North America Trauma Fixation Market

Marktgröße in Milliarden USD

CAGR :

%

USD

5.65 Billion

USD

12.38 Billion

2024

2032

USD

5.65 Billion

USD

12.38 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 12.38 Billion | |

|

|

|

|

Marktsegmentierung für Traumafixierungen in Nordamerika nach Produkttyp (interne Fixateure und externe Fixateure), Material (metallische Implantate (Stahl, Titan und andere), Kohlefaser ( Thermoplast ), Hybridimplantate, bioabsorbierbare Implantate, Transplantate und orthobiologische Implantate), Anwendung (Schulter und Ellenbogen, Hand und Handgelenk, Becken, Hüfte und Femur, Tibia, kraniomaxillofaziale Implantate, Knie, Fuß und Knöchel, Wirbelsäule und andere), Endverbraucher (Krankenhäuser, ambulante chirurgische Zentren, Traumazentren und andere), Vertriebskanal (Direktausschreibung, Einzelhandel und Online-Verkauf), Branchentrends und Prognose bis 2032

Marktgröße für Traumafixierungen in Nordamerika

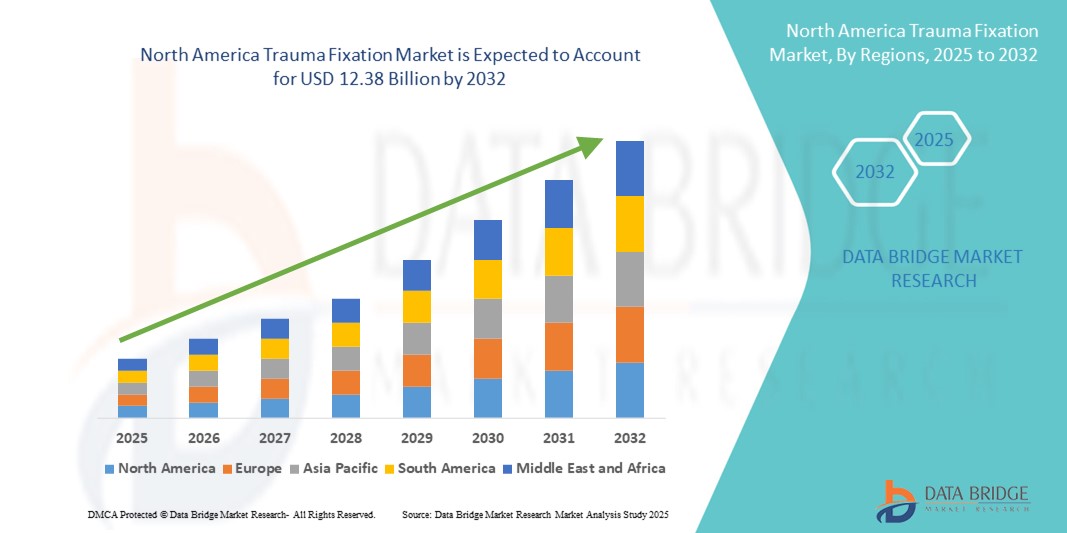

- Der nordamerikanische Markt für Traumafixierungen hatte im Jahr 2024 einen Wert von 5,65 Milliarden US-Dollar und dürfte bis 2032 12,38 Milliarden US-Dollar erreichen , bei einer CAGR von 10,3 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die steigende Zahl von Traumata durch Verkehrsunfälle, Stürze und Sportverletzungen vorangetrieben – ein Trend, der durch Urbanisierung, zunehmende Autonutzung und eine alternde Bevölkerung noch verstärkt wird. Diese Faktoren steigern die Nachfrage nach effektiven Traumafixierungsprodukten, die Frakturen stabilisieren und die Genesung unterstützen.

- Darüber hinaus spielen technologische Innovationen eine entscheidende Rolle – Fortschritte wie minimalinvasive Operationstechniken, bioabsorbierbare Materialien in internen Fixateuren, 3D-gedruckte, maßgeschneiderte Implantate und intelligente Gerätebeschichtungen erhöhen die Wirksamkeit der Geräte, verkürzen die Genesungszeit und verbessern die Patientenergebnisse.

Marktanalyse für Traumafixierungen in Nordamerika

- Traumafixierungsgeräte erfreuen sich in Nordamerika einer starken Verbreitung, die auf die steigende Zahl traumatischer Verletzungen, die wachsende geriatrische Bevölkerung und die zunehmende Zahl orthopädischer Operationen zurückzuführen ist. Im Jahr 2024 entfielen etwa 41,5 % des weltweiten Marktumsatzes für Traumafixierungsgeräte auf Nordamerika. Dies wird durch eine fortschrittliche Gesundheitsinfrastruktur, ein hohes Bewusstsein für innovative Fixierungstechniken und starke Erstattungsrahmen in der gesamten Region unterstützt.

- Die zunehmende Zahl von Verkehrsunfällen, Sportverletzungen und altersbedingten Knochenerkrankungen treibt die Nachfrage nach zuverlässigen internen und externen Fixationssystemen an. Krankenhäuser, Traumazentren und ambulante chirurgische Zentren in Nordamerika investieren aktiv in Traumafixierungslösungen, um die Patientenergebnisse zu verbessern, die Genesungszeit zu verkürzen und Komplikationen zu minimieren. Das Krankenhaussegment trug im Jahr 2024 rund 72,3 % zum Gesamtumsatz des nordamerikanischen Marktes für Traumafixierungen bei, was die Konzentration der komplexen Traumaversorgung in Krankenhäusern widerspiegelt.

- Die USA dominieren den nordamerikanischen Markt für Traumafixierungen und erwirtschaften im Jahr 2024 mit 85,4 % den größten Umsatzanteil. Dies ist auf die gut ausgebaute orthopädische Chirurgie-Infrastruktur des Landes, die kontinuierliche technologische Weiterentwicklung von Fixierungsgeräten und die Präsenz wichtiger Marktteilnehmer mit Hauptsitz in den USA zurückzuführen. Kontinuierliche Investitionen in die Traumaversorgungsforschung und eine steigende Versicherungsdeckung stärken die Marktdominanz weiter.

- Kanada wird voraussichtlich das am schnellsten wachsende Land im nordamerikanischen Markt für Traumafixierungen sein, mit einer geschätzten jährlichen Wachstumsrate von 10,9 % zwischen 2025 und 2032. Das Wachstum in Kanada wird durch steigende staatliche Gesundheitsausgaben, den Ausbau der Traumaversorgungseinrichtungen und die zunehmende Nutzung minimalinvasiver Fixierungstechniken in der orthopädischen Chirurgie vorangetrieben. Die wachsende geriatrische Bevölkerung und das steigende Bewusstsein für fortschrittliche Fixierungsmöglichkeiten in ländlichen Gebieten unterstützen diesen Trend ebenfalls.

- Das Segment der internen Fixateure dominierte den nordamerikanischen Markt für Traumafixierungen mit 61,4 % des Marktumsatzanteils im Jahr 2024, getrieben von ihrer Fähigkeit, eine stabile Fixierung zu gewährleisten, eine frühzeitige Mobilisierung zu ermöglichen und die Genesungszeiten von Patienten mit komplexen Frakturen zu verkürzen.

Berichtsumfang und Marktsegmentierung für Traumafixierungen in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke zur Traumafixierung in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Traumafixierungen in Nordamerika

Zunahme minimalinvasiver und patientenzentrierter Traumafixierungstechniken

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für Traumafixierungen ist die zunehmende Verlagerung hin zu minimalinvasiven chirurgischen Verfahren (MIS). Diese Verfahren – wie perkutane Fixierung, intramedulläre Nagelung und fortschrittliche Plattensysteme – werden zunehmend eingesetzt, da sie Gewebetraumata reduzieren, Infektionsrisiken senken und die Genesungszeit der Patienten deutlich verkürzen. Dies ermöglicht eine schnellere Entlassung und verbesserte klinische Ergebnisse.

- DePuy Synthes bietet beispielsweise das VA LCP Periprothetische Plattensystem an, das für die MIS-Anwendung entwickelt wurde und die chirurgische Belastung minimiert, während gleichzeitig eine stabile Fixierung bei komplexen Frakturen gewährleistet bleibt. Ebenso ermöglicht der TRIGEN INTERTAN Intertrochantäre Nagel von Smith+Nephew die Frakturstabilisierung durch kleinere Inzisionen, was zu geringerem Blutverlust und einer schnelleren Mobilisierung führt.

- Auch hybride Fixierungssysteme – eine Kombination aus interner und externer Fixierung – gewinnen an Bedeutung, da sie individuelle Stabilisierungsstrategien für komplexe Frakturen ermöglichen. Beispielsweise ermöglicht das Galaxy Fixation Gemini von Orthofix den Übergang von der externen zur internen Fixierung, ohne die Stabilisierung vollständig zu entfernen. Dies ermöglicht eine Anpassung an patientenspezifische Bedürfnisse.

- Ein weiterer wichtiger Fortschritt ist die Entwicklung patientenspezifischer Implantate, die mithilfe hochauflösender Bildgebung und additiver Fertigung (3D-Druck) hergestellt werden. So haben Materialise und Johnson & Johnson beispielsweise gemeinsam maßgeschneiderte CMF-Platten entwickelt, die auf die individuelle Anatomie jedes Patienten zugeschnitten sind. Dies verbessert die Passform der Implantate, die biomechanische Leistung und die Patientenzufriedenheit.

- Auch die Einführung moderner Biomaterialien verändert den Markt. Titan bleibt der Goldstandard in Sachen Festigkeit und Biokompatibilität, während bioresorbierbare Materialien wie PLA und PGA insbesondere bei Kindern immer beliebter werden und so eine zweite Operation zur Implantatentfernung überflüssig machen. Strykers Vitoss Bioactive Foam ist ein Beispiel für ein Biomaterial, das die Knochenregeneration fördert und gleichzeitig mit der Zeit resorbierbar ist.

- Auch der Trend zu ambulanten, chirurgischen Fixiersystemen nimmt zu. Produkte für ambulante Eingriffe – wie das periartikuläre Verriegelungsplattensystem von Zimmer Biomet – unterstützen eine schnellere Genesung, kürzere Krankenhausaufenthalte und ein geringeres Infektionsrisiko. Dies entspricht dem zunehmenden Fokus der Gesundheitssysteme auf Kosteneffizienz und Patientenkomfort.

Marktdynamik für Traumafixierungen in Nordamerika

Treiber

Wachsender Bedarf aufgrund der steigenden Zahl orthopädischer Verletzungen und der Fortschritte bei chirurgischen Eingriffen

- Die zunehmende Zahl orthopädischer Verletzungen, Frakturen und Traumata durch Verkehrsunfälle, Sportunfälle und altersbedingten Knochenabbau ist ein wichtiger Faktor für die Nachfrage nach Traumafixierungsgeräten in Nordamerika. Sowohl in Industrie- als auch in Entwicklungsländern ist ein Anstieg der Fälle zu verzeichnen, die chirurgische Eingriffe zur Knochenstabilisierung und -ausrichtung erfordern.

- So wurde beispielsweise im Mai 2024 in einer Studie ein automatisiertes genetisches Algorithmus-Framework zur Optimierung dreidimensionaler Operationspläne für korrigierende Unterarmosteotomien vorgeschlagen. Dieses Framework nutzt patientenspezifische 3D-Modelle und eine multikriterielle Optimierung, um die optimale Position und Ausrichtung der Osteotomieebene und der Fixierungshardware zu bestimmen und so die Operationsergebnisse zu verbessern.

- Da medizinisches Fachpersonal die Genesungszeiten verkürzen und postoperative Komplikationen reduzieren möchte, werden Traumafixierungsgeräte – wie Platten, Schrauben, Stäbe und externe Fixateure – zunehmend bevorzugt, da sie sofortige Knochenstabilität gewährleisten und eine frühzeitige Mobilisierung der Patienten ermöglichen.

- Darüber hinaus sorgen kontinuierliche Fortschritte in der minimalinvasiven orthopädischen Chirurgie und die Entwicklung biokompatibler Fixierungsmaterialien dafür, dass Traumafixierungslösungen effektiver und sicherer werden. Solche Innovationen tragen zudem zu kürzeren Krankenhausaufenthalten und einer verbesserten Lebensqualität der Patienten bei.

- Die wachsende Nachfrage nach maßgeschneiderten Fixierungsvorrichtungen, die Verfügbarkeit von 3D-Druck in der medizinischen Fertigung und eine zunehmende Anzahl spezialisierter orthopädischer Trauma-Pflegeeinheiten treiben die Expansion des Marktes für Traumafixierungen sowohl in stationären Kliniken als auch in großen Krankenhäusern weiter voran.

Einschränkung/Herausforderung

Bedenken hinsichtlich chirurgischer Risiken und hoher Anfangskosten

- Trotz des starken Marktpotenzials ist die Einführung von Traumafixierungen aufgrund chirurgischer Risiken wie Infektionen, Implantatabstoßung und der Notwendigkeit von Revisionsoperationen mit Herausforderungen verbunden. Diese Komplikationen können das Vertrauen der Patienten beeinträchtigen und die Empfehlungen der Chirurgen beeinflussen, insbesondere in Regionen mit eingeschränktem Zugang zu fortschrittlicher postoperativer Versorgung.

- So haben beispielsweise viel beachtete klinische Berichte über postoperative Komplikationen – wie etwa die Lockerung von Implantaten oder Hardware-Versagen – das Bewusstsein für die Bedeutung der Qualitätssicherung bei der Herstellung von Traumafixierungen und der Verbesserung der chirurgischen Fähigkeiten geschärft.

- Um diesen Risiken zu begegnen, sind hochwertige, biokompatible Materialien, die Einhaltung strenger Sterilisationsprotokolle und kontinuierliche Schulungen für orthopädische Chirurgen erforderlich. Unternehmen wie Stryker und Zimmer Biomet betonen ihre intensiven Forschungs- und Entwicklungsanstrengungen zur Herstellung von Fixiersystemen mit verbesserter Haltbarkeit, geringerem Infektionsrisiko und verbesserter Patientenverträglichkeit.

- Ein weiteres erhebliches Hindernis sind die relativ hohen Anschaffungskosten moderner Traumafixierungssysteme im Vergleich zu herkömmlichen orthopädischen Reparaturmethoden. In preissensiblen Regionen, insbesondere in Ländern mit niedrigem und mittlerem Einkommen, kann dies Krankenhäuser und Patienten von der Einführung hochwertiger Lösungen abhalten. Während einfache Fixierungsgeräte immer erschwinglicher werden, bleiben fortschrittliche Systeme – mit integrierten Navigationsinstrumenten oder aus Speziallegierungen gefertigt – teuer.

- Um diese Herausforderungen zu bewältigen, müssen nicht nur Traumafixierungssysteme kostengünstiger gestaltet werden, sondern auch öffentliche Gesundheitspolitiken umgesetzt werden, die eine subventionierte orthopädische Versorgung unterstützen, den Krankenversicherungsschutz ausweiten und das Bewusstsein der Patienten für die langfristigen Vorteile hochwertiger Traumafixierungsgeräte schärfen.

Nordamerika: Marktumfang für Traumafixierung

Der Markt ist nach Produkttyp, Material, Anwendung, Endbenutzer und Vertriebskanal segmentiert.

- Nach Produkttyp

Der Markt für Traumafixierungen ist nach Produkttyp in interne und externe Fixateure unterteilt. Das Segment der internen Fixateure machte im Jahr 2024 61,4 % des Marktumsatzes aus. Dies ist auf ihre Fähigkeit zurückzuführen, eine stabile Fixierung zu gewährleisten, eine frühzeitige Mobilisierung zu ermöglichen und die Genesungszeit von Patienten mit komplexen Frakturen zu verkürzen. Geräte wie Platten, Schrauben, Stäbe und Nägel werden aufgrund ihrer nachgewiesenen Langzeitergebnisse und ihrer Kompatibilität mit minimalinvasiven Techniken sowohl bei elektiven als auch bei orthopädischen Notfalloperationen bevorzugt eingesetzt. Das Segment profitiert zudem von kontinuierlichen Designinnovationen, wie beispielsweise anatomisch geformten Platten und Verriegelungsschraubensystemen, die die chirurgische Präzision verbessern.

Das Segment der externen Fixateure wird voraussichtlich von 2025 bis 2032 mit 7,9 % die höchste durchschnittliche jährliche Wachstumsrate verzeichnen. Dies wird durch ihre Vielseitigkeit bei der Behandlung offener Frakturen, komplexer Knochendeformationen und schwerer Traumata unterstützt, bei denen eine interne Fixierung nicht möglich ist. Die steigende Nachfrage nach modularen und leichten externen Fixateuren sowie die zunehmende Verbreitung in ressourcenarmen Umgebungen aufgrund ihrer Wiederverwendbarkeit treiben das Marktwachstum weiter voran.

- Nach Material

Der Markt für Traumafixierungen ist nach Materialien segmentiert in metallische Implantate (Stahl, Titan und andere), Kohlefaser (Thermoplast), Hybridimplantate, bioresorbierbare Materialien sowie Transplantate und orthobiologische Produkte. Das Segment der metallischen Implantate hielt im Jahr 2024 54,8 % des Marktanteils, wobei Titan aufgrund seiner Biokompatibilität, Korrosionsbeständigkeit und Fähigkeit zur Integration in das Knochengewebe dominierte. Edelstahl bleibt insbesondere in Schwellenländern eine kostengünstige Option für hochfeste, lasttragende Anwendungen.

Das Segment der Kohlefaser (Thermoplast) wird voraussichtlich zwischen 2025 und 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 8,4 % am schnellsten wachsen. Grund hierfür sind die Röntgendurchlässigkeit, die eine klare, störungsfreie Bildgebung ermöglicht, und das geringe Gewicht, das den Patientenkomfort verbessert. Die Entwicklung von Hybridimplantaten aus Metall und Verbundwerkstoffen sowie die zunehmende Verbreitung bioresorbierbarer Implantate, die eine operative Entfernung überflüssig machen, verändern die Materiallandschaft in der Traumafixierung.

- Nach Anwendung

Der Markt für Traumafixierungen ist nach Anwendungsgebieten in die Bereiche Schulter und Ellenbogen, Hand und Handgelenk, Becken, Hüfte und Oberschenkelknochen, Tibia, Gesichts- und Kiefergelenke, Knie, Fuß und Knöchel, Wirbelsäule und weitere Bereiche unterteilt. Das Segment Hüfte und Oberschenkelknochen hatte im Jahr 2024 mit 28,3 % den größten Umsatzanteil, was auf die hohe Frakturrate bei älteren Menschen und die weltweit steigende Zahl von Hüftgelenkersatzoperationen zurückzuführen ist. Diese Verletzungen erfordern oft robuste Fixierungssysteme, um die Mobilität wiederherzustellen und das Risiko von Komplikationen zu verringern.

Für den Bereich der kraniomaxillofazialen Chirurgie wird von 2025 bis 2032 mit 9,1 % die höchste durchschnittliche jährliche Wachstumsrate erwartet. Diese Entwicklung wird durch Fortschritte in der 3D-Drucktechnologie für patientenspezifische Implantate und die steigende Nachfrage nach rekonstruktiven Operationen nach Traumata oder angeborenen Defekten vorangetrieben.

- Nach Endbenutzer

Der Markt für Traumafixierungen ist nach Endverbrauchern in Krankenhäuser, ambulante Operationszentren, Traumazentren und andere Bereiche unterteilt. Das Krankenhaussegment dominierte den Markt im Jahr 2024 mit einem Marktanteil von 66,5 %. Dies ist auf die moderne Infrastruktur, qualifizierte orthopädische Chirurgen und die Fähigkeit zurückzuführen, komplexe Traumafälle mit multidisziplinärer Versorgung zu behandeln. Krankenhäuser sind zudem führend bei der Einführung neuer Operationstechnologien und hochwertiger Fixierungssysteme durch die Zusammenarbeit mit Medizinprodukteherstellern.

Das Segment der ambulanten Operationszentren wird voraussichtlich zwischen 2025 und 2032 mit 8,2 % die höchste durchschnittliche jährliche Wachstumsrate aufweisen, was auf die Verlagerung hin zu ambulanten orthopädischen Eingriffen, Kosteneffizienz und kürzere Wartezeiten für Patienten zurückzuführen ist.

- Nach Vertriebskanal

Der Markt für Traumafixierungen ist nach Vertriebskanälen in Direktausschreibungen, Einzelhandelsverkäufe und Online-Verkäufe unterteilt. Das Segment Direktausschreibungen machte im Jahr 2024 72,8 % des Umsatzanteils aus, unterstützt durch Großeinkäufe von Krankenhäusern und staatlichen Gesundheitseinrichtungen, die eine konsistente Versorgung und Kosteneinsparungen gewährleisten.

Aufgrund der zunehmenden Akzeptanz digitaler Beschaffungsplattformen, der verbesserten Produktsichtbarkeit und der wettbewerbsfähigen Preise wird für das Online-Verkaufssegment von 2025 bis 2032 mit 9,4 % die höchste durchschnittliche jährliche Wachstumsrate erwartet.

Regionale Analyse des nordamerikanischen Marktes für Traumafixierungen

- Der nordamerikanische Markt für Traumafixierungen machte im Jahr 2024 47 % des weltweiten Marktumsatzes aus. Dies ist auf die steigende Zahl von Traumafällen, hohe Gesundheitsausgaben und starke Erstattungsrahmen für fortschrittliche Fixierungstechnologien in Krankenhäusern, Traumazentren und orthopädischen Kliniken zurückzuführen. Nordamerika profitiert von einer ausgereiften Gesundheitsinfrastruktur, der weit verbreiteten Einführung minimalinvasiver Operationstechniken und kontinuierlichen Innovationen bei Traumaversorgungsgeräten.

- Die zunehmende Zahl orthopädischer Verletzungen durch Verkehrsunfälle, Sporttraumata und altersbedingte Frakturen beschleunigt die Einführung interner und externer Fixierungssysteme in der Region. Investitionen in chirurgische Innovationen und Initiativen zur Patientenrehabilitation kurbeln die Nachfrage an, insbesondere in orthopädischen Zentren und Krankenhäusern mit hohem Patientenaufkommen. Das Segment der internen Fixateure dominierte 2024 den Umsatz und spiegelt die Präferenz für stabile, langfristige Lösungen zur Knochenstabilisierung wider.

- Technologische Fortschritte bei Materialien und Gerätedesign – darunter Titan- und Verriegelungsplattensysteme, anpassbare Implantate und optimierte chirurgische Instrumente – kurbeln das Marktwachstum weiter an, insbesondere in Einrichtungen, die sich auf die Verbesserung klinischer Ergebnisse und die Verkürzung der Genesungszeiten konzentrieren. Nordamerikas Führungsposition wird durch intensive Forschung und Entwicklung, schnelle behördliche Genehmigungen und die Zusammenarbeit zwischen Herstellern und Gesundheitsdienstleistern gestärkt.

Einblicke in den US-Markt für Traumafixierung

Der US-Markt für Traumafixierungen dominiert weiterhin den nordamerikanischen Markt und wird im Jahr 2024 mit etwa 85,4 % den größten Umsatzanteil aufweisen. Diese Marktführerschaft wird durch die hoch entwickelte orthopädische Chirurgie-Infrastruktur des Landes untermauert, die ein ausgedehntes Netzwerk spezialisierter Traumazentren, moderne chirurgische Einrichtungen und ein robustes Ökosystem für die postoperative Rehabilitation umfasst. Die USA sind zudem die Heimat mehrerer weltweit anerkannter Marktteilnehmer – wie Johnson & Johnson (DePuy Synthes), Stryker und Zimmer Biomet – deren Hauptsitze und F&E-Zentren maßgeblich zur Innovation bei Traumafixierungsgeräten beitragen. Technologische Fortschritte, darunter patientenspezifische Implantate, Titan-Verriegelungsplatten, biologisch abbaubare Schrauben und computergestützte chirurgische Navigation, haben die chirurgische Präzision und die Genesungsergebnisse der Patienten deutlich verbessert. Darüber hinaus ermöglichen kontinuierliche Investitionen in die Traumaversorgungsforschung, gepaart mit einem breiten Versicherungsschutz für orthopädische Eingriffe, eine höhere Akzeptanz sowohl traditioneller als auch zukunftsweisender Fixierungslösungen. Die hohe Zahl an Verkehrsunfällen, Sportverletzungen und Knochenbrüchen unter der älteren Bevölkerung des Landes trägt zusätzlich zur Nachfrage nach modernen Fixierungsvorrichtungen bei.

Einblicke in den kanadischen Markt für Traumafixierungen

Der kanadische Markt für Traumafixierungen ist das am schnellsten wachsende Land im nordamerikanischen Markt und wird zwischen 2025 und 2032 voraussichtlich eine durchschnittliche jährliche Wachstumsrate (CAGR) von 10,9 % verzeichnen. Unterstützt wird dieser robuste Wachstumstrend durch steigende staatliche Gesundheitsausgaben, die auf die Modernisierung der Traumaversorgungsinfrastruktur und die Gewährleistung der Zugänglichkeit sowohl in städtischen Krankenhäusern als auch in abgelegenen medizinischen Einrichtungen abzielen. Der Ausbau spezialisierter Traumaeinheiten sowie die Integration fortschrittlicher chirurgischer Technologien wie minimalinvasiver Fixierungstechniken und Hybridplattensysteme verändern die orthopädische Versorgung des Landes. Darüber hinaus erlebt Kanada einen demografischen Wandel, der durch eine schnell wachsende geriatrische Bevölkerung gekennzeichnet ist, die anfälliger für osteoporosebedingte Frakturen und andere Skelettverletzungen ist. Öffentliche Aufklärungskampagnen, insbesondere in ländlichen und unterversorgten Gebieten, fördern zudem eine frühzeitige Diagnose und Behandlung, was zu einer höheren Akzeptanz fortschrittlicher Fixierungslösungen führt. Das unterstützende Erstattungsumfeld und die Zusammenarbeit zwischen kanadischen Krankenhäusern und globalen Herstellern orthopädischer Geräte beschleunigen die Einführung modernster Traumafixierungsgeräte zusätzlich.

Marktanteil der Traumafixierung in Nordamerika

Die Branche der Traumafixierung wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Weigao-Gruppe (China)

- Orthofix Medical Inc. (USA)

- CONMED Corporation (USA)

- Wright Medical Group NV (Niederlande)

- OsteoMed (USA)

- Invibio Ltd. (Großbritannien)

- Medtronic (Irland)

- Smith + Nephew (Großbritannien)

- Zimmer Biomet (US)

- B. Braun SE (Deutschland)

- Stryker (USA)

- Implantate AG (Deutschland)

- Johnson & Johnson und seine Tochtergesellschaften (USA)

- Inion OY (Finnland)

- Arthrex Inc. (USA)

- Jeil Medical Corporation (Südkorea)

- Bioretec Ltd. (Finnland)

Neueste Entwicklungen auf dem nordamerikanischen Markt für Traumafixierungen

- Im August 2021 gab Zimmer Biomet Holdings Inc. bekannt, dass das Unternehmen die FDA-Zulassung für das ROSA Hip-System zur Behandlung von Hüfttotalarthroplastiken erhalten hat. Dieses Robotersystem unterstützt Chirurgen bei der Evaluierung und Durchführung ihres Operationsplans und misst intraoperativ Pfannenausrichtung, Beinlänge und Offset.

- Im März 2024 brachte die Stryker Corporation den SmartScrew Pro auf den Markt, ein fortschrittliches Traumafixierungsgerät mit Echtzeit-Überwachung der Knochenheilung. Diese Innovation soll die Behandlungsergebnisse verbessern, indem sie Chirurgen sofortiges Feedback zum Heilungsprozess gibt und so die chirurgische Präzision und die Genesungszeit verkürzt.

- Im Januar 2024 stellte Zimmer Biomet das BioFIX Absorbable System vor, ein bioresorbierbares Plattensystem, das in erster Linie für pädiatrische Traumafälle entwickelt wurde. Klinische Studien in der Europäischen Union zeigten eine 42-prozentige Reduzierung des Bedarfs an Folgeoperationen und unterstrichen damit das Potenzial des Systems, die Genesung der Patienten zu verbessern und die Gesundheitskosten zu senken.

- Im September 2023 gab Orthofix die Markteinführung seines Galaxy Fixation Gemini Systems bekannt. Dieses System ist für orthopädische Traumaeingriffe konzipiert und bietet verbesserte Stabilität und Flexibilität bei der Behandlung von Frakturen der unteren und oberen Extremitäten. Die Markteinführung unterstreicht das Engagement von Orthofix, die Traumaversorgung durch innovative Lösungen voranzutreiben.

- Im Oktober 2024 stellte eine Studie das „StraightTrack“-System vor, ein Mixed-Reality-Navigationssystem, das die präzise Platzierung von Kirschnerdrähten (K-Drähten) bei perkutanen Beckentraumaoperationen unterstützt. Dieses System bietet 3D-Visualisierung und -Führung in Echtzeit, verbessert die Genauigkeit der Drahtplatzierung und reduziert Komplikationen durch Fehlplatzierungen.

- Im Mai 2024 wurde in einer Studie ein automatisiertes genetisches Algorithmus-Framework zur Optimierung dreidimensionaler Operationspläne für korrigierende Unterarmosteotomien vorgeschlagen. Dieses Framework nutzt patientenspezifische 3D-Modelle und eine multikriterielle Optimierung, um die optimale Position und Ausrichtung der Osteotomieebene und der Fixierungshardware zu bestimmen und so die Operationsergebnisse zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.