North America Decorative Plastic Sheet For Furniture Market

Marktgröße in Milliarden USD

CAGR :

%

USD

639.15 Million

USD

1,025.17 Million

2024

2032

USD

639.15 Million

USD

1,025.17 Million

2024

2032

| 2025 –2032 | |

| USD 639.15 Million | |

| USD 1,025.17 Million | |

|

|

|

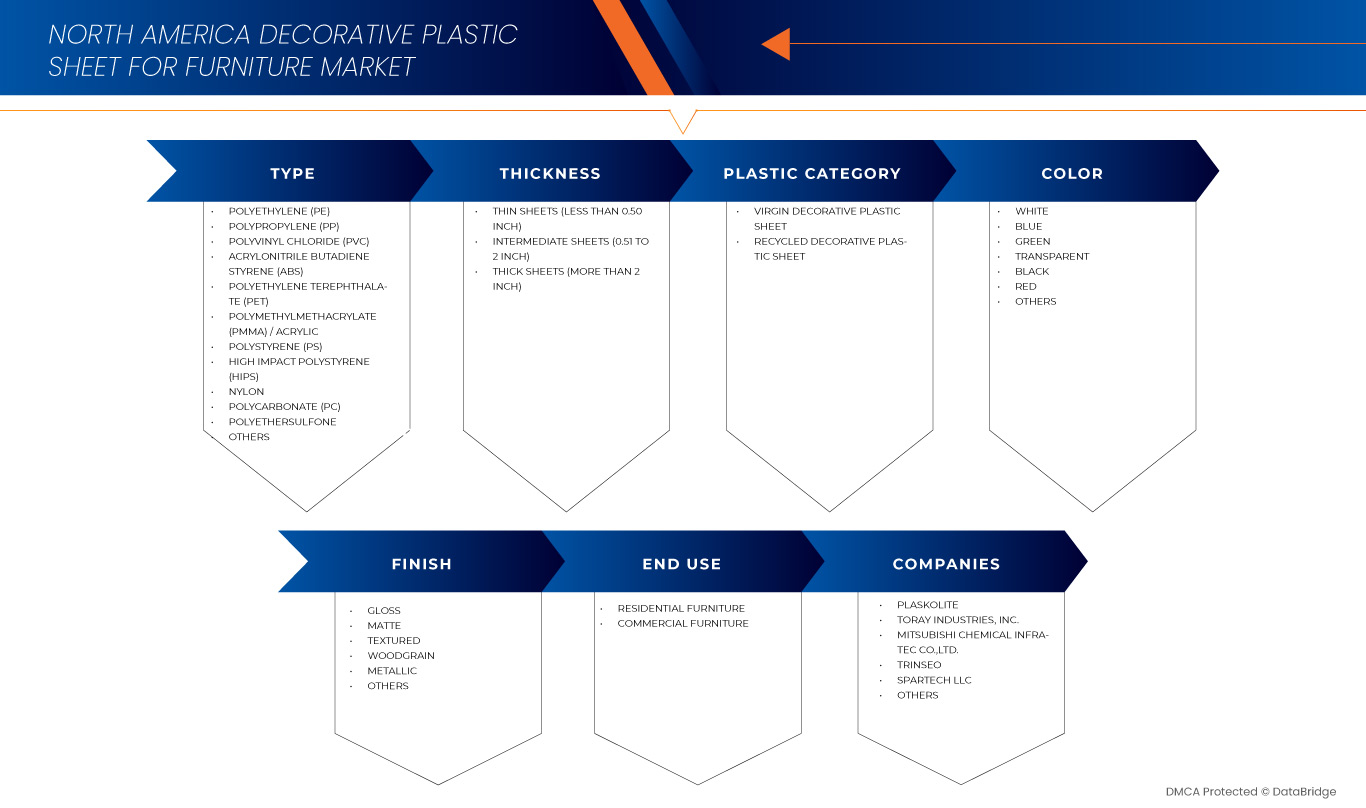

North America Decorative Plastic Sheet for Furniture Market Segmentation, By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC)Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Polymethylmethacrylate (PMMA) / Acrylic, Polystyrene (PS), High Impact Polystyrene (HIPS), NylonPolycarbonate (PC), Polyethersulfone, and Others), Thickness (Thin Sheets (Less Than 0.50 Inch), Intermediate Sheets (0.51 To 2 Inch), and Thick Sheets (More Than 2 Inch)), Plastic Category (Virgin Decorative Plastic Sheet and Recycled Decorative Plastic Sheet), Color (White, Blue, Green, Transparent, Black, Red, and Others), Finish (Gloss, Matte, Textured, Woodgrain, Metallic, and Others), End Use (Residential Furniture and Commercial Furniture) – Industry Trends and Forecast to 2032

Decorative Plastic Sheet for Furniture Market Analysis

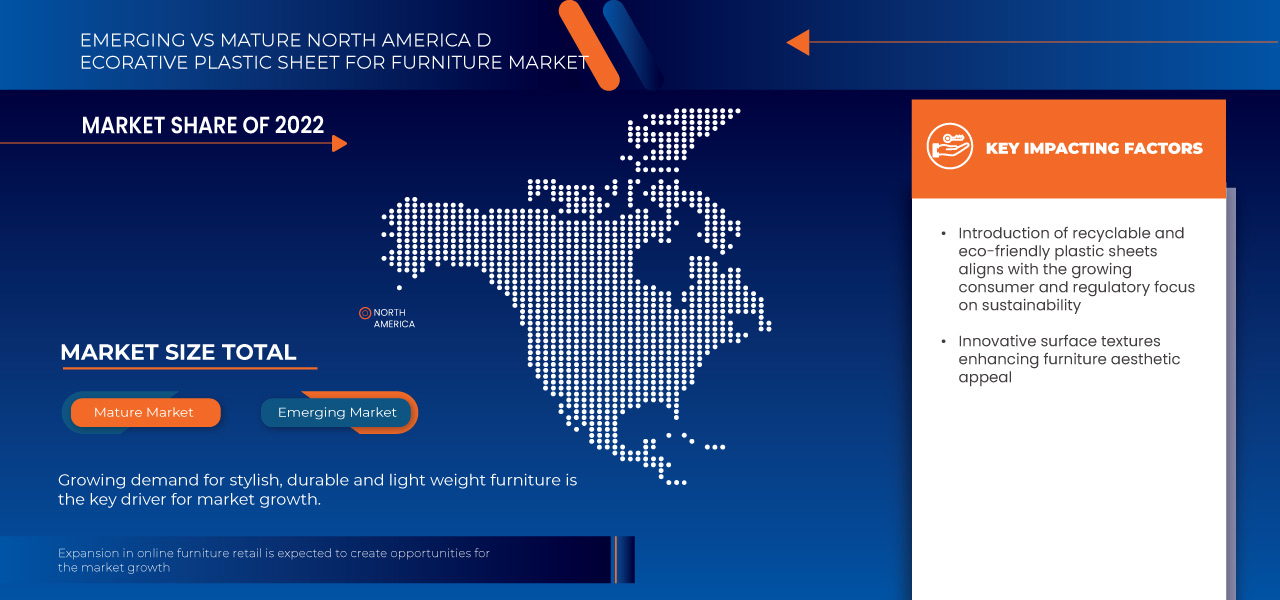

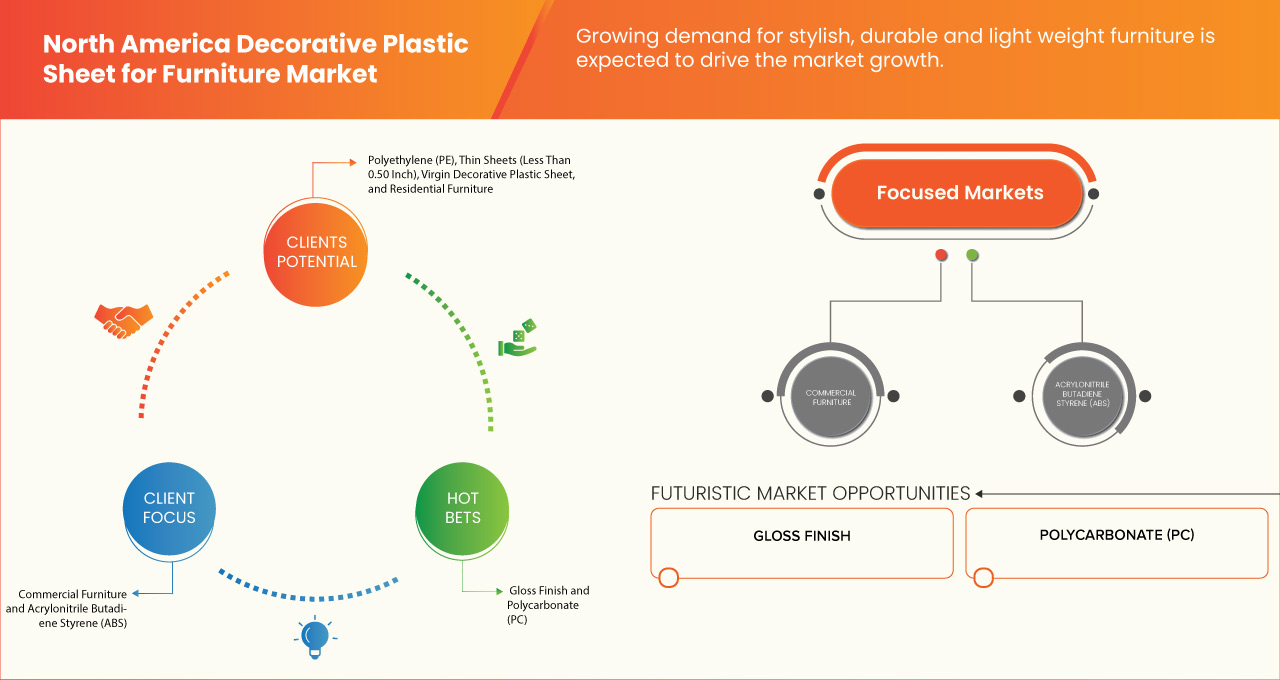

The decorative plastic sheet for furniture market is experiencing robust growth, driven by growing demand for stylish, durable and light weight furniture. As the North America furniture industry continues to expand, the need for innovative surface textures enhancing furniture aesthetic appeal has increased. Rapidly growing popularity of customizable and innovative furniture designs and expansion in online furniture retail are creating opportunities for the market. Market dynamics are also influenced by competition from alternative materials. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Decorative Plastic Sheet for Furniture Market Size

North America decorative plastic sheet for furniture market size was valued at USD 639.15 million in 2024 and is projected to reach USD 1,025.17 million by 2032, with a CAGR of 6.2% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Decorative Plastic Sheet for Furniture Market Trends

“Advancements in Material Technology”

Advancements in material technology are significantly transforming the furniture industry, offering new possibilities for creating innovative, functional, and sustainable products. These advancements are driving the development of materials that are not only stronger, lighter, and more durable but also more eco-friendly, opening up new opportunities for both manufacturers and consumers.

One key trend of progress is the development of high-performance, lightweight materials. Traditional materials such as wood, metal, and glass, while reliable, are often heavy. In contrast, modern materials such as carbon fiber, lightweight composites, and advanced plastics offer reduced weight without compromising strength. This shift allows for the design of furniture that is easier to move, transport, and assemble, appealing to consumers living in smaller spaces or urban environments.

Another notable advancement is the use of sustainable materials. With increasing consumer demand for eco-friendly products, the furniture industry is turning to materials that are both renewable and recyclable. Innovations such as bamboo, recycled plastics, and bio-based resins are being used to create furniture that minimizes environmental impact. These materials are not only sustainable but often have enhanced durability, offering long-lasting solutions that reduce the need for frequent replacements.

Report Scope and Decorative Plastic Sheet for Furniture Market Segmentation

|

Attributes |

Decorative Plastic Sheet for Furniture Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Plaskolite (U.S.), TORAY INDUSTRIES, INC. (Tokyo), Mitsubishi Chemical Infratec Co.,Ltd. (Japan), Trinseo (U.S.), Spartech LLC (U.S.), Asia Poly Holdings Berhad (Malaysia), Gevacril (Italy), MADREPERLA s.p.a. (Italy), and POLYVANTIS (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Decorative Plastic Sheet for Furniture Market Definition

Decorative plastic sheets for furniture are versatile materials used to enhance the aesthetic appeal of various furniture items. These sheets, typically made from high-quality plastic materials such as PVC, acrylic, or polyester, feature a wide range of colors, patterns, and textures, making them ideal for applications such as cabinetry, tables, and paneling. They offer durability, resistance to wear and tear, and ease of maintenance, while providing a cost-effective alternative to natural materials such as wood or metal. With growing demand in interior design and home renovation, decorative plastic sheets are increasingly popular in both residential and commercial furniture markets.

Decorative Plastic Sheet for Furniture Market Dynamics

Drivers

- Growing Demand for Stylish, Durable and Light Weight Furniture

The growing demand for stylish, durable, and lightweight furniture is a key driver in the furniture industry, particularly in North America. Consumers today are increasingly seeking furniture that not only enhances the aesthetic appeal of their living spaces but also meets practical needs such as durability, ease of maintenance, and portability.

Stylish furniture designs, often incorporating modern aesthetics, minimalism, or vibrant colors, are a significant factor driving demand. As people look to create unique and personalized interiors, furniture that can blend seamlessly with contemporary or eclectic styles is highly sought after. This trend is powerful among younger consumers, including millennials and Gen Z, who prioritize aesthetics in their purchasing decisions. Social media platforms like Instagram and Pinterest have amplified this demand, as users often share photos of stylish interiors, encouraging others to invest in visually striking furniture pieces.

Durability is another crucial factor. Consumers now expect furniture to last longer, withstand daily wear and tear, and remain functional over time. The demand for long-lasting furniture is fueling the use of high-quality materials, such as advanced plastics, metals, and composite wood, which are engineered for strength and longevity. This shift towards durability is especially evident in the growing popularity of modular furniture, which allows for easy assembly, reconfiguration, and maintenance.

Lightweight furniture has become increasingly important, particularly in urban areas where space is limited and people frequently move homes or apartments. Easy-to-move furniture that does not compromise on comfort or durability is in high demand, as it provides practicality without sacrificing design. Materials such as lightweight plastics, aluminum, and engineered wood are increasingly being used to meet this demand for both aesthetic and functional benefits.

For instance,

In September 2024, according to a blog published by Amish Furniture Factory, Amish craftsmen combine traditional skills with innovative materials to create versatile pieces that are easy to move, eco-friendly, space-saving, and perfect for smaller living spaces, without compromising on quality, durability, or design.

- Innovative Surface Textures Enhancing Furniture Aesthetic Appeal

Innovative surface textures play a crucial role in enhancing the aesthetic appeal of furniture, offering unique visual and tactile experiences that attract modern consumers. As the furniture market evolves, designers are increasingly incorporating textured surfaces to create distinctive and visually dynamic pieces. These textures can range from subtle patterns to bold, sculptural designs, all aimed at adding depth, interest, and personality to furniture.

One of the key trends in innovative surface textures is the use of 3D designs and patterns. These textures can mimic natural elements such as wood grain, stone, or leather, offering a luxurious and organic feel without the cost or environmental impact associated with traditional materials. By incorporating textures such as raised patterns, geometric shapes, or intricate embossing, manufacturers can elevate the look of basic furniture items, such as tables, chairs, or cabinet doors, making them more visually engaging and sophisticated.

For instance,

In January 2024, according to a blog published by Analogy, furniture design blends functionality and aesthetics, evolving through materials such as wood, metal, glass, and recycled plastics. From timeless wood craftsmanship to modern innovations such as sustainable materials and custom designs, furniture is increasingly tailored to individual needs. The future promises smart, ergonomic, and eco-friendly options, with 3D printing, AI integration, and biophilic designs shaping tomorrow’s living spaces.

Opportunities

- Rising Popularity of Modular and Space-Saving Furniture Designs

The rising popularity of modular and space-saving furniture designs is a key trend in the furniture industry, driven by changing consumer needs, especially in urban areas with limited living space. As cities continue to grow and more people move into smaller apartments or shared living spaces, there is an increasing demand for furniture that maximizes functionality while minimizing the amount of space it occupies. Modular and space-saving furniture designs offer practical solutions to these challenges, appealing to a wide range of consumers, from young professionals to families living in compact homes.

Modular furniture is highly adaptable, allowing consumers to customize their living spaces to fit their specific needs. These designs consist of individual components or units that can be mixed, matched, and rearranged to create different configurations. For instance, modular sofas can be expanded or contracted depending on the room size, and modular shelving units can be stacked or spread out to optimize wall space. This flexibility makes modular furniture an ideal choice for renters or people who move frequently, as it can be easily reconfigured to suit new spaces.

Space-saving furniture designs are particularly popular in urban environments, where living spaces are often small and expensive. Furniture pieces such as fold-out beds, wall-mounted desks, extendable dining tables, and stackable chairs allow consumers to make the most of limited space without sacrificing comfort or style. These space-saving solutions are ideal for multifunctional rooms, such as studios or guest rooms, where furniture needs to serve multiple purposes.

For instance,

According to a blog published by KGMI Services Pvt. Ltd., modular furniture is revolutionizing interior design with its flexibility, space-saving features, and customization options. Perfect for modern living, it adapts to changing needs, from hosting gatherings to creating cozy nooks. Offering quality, eco-friendly choices, and a personal touch

- Expansion in Online Furniture Retail

The expansion of online furniture retail is a significant opportunity for the furniture industry, driven by changing consumer shopping habits, advancements in technology, and the growing desire for convenience. With the rise of e-commerce, furniture companies are increasingly turning to digital platforms to reach a broader audience and provide a seamless shopping experience for consumers who prefer to shop from the comfort of their homes.

One of the key advantages of online furniture retail is the ability to offer a wide range of products to customers without the need for physical store space. Consumers can explore an extensive selection of furniture styles, colors, sizes, and designs, often with more detailed product descriptions, images, and customer reviews than they would encounter in brick-and-mortar stores. This convenience is particularly appealing to time-constrained shoppers, as they can browse multiple options, compare prices, and make purchases at any time, without being limited to store hours.

Another key benefit is the integration of advanced technologies such as Augmented Reality (AR), which allows consumers to visualize how furniture will look in their own homes before making a purchase. This reduces the uncertainty and hesitation that often accompany buying large items such as sofas or dining tables online. AR technology can also help overcome spatial concerns, ensuring that furniture fits appropriately in a given space.

For instance,

In August 2023, according to a blog published by Bennett, Coleman & Co. Ltd., the Indian furniture market, valued at USD 23.3 billion in 2021, is projected to grow to USD 35.9 billion by 2028. This growth is driven by rising urbanization, disposable income, and demand for durable furniture. The industry benefits from advancements such as IoT, e-commerce, and data-driven insights, enhancing convenience, product variety, and market reach. Increased competition and the entry of multinational companies further boost growth.

Restraints/Challenges

- Fluctuations in Raw Material Prices

Fluctuations in raw material prices pose a significant restraint in the furniture industry, affecting both manufacturers and consumers. The prices of key materials such as wood, plastics, metals, and textiles are subject to market dynamics, supply chain disruptions, and global economic conditions, creating uncertainty for businesses in terms of cost planning and pricing strategies.

One of the leading causes of raw material price fluctuations is the volatility of global markets. For instance, the prices of wood and lumber can be influenced by factors such as climate conditions, deforestation regulations, and the demand for construction materials. Similarly, the cost of plastics and metals can be affected by changes in oil prices, mining outputs, or geopolitical tensions that disrupt the supply chain. When the cost of these raw materials rises, manufacturers face increased production costs, which may lead to higher prices for consumers. In some cases, furniture companies may absorb these costs to maintain competitive pricing, which impacts their profit margins.

Supply chain disruptions, such as those experienced during the COVID-19 pandemic, have also exacerbated the issue of price fluctuations. Global trade restrictions, factory shutdowns, and labor shortages have caused delays and shortages in material supplies, driving up prices. These disruptions have forced manufacturers to seek alternative materials, which may not be as cost-effective or widely available, further compounding the problem.

For instances

According to a blog published by FURNITURE KRAFT INTERNATIONAL PRIVATE LIMITED, rising raw material costs, including polyurethane foam and other components, have led to higher furniture prices. Freight and container shipping costs have surged due to a global shortage, increasing transportation expenses. In addition, shifting consumer demand for cheaper, lower-quality ‘fast furniture’ is growing as prices rise, making durable, high-quality furniture less affordable.

- High Production Costs of Plastic Sheets

High production costs of plastic sheets pose a significant challenge in the furniture and interior design industries. While plastic sheets offer versatility, durability, and aesthetic appeal, the costs associated with producing high-quality plastic sheets can be a considerable barrier for manufacturers. These costs are influenced by several factors, including the price of raw materials, energy-intensive manufacturing processes, and the technological investments required to maintain high production standards.

One major contributor to high production costs is the volatility in the prices of raw materials used in plastic sheet manufacturing, such as petroleum-based products. Plastics, particularly Polyvinyl Chloride (PVC) and Polyethylene Terephthalate (PET), are derived from crude oil, which is subject to fluctuations in global oil prices. As oil prices rise, so do the costs of producing these plastic materials. This can lead to higher production costs for furniture companies, which may, in turn, pass these increased costs on to consumers, making plastic furniture products less affordable.

The manufacturing process for plastic sheets is also energy-intensive. The production of plastic involves heating and molding the raw material into sheets, which requires a substantial amount of energy, especially when creating specialized textures or finishes. This reliance on energy can lead to increased operational costs, particularly when energy prices are high or when manufacturers are required to invest in environmentally friendly, energy-efficient technologies.

For instances

In March 2024, according to a blog published by Tilara Polyplast Private Limited, acrylic sheet prices vary based on factors such as material quality, thickness, transparency, surface finish, color, size, and customization. Higher-quality resins, thicker sheets, superior clarity, and specialized finishes increase costs. Custom sizes, branding, and market demand also play a role. Balancing quality and cost are crucial to ensure durability, performance, and value for your project.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Decorative Plastic Sheet for Furniture Market Scope

The market is segmented on the basis of type, temperature, thickness, plastic category, color, finish, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Polyethylene (PE)

- By Type

- High Density Polyethylene (HDPE)

- Low Density Polyethylene (LDPE)

- Nach Herstellungsverfahren

- Extrudierte Polyethylenplatten

- Kalandrierte Polyethylenplatten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- By Type

- Polypropylen (PP)

- Nach Typ

- BOPP-Platten

- Normale PP-Blätter

- CPP-Blätter

- Nach Polymertyp

- Homopolymer-Polypropylenplatten

- Copolymer-Polypropylenplatten

- Random-Copolymer-Polypropylenplatten

- Nach Produktform

- Massivplatten aus Polypropylen

- Polypropylen-Schaumstoffplatten

- Wellplatten aus Polypropylen

- Nach Fachgebiet

- Chemikalienbeständige Polypropylenplatten

- Flammhemmende Polypropylenplatten

- UV-beständige Polypropylenplatten

- Leitfähige Polypropylenplatten

- Andere besondere Merkmale

- Nach Oberflächenbeschaffenheit

- Glatte PP-Platten

- Strukturierte oder geprägte PP-Platten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Typ

- Polyvinylchlorid (PVC)

- Nach Typ

- Flexible PVC-Platten

- Hart-PVC-Platten

- Nach Produktform

- PVC Massivplatten

- PVC-Schaumplatten

- Nach Oberflächenbeschaffenheit

- Glatte PVC Platten

- Geprägte PVC-Platten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Typ

- Acrylnitril-Butadien-Styrol (ABS)

- Nach Produktform

- ABS Massivplatten

- ABS-Schaumplatten

- Nach Blatttyp

- Allzweck-ABS-Platten

- Flammhemmende ABS-Platten

- UV-beständige ABS Platten

- Leitfähige ABS-Platten

- Sonstiges

- Nach Oberflächenbeschaffenheit

- Glatte ABS Platten

- Strukturierte oder geprägte ABS-Platten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Produktform

- Polyethylenterephthalat (PET)

- Nach Produkttyp

- PETG-Platten (Glykolmodifiziertes PET)

- Nach Produkttyp

- Klare/transparente PETG-Platten

- Undurchsichtige/farbige PETG-Platten

- Nach Fachgebiet

- Feuerhemmende PETG-Platten

- UV-beständige PETG-Platten

- Andere spezielle PETG-Platten

- Nach Produktform

- PETG-Rollenware

- PETG-Massivplatten

- Nach Oberflächenbeschaffenheit

- Glatte PETG-Platten

- Strukturierte oder geprägte PETG-Platten

- Nach Produkttyp

- APET (Amorphes PET) Platten

- CPET-Platten (kristallisiertes PET)

- PETG-Platten (Glykolmodifiziertes PET)

- Nach Blatttyp

- Klare/transparente PET-Platten

- Undurchsichtige PET-Platten

- Nach Fachgebiet

- Massivplatten aus Polypropylen

- Polypropylen-Schaumstoffplatten

- Wellplatten aus Polypropylen

- Nach Produktform

- PET-Rollenware

- PET-Massivplatten

- Nach Oberflächenbeschaffenheit

- Glatte PET-Platten

- Strukturierte oder geprägte PET-Platten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Produkttyp

- Polymethylmethacrylat (PMMA) / Acryl

- Nach Typ

- Gegossene Acrylplatte

- Nach Typ

- Kontinuierlich gegossene Acrylplatten

- Zellgegossene Acrylplatte

- Extrudierte Acrylplatte

- Nach Typ

- Halbtransparente extrudierte Acrylplatte

- Farbig extrudierte Acrylplatte

- Transparente extrudierte Acrylplatte

- Nach Typ

- Gegossene Acrylplatte

- Nach Dicke

- Zwischenblätter (0,51 bis 2 Zoll)

- Dünne Blätter (weniger als 0,50 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Typ

- Polystyrol (PS)

- Nach Typ

- Extrudierte Polystyrolplatten (XPS)

- Platten aus expandiertem Polystyrol (EPS)

- Nach Dicke

- Dicke Blätter (mehr als 2 Zoll)

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Nach Typ

- Hochschlagfestes Polystyrol (HIPS)

- Nach Produktform

- HIPS Massivplatten

- HIPS-Schaumstoffplatten

- Nach Oberflächenbeschaffenheit

- Glatte HIPS-Platten

- Strukturierte oder geprägte HIPS-Platten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Produktform

- Nylon

- Nach Blatttyp

- Nylon 66 Blätter

- Nylon 6 Blätter

- Nylon 12 Blätter

- Andere Nylontypen

- Nach Blatttyp

- Polycarbonat (PC)

- Nach Blatttyp

- Massive Polycarbonatplatten

- Geprägte Polycarbonatplatten

- Mehrwandige Polycarbonatplatten

- Gewellte Polycarbonatplatten

- Andere Spezial-Polycarbonatplatten

- Nach Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

- Nach Blatttyp

- Polyethersulfon

- Nach Dicke

- Dünne Bleche (weniger als 0,50 Zoll

- Zwischenblätter (0,51 bis 2 Zoll

- Dicke Blätter (mehr als 2 Zoll)

- Nach Dicke

- Sonstiges

Dicke

- Dünne Blätter (weniger als 0,50 Zoll)

- Zwischenblätter (0,51 bis 2 Zoll)

- Dicke Blätter (mehr als 2 Zoll)

Kunststoffkategorie

- Dekorative Kunststoffplatte aus Neuware

- Dekorative Kunststoffplatte aus recyceltem Kunststoff

Farbe

- Weiß

- Blau

- Grün

- Transparent

- Schwarz

- Rot

- Sonstiges

Beenden

- Glanz

- Matt

- Strukturiert

- Holzmaserung

- Metallisch

- Sonstiges

Endverwendung

- Wohnmöbel

- Nach Anwendung

- Küchenschränke

- Kleiderschränke

- Tische und Schreibtische

- Bettrahmen und Kopfteile

- TV-Ständer und Entertainment-Einheiten

- Regale und Lagereinheiten

- Esszimmerstühle

- Badezimmerwaschtische

- Sonstiges

- Nach Blatttyp

- Polyethylen (PE)

- Polypropylen (PP)

- Polyvinylchlorid (PVC)

- Acrylnitril-Butadien-Styrol (ABS)

- Polyethylenterephthalat (PET)

- Polymethylmethacrylat (PMMA) / Acryl

- Polystyrol (PS)

- High Impact Polystyrene (HIPS)

- Nylon

- Polycarbonate (PC)

- Polyethersulfone

- Others

- Nach Anwendung

- Commercial Furniture

- By Application

- Office Furniture

- Retail Display Furniture

- Hospitality Furniture

- Others

- By Sheet Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Polymethylmethacrylate (PMMA) / Acrylic

- Polystyrene (PS)

- High Impact Polystyrene (HIPS)

- Nylon

- Polycarbonate (PC)

- Polyethersulfone

- Others

- By Application

Decorative Plastic Sheet for Furniture Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, temperature, thickness, plastic category, color, finish, and end use as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate and the fastest growing country in the North America decorative plastic sheet for furniture market due to growing demand for stylish, durable and light weight furniture.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Decorative Plastic Sheet for Furniture Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Decorative Plastic Sheet for Furniture Market Leaders Operating in the Market Are:

- Plaskolite (U.S.)

- TORAY INDUSTRIES, INC. (Tokyo)

- Mitsubishi Chemical Infratec Co.,Ltd. (Japan)

- Trinseo (U.S.)

- Spartech LLC (U.S.)

- Asia Poly Holdings Berhad (Malaysia)

- Gevacril (Italy)

- MADREPERLA s.p.a. (Italy)

- POLYVANTIS (U.S.)

Latest Development in Decorative Plastic Sheet for Furniture Market

- In November 2023, Plaskolite announced the acquisition of Vycom, a leading manufacturer of Olefin and PVC thermoplastic sheets. This move has helped the company expand its product offerings and customer base, enhancing sustainability efforts through Vycom’s 99% scrap recycling commitment

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT-EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.5.5 CONCLUSION

4.6 PRODUCTION CAPACITY OVERVIEW

4.6.1 MARKET DEMAND AND GROWTH

4.6.2 PRODUCTION TECHNOLOGIES AND INNOVATIONS

4.6.3 RAW MATERIAL SUPPLY AND SOURCING

4.6.4 OPERATIONAL CAPACITY AND MANUFACTURING FACILITIES

4.6.5 CONCLUSION

4.7 SCENARIO: ACTUAL PRICE AND VOLUME

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 LOGISTIC COST SCENARIO

4.8.1.1 TRANSPORTATION COSTS

4.8.1.2 WAREHOUSING AND INVENTORY MANAGEMENT COSTS

4.8.1.3 PACKAGING AND HANDLING COSTS

4.8.1.4 ORDER FULFILLMENT AND DISTRIBUTION COSTS

4.8.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8.2.1 EXPERTISE IN TRANSPORTATION AND DELIVERY

4.8.2.2 WAREHOUSING AND INVENTORY MANAGEMENT SOLUTIONS

4.8.2.3 PACKAGING AND HANDLING EXPERTISE

4.8.2.4 FLEXIBILITY AND SCALABILITY

4.8.2.5 TECHNOLOGY INTEGRATION AND REAL-TIME TRACKING

4.8.3 CONCLUSION

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9.1 ADVANCED INJECTION MOLDING TECHNIQUES

4.9.2 3D PRINTING FOR PROTOTYPING AND CUSTOMIZATION

4.9.3 ENHANCED SURFACE COATING TECHNOLOGIES

4.9.4 SUSTAINABLE AND ECO-FRIENDLY MANUFACTURING PROCESSES

4.9.5 AUTOMATION AND ROBOTICS IN PRODUCTION

4.9.6 SMART MANUFACTURING AND IOT INTEGRATION

4.9.7 CONCLUSION

4.1 VENDOR SELECTION CRITERIA

4.10.1 PRODUCT QUALITY AND INNOVATION

4.10.2 COST AND PRICING STRUCTURE

4.10.3 DELIVERY TIME AND LEAD TIME

4.10.4 SUPPLIER REPUTATION AND RELIABILITY

4.10.5 CUSTOMER SUPPORT AND RELATIONSHIP MANAGEMENT

4.10.6 SUSTAINABILITY PRACTICES

4.10.7 TECHNOLOGICAL CAPABILITY

4.10.8 FINANCIAL STABILITY

4.10.9 CONCLUSION

4.11 RAW MATERIAL COVERAGE

4.11.1 POLYVINYL CHLORIDE (PVC)

4.11.2 ACRYLONITRILE BUTADIENE STYRENE (ABS)

4.11.3 HIGH-DENSITY POLYETHYLENE (HDPE)

4.11.4 POLYSTYRENE (PS)

4.11.5 RECYCLED PLASTICS

4.11.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR STYLISH, DURABLE AND LIGHT WEIGHT FURNITURE

6.1.2 INNOVATIVE SURFACE TEXTURES ENHANCING FURNITURE AESTHETIC APPEAL

6.1.3 INTRODUCTION OF RECYCLABLE AND ECO-FRIENDLY PLASTIC SHEETS ALIGNS WITH THE GROWING CONSUMER AND REGULATORY FOCUS ON SUSTAINABILITY

6.1.4 ADVANCEMENTS IN MATERIAL TECHNOLOGY

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN RAW MATERIAL PRICES

6.2.2 COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 RAPIDLY GROWING POPULARITY OF CUSTOMIZABLE AND INNOVATIVE FURNITURE DESIGNS

6.3.2 EXPANSION IN ONLINE FURNITURE RETAIL

6.3.3 RISING POPULARITY OF MODULAR AND SPACE-SAVING FURNITURE DESIGNS

6.4 CHALLENGES

6.4.1 HIGH PRODUCTION COSTS OF PLASTIC SHEETS

6.4.2 ENVIRONMENTAL CONCERNS REGARDING PLASTIC WASTE AND DISPOSAL

7 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE

7.1 OVERVIEW

7.2 POLYETHYLENE (PE)

7.3 POLYPROPYLENE (PP)

7.4 POLYVINYL CHLORIDE (PVC)

7.5 ACRYLONITRILE BUTADIENE STYRENE (ABS)

7.6 POLYETHYLENE TEREPHTHALATE (PET)

7.7 POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC

7.8 POLYSTYRENE (PS)

7.9 HIGH IMPACT POLYSTYRENE (HIPS)

7.1 NYLON

7.11 POLYCARBONATE (PC)

7.12 POLYETHERSULFONE

7.13 OTHERS

8 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 THIN SHEETS (LESS THAN 0.50 INCH)

8.3 INTERMEDIATE SHEETS (0.51 TO 2 INCH)

8.4 THICK SHEETS (MORE THAN 2 INCH)

9 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY

9.1 OVERVIEW

9.2 VIRGIN DECORATIVE PLASTIC SHEET

9.3 RECYCLED DECORATIVE PLASTIC SHEET

10 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR

10.1 OVERVIEW

10.2 WHITE

10.3 BLUE

10.4 GREEN

10.5 TRANSPARENT

10.6 BLACK

10.7 RED

10.8 OTHERS

11 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH

11.1 OVERVIEW

11.2 GLOSS

11.3 MATTE

11.4 TEXTURED

11.5 WOODGRAIN

11.6 METALLIC

11.7 OTHERS

12 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE

12.1 OVERVIEW

12.2 RESIDENTIAL FURNITURE

12.3 COMMERCIAL FURNITURE

13 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 PLASKOLITE

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENT

16.2 TORAY INDUSTRIES, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 MITSUBISHI CHEMICAL INFRATEC CO.,LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRINSEO

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 SPARTECH LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 ASIA POLY HOLDINGS BERHAD

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 GEVACRIL

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 MADREPERLA S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 POLYVANTIS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ESTIMATED PRICE AND VOLUME OF NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET ACROSS THE SUPPLY CHAIN:

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 5 NORTH AMERICA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALITY, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALITY, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALITY, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CAST ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA EXTRUDED ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA NYLON IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (THOUSAND SQ. MT.)

TABLE 47 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (THOUSAND SQ. MT.)

TABLE 49 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (THOUSAND SQ. MT.)

TABLE 51 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (THOUSAND SQ. MT)

TABLE 53 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 55 NORTH AMERICA RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COUNTRY, 2018-2032 (THOUSAND SQ. MT.)

TABLE 61 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 63 U.S. POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. CAST ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. EXTRUDED ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. NYLON IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. POLYETHERSULFONE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (THOUSAND SQ. MT.)

TABLE 105 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (THOUSAND SQ. MT.)

TABLE 107 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (THOUSAND SQ. MT.)

TABLE 109 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (THOUSAND SQ. MT.)

TABLE 111 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 113 U.S. RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 119 CANADA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 135 CANADA ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 136 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CANADA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 140 CANADA PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA CAST ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA EXTRUDED ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA NYLON IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA POLYETHERSULFONE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (THOUSAND SQ. MT.)

TABLE 161 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (THOUSAND SQ. MT.)

TABLE 163 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (THOUSAND SQ. MT.)

TABLE 165 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (THOUSAND SQ. MT.)

TABLE 167 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 169 CANADA RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 175 MEXICO POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 MEXICO POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY MANUFACTURING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO POLYETHYLENE (PE) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY POLYMER TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO POLYPROPYLENE (PP) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO POLYVINYL CHLORIDE (PVC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO ACRYLONITRILE BUTADIENE STYRENE (ABS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO PETG (GLYCOL-MODIFIED PET) SHEETS IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SPECIALTY, 2018-2032 (USD THOUSAND)

TABLE 199 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO CAST ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO EXTRUDED ACRYLIC SHEET IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO POLYMETHYLMETHACRYLATE (PMMA) / ACRYLIC IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO POLYSTYRENE (PS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SURFACE FINISH, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO HIGH IMPACT POLYSTYRENE (HIPS) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO NYLON IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO POLYCARBONATE (PC) IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO POLYETHERSULFONE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY THICKNESS, 2018-2032 (THOUSAND SQ. MT.)

TABLE 217 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY PLASTIC CATEGORY, 2018-2032 (THOUSAND SQ. MT.)

TABLE 219 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY COLOR, 2018-2032 (THOUSAND SQ. MT.)

TABLE 221 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY FINISH, 2018-2032 (THOUSAND SQ. MT.)

TABLE 223 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY END USE, 2018-2032 (THOUSAND SQ. MT.)

TABLE 225 MEXICO RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO RESIDENTIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO COMMERCIAL FURNITURE IN DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY SHEET TYPE, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET

FIGURE 2 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWELVE SEGMENTS COMPRISE THE NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET, BY TYPE

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR STYLISH, DURABLE AND LIGHT WEIGHT FURNITURE IS EXPECTED TO DRIVE THE NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET IN THE FORECAST PERIOD

FIGURE 16 THE POLYETHYLENE (PE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET

FIGURE 22 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY TYPE, 2024

FIGURE 23 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY THICKNESS, 2024

FIGURE 24 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY PLASTIC CATEGORY, 2024

FIGURE 25 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY COLOR, 2024

FIGURE 26 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY FINISH, 2024

FIGURE 27 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: BY END USE, 2024

FIGURE 28 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA DECORATIVE PLASTIC SHEET FOR FURNITURE MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.