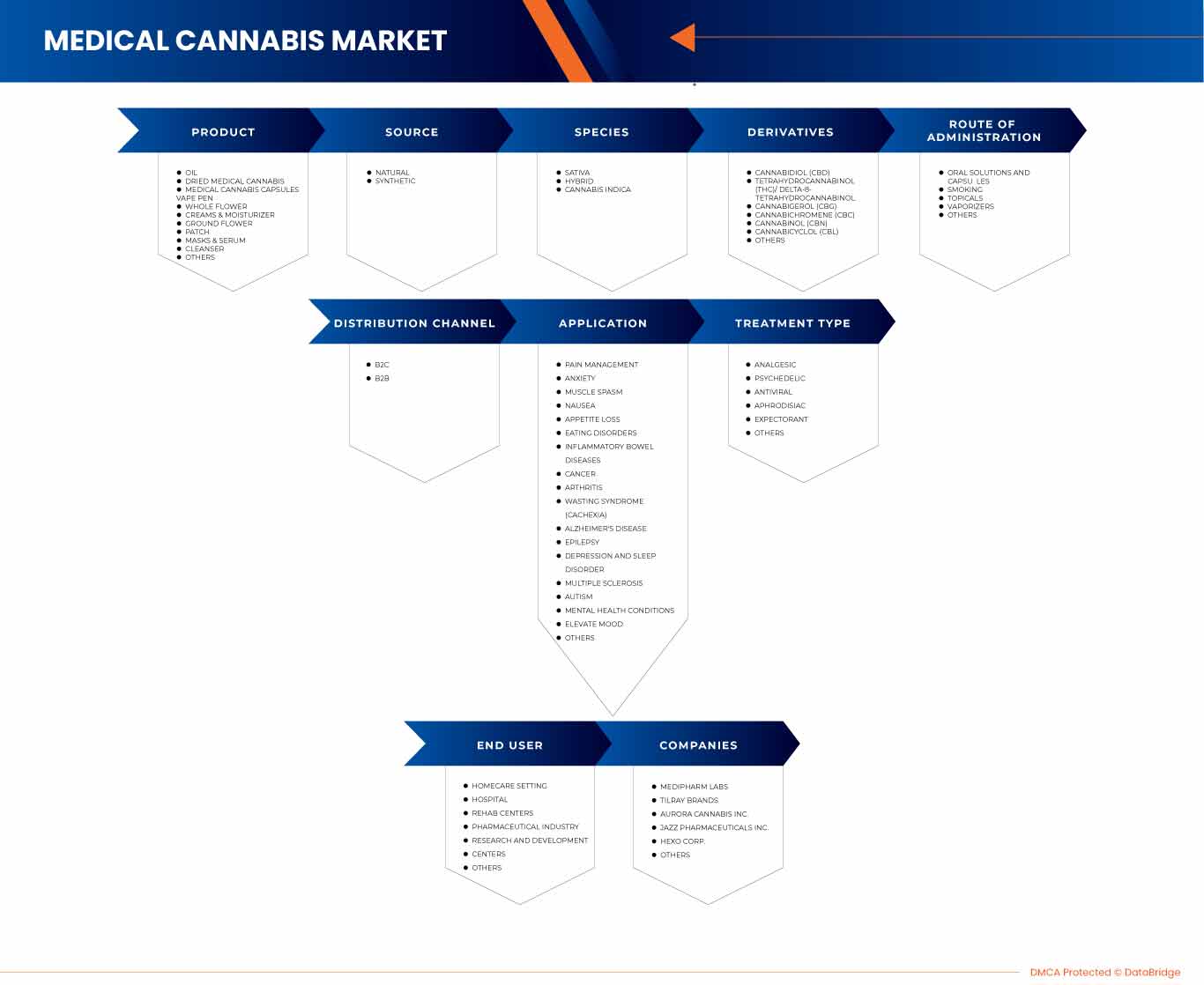

North America Medical Cannabis Market, By Product (Oil, Medical Cannabis Capsules, Patch, Whole Flower, Ground Flower, Vape Pen, Dried Medical Cannabis, Creams & Moisturizer, Masks & Serum, Cleanser, and Others), Source (Natural and Synthetic), Species (Cannabis Indica, Sativa, and Hybrid), Application (Alzheimer’s Disease, Appetite Loss, Cancer, Inflammatory Bowel Diseases, Eating Disorders, Epilepsy, Autism, Mental Health Conditions, Multiple Sclerosis, Pain Management, Nausea, Muscle Spasms, Wasting Syndrome (Cachexia), Elevate Mood, Depression and Sleep Disorders, Anxiety, and Others), Derivatives (Cannabidiol (CBD), Tetrahydrocannabinol (THC)/ Delta-8-Tetrahydrocannabinol, Cannabinol (CBN), Cannabicyclol (CBL), Cannabichromene (CBC), Cannabigerol (CBG), and Others), Treatment Type (Expectorant, Antiviral, Analgesic, Aphrodisiac, Psychedelic, and Others), Route of Administration (Oral Solutions and Capsules, Smoking, Vaporizers, Topicals, and Others), End User (Pharmaceutical Industry, Research and Development Centers, Homecare Setting, Hospital, Rehab Centers, and Others), Distribution Channel (B2B and B2C) - Industry Trends and Forecast to 2030.

North America Medical Cannabis Market Analysis and Insights

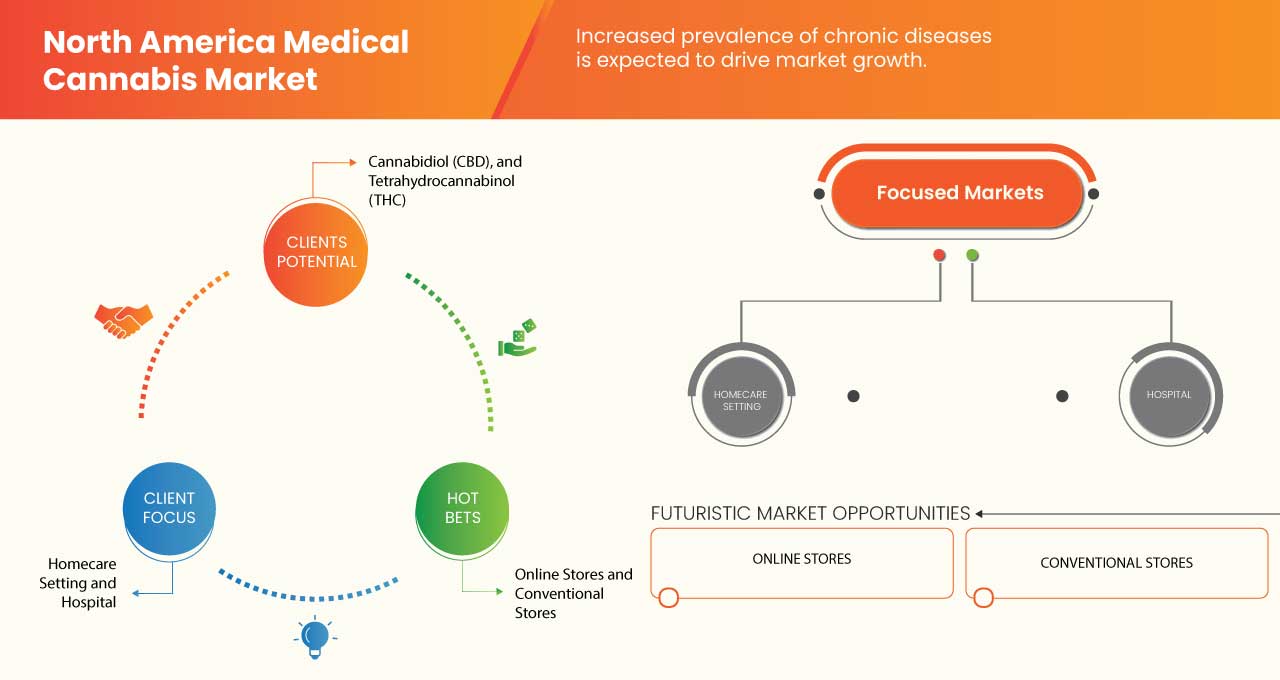

The rising number of patients related to chronic diseases North America and an increased inclination towards a healthy lifestyle are some of the factors that are expected to drive market growth. In addition, the rise in the number of product approvals and increasing R&D activities for medical cannabis devices are expected to drive market growth. However, the high cost of medical cannabis devices and procedures, medicinal drugs, safety concerns and adverse effects associated with laser procedures, and lack of awareness about the treatment from laser devices are expected to restrain the market growth. Additional technological advancements in medical cannabis and strategic initiatives by emerging players are expected to act as opportunities for market growth. However, stringent regulations and a lack of skilled professionals are expected to pose a challenge to market growth.

The use of cannabis as medicine is not rigorously tested due to government restrictions and resulting in limited clinical research to define the efficacy of cannabis in medical and clinical applications. However, preliminary studies suggest that cannabis reduces vomiting and nausea in chemotherapy patients and helps in increasing appetite.

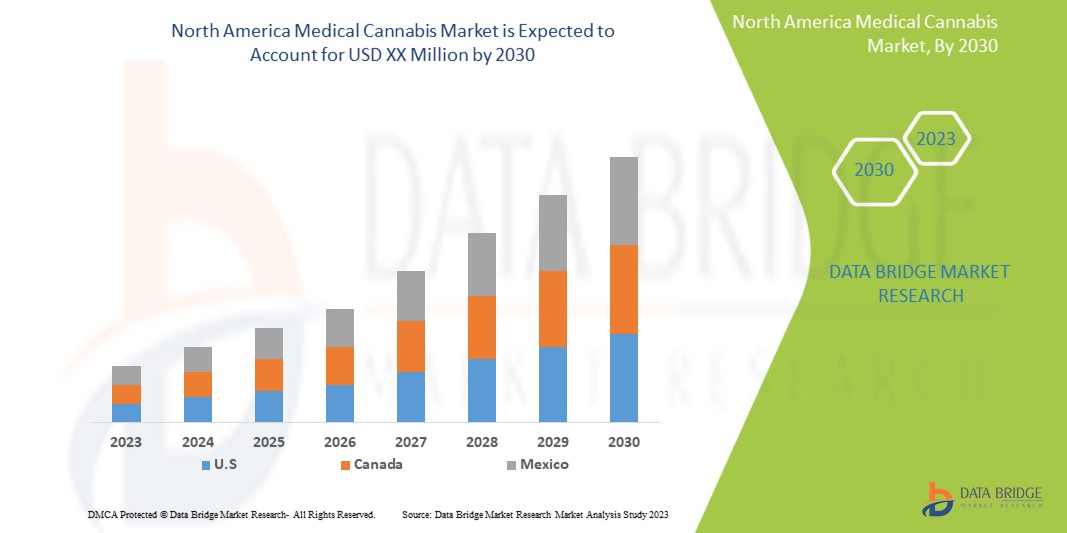

Data Bridge Market Research analyzes that the North America medical cannabis market is expected to grow at a CAGR of 23.2% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Produkt (Öl, medizinische Cannabiskapseln, Pflaster, ganze Blüte, gemahlene Blüte, Vape Pen, getrocknetes medizinisches Cannabis, Cremes und Feuchtigkeitscreme, Masken und Serum, Reinigungsmittel und andere), Quelle (natürlich und synthetisch), Art (Cannabis Indica, Sativa und Hybrid), Anwendung (Alzheimer-Krankheit, Appetitverlust, Krebs, entzündliche Darmerkrankungen, Essstörungen, Epilepsie, Autismus, psychische Erkrankungen, Multiple Sklerose, Schmerzbehandlung, Übelkeit, Muskelkrämpfe, Auszehrungssyndrom (Kachexie), Stimmungsaufhellung, Depressionen und Schlafstörungen, Angstzustände und andere), Derivate (Cannabidiol (CBD), Tetrahydrocannabinol (THC)/ Delta-8-Tetrahydrocannabinol, Cannabinol (CBN), Cannabicyclol (CBL), Cannabichromen (CBC), Cannabigerol (CBG) und andere), Behandlungstyp (Expektorans, Antiviral, Analgetikum, Aphrodisiakum, Psychedelikum und andere), Verabreichungsweg (orale Lösungen und Kapseln, Rauchen, Verdampfer, topische Mittel und andere), Endverbraucher (Pharmaindustrie, Forschungs- und Entwicklungszentren, häusliche Pflege, Krankenhaus, Reha-Zentren und andere), Vertriebskanal (B2B und B2C) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

MediPharm Labs Inc., Tilray, Aurora Cannabis, JAZZ Pharmaceuticals Inc. (GW Pharmaceuticals plc), HEXO Corp. (Zenabis North America Ltd), Cresco Labs, Peace Naturals Project Inc., CANOPY GROWTH CORPORATION, Medical Marijuana, Inc., Seed Cellar, EcoGen Biosciences, CANNABIS SEEDS USA, Seeds For Me, HUMBOLDT SEED COMPANY, Extractas, World Class Cannabis Seeds (Crop King Seeds), BARNEY'S FARM, FOLIUM BIOSCIENCES, PharmaHemp, Elixinol North America Limited, ENDOCA, Harmony, MARY'S nutritionals, LLC, Pure Ratios, Greenwich Biosciences, Inc., Upstate Elevator Supply Co., Apothecanna, BOL Pharma und IDT Australia unter anderem |

Marktdefinition

Cannabis ist eine psychoaktive Droge, die aus der Cannabispflanze der Familie der Hanfgewächse gewonnen wird. Seit mehreren Jahren wird es medizinisch verwendet und hat ein breites Anwendungsspektrum bei der Behandlung verschiedener Krankheiten, darunter chronische Schmerzen, Krebs, Depressionen, Diabetes, Arthritis, Glaukom, Epilepsie, Migräne, AIDS und Alzheimer.

Der zunehmende medizinische Einsatz von Cannabis, die kontrollierte Legalisierung und Verwendung von Cannabis in verschiedenen Branchen sowie die in diesem Bereich eingesetzten fortschrittlichen Methoden sind einige der Faktoren, die voraussichtlich das Marktwachstum vorantreiben werden.

Dynamik des nordamerikanischen Marktes für medizinisches Cannabis

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Vermehrter Einsatz von Cannabis in Medikamenten

Medizinisches Cannabis wird aus Cannabispflanzen gewonnen und kann zur Behandlung der Symptome bestimmter Erkrankungen sowie der Nebenwirkungen einiger Behandlungen eingesetzt werden. Die häufigste Form der medizinischen Verwendung von Cannabis ist die Schmerzbehandlung. Mit der wachsenden Zahl von Ländern, die die Verwendung von Cannabis für verschiedene Indikationen legalisiert haben, hat die Akzeptanz und Verwendung von medizinischem Cannabis allmählich zugenommen. Medizinisches Cannabis wurde von der FDA für drei Indikationen zugelassen: seltene und schwere Formen der Epilepsie, das Dravet-Syndrom und das Lennox-Gastaut-Syndrom sowie zur Behandlung der Spastik bei Multipler Sklerose (MS).

Bei medizinischem Marihuana werden die Marihuanapflanze oder die darin enthaltenen Chemikalien zur Behandlung von Krankheiten oder Beschwerden verwendet. Abgesehen von den zugelassenen Medikamenten besteht ein zunehmendes Interesse an zwei Cannabinoiden, nämlich Delta-9-Tetrahydrocannabinol und Cannabidiol. Tetrahydrocannabinol steigert nachweislich den Appetit, minimiert Müdigkeit und behandelt Muskelfunktionsstörungen, während Cannabidiol bei der Behandlung epileptischer Anfälle, der Heilung psychischer Erkrankungen und der Verringerung von Entzündungen wirksam ist.

- Legalisierung von Cannabis

Die Verwendung und Akzeptanz von medizinischem Cannabis entwickeln sich weiter, da immer mehr Staaten die Verwendung für bestimmte medizinische Indikationen erlauben. Viele Länder haben Marihuana entweder für medizinische oder Freizeitzwecke legalisiert, während andere Länder die Verwendung eingeschränkt haben. In den letzten Jahren haben immer mehr Staaten in den USA die Droge für medizinische oder Freizeitzwecke legalisiert. Mit der weit verbreiteten Legalisierung von Cannabis werden auch viele Unternehmen proaktiv und ergreifen Initiativen zur vollständigen Legalisierung von Cannabis.

Die Legalisierung von Marihuana in verschiedenen Teilen der Welt kann als Versuch gesehen werden, zusätzliche Einnahmen zu erzielen. Auf diese Weise werden die Einnahmen gesteigert, ohne dass die Steuern erhöht werden müssen. Die Legalisierung von Cannabis wird einen höheren Konsum zu medizinischen oder Freizeitzwecken ermöglichen. Darüber hinaus wird sie auch das Cannabisgeschäft ankurbeln und so die Nachfrage nach Cannabis steigern. Daher wird erwartet, dass die Legalisierung von Cannabis das Marktwachstum ankurbelt.

Gelegenheiten

- Neuartige Produktentwicklung mit zunehmenden F&E-Aktivitäten

Medizinisches Cannabis gibt es in vielen verschiedenen Formen, darunter Kapseln, Kaugummi, Cremes, Kristalle, Blüten, Lutschtabletten, Öl und Mundschleimhautsprays. Das starke Wachstum der Nachfrage nach Cannabis mit der Legalisierung hat die Notwendigkeit erhöht, bessere Produktsorten und Verabreichungssysteme zu entwickeln. Dies hat viele Unternehmen dazu veranlasst, Forschungs- und Entwicklungsaktivitäten durchzuführen, um die genetischen Verbesserungsstrategien für Cannabis zu prüfen. Das Cannabis Product Committee (CPC) der FDA entwickelt und implementiert behördenübergreifende Strategien und Richtlinien zur Regulierung von Cannabisprodukten. Die neuen Produkte, die entwickelt werden und auf dem Vormarsch sind, sind Hanfproteinpulver, Energieriegel, Hanfmilch, Hanfmehl und Hanftee, von denen erwartet wird, dass sie Möglichkeiten für Marktwachstum schaffen.

- Zunehmender Konsum von Cannabis zu Freizeitzwecken

Die Legalisierung von Freizeitmarihuana führt zu einer hilfreichen Regulierung einer sicheren Droge, ohne die potenziellen negativen Folgen zu erhöhen. Die Legalisierung von Marihuana hat verschiedene gesellschaftliche Vorteile, wie z. B. einen Wirtschaftsanstieg ohne Steuererhöhungen, die Schaffung von Tausenden von Arbeitsplätzen, die Beseitigung der Rassenunterschiede bei der Durchsetzung von Marihuanagesetzen und die Freisetzung knapper Polizeiressourcen. Legales Freizeitmarihuana kann die kostspielige Durchsetzung von Marihuanagesetzen beenden und den illegalen Marihuanamarkt schwächen.

Aufgrund dieser Vorteile wurde Marihuana legalisiert und wird zunehmend von Menschen unterschiedlicher Altersgruppen verwendet. Dies führt zu einer Nachfrage nach hochwertigem Marihuana für Spaß und Entspannung. Daher wird erwartet, dass die zunehmende Verwendung von Cannabis für Freizeitzwecke Chancen für Hersteller auf dem Markt schafft.

Einschränkung/Herausforderung

- Teure Anschaffungen und Jagd nach Premiumqualität

Die Herstellung und Anschaffung von medizinischen Cannabisgeräten kann teuer sein, und auch die Kosten für die Behandlung können aufgrund der erforderlichen Spezialausrüstung und Schulung hoch sein. Dies kann die Zugänglichkeit von medizinischen Cannabisbehandlungen für Patienten und Gesundheitseinrichtungen einschränken, insbesondere in Regionen mit niedrigerem Einkommen. Darüber hinaus können die hohen Kosten für medizinische Cannabisgeräte und -behandlungen einige Patienten davon abhalten, sich für diese Behandlungen zu entscheiden, insbesondere wenn sie diese aus eigener Tasche bezahlen müssen. Auch der Versicherungsschutz für medizinische Cannabisbehandlungen kann begrenzt sein, was ihre Akzeptanz einschränkt.

Infolgedessen können die hohen Kosten für medizinische Cannabisgeräte und -verfahren ein erhebliches Hindernis für das Marktwachstum darstellen, insbesondere in Regionen, in denen die Kosten ein wichtiger Faktor sind. Mit dem technologischen Fortschritt können die Kosten dieser Geräte und Verfahren jedoch sinken, sodass sie für Patienten und Gesundheitseinrichtungen erschwinglicher werden.

Die zunehmende Komplexität der medizinischen Cannabisgeräte und die hohen Kosten der medizinischen Cannabisbehandlung werden das Marktwachstum voraussichtlich bremsen.

Jüngste Entwicklung

- Im Mai 2018 wird mit dem Cannabis Act der kanadischen Regierung ein strenger Rechtsrahmen für die Kontrolle der Produktion, des Vertriebs, des Verkaufs und des Besitzes von Cannabis in ganz Kanada geschaffen. Ziel ist die Förderung einer robusten, legalen und regulierten Branche, die Cannabis von Jugendlichen fernhalten und Gewinne aus der Tasche der organisierten Kriminalität fernhalten soll.

Umfang des nordamerikanischen Marktes für medizinisches Cannabis

Der nordamerikanische Markt für medizinisches Cannabis ist in neun wichtige Segmente unterteilt, basierend auf Produkt, Quelle, Art, Derivaten, Anwendung, Verabreichungsweg, Behandlungsart, Endverbraucher und Vertriebskanal. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse der Marktwachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Produkt

- Öl

- Getrocknetes medizinisches Cannabis

- Medizinische Cannabiskapseln

- Vape-Stift

- Ganze Blüte

- Cremes & Feuchtigkeitscremes

- Bodenblume

- Pflaster

- Masken & Serum

- Reinigungsmittel

- Sonstiges

Auf der Grundlage des Produkts ist der Markt in Öl, medizinische Cannabiskapseln, Pflaster, ganze Blüten, gemahlene Blüten, Vape-Pen, getrocknetes medizinisches Cannabis, Cremes und Feuchtigkeitscremes, Masken und Seren, Reinigungsmittel und Sonstiges segmentiert .

Quelle

- Synthetik

- Natürlich

Auf Grundlage der Quelle wird der Markt in synthetische und natürliche Produkte segmentiert.

Spezies

- Cannabis Indica

- Sativa

- Hybrid

Auf der Grundlage der Arten ist der Markt in Cannabis Indica, Sativa und Hybrid segmentiert.

Derivate

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)/ Delta-8-Tetrahydrocannabinol

- Cannabigerol (CBG)

- Cannabichromen (CBC)

- Cannabinol (CBN)

- Cannabicyclol (CBL)

- Sonstiges

Auf der Grundlage von Derivaten ist der Markt in Cannabidiol (CBD), Tetrahydrocannabinol (THC)/Delta-8-Tetrahydrocannabinol, Cannabinol (CBN), Cannabicyclol (CBL), Cannabichromen (CBC), Cannabigerol (CBG) und andere unterteilt.

Anwendung

- Schmerztherapie

- Angst

- Muskelkrampf

- Brechreiz

- Appetitlosigkeit

- Essstörungen

- Entzündliche Darmerkrankungen

- Krebs

- Arthritis

- Wasting-Syndrom (Kachexie)

- Alzheimer-Krankheit

- Epilepsie

- Depression und Schlafstörungen

- Multiple Sklerose

- Autismus

- Psychische Erkrankungen

- Stimmung verbessern

- Sonstiges

Auf der Grundlage der Anwendung ist der Markt in Alzheimer-Krankheit, Appetitlosigkeit, Krebs, entzündliche Darmerkrankungen, Essstörungen, Epilepsie, Autismus, psychische Erkrankungen, Multiple Sklerose, Schmerzbehandlung, Übelkeit, Muskelkrämpfe, Auszehrungssyndrom (Kachexie), Stimmungsaufhellung, Multiple Sklerose, Depressionen und Schlafstörungen, Angstzustände und andere unterteilt.

Verabreichungsweg

- Orale Lösungen und Kapseln

- Rauchen

- Verdampfer

- Themen

- Sonstiges

Auf der Grundlage der Verabreichungsart ist der Markt in orale Lösungen und Kapseln, Rauchen, Verdampfer, topische Mittel und Sonstiges segmentiert.

Behandlungstyp

- Analgetikum

- Psychedelisch

- Virostatikum

- Aphrodisiakum

- Expektorans

- Sonstiges

Auf der Grundlage der Behandlungsart ist der Markt in Expektorantien, antivirale Mittel, Analgetika, Aphrodisiaka, Psychedelika und andere unterteilt.

Endbenutzer

- Häusliche Pflege

- Krankenhaus

- Reha-Zentren

- Pharmazeutische Industrie

- Forschungs- und Entwicklungszentren

- Sonstiges

Auf der Grundlage des Endverbrauchers ist der Markt in die Pharmaindustrie, Forschungs- und Entwicklungszentren, Einrichtungen der häuslichen Pflege, Krankenhäuser, Reha-Zentren und andere segmentiert.

Vertriebskanal

- B2B

- B2C

Auf der Grundlage des Vertriebskanals ist der Markt in B2B und B2C segmentiert.

Regionale Analyse/Einblicke zum nordamerikanischen Markt für medizinisches Cannabis

Der nordamerikanische Markt für medizinisches Cannabis ist in neun wichtige Segmente unterteilt, basierend auf Produkt, Quelle, Art, Derivaten, Anwendung, Verabreichungsweg, Behandlungsart, Endverbraucher und Vertriebskanal.

Die in diesem Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko.

Aufgrund der Legalisierung des medizinischen Cannabiskonsums wird erwartet, dass die USA den nordamerikanischen Markt für medizinisches Cannabis dominieren werden.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Medical Cannabis Market Share Analysis

The North America medical cannabis market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, regional presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the major market players operating in this market are MediPharm Labs Inc., Tilray, Aurora Cannabis, JAZZ Pharmaceuticals Inc. (GW Pharmaceuticals plc), HEXO Corp. (Zenabis North America Ltd), Cresco Labs, Peace Naturals Project Inc., CANOPY GROWTH CORPORATION, Medical Marijuana, Inc., Seed Cellar, EcoGen Biosciences, CANNABIS SEEDS USA, Seeds For Me, HUMBOLDT SEED COMPANY, Extractas, World Class Cannabis Seeds (Crop King Seeds), BARNEY'S FARM, FOLIUM BIOSCIENCES, PharmaHemp, Elixinol North America Limited, ENDOCA, Harmony, MARY’S nutritionals, LLC, Pure Ratios, Greenwich Biosciences, Inc., Upstate Elevator Supply Co., Apothecanna, BOL Pharma, and IDT Australia among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA MEDICAL CANNABIS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 INDUSTRY INSIGHTS

5.1 INDUSTRY INSIGHTS PATENT ANALYSIS

5.2 DRUG TREATMENT RATE BY MATURED MARKETS

5.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

5.4 PATIENT FLOW DIAGRAM

5.5 KEY PRICING STRATEGIES

5.6 KEY PATIENT ENROLLMENT STRATEGIES

6 REGULATORY SCENARIO

6.1 U.S.

6.2 CANADA

6.3 MEXICO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASED USE OF CANNABIS IN MEDICINES

7.1.2 LEGALIZATION OF CANNABIS

7.1.3 STRATEGIC INITIATIVES TAKEN BY KEY PLAYERS

7.1.4 RISE IN THE PREVALENCE OF DISEASES THAT REQUIRE THE USE OF CANNABIS

7.2 RESTRAINTS

7.2.1 COMPLEX REGULATORY STRUCTURE FOR THE USAGE OF CANNABIS

7.2.2 ADVERSE EFFECTS DUE TO LONG-TERM USE

7.2.3 HIGH-COST PURCHASING AND RUSH FOR PREMIUM QUALITY

7.3 OPPORTUNITIES

7.3.1 NOVEL PRODUCT DEVELOPMENT WITH INCREASING R&D ACTIVITIES

7.3.2 INCREASED ADOPTION OF CANNABIS FOR RECREATIONAL PURPOSES

7.3.3 GROWING GERIATRIC POPULATION

7.4 CHALLENGES

7.4.1 RISE OF THE CANNABIS BLACK MARKET

7.4.2 SIDE EFFECTS RELATED TO THE USE OF CANNABIS

7.4.3 SHORTAGE OF SKILLED PERSONNEL

8 NORTH AMERICA MEDICAL CANNABIS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 OIL

8.2.1 OIL, BY TYPE

8.2.1.1 CBD OIL CONCENTRATES

8.2.1.2 CBD VAPE OIL

8.2.1.3 CBD TINCTURES

8.2.2 OIL, BY SOURCE

8.2.2.1 HEMP BASED

8.2.2.2 MARIJUANA BASED

8.2.3 OIL, BY SPECIES

8.2.3.1 SATIVA

8.2.3.2 HYBRID

8.2.3.3 CANNABIS INDICA

8.2.4 OIL, BY PRODUCT TYPE

8.2.4.1 BRANDED

8.2.4.1.1 PENGUIN CBD OIL

8.2.4.1.2 FAB CBD OIL

8.2.4.1.3 GREEN ROADS BROAD SPECTRUM CBD OIL

8.2.4.1.4 OTHERS

8.2.4.2 GENERIC

8.3 DRIED MEDICAL CANNABIS

8.3.1 CANNABIS INDICA

8.3.2 SATIVA

8.3.3 HYBRID

8.4 MEDICAL CANNABIS CAPSULES

8.4.1 MEDICAL CANNABIS CAPSULES, BY TYPE

8.4.1.1 OIL BASED CANNABIS CAPSULES

8.4.1.2 POWDER BASED CANNABIS CAPSULES

8.4.1.3 LIQUID BASED CANNABIS CAPSULES

8.4.1.4 OTHERS

8.4.2 MEDICAL CANNABIS CAPSULES, BY CONCENTRATES

8.4.2.1 HIGH CBD CAPSULES DIGITAL

8.4.2.2 HIGH THC CAPSULE

8.4.2.3 THC/CBD BALANCED CAPSULE

8.4.2.4 CBD ISOLATE CAPSULE

8.4.3 MEDICAL CANNABIS CAPSULES, BY SPECIES

8.4.3.1 SATIVA

8.4.3.2 CANNABIS INDICA

8.4.4 MEDICAL CANNABIS CAPSULES, BY PRODUCT TYPE

8.4.4.1 BRANDED

8.4.4.1.1 JOY NUTRITION

8.4.4.1.2 MEDTERRA ISOLATE CBD GEL CAPSULES

8.4.4.1.3 LAZARUS NATURALS

8.4.4.1.4 OTHERS

8.4.4.2 GENERIC

8.5 VAPE PEN

8.5.1 VAPE PEN, BY SPECIES

8.5.1.1 SATIVA

8.5.1.2 HYBRID

8.5.1.3 CANNABIS INDICA

8.5.2 VAPE PEN, BY PRODUCT TYPE

8.5.2.1 BRANDED

8.5.2.1.1 KANDYPENS RUBI

8.5.2.1.2 SOL E-NECTAR COLLECTOR

8.5.2.1.3 PAX ERA PRO-OIL VAPE PEN

8.5.2.2 GENERIC

8.6 WHOLE FLOWER

8.6.1 WHOLE FLOWER, SPECIES

8.6.1.1 SATIVA

8.6.1.2 HYBRID

8.6.1.3 CANNABIS INDICA

8.6.2 WHOLE FLOWER, PRODUCT TYPE

8.6.2.1 BRANDED

8.6.2.1.1 ASTER FARMS

8.6.2.1.2 RA FLOWER

8.6.2.1.3 BAD APPLE

8.6.2.2 GENERIC

8.7 CREAMS & MOISTURIZER

8.7.1 CREAMS & MOISTURIZER, BY SPECIES

8.7.1.1 SATIVA

8.7.1.2 HYBRID

8.7.1.3 CANNABIS INDICA

8.7.2 CREAMS & MOISTURIZER, BY PRODUCT TYPE

8.7.2.1 BRANDED

8.7.2.1.1 CBDFX MUSCLE & JOINT

8.7.2.1.2 ASPEN GREEN MUSCLE RELIEF COOLING CREAM

8.7.2.1.3 MEDTERRA PAIN CREAM

8.7.2.2 GENERIC

8.8 GROUND FLOWER

8.8.1 GROUND FLOWER, BY SPECIES

8.8.1.1 SATIVA

8.8.1.2 HYBRID

8.8.1.3 CANNABIS INDICA

8.8.2 GROUND FLOWER, BY PRODUCT TYPE

8.8.2.1 BRANDED

8.8.2.1.1 ASTER FARMS

8.8.2.1.2 RA FLOWER

8.8.2.1.3 BAD APPLE

8.8.2.2 GENERIC

8.9 PATCH

8.9.1 PATCH, BY TYPE

8.9.1.1 RESERVOIR

8.9.1.2 LAYER DRUG-IN-ADHESIVE

8.9.1.3 OTHERS

8.9.2 PATCH, BY SPECIES

8.9.2.1 SATIVA

8.9.2.2 CANNABIS INDICA

8.9.2.3 HYBRID

8.9.3 PATCH, BY PRODUCT TYPE

8.9.3.1 BRANDED

8.9.3.1.1 HEMP BOMBS

8.9.3.1.2 PUREKANA

8.9.3.1.3 PURE RATIOS

8.9.3.1.4 RESERVOIR

8.9.3.2 GENERIC

8.1 MASKS & SERUM

8.10.1 MASKS & SERUM, BY SPECIES

8.10.1.1 SATIVA

8.10.1.2 CANNABIS INDICA

8.10.1.3 HYBRID

8.10.2 MASKS & SERUM, BY PRODUCT TYPE

8.10.2.1 BRANDED

8.10.2.1.1 BUMP & SMOOTH CBD

8.10.2.1.2 FACIAL ESSENCE

8.10.2.1.3 OTHERS

8.10.2.2 GENERIC

8.11 CLEANSER

8.11.1 CLEANSER, BY SPECIES

8.11.1.1 SATIVA

8.11.1.2 HYBRID

8.11.1.3 CANNABIS INDICA

8.11.2 CLEANSER, BY PRODUCT TYPE

8.11.2.1 BRANDED

8.11.2.1.1 KIEHL’S

8.11.2.1.2 CBD 101

8.11.2.1.3 OTHERS

8.11.2.2 GENERIC

8.12 OTHERS

9 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES

9.1 OVERVIEW

9.2 SATIVA

9.3 HYBRID

9.4 CANNABIS INDICA

10 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES

10.1 OVERVIEW

10.2 CANNABIDIOL (CBD)

10.3 TETRAHYDROCANNABINOL (THC)/DELTA-8-TETRAHYDROCANNABINOL

10.4 CANNABIGEROL (CBG)

10.5 CANNABICHROMENE (CBC)

10.6 CANNABINOL (CBN)

10.7 CANNABICYCLOL (CBL)

10.8 OTHERS

11 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 PAIN MANAGEMENT

11.2.1 PAIN MANAGEMENT, BY TYPE

11.2.1.1 CHRONIC PAIN

11.2.1.2 NON-CANCER CHRONIC PAIN

11.2.1.3 NEUROLOGICAL PAIN

11.2.2 PAIN MANAGEMENT, BY PRODUCT

11.2.2.1 OIL

11.2.2.2 DRIED MEDICAL CANNABIS

11.2.2.3 MEDICAL CANNABIS CAPSULES

11.2.2.4 PATCH

11.2.2.5 GROUND FLOWER

11.2.2.6 CREAMS & MOISTURIZER

11.2.2.7 VAPE PEN

11.2.2.8 WHOLE FLOWER

11.2.2.9 MASKS & SERUM

11.2.2.10 CLEANSER

11.2.2.11 OTHERS

11.3 ANXIETY

11.3.1 OIL

11.3.2 DRIED MEDICAL CANNABIS

11.3.3 MEDICAL CANNABIS CAPSULES

11.3.4 PATCH

11.3.5 GROUND FLOWER

11.3.6 CREAMS & MOISTURIZER

11.3.7 VAPE PEN

11.3.8 WHOLE FLOWER

11.3.9 MASKS & SERUM

11.3.10 CLEANSER

11.3.11 OTHERS

11.4 MUSCLE SPASM

11.4.1 OIL

11.4.2 DRIED MEDICAL CANNABIS

11.4.3 MEDICAL CANNABIS CAPSULES

11.4.4 PATCH

11.4.5 GROUND FLOWER

11.4.6 CREAMS & MOISTURIZER

11.4.7 VAPE PEN

11.4.8 WHOLE FLOWER

11.4.9 MASKS & SERUM

11.4.10 CLEANSER

11.4.11 OTHERS

11.5 NAUSEA

11.5.1 OIL

11.5.2 DRIED MEDICAL CANNABIS

11.5.3 MEDICAL CANNABIS CAPSULES

11.5.4 PATCH

11.5.5 GROUND FLOWER

11.5.6 CREAMS & MOISTURIZER

11.5.7 VAPE PEN

11.5.8 WHOLE FLOWER

11.5.9 MASKS & SERUM

11.5.10 CLEANSER

11.5.11 OTHERS

11.6 APPETITE LOSS

11.6.1 OIL

11.6.2 DRIED MEDICAL CANNABIS

11.6.3 MEDICAL CANNABIS CAPSULES

11.6.4 PATCH

11.6.5 GROUND FLOWER

11.6.6 CREAMS & MOISTURIZER

11.6.7 VAPE PEN

11.6.8 WHOLE FLOWER

11.6.9 MASKS & SERUM

11.6.10 CLEANSER

11.6.11 OTHERS

11.7 EATING DISORDERS

11.7.1 OIL

11.7.2 DRIED MEDICAL CANNABIS

11.7.3 MEDICAL CANNABIS CAPSULES

11.7.4 PATCH

11.7.5 GROUND FLOWER

11.7.6 CREAMS & MOISTURIZER

11.7.7 VAPE PEN

11.7.8 WHOLE FLOWER

11.7.9 MASKS & SERUM

11.7.10 CLEANSER

11.7.11 OTHERS

11.8 INFLAMMATORY BOWEL DISEASES

11.8.1 OIL

11.8.2 DRIED MEDICAL CANNABIS

11.8.3 MEDICAL CANNABIS CAPSULES

11.8.4 PATCH

11.8.5 GROUND FLOWER

11.8.6 CREAMS & MOISTURIZER

11.8.7 VAPE PEN

11.8.8 WHOLE FLOWER

11.8.9 MASKS & SERUM

11.8.10 CLEANSER

11.8.11 OTHERS

11.9 CANCER

11.9.1 OIL

11.9.2 DRIED MEDICAL CANNABIS

11.9.3 MEDICAL CANNABIS CAPSULES

11.9.4 PATCH

11.9.5 GROUND FLOWER

11.9.6 CREAMS & MOISTURIZER

11.9.7 VAPE PEN

11.9.8 WHOLE FLOWER

11.9.9 MASKS & SERUM

11.9.10 CLEANSER

11.9.11 OTHERS

11.1 ARTHRITIS

11.10.1 OIL

11.10.2 DRIED MEDICAL CANNABIS

11.10.3 MEDICAL CANNABIS CAPSULES

11.10.4 PATCH

11.10.5 GROUND FLOWER

11.10.6 CREAMS & MOISTURIZER

11.10.7 VAPE PEN

11.10.8 WHOLE FLOWER

11.10.9 MASKS & SERUM

11.10.10 CLEANSER

11.10.11 OTHERS

11.11 WASHING SYNDROME (CACHEXIA)

11.11.1 OIL

11.11.2 DRIED MEDICAL CANNABIS

11.11.3 MEDICAL CANNABIS CAPSULES

11.11.4 PATCH

11.11.5 GROUND FLOWER

11.11.6 CREAMS & MOISTURIZER

11.11.7 VAPE PEN

11.11.8 WHOLE FLOWER

11.11.9 MASKS & SERUM

11.11.10 CLEANSER

11.11.11 OTHERS

11.12 ALZHEIMER’S DISEASE

11.12.1 OIL

11.12.2 DRIED MEDICAL CANNABIS

11.12.3 MEDICAL CANNABIS CAPSULES

11.12.4 PATCH

11.12.5 GROUND FLOWER

11.12.6 CREAMS & MOISTURIZER

11.12.7 VAPE PEN

11.12.8 WHOLE FLOWER

11.12.9 MASKS & SERUM

11.12.10 CLEANSER

11.12.11 OTHERS

11.13 EPILEPSY

11.13.1 OIL

11.13.2 DRIED MEDICAL CANNABIS

11.13.3 MEDICAL CANNABIS CAPSULES

11.13.4 PATCH

11.13.5 GROUND FLOWER

11.13.6 CREAMS & MOISTURIZER

11.13.7 VAPE PEN

11.13.8 WHOLE FLOWER

11.13.9 MASKS & SERUM

11.13.10 CLEANSER

11.13.11 OTHERS

11.14 DEPRESSION AND SLEEP DISORDER

11.14.1 OIL

11.14.2 DRIED MEDICAL CANNABIS

11.14.3 MEDICAL CANNABIS CAPSULES

11.14.4 PATCH

11.14.5 GROUND FLOWER

11.14.6 CREAMS & MOISTURIZER

11.14.7 VAPE PEN

11.14.8 WHOLE FLOWER

11.14.9 MASKS & SERUM

11.14.10 CLEANSER

11.14.11 OTHERS

11.15 MULTIPLE SCLEROSIS

11.15.1 OIL

11.15.2 DRIED MEDICAL CANNABIS

11.15.3 MEDICAL CANNABIS CAPSULES

11.15.4 PATCH

11.15.5 GROUND FLOWER

11.15.6 CREAMS & MOISTURIZER

11.15.7 VAPE PEN

11.15.8 WHOLE FLOWER

11.15.9 MASKS & SERUM

11.15.10 CLEANSER

11.15.11 OTHERS

11.16 AUTISM

11.16.1 OIL

11.16.2 DRIED MEDICAL CANNABIS

11.16.3 MEDICAL CANNABIS CAPSULES

11.16.4 PATCH

11.16.5 GROUND FLOWER

11.16.6 CREAMS & MOISTURIZER

11.16.7 VAPE PEN

11.16.8 WHOLE FLOWER

11.16.9 MASKS & SERUM

11.16.10 CLEANSER

11.16.11 OTHERS

11.17 MENTAL HEALTH CONDITIONS

11.17.1 MENTAL HEALTH CONDITIONS, BY TYPE

11.17.1.1 POSTTRAUMATIC STRESS DISORDER (PTSD)

11.17.1.2 SCHIZOPHRENIA

11.17.1.3 OTHERS

11.17.2 MENTAL HEALTH CONDITIONS, BY TYPE

11.17.2.1 OIL

11.17.2.2 DRIED MEDICAL CANNABIS

11.17.2.3 MEDICAL CANNABIS CAPSULES

11.17.2.4 PATCH

11.17.2.5 GROUND FLOWER

11.17.2.6 CREAMS & MOISTURIZER

11.17.2.7 VAPE PEN

11.17.2.8 WHOLE FLOWER

11.17.2.9 MASKS & SERUM

11.17.2.10 CLEANSER

11.17.2.11 OTHERS

11.18 ELEVATE MOOD

11.18.1 OIL

11.18.2 DRIED MEDICAL CANNABIS

11.18.3 MEDICAL CANNABIS CAPSULES

11.18.4 PATCH

11.18.5 GROUND FLOWER

11.18.6 CREAMS & MOISTURIZER

11.18.7 VAPE PEN

11.18.8 WHOLE FLOWER

11.18.9 MASKS & SERUM

11.18.10 CLEANSER

11.18.11 OTHERS

11.19 OTHERS

12 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION

12.1 OVERVIEW

12.2 ORAL SOLUTIONS AND CAPSULES

12.3 SMOKING

12.4 TOPICALS

12.5 VAPORIZERS

12.6 OTHERS

13 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE

13.1 OVERVIEW

13.2 ANALGESIC

13.3 PSYCHEDELIC

13.4 ANTIVIRAL

13.5 APHRODISIAC

13.6 EXPECTORANT

13.7 OTHERS

14 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER

14.1 OVERVIEW

14.2 HOMECARE SETTING

14.3 HOSPITAL

14.4 REHAB CENTERS

14.5 PHARMACEUTICAL INDUSTRY

14.6 RESEARCH AND DEVELOPMENT CENTERS

14.7 OTHERS

15 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 B2C

15.2.1 PHARMACIES

15.2.2 CONVENTIONAL STORES

15.2.3 ONLINE STORES

15.2.4 OTHERS

15.3 B2B

16 NORTH AMERICA MEDICAL CANNABIS MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA MEDICAL CANNABIS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 COMPANY PROFILE

18.1 MEDIPHARM LABS INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TILRAY

18.2.1 COMPANY SNAPSHOT

18.2.2 COMPANY SHARE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 AURORA CANNABIS

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 JAZZ PHARMACEUTICALS INC. (GW PHARMACEUTICALS PLC)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HEXO CORP. (ZENABIS NORTH AMERICA LTD)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 APOTHECANNA

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BOL PHARMA

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 BARNEY’S FARM

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CANOPY GROWTH CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 CANNABIS SEEDS USA

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 CRESCO LABS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ECOGEN BIOSCIENCES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 ELIXINOL NORTH AMERICA LIMITED

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 ENDOCA

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 EXTRACTAS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 FOLIUM BIOSCIENCES

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 GREENWICH BIOSCIENCES, INC.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 HARMONY

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 HUMBOLDT SEED COMPANY

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 IDT AUSTRALIA

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT DEVELOPMENTS

18.21 MARY’S NUTRITIONALS, LLC

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 MEDICAL MARIJUANA, INC.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENTS

18.23 PEACE NATURALS PROJECT INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 PHARMAHEMP

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 PURE RATIOS

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

18.26 SEEDS FOR ME

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 SEED CELLAR

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 UPSTATE ELEVATOR SUPPLY CO.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENT

18.29 WORLD CLASS CANNABIS SEEDS (CROP KING SEEDS)

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SATIVA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA HYBRID IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CANNABIS INDICA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA CANNABIDIOL (CBD) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA TETRAHYDROCANNABINOL (THC)/DELTA-8-TETRAHYDROCANNABINOL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CANNABIGEROL (CBG) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CANNABICHROMENE (CBC) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA CANNABINOL (CBN) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA CANNABICYCLOL (CBL) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA WASHING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA WASHING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA ALZHEIMER’S DISEASE IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA ALZHEIMER’S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA ORAL SOLUTIONS AND CAPSULES IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA SMOKING IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA TOPICALS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA VAPORIZERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA ANALGESIC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA PSYCHEDELIC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA ANTIVIRAL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA APHRODISIAC IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA EXPECTORANT IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA HOMECARE SETTING IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA HOSPITAL IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA REHAB CENTERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA PHARMACEUTICAL INDUSTRY IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA RESEARCH AND DEVELOPMENT CENTERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA OTHERS IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA B2B IN MEDICAL CANNABIS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA MEDICAL CANNABIS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 143 NORTH AMERICA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 145 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 147 NORTH AMERICA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 149 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 151 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 153 NORTH AMERICA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 155 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 157 NORTH AMERICA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 159 NORTH AMERICA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 NORTH AMERICA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 163 NORTH AMERICA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 165 NORTH AMERICA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 167 NORTH AMERICA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 169 NORTH AMERICA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 171 NORTH AMERICA ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 173 NORTH AMERICA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 175 NORTH AMERICA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 178 NORTH AMERICA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 179 NORTH AMERICA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 181 NORTH AMERICA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 183 NORTH AMERICA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 184 U.S. MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 185 U.S. OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 187 U.S. OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 188 U.S. OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 189 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 190 U.S. DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 191 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 192 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 193 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 194 U.S. MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 195 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 196 U.S. VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 197 U.S. VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 198 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 199 U.S. WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 200 U.S. WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 201 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 202 U.S. CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 203 U.S. CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 205 U.S. GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 206 U.S. GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 207 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 208 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 210 U.S. PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 211 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 212 U.S. MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 213 U.S. MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 214 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 215 U.S. CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 216 U.S. CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 217 U.S. BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 U.S. MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 219 U.S. SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 220 U.S. MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 221 U.S. MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 222 U.S. MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 223 U.S. PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 U.S. PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 225 U.S. ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 226 U.S. MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 227 U.S. NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 228 U.S. APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 229 U.S. EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 230 U.S. INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 U.S. CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 232 U.S. ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 233 U.S. WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 234 U.S. ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 235 U.S. EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 236 U.S. DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 237 U.S. MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 238 U.S. AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 239 U.S. MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 241 U.S. ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 242 U.S. MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 243 U.S. MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 245 U.S. MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 246 U.S. B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 247 CANADA MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 248 CANADA OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 CANADA OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 250 CANADA OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 251 CANADA OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 252 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 254 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 256 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 257 CANADA MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 259 CANADA VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 260 CANADA VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 262 CANADA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 263 CANADA WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 264 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 265 CANADA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 266 CANADA CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 267 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 268 CANADA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 269 CANADA GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 270 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 271 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 273 CANADA PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 274 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 275 CANADA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 276 CANADA MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 277 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 278 CANADA CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 279 CANADA CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 280 CANADA BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 281 CANADA MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 282 CANADA SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 283 CANADA MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 284 CANADA MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 285 CANADA MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 286 CANADA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 287 CANADA PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 288 CANADA ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 289 CANADA MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 290 CANADA NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 291 CANADA APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 292 CANADA EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 293 CANADA INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 294 CANADA CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 295 CANADA ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 296 CANADA WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 297 CANADA ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 298 CANADA EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 299 CANADA DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 300 CANADA MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 CANADA AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 302 CANADA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 CANADA MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 304 CANADA ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 305 CANADA MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 306 CANADA MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 307 CANADA MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 308 CANADA MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 309 CANADA B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 310 MEXICO MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 311 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 312 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 313 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 314 MEXICO OIL IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 315 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 316 MEXICO DRIED MEDICAL CANNABIS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 317 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 318 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY CONCENTRATES, 2021-2030 (USD MILLION)

TABLE 319 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 320 MEXICO MEDICAL CANNABIS CAPSULES IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 321 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 322 MEXICO VAPE PEN IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 323 MEXICO VAPE PEN IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 325 MEXICO WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 326 MEXICO WHOLE FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 327 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 328 MEXICO CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 329 MEXICO CREAMS & MOISTURIZER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 330 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 331 MEXICO GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 332 MEXICO GROUND FLOWER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 333 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 334 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 335 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 336 MEXICO PATCH IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 337 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 338 MEXICO MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 339 MEXICO MASKS & SERUM IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 340 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 341 MEXICO CLEANSER IN MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 342 MEXICO CLEANSER IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 343 MEXICO BRANDED IN MEDICAL CANNABIS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 344 MEXICO MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 345 MEXICO SYNTHETIC IN MEDICAL CANNABIS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 346 MEXICO MEDICAL CANNABIS MARKET, BY SPECIES, 2021-2030 (USD MILLION)

TABLE 347 MEXICO MEDICAL CANNABIS MARKET, BY DERIVATIVES, 2021-2030 (USD MILLION)

TABLE 348 MEXICO MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 349 MEXICO PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 350 MEXICO PAIN MANAGEMENT IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 351 MEXICO ANXIETY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 MEXICO MUSCLE SPASM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 353 MEXICO NAUSEA IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 354 MEXICO APPETITE LOSS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 355 MEXICO EATING DISORDERS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 356 MEXICO INFLAMMATORY BOWEL DISEASES IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 357 MEXICO CANCER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 358 MEXICO ARTHRITIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 359 MEXICO WASTING SYNDROME (CACHEXIA) IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 360 MEXICO ALZHEIMER'S DISEASE IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 361 MEXICO EPILEPSY IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 362 MEXICO DEPRESSION AND SLEEP DISORDER IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 363 MEXICO MULTIPLE SCLEROSIS IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 364 MEXICO AUTISM IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 365 MEXICO MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 366 MEXICO MENTAL HEALTH CONDITIONS IN MEDICAL CANNABIS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 367 MEXICO ELEVATE MOOD IN MEDICAL CANNABIS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 368 MEXICO MEDICAL CANNABIS MARKET, BY ROUTE OF ADMINISTRATION, 2021-2030 (USD MILLION)

TABLE 369 MEXICO MEDICAL CANNABIS MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 370 MEXICO MEDICAL CANNABIS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 371 MEXICO MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 372 MEXICO B2C IN MEDICAL CANNABIS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA MEDICAL CANNABIS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICAL CANNABIS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICAL CANNABIS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MEDICAL CANNABIS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICAL CANNABIS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICAL CANNABIS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICAL CANNABIS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MEDICAL CANNABIS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA MEDICAL CANNABIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICAL CANNABIS MARKET: SEGMENTATION

FIGURE 11 INCREASING MEDICINAL USE AND LEGALIZATION OF MEDICAL CANNABIS ARE EXPECTED TO DRIVE THE NORTH AMERICA MEDICAL CANNABIS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICAL CANNABIS MARKET IN 2023 AND 2030

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA MEDICAL CANNABIS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR MEDICAL CANNABIS MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MEDICAL CANNABIS MARKET

FIGURE 16 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, 2022

FIGURE 17 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 18 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA MEDICAL CANNABIS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, 2022

FIGURE 21 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, 2023-2030 (USD MILLION)

FIGURE 22 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA MEDICAL CANNABIS MARKET: BY SPECIES, LIFELINE CURVE

FIGURE 24 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, 2022

FIGURE 25 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, 2023-2030 (USD MILLION)

FIGURE 26 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DERIVATIVES, LIFELINE CURVE

FIGURE 28 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION, 2022

FIGURE 29 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION , 2023-2030 (USD MILLION)

FIGURE 30 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION , CAGR (2023-2030)

FIGURE 31 NORTH AMERICA MEDICAL CANNABIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, 2022

FIGURE 33 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, 2023-2030 (USD MILLION)

FIGURE 34 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA MEDICAL CANNABIS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA MEDICAL CANNABIS MARKET: BY TREATMENT TYPE, 2022

FIGURE 37 NORTH AMERICA MEDICAL CANNABIS MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 38 NORTH AMERICA MEDICAL CANNABIS MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 39 NORTH AMERICA MEDICAL CANNABIS MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 40 NORTH AMERICA MEDICAL CANNABIS MARKET: BY END USER, 2022

FIGURE 41 NORTH AMERICA MEDICAL CANNABIS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 42 NORTH AMERICA MEDICAL CANNABIS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 43 NORTH AMERICA MEDICAL CANNABIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 45 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 46 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 47 NORTH AMERICA MEDICAL CANNABIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 NORTH AMERICA MEDICAL CANNABIS MARKET: SNAPSHOT (2022)

FIGURE 49 NORTH AMERICA MEDICAL CANNABIS MARKET: BY COUNTRY (2022)