North America Liver Cancer Diagnostics Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4,031.47 Million

USD

6,707.57 Million

2022

2030

USD

4,031.47 Million

USD

6,707.57 Million

2022

2030

| 2023 –2030 | |

| USD 4,031.47 Million | |

| USD 6,707.57 Million | |

|

|

|

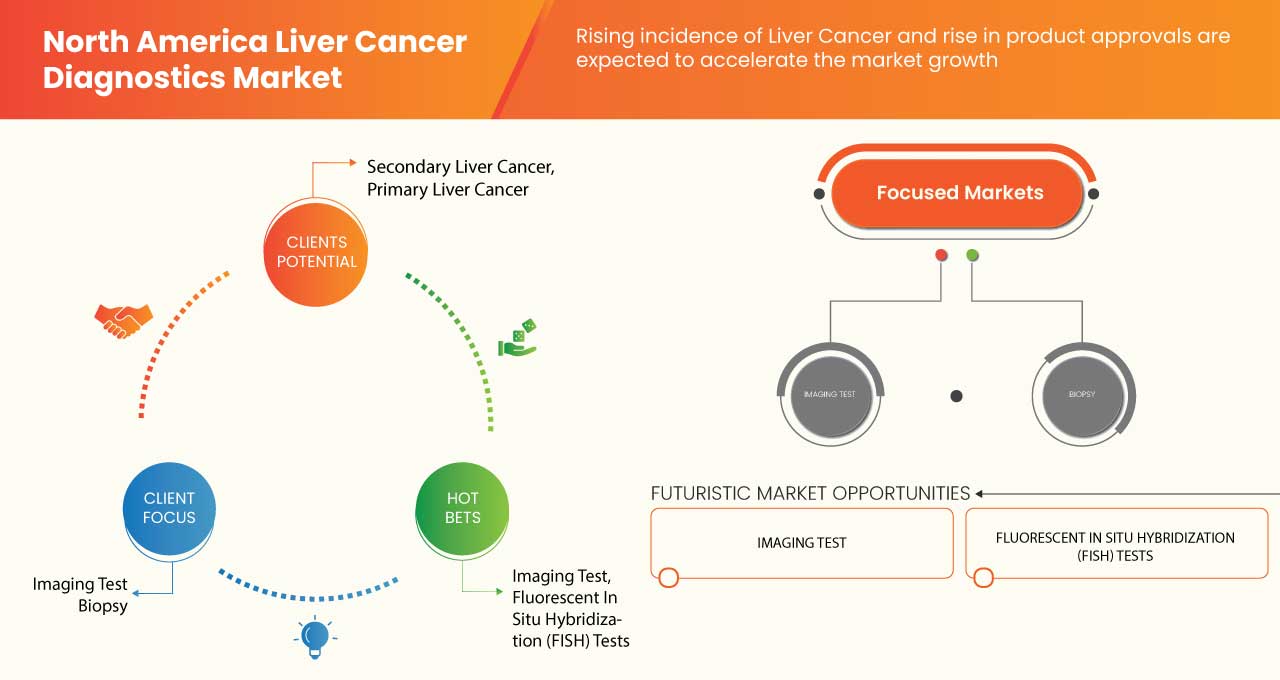

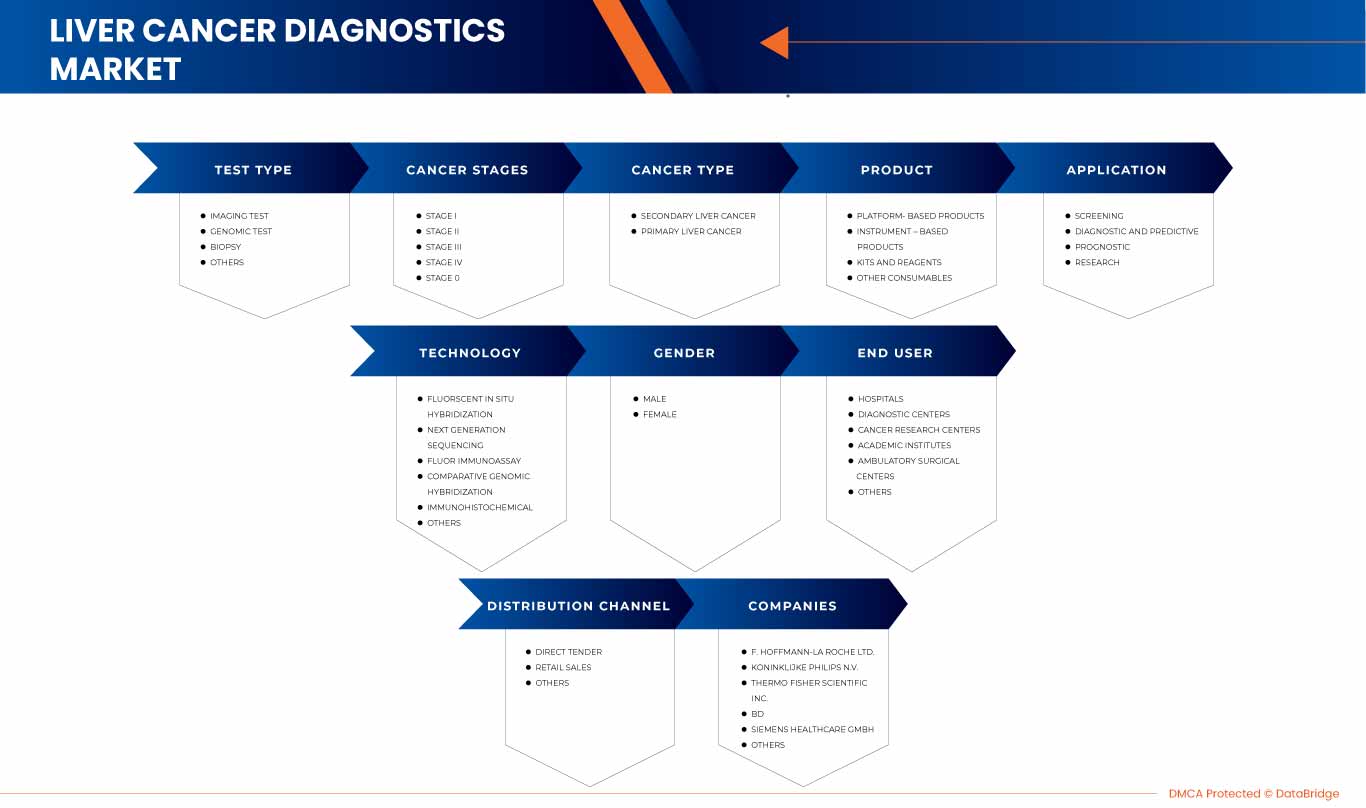

North America Liver Cancer Diagnostics Market, By Test Type (Imaging Test, Biopsy, Genomic Test, and Others), Cancer Stages (Stage 0, Stage I , Stage II, Stage III, and Stage IV), Cancer Type (Primary Liver Cancer and Secondary Liver Cancer), Product (Platform-Based Products, Instrument Based Products, Kits and Reagents, and Other Consumables), Technology (Fluorescent In Situ Hybridization, Next Generation Sequencing, Fluorimmunoassay, Comparative Genomic Hybridization, Immunohistochemical, and Others), Application (Screening, Diagnostic and Predictive, Prognostic, and Research), Gender (Female and Male), End-User (Hospitals, Diagnostic Centers, Cancer Research Centers, Academic Institutes, Ambulatory Surgical Centers, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others) - Industry Trends and Forecast to 2030.

North America Liver Cancer Diagnostics Market Analysis and Insights

North America liver cancer diagnostics market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in R&D activity for launching novel services in the market. The growing demand for better quality healthcare for liver cancer and rising preference for preventative health checkups is expected to boost the market’s growth.

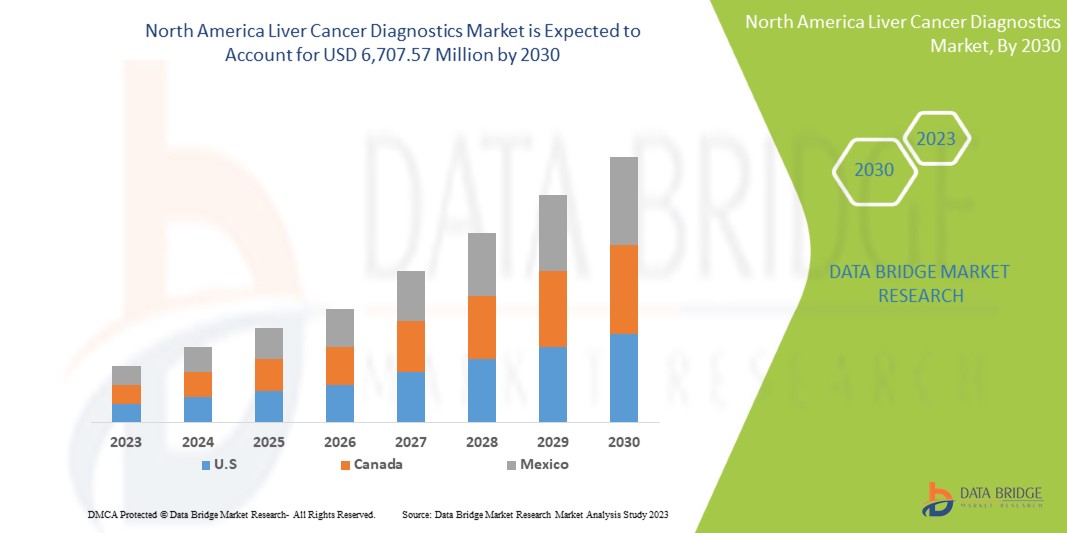

North America liver cancer diagnostics market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.6% in the forecast period of 2023 to 2030 and is expected to reach USD 6,707.57 Million by 2030 from USD 4,031.47 Million in 2022.

North America liver cancer diagnostics market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue impact solution to achieve your desired goal. The scalability and business expansion of the retail units in the developing countries of various regions and partnership with suppliers for the safe distribution of machine and drug products are the major drivers which propelled the demand of the market in the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Nach Testtyp (Bildgebung, Biopsie, Genomtest und andere), Krebsstadien (Stadium 0, Stadium I, Stadium II, Stadium III und Stadium IV), Krebsart (primärer Leberkrebs und sekundärer Leberkrebs), Produkt (plattformbasierte Produkte, instrumentenbasierte Produkte, Kits und Reagenzien und andere Verbrauchsmaterialien), Technologie (Fluoreszenz-in-situ-Hybridisierung, Sequenzierung der nächsten Generation, Fluorimmunoassay, vergleichende genomische Hybridisierung, immunhistochemisch und andere), Anwendung (Screening, Diagnose und Vorhersage, Prognose und Forschung), Geschlecht (weiblich und männlich), Endbenutzer (Krankenhäuser, Diagnosezentren, Krebsforschungszentren, akademische Institute, ambulante chirurgische Zentren und andere), Vertriebskanal (direkte Ausschreibung, Einzelhandelsverkauf und andere) |

|

Abgedeckte Länder |

USA, Kanada, Mexiko |

|

Abgedeckte Marktteilnehmer |

Siemens Healthcare GmbH (Deutschland), Koninklijke Philips NV (Niederlande), Agilent Technologies, Inc. (USA), Illumina, Inc. (USA), Epigenomics AG (Deutschland), Thermo Fisher Scientific Inc. (USA), QIAGEN (USA), F. Hoffmann-La Roche Ltd (Schweiz), Diagnostic Biosystems Inc. (USA), FUJIFILM Corporation (Japan), BD (USA), MOLGEN (Niederlande), BIOCEPT, INC. (USA), Sysmex Corporation (Japan), Elabscience Biotechnology Inc. (USA), Hipro Biotechnology Co., Ltd. (China), Altogen Biosystems (USA), ABK Biomedical Inc. (Kanada), Diazyme Laboratories, Inc. (USA) und AB Sciex Pte Ltd. (Tochtergesellschaft von Danaher) (USA) unter anderem |

Marktdefinition

Die Diagnostik von Leberkrebs bezieht sich auf die verschiedenen Methoden und Techniken zur Erkennung und Diagnose von Leberkrebs. Dazu können Labortests, bildgebende Verfahren und körperliche Untersuchungen gehören.

Der Markt für Leberkrebsdiagnostik umfasst eine breite Palette von Produkten und Dienstleistungen verschiedener Unternehmen, darunter Diagnoselabore, Hersteller medizinischer Geräte und Pharmaunternehmen. Der Markt wird durch die zunehmende Häufigkeit von Leberkrebs und die wachsende Nachfrage nach genauen und zuverlässigen Diagnosetests angetrieben.

Nordamerika: Marktdynamik für Leberkrebsdiagnostik

Treiber

-

Ungedeckter Bedarf an nicht-invasiven, genauen und zuverlässigen Diagnosetests zur früheren Krebserkennung

Diagnostik wird auch zu einem immer wichtigeren Instrument, um die neuesten Erkenntnisse der Grundlagenforschung in bessere klinische Ergebnisse für Patienten umzusetzen. Die Entwicklung neuartiger, schneller, empfindlicher, weniger invasiver und genauerer molekulardiagnostischer Tests wird durch einige der aufregendsten wissenschaftlichen Entwicklungen der Zeit beschleunigt, darunter Genomik, Proteomik und andere „Omics“-Technologien. Dies hat erhebliche Auswirkungen auf die Fähigkeit, verschiedene Krebsarten früher und präziser zu identifizieren und zu behandeln. Durch die Anpassung von Medikamenten an das individuelle molekulare Profil jedes Patienten können Ärzte mithilfe von Diagnostik fundiertere Behandlungsentscheidungen treffen.

Daher ist zu erwarten, dass der ungedeckte Bedarf an nicht-invasiven, genauen und zuverlässigen Diagnosetests zur früheren Krebserkennung das Marktwachstum vorantreiben wird.

-

Immer frühere Diagnose von Leberkrebs

Maschinelles Lernen könnte die Krebsfrüherkennung revolutionieren, indem es Computer trainiert, Muster in komplexen Daten zu erkennen. Zu den Werkzeugen gehören die Auswertung allgemeiner Gesundheitsdaten, medizinischer Bildgebung, Biopsieproben und Bluttests, die bei der Frühdiagnose und Risikostratifizierung helfen. Bei vielen Tumorarten steigt die Wahrscheinlichkeit einer erfolgreichen Therapie mit einer frühen Krebsdiagnose. Eine wichtige Strategie besteht darin, Risikopatienten zu beurteilen, die keine Symptome aufweisen, und auf Patienten mit Symptomen schnell und angemessen zu reagieren.

Eine frühere Diagnose verbessert somit die Behandlungsmöglichkeiten, die Behandlungsergebnisse sowie die Überlebenschancen der Patienten und dürfte das Wachstum des nordamerikanischen Marktes für Leberkrebsdiagnostik vorantreiben.

Zurückhaltung

-

Hindernisse bei der Diagnose von Leberkrebs und schlechte Prognose

Krebs ist die häufigste Todesursache in Industrie- und Entwicklungsländern. Bis 2030 wird die Krebsmortalität voraussichtlich auf schätzungsweise 13,1 Millionen Todesfälle pro Jahr steigen. Bestimmte Krebsarten haben jedoch eine hohe Heilungschance, wenn sie frühzeitig erkannt und angemessen behandelt werden. Verzögerungen bei der Krebsdiagnose können im gesamten Diagnosepfad auftreten: Patient, Erstversorgung und Sekundärversorgung. Verzögerungen können auftreten, wenn der Patient verdächtige Krebssymptome nicht erkennt und nicht darauf reagiert. Mangelndes öffentliches Bewusstsein für frühe Krebssymptome gilt als Hauptgrund für eine verspätete Diagnose, insbesondere wenn die Symptome atypischer Natur sind.

Diese Faktoren führen häufig zu einer späten Diagnose und damit zu einer schlechten Prognose. Daher ist zu erwarten, dass diese Faktoren das Wachstum des nordamerikanischen Marktes für Leberkrebsdiagnostik bremsen werden.

Gelegenheit

-

Sensibilisierung für Leberkrebs

Die Aufklärung über Leberkrebs ist eine Chance, das Wissen über diese Krankheiten zu erweitern und die Erforschung ihrer Ursachen, Prävention, Diagnose, Behandlung und Überlebenschancen in den Mittelpunkt zu rücken. Ziel ist es, Menschen zu helfen, die von der Leber betroffen sind, und gesunde Gewohnheiten zu fördern. Primärer Leberkrebs ist die Bezeichnung für Krebs, der sich in der Leber entwickelt. Das hepatozelluläre Karzinom ist die häufigste Art von primärem Leberkrebs bei Erwachsenen (HCC). Diese besondere Form von Leberkrebs ist die dritthäufigste Ursache für krebsbedingte Todesfälle weltweit. In den USA werden jedes Jahr etwa 25.000 Männer und 11.000 Frauen mit Leberkrebs diagnostiziert, und die Krankheit fordert das Leben von 19.000 Männern und 9.000 Frauen.

Daher ist zu erwarten, dass staatliche Initiativen zur Leberkrebsdiagnostik Chancen für das Marktwachstum schaffen.

Herausforderung

- Strenge Vorschriften für die Zulassung von Leberkrebsdiagnostika

Die strengen Richtlinien für die Produktzulassung und Markteinführung stellen für Hersteller von Krebsdiagnostikprodukten weltweit ein großes Hindernis dar. Jedes Land hat seine eigenen Vorschriften und beschäftigt eine andere Regulierungsbehörde.

Die an der Produktion und Vermarktung von Medizinprodukten beteiligten Akteure müssen sich aufgrund der strengen Vorschriften anpassen. Dies würde alle Beteiligten weltweit betreffen und den Markt voraussichtlich im gesamten Prognosezeitraum vor Herausforderungen stellen. Daher wird erwartet, dass dies eine Herausforderung für den nordamerikanischen Markt für Leberkrebsdiagnostik darstellt und sein Wachstum behindert.

Jüngste Entwicklung

- Im Dezember 2022 gab die FUJIFILM Holdings America Corporation bekannt, dass das Unternehmen einen Kaufvertrag mit Inspirata, Inc. zur Übernahme eines digitalen Pathologieunternehmens abgeschlossen hat, um sein robustes Enterprise-Imaging-Angebot zu erweitern. Dies ermöglicht die Integration von Pathologiebildern und -daten in das elektronische Patientenaktensystem einer Gesundheitsorganisation, um die Versorgung von Krebspatienten zu optimieren.

Nordamerika: Umfang des Marktes für Leberkrebsdiagnostik

Der nordamerikanische Markt für Leberkrebsdiagnostik ist in neun wichtige Segmente unterteilt: Testtyp, Krebsart, Krebsstadium, Produkt, Anwendung, Technologie, Geschlecht, Endbenutzer und Vertriebskanäle.

Nach Testtyp

- Bildgebungstest

- Biopsie

- Genomischer Test

- Sonstiges

Nach Krebsstadien

- Etappe 0

- Stufe I

- Stufe II

- Stufe III

- Stadium IV

Nach Krebsart

- Primärer Leberkrebs

- Sekundärer Leberkrebs

Nach Produkt

- Plattformbasierte Produkte

- Instrumentenbasierte Produkte

- Kits und Reagenzien

- Andere Verbrauchsmaterialien

Nach Technologie

- Fluoreszenz-in-situ-Hybridisierung

- Sequenzierung der nächsten Generation

- Fluorimmunoassay

- Vergleichende genomische Hybridisierung

- Immunhistochemisch

- Sonstiges

Nach Anwendung

- Vorsorgeuntersuchungen

- Diagnostisch und prädiktiv

- Prognose

- Forschung

Nach Geschlecht

- Weiblich

- Männlich

Nach Endbenutzer

- Krankenhäuser

- Krebsforschungszentren

- Akademische Institute

- Diagnostikzentren

- Ambulante Chirurgische Zentren

- Sonstiges

Nach Vertriebskanal

- Direkte Ausschreibungen

- Einzelhandelsumsätze

- Sonstiges

Nordamerika: Regionale Analyse/Einblicke zum Leberkrebsdiagnostikmarkt

Der nordamerikanische Markt für Leberkrebsdiagnostik ist in neun wichtige Segmente unterteilt, basierend auf Testtyp, Krebsstadium, Krebsart, Produkt, Anwendung, Technologie, Geschlecht, Endbenutzer und Vertriebskanal.

Die in diesem Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko.

Die USA dominieren aufgrund der Präsenz wichtiger Marktteilnehmer im größten Verbrauchermarkt mit hohem BIP.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und Marktanteilsanalyse für Leberkrebsdiagnostik in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Marktes für Leberkrebsdiagnostik liefert Einzelheiten nach Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf den nordamerikanischen Markt für Leberkrebsdiagnostik.

Zu den wichtigsten Akteuren auf dem nordamerikanischen Markt für Leberkrebsdiagnostik zählen unter anderem Siemens Healthcare GmbH (Deutschland), Koninklijke Philips NV (Niederlande), Agilent Technologies, Inc. (USA), Illumina, Inc. (USA), Epigenomics AG (Deutschland), Thermo Fisher Scientific Inc. (USA), QIAGEN (USA), F. Hoffmann-La Roche Ltd (Schweiz), Diagnostic Biosystems Inc. (USA), FUJIFILM Corporation (Japan), BD (USA), MOLGEN (Niederlande), BIOCEPT, INC. (USA), Sysmex Corporation (Japan), Elabscience Biotechnology Inc. (USA), Hipro Biotechnology Co., Ltd. (China), Altogen Biosystems (USA), ABK Biomedical Inc. (Kanada), Diazyme Laboratories, Inc. (USA), AB Sciex Pte Ltd. (Tochtergesellschaft von Danaher) (USA).

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TEST TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER ANALYSIS

4.3 EPIDEMIOLOGY

5 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, REGULATIONS

6 INDUSTRY INSIGHTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 UNMET NEED FOR NON-INVASIVE, ACCURATE, AND RELIABLE DIAGNOSTIC TESTS FOR EARLIER CANCER DETECTION

7.1.2 INCREASING EARLY DIAGNOSIS OF LIVER CANCER

7.1.3 INCREASING CASES OF LIVER CANCER

7.1.4 RISE IN DIAGNOSTIC PRODUCT APPROVALS

7.2 RESTRAINTS

7.2.1 BARRIERS TO LIVER CANCER DIAGNOSIS AND POOR PROGNOSIS

7.2.2 HIGH FALSE-POSITIVES AND POOR SENSITIVITY OF LIVER CANCER DIAGNOSIS

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS TOWARDS LIVER CANCER

7.3.2 GOVERNMENT INITIATIVES TOWARD LIVER CANCER DIAGNOSTICS

7.3.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE

7.4 CHALLENGES

7.4.1 STRICT REGULATIONS FOR THE APPROVAL OF LIVER CANCER DIAGNOSTIC PRODUCTS

7.4.2 LACK OF SKILLED AND CERTIFIED EXPERTISE

8 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE

8.1 OVERVIEW

8.2 IMAGING TEST

8.2.1 MAGNETIC RESONANCE IMAGING (MRI)

8.2.1.1 MR ANGIOGRAPHY (MRA)

8.2.1.2 MR CHOLANGIOPANCREATOGRAPHY

8.2.2 COMPUTED TOMOGRAPHY

8.2.3 POSITRON EMISSION TOMOGRAPHY

8.2.4 ULTRASOUND

8.2.5 OTHERS

8.3 GENOMIC TEST

8.4 BIOPSY

8.4.1 FINE NEEDLE ASPIRATION BIOPSY

8.4.2 CORE NEEDLE BIOPSY

8.4.3 LAPAROSCOPY

8.5 OTHERS

9 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGE

9.1 OVERVIEW

9.2 STAGE III

9.3 STAGE II

9.4 STAGE IV

9.5 STAGE I

9.6 STAGE 0

10 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 SECONDARY LIVER CANCER

10.2.1 HEMANGIOMA

10.2.2 HEPATIC ADENOMA

10.2.3 FOCAL NODULAR HYPERPLASIA

10.3 PRIMARY LIVER CANCER

10.3.1 HEPATOCELLULAR CARCINOMA (HCC)

10.3.2 INTRAHEPATIC CHOLANGIOCARCINOMA (BILE DUCT CANCER)

10.3.3 ANGIOSARCOMA HEMANGIOSARCOMA

10.3.4 HEPATOBLASTOMA

11 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT

11.1 OVERVIEW

11.2 PLATFORM BASED PRODUCTS

11.2.1 NEXT GENERATION SEQUENCING

11.2.2 MICROARRAYS

11.2.3 PCR

11.2.4 OTHERS

11.3 INSTRUMENT BASED PRODUCTS

11.3.1 IMAGING

11.3.2 BIOPSY

11.4 KITS AND REAGENTS

11.4.1 ELISA TEST KITS

11.4.2 CASSETTE TEST KITS

11.4.3 OTHERS

11.5 OTHER CONSUMABLES

12 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 SCREENING

12.2.1 PLATFORM BASED PRODUCTS

12.2.2 INSTRUMENT BASED PRODUCTS

12.2.3 KITS AND REAGENTS

12.2.4 OTHER CONSUMABLES

12.3 DIAGNOSTIC AND PREDICTIVE

12.3.1 PLATFORM BASED PRODUCTS

12.3.2 INSTRUMENT BASED PRODUCTS

12.3.3 KITS AND REAGENTS

12.3.4 OTHER CONSUMABLES

12.4 PROGNOSTIC

12.4.1 PLATFORM BASED PRODUCTS

12.4.2 INSTRUMENT BASED PRODUCTS

12.4.3 KITS AND REAGENTS

12.4.4 OTHER CONSUMABLES

12.5 RESEARCH

12.5.1 PLATFORM BASED PRODUCTS

12.5.2 INSTRUMENT BASED PRODUCTS

12.5.3 KITS AND REAGENTS

12.5.4 OTHER CONSUMABLES

13 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY

13.1 OVERVIEW

13.2 FLUORESCENT IN SITU HYBRIDIZATION

13.3 NEXT GENERATION SEQUENCING

13.4 FLUORIMMUNOASSAY

13.5 COMPARATIVE GENOMIC HYBRIDIZATION

13.6 IMMUNOHISTOCHEMICAL

13.7 OTHERS

14 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER

14.1 OVERVIEW

14.2 MALE

14.3 FEMALE

15 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.3 DIAGNOSTIC CENTERS

15.4 CANCER RESEARCH CENTERS

15.5 AMBULATORY SURGICAL CENTERS

15.6 ACADEMIC INSTITUTES

15.7 OTHERS

16 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 F. HOFFMANN-LA ROCHE LTD.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 KONINLIJKE PHILIPS N.V.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 THERMO FISHER SCIENTIFIC INC.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 BD

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 SIEMENS HEALTHCARE GMBH

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 AGILENT TECHNOLOGIES, INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENTS

20.7 ABK BIOMEDICAL INC.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AB SCIEX PTE LTD. (SUBSIDIARY OF DANAHER.)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 ALTOGEN BIOSYSTEMS

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 BIOCEPT, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 BODITECH MED INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENTS

20.12 DIAGNOSTIC BIOSYSTEMS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 DIAZYME LABORATORIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 ELABSCIENCE BIOTECHNOLOGY INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 EPIGENOMICS AG

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 FUJIFILM CORPORATION

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 FUJIREBIO

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 HIPRO BIOTECHNOLOGY CO., LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ILLUMINA, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 MOLGEN

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 QIAGEN

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 Q-LINE BIOTECH PVT LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SYSMEX CORPORATION

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENT

20.24 TEBUBIO

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 TOSOH INDIA PVT. LTD.

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 DIFFERENT TYPES OF CANCER NON-INVASIVE SCREENING TESTS FOR DIFFERENT TYPES OF CANCERS

TABLE 2 LIVER CANCER RATES

TABLE 3 APPROVED DIAGNOSTICS OF LIVER CANCER

TABLE 4 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA IMAGING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA GENETIC TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA STAGE III IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA STAGE II IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA STAGE IV IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA STAGE I IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA STAGE 0 IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA CLEAR CELL RENAL CELL CARCINOMA IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PLATFORM BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA PLATFORM BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INSTRUMENT BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA KITS AND REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA KITS AND REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHER CONSUMABLES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FLUORESCENT IN SITU HYBRIDIZATION IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA NEXT GENERATION SEQUENCING IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA FLUORIMMUNOASSAY IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA COMPARATIVE GENOMIC HYBRIDIZATION IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA IMMUNOHISTOCHEMICAL IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA MALE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA FEMALE IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA DIAGNOSTIC CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CANCER RESEARCH CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ACADEMIC INSTITUTES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA DIRECT TENDER IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA RETAIL SALES IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 83 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 85 U.S. MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 86 U.S. BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 87 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 88 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 91 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 U.S. PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 93 U.S. INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 94 U.S. KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 96 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 U.S. SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 98 U.S. DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 99 U.S. PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 100 U.S. RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 102 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 103 U.S. LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 104 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 105 CANADA IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 106 CANADA MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 107 CANADA BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 108 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 109 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 110 CANADA SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 111 CANADA PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 112 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 CANADA PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 CANADA INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 CANADA KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 116 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 117 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 118 CANADA SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 119 CANADA DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 120 CANADA PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 121 CANADA RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 122 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 123 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 CANADA LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 125 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 126 MEXICO IMAGING TEST IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 127 MEXICO MAGNETIC RESONANCE IMAGING (MRI) IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE 2021-2030 (USD MILLION)

TABLE 128 MEXICO BIOPSY IN LIVER CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY CANCER STAGES, 2021-2030 (USD MILLION)

TABLE 130 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 131 MEXICO SECONDARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 132 MEXICO PRIMARY LIVER CANCER IN LIVER CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 133 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 134 MEXICO PLATFORM-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 135 MEXICO INSTRUMENT-BASED PRODUCTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 136 MEXICO KITS & REAGENTS IN LIVER CANCER DIAGNOSTICS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 137 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 138 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 139 MEXICO SCREENING IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 140 MEXICO DIAGNOSTIC AND PREDICTIVE IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 MEXICO PROGNOSTIC IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 142 MEXICO RESEARCH IN LIVER CANCER DIAGNOSTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 143 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 144 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 145 MEXICO LIVER CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF LIVER CANCER AND INCREASING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET FROM 2023 TO 2030

FIGURE 12 THE IMAGING TEST SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET

FIGURE 14 THE NORTH AMERICA MORTALITY RATE DUE TO CANCER

FIGURE 15 INCREASING NORTH AMERICA CANCER RATE IN 2020

FIGURE 16 BARRIERS TO EARLY CANCER DIAGNOSIS AND TREATMENT

FIGURE 17 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 18 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, 2022

FIGURE 22 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER STAGE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 26 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, 2022

FIGURE 30 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, 2022

FIGURE 34 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 35 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, 2022

FIGURE 38 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 39 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 40 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 41 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, 2022

FIGURE 42 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, 2023-2030 (USD MILLION)

FIGURE 43 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, CAGR (2023-2030)

FIGURE 44 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 45 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 46 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 47 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 48 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 49 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 50 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 51 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 52 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 53 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 54 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 55 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 56 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 57 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: TEST TYPE (2023-2030)

FIGURE 58 NORTH AMERICA LIVER CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.