARABIA

14.1.1 JEDDAH

14.1.2 RIYADH

14.1.3 DAMMAM

14.1.4 AL KHOBAR

14.1.5 REST OF SAUDI ARABIA

15 SAUDI ARABIA WAREHOUSING MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

16 SWOT ANALYSIS

17 COMPANY PROFILINGS

17.1 KUEHNE+NAGEL

17.1.1 COMPANY SNAPSHOT

17.1.2 SERVICES PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 CEVA LOGISTICS

17.2.1 COMPANY SNAPSHOT

17.2.2 SERVICES PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 YBA KANOO

17.3.1 COMPANY SNAPSHOT

17.3.2 SERVICE PORTFOLIO

17.3.3 RECENT DEVELOPMENTS

17.4 GAC

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICES PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 TAMER LOGISTICS

17.5.1 COMPANY SNAPSHOT

17.5.2 SERVICES PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 AGILITY (A SUBSIDIARY OF DSV)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 SOLUTION PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AIDUK

17.7.1 COMPANY SNAPSHOT

17.7.2 SERVICES PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ALMAJDOUIE LOGISTICS

17.8.1 COMPANY SNAPSHOT

17.8.2 SERVICES PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ARAMEX

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 SERVICES PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BAFCO

17.10.1 COMPANY SNAPSHOT

17.10.2 SERVICES PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BINZAGR

17.11.1 COMPANY SNAPSHOT

17.11.2 SERVICES PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CAMELS PARTY LOGISTICS

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICES PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 DB SCHENKER (A SUBSIDIARY OF DEUTSCHE BAHN)

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SERVICES PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 DHL

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 SOLUTION PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 FOURWINDS-KSA

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HALA

17.16.1 COMPANY SNAPSHOT

17.16.2 SERVICES PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 LOGIPOINT

17.17.1 COMPANY SNAPSHOT

17.17.2 SERVICES PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LSC WAREHOUSING AND LOGISTICS SERVICES CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 SERVICES PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MLS

17.19.1 COMPANY SNAPSHOT

17.19.2 SOLUTION PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 S.A. TALKE LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 SERVICES PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SIGN LOGISTICS

17.21.1 COMPANY SNAPSHOT

17.21.2 SERVICES PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SMSA EXPRESS TRANSPORTATION COMPANY LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 SERVICES PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 TAKHZEEN

17.23.1 COMPANY SNAPSHOT

17.23.2 SERVICE PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 UNITED GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WARED LOGISTICS

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPARISON OF AUTOMATED WAREHOUSE AND TRADITIONAL WAREHOUSE

TABLE 3 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 5 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 6 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 10 SAUDI ARABIA AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 SAUDI ARABIA FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 SAUDI ARABIA AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 SAUDI ARABIA FOOD IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 SAUDI ARABIA REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 SAUDI ARABIA BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 20 SAUDI ARABIA FRUITS AND VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA WAREHOUSING MARKET, BY WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA WAREHOUSING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SAUDI ARABIA E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 60 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 62 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 64 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 SAUDI ARABIA PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 SAUDI ARABIA PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA WAREHOUSING MARKET, BY CITY, 2021-2030 (USD MILLION)

TABLE 76 JEDDAH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 77 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JEDDAH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JEDDAH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JEDDAH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JEDDAH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JEDDAH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JEDDAH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 JEDDAH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JEDDAH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JEDDAH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 JEDDAH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 JEDDAH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 JEDDAH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 BY FUNCTION

TABLE 91 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 JEDDAH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 JEDDAH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 95 JEDDAH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 JEDDAH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 JEDDAH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 JEDDAH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 JEDDAH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 JEDDAH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 JEDDAH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 BY TYPE

TABLE 103 BY SIZE

TABLE 104 JEDDAH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 JEDDAH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 JEDDAH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 JEDDAH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 JEDDAH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 JEDDAH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 JEDDAH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 111 JEDDAH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 112 JEDDAH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 114 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 115 JEDDAH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 116 JEDDAH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 118 JEDDAH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 119 JEDDAH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 120 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 122 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 125 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 126 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 127 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 JEDDAH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 131 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 134 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 JEDDAH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 136 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 JEDDAH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 138 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 JEDDAH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 140 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 143 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 JEDDAH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 145 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 RIYADH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 147 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 RIYADH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 RIYADH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 RIYADH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 RIYADH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 RIYADH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 RIYADH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 RIYADH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 RIYADH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 RIYADH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 RIYADH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 RIYADH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 RIYADH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 RIYADH WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 161 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 RIYADH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 RIYADH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 165 RIYADH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 RIYADH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 RIYADH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 RIYADH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 RIYADH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 RIYADH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 RIYADH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 RIYADH WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 RIYADH WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 174 RIYADH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 RIYADH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 RIYADH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 RIYADH WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 178 RIYADH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 179 RIYADH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 180 RIYADH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 RIYADH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 182 RIYADH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 183 RIYADH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 184 RIYADH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 186 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 187 RIYADH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 188 RIYADH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 189 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 190 RIYADH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 191 RIYADH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 192 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 194 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 197 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 198 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 199 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 RIYADH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 203 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 206 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 RIYADH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 208 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 RIYADH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 210 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 RIYADH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 212 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 215 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 RIYADH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 217 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 DAMMAM WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 219 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 DAMMAM PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 DAMMAM CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 DAMMAM AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 DAMMAM TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 DAMMAM AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 DAMMAM SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 DAMMAM UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 DAMMAM CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 DAMMAM AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 DAMMAM SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 DAMMAM SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 DAMMAM PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 DAMMAM WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 233 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 DAMMAM INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 DAMMAM REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 237 DAMMAM ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 DAMMAM PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 DAMMAM ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 DAMMAM ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 DAMMAM PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 DAMMAM EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 DAMMAM PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 DAMMAM WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 DAMMAM WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 246 DAMMAM SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 DAMMAM MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 DAMMAM LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 DAMMAM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 250 DAMMAM WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 251 DAMMAM AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 252 DAMMAM FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 DAMMAM AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 254 DAMMAM FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 255 DAMMAM FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 256 DAMMAM REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 257 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 258 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 259 DAMMAM BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 260 DAMMAM COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 262 DAMMAM WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 263 DAMMAM WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 264 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 266 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 269 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 270 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 271 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 DAMMAM E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 275 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 278 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 DAMMAM CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 280 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 DAMMAM AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 282 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 283 DAMMAM ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 284 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 286 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 287 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 DAMMAM AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 289 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 AL KHOBAR WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 291 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 AL KHOBAR PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 AL KHOBAR CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 AL KHOBAR AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 AL KHOBAR TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 AL KHOBAR AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 AL KHOBAR SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 AL KHOBAR UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 AL KHOBAR CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 AL KHOBAR AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 AL KHOBAR SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 302 AL KHOBAR SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 AL KHOBAR PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 304 AL KHOBAR WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 305 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 AL KHOBAR INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 AL KHOBAR REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 309 AL KHOBAR ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 AL KHOBAR PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 AL KHOBAR ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 312 AL KHOBAR ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 AL KHOBAR PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 AL KHOBAR EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 315 AL KHOBAR PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 316 AL KHOBAR WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 317 AL KHOBAR WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 318 AL KHOBAR SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 AL KHOBAR MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 320 AL KHOBAR LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 321 AL KHOBAR MEDIUM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 322 AL KHOBAR WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 323 AL KHOBAR AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 AL KHOBAR FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 AL KHOBAR AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 326 AL KHOBAR FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 327 AL KHOBAR FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 328 AL KHOBAR REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 329 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 330 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 331 AL KHOBAR BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 332 AL KHOBAR COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 333 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 334 AL KHOBAR WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 335 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 336 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 337 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 338 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 340 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 341 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 342 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 AL KHOBAR E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 346 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 349 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 350 AL KHOBAR CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 351 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 352 AL KHOBAR AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 353 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 354 AL KHOBAR ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 355 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 356 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 358 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 AL KHOBAR AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 360 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 REST OF SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA WAREHOUSING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA WAREHOUSING MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SAUDI ARABIA WAREHOUSING MARKET: MULTIVARIATE MODELLING

FIGURE 10 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 12 GROWING E-COMMERCE MARKET IN SAUDI ARABIA IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA WAREHOUSING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 HARDWARE/SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA WAREHOUSING MARKET FROM 2023 TO 2030

FIGURE 14 VALUE CHAIN FOR SAUDI ARABIA WAREHOUSING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA WAREHOUSING MARKET

FIGURE 16 GROWING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 17 RISING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 18 COMPARISON OF E-COMMERCE SALES IN SAUDI ARABIA WITH OTHER COUNTRIES IN 2020

FIGURE 19 LAST-MILE GOODS DISTRIBUTION IN SAUDI ARABIA (NUMBER OF ORDERS IN MILLION) (2017-20)

FIGURE 20 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 21 IMPACT OF GEOPOLITICAL TENSIONS

FIGURE 22 SAUDI ARABIA WAREHOUSING MARKET: BY TYPE, 2022

FIGURE 23 SAUDI ARABIA WAREHOUSING MARKET: BY OWNERSHIP, 2022

FIGURE 24 SAUDI ARABIA WAREHOUSING MARKET: BY SIZE, 2022

FIGURE 25 SAUDI ARABIA WAREHOUSING MARKET: BY WAREHOUSING STORAGE NATURE, 2022

FIGURE 26 SAUDI ARABIA WAREHOUSING MARKET: WMS TIER TYPE, 2022

FIGURE 27 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT, 2022

FIGURE 28 SAUDI ARABIA WAREHOUSING MARKET: BY END USER, 2022

FIGURE 29 SAUDI ARABIA WAREHOUSING MARKET: BY FUNCTION, 2022

FIGURE 30 SAUDI ARABIA WAREHOUSING MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.