Global Vegan Protein Market

Marktgröße in Milliarden USD

CAGR :

%

USD

10.90 Billion

USD

18.98 Billion

2024

2032

USD

10.90 Billion

USD

18.98 Billion

2024

2032

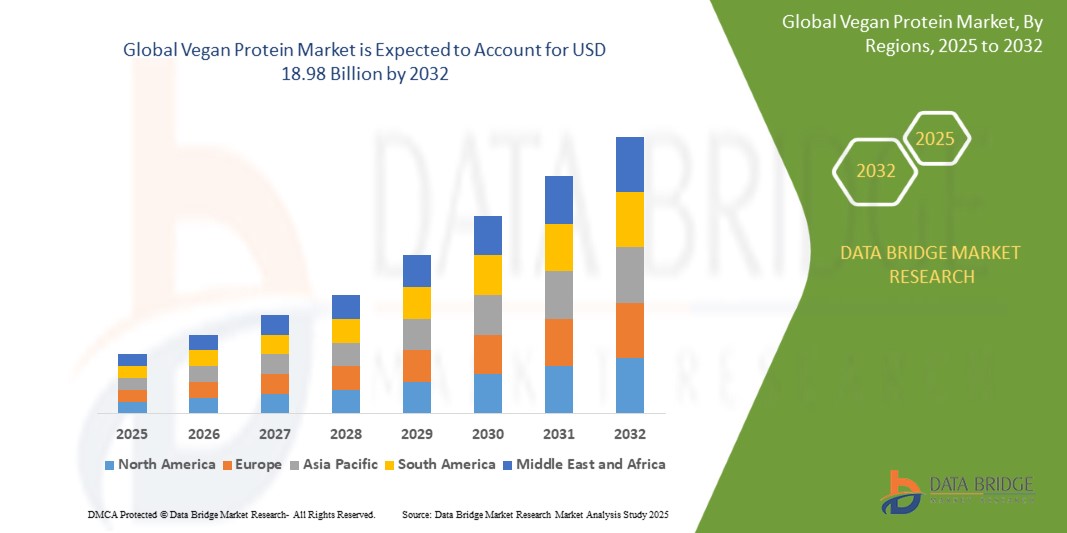

| 2025 –2032 | |

| USD 10.90 Billion | |

| USD 18.98 Billion | |

|

|

|

>Global Vegan Protein Market Segmentation, By Source (Soy Protein, Pea Protein, Rice Protein, Hemp Protein, Spirulina, Quinoa Protein, Flaxseeds Protein, Chia Protein, Canola Protein, Pumpkin Seed, and Others) Protein Type (Isolates, Concentrates, and Hydrolysate), Level of Hydrolisation (Intact, Mildly Hydrolized, and Strongly Hydrolized), Form (Dry and Liquid), Nature (Conventional and Organic), Function (Solubility, Emulsification, Gelation, Water Binding, Foaming, and Others), Application (Food Products, Beverages, Nutraceuticals and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, and Others) – Industry Trends and Forecast to 2031

Vegan Protein Market Analysis

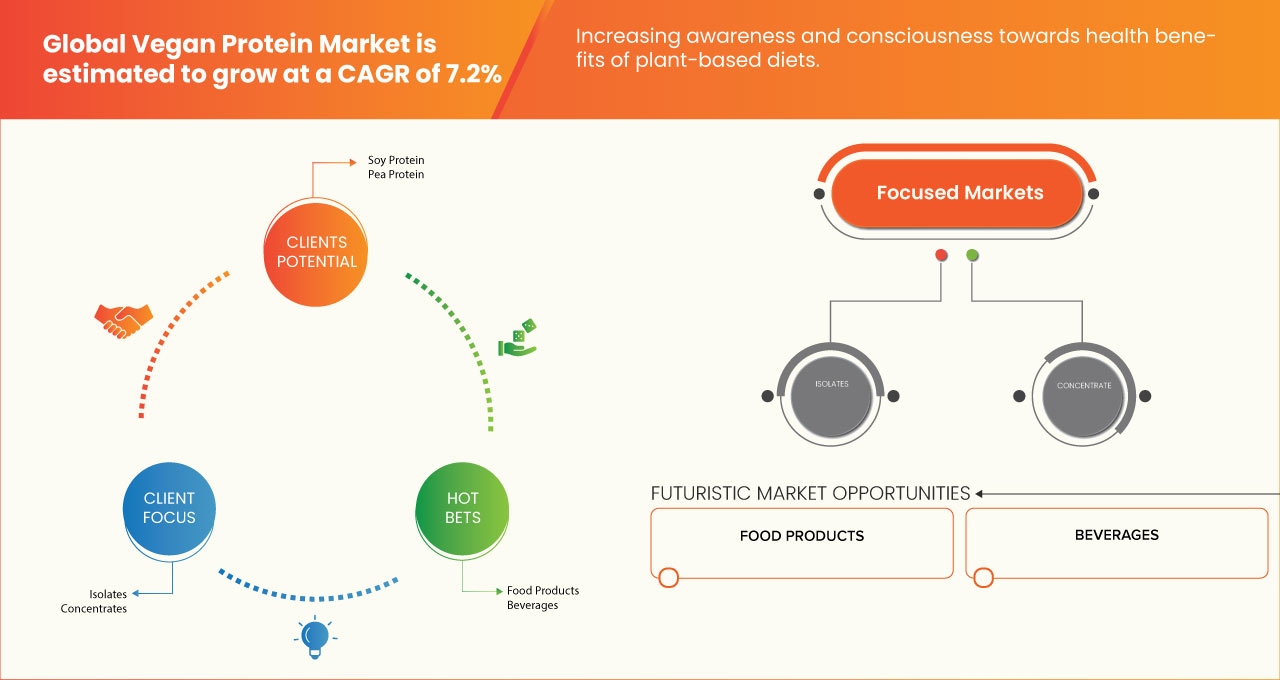

The vegan protein market is experiencing rapid growth, driven by increasing health consciousness, environmental concerns, and ethical considerations. Consumers are shifting towards plant-based diets, seeking alternatives to animal-derived proteins for both health benefits and sustainability. Key players are expanding their product lines to include diverse sources like pea, soy, rice, and hemp proteins. Innovations in taste and texture are enhancing appeal, particularly in snacks, beverages, and meal replacements. Additionally, the rise of flexitarian diets is broadening the consumer base. Overall, the vegan protein market is poised for continued expansion, reflecting a significant trend in dietary preferences worldwide.

Vegan Protein Market Size

Global vegan protein market size was valued at USD 10.20 billion in 2023 and is projected to reach USD 17.71 billion by 2031, growing with a CAGR of 7.2% during the forecast period of 2024 to 2031.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

Vegan Protein Market Trends

“Increasing Health Consciousness”

Increasing health consciousness is a major driver of the vegan protein market. As consumers become more aware of the benefits of plant-based diets, they seek alternatives to animal proteins that are lower in saturated fats and cholesterol. Vegan proteins, rich in essential nutrients, are increasingly recognized for promoting heart health, aiding digestion, and supporting weight management. Additionally, the rise in lifestyle-related health issues has prompted many to explore clean-label, high-protein options that align with their wellness goals. This trend is further supported by growing research on the positive impacts of plant-based nutrition, solidifying vegan protein's place in health-focused diets.

Report Scope and Market Segmentation

|

Attributes |

Vegan Protein Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico, Germany, U.K., Italy, France, Russia, Netherlands, Switzerland, Spain, Belgium, Turkey, Rest of Europe, China, Australia & New Zealand, India, Japan, South Korea, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina and Rest of South America, South Africa, U.A.E., Saudi Arabia, Egypt, Israel, Rest of Middle East and Africa |

|

Key Market Players |

ADM (U.S.), Wilmar International Ltd (Singapore), Axiom Foods, Inc. (U.S.), Golden Grain Group Limited (China), Pioneer Industries Private Limited (India), Creative Enzymes. (U.S.), Sweet Additions (U.S.), The Green Labs LLC. (U.S.), Tiba Trade (Egypt), ETChem (China), Ingredion, Incorporated (U.S.), Z-COMPANY (Netherlands), Kerry Group plc. (Ireland), Cargill, Incorporated. (U.S.), BENEO (Germany), Sacchetto S.p.A. (Italy), Singsino Group Limited (China), Rajvi Enterprise (India), Foodchem International Corporation (China), Emsland-Stärke Gesellschaft mit beschränkter Haftung (Germany), Farbest-Tallman Foods Corporation (U.S.), Roquette Frères (France), A&B Ingredients, Inc. (U.S.), AGT Food and Ingredients Inc. (Canada), BRF (Brazil), Crown Soya Protein Group Company (China), Sonic Biochem (India), Bunge (U.S.), Foodrich Soya Co.,LTD. (China), The Scoular Company (U.S.), AIDP (U.S.), Prinova Group LLC. (U.K.), FUJI OIL HOLDINGS INC (Japan), Titan Biotech. (India), Gehl Foods, LLC (U.S.), International Flavors & Fragrances Inc (U.S.), Sun Nutrafoods (India), Shafi Gluco Chem (Pvt) Ltd. (Pakistan), and Bioway Organic Group Limited (China) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vegan Protein Market Definition

The vegan protein market encompasses the production and sale of protein products derived from plant sources, excluding any animal-derived ingredients. This market includes a variety of protein sources such as peas, soy, rice, hemp, and legumes, catering to the increasing demand for health-conscious, sustainable, and ethical food options. Driven by a rising trend toward plant-based diets, the market serves not only vegans and vegetarians but also flexitarians seeking healthier alternatives. Products range from protein powders and bars to fortified snacks and meal replacements, reflecting a growing consumer focus on nutrition, fitness, and environmental sustainability in their dietary choices.

Vegan Protein Market Dynamics

Drivers

- Rising Shift Towards Veganism and Flexitarian Diets

The growing shift towards veganism and flexitarian diets is a significant driver of the global vegan protein market, driven by increasing consumer awareness of health, environmental, and ethical issues. As more individuals seek alternatives to animal-based products, plant-based proteins are gaining popularity due to their perceived health benefits and their alignment with sustainable and cruelty-free living.

One of the primary factors contributing to the rise of veganism and flexitarians is the growing research highlighting the health advantages of plant-based diets. Studies have shown that plant protein can reduce the risk of chronic diseases, such as heart disease, diabetes, and certain cancers, while also aids in weight management and improving overall well-being. Consumers, especially in developed markets, are becoming more conscious of their dietary choices and are actively seeking products that promote health and longevity. This shift in preferences is encouraging food manufacturers to develop innovative vegan protein products, ranging from protein powders and bars to plant-based meat substitutes, driving growth in the global market.

Moreover, the environmental benefits associated with plant-based diets are further boosting this trend. The production of animal-based proteins, particularly from livestock, contributes significantly to greenhouse gas emissions, deforestation, and water usage. As concerns over climate change and sustainability continue to rise, many consumers are opting for more eco-friendly dietary choices. Vegan and flexitarian diets, which emphasize plant-based proteins, are seen as a sustainable alternative to traditional meat and dairy products. This environmental consciousness is pushing manufacturers to expand their portfolios with sustainable protein options, which in turn is propelling the vegan protein market forward.

For instance,

- In February 2020, according to an article on Vox, the surge in plant-based meat alternatives like the Impossible Burger and Beyond Meat reflects a growing shift towards veganism and flexitarian diets. These products appeal to both vegans and meat-eaters seeking healthier and more sustainable options, contributing to the rapid rise of plant-based food products in mainstream markets. The increasing availability of these alternatives in restaurants and grocery stores is driving consumer adoption across dietary preferences

Increasing Awareness and Consciousness Towards Health Benefits of Plant-Based Diets

The increasing awareness and consciousness towards the health benefits of plant-based diets is a key driver of the global vegan protein market. As more consumers become informed about the positive impact of plant-based diets on personal health, the demand for vegan protein products is growing rapidly. This shift is primarily driven by the rising prevalence of diet-related chronic diseases and a growing desire for healthier, more natural food options.

Plant-based diets, which are rich in essential nutrients like fiber, vitamins, and antioxidants, have been shown to reduce the risk of chronic diseases such as heart disease, type 2 diabetes, obesity, and certain cancers. With this mounting evidence, health professionals, influencers, and media outlets have played a significant role in educating consumers about the long-term benefits of incorporating plant-based proteins into their diets. As a result, consumers are increasingly seeking out vegan protein sources like pea, soy, rice, and hemp proteins as healthier alternatives to animal-based proteins, driving growth in the vegan protein market.

Furthermore, the rise in plant-based diets is particularly evident among individuals seeking to manage weight and improve overall well-being. Many people are adopting plant-based proteins to meet their nutritional needs while avoiding the health risks associated with high cholesterol, saturated fats, and hormones often found in animal products. Vegan protein supplements, bars, and meat alternatives are especially popular among health-conscious consumers and fitness enthusiasts, as these products provide a high-quality protein source that supports muscle development and recovery without the negative side effects of traditional animal proteins.

For instance,

- In April 2022, according to a blog published by YOUSTORY, Bengaluru-based startup has gained significant traction in India by offering plant-based dairy alternatives such as almond and cashew milk. Goodmylk’s products cater to the growing number of health-conscious Indian consumers looking to avoid lactose and cholesterol found in traditional dairy products. The rise in demand for these alternatives is closely tied to increasing awareness of the health benefits of plant-based diets in managing conditions like lactose intolerance and heart health.

Opportunities

- Product Innovations and Diversifications in Functional Foods and Food Technology

The global vegan protein market is experiencing a surge in innovation and diversification driven by advancements in functional foods and food technology. As consumer demand for plant-based options continues to grow, companies are investing heavily in research and development to enhance the functionality and appeal of vegan proteins. One significant area of innovation is the development of novel protein sources derived from legumes, grains, and algae, which are being engineered to offer improved taste, texture, and nutritional profiles.

Furthermore, advancements in food technology, such as 3D food printing and precision fermentation, are revolutionizing the way vegan proteins are produced and consumed. 3D food printing allows for the creation of complex textures and flavors that closely mimic traditional meat products, while precision fermentation can produce specific proteins and peptides with enhanced functional properties. This not only improves the sensory experience of vegan products but also enables the formulation of highly customized nutritional solutions to meet diverse dietary needs.

The integration of functional ingredients, such as vitamins, minerals, and probiotics, into vegan protein products is expanding their health benefits beyond basic nutrition. This approach caters to health-conscious consumers seeking functional benefits such as enhanced gut health or immune support. As these innovations continue to evolve, the global vegan protein market is poised for substantial growth, driven by the increasing consumer preference for sustainable, nutritious, and versatile plant-based options. The convergence of functional food innovations and advanced food technologies is set to redefine the landscape of vegan proteins, creating a wealth of opportunities for companies and consumers alike.

For instance,

- In March 2023, according to an article published by the National Library of Medicine, the potential of plant-based diets in addressing health and environmental issues is discussed. It highlights how increasing consumer interest in vegan proteins is driven by their health and sustainability benefits. Innovations in plant-based products and food technology offer significant opportunities in this growing market

Rising Collaborations Between Vegan Protein Manufacturers and Foodservice Companies

The global vegan protein market is witnessing a notable rise in collaborations between vegan protein manufacturers and foodservice companies, unlocking significant opportunities for growth and vegan protein market expansion. As the demand for plant-based diets surges, foodservice companies are increasingly seeking to diversify their menus to include innovative vegan options that appeal to a broad consumer base. In response, vegan protein manufacturers are partnering with these companies to integrate their products into various culinary applications, from fast food chains to fine dining establishments.

These collaborations offer a win-win scenario: foodservice companies gain access to cutting-edge vegan protein products that can differentiate their offerings in a competitive market, while manufacturers benefit from increased market exposure and consumer testing. For instance, partnerships allow foodservice companies to experiment with new formulations and recipes, leveraging the expertise of vegan protein producers to enhance product taste, texture, and nutritional value. This not only helps meet evolving consumer preferences but also enables foodservice providers to position themselves as leaders in the plant-based food revolution.

Moreover, such alliances often result in co-branding opportunities and joint marketing efforts, amplifying brand visibility and consumer engagement. The shared knowledge and resources from these partnerships can also drive innovation, leading to the development of new, high-quality vegan protein products tailored to specific market needs. Additionally, these collaborations contribute to supply chain efficiency and scalability, making it easier for vegan protein products to reach a wider audience. As the market continues to grow, the synergistic relationships between vegan protein manufacturers and foodservice companies are set to play a crucial role in shaping the future of plant-based dining, creating ample opportunities for innovation and expansion in the global vegan protein market.

For instance,

- In October 2024, an article published by Elsevier B.V. examines recent trends in plant-based diets and their impact on sustainability and health. It highlights the growing consumer interest in vegan proteins driven by their environmental and health benefits. Advances in food technology and product innovation offer significant opportunities for growth in the vegan protein market

Restraints/Challenges

- Higher Costs of Vegan Protein Products

The global vegan protein market faces a significant challenge due to the higher costs associated with plant-based protein products. While the demand for vegan proteins continues to rise, driven by health consciousness, dietary preferences, and environmental concerns, the elevated price of these products poses a notable restraint on market growth.

The primary factor contributing to the higher costs of vegan protein products is the expense of raw materials. Plant-based proteins, such as those derived from peas, soy, and other legumes, often require specialized processing techniques to extract and refine the protein. This processing involves advanced technology and equipment, which can be costly to acquire and maintain. Additionally, sourcing high-quality, non-GMO, and organic plant-based ingredients can further drive-up costs, as these ingredients are often more expensive than conventional alternatives. Another significant cost factor is research and development (R&D). Companies investing in vegan protein products must conduct extensive R&D to improve the taste, texture, and nutritional profile of these products. This involves formulating and testing new recipes, optimizing manufacturing processes, and ensuring product consistency. The costs associated with these activities are passed on to consumers, resulting in higher retail prices for vegan protein products.

Distribution and supply chain logistics also contribute to the increased costs. Vegan protein products often require temperature-controlled storage and transportation to maintain freshness and prevent spoilage. This necessitates a more complex and expensive logistics infrastructure compared to traditional animal-based proteins. Additionally, because vegan protein products are still a relatively niche market compared to conventional proteins, economies of scale have not yet been fully realized, which further exacerbates cost issues.

For instances

- In July 2022, according to an article published by Corporate Knights, a study by Dalhousie University's Agri-Food Analytics Lab revealed that plant-based meat alternatives in Canada cost, on average, 38% more than their animal-based counterparts. In addition, chicken nugget substitutes were found to be up to 104% more expensive than traditional chicken nuggets. This price disparity is largely attributed to government subsidies for the meat industry, which keep animal products cheaper. Such subsidies, totaling over USD 1.7 billion in Canada in 2021, contribute to lower meat prices, making it challenging for plant-based products to achieve price parity and reducing their competitiveness in the market

Stiff Competition from Conventional Proteins

The global vegan protein market faces significant challenges due to stiff competition from conventional proteins. Despite the growing popularity of plant-based diets and increased consumer awareness of sustainability and animal welfare, conventional proteins—primarily sourced from meat, dairy, and eggs—remain deeply entrenched in the food industry. These traditional proteins benefit from well-established supply chains, economies of scale, and longstanding consumer preferences, which create a formidable barrier for plant-based alternatives.

Conventional proteins also have the advantage of familiarity and taste, which can be a critical factor for many consumers. While vegan proteins have made strides in taste and texture, they still face hurdles in matching the sensory qualities and culinary versatility of animal-based proteins. Additionally, the price of conventional proteins often undercuts plant-based options due to subsidies and established agricultural practices that make them more cost-effective. This pricing disparity can make it challenging for vegan proteins to compete on price, especially in price-sensitive markets.

Moreover, conventional protein sources are backed by extensive marketing resources and brand loyalty, which can overshadow newer vegan products entering the market. Many consumers are reluctant to change their dietary habits or perceive plant-based proteins as less satisfying compared to traditional options. This resistance can be compounded by the perceived complexity and unfamiliarity of vegan proteins, which can slow market adoption.

To overcome these challenges, vegan protein manufacturers need to focus on enhancing product taste, texture, and nutritional value while striving for cost competitiveness. Additionally, strategic marketing efforts and consumer education are essential to shift perceptions and build trust in plant-based alternatives. As the market evolves, overcoming these competitive hurdles will be crucial for the growth and mainstream acceptance of vegan proteins.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Marktumfang für veganes Protein

Der globale Markt für vegane Proteine ist in sieben wichtige Segmente unterteilt, basierend auf Quelle, Proteintyp, Hydrolysegrad, Form, Natur, Funktion und Anwendung. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Quelle

- Sojaprotein

- Sojaprotein, nach Proteintyp

- Sojaproteinisolat

- Sojaprotein-Konzentrat

- Sojaproteinhydrolysat

- Sojaprotein, nach Proteintyp

- Erbsenprotein

- Erbsenprotein, nach Proteintyp

- Erbsenproteinisolat

- Erbsenprotein-Konzentrat

- Erbsenproteinhydrolysat

- Erbsenprotein, nach Proteintyp

- Reisprotein

- Reisprotein, nach Proteintyp

- Reisproteinisolat

- Reisproteinkonzentrat

- Reisproteinhydrolysat

- Reisprotein, nach Proteintyp

- Hanfprotein

- Hanfprotein, nach Proteintyp

- Hanfproteinisolat

- Hanfproteinkonzentrat

- Hanfproteinhydrolysat

- Hanfprotein, nach Proteintyp

- Spirulina

- Spirulina, nach Proteintyp

- Spirulina-Isolat

- Spirulina-Konzentrat

- Spirulina-Hydrolysat

- Spirulina, nach Proteintyp

- Quinoa-Protein

- Quinoa-Protein, nach Proteintyp

- Quinoa-Protein-Isolat

- Quinoa Protein Konzentrat

- Quinoa-Proteinhydrolysat

- Quinoa-Protein, nach Proteintyp

- Leinsamen Protein

- Leinsamenprotein, nach Proteintyp

- Leinsamen-Proteinisolat

- Leinsamen Protein Konzentrat

- Leinsamen-Proteinhydrolysat

- Leinsamenprotein, nach Proteintyp

- Chia-Protein

- Chia-Protein, nach Proteintyp

- Chia-Protein-Isolat

- Chia Protein Konzentrat

- Chia-Protein-Hydrolysat

- Chia-Protein, nach Proteintyp

- Rapsprotein

- Rapsprotein, nach Proteintyp

- Rapsproteinisolat

- Rapsprotein-Konzentrat

- Rapsproteinhydrolysat

- Rapsprotein, nach Proteintyp

- Kürbiskerne

- Kürbiskerne, nach Proteintyp

- Kürbiskernisolat

- Kürbiskernkonzentrat

- Kürbiskernhydrolysat

- Kürbiskerne, nach Proteintyp

- Sonstiges

- Andere, nach Proteintyp

- Andere isolieren

- Andere konzentrieren

- Andere Hydrolysate

- Andere, nach Proteintyp

Proteintyp

- Isolate

- Isolate, nach Proteinkonzentration

- Zwischen 20 % und 70 %

- <20 % Eiweiß

- >70 % Eiweiß

- Isolate, nach Proteinkonzentration

- Konzentrate

- Hydrolysat, nach Proteinkonzentration

- Zwischen 20 % und 70 %

- <20 % Eiweiß

- >70 % Eiweiß

- Hydrolysat, nach Proteinkonzentration

- Hydrolysat

- Hydrolysat, nach Proteinkonzentration

- Zwischen 20 % und 70 %

- <20 % Eiweiß

- >70 % Eiweiß

- Hydrolysat, nach Proteinkonzentration

Hydrolysegrad

- Intakt

- Mild hydrolysiert

- Stark hydrolysiert

Bilden

- Trocken

- Flüssig

Natur

- Konventionell

- Organisch

Funktion

- Löslichkeit

- Emulgierung

- Gelierung

- Wasserbindung

- Schäumen

- Sonstiges

Anwendung

- Nahrungsmittel

- Getränke

- Nutraceuticals und Nahrungsergänzungsmittel

- Kosmetik und Körperpflege

- Tierfutter

- Pharmazeutika

- Sonstiges

- Lebensmittelprodukte, nach Anwendung

- Milchalternativen

- Verarbeitete Lebensmittel

- Fleisch- und Geflügelprodukte

- Sporternährung

- Backwaren

- Frühstückscerealien

- Fertiggerichte

- Milchprodukte

- Schokolade und Süßwaren

- Müsliriegel

- Dressings und Gewürze

- Milchalternative, Nach Lebensmittelprodukten

- Fleischalternativen

- Tiefkühlkost

- Säuglingsnahrung

- Sonstiges

- Verarbeitete Lebensmittel, nach Lebensmittelprodukten

- Extrudierte Snacks

- Suppen und Saucen

- Pasta

- Nudeln

- Sonstiges

- Sporternährung, nach Nahrungsmitteln

- Sport-Proteinpulver

- Sporternährungsriegel

- Sonstiges

- Backwaren, Nach Lebensmittelprodukten

- Cookies und Kekse

- Brot und Brötchen

- Kuchen und Gebäck

- Donuts

- Sonstiges

- Milchprodukte, nach Lebensmittelprodukten

- Milch

- Käse

- Du bist gut

- Eiscreme

- Creme

- Butter

- Pudding

- Sonstiges

- Schokolade und Süßwaren, Nach Nahrungsmitteln

- Pralinen

- Gummibärchen/Gelees

- Harte Bonbons

- Zuckerwaren

- Sonstiges

- Getränke nach Anwendung

- Alkoholfreie Getränke

- Alkoholische Getränke

- Alkoholfreie Getränke, Nach Getränken

- Smoothies

- Sport- und Energydrinks

- RTD Kaffee & Tee

- Kohlensäurehaltige Getränke

- Sonstiges

- Alkoholische Getränke, Nach Getränken

- Bier

- Wein

- Spirituosen

- Sonstiges

- Kosmetik und Körperpflege, nach Anwendung

- Lebensmittelprodukte, nach Anwendung

- Hautpflege

- Haarpflege

- Hautpflege, Nach Kosmetik und Körperpflege

- Feuchtigkeitscreme

- Serum

- Sonnenschutzlotion

- Seifen und Duschgel

- Schrubben

- Lippenpflegecreme

- Sonstiges

- Haarpflege, Nach Kosmetik und Körperpflege

- Shampoo

- Spülung

- Haaröl und Serum

- Sonstiges

- Tierfutter, nach Anwendung

- Geflügel

- Schwein

- Wiederkäuer

- Haustiere

- Wassertier

- Sonstiges

Regionale Analyse des veganen Proteinmarktes

Der Markt wird analysiert und Erkenntnisse über die Marktgröße und Trends werden auf Grundlage von Quelle, Proteintyp, Hydrolysegrad, Form, Beschaffenheit, Funktion und Anwendung gewonnen.

Die vom Markt abgedeckten Länder sind die USA, Kanada und Mexiko, Deutschland, Großbritannien, Italien, Frankreich, Russland, die Niederlande, die Schweiz, Spanien, Belgien, die Türkei, das übrige Europa, China, Australien und Neuseeland, Indien, Japan, Südkorea, Singapur, Malaysia, Thailand, Indonesien, die Philippinen, der übrige asiatisch-pazifische Raum, Brasilien, Argentinien und der Rest von Südamerika, Südafrika, die Vereinigten Arabischen Emirate, Saudi-Arabien, Ägypten, Israel sowie der restliche Nahe Osten und Afrika.

Aufgrund der zunehmenden Hinwendung zu veganer und flexitarischer Ernährung sowie dem zunehmenden Bewusstsein für die gesundheitlichen Vorteile einer pflanzlichen Ernährung und dem wachsenden Bewusstsein für Nachhaltigkeit wird erwartet, dass Nordamerika den Markt dominieren wird.

Der globale Markt für vegane Proteine verzeichnet im asiatisch-pazifischen Raum ein rasantes Wachstum. Grund dafür sind Produktinnovationen und Diversifizierungen im Bereich funktioneller Lebensmittel und Lebensmitteltechnologie sowie eine zunehmende Zusammenarbeit zwischen Herstellern veganer Proteine und Foodservice-Unternehmen.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil veganer Proteine

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die Marktführer für veganes Protein sind:

- ADM (USA)

- Wilmar International Ltd (Singapur)

- Axiom Foods, Inc. (USA)

- Golden Grain Group Limited (China)

- Pioneer Industries Private Limited (Indien)

- Kreative Enzyme. (USA)

- Süße Ergänzungen (USA)

- The Green Labs LLC. (USA)

- Tiba Trade (Ägypten)

- ETChem (China)

- Ingredion, Incorporated (USA)

- Z-COMPANY (Niederlande)

- Kerry Group plc. (Irland)

- Cargill, Incorporated. (USA)

- BENEO (Deutschland)

Neueste Entwicklungen auf dem Markt für veganes Protein

- Im März 2023 untersucht ein von der National Library of Medicine veröffentlichter Artikel die Rolle pflanzlicher Ernährung bei der Förderung der Gesundheit und der Reduzierung der Umweltbelastung. Er betont die steigende Verbrauchernachfrage nach veganen Proteinen aufgrund ihrer gesundheitlichen Vorteile und Nachhaltigkeit. Die Weiterentwicklung pflanzlicher Produkte und Lebensmitteltechnologie bietet erhebliche Wachstumschancen auf dem Markt

- Im Oktober 2024 untersucht ein von Elsevier BV veröffentlichter Artikel die jüngsten Trends in der pflanzlichen Ernährung und ihre Auswirkungen auf Nachhaltigkeit und Gesundheit. Er unterstreicht das wachsende Interesse der Verbraucher an veganen Proteinen, das auf ihre ökologischen und gesundheitlichen Vorteile zurückzuführen ist. Fortschritte in der Lebensmitteltechnologie und Produktinnovation bieten erhebliche Wachstumschancen für den Markt für vegane Proteine

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.