Japan Tax It Software Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.58 Billion

USD

4.66 Billion

2024

2032

USD

2.58 Billion

USD

4.66 Billion

2024

2032

| 2025 –2032 | |

| USD 2.58 Billion | |

| USD 4.66 Billion | |

|

|

|

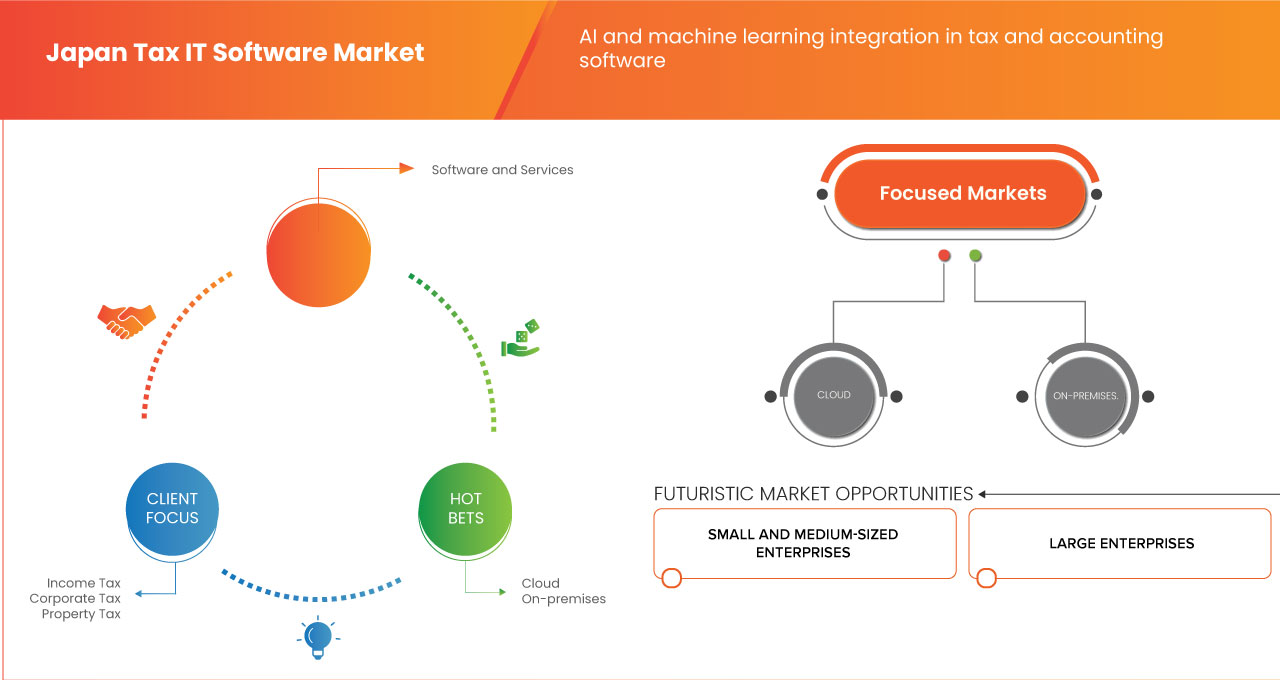

Marktsegmentierung für Steuer-IT-Software in Japan nach Angebot (Software und Dienstleistungen), Steuerart (Einkommensteuer, Körperschaftsteuer, Grundsteuer und andere), Bereitstellungsmodus (Neue Cloud und vor Ort), Unternehmensgröße (kleine und mittlere Unternehmen und große Unternehmen), Umsatzmodell (einmaliger Kauf und abonnementbasiert), Branche (Bankwesen, Finanzdienstleistungen und Versicherungen (BFSI), IT und Telekommunikation, Fertigung, Einzelhandel und Konsumgüter, Gesundheitswesen, Energie und Versorgung, Medien und Unterhaltung und andere) – Branchentrends und Prognose bis 2032

Analyse und Größe des japanischen Marktes für IT-Steuersoftware

Der japanische Markt für IT-Steuersoftware wächst aufgrund der steigenden Nachfrage nach Compliance mit sich entwickelnden Steuervorschriften und staatlichen Digitalisierungsinitiativen wie E-Tax. Unternehmen setzen auf automatisierte Lösungen, um Fehler zu reduzieren und die betriebliche Effizienz bei der Steuererklärung zu verbessern. Die Integration von KI und Echtzeitanalysen ist ein wichtiger Trend, der dynamische Updates und personalisierte Einblicke ermöglicht. Wichtige Akteure konzentrieren sich auf benutzerfreundliche Schnittstellen und robuste Cybersicherheit, um den vielfältigen Geschäftsanforderungen gerecht zu werden. Zu den Herausforderungen zählen hohe Implementierungskosten für kleine Unternehmen und Widerstand gegen die digitale Transformation. Chancen liegen in der Ausweitung cloudbasierter Lösungen und der Versorgung des wachsenden KMU-Sektors. Der Wettbewerb verschärft sich, da sowohl inländische als auch internationale Anbieter den Markt ins Visier nehmen.

Laut einer Analyse von Data Bridge Market Research dürfte der japanische Markt für IT-Steuersoftware von 2,58 Milliarden US-Dollar im Jahr 2024 auf 4,66 Milliarden US-Dollar im Jahr 2032 anwachsen und im Prognosezeitraum zwischen 2025 und 2032 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 7,7 % aufweisen.

Berichtsumfang und Marktsegmentierung für Steuer-IT-Software

|

Eigenschaften |

Wichtige Markteinblicke in Sensorreinigungssysteme |

|

Abgedeckte Segmente |

|

|

Wichtige Marktteilnehmer |

SAP (Deutschland), ADP, Inc. (USA), freee KK (Japan), Money Forward, Inc. (Japan), PCA Corporation (USA), QUICKBOOKS (INTUIT INC.) (USA), SAGE GROUP PLC (Großbritannien), TKC Corporation (Japan) und Wolters Kluwer NV (Niederlande) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Marktdefinition

Der japanische Markt für Steuer-IT-Software umfasst eine Reihe von Softwarelösungen, die darauf ausgelegt sind, steuerbezogene Prozesse für Privatpersonen, Unternehmen und Steuerfachleute zu rationalisieren und zu automatisieren. Dieser Markt umfasst Softwareanwendungen, die die Steuervorbereitung, -einreichung, -einhaltung und -berichterstattung gemäß den spezifischen Steuervorschriften Japans unterstützen. Zu den wichtigsten Funktionen gehören in der Regel Echtzeit-Datenanalysen, E-Filing-Funktionen, Steuerplanung und regulatorische Updates, die den Benutzern helfen, sowohl lokale als auch internationale Steueranforderungen einzuhalten. Da die Nachfrage nach digitaler Transformation steigt, integrieren diese Lösungen zunehmend Technologien wie Cloud Computing, künstliche Intelligenz und Datensicherheit und ermöglichen so eine höhere Effizienz und Genauigkeit im Steuermanagement.

Dynamik des japanischen Marktes für Steuer-IT-Software

Treiber

- Wachsende Nachfrage bei Japans kleinen und mittleren Unternehmen

Der Sektor der kleinen und mittleren Unternehmen (KMU) in Japan wächst rasant, was zu einer erhöhten Nachfrage nach effizienten und kostengünstigen Lösungen, insbesondere in den Bereichen Steuern und Buchhaltung, führt. Mit dem Wachstum der Unternehmen wird es immer wichtiger, Finanzvorgänge zu rationalisieren und die Einhaltung sich ändernder Gesetze zu gewährleisten. In diesem Zusammenhang bietet cloudbasierte Steuer- und Buchhaltungssoftware eine perfekte Alternative für KMU, die ihr Finanzmanagement verbessern und gleichzeitig die Kosten unter Kontrolle halten möchten.

- Die Integration von KI und maschinellem Lernen in Steuer- und Buchhaltungssoftware

Die Integration von künstlicher Intelligenz (KI) und maschinellem Lernen (ML) in Steuer- und Buchhaltungssoftware verändert die Finanzmanagementlandschaft von Unternehmen. Da Unternehmen mit zunehmend komplizierteren Finanzsituationen konfrontiert sind, bietet der Einsatz von KI für prädiktive Analysen, Steueroptimierung und Betrugserkennung einen erheblichen Wettbewerbsvorteil. Diese Technologien ermöglichen es Unternehmen, zeitaufwändige Vorgänge zu automatisieren und eine höhere Genauigkeit zu erzielen, was zu einer höheren Betriebseffizienz führt.

Gelegenheiten

- Ausbau der Cloud-Dienste für Unternehmen

Die rasante Verbreitung von Cloud-Diensten hat in Japan neue Möglichkeiten für kleine und mittlere Unternehmen (KMU) geschaffen. Während das Land auf eine digitale Transformation zusteuert , wird cloudbasierte Steuer- und Buchhaltungssoftware immer attraktiver. Diese Lösungen bieten Unternehmen eine kostengünstige, skalierbare und benutzerfreundliche Möglichkeit, ihre Finanzgeschäfte zu verwalten, ohne dass erhebliche Investitionen in die Infrastruktur erforderlich sind.

- Regierungsinitiativen zur Förderung digitaler Compliance-Software

Regierungen auf der ganzen Welt, darunter auch Japan, unterstützen aktiv den Einsatz digitaler Compliance-Software in Unternehmen, um die Produktivität zu steigern, Fehler zu vermeiden und die Einhaltung gesetzlicher Vorschriften zu gewährleisten. Mit dem Aufkommen der digitalen Transformationsaktivitäten erstellen Regierungen Programme und Gesetze, die Unternehmen dazu ermutigen, moderne Technologien wie Steuer- und Buchhaltungssoftware zu verwenden, um ihre Abläufe zu vereinfachen und den steigenden Anforderungen an die Einhaltung gesetzlicher Vorschriften gerecht zu werden.

Einschränkungen/Herausforderungen

- Hohe Kosten und anfängliche Investitionsbeschränkungen

Obwohl moderne Steuer- und Buchhaltungssoftware viele Vorteile bietet, können die hohen Kosten für die Anschaffung, Bereitstellung und Wartung dieser Systeme ein erhebliches Hindernis darstellen, insbesondere für kleine und mittlere Unternehmen (KMU). Da Unternehmen versuchen, ihre Finanzabläufe zu rationalisieren und wettbewerbsfähig zu bleiben, kann die anfängliche Investition für eine solche Software viele abschrecken, insbesondere wenn zusätzliche Anpassungs- und Integrationsgebühren anfallen.

- Bedenken hinsichtlich Cybersicherheit und Datenschutz

Da Unternehmen ihre Finanzgeschäfte digitalisieren, sind Cybersicherheitsbedenken zu einem großen Hindernis für den Einsatz moderner Steuer- und Buchhaltungssoftware geworden. Unternehmen sind einem erhöhten Risiko von Datenlecks, Cyberangriffen und Datenschutzverletzungen ausgesetzt, da sie bei der Verwaltung sensibler Finanzdaten immer stärker auf digitale Plattformen angewiesen sind. Diese Probleme verhindern häufig, dass Unternehmen vollständig digitale Finanzmanagementsysteme einführen.

Jüngste Entwicklungen

- Im Oktober 2024 hat ADP Workforce Software übernommen, einen führenden Anbieter von Workforce-Management-Lösungen für globale Unternehmen. Diese Übernahme erweitert das Angebot von ADP, verbessert die globalen Workforce-Management-Fähigkeiten und treibt zukünftige Innovationen voran, um den sich entwickelnden Geschäftsanforderungen gerecht zu werden.

- Im Oktober 2024 brachte TKC Co., Ltd. das TKC-Phone SE3 auf den Markt, ein sicheres Smartphone für Steuerberaterbüros. Dieses Gerät hilft Unternehmen, die Vertraulichkeits- und Aufsichtsanforderungen des Steuerberatergesetzes einzuhalten. Es verfügt über App-Einschränkungen, Datenschutz und Geräteverwaltung, um die Privatsphäre der Mitarbeiter und eine sichere Kommunikation zu gewährleisten. Die landesweite Einführung ist für Dezember 2024 geplant.

Umfang des japanischen Marktes für Steuer-IT-Software

Der japanische Markt für Steuer-IT-Software ist in sechs wichtige Segmente unterteilt, basierend auf Angebot, Steuerart, Bereitstellungsmodus, Unternehmensgröße, Umsatzmodell und Branche. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Angebot

- Software

- Dienstleistungen

Steuerart

- Einkommensteuer

- Körperschaftssteuer

- Vermögenssteuer

- Sonstiges

Bereitstellungsmodus

- Neue Cloud

- Vor Ort

Größe der Organisation

- Kleine und mittlere Unternehmen

- Große Unternehmen

Erlösmodell

- Einmaliger Kauf

- Abonnementbasiert

Industrie

- Bankwesen

- Finanzdienstleistungen und Versicherungen BFSI

- IT und Telekommunikation

- Herstellung

- Einzelhandel und Konsumgüter

- Gesundheitspflege

- Energie und Versorgung

- Medien und Unterhaltung

- Sonstiges

Wettbewerbsumfeld und Marktanteilsanalyse für IT-Steuersoftware in Japan

Die Wettbewerbslandschaft des japanischen Marktes für Steuer-IT-Software liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz . Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den japanischen Markt für Steuer-IT-Software.

- SAP (Deutschland)

- ADP, Inc. (USA)

- freee KK (Japan)

- Money Forward, Inc. (Japan)

- PCA Corporation (USA)

- QUICKBOOKS (INTUIT INC.) (USA)

- SAGE GROUP PLC (Großbritannien)

- TKC Corporation (Japan)

- Wolters Kluwer NV (Niederlande)

- (Japan)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.1.1 INDUSTRY ANALYSIS

4.1.2 CURRENT MARKET LANDSCAPE

4.1.3 FUTURISTIC SCENARIO

4.1.3.1 TECHNOLOGY TRENDS

4.1.4 COMPETITIVE LANDSCAPE

4.1.5 FUTURE OUTLOOK

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 MARKET OPPORTUNITIES

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESSES

6.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

6.1.3 BUSINESSES AIM TO SIMPLIFY FREQUENT ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

6.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

6.2 RESTRAINTS

6.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

6.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

6.3.2 GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

6.4 CHALLENGES

6.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

6.4.2 CHALLENGES OF INTEGRATING LEGACY SYSTEMS FOR BUSINESSES IN JAPAN

7 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOFTWARE

7.3 SERVICES

7.3.1 SERVICES, BY TYPE

7.4 TRAINING AND CONSULTING

7.5 SUPPORT

8 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE

8.1 OVERVIEW

8.2 INCOME TAX

8.3 CORPORATE TAX

8.4 PROPERTY TAX

8.5 OTHERS

9 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL

11.1 OVERVIEW

11.2 SUBSCRIPTION BASED

11.3 ONE-TIME PURCHASE

12 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY

12.1 OVERVIEW

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

12.3 IT AND TELECOMMUNICATIONS

12.4 MANUFACTURING

12.5 RETAIL AND CONSUMER GOODS

12.6 HEALTHCARE

12.7 MEDIA AND ENTERTAINMENT

12.8 ENERGY AND UTILITIES

12.9 OTHERS

13 JAPAN TAX IT SOFTWARE MARKET

13.1 COMPANY SHARE ANALYSIS: JAPAN

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ADP,INC

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 YAYOI CO., LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 TKC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SAGE GROUP PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 MONEY FORWARD, INC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FREEE KK

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 INTUIT INC

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 PCA CORPORATION

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 SAP SE

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 WOLTERS KLUWER N.V.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 COMPARATIVE ANALYSIS

TABLE 4 REGULATIONS AND STANDARDS FOR JAPAN TAX AND ACCOUNTING SOFTWARE MARKET

TABLE 5 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 6 JAPAN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 7 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 9 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022-2032 (USD THOUSAND)

TABLE 10 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 11 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 JAPAN TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 JAPAN TAX IT SOFTWARE MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 JAPAN TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 JAPAN TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 JAPAN TAX IT SOFTWARE MARKET: PRODUCT TIMELINE CURVE

FIGURE 10 JAPAN TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE JAPAN TAX IT SOFTWARE MARKET, BY PRODUCT (2024)

FIGURE 12 JAPAN TAX IT SOFTWARE MARKET, BY MARKET REVENUE, PRODUCT & VENDOR PENETRATION MATRIX

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND AMONG JAPAN’S SMALL AND MEDIUM-SIZED BUSINESS IS EXPECTED TO DRIVE THE JAPAN TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 16 JAPAN’S METHODS OF PREPARING TAXES

FIGURE 17 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE JAPAN TAX IT SOFTWARE MARKET

FIGURE 19 JAPAN TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 20 JAPAN TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 21 JAPAN TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 22 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 23 JAPAN TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 24 JAPAN TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 25 JAPAN TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.