North America X Ray Inspection System Market

Marktgröße in Milliarden USD

CAGR :

%

| 2024 –2030 | |

| USD 476,478.24 | |

|

|

|

>Nordamerikanischer Markt für Röntgeninspektionssysteme, nach Angebot (Hardware, Software und Dienstleistungen), Bildgebungstechnik (filmbasierte Bildgebung und digitale Bildgebung ), Dimension (2D und 3D), Produkttyp (verpackte Produkte, unverpackte Produkte, gepumpt und andere), Scantechnologie (HD-Technologie, Ultra-HD-Technologie und andere), Anzahl der Spuren (Einzelspur, Mehrspur und Doppelspur), Endverwendung (Öl und Gas, Stromerzeugung, staatliche Infrastruktur, Lebensmittel und Getränke, Luft- und Raumfahrt, Automobil, Pharmazeutika und Nutraceutika, Halbleiter und andere), Branchentrends und Prognose bis 2030.

Marktanalyse und -größe für Röntgeninspektionssysteme in Nordamerika

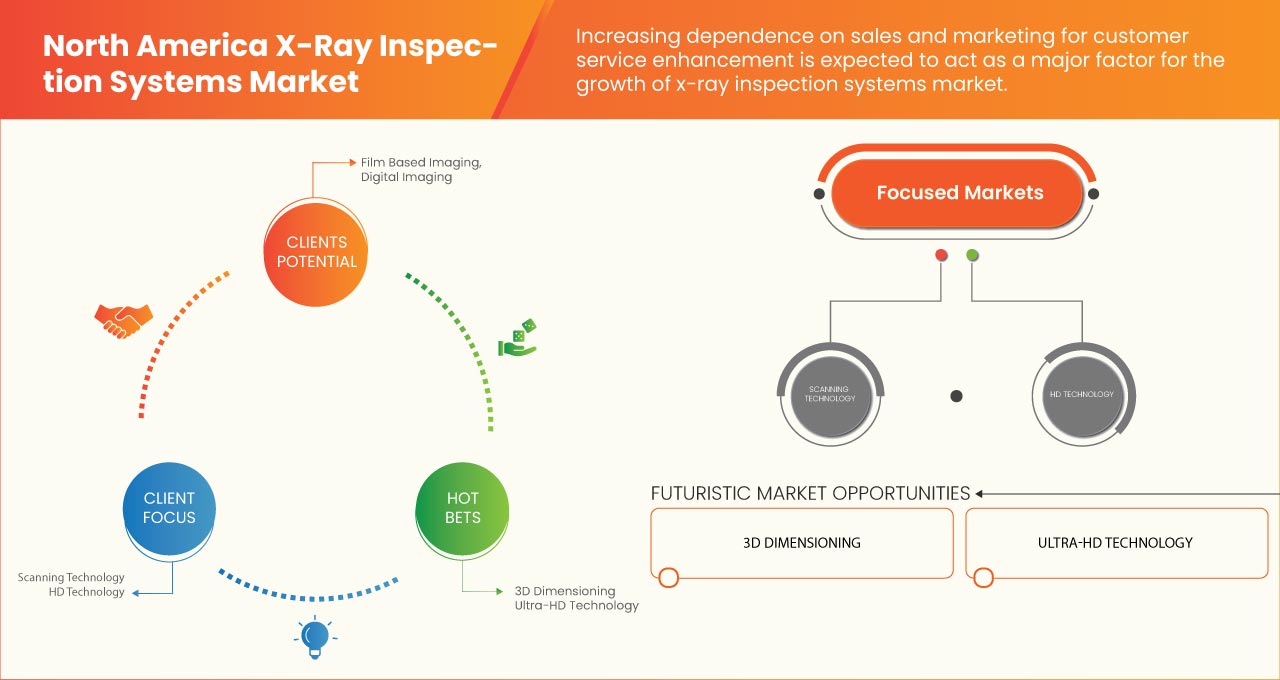

Aufgrund strenger staatlicher Vorschriften, die Sicherheit fordern, und der steigenden Nachfrage nach zerstörungsfreien Prüfungen sind dies die treibenden Faktoren auf dem nordamerikanischen Markt für Röntgeninspektionssysteme. Sicherheitsbedrohungen im Zusammenhang mit Röntgeninspektionssystemen und Röntgeninspektionssystemen bremsen jedoch das Wachstum des nordamerikanischen Marktes für Röntgeninspektionssysteme. Die zunehmende Verbreitung in der Lebensmittel- und Getränkeindustrie und anderen Branchen dürfte Chancen für das Wachstum des nordamerikanischen Marktes für Röntgeninspektionssysteme bieten. Die mangelnde Einhaltung gesetzlicher Vorschriften im Zusammenhang mit Röntgeninspektionssystemen ist jedoch zu einer Herausforderung für das Marktwachstum geworden.

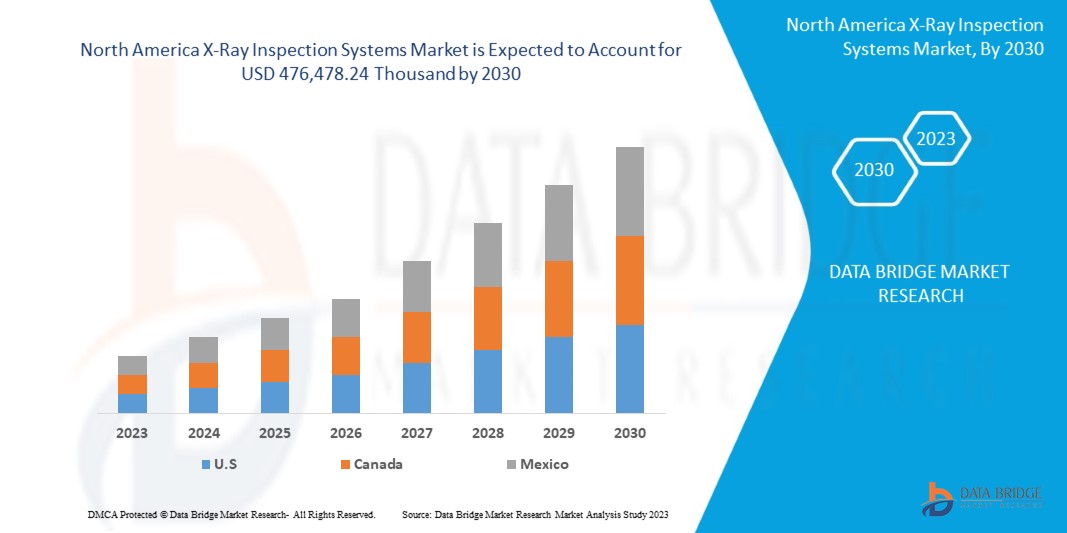

Data Bridge Market Research analysiert, dass der nordamerikanische Markt für Röntgeninspektionssysteme bis 2030 voraussichtlich einen Wert von 476.478,24 Tausend USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 7,6 % während des Prognosezeitraums entspricht. Der Marktbericht für nordamerikanische Röntgeninspektionssysteme umfasst auch ausführliche Preisanalysen, Patentanalysen und technologische Fortschritte.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2020–2016) |

|

Quantitative Einheiten |

Umsatz in Tausend, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Nach Angebot (Hardware, Software und Services), Bildgebungstechnik (filmbasierte Bildgebung und digitale Bildgebung), Dimension (2D und 3D), Produkttyp (verpackte Produkte, unverpackte Produkte, gepumpte Produkte und andere), Scantechnologie (HD-Technologie, Ultra-HD-Technologie und andere), Anzahl der Fahrspuren (einspurig, mehrspurig und zweispurig), Endverbrauch (Öl und Gas, Stromerzeugung, staatliche Infrastruktur, Lebensmittel und Getränke, Luft- und Raumfahrt, Automobilindustrie, Pharmazeutika und Nutraceutika, Halbleiter und andere). |

|

Abgedecktes Land |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, Smiths Detection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Limited, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging Inc, Viscom AG, ISHIDA CO., LTD, Mekitec group, MATSUSADA PRECISION Inc, Scienscope, SYSTEMS SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJ Electronix, Inc., Loma Systems, Minebea Intec GmbH, TDI PACKSYS, unter anderem |

Marktdefinition

Röntgeninspektionssysteme werden zur zerstörungsfreien Prüfung eines Probenbereichs verwendet. Röntgeninspektionssysteme werden verwendet, um Materialfehler mit zerstörungsfreien Methoden zu erkennen. Zu den Vorteilen von Röntgeninspektionssystemen gehören bessere Qualitätskontrollmechanismen, einfache Überprüfung fehlender Produkte, verbesserte Datenerfassung, geringeres Risiko von Produktrückrufen und vieles mehr. In Röntgeninspektionssystemen wird das zu prüfende Objekt und sein Bild mithilfe von Röntgenstrahlen erzeugt, die wiederum durch eine Bildverarbeitungssoftware verarbeitet werden, um fehlende Artikel zu überprüfen, Formanalysen durchzuführen, die Integrität der Verpackung zu überprüfen und etwaige Verunreinigungen zu erkennen.

Marktdynamik für Röntgeninspektionssysteme in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Steigende Nachfrage nach zerstörungsfreien Prüfungen

Zerstörungsfreie Prüfung (ZfP) ist eine Prüf- und Analysetechnik, die in der Industrie eingesetzt wird, um die Eigenschaften eines Materials, einer Komponente, einer Struktur oder eines Systems auf charakteristische Unterschiede oder Schweißfehler und Unstetigkeiten zu untersuchen, ohne das Originalteil zu beschädigen. ZfP ist auch als zerstörungsfreie Prüfung (NDE), zerstörungsfreie Inspektion (NDI) oder zerstörungsfreie Bewertung (NDE) bekannt. Diese Methoden werden in Branchen wie der Luft- und Raumfahrt, der Automobilindustrie und der Fertigung häufig eingesetzt, um Produktqualität und -sicherheit zu gewährleisten. Röntgeninspektionssysteme sind ein entscheidender Bestandteil der ZfP, da sie eine genaue und zuverlässige Erkennung von Defekten und Verunreinigungen ermöglichen, die die Produktqualität und -sicherheit beeinträchtigen können. Heutzutage werden moderne zerstörungsfreie Prüfungen in der Produktion, Herstellung und bei Inspektionen im Einsatz eingesetzt, um die Produktintegrität und -zuverlässigkeit sicherzustellen, Herstellungsprozesse zu steuern, die Produktionskosten zu senken und ein einheitliches Qualitätsniveau aufrechtzuerhalten.

- Technologische Fortschritte bei Röntgeninspektionssystemen

Technologische Fortschritte bei Röntgeninspektionssystemen dürften den Markt ankurbeln. Die Entwicklung neuer und fortschrittlicher Technologien wie hochauflösende Bildgebung, 3D-Bildgebung und schnellere Scanzeiten machen Röntgeninspektionssysteme genauer, effizienter und benutzerfreundlicher. Dies führt zu ihrer zunehmenden Verbreitung in verschiedenen Branchen wie der Automobil-, Luft- und Raumfahrt- und Elektronikindustrie. In den letzten 10 Jahren hat die 2D-Röntgeninspektionstechnologie enorme Leistungsfortschritte verzeichnet. Aktuelle fortschrittliche 2D-Röntgeninspektionssysteme verfügen über extrem scharfe und leistungsstarke Röntgenquellen (Röntgenröhren) mit Submikrometer-Merkmalerkennung bis zu 0,1 Mikrometer oder 100 Nanometer.

Gelegenheit

- Steigende Akzeptanz im Lebensmittel- und Getränkesektor

Ein Röntgenprüfsystem ist eine zerstörungsfreie Prüfmethode, bei der Röntgenstrahlen verwendet werden, um die innere Struktur von Objekten oder Materialien zu untersuchen. Röntgenstrahlen sind eine Form elektromagnetischer Strahlung, die Materialien durchdringen und ein Bild erzeugen kann, das auf der Absorption der Röntgenstrahlen durch verschiedene Teile des Objekts basiert. Diese Systeme werden häufig in verschiedenen Branchen wie der Fertigung, der Luft- und Raumfahrt, der Automobilindustrie und der Medizin verwendet, um Komponenten, Produkte und Materialien auf Defekte, Risse, Hohlräume, Fremdkörper oder andere Anomalien zu untersuchen. Diese Systeme bestehen normalerweise aus einer Röntgenquelle, einem Detektor oder Sensor und einer Verarbeitungseinheit, die aus den erfassten Röntgenstrahlen ein Bild erzeugt. Im letzten Jahrzehnt hat die Verwendung von Röntgenprüfsystemen im Lebensmittel- und Getränkesektor stark zugenommen. Da der Lebensmittel- und Getränkesektor hohe Qualitätsstandards erfordert, sind Röntgenprüfsysteme in der Lage, Verunreinigungen wie Metall, Glas und Knochenfragmente in Lebensmittelprodukten zu erkennen.

Einschränkung/Herausforderung

- Hohe Kosten im Zusammenhang mit Röntgeninspektionssystemen

Die Nutzung und Anwendung von Röntgeninspektionssystemen hat in den letzten zwei Jahrzehnten zugenommen, und mit der Zunahme der Eigenschaften und Spezifikationen sind auch die Kosten dieser Systeme gestiegen. Heute variieren die Kosten von Röntgeninspektionssystemen je nach verwendeter Technologie, Komplexität des Systems und Anwendung. Beispielsweise können einige High-End-Röntgeninspektionssysteme, die in der Halbleiter- und Elektronikindustrie verwendet werden, für Unternehmen Hunderttausende oder sogar Tausende von Dollar kosten. Diese hohen Kosten können ein großes Hindernis für kleine und mittlere Unternehmen darstellen, die möglicherweise nicht über die finanziellen Mittel verfügen, um in diese Systeme zu investieren.

Auswirkungen von COVID-19 auf den nordamerikanischen Markt für Röntgeninspektionssysteme

COVID-19 hatte aufgrund der Schließung der nordamerikanischen Logistik und des Transportwesens sowie fehlender Tests für das System negative Auswirkungen auf den nordamerikanischen Markt für Röntgeninspektionssysteme.

Die COVID-19-Pandemie hat den nordamerikanischen Markt für Röntgeninspektionssysteme in gewissem Maße negativ beeinflusst. Die Automatisierung ist jedoch in vielen Branchen, darunter der Automobil-, Elektronik- und Luft- und Raumfahrtindustrie, zu einem zentralen Schwerpunkt geworden, da sie mehrere Vorteile bietet, darunter eine höhere Produktivität, eine verbesserte Qualitätskontrolle und geringere Arbeitskosten. Röntgeninspektionssysteme spielen eine entscheidende Rolle bei der Automatisierung, indem sie während des Herstellungsprozesses zerstörungsfreie Prüfungen von Produkten und Komponenten ermöglichen. Die steigende Nachfrage nach Automatisierung wirkt sich daher positiv auf die weltweite Nachfrage nach Röntgeninspektionssystemen aus. Die Marktteilnehmer auf dem nordamerikanischen Markt für Röntgeninspektionssysteme reagieren darauf, indem sie ihr Produktportfolio für Inspektionssysteme erweitern.

Die Marktteilnehmer führen zahlreiche Forschungs- und Entwicklungsaktivitäten durch, um die Technologie der Zubehörteile zu verbessern. Damit werden die Unternehmen Fortschritt und Innovation auf den Markt bringen. Darüber hinaus hat die staatliche Förderung des Röntgeninspektionssystems zum Marktwachstum beigetragen.

Jüngste Entwicklungen

- Im September 2023 gab METTLER TOLEDO auf seiner offiziellen Website bekannt, dass das Unternehmen eine Partnerschaft mit Relevant Industrial, LLC eingegangen ist. Im Rahmen dieser Partnerschaft entwickelt das Unternehmen verschiedene Produkte, darunter Inspektionssysteme, Präzisionsinstrumente und Dienstleistungen für viele Anwendungen in Forschung und Entwicklung, Qualitätskontrolle, Produktion, Logistik und Einzelhandel für Kunden weltweit. Dies hat die Position des Unternehmens auf dem nordamerikanischen Markt für Röntgeninspektionssysteme gestärkt.

- Im August 2022 gab ANRITSU CORPORATION bekannt, dass das Unternehmen von der Zeitung The Daily Herald als einer der „Best Places to Work in Illinois“ für 2022 ausgezeichnet wurde. Das Unternehmen hat diese Anerkennung erhalten und sie genutzt, um seine Unternehmenskultur und sein Produktportfolio in der gesamten US-Region bekannt zu machen. Dies hat es dem Unternehmen ermöglicht, durch die Steigerung seiner Produktverkäufe auf dem nordamerikanischen Markt für Röntgeninspektionssysteme Umsatz zu erzielen.

Marktumfang für Röntgeninspektionssysteme in Nordamerika

Der nordamerikanische Markt für Röntgeninspektionssysteme ist segmentiert auf der Grundlage von Angebot, Bildgebungstechnik, Dimension, Produkttyp, Scantechnologie, Anzahl der Spuren und Endverbrauch. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

ANGEBOT

- HARDWARE

- SOFTWARE

- DIENSTLEISTUNGEN

Auf der Grundlage des Angebots ist der nordamerikanische Markt für Röntgeninspektionssysteme in Hardware, Software und Dienstleistungen segmentiert.

BILDGEBUNGSTECHNIK

- Filmbasierte Bildgebung

- DIGITALE BILDGEBUNG

Auf der Grundlage der Bildgebungstechnik ist der nordamerikanische Markt für Röntgeninspektionssysteme in filmbasierte Bildgebung und digitale Bildgebung segmentiert.

DIMENSION

- 2D

- 3D

Auf Grundlage der Dimension ist der nordamerikanische Markt für Röntgeninspektionssysteme in 2D und 3D segmentiert.

- PRODUKTTYP

- VERPACKTE PRODUKTE

- UNVERPACKTE PRODUKTE

- GEPUMPT

- ANDERE

Auf der Grundlage des Produkttyps ist der nordamerikanische Markt für Röntgeninspektionssysteme in verpackte Produkte, unverpackte Produkte, Pumpen und Sonstiges segmentiert.

SCAN-TECHNOLOGIE

- HD-TECHNOLOGIE

- ULTRA-HD-TECHNOLOGIE

- ANDERE

Auf der Grundlage der Scantechnologie ist der nordamerikanische Markt für Röntgeninspektionssysteme in HD-Technologie, Ultra-HD-Technologie und andere segmentiert.

ANZAHL DER SPUREN

- EINSPURIG

- ZWEISPUREN

- MULTI-LANE

Auf Grundlage der Anzahl der Spuren ist der nordamerikanische Markt für Röntgeninspektionssysteme in einspurige, mehrspurige und zweispurige Systeme segmentiert.

ENDVERWENDUNG

- ESSEN & TRINKEN

- HALBLEITER

- PHARMAZEUTIKA UND NUTRACEUTICAS

- AUTOMOBIL

- ÖL & GAS

- LUFT- UND RAUMFAHRT

- STROMERZEUGUNG

- REGIERUNGSINFRASTRUKTUR

- ANDERE

Auf der Grundlage der Endverwendung ist der nordamerikanische Markt für Röntgeninspektionssysteme in die Branchen Öl und Gas, Stromerzeugung, Halbleiter, staatliche Infrastruktur, Lebensmittel und Getränke, Luft- und Raumfahrt, Automobil, Pharmazeutika und Nutraceutika und andere unterteilt.

Regionale Analyse/Einblicke

Der nordamerikanische Markt für Röntgeninspektionssysteme wird analysiert und es werden Einblicke in die Marktgröße und -trends nach Land, Angebot, Abbildungstechnik, Dimension, Produkttyp, Scantechnologie, Anzahl der Spuren und Endverwendung wie oben angegeben bereitgestellt.

Die im Marktbericht zu Röntgeninspektionssystemen für Nordamerika abgedeckten Länder sind die USA, Kanada und Mexiko.

Dabei dominieren die USA den Markt, da das Land aufgrund seiner starken Basis an Gesundheitseinrichtungen, der strengen Regulierung und Umsetzung von von verschiedenen Verbänden vorgeschriebenen Standards und der steigenden Zahl an Forschungsaktivitäten in dieser Region über einen industriellen Röntgenmarkt verfügt. Der Länderabschnitt des Berichts liefert auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalyse, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Bereitstellung von Prognoseanalysen der Länderdaten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Röntgeninspektionssystemen in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Marktes für Röntgeninspektionssysteme liefert Details nach Wettbewerbern. Die enthaltenen Details umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz in Nordamerika, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den nordamerikanischen Markt für Röntgeninspektionssysteme.

Zu den wichtigsten Akteuren auf dem Markt zählen unter anderem SHIMADZU CORPORATION, METTLER TOLEDO, Nordson Corporation, Smiths Detection Group Ltd, ANRITSU CORPORATION, ZEISS, A&D Company, Limited, Sesotec GmbH, Nikon Metrology Inc., Comet Group, North Star Imaging Inc, Viscom AG, ISHIDA CO., LTD, Mekitec group, MATSUSADA PRECISION Inc, Scienscope, SYSTEMS SQUARE INC., MAHA X-RAY EQUIPMENTS PVT. LTD, Sapphire Inspection, VJ Electronix, Inc., Loma Systems, Minebea Intec GmbH, TDI PACKSYS und andere.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 OFFERING TIMELINE

2.1 END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PRICING ANALYSIS

4.3 COMPANY COMPARATIVE ANALYSIS

4.4 CASE STUDY

4.5 VALUE CHAIN ANALYSIS

4.6 TECHNOLOGICAL TRENDS

4.7 PATENT ANALYSIS

4.8 IMPORTANCE OF X-RAY INSPECTION SYSTEMS IN DIFFERENT VERTICALS

4.9 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR NON-DESTRUCTIVE TESTING

5.1.2 TECHNOLOGICAL ADVANCEMENTS IN X-RAY INSPECTION SYSTEMS

5.1.3 GROWTH IN SAFETY REGULATIONS AND QUALITY STANDARDS

5.1.4 DEVELOPMENT OF PORTABLE AND MOBILE INSPECTION SYSTEMS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH X-RAY INSPECTION SYSTEMS

5.2.2 POTENTIAL RADIATION EXPOSURE BY X-RAY INSPECTION SYSTEMS

5.3 OPPORTUNITIES

5.3.1 RISING ADOPTION IN THE FOOD AND BEVERAGE SECTOR

5.3.2 INCREASING PARTNERSHIP, ACQUISITION AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 HIGH INCREASE IN AUTOMATION ACROSS VARIOUS APPLICATION

5.3.4 PRESENCE OF DIFFERENT SCANNING TECHNOLOGY FOR X-RAY INSPECTION SYSTEMS

5.4 CHALLENGES

5.4.1 REGULATORY COMPLIANCE ASSOCIATED WITH X-RAY INSPECTION SYSTEMS

5.4.2 PRESENCE OF ALTERNATIVE INSPECTION SYSTEMS

6 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.3 SOFTWARE

6.4 SERVICES

6.4.1 SUPPORT & MAINTENANCE

6.4.2 INSTALLATION & INTEGRATION

6.4.3 TRAINING

7 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PACKAGED PRODUCTS

7.3 UN-PACKAGED PRODUCTS

7.4 PUMPED

7.4.1 SEMI-SOLIDS

7.4.2 FLUIDS

7.5 OTHERS

8 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY

8.1 OVERVIEW

8.2 HD TECHNOLOGY

8.3 ULTRA-HD TECHNOLOGY

8.4 OTHERS

9 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY NUMBER OF LANES

9.1 OVERVIEW

9.2 SINGLE LANE

9.3 DUAL LANE

9.4 MULTI LANE

10 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY END-USE

10.1 OVERVIEW

10.2 FOOD & BEVERAGE

10.2.1 BY OFFERING

10.2.1.1 HARDWARE

10.2.1.2 SOFTWARE

10.2.1.3 SERVICES

10.2.1.3.1 SUPPORT & MAINTENANCE

10.2.1.3.2 INSTALLATION & INTEGRATION

10.2.1.3.3 TRAINING

10.2.2 BY IMAGING TECHNIQUE

10.2.2.1 DIGITAL IMAGING

10.2.2.2 FILM BASED IMAGING

10.3 SEMICONDUCTOR

10.3.1 BY OFFERING

10.3.1.1 HARDWARE

10.3.1.2 SOFTWARE

10.3.1.3 SERVICES

10.3.1.3.1 Support & Maintenance

10.3.1.3.2 INSTALLATION & INTEGRATION

10.3.1.3.3 TRAINING

10.3.2 BY IMAGING TECHNIQUE

10.3.2.1 DIGITAL IMAGING

10.3.2.2 FILM BASED IMAGING

10.4 PHARMACEUTICALS & NUTRACEUTICALS

10.4.1 BY OFFERING

10.4.1.1 HARDWARE

10.4.1.2 SOFTWARE

10.4.1.3 SERVICES

10.4.1.3.1 SUPPORT & MAINTENANCE

10.4.1.3.2 INSTALLATION & INTEGRATION

10.4.1.3.3 TRAINING

10.4.2 BY IMAGING TECHNIQUE

10.4.2.1 DIGITAL IMAGING

10.4.2.2 FILM BASED IMAGING

10.5 AUTOMOTIVE

10.5.1 BY OFFERING

10.5.1.1 HARDWARE

10.5.1.2 SOFTWARE

10.5.1.3 SERVICES

10.5.1.3.1 SUPPORT & MAINTENANCE

10.5.1.3.2 INSTALLATION & INTEGRATION

10.5.1.3.3 TRAINING

10.5.2 BY IMAGING TECHNIQUE

10.5.2.1 DIGITAL IMAGING

10.5.2.2 FILM BASED IMAGING

10.6 OIL & GAS

10.6.1 BY OFFERING

10.6.1.1 HARDWARE

10.6.1.2 SOFTWARE

10.6.1.3 SERVICES

10.6.1.3.1 SUPPORT & MAINTENANCE

10.6.1.3.2 INSTALLATION & INTEGRATION

10.6.1.3.3 TRAINING

10.6.2 BY IMAGING TECHNIQUE

10.6.2.1 DIGITAL IMAGING

10.6.2.2 FILM BASED IMAGING

10.7 AEROSPACE

10.7.1 BY OFFERING

10.7.1.1 HARDWARE

10.7.1.2 SOFTWARE

10.7.1.3 SERVICES

10.7.1.3.1 SUPPORT & MAINTENANCE

10.7.1.3.2 INSTALLATION & INTEGRATION

10.7.1.3.3 TRAINING

10.7.2 BY IMAGING TECHNIQUE

10.7.2.1 DIGITAL IMAGING

10.7.2.2 FILM BASED IMAGING

10.8 POWER GENERATION

10.8.1 BY OFFERING

10.8.1.1 HARDWARE

10.8.1.2 SOFTWARE

10.8.1.3 SERVICES

10.8.1.3.1 SUPPORT & MAINTENANCE

10.8.1.3.2 INSTALLATION & INTEGRATION

10.8.1.3.3 TRAINING

10.8.2 BY IMAGING TECHNIQUE

10.8.2.1 DIGITAL IMAGING

10.8.2.2 FILM BASED IMAGING

10.9 GOVERNMENT INFRASTRUCTURE

10.9.1 BY TYPE

10.9.1.1 AIRPORT

10.9.1.2 RAILWAY

10.9.1.3 OTHERS

10.9.2 BY OFFERING

10.9.2.1 HARDWARE

10.9.2.2 SOFTWARE

10.9.2.3 SERVICES

10.9.2.3.1 SUPPORT & MAINTENANCE

10.9.2.3.2 INSTALLATION & INTEGRATION

10.9.2.3.3 TRAINING

10.9.3 BY IMAGING TECHNIQUE

10.9.3.1 DIGITAL IMAGING

10.9.3.2 FILM BASED IMAGING

10.1 OTHERS

11 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE

11.1 OVERVIEW

11.2 DIGITAL IMAGING

11.3 FILM BASED IMAGING

12 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION

12.1 OVERVIEW

12.2 2D

12.3 3D

13 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 U.A.E.

13.1.2 SAUDI ARABIA

13.1.3 SOUTH AFRICA

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 OMAN

13.1.7 BAHRAIN

13.1.8 KUWAIT

13.1.9 QATAR

13.1.10 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA X-RAY INSPECTION SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILINGS

16.1 SHIMADZU CORPORATION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 METTLER TOLEDO

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 NORDSON CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SMITHS DETECTION GROUP LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 ANRITSU CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 A&D COMPANY, LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 COMET GROUP

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ISHIDA CO.,LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 LOMA SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 MAHA X-RAY EQUIPMENTS PVT. LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 MATSUSADA PRECISION INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 MEKITEC GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 MINEBEA INTEC GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 NIKON METROLOGY INC

16.14.1 COMPANY SNAPSHOT

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 NORTH STAR IMAGING INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 SAPPHIRE INSPECTION

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 SCIENSCOPE

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENT

16.18 SESOTEC GMBH

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SYSTEM SQUARE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 TDI PACKSYS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 VISCOM AG

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 VJ ELECTRONIX

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 ZEISS

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 PRICING

TABLE 2 REGULATORY BODIES IN CONCERNING REGIONS

TABLE 3 X-RAY INSPECTION SYSTEMS AND COST ASSOCIATED

TABLE 4 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA HARDWARE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA SOFTWARE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA PACKAGED PRODUCTS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA UN-PACKAGED PRODUCTS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA HD TECHNOLOGY IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ULTRA-HD TECHNOLOGY IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA SINGLE LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA DUAL LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA MULTI LANE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET) MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA OTHERS IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2022 (USD THOUSAND)

TABLE 59 NORTH AMERICA DIGITAL IMAGING IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA FILM BASED IMAGING IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2022 (USD THOUSAND)

TABLE 62 NORTH AMERICA 2D IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA 3D IN X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 NORTH AMERICA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 92 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 NORTH AMERICA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 95 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 97 NORTH AMERICA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 NORTH AMERICA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 U.S. AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 126 U.S. POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 U.S. POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 129 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 131 U.S. SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 U.S. GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 CANADA AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 160 CANADA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 162 CANADA POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 163 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 165 CANADA SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 166 CANADA GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY DIMENSION, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO PUMPED IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY SCANNING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY NUMBER OF LANES, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO X-RAY INSPECTION SYSTEMS MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO FOOD & BEVERAGE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SEMICONDUCTOR IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO SEMICONDUCTOR IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO PHARMACEUTICALS & NUTRACEUTICALS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO AUTOMOTIVE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 MEXICO AEROSPACE IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 194 MEXICO POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 195 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 196 MEXICO POWER GENERATION IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

TABLE 197 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 199 MEXICO SERVICES IN X-RAY INSPECTION SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 200 MEXICO GOVERNMENT INFRASTRUCTURE IN OIL & GAS IN X-RAY INSPECTION SYSTEMS MARKET, BY IMAGING TECHNIQUE, 2021-2030 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 3 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: OFFERING TIMELINE

FIGURE 11 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: MARKET PLATFORM COVERAGE GRID

FIGURE 12 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR NON-DESTRUCTIVE TESTING IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HARDWARE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET FROM 2023 TO 2030

FIGURE 15 BRAND COMPARISON

FIGURE 16 VALUE CHAIN FOR THE NORTH AMERICA X-RAY INSPECTION MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET

FIGURE 18 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY OFFERING, 2022

FIGURE 19 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET, BY PRODUCT TYPE, 2022

FIGURE 20 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY SCANNING TECHNOLOGY, 2022

FIGURE 21 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY NUMBER OF LANES, 2022

FIGURE 22 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY END-USE, 2022

FIGURE 23 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY IMAGING TECHNIQUE, 2022 (USD THOUSAND)

FIGURE 24 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY DIMENSION, 2022 (USD THOUSAND)

FIGURE 25 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 28 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 29 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: BY SERVICE (2023-2030)

FIGURE 30 NORTH AMERICA X-RAY INSPECTION SYSTEMS MARKET: 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.