North America Medical Device Outsourcing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

70.71 Billion

USD

185.34 Billion

2023

2031

USD

70.71 Billion

USD

185.34 Billion

2023

2031

| 2024 –2031 | |

| USD 70.71 Billion | |

| USD 185.34 Billion | |

|

|

|

|

Marktsegmentierung für das Outsourcing medizinischer Geräte in Nordamerika nach Dienstleistungen (Qualitätssicherung, Zulassungsdienstleistungen, Produktdesign- und -entwicklungsdienstleistungen, Produktprüfungs- und Sterilisationsdienstleistungen, Produktimplementierungsdienstleistungen, Produktupgradedienstleistungen, Produktwartungsdienstleistungen, Rohstoffdienstleistungen, Dienstleistungen für medizinische elektrische Geräte, Auftragsfertigung, Materialien und chemische Charakterisierung), Produkt (Fertigprodukte, Elektronik und Rohstoffe), Gerätetyp (Klasse I, Klasse II und Klasse III), Anwendung (Kardiologie, diagnostische Bildgebung, Orthopädie, IVD, Augenheilkunde, allgemeine und plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und andere), Endbenutzer (kleine Medizingerätehersteller, mittlere Medizingerätehersteller, große Medizingerätehersteller und andere) – Branchentrends und Prognose bis 2032

Marktgröße für das Outsourcing medizinischer Geräte in Nordamerika

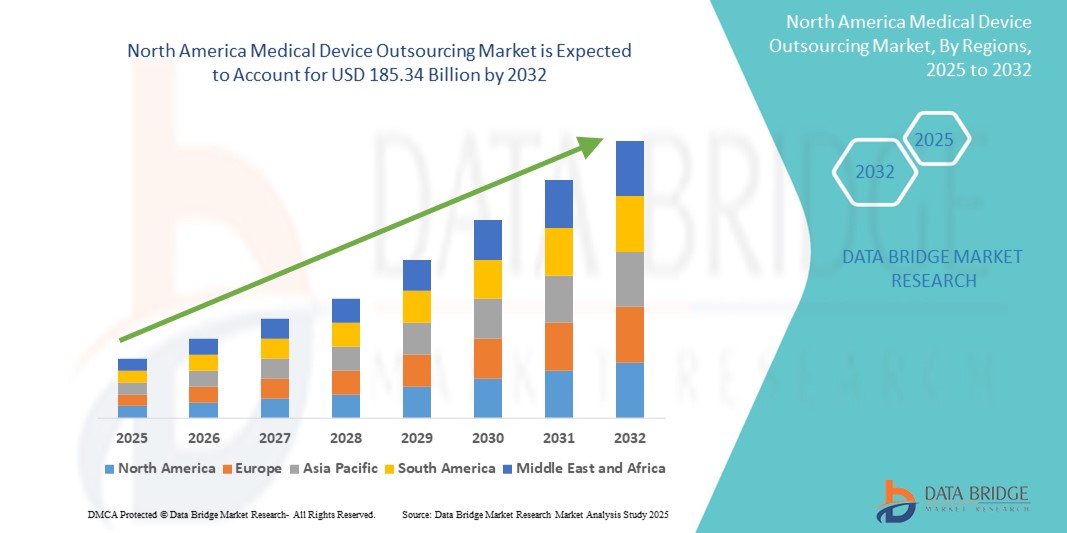

- Der nordamerikanische Markt für das Outsourcing medizinischer Geräte wurde im Jahr 2024 auf 70,71 Milliarden US-Dollar geschätzt und dürfte bis 2032 185,34 Milliarden US-Dollar erreichen , bei einer CAGR von 12,80 % im Prognosezeitraum.

- Das Marktwachstum wird vor allem durch den steigenden Bedarf an kostengünstigen Fertigungslösungen und die zunehmende Komplexität medizinischer Geräte vorangetrieben, was OEMs dazu veranlasst, sich bei Design, Entwicklung und Produktion auf Outsourcing-Partner zu verlassen.

- Darüber hinaus ermutigen verschärfte regulatorische Anforderungen und die Notwendigkeit schnellerer Produkteinführungen Unternehmen dazu, mit spezialisierten Outsourcing-Unternehmen zusammenzuarbeiten, die regulatorisches Know-how und Skalierbarkeit bieten. Diese Faktoren treiben gemeinsam die Einführung von Outsourcing im Medizinproduktesektor voran und fördern die Marktexpansion deutlich.

Marktanalyse für das Outsourcing medizinischer Geräte in Nordamerika

- Das Outsourcing medizinischer Geräte, das die Inanspruchnahme von Dienstleistungen Dritter für Design, Entwicklung, Herstellung und regulatorische Unterstützung umfasst, wird im nordamerikanischen Gesundheitswesen immer wichtiger, da in der Region der Fokus auf Kosteneffizienz, Innovation und Beschleunigung der Markteinführung liegt.

- Die wachsende Nachfrage nach ausgelagerten Dienstleistungen ist vor allem auf die zunehmende Komplexität der Medizintechnik, steigende F&E-Kosten und den zunehmenden Druck auf die OEMs zurückzuführen, die sich entwickelnden regulatorischen Standards einzuhalten und gleichzeitig die Rentabilität aufrechtzuerhalten.

- Die USA dominierten den nordamerikanischen Outsourcing-Markt für Medizinprodukte mit dem größten Umsatzanteil von 79,1 % im Jahr 2024, unterstützt durch eine starke Basis von Medizinprodukteunternehmen, eine fortschrittliche Gesundheitsinfrastruktur und ein gut etabliertes Netzwerk von Auftragsherstellern und Dienstleistern

- Kanada wird im Prognosezeitraum voraussichtlich das schnellste Wachstum im nordamerikanischen Outsourcing-Markt für Medizinprodukte verzeichnen, was auf unterstützende Regierungsinitiativen, einen expandierenden Gesundheitssektor und eine zunehmende Zusammenarbeit zwischen OEMs und inländischen Outsourcing-Partnern zurückzuführen ist.

- Das Segment Auftragsfertigung wird mit einem Anteil von 45,8 % im Jahr 2024 Marktführer sein, angetrieben durch den Bedarf an skalierbaren Produktionslösungen, Qualitätssicherung und der Fähigkeit, strenge gesetzliche Compliance-Anforderungen zu erfüllen.

Berichtsumfang und Marktsegmentierung für das Outsourcing medizinischer Geräte in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke in das Outsourcing medizinischer Geräte in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für das Outsourcing medizinischer Geräte in Nordamerika

„Digitale Transformation und technologische Integration in Outsourcing-Dienstleistungen“

- Ein bemerkenswerter und schnell wachsender Trend im nordamerikanischen Outsourcing-Markt für Medizinprodukte ist die digitale Transformation ausgelagerter Dienstleistungen. Dazu gehört die Integration fortschrittlicher Technologien wie künstliche Intelligenz (KI), additive Fertigung und Echtzeit-Datenanalyse in Produktentwicklungs- und Fertigungsprozesse. Diese Innovationen ermöglichen höhere Präzision, schnelleres Prototyping und eine verbesserte Qualitätskontrolle in ausgelagerten Betrieben.

- Unternehmen wie Jabil und Flex nutzen beispielsweise KI und Datenanalyse, um die Transparenz der Lieferkette zu verbessern und die Rückverfolgbarkeit in der Fertigung sicherzustellen. So unterstützen sie OEMs bei der Einhaltung strenger gesetzlicher Vorschriften. Auch die Integer Holdings Corporation nutzt fortschrittliche Robotik und Automatisierung in ihren ausgelagerten Fertigungsdienstleistungen, um Vorlaufzeiten zu verkürzen und menschliche Fehler zu minimieren.

- Der Einsatz digitaler Zwillinge und 3D-Drucktechnologien revolutioniert das Rapid Prototyping und die Personalisierung medizinischer Geräte und ermöglicht es Auftragsherstellern, komplexe, patientenspezifische Lösungen effizient zu liefern. Diese Fähigkeiten sind besonders in den Bereichen Orthopädie, Herz-Kreislauf und Diagnostik von entscheidender Bedeutung.

- Darüber hinaus bieten Outsourcing-Partner zunehmend End-to-End-Services an, die Forschung und Entwicklung, regulatorische Beratung, Designvalidierung und Lebenszyklusmanagement umfassen und so integrierte und nahtlose Lösungen für OEMs schaffen. Der Wandel von Transaktionsbeziehungen zu strategischen Partnerschaften verändert die Outsourcing-Landschaft in der Region.

- Dieser Trend zum Hightech-Outsourcing mit Mehrwert setzt neue Maßstäbe in der Branche und zwingt Unternehmen, kontinuierlich in Spitzentechnologien zu investieren. Outsourcing ist daher nicht nur eine Kostensparstrategie, sondern auch ein Wettbewerbsvorteil. Es beschleunigt Innovationen und gewährleistet gleichzeitig Compliance und Qualität über den gesamten Gerätelebenszyklus.

Marktdynamik für das Outsourcing medizinischer Geräte in Nordamerika

Treiber

„Steigerte Nachfrage nach Kosteneffizienz und spezialisiertem Know-how“

- Die zunehmende Komplexität medizinischer Geräte und der zunehmende Druck auf OEMs, die Betriebskosten zu senken und gleichzeitig hohe Qualitätsstandards einzuhalten, sind die Haupttreiber für das Wachstum des Outsourcing-Marktes für medizinische Geräte in Nordamerika.

- So kündigte beispielsweise MedPlast, ein Auftragsfertigungsunternehmen, im März 2024 die Erweiterung seiner nordamerikanischen Produktionsanlagen an, um der wachsenden Nachfrage der OEMs nach effizienter, skalierbarer Produktion und regulatorischer Unterstützung gerecht zu werden. Diese Erweiterungen unterstreichen den Trend der Branche zum Outsourcing, um die Marktbedürfnisse effektiv zu erfüllen.

- Durch Outsourcing erhalten OEMs Zugriff auf spezialisiertes Fachwissen in Bereichen wie Biokompatibilitätstests, Sterilisation und regulatorischen Angelegenheiten, die für die Produktzulassung in einem stark regulierten Umfeld von entscheidender Bedeutung sind.

- Darüber hinaus ermöglicht es Unternehmen, sich auf Kernkompetenzen wie Innovation und Markenentwicklung zu konzentrieren und gleichzeitig Produktion und Compliance an erfahrene Partner zu delegieren.

- Diese Strategie verkürzt die Markteinführungszeit und sorgt für vorhersehbarere Kostenstrukturen, was sie besonders für Startups und mittelständische Unternehmen attraktiv macht.

Einschränkung/Herausforderung

„Regulierungskomplexität und Bedenken hinsichtlich des geistigen Eigentums“

- Eine der größten Herausforderungen im nordamerikanischen Outsourcing-Markt für Medizinprodukte besteht darin, sich in der komplexen regulatorischen Landschaft zurechtzufinden, insbesondere angesichts der häufigen Aktualisierungen durch Behörden wie die FDA. Die Gewährleistung der Compliance beim Outsourcing kritischer Entwicklungs- und Fertigungsprozesse erfordert robuste Qualitätsmanagementsysteme und eine sorgfältige Überwachung.

- Beispielsweise müssen Dritthersteller die Qualitätssystemvorschriften (QSR) der FDA und die ISO 13485-Standards einhalten, deren Implementierung und Überwachung ressourcenintensiv und kostspielig sein kann. Diese regulatorischen Komplexitäten können kleinere Unternehmen von Outsourcing-Beziehungen abhalten oder zu Verzögerungen und zusätzlichen Kosten führen.

- Darüber hinaus stellen Bedenken hinsichtlich des Schutzes geistigen Eigentums (IP) ein Hindernis dar. OEMs müssen sicherstellen, dass Outsourcing-Partner strenge Vertraulichkeits- und Datenschutzprotokolle einhalten, insbesondere beim Outsourcing von Produktdesign und innovationsbezogenen Aufgaben.

- Vertrauensprobleme und mangelnde Transparenz in der Outsourcing-Kette können die Zusammenarbeit behindern und zu Rechtsstreitigkeiten oder der unbefugten Nutzung proprietärer Technologien führen. Um diese Bedenken auszuräumen, investieren führende Outsourcing-Unternehmen in sichere IT-Infrastrukturen und schließen strenge vertragliche Vereinbarungen zum Schutz des geistigen Eigentums ihrer Kunden ab.

- Die Bewältigung dieser regulatorischen und IP-bezogenen Herausforderungen durch verbesserte Zusammenarbeit, Compliance-Audits und Strategien zur Risikominderung wird für ein nachhaltiges Wachstum im Outsourcing-Sektor von entscheidender Bedeutung sein.

Umfang des nordamerikanischen Outsourcing-Marktes für Medizinprodukte

Der Markt ist nach Diensten, Produkten, Gerätetypen, Anwendungen und Endbenutzern segmentiert.

- Nach Dienstleistungen

Der nordamerikanische Outsourcing-Markt für Medizinprodukte ist nach Dienstleistungen segmentiert in Qualitätssicherung, Zulassungsdienstleistungen, Produktdesign und -entwicklung, Produkttests und Sterilisation, Produktimplementierung, Produktupgrades, Produktwartung, Rohstoffdienstleistungen, Dienstleistungen für medizinische Elektrogeräte, Auftragsfertigung sowie Material- und chemische Charakterisierung. Das Segment Auftragsfertigung dominierte den Markt mit dem größten Umsatzanteil von 45,8 % im Jahr 2024, angetrieben durch den steigenden Bedarf der OEMs an skalierbaren, effizienten und kostengünstigen Produktionslösungen. Auftragsfertiger bieten umfassende Leistungen, darunter Präzisionsbearbeitung, Montage und Verpackung, und sind damit wichtige Partner für die Produktion von Medizinprodukten im großen Maßstab.

Das Segment Regulatory Affairs Services wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen, angetrieben durch die sich entwickelnde und zunehmend strengere Regulierungslandschaft in Nordamerika. Da die Compliance-Anforderungen, insbesondere der US-amerikanischen FDA und von Health Canada, immer komplexer werden, lagern viele Medizinproduktehersteller diese Dienstleistungen an spezialisierte Unternehmen aus, die Expertise in den Bereichen Einreichungen, Audits und Qualitätssicherung bieten.

- Nach Produkt

Der nordamerikanische Outsourcing-Markt für Medizinprodukte ist produktbezogen in Fertigprodukte, Elektronik und Rohstoffe segmentiert. Das Segment Fertigprodukte hatte 2024 den größten Marktanteil, da OEMs zunehmend dazu tendieren, die Endfertigung und Montage fertig verpackter Medizinprodukte auszulagern und sich so auf Innovation und Vermarktung zu konzentrieren.

Der Elektroniksektor wird voraussichtlich von 2025 bis 2032 die höchste jährliche Wachstumsrate verzeichnen, was auf die zunehmende Integration elektronischer Komponenten in Diagnose-, Überwachungs- und tragbare Geräte zurückzuführen ist. Das Outsourcing der Leiterplattenfertigung, der Sensorintegration und der Mikroelektronik wird für Unternehmen immer wichtiger, um die Anforderungen an Leistung und Miniaturisierung zu erfüllen.

- Nach Gerätetyp

Der nordamerikanische Markt für das Outsourcing von Medizinprodukten ist nach Gerätetyp in Klasse I, Klasse II und Klasse III unterteilt. Das Segment Klasse II dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, was auf die breite Verwendung dieser moderat regulierten Geräte in Bereichen wie Diagnostik, zahnärztlichen Instrumenten und chirurgischen Instrumenten zurückzuführen ist. Das Outsourcing der Herstellung und des Compliance-Managements für Geräte der Klasse II hilft OEMs, die regulatorischen Erwartungen zu erfüllen und gleichzeitig Kosten zu senken.

Das Segment der Klasse III wird im Prognosezeitraum voraussichtlich ein starkes Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach risikoreichen und lebenserhaltenden Medizinprodukten, wie implantierbaren Herz- und Neurostimulationsgeräten. Diese Geräte erfordern anspruchsvolle Technik und die Einhaltung strenger Vorschriften, was Outsourcing zu einer attraktiven Option macht.

- Nach Anwendung

Der nordamerikanische Markt für das Outsourcing von Medizinprodukten ist nach Anwendungsgebieten in die Bereiche Kardiologie, diagnostische Bildgebung, Orthopädie, IVD, Augenheilkunde, allgemeine und plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und weitere unterteilt. Das Segment Kardiologie dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, unterstützt durch die hohe Nachfrage nach Outsourcing von Stents, Herzschrittmachern und Kathetern. Outsourcing gewährleistet eine schnellere Markteinführung, regulatorische Unterstützung und Kostenkontrolle in diesem stark nachgefragten Fachgebiet.

Das IVD-Segment dürfte zwischen 2025 und 2032 die höchste Wachstumsrate aufweisen. Grund hierfür sind die steigende Nachfrage nach Diagnoselösungen, die zunehmende Anzahl an Tests und die Komplexität von Reagenzienkits und automatisierten Analysegeräten, die OEMs dazu bewegen, Partnerschaften mit spezialisierten Outsourcing-Unternehmen einzugehen.

- Nach Endbenutzer

Der nordamerikanische Markt für das Outsourcing von Medizinprodukten ist nach Endnutzern in kleine, mittlere und große Medizinprodukteunternehmen sowie weitere Segmente unterteilt. Das Segment der großen Medizinprodukteunternehmen dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024. Dies ist auf die strategische Nutzung von Outsourcing zurückzuführen, um Abläufe zu optimieren, Kapazitäten zu erweitern und die Produktentwicklung über verschiedene Gerätekategorien hinweg zu beschleunigen.

Das Segment der kleinen Medizintechnikunternehmen dürfte zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, da diese Unternehmen zunehmend auf Outsourcing-Partner angewiesen sind, um Zugang zu spezialisierter Forschung und Entwicklung, Fertigungsinfrastruktur und regulatorischem Know-how zu erhalten, ohne die Kapitallast einer internen Entwicklung tragen zu müssen.

Regionale Analyse des nordamerikanischen Outsourcing-Marktes für Medizinprodukte

- Die USA dominierten den nordamerikanischen Outsourcing-Markt für Medizinprodukte mit dem größten Umsatzanteil von 79,1 % im Jahr 2024, unterstützt durch eine starke Basis von Medizinprodukteunternehmen, eine fortschrittliche Gesundheitsinfrastruktur und ein gut etabliertes Netzwerk von Auftragsherstellern und Dienstleistern

- In den USA ansässige Unternehmen legen großen Wert auf Outsourcing, um Betriebsabläufe zu rationalisieren, gesetzliche Vorschriften einzuhalten und die Produktentwicklung zu beschleunigen. Dabei profitieren sie von den qualifizierten Arbeitskräften des Landes, der Spitzentechnologie und der Nähe zur US-amerikanischen FDA.

- Die Dominanz der USA wird durch hohe Gesundheitsausgaben, kontinuierliche Innovationen in der Medizintechnik und eine steigende Nachfrage nach spezialisierten Dienstleistungen in den Phasen Design, Entwicklung und Fertigung weiter verstärkt, was sie zu einem zentralen Wachstumsmotor in der regionalen Outsourcing-Landschaft macht.

Einblicke in den US-amerikanischen Outsourcing-Markt für Medizinprodukte

Der US-Markt für Medizinprodukte-Outsourcing erzielte 2024 mit 78,6 % den größten Umsatzanteil innerhalb Nordamerikas. Dies ist auf die starke Präsenz großer OEMs, eine robuste regulatorische Infrastruktur und ein hochentwickeltes Ökosystem von Auftragsherstellern zurückzuführen. Outsourcing in den USA wird durch den Bedarf an spezialisiertem Know-how in Design, Compliance und skalierbarer Produktion zur Einhaltung der FDA-Vorschriften vorangetrieben. Der zunehmende Druck, Betriebskosten zu senken und Innovationszeiten zu beschleunigen, unterstützt diesen Trend zusätzlich. Der US-Markt profitiert von einer ausgereiften Outsourcing-Landschaft mit umfangreichen Serviceangeboten in den Bereichen Forschung und Entwicklung, Prototyping und Fertigung fertiger Geräte.

Einblicke in den kanadischen Outsourcing-Markt für Medizinprodukte

Der kanadische Markt für Medizinprodukte-Outsourcing wird im Prognosezeitraum voraussichtlich stetig wachsen, unterstützt durch staatliche Initiativen zur Verbesserung der Gesundheitsinfrastruktur und steigende Investitionen in Medizintechnik. Kanadische OEMs setzen zunehmend auf Outsourcing-Partner, um Zugang zu regulatorischem Wissen, kostengünstiger Produktion und einem schnelleren Markteintritt zu erhalten. Der Aufstieg von Medtech-Clustern, insbesondere in Ontario und Quebec, sowie strategische Kooperationen zwischen lokalen Unternehmen und globalen Auftragsherstellern tragen zum Wachstum des Sektors bei. Besonders stark ist die Nachfrage in den Bereichen Diagnostik, Orthopädie und minimalinvasive Geräte.

Einblicke in den Outsourcing-Markt für Medizinprodukte in Mexiko

Der mexikanische Outsourcing-Markt für Medizinprodukte gewinnt aufgrund seiner Kostenvorteile, der qualifizierten Arbeitskräfte und der Nähe zu den USA an Bedeutung und ist daher ein attraktiver Nearshoring-Standort für amerikanische OEMs. Das Wachstum wird durch die Entwicklung von Produktionszentren in Baja California und Chihuahua mit zahlreichen FDA-konformen Anlagen vorangetrieben. Mexikos strategische Handelsabkommen, darunter das USMCA, und der Fokus auf den Export von Medizinprodukten ziehen verstärkt Outsourcing-Investitionen an. Der Markt verzeichnet eine steigende Nachfrage nach Auftragsfertigungs- und Montagedienstleistungen, insbesondere für Geräte der Klassen II und III für den Export in die USA und nach Kanada.

Marktanteil im Outsourcing medizinischer Geräte in Nordamerika

Die nordamerikanische Outsourcing-Branche für medizinische Geräte wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Integer Holdings Corporation (USA)

- Jabil Inc. (USA)

- TE Connectivity Ltd. (Schweiz)

- Sanmina Corporation (USA)

- Celestica Inc. (Kanada)

- Flex Ltd. (Singapur)

- Viant Medical, Inc. (USA)

- Nortech Systems Incorporated (USA)

- Plexus Corp. (USA)

- Benchmark Electronics, Inc. (USA)

- TTM Technologies, Inc. (USA)

- West Pharmaceutical Services, Inc. (USA)

- Phillips-Medisize, LLC (USA)

- Cadence, Inc. (USA)

- SteriPack Group Ltd. (Irland)

- Provider, LLC (USA)

- Gerresheimer AG (Deutschland)

- Circec Medical (USA)

- Millstone Medical Outsourcing, LLC (USA)

Was sind die jüngsten Entwicklungen auf dem nordamerikanischen Outsourcing-Markt für Medizinprodukte?

- Im Mai 2024 gab die Integer Holdings Corporation, ein führender US-amerikanischer Auftragshersteller von Medizinprodukten, die Erweiterung seines Werks in Alden, New York, bekannt. Ziel dieser Initiative ist es, die Produktionskapazität zu erhöhen und die Reinraumfertigung für kardiovaskuläre und neuromodulierende Geräte zu verbessern. Die Erweiterung unterstreicht Integers Engagement, OEMs mit fortschrittlichen Fertigungslösungen zu unterstützen und die steigende Nachfrage nach ausgelagerter Produktion hochkomplexer Medizinprodukte der Klasse III in Nordamerika zu decken.

- Im April 2024 übernahm Viant Medical, ein führender Outsourcing-Partner für Medizinprodukte, LayerMed, ein kanadisches Design- und Entwicklungsunternehmen, das auf minimalinvasive chirurgische Instrumente spezialisiert ist. Die Übernahme stärkt Viants Innovationskraft und ermöglicht es dem Unternehmen, OEMs umfassende Entwicklungsdienstleistungen anzubieten. Dieser strategische Schritt stärkt Viants Position im nordamerikanischen Outsourcing-Ökosystem durch die Erweiterung seines Serviceangebots und seiner geografischen Reichweite.

- Im März 2024 führte die Sanmina Corporation, ein US-amerikanischer Auftragshersteller, eine neue digitale Plattform ein, die die Prototypenentwicklung medizinischer Geräte optimieren und die Zeit von der Entwicklung bis zur Fertigung verkürzen soll. Die Plattform umfasst KI-gestützte Modellierung und Echtzeit-Regulierungsverfolgung, was schnellere Design-Iterationen und eine verbesserte Compliance ermöglicht. Diese Entwicklung unterstreicht Sanminas Fokus auf die Integration der digitalen Transformation in Outsourcing-Dienstleistungen für Medizinprodukte.

- Im Februar 2024 eröffnete TE Connectivity ein neues Innovations- und Fertigungszentrum in Hermosillo, Mexiko, um die Unterstützung für Medizingerätehersteller in ganz Nordamerika zu erweitern. Die Anlage verfügt über fortschrittliche Form-, Extrusions- und Montagekapazitäten für minimalinvasive, interventionelle und diagnostische Geräte. Diese Erweiterung unterstreicht die steigende Nachfrage nach Nearshore-Fertigungslösungen und das Engagement von TE, vertikal integrierte Dienstleistungen an einem kostengünstigen Standort anzubieten.

- Im Januar 2024 gab Jabil Healthcare, ein Geschäftsbereich von Jabil Inc., eine Zusammenarbeit mit einem US-Startup bekannt. Ziel ist die Entwicklung KI-gestützter tragbarer Medizingeräte für das Management chronischer Krankheiten. Im Rahmen der Vereinbarung wird Jabil umfassende Outsourcing-Dienstleistungen anbieten, darunter Design, Miniaturisierung und regulatorische Unterstützung. Diese Partnerschaft unterstreicht die wachsende Rolle von Auftragsherstellern bei der Beschleunigung von Innovation und Kommerzialisierung von Medizintechnologien der nächsten Generation auf dem nordamerikanischen Markt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.