Nordamerikanischer Markt für gestrichenes Papier, nach Produkt (gestrichenes Holzschliffpapier, standardmäßig gestrichenes Feinpapier, Papier mit geringer Strichstärke, pigmentbeschichtetes Papier, Kunstdruckpapier, Emaillepapier und andere), Strichschicht (einseitig und beidseitig gestrichen), Strichmaterial (Ton, Kalziumkarbonat , Talk, Kaolin, Wachs, Titandioxid und andere), Oberfläche (glänzend, seidenmatt, matt und andere), Streichmethode (handgestrichen, gebürstet, maschinengestrichen und andere), Veredelungsprozess (Online-Kalender und Offline-Kalender), Anwendung (Drucken, Verpacken und Etikettieren und andere) – Branchentrends und Prognose bis 2030.

Marktanalyse und Einblicke für beschichtetes Papier in Nordamerika

Papier, das während des Herstellungsprozesses mit einer Deckschicht oder Beschichtung versehen wurde, um seine Oberfläche und Bedruckbarkeit zu verbessern. Die Beschichtung soll bestimmte Eigenschaften des Papiers verbessern, wie Opazität, Helligkeit, Weiße, Farbe, Oberflächenglätte, Glanz und Tintenaufnahmefähigkeit, sodass das fertige Papierprodukt die für seinen Verwendungszweck erforderlichen Eigenschaften aufweist. Beschichtete Papiere werden nach der aufgetragenen Beschichtungsmenge klassifiziert; diese Klassifizierungen umfassen leicht gestrichenes, mittel gestrichenes, stark gestrichenes und Kunstdruckpapier (das für hochauflösende Kunstwerke verwendet wird).

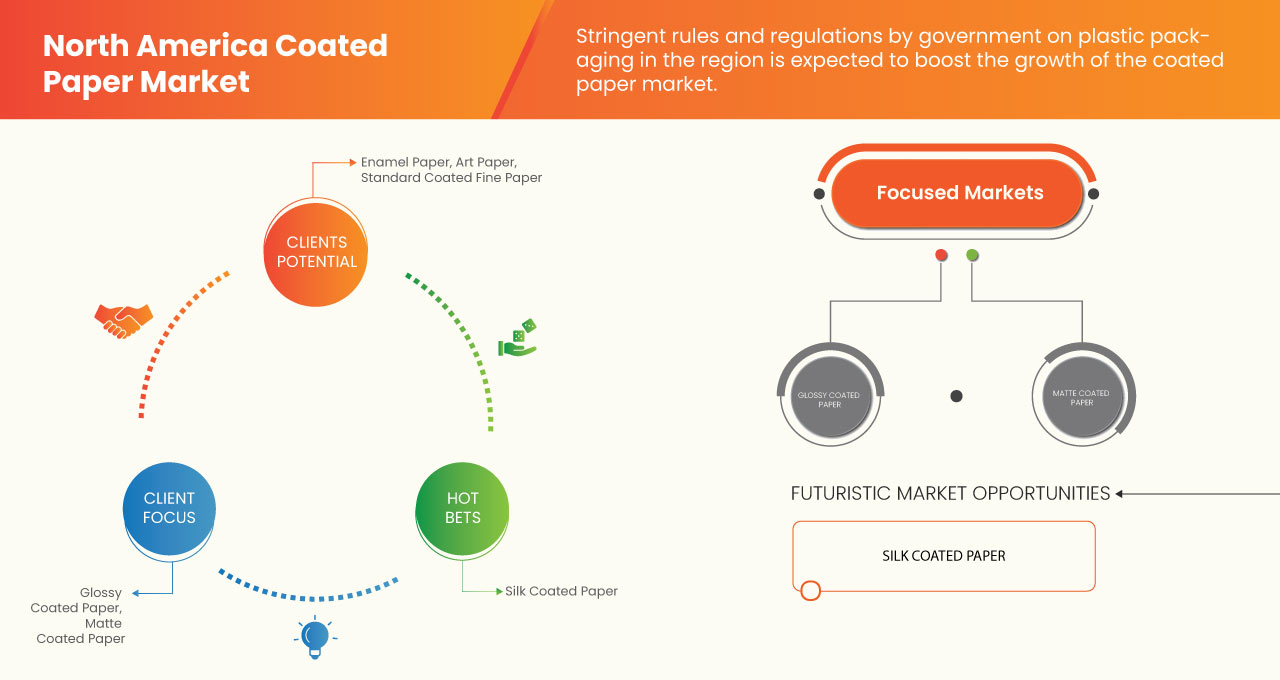

Neue Fortschritte in der Papierbeschichtungstechnologie in Verbindung mit dem sich ändernden und verbessernden Lebensstil der Verbraucher führen zu einer erheblichen Nachfrage nach Produkten mit beschichteter Verpackung und bieten den Herstellern von beschichtetem Papier enorme Chancen. Die Schwankungen der Rohstoffpreise dürften das Wachstum des Marktes beeinträchtigen.

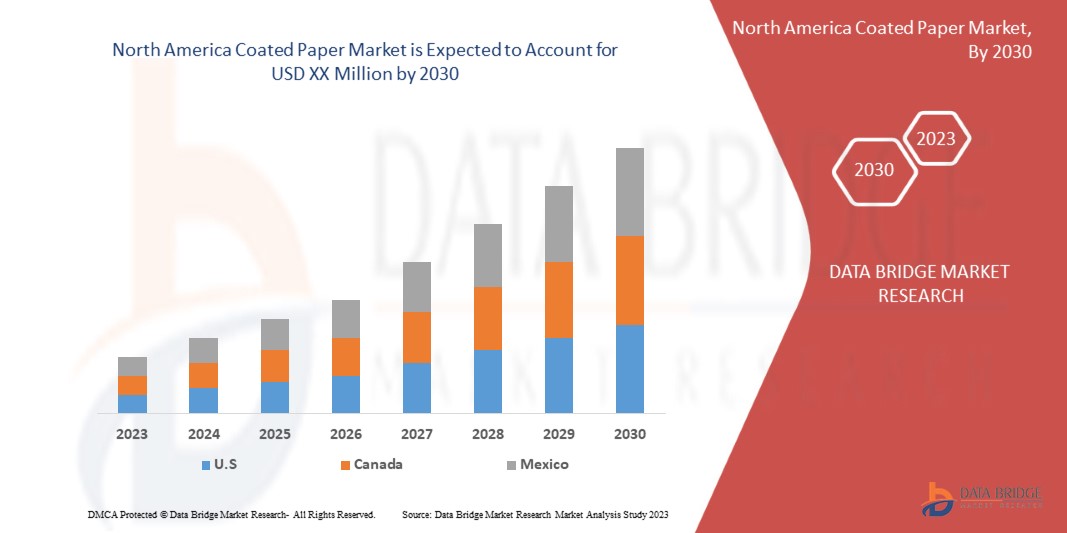

Laut einer Analyse von Data Bridge Market Research wird der nordamerikanische Markt für gestrichenes Papier im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate von 4,2 % wachsen.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2020 – 2015) |

|

Quantitative Einheiten |

Umsatz in Millionen USD, Preise in USD |

|

Abgedeckte Segmente |

Produkt (beschichtet Holzschliffpapier, standardmäßig beschichtetes Feinpapier, Papier mit geringer Strichstärke, pigmentbeschichtetes Papier, Kunstdruckpapier, Emaillepapier und andere), Beschichtungsschicht (einseitig beschichtet und beidseitig beschichtet), Beschichtungsmaterial (Ton, Kalziumkarbonat, Talk, Kaolin, Wachs, Titandioxid und andere), Oberfläche (glänzend, seidenmatt, matt und andere), Beschichtungsverfahren (handbeschichtet, gebürstet, maschinenbeschichtet und andere), Veredelungsprozess (Online-Kalender und Offline-Kalender), Anwendung (Drucken, Verpacken und Etikettieren und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ) und Billerud Americas Corporation unter anderem. |

Marktdefinition

Beschichtetes Papier ist ein Papier, das mit einem Polymer oder einer Materialmischung beschichtet wurde, um dem Papier bestimmte Eigenschaften zu verleihen, wie z. B. Gewicht, Oberflächenglanz, Glätte oder verringerte Tintenaufnahmefähigkeit. Zum Beschichten von Papier für hochwertige Drucke in der Verpackungsindustrie und für Zeitschriften können verschiedene Materialien wie Kaolinit, Kalziumkarbonat, Bentonit und Talk verwendet werden. Beschichtete Papiere haben eine glänzende, halbglänzende oder matte Oberfläche. Ein Beschichtungsmittel wird auf die Oberfläche von beschichtetem Papier aufgetragen, um Helligkeit, Glätte oder andere Druckeigenschaften zu verbessern. Nach dem Beschichten wird das Papier mit Walzen poliert. Es füllt die winzigen Vertiefungen und Lücken zwischen den Fasern, um eine glatte, flache Oberfläche zu erzeugen.

Marktdynamik für beschichtetes Papier in Nordamerika

Treiber

-

Steigende Nachfrage nach hochwertigen Druckbildern

Beschichtete Papiere drucken aufgrund ihrer hohen Reflektivität scharfe und brillante Bilder. Darüber hinaus bieten sie eine bessere Druckoberfläche als unbeschichtete Papiere, was zu hochwertigen Drucken führt. Beschichtete Papiere sind schmutz- und feuchtigkeitsbeständig und verbrauchen weniger Tinte zum Drucken, da sie nicht absorbierend sind. Das beschichtete Papier wird häufig mit Wachs, Ton, Kaolin, Latex, Titanoxid usw. beschichtet, wodurch das Papier heller glänzt und die Qualität der darauf gedruckten Bilder verbessert wird. Beschichtetes Papier kann in einer Vielzahl von Endanwendungen wie Katalogen, Zeitungsbeilagen, verarbeiteten Papierprodukten, Sicherheitspapieren, Zeitschriften und Werbematerialien verwendet werden, da es normalerweise eine glänzende oder matte Oberfläche hat. Da es scharfe und komplexe Bilder erzeugt, wird beschichtetes Papier häufig für Druckzwecke verwendet.

Beschichtete Papiere sind in der Regel schwerer als unbeschichtete Papiere und verleihen einem Druckauftrag Gewicht. Beschichtetes Papier eignet sich besser für bestimmte Veredelungstechniken wie Flächen- oder Spotlack oder andere Veredelungsbeschichtungen, da es glatter ist und die Tinte besser hält (weniger saugfähig ist) als unbeschichtetes Papier. Beschichtete Papiere liefern hochwertige Drucke und werden von verschiedenen wichtigen Akteuren auf dem nordamerikanischen Markt für beschichtetes Papier hergestellt.

Daher wird erwartet, dass die steigende Nachfrage nach hochwertigen Drucken und Bildern in verschiedenen Zeitschriften, Broschüren, Prospekten usw. das Wachstum des nordamerikanischen Marktes für gestrichenes Papier vorantreiben wird.

-

Steigende Nachfrage nach beschichtetem Papier in der Lebensmittelindustrie

Beschichtete Papiere werden in verschiedenen Branchen vielfältig eingesetzt, darunter auch in der Lebensmittelindustrie, wo beschichtetes Papier weltweit häufig zum Verpacken von Lebensmitteln verwendet wird. Da in Nordamerika die Nachfrage nach nachhaltigen Lösungen steigt, wird bei Lebensmittelverpackungen zunehmend Kunststoff durch biologisch abbaubares, recycelbares Papier ersetzt. Um die Qualität und Leistung zu verbessern und die Kunststofffüllungen zu ersetzen, müssen die verwendeten beschichteten Papiere von hoher Qualität und nicht reaktiv sein.

Wachspapier eignet sich aufgrund seiner Nässe- und Fettbeständigkeit vor allem für Lebensmittel, vor allem zum Verpacken von Fisch, Fleisch und Schokoriegeln. Es eignet sich daher besonders für den direkten Kontakt mit Käse, Butter und zum Verpacken von Schokoriegeln und fettigen Lebensmitteln. Da Wachspapier wasser-, öl- und fettbeständig ist, hilft es bei der Konservierung von Lebensmitteln. Harzbeschichtete Papiere eignen sich ideal für frische Lebensmittel, fettige Lebensmittel und feuchte Lebensmittel sowie für Lebensmittelbeutel.

Verpackungen aus Polyethylenpapier sind für den direkten Kontakt mit Lebensmitteln geeignet, bieten Frischegarantie, Schutz und erfüllen höchste Lebensmittelhygienestandards. Beschichtete Papiere und Burger-Zwischenblätter werden zum Verpacken von Thekenlebensmitteln wie Fleisch, Käse und gekochten Lebensmitteln in Supermärkten, Metzgereien, Feinkostläden und Feinkostläden verwendet. Polyethylenbeschichtete Papiere werden in Metzgereien, Feinkostläden und Supermärkten zum Verpacken frischer Lebensmittel verwendet. Tatsächlich fungiert Polyethylenfolie mit hoher Dichte als Schutzbarriere gegen Feuchtigkeit, Fett und Gerüche.

Gelegenheiten

-

Der veränderte und verbesserte Lebensstil der Verbraucher führt zu einer erheblichen Nachfrage nach Produkten mit beschichteten Verpackungen

Der Lebensstil der Verbraucher ändert und verbessert sich, wenn ihr verfügbares Einkommen steigt, ebenso wie ihr Verbrauch von Gesundheits-, Nahrungsmittel- und Getränke- sowie Haushaltspflegeprodukten, insbesondere in Entwicklungsländern. In den kommenden Jahren wird dies voraussichtlich zu einer steigenden Nachfrage nach beschichtetem Papier führen.

Darüber hinaus interessieren sich Markeninhaber aufgrund staatlicher Vorschriften zur Einschränkung von Einwegkunststoffen immer mehr für umweltfreundliche Druck- und Verpackungstechniken. Aus diesem Grund setzen Hersteller auf umweltfreundlichere Druck- und Verpackungstechniken, was zu neuen Möglichkeiten auf dem Markt für beschichtetes Papier führen wird.

Aufgrund ihres geschäftigen Lebensstils und ihres wachsenden Gesundheitsbewusstseins bevorzugen Millennials den Kauf von Fertiggerichten. Dies treibt die Nachfrage nach beschichteten Verpackungsmaterialien aufgrund des steigenden Bedarfs an modifizierten Verpackungen an. Dies schafft weitere Möglichkeiten zur Markterweiterung.

Einschränkungen/Herausforderungen

- Weit verbreitete Digitalisierung in allen Branchen begrenzt die Verwendung von Papier

In allen Branchen ist ein Aufschwung bei der Digitalisierung zu verzeichnen. Die Einfachheit und Bequemlichkeit der Digitalisierung ermöglicht es den Industriellen, sich für digitale Plattformen zu entscheiden. Während die Welt weiterhin einen massiven digitalen Wandel durchläuft, übernehmen Schlüsselsektoren und -industrien digitale Technologien, um sicherzustellen, dass sie zukunftsfähig und gut positioniert sind, um weltweit Erfolg zu haben.

Zum Beispiel,

- Laut CII haben sich digitale Unternehmen im März 2022 über das bloße Kaufen und Verkaufen auf einer Website hinaus entwickelt. Digital ist heute eher ein Medium zum Austausch von Waren und Dienstleistungen und sorgt gleichzeitig dafür, dass sie die richtigen Leute erreichen. Mehrseitige Marktplätze nutzen die Macht der Netzwerkeffekte durch kollaborativen Handel, um exponentiell zu wachsen und kontinuierlich Mehrwert für ihre Benutzer zu schaffen.

Darüber hinaus hat die zunehmende Digitalisierung es den Industrien ermöglicht, ihre Dienstleistungen und Informationen nur noch auf ihren Websites anzubieten. Verschiedene Hersteller in den Branchen sind auf E-Broschüren, Zeitschriften und Jahresberichte usw. umgestiegen, was sich für die beschichtete Papierindustrie als großer Nachteil herausgestellt hat. Die Hersteller werben über Online-Medien, Fernsehwerbung und andere Social-Media-Plattformen, was das Wachstum der Papiermedien gebremst hat, was die beschichtete Papierindustrie erheblich beeinträchtigt.

Daher könnte die zunehmende Digitalisierung in allen Branchen das Wachstum des nordamerikanischen Marktes für gestrichenes Papier behindern.

Auswirkungen von COVID-19 auf den nordamerikanischen Markt für beschichtetes Papier

COVID-19 hat den Markt in gewissem Maße beeinflusst. Aufgrund der Sperrung wurde die Herstellung und Produktion vieler kleiner und großer Unternehmen eingestellt, und auch die Nachfrage nach beschichtetem Papier ging zurück, was den Markt beeinflusste. Aufgrund der Änderung vieler Mandate und Vorschriften können Hersteller neue Produkte entwickeln und auf den Markt bringen, was das Marktwachstum fördern wird.

Jüngste Entwicklungen

- Im Dezember 2021 kündigte Lecta die Markteinführung von Linerpapieren an. Linerset CCK Duo ist ein beidseitig tonbeschichtetes Trennpapier zur Silikonisierung mit einer speziellen Rückseitenbehandlung. Es erweitert das Produktportfolio des Unternehmens.

Marktumfang für beschichtetes Papier in Nordamerika

Der nordamerikanische Markt für gestrichenes Papier ist in bemerkenswerte Segmente unterteilt, basierend auf Produkt, Beschichtungsschicht, Beschichtungsmaterial, Finish, Beschichtungsmethode, Finishing-Prozess und Anwendung. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Produkt

- Beschichtetes Holzschliffpapier

- Standard gestrichenes Feinpapier

- Papier mit geringer Strichstärke

- Pigmentbeschichtetes Papier

- Kunstdruckpapier

- Emaillepapier

- Sonstiges

Basierend auf dem Produkt ist der nordamerikanische Markt für gestrichenes Papier in gestrichenes Holzschliffpapier, standardmäßig gestrichenes Feinpapier, Papier mit geringer Strichstärke, pigmentbeschichtetes Papier, Kunstdruckpapier, Emaillepapier und andere unterteilt.

Beschichtungsschicht

- Einseitig beschichtet

- Beidseitig beschichtet

Basierend auf der Beschichtungsschicht ist der nordamerikanische Markt für beschichtetes Papier in einseitig beschichtetes und beidseitig beschichtetes Papier unterteilt.

Beschichtungsmaterial

- Ton

- Kalziumkarbonat

- Talk

- Kaolin-Ton

- Wachs

- Titandioxid

- Sonstiges

Basierend auf dem Beschichtungsmaterial ist der nordamerikanische Markt für beschichtetes Papier in Ton, Kalziumkarbonat, Talk, Kaolin, Wachs, Titandioxid und andere unterteilt.

Beenden

- Glanz

- Satin

- Matt

- Langweilig

- Sonstiges

Based on finish, the North America coated paper market is segmented into gloss, satin, matte, dull and others

Coating Method

- Hand-Coated

- Brush-Coated

- Machine Coated

- Others

Based on coating method, the North America coated paper market is segmented into hand-coated, brush-coated and machine coated and others.

Finishing Process

- Online Calendaring

- Offline Calendaring

Based on finishing process, the North America coated paper market is segmented into online calendaring and offline calendaring

Application

- Printing

- Packaging and Labelling

- Others

Based on application, the North America coated paper market is segmented into printing, packaging and labelling and others

North America Coated Paper Market Regional Analysis/Insights

The North America coated paper market is analyzed, and market size insights and trends are provided based on country and as referenced above.

The countries covered in the North America coated market report are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America coated paper market in terms of market share and revenue and is estimated to maintain its dominance during the forecast period due to the growing surge for coated paper in various industries and growing consumer demand from end users.

The region section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Coated Paper Market Share Analysis

The North America coated paper market competitive landscape provides details about the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company’s focus on the North America coated paper market.

Some of the major players operating in the North America coated paper market are Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Stora Enso, Sappi Ltd., Asia Pulp & Paper (APP) Sinar Mas, skpmil.com, UPM, DS Smith, Dunn Paper Company, Paradise Packaging, Burgo Group Spa, JK Paper, Emami Paper Mills Ltd., Koehler Holding SE & Co. KG, Lecta, Twin Rivers Paper Company, Svenska Cellulosa Aktiebolaget SCA (Publ), and Billerud Americas Corporation among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA COATED PAPER MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TESTING TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 TECHNOLOGICAL ADVANCEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR HIGH-QUALITY PRINT IMAGES

5.1.2 INCREASE IN DEMAND FOR COATED PAPER IN THE FOOD INDUSTRY

5.1.3 RISE IN E-COMMERCE AND ONLINE SHOPPING ACTIVITIES THUS CREATING DEMAND FOR THE PACKAGING INDUSTRY

5.1.4 STRINGENT GOVERNMENT RULES ON PLASTIC PACKAGING

5.2 RESTRAINTS

5.2.1 WIDESPREAD DIGITALIZATION ACROSS INDUSTRIES LIMITING THE USE OF PAPER

5.2.2 NEGATIVE IMPACT OF THE PAPER INDUSTRY ON THE ENVIRONMENT

5.2.3 HIGH INITIAL INVESTMENT IN COATED PAPER INDUSTRY

5.3 OPPORTUNITIES

5.3.1 NEW ADVANCES IN PAPER COATING TECHNOLOGY

5.3.2 CONSUMERS' CHANGING AND IMPROVING LIFESTYLES RESULT IN A SIGNIFICANT DEMAND FOR PRODUCTS WITH COATED PACKAGING

5.3.3 SHIFTING TOWARDS THE ECO-FRIENDLY PRINTING AND PACKAGING FORMATS

5.4 CHALLENGES

5.4.1 FLUCTUATION IN PRICES OF RAW MATERIAL

5.4.2 LOW RECYCLING VALUE FOR COATED PAPER

5.4.3 GOVERNMENT OVERSEAS REGULATIONS FOR IMPORT-EXPORT

6 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 STANDARD COATED FINE PAPER

6.2.1 TWO-COATED

6.2.1.1 MACHINE COATED

6.2.1.2 HAND-COATED

6.2.1.3 BRUSH-COATED

6.2.1.4 OTHERS

6.2.2 ONE-SIDE COATED

6.2.3 MACHINE COATED

6.2.4 BRUSH-COATED

6.2.5 OTHERS

6.3 COATED GROUND WOOD PAPER

6.3.1 TWO-COATED

6.3.1.1 MACHINE COATED

6.3.1.2 HAND-COATED

6.3.1.3 BRUSH-COATED

6.3.1.4 OTHERS

6.3.2 ONE-SIDE COATED

6.3.3 MACHINE COATED

6.3.4 HAND-COATED

6.3.5 BRUSH-COATED

6.3.6 OTHERS

6.4 ART PAPER

6.4.1 TWO-COATED

6.4.1.1 MACHINE COATED

6.4.1.2 HAND-COATED

6.4.1.3 BRUSH-COATED

6.4.1.4 OTHERS

6.4.2 ONE-SIDE COATED

6.4.2.1 MACHINE COATED

6.4.2.2 HAND-COATED

6.4.2.3 BRUSH-COATED

6.4.2.4 OTHERS

6.5 PIGMENT COATED PAPER

6.5.1 TWO-COATED

6.5.1.1 MACHINE COATED

6.5.1.2 HAND-COATED

6.5.1.3 BRUSH-COATED

6.5.1.4 OTHERS

6.5.2 ONE-SIDE COATED

6.5.2.1 MACHINE COATED

6.5.2.2 HAND-COATED

6.5.2.3 BRUSH-COATED

6.5.2.4 OTHERS

6.6 ENAMEL PAPER

6.6.1 TWO-COATED

6.6.1.1 MACHINE COATED

6.6.1.2 HAND-COATED

6.6.1.3 BRUSH-COATED

6.6.1.4 OTHERS

6.6.2 ONE-SIDE COATED

6.6.2.1 MACHINE COATED

6.6.2.2 HAND-COATED

6.6.2.3 BRUSH-COATED

6.6.2.4 OTHERS

6.7 LOW COAT WEIGHT PAPER

6.7.1 TWO-COATED

6.7.1.1 MACHINE COATED

6.7.1.2 HAND-COATED

6.7.1.3 BRUSH-COATED

6.7.1.4 OTHERS

6.7.2 ONE-SIDE COATED

6.7.2.1 MACHINE COATED

6.7.2.2 HAND-COATED

6.7.2.3 BRUSH-COATED

6.7.2.4 OTHERS

6.8 OTHERS

6.8.1 TWO-COATED

6.8.1.1 MACHINE COATED

6.8.1.2 HAND-COATED

6.8.1.3 BRUSH-COATED

6.8.1.4 OTHERS

6.8.2 ONE-SIDE COATED

6.8.2.1 MACHINE COATED

6.8.2.2 HAND-COATED

6.8.2.3 BRUSH-COATED

6.8.2.4 OTHERS

7 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER

7.1 OVERVIEW

7.2 TWO-SIDE COATED

7.3 ONE-SIDE COATED

8 NORTH AMERICA COATED PAPER MARKET, BY FINISH

8.1 OVERVIEW

8.2 GLOSS

8.3 SATIN

8.4 MATTE

8.5 DULL

8.6 OTHERS

9 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PACKAGING AND LABELLING

9.2.1 STANDARD COATED FINE PAPER

9.2.2 COATED GROUND WOOD PAPER

9.2.3 ART PAPER

9.2.4 PIGMENT COATED PAPER

9.2.5 ENAMEL PAPER

9.2.6 LOW COAT WEIGHT PAPER

9.2.7 OTHERS

9.3 PRINTING

9.3.1 STANDARD COATED FINE PAPER

9.3.2 COATED GROUND WOOD PAPER

9.3.3 ART PAPER

9.3.4 PIGMENT COATED PAPER

9.3.5 ENAMEL PAPER

9.3.6 LOW COAT WEIGHT PAPER

9.3.7 OTHERS

9.4 OTHERS

9.4.1 STANDARD COATED FINE PAPER

9.4.2 COATED GROUND WOOD PAPER

9.4.3 ART PAPER

9.4.4 PIGMENT COATED PAPER

9.4.5 ENAMEL PAPER

9.4.6 LOW COAT WEIGHT PAPER

9.4.7 OTHERS

10 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS

10.1 OVERVIEW

10.2 ONLINE CALENDARING

10.3 OFFLINE CALENDARING

11 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD

11.1 OVERVIEW

11.2 MACHINE COATED

11.3 HAND-COATED

11.4 BRUSH-COATED

11.5 OTHERS

12 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL

12.1 OVERVIEW

12.2 CALCIUM CARBONATE

12.2.1 PRECIPITATED CALCIUM CARBONATE (PCC)

12.2.2 GROUND CALCIUM CARBONATE (GCC)

12.3 KAOLIN CLAY

12.4 CLAY

12.5 TITANIUM DIOXIDE

12.6 WAX

12.7 TALC

12.8 OTHERS

13 NORTH AMERICA COATED PAPER MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA COATED PAPER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 SAPPI

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 BILLERUD AMERICAS CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UPM

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 DS SMITH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 STORA ENSO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 OJI HOLDINGS CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 NIPPON PAPER INDUSTRIES CO., LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 LECTA

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EMAMI PAPER MILLS LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 SVENSKA CELLULOSA AKTIEBOLAGET SCA

16.10.1 COMPANY SNAPSHOT

16.10.2 RECENT FINANCIALS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 DUNN PAPER COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 KOEHLER HOLDING SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 BURGO GROUP S.P.A.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 JK PAPER

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 ASIA PULP & PAPER (APP) SINAR MAS.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 TWIN RIVERS PAPER COMPANY

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SKPMILL.COM

16.17.1 COMPANY SNAPSHOT

16.17.2 RECENT FINANCIALS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 PARADISE PACKAGING

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 3 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 5 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 7 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 9 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 11 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 13 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 15 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 17 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 19 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 21 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 23 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 25 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 27 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 29 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 31 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 33 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 35 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)(B2C)

TABLE 36 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 37 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 39 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 41 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 43 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 45 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 47 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 49 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 51 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 53 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 55 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA TWO-COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 57 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 59 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 61 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 63 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 65 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 67 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA GLOSS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 69 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA SATIN IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 71 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA MATTE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 73 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA DULL IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 75 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 77 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 79 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA PACKAGING AND LABELLING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 81 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 83 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 85 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 87 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 89 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 91 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 93 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA ONLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 95 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA OFFLINE CALENDARING IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 97 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 99 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA MACHINE COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 101 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA HAND-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 103 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA BRUSH-COATED IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 105 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 107 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 109 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 111 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 113 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA KAOLIN CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 115 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA CLAY IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 117 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA TITANIUM DIOXIDE IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 119 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA WAX IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 121 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA TALC IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 123 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY REGION, 2021-2030 (KILO TON)

TABLE 125 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (KILO TON)

TABLE 127 NORTH AMERICA COATED PAPER MARKET, BY COUNTRY, 2021-2030 (ASP)

TABLE 128 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 130 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 131 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 133 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 135 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 137 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 139 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 141 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 143 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 145 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 147 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 149 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 151 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 153 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 155 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 157 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 159 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 161 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 163 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 165 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 167 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 169 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 171 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 173 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 175 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 176 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 178 NORTH AMERICA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 179 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 181 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 183 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 184 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 185 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 186 NORTH AMERICA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 187 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 188 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 189 NORTH AMERICA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 190 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 191 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 192 NORTH AMERICA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 193 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 NORTH AMERICA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 195 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 196 NORTH AMERICA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 197 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 NORTH AMERICA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 199 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 200 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 201 U.S. COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 202 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 203 U.S. STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 204 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 205 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 206 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 207 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 208 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 209 U.S. COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 210 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 211 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 212 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 213 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 214 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 215 U.S. ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 216 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 217 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 218 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 219 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 220 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 221 U.S. PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 222 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 223 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 224 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 225 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 226 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 227 U.S. ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 228 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 229 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 230 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 231 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 232 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 233 U.S. LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 234 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 235 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 236 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 237 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 238 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 239 U.S. OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 240 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 241 U.S. ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 242 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 243 U.S. TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 244 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 245 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 246 U.S. COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 247 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 248 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 249 U.S. COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 250 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 251 U.S. CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 252 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 253 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 254 U.S. COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 255 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 256 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 257 U.S. COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 258 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 259 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 260 U.S. COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 261 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 262 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 263 U.S. COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 264 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 265 U.S. PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 266 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 267 U.S. PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 268 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 269 U.S. OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 270 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 271 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 272 CANADA COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 273 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 274 CANADA STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 275 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 276 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 277 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 278 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 279 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 280 CANADA COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 281 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 282 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 283 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 284 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 285 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 286 CANADA ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 287 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 288 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 289 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 290 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 291 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 292 CANADA PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 293 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 294 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 295 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 296 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 297 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 298 CANADA ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 299 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 300 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 301 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 302 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 303 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 304 CANADA LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 305 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 306 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 307 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 308 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 309 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 310 CANADA OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 311 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 312 CANADA ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 313 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 314 CANADA TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 315 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 316 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 317 CANADA COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 318 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 319 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 320 CANADA COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 321 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 322 CANADA CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 323 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 324 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 325 CANADA COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 326 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 327 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 328 CANADA COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 329 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 330 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 331 CANADA COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 332 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 333 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 334 CANADA COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 335 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 336 CANADA PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 337 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 338 CANADA PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 339 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 340 CANADA OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 341 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 342 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 343 MEXICO COATED PAPER MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 344 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 345 MEXICO STANDARD COATED FINE PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 346 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 347 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 348 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 349 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 350 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 351 MEXICO COATED GROUND WOOD PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 352 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 353 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 354 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 355 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 356 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 357 MEXICO ART PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 358 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 359 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 360 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 361 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 362 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 363 MEXICO PIGMENT COATED PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 364 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 365 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 366 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 367 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 368 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 369 MEXICO ENAMEL PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 370 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 371 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 372 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 373 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 374 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 375 MEXICO LOW COAT WEIGHT PAPER IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 376 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 377 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 378 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 379 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 380 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 381 MEXICO OTHERS IN COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 382 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 383 MEXICO ONE-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 384 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 385 MEXICO TWO-SIDE COATED IN COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 386 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (USD MILLION)

TABLE 387 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (KILO TON)

TABLE 388 MEXICO COATED PAPER MARKET, BY COATING LAYER, 2021-2030 (ASP)

TABLE 389 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 390 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 391 MEXICO COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (ASP)

TABLE 392 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (USD MILLION)

TABLE 393 MEXICO CALCIUM CARBONATE IN COATED PAPER MARKET, BY COATING MATERIAL, 2021-2030 (KILO TON)

TABLE 394 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (USD MILLION)

TABLE 395 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (KILO TON)

TABLE 396 MEXICO COATED PAPER MARKET, BY FINISH, 2021-2030 (ASP)

TABLE 397 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (USD MILLION)

TABLE 398 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (KILO TON)

TABLE 399 MEXICO COATED PAPER MARKET, BY COATING METHOD, 2021-2030 (ASP)

TABLE 400 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (USD MILLION)

TABLE 401 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (KILO TON)

TABLE 402 MEXICO COATED PAPER MARKET, BY FINISHING PROCESS, 2021-2030 (ASP)

TABLE 403 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 404 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (KILO TON)

TABLE 405 MEXICO COATED PAPER MARKET, BY APPLICATION, 2021-2030 (ASP)

TABLE 406 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 407 MEXICO PRINTING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 408 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 409 MEXICO PACKAGING AND LABELING IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

TABLE 410 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 411 MEXICO OTHERS IN COATED PAPER MARKET, BY PRODUCT, 2021-2030 (KILO TON)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COATED PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COATED PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COATED PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COATED PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COATED PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA COATED PAPER MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA COATED PAPER MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA COATED PAPER MARKET VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA COATED PAPER MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF COATED PAPER IN FOOD INDUSTRY IS DRIVING THE COATED PAPER MARKET IN THE FORECAST PERIOD

FIGURE 12 STANDARD COATED FINE PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COATED PAPER MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COATED PAPER MARKET

FIGURE 14 NORTH AMERICA COATED PAPER MARKET, BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA COATED PAPER MARKET, BY COATING LAYER, 2022

FIGURE 16 NORTH AMERICA COATED PAPER MARKET, BY FINISH, 2022

FIGURE 17 NORTH AMERICA COATED PAPER MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA COATED PAPER MARKET: BY FINISHING PROCESS, 2022

FIGURE 19 NORTH AMERICA COATED PAPER MARKET: BY COATING METHOD, 2022

FIGURE 20 NORTH AMERICA COATED PAPER MARKET: BY COATING MATERIAL, 2022

FIGURE 21 NORTH AMERICA COATED PAPER MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022)

FIGURE 23 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 NORTH AMERICA COATED PAPER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 NORTH AMERICA COATED PAPER MARKET: BY PRODUCT (2023-2030)

FIGURE 26 NORTH AMERICA COATED PAPER MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.