Nordamerikanischer RFID-Markt (Radio Frequency Identification), Angebot (Hardware, Software und Dienste), Konnektivität (Bluetooth, Ultrawide Band und andere), Materialtyp (Kunststoff, Metall, Papier, Glas und andere), Endbenutzer (Einzelhandel/Gewerbe, Industrie, Gesundheitswesen, Konsumgüter, Automobil, Luft- und Raumfahrt, Überwachung und Sicherheit, Logistik und Transport, Sport, Verteidigung, Bildung, Vieh- und Wildtierzucht und andere) – Branchentrends und Prognose bis 2030.

Nordamerika RFID (Radio Frequency Identification) Marktanalyse und Größe

Die RFID-Technologie nutzt das elektromagnetische Feld, um die an Produkten angebrachten Etiketten zu erkennen. Die Etiketten enthalten elektronisch gespeicherte Informationen und können an Produkten, Tieren und Menschen angebracht werden. RFID-Etiketten wurden ursprünglich entwickelt, um die Barcodes in Lieferketten zu ersetzen. RFID-Etiketten können drahtlos und ohne Sichtverbindung gelesen werden. RFID ist eine schnell wachsende drahtlose Technologie, die der Textil- und Bekleidungsindustrie geholfen hat, Milliarden von Dollar zu sparen, indem sie jederzeit genaue Daten zu verschiedenen Artikeln liefert, die sich dort befinden. Das Wachstum des Marktes wurde durch die zunehmende Installation von RFID-Systemen in Fertigungseinheiten zur Verbesserung der Produktivität stark gefördert. Die zunehmende Akzeptanz elektronischer Ausweise und RFID-Etiketten in Chipkarten fördert das Wachstum des nordamerikanischen RFID-Marktes (Radio Frequency Identification).

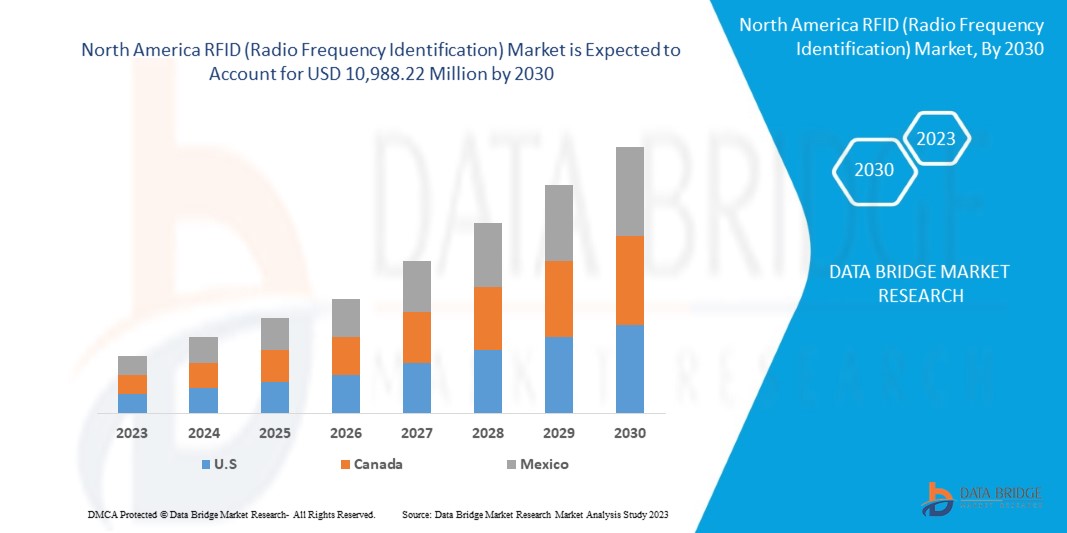

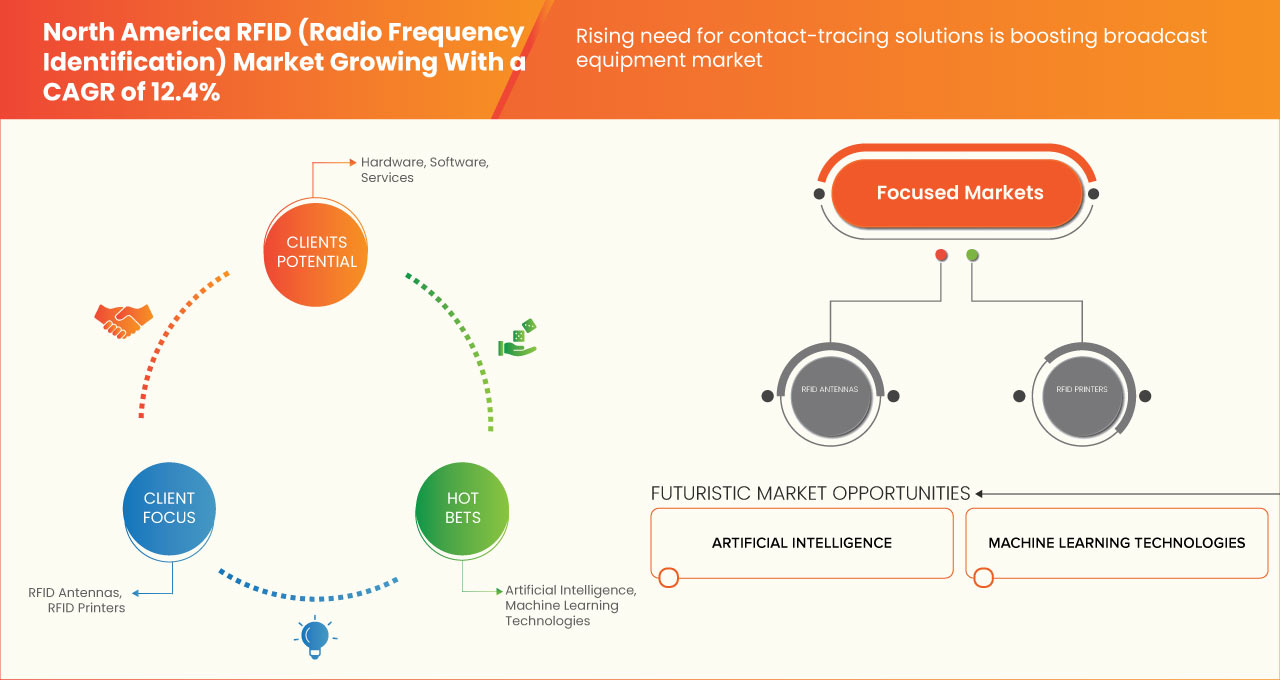

Data Bridge Market Research analysiert, dass der nordamerikanische RFID-Markt (Radio Frequency Identification) bis 2030 voraussichtlich einen Wert von 10.988,22 Millionen USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 12,4 % während des Prognosezeitraums entspricht. Der nordamerikanische RFID-Marktbericht (Radio Frequency Identification) umfasst auch ausführliche Preisanalysen, Patentanalysen und technologische Fortschritte.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Angebot (Hardware, Software und Dienste), Konnektivität (Bluetooth, Ultrawide Band und andere), Materialtyp (Kunststoff, Metall, Papier, Glas und andere), Endbenutzer (Einzelhandel/Gewerbe, Industrie, Gesundheitswesen, Konsumgüter, Automobil, Luft- und Raumfahrt, Überwachung und Sicherheit, Logistik und Transport, Sport, Verteidigung, Bildung, Viehzucht und Wildtiere und andere) |

|

Abgedecktes Land |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, Teil von ASSA ABLOY und andere |

Marktdefinition

RFID (Radio Frequency Identification) ist Teil eines Tracking-Systems, das intelligente Barcodes zur Identifizierung von Artikeln mithilfe von Radiofrequenztechnologie verwendet. Die Radiowellen übertragen Daten vom Etikett an ein Lesegerät, und die empfangenen Daten werden dann als Informationen an ein RFID-Computerprogramm übertragen. RFID-Etiketten sind mit integrierten Schaltkreisen und Antennen ausgestattet , die an Produkten und Verpackungen angebracht werden können. Die RFID-Etiketten übertragen Daten über die Radiowellen, die von RFID-Lesegeräten in eine besser nutzbare Datenform umgewandelt werden, die dann vom Backend analysiert wird.

Marktdynamik für RFID (Radio Frequency Identification) in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

Zunehmender Einsatz von RFID-Systemen in der Fertigungsindustrie zur Verbesserung der Produktivität

Hersteller sind immer auf der Suche nach fortschrittlichen Möglichkeiten, um Abläufe zu optimieren und Kosten zu senken. Die Radiofrequenz-Identifikationstechnologie (RFID) kann die Lieferkette optimieren, indem sie den Materialfluss verbessert und Schäden nachverfolgt. Eine zunehmende Automatisierung, gepaart mit der weit verbreiteten Verfügbarkeit intelligenter Geräte und zugehöriger drahtloser Netzwerke wie RFID, ermöglicht ein beispielloses Maß an Flexibilität und Effizienz. RFID-Technologie wird in der Fertigung häufig eingesetzt, da sie zahlreiche Vorteile bietet, wie z. B. eine bessere Produktüberwachung, einen genaueren WIP-Status, weniger Herstellungsfehler und ein qualitativ hochwertigeres Produkt. RFID ermöglicht eine Echtzeitansicht von Material und Anlagen, was für einen reibungslosen Produktionsablauf unerlässlich ist.

Wachsende Akzeptanz elektronischer Ausweise und RFID-Tags in Chipkarten,

Im Februar 2023 veröffentlichte die Security Technology Alliance einen ausführlichen Bericht über die Smartcard-Initiativen der US-Regierung und von Instituten. In diesem Bericht wurde erwähnt, dass die US-Bundesregierung Smartcard-Programme gestartet hat, um die Verwendung von Smartcards für Mitarbeiter- und Auftragnehmerausweise zu regulieren. In neuen Identitätsprogrammen werden auch Smartcards für Bürger, Transportarbeiter und Ersthelfer festgelegt. Dieser Schritt der US-Bundesregierung fördert die Akzeptanz elektronischer Ausweise und RFID-Tags in Smartcards.

Gelegenheit

Steigender Bedarf an Lösungen zur Kontaktverfolgung

Die Kontaktverfolgung ist ein wichtiger und anerkannter Bestandteil jeder Strategie zur Verhinderung und Überwachung des Ausbruchs und der Verbreitung von Infektionskrankheiten . Die Radiofrequenz-Identifikationstechnologie (RFID) nutzt elektromagnetische Felder, um an Personen oder Objekten angebrachte Tags automatisch zu identifizieren und zu verfolgen und so ein Echtzeit-Ortungssystem zu erstellen. Die Auswirkungen von COVID-19 zeigen, wie wichtig Rückverfolgbarkeit und Standardisierung sind, um Personen, Lieferketten und Vermögenswerte im Gesundheitswesen effektiv zu überwachen. Der Ausbruch von COVID-19 hat die Risiken durch den weltweiten Handel mit gefälschten Arzneimitteln erhöht

Einschränkung/Herausforderung

Hohe Anschaffungs-, Installations- und Wartungskosten

Die Einführung von RFID-Systemen in jeder Branche erfordert hohe Investitionen, einschließlich der Anschaffungskosten für RFID-Tags, Lesegeräte und Software sowie der Kosten für Ersatzleistungen und Strom. Zusatzfunktionen wie die kontinuierliche Genauigkeitsprüfung von Systemen, IoT-Integration und Schulungskosten machen RFID-Lösungen teurer. Dies führt zu einer geringen Einführungsrate von RFID-Systemen. Es gibt zwei Arten von RFID-Tags: aktive und passive. Passive RFID-Tags sind im Vergleich zu aktiven RFID-Tags kostengünstig, aber die Infrastruktur passiver RFID-Tags ist recht teuer.

Auswirkungen von COVID-19 auf den nordamerikanischen RFID-Markt (Radio Frequency Identification)

COVID-19 hatte aufgrund der Schließung der weltweiten Logistik und des Transports sowie fehlender Tests für das System negative Auswirkungen auf den nordamerikanischen RFID-Markt (Radio Frequency Identification).

Die COVID-19-Pandemie hat den nordamerikanischen RFID-Markt (Radio Frequency Identification) in gewissem Maße negativ beeinflusst. Das Wort RAIN leitet sich jedoch von Radiofrequenz-Identifikation ab und dient als Verbindung zwischen UHF-RFID und der Cloud. Die Cloud hilft beim Speichern und Verwalten der Daten, die über das Internet weiter geteilt werden können. RAIN RFID ist daher eine drahtlose Technologie, die dabei hilft, Milliarden von Alltagsgegenständen mit dem Internet zu verbinden, sodass mehrere Verbraucher jeden Gegenstand weiter identifizieren, lokalisieren, authentifizieren und verwenden können. Mit zunehmender Automatisierung in verschiedenen Branchen und zunehmender Nutzung vernetzter Geräte entwickeln Hersteller RAIN RFID-Tags, um einen größeren Marktanteil zu gewinnen und so das Marktwachstum zu steigern.

Die Marktteilnehmer führen zahlreiche Forschungs- und Entwicklungsaktivitäten durch, um die Technologie der Zubehörteile zu verbessern. Damit werden die Unternehmen Fortschritt und Innovation auf den Markt bringen. Darüber hinaus hat die staatliche Förderung von RFID zum Marktwachstum beigetragen.

Jüngste Entwicklungen

- Im August 2023 gab HL bekannt, dass das Unternehmen einen neuen UHF-RFID-Industriestromanschluss auf den Markt gebracht hat. Mit diesem Schritt konnte das Unternehmen sein Produktportfolio auf dem nordamerikanischen Markt für Radiofrequenzidentifikationstechnologie erweitern und ein breiteres Verbraucherspektrum in Europa und Nordamerika bedienen.

- CCL Industries gab bekannt, dass das Unternehmen ein neues klinisches System für den Gesundheitssektor auf den Markt gebracht hat. Dieses System wird eine neue digitale Funktion für die nächste Generation der klinischen Kennzeichnung enthalten. Das Unternehmen hat mit dieser Markteinführung seine Dominanz auf dem nordamerikanischen Markt für Radiofrequenzidentifikationstechnologie ausgebaut.

Nordamerika RFID (Radio Frequency Identification) Marktumfang

Der nordamerikanische RFID-Markt (Radio Frequency Identification) ist nach Angebot, Konnektivität, Materialtyp und Endbenutzer segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

NORDAMERIKA RFID (RADIO FREQUENCY IDENTIFICATION) MARKT, DURCH ANGEBOT

- HARDWARE

- SOFTWARE

- DIENSTLEISTUNGEN

Auf der Grundlage des Angebots ist der Markt in Hardware, Software und Dienstleistungen segmentiert.

NORDAMERIKANISCHER RFID-MARKT (RADIO FREQUENCY IDENTIFICATION) NACH VERBINDUNG

- BLUETOOTH-BAND

- ULTRABREITES BAND

- ANDERE

Auf der Grundlage der Konnektivität wurde der Markt in Bluetooth, Ultrabreitband und Sonstiges segmentiert.

NORDAMERIKANISCHER RFID-MARKT (RADIO FREQUENCY IDENTIFICATION) NACH MATERIALART

- PLASTIK

- METALL

- PAPIER

- GLAS

- ANDERE

Auf der Grundlage der Materialart wurde der Markt in Kunststoff, Metall, Papier, Glas und andere segmentiert.

NORDAMERIKA RFID (RADIO FREQUENCY IDENTIFICATION) MARKT, NACH ENDBENUTZER

- EINZELHANDEL/GEWERBE

- INDUSTRIE

- GESUNDHEITSPFLEGE

- Konsumgüter

- AUTOMOBIL

- LUFT- UND RAUMFAHRT

- Überwachung und Sicherheit

- LOGISTIK UND TRANSPORT

- INFORMATIONSTECHNOLOGIE (IT)

- SPORT

- VERTEIDIGUNG

- TIERWELT

- AUSBILDUNG

- VIEH

- ANDERE

Auf der Grundlage des Endverbrauchers ist der Markt in die Bereiche Einzelhandel/Gewerbe, Industrie, Gesundheitswesen, Konsumgüter, Automobil, Luft- und Raumfahrt, Überwachung und Sicherheit, Logistik und Transport, Informationstechnologie (IT), Sport, Verteidigung, Wildtiere, Bildung, Viehzucht und Sonstige segmentiert.

Länderanalyse/Einblicke

Der nordamerikanische RFID-Markt (Radio Frequency Identification) wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ, Vertriebskanal, demografischen Merkmalen und Preisspanne wie oben angegeben bereitgestellt. Die im nordamerikanischen RFID-Marktbericht (Radio Frequency Identification) abgedeckten Länder sind die USA, Kanada und Mexiko. Es wird erwartet, dass die USA den Markt dominieren werden, da das Land im Vergleich zu anderen Regionen eine zunehmende Verbreitung von RFID-Tags für Industrie 4.0, IoT und Smart Manufacturing aufweist. Der Länderabschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie die Analyse der nachgelagerten und vorgelagerten Wertschöpfungskette, technische Trends, die Fünf-Kräfte-Analyse von Porter und Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von RFID (Radio Frequency Identification) in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen RFID-Marktes (Radio Frequency Identification) liefert Einzelheiten zu den Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den nordamerikanischen RFID-Markt (Radio Frequency Identification).

Zu den wichtigsten Akteuren auf dem nordamerikanischen RFID-Markt (Radio Frequency Identification) zählen unter anderem CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, ein Teil von ASSA ABLOY.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN THE MANUFACTURING INDUSTRY TO IMPROVE PRODUCTIVITY

5.1.2 RISE IN ACCEPTANCE OF ELECTRONIC IDENTITY CARDS AND RFID TAGS LOCATED IN SMART CARDS

5.1.3 INCREASE IN REGULATIONS AND GOVERNMENT INITIATIVES FOR VARIOUS INDUSTRIES

5.1.4 GROWTH IN THE USAGE OF RFID TAGS IN DIFFERENT INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH PURCHASE, INSTALLATION, AND MAINTENANCE COSTS

5.2.2 CYBER ATTACKS AND DATA BREACHES WITH RFID

5.3 OPPORTUNITIES

5.3.1 RISE IN NEED FOR CONTACT-TRACING SOLUTIONS

5.3.2 INCREASE IN ADOPTION OF RFID TAGS FOR INDUSTRY 4.0, IOT, AND SMART MANUFACTURING

5.3.3 INCREASE IN DEVELOPMENTS IN RAIN RFID

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS ABOUT RFID SOLUTIONS AND EXPERT WORKFORCE

6 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 TAGS

6.2.1.1 BY PRODUCT TYPE

6.2.1.1.1 INLAY TAGS

6.2.1.1.2 COMPOSITE TAGS

6.2.1.1.3 CERAMIC TAGS

6.2.1.2 BY TYPE

6.2.1.2.1 PASSIVE TAGS

6.2.1.2.2 ACTIVE TAGS

6.2.1.2.3 BATTERY-ASSISTED PASSIVE (BAP) RFID TAGS

6.2.1.3 BY WAFER SIZE

6.2.1.3.1 300MM

6.2.1.3.2 200MM

6.2.1.3.3 OTHERS

6.2.1.4 BY FREQUENCY

6.2.1.4.1 LOW FREQUENCY

6.2.1.4.2 ULTRA-HIGH FREQUENCY

6.2.1.4.3 HIGH FREQUENCY

6.2.1.5 BY APPLICATION

6.2.1.5.1 RETAIL

6.2.1.5.2 ASSET MANAGEMENT

6.2.1.5.3 ACCESS CONTROL/ TICKETING

6.2.1.5.4 LOGISTICS

6.2.1.5.5 AIRLINES

6.2.1.5.6 HEALTHCARE

6.2.1.5.7 PEOPLE MANAGEMENT

6.2.1.5.8 EMBEDDED SYSTEMS

6.2.1.5.9 OTHERS

6.2.1.6 BY FORM FACTOR

6.2.1.6.1 CARD

6.2.1.6.2 IMPLANT

6.2.1.6.3 KEY FOB

6.2.1.6.4 LABEL

6.2.1.6.5 PLASTIC MOULDING

6.2.1.6.6 WRISTBAND

6.2.1.6.7 BUTTONS

6.2.1.6.8 BADGES

6.2.1.6.9 OTHERS

6.2.1.7 BY MATERIAL TYPE

6.2.1.7.1 PLASTIC

6.2.1.7.2 PAPER

6.2.1.7.3 GLASS

6.2.1.7.4 METAL

6.2.1.7.5 OTHERS

6.2.2 READERS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 FIXED RFID READERS

6.2.2.1.2 PORTABLE/HANDHELD RFID

6.2.2.1.2.1 HANDHELD TABLET READERS

6.2.2.1.2.2 HANDHELD PDA/EDA READERS

6.2.2.1.2.3 HANDHELD PISTOL GRIP READERS

6.2.2.1.3 USB RFID READERS

6.2.2.1.4 BLUETOOTH RFID READERS

6.2.2.1.5 RUGGED & VEHICLE MOUNTED RFID READERS

6.2.2.1.6 GPS RFID READERS

6.2.2.1.7 OTHERS

6.2.2.2 BY TECHNOLOGY

6.2.2.2.1 RAIN RFID READER

6.2.2.2.2 ANDROID RFID READER

6.2.2.2.3 IPHONE RFID READER

6.2.2.2.4 OTHER

6.2.2.3 BY FREQUENCY

6.2.2.3.1 LOW FREQUENCY READERS

6.2.2.3.2 ULTRA-HIGH FREQUENCY READERS

6.2.2.3.3 HIGH FREQUENCY READERS

6.2.2.4 BY APPLICATION

6.2.2.4.1 RETAIL

6.2.2.4.2 ASSET MANAGEMENT

6.2.2.4.3 ACCESS CONTROL/TICKETING

6.2.2.4.4 LOGISTICS

6.2.2.4.5 AIRLINES

6.2.2.4.6 HEALTHCARE

6.2.2.4.7 PEOPLE MANAGEMENT

6.2.2.4.8 EMBEDDED SYSTEMS

6.2.2.4.9 OTHERS

6.2.3 RFID ANTENNAS

6.2.4 RFID PRINTERS

6.2.4.1 DESKTOP PRINTER

6.2.4.2 MOBILE PRINTER

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 ANDROID

6.3.1.2 WINDOW

6.3.1.3 IOS

6.3.1.4 WEB

6.3.1.5 OTHERS

6.3.2 BY DEPLOYMENT

6.3.2.1 ON-PREMISE

6.3.2.2 CLOUD

6.3.3 BY APPLICATION

6.3.3.1 ACCESS CONTROL RFID SOFTWARE

6.3.3.2 ASSET TRACKING RFID SOFTWARE

6.3.3.3 PARKING CONTROL RFID SOFTWARE

6.3.3.4 PERSONAL TRACKING RFID SOFTWARE

6.3.3.5 AUTO-ID ENGINE

6.3.3.6 OTHERS

6.4 SERVICES

6.4.1 SYSTEM IMPLEMENTATION/MAINTENANCE

6.4.2 SYSTEM DESIGNING/DEVELOPMENT/TESTING

6.4.3 CONSULTING, SELECTION GUIDANCE

7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 BLUETOOTH

7.3 ULTRA WIDE BAND

7.4 OTHER

8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 GLASS

8.5 METAL

8.6 OTHERS

8.6.1 SILICON

8.6.2 CERAMIC

8.6.3 RUBBER

9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER

9.1 OVERVIEW

9.2 RETAIL/COMMERCIAL

9.2.1 APPAREL

9.2.2 JEWELLER TRACKING

9.2.3 KIOSK

9.2.4 IT ASSET TRACKING

9.2.5 ADVERTISEMENT

9.2.6 LAUNDRY

9.2.7 OTHER

9.3 LOGISTICS AND TRANSPORTATION

9.4 SURVEILLANCE AND SECURITY

9.5 AUTOMOTIVE

9.6 INDUSTRIAL

9.7 AEROSPACE/AVIATION

9.7.1 BAGGAGE TRACKING

9.7.2 MATERIALS MANAGEMENT

9.7.3 FLY PARTS TRACKING

9.7.4 LIFETIME TRACEABILITY

9.7.5 MRO

9.7.6 OTHER

9.8 CONSUMER PACKAGE GOODS

9.9 HEALTHCARE

9.9.1 PATIENTS MANAGEMENT

9.9.2 WASTE MANAGEMENT

9.9.3 DRUGS MANAGEMENT

9.9.4 LABORATORY MANAGEMENT

9.9.5 EQUIPMENT MANAGEMENT

9.9.6 OTHER

9.1 LIVESTOCK & WILDLIFE

9.11 SPORTS

9.12 EDUCATION

9.13 DEFENSE

9.13.1 BORDER SECURITY

9.13.2 WEAPON MANAGEMENT TRACKING

9.13.3 SOLDIER MOVEMENT TRACKING

9.13.4 OTHER

9.14 OTHER

10 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILING

13.1 ZEBRA TECHNOLOGIES CORP.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 AVERY DENNISON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 HONEYWELL INTERNATIONAL INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 CCL INDUSTRIES

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 IMPINJ, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALIEN TECHNOLOGY, LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 CORERFID

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IDENTIV, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 INVENGO TECHNOLOGY PTE. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JADAK – A NOVANTA COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 NEDAP N.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 NXP SEMICONDUCTORS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 OMNIA TECHNOLOGIES

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PEPPERL+FUCHS SE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 RFID4U

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 SES RFID GMBH

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SIMPLYRFID

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SMART LABEL SOLUTION

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 3 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 4 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 5 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2023-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2023-2030 (USD MILLION)

TABLE 9 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 12 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

TABLE 13 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 15 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 16 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SERVICES IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2023-2030

TABLE 21 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2023-2030

TABLE 22 NORTH AMERICA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2023-2030

TABLE 24 NORTH AMERICA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 U.S. HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 34 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 35 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 37 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 42 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 45 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 46 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 49 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 U.S. RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 CANADA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 62 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 69 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 CANADA SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 76 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 CANADA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 84 MEXICO HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 89 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 91 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 95 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 96 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 100 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 MEXICO SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 103 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 106 MEXICO RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MEXICO AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MEXICO HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN MANUFACTURING UNITS TO IMPROVE PRODUCTIVITY IS EXPECTED TO DRIVE THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN THE FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

FIGURE 13 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY OFFERING, 2022

FIGURE 14 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2022

FIGURE 15 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2022

FIGURE 16 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY OFFERING (2023-2030)

FIGURE 22 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.