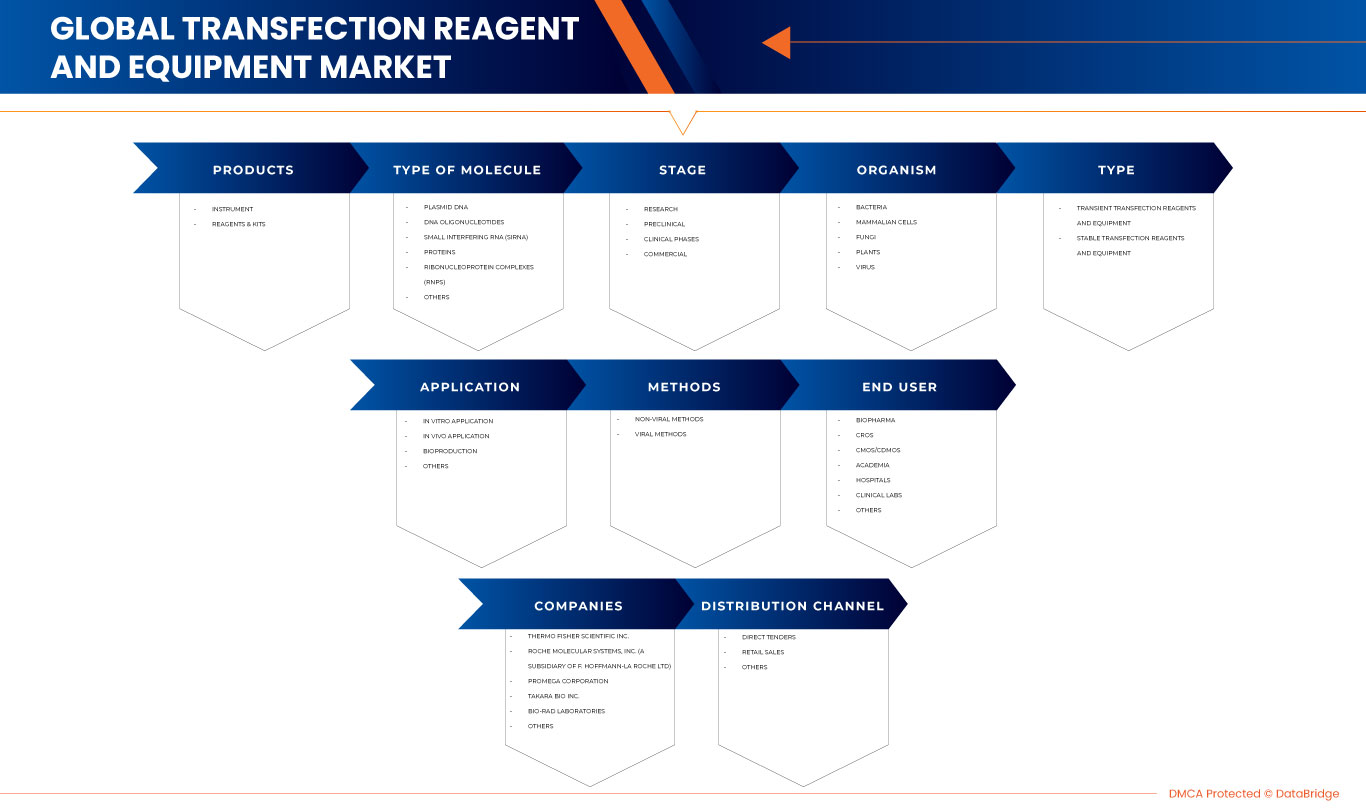

Global Transfection Reagent and Equipment Market, By Products (Reagent & Kits and Instruments), Stage (Research, Preclinical, Clinical Phases, and Commercial), Type (Transient Transfection Reagent and Equipment, Stable Transfection Reagent, and Equipment), Methods (Non-viral Methods and Viral Methods), Types of Molecule (Plasmid DNA, Small Interfering RNA (siRNA), Proteins, DNA Oligonucleotides, Ribonucleoprotein Complexes (RNPs), and Others), Organism (Mammalian Cells, Plants, Fungi, Virus, and Bacteria), Application (In Vitro Application, In Vivo Application, Bioproduction and Others), End User (Biopharma, CROs, (CMOs/CDMOs), Academia, Hospitals, Clinical Labs, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others), Industry Trends and Forecast to 2030

Transfection Reagent and Equipment Market Analysis and Insights

Transfection involves nucleic acid introduction in eukaryotic cells by viral and non-viral methods. The transfection method can overcome the challenge of transferring the negatively charged membrane. Chemicals such as calcium phosphate and diethylaminoethyl (DEAE) ‐dextran or cationic lipid-based Reagent react with the outer DNA coat. It neutralizes the overall negative charge, imparts the positive amount to the molecule, and hence allows DNA delivery. Physical methods such as electroporation create minute pores in the cell membrane by applying electric voltage, allowing entry of DNA directly into the cytoplasm. DEAE-dextran is used for transient transfection; however, lipofection can achieve stable transfection and hence can be used for long-term protein expression. Calcium phosphate-mediated transfection can also be used for stable transfection. The viral transfection method achieves high efficiency and is used for several phases of pharmaceutical product development.

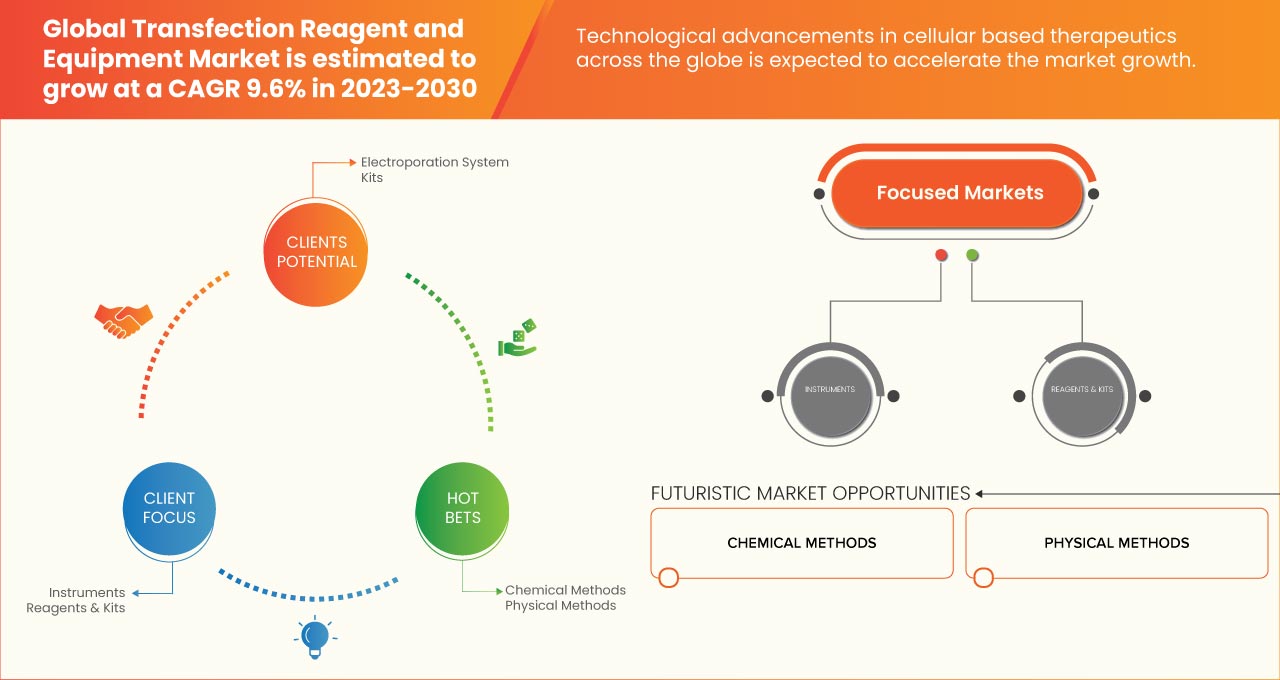

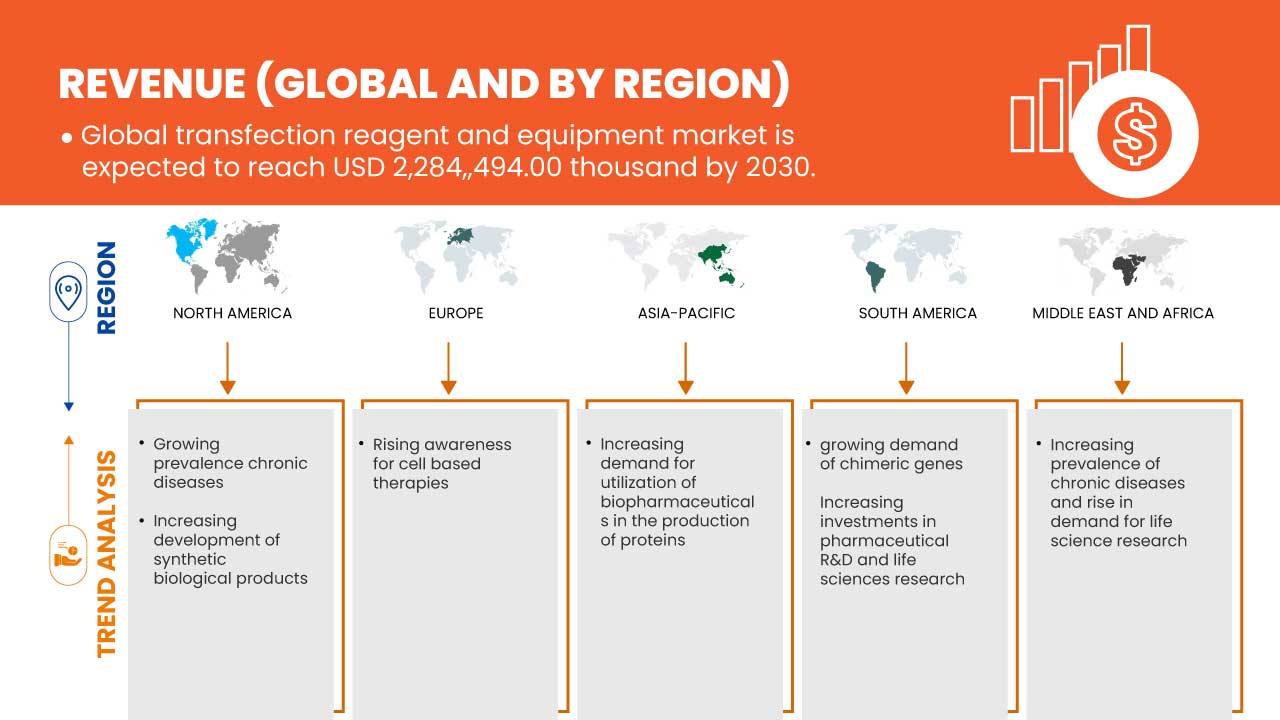

The transfection method is used for several applications involving agriculture for crop protection and enhancing yield, for the production of synthetic biology products to enhance flavors and fragrances, and for enhancing single-cell protein, among others. The demand for transfection has increased in both developed and developing countries, and the reason behind this is the increasing occurrence of chronic diseases. The transfection market is growing due to the growing demand for chimeric genes and the utilization of biopharmaceuticals in the production of proteins. The market will grow in the forecast period due to the exploration of emerging markets, strategic initiatives by market players, and increasing government support.

Die hohen Kosten der Instrumente, die selektive Wirksamkeit der Transfektionsreagenzien und die durch die Transfektionsmethoden verursachten Zellschäden werden voraussichtlich das Wachstum des weltweiten Marktes für Transfektionsreagenzien und -geräte bremsen.

Der Markt wächst aufgrund mehrerer strategischer Initiativen der Marktteilnehmer, die Akquisition, Zusammenarbeit und Partnerschaften umfassen.

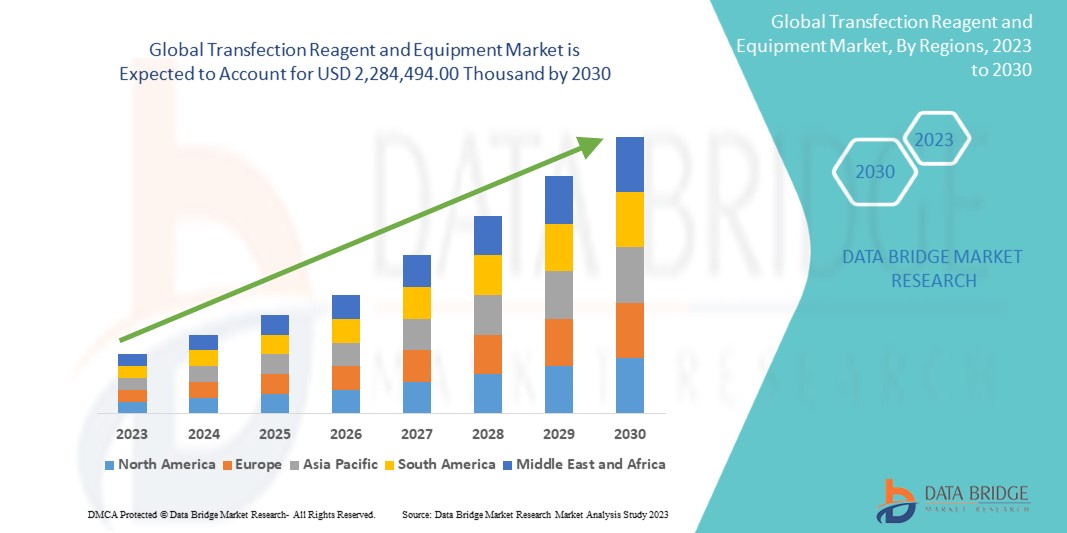

Data Bridge Market Research analysiert, dass der globale Markt für Transfektionsreagenzien und -geräte voraussichtlich bis 2030 einen Wert von 2.284.494,00 USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 9,6 % während des Prognosezeitraums entspricht.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2020–2016) |

|

Quantitative Einheiten |

Umsatz in Tausend, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Nach Produkten (Reagenzien & Kits und Instrumente), Stadium (Forschung, präklinische, klinische Phasen und kommerziell), Typ (Reagenzien und Ausrüstung für vorübergehende Transfektion, Reagenzien und Ausrüstung für stabile Transfektion), Methoden (Nicht-virale Methoden und virale Methoden), Molekültypen (Plasmid-DNA, Small Interfering RNA (siRNA), Proteine, DNA-Oligonukleotide, Ribonukleoproteinkomplexe (RNPs) und andere), Organismus (Säugetierzellen, Pflanzen, Pilze, Viren und Bakterien), Anwendung (In-vitro-Anwendung, In-vivo-Anwendung, Bioproduktion und andere), Endbenutzer (Biopharma, CROs, (CMOs/CDMOs), Hochschulen, Krankenhäuser, klinische Labore und andere), Vertriebskanal (Direktausschreibung, Einzelhandelsverkauf und andere). |

|

Abgedeckte Länder |

USA, Kanada, Mexiko, Deutschland, Frankreich, Italien, Großbritannien, Spanien, Schweiz, Russland, Niederlande, Belgien, Türkei und restliches Europa, China, Japan, Indien, Australien, Südkorea, Singapur, Thailand, Malaysia, Philippinen, Indonesien und restlicher asiatisch-pazifischer Raum, Brasilien, Argentinien, restliches Südamerika, Südafrika, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten und restlicher Naher Osten und Afrika. |

|

Abgedeckte Marktteilnehmer |

Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (eine Tochtergesellschaft der FUJIFILM Holdings Corporation), Avanti Polar Lipids (eine Tochtergesellschaft von Croda International Plc), PerkinElmer chemagen Technologie GmbH (eine Tochtergesellschaft von PerkinElmer Inc.), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc. (eine Tochtergesellschaft von F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. (abm), Beckman Coulter, Inc. (eine Tochtergesellschaft von Danaher), Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc. und Twist Bioscience, um nur einige zu nennen. |

Marktdefinition

Die Transfektionsmethode wird verwendet, um RNA, DNA oder Proteinprodukte in Zellen einzuführen, um den Phänotyp und Genotyp des Organismus zu verändern. Die Transfektionsmethode umfasst den Transfer neuer Gene oder die Übertragung eines Genkonstrukts wie Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) zum Zweck der Genombearbeitung. Die Transfektion findet breite Anwendung in den Bereichen Immuntherapie, Gentherapie und Zelltherapie, um nur einige zu nennen. Die Transfektion umfasst sowohl nicht-virale als auch viral vermittelte Transfektion. Die chemischen und physikalischen Methoden können eine nicht-virale Transfektion erreichen. Die am häufigsten zur Transfektion verwendeten chemischen Methoden sind unter anderem die Calciumphosphat-Transfektion und die Liposomen-Transfektion. Die virale Transfektion führt zu hohen Transfektionseffizienzen, und verschiedene Arten physikalischer Methoden, die zur Transfektion eingesetzt werden, umfassen Mikroinjektion, biolistische Partikelabgabe und Elektroporation, wobei die Elektroporation eine hohe Transfektionseffizienz bietet. Es gibt zwei Arten der Transfektion, entweder eine transiente oder eine stabile Transfektion. Für kurzfristige Studien zur Genexpression, wie etwa Gen-Knock-out-Studien, wird die Methode der transienten Transfektion im kleinen Maßstab bevorzugt; für langfristige Forschungsstudien und die Proteinproduktion im großen Maßstab werden jedoch häufig stabile Transfektionsmethoden eingesetzt.

Globale Marktdynamik für Transfektionsreagenzien und -geräte

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Anstieg der Häufigkeit chronischer Krankheiten

Die Prävalenz chronischer Krankheiten nimmt weltweit zu, was zu einer Nachfrage nach effektiven und präzisen Behandlungsmöglichkeiten führt. Transfektion wird verwendet, um gezielt modifizierte Gene zu übertragen, mit denen verschiedene genetische Krankheiten behandelt werden können. Die Transfektionsmethode wird auch für die Übertragung des CRISPR-Gens verwendet, das die adaptive Immunität verbessern und ein Individuum vor verschiedenen Krankheiten schützen kann.

Die zunehmenden Fälle chronischer Krankheiten wie COVID-19 und anderer Infektionskrankheiten haben zur Entdeckung wirksamer Gentherapieprodukte geführt, die das defekte Gen durch das richtige Gen ersetzen können. Die Transfektionsmethode wird unter anderem häufig für die Gentherapie eingesetzt. Da die Nachfrage nach wirksamen und genauen Behandlungen weltweit steigt, steigt auch die Nachfrage nach Gentherapie und Transfektionsmethoden. Darüber hinaus erhöhen mehrere laufende Forschungsarbeiten, die belegen, dass Gentherapie das Potenzial zur Behandlung chronischer Krankheiten hat, auch die Nachfrage bei Ärzten und Patienten. Dies bedeutet, dass der Anstieg der Prävalenz chronischer Krankheiten als Treiber für das Wachstum des globalen Marktes für Transfektionsreagenzien und -geräte wirkt.

- ENTWICKLUNG SYNTHETISCH BIOLOGISCHER PRODUKTE

Synthetische Biologie ist eine neue Ära der Biologie, die das Prinzip der Technik in die Biologie einbezieht. Synthetische Biologie beinhaltet die chemische Synthese von DNA durch Kombination des Wissens der Genomik, um die DNA-Genome neu zusammenzusetzen. Die synthetische Biologie, die die Sequenzen in die neuen Gene einbringt, beinhaltet genetische Technik, die unter anderem die Transfektionsmethode einbezieht. Da die Nachfrage nach synthetischen Biologieprodukten weltweit steigt, steigt auch die Verwendung von Transfektionsprodukten.

Die Nachfrage nach synthetischen Bioprodukten steigt aufgrund der steigenden Nachfrage nach wirksamen und innovativen Produkten. Die Herstellung synthetischer Produkte steigert die Nachfrage nach Transfektionsprodukten, da Gentransfer unter anderem mit der Transfektionsmethode einhergehen kann. Dies bedeutet, dass die Entwicklung synthetischer Produkte das Wachstum des globalen Marktes für Transfektionsreagenzien und -geräte vorantreibt.

Zurückhaltung

- Zellschäden durch Transfektionsverfahren

Einige Transfektionsmethoden können Zellschäden verursachen, was die Reproduzierbarkeit der Gesamtmethode verringert. Unter den verschiedenen Transfektionsverfahren verursacht die Elektroporation Berichten zufolge bei steigender Spannung die größten Zellschäden. Diese Zellschäden verringern die Effizienz und wirken sich auf das laufende Projekt aus.

Eine der häufigsten Nebenwirkungen des Transfektionsverfahrens ist die Zellschädigung, die den Stoffwechsel der Zelle verlangsamt und zum Zelltod führt. Diese geschädigte Zelle kann die Toxizität des Mediums erhöhen und somit zu ungeeigneten Ergebnissen führen. Dies lässt darauf schließen, dass die durch das Transfektionsverfahren verursachte Zellschädigung das Wachstum des weltweiten Marktes für Transfektionsreagenzien und -geräte hemmt.

Gelegenheit

- ERKUNDUNG DER SCHWELLENMÄRKTE

Die Transfektionsprodukte haben sich als vielversprechende Werkzeuge für die Gentechnik- und Proteomikbranche erwiesen. Der größte Markt für Transfektionsprodukte liegt in Europa und Nordamerika. Angesichts der positiven Ergebnisse dieser Produkte dringen viele Marktteilnehmer in wachsende Volkswirtschaften vor, darunter China und Indien. Der aufstrebende Markt ermöglicht es diesen Marktteilnehmern, die Verluste auszugleichen, die aus dem etablierten Markt resultieren.

Da Schwellenmärkte es den Marktteilnehmern ermöglichen, den wirtschaftlichen Abschwung zu überwinden, der für bestimmte etablierte Märkte charakteristisch ist, können sich die Marktteilnehmer durch Investitionen und die Erschließung von Schwellenmärkten an der Entwicklung und Herstellung von Transfektionsprodukten beteiligen, um lukratives Wachstum zu erzielen. Dies bedeutet also, dass die Erschließung von Schwellenmärkten eine Chance ist, den globalen Markt für Transfektionsreagenzien und -geräte auszubauen.

Herausforderung

- LANGES GENEHMIGUNGSVERFAHREN

Das langwierige Genehmigungsverfahren für Transfektionsreagenzien und -instrumente ist ein Hemmfaktor für das Wachstum des Transfektionsmarktes. Transfektionsprodukte unterliegen umfangreichen Vorschriften und müssen jedes Mal überwacht werden. Die Transfektionsprodukte werden häufig zum Einfügen gewünschter Genmoleküle in eine bestimmte Zelllinie verwendet, um Proteine und andere biologische Verbindungen zu erhalten. Dieser Prozess wird daher durch lange und strenge Regulierungsverfahren untersucht und genehmigt. Der lange Prozess, der erforderlich ist, um bei jeder durchgeführten klinischen Studie ein positives Ergebnis zu erzielen, führt zu einem höheren Zeitaufwand und hohen Investitionen der Marktteilnehmer.

Die Transfektionsreagenzien unterliegen größtenteils den 21CFR-Richtlinien 210 und 211 der US-amerikanischen FDA, wonach die Hersteller sicherstellen müssen, dass das hergestellte Reagenz die von den Aufsichtsbehörden vorgeschlagenen Sicherheits-, Verpackungs- und Verarbeitungseigenschaften erfüllt. Der Eigentümer oder Hersteller muss Lizenzen gemäß Abschnitt 351 des PHS-Gesetzes (Public Health Services) einreichen, was ein recht langwieriges Verfahren ist. Dies bedeutet, dass lange Genehmigungsverfahren das Wachstum des globalen Marktes für Transfektionsreagenzien und -geräte behindern.

Jüngste Entwicklungen

- Im August 2021 erweiterte Mirus Bio die TransIT VirusGen-Plattform für die Produktion viraler Vektoren nach Good Manufacturing Practice (GMP), um die Entwicklung von Zell- und Gentherapien, Prozessabläufe und die kommerzielle Produktion zu unterstützen. Die Erweiterung, die als TransIT VirusGen GMP Transfection Reagent bezeichnet wird, soll die Verpackung und Abgabe von Vektor-DNA an Suspensions- und anhaftende HEK 293-Zelltypen verbessern, um die Produktion rekombinanter Adeno-assoziierter Viren und lentiviraler Vektoren zu verbessern.

- Im April 2021 kündigte BOC Sciences die Einführung von zwei In-vivo-RNA-Transfektionskits an, nämlich siRNA-In-vivo-Transfektionskits und mRNA-In-vivo-Transfektionskits, die für die In-vivo-Transfektion von siRNA bzw. mRNA geeignet sind.

Globaler Markt für Transfektionsreagenzien und -geräte

Der globale Markt für Transfektionsreagenzien und -geräte ist in neun wichtige Segmente unterteilt, wie Produkte, Stadium, Methoden, Typ, Molekültypen, Anwendung, Endbenutzer, Organismus und Vertriebskanal. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

PRODUKTE

- INSTRUMENTE

- REAGENZIEN & KITS

Auf der Grundlage der Produkte ist der globale Markt für Transfektionsreagenzien und -geräte in Instrumente sowie Reagenzien und Kits segmentiert.

BÜHNE

- FORSCHUNG

- PRÄKLINISCH

- KLINISCHE PHASEN

- KOMMERZIELL

Auf Grundlage der Entwicklungsphase wird der globale Markt für Transfektionsreagenzien und -geräte in die Forschungs-, präklinischen und klinischen Phasen sowie in den kommerziellen Bereich segmentiert.

TYP

- REAGENZIEN UND AUSRÜSTUNG FÜR VORÜBERGEHENDE TRANSFEKTION

- Stabile Transfektionsreagenzien und Ausrüstung

Auf der Grundlage des Typs ist der globale Markt für Transfektionsreagenzien und -geräte in transiente Transfektionsreagenzien und -geräte sowie stabile Transfektionsreagenzien und -geräte segmentiert.

METHODEN

- NICHT-VIRALE METHODEN

- VIRALE METHODEN

Auf der Grundlage der Methoden wird der globale Markt für Transfektionsreagenzien und -geräte in nicht-virale und virale Methoden unterteilt.

MOLEKÜLARTYPEN

- PLASMID-DNA

- DNA-OLIGONUKLEOTIDE

- Kleine interferierende RNA (SIRNA)

- PROTEINE

- RIBONUCLEOPROTEINKOMPLEXE (RNPS)

- ANDERE

Auf der Grundlage der Molekültypen ist der globale Markt für Transfektionsreagenzien und -geräte in Plasmid-DNA, DNA-Oligonukleotide, kleine interferierende RNA (siRNA), Proteine, Ribonukleoproteinkomplexe (RNPs) und andere unterteilt.

ORGANISMUS

- BAKTERIEN

- SÄUGETIERZELLEN

- PILZE

- PFLANZEN

- VIRUS

Auf der Grundlage des Organismus ist der globale Markt für Transfektionsreagenzien und -geräte in Bakterien, Säugetierzellen, Pilze, Pflanzen und Viren segmentiert.

ANWENDUNG

- NACH TYP

- IN VITRO-ANWENDUNG

- IN VIVO-ANWENDUNG

- BIOPRODUKTION

- ANDERE

- NACH BRANCHE

- LANDWIRTSCHAFT

- SYNTHETISCHE BIOLOGIE

- ANDERE

Auf der Grundlage der Anwendung ist der globale Markt für Transfektionsreagenzien und -geräte nach Typ in In-vitro-Anwendung, In-vivo-Anwendung, Bioproduktion und Sonstiges sowie nach Branchen in Landwirtschaft, synthetische Biologie und Sonstiges segmentiert.

Endverbraucher

- BIOPHARMA

- CROS

- CMOS/CDMOS

- WISSENSCHAFT

- KRANKENHÄUSER

- KLINISCHE LABORE

- ANDERE

Auf der Grundlage des Endbenutzers ist der globale Markt für Transfektionsreagenzien und -geräte in Biopharma, CROs, CMOs/CDMOs, Hochschulen, Krankenhäuser, klinische Labore und andere segmentiert.

VERTRIEBSKANAL

- DIREKTE AUSSCHREIBUNG

- EINZELHANDELSVERKÄUFE

- ANDERE

Auf der Grundlage der Vertriebskanäle ist der globale Markt für Transfektionsreagenzien und -geräte in Direktausschreibungen, Einzelhandelsverkäufe und Sonstiges segmentiert.

Globaler Markt für Transfektionsreagenzien und -geräte – Regionale Analyse/Einblicke

Der globale Markt für Transfektionsreagenzien und -geräte ist in viele wichtige Segmente unterteilt, wie etwa Geografie, Produkte, Phasen, Methoden, Typ, Molekülarten, Anwendung, Endbenutzer, Organismus und Vertriebskanal.

Die in diesem Marktbericht abgedeckten Länder sind die USA, Kanada, Mexiko, Deutschland, Frankreich, Italien, Großbritannien, Spanien, die Schweiz, Russland, die Niederlande, Belgien, die Türkei und der Rest von Europa, China, Japan, Indien, Australien, Südkorea, Singapur, Thailand, Malaysia, die Philippinen, Indonesien und der Rest des asiatisch-pazifischen Raums, Brasilien, Argentinien, der Rest von Südamerika, Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Israel, Ägypten und der Rest des Nahen Ostens und Afrikas.

Im Jahr 2023 dominiert die Region Nordamerika aufgrund der Präsenz wichtiger Marktteilnehmer auf dem größten Verbrauchermarkt mit hohem BIP. In den USA wird aufgrund der Zunahme chronischer und seltener Krankheiten und der damit einhergehenden Zunahme der Verwendung von Transfektionsreagenzien und -geräten mit einem Wachstum gerechnet.

Nordamerika dominiert den Markt, da die steigenden Investitionen in das Gesundheitswesen das Marktwachstum ankurbeln dürften. Die USA dominieren die Region Nordamerika aufgrund der starken Präsenz wichtiger Akteure. Deutschland dominiert die Region Europa aufgrund der steigenden Nachfrage aus den Schwellenmärkten und der Expansion. China dominiert die Region Asien-Pazifik aufgrund der zunehmenden Neigung der Kunden zu fortschrittlichen technologischen Prozessen.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Darüber hinaus werden bei der Prognoseanalyse der Länderdaten die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und globale Analyse der Marktanteile für Transfektionsreagenzien und -geräte

Die Wettbewerbslandschaft des globalen Marktes für Transfektionsreagenzien und -geräte liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktzulassungen, Produktbreite und -breite, Anwendungsdominanz, Produkttyp-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf den globalen Markt für Transfektionsreagenzien und -geräte.

Einige der wichtigsten Akteure auf diesem Markt sind Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (eine Tochtergesellschaft der FUJIFILM Holdings Corporation), Avanti Polar Lipids (eine Tochtergesellschaft von Croda International Plc), PerkinElmer chemagen Technologie GmbH (eine Tochtergesellschaft von PerkinElmer Inc.), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc. (eine Tochtergesellschaft von F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. (abm), Beckman Coulter, Inc. (eine Tochtergesellschaft von Danaher), Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc. und Twist Bioscience, um nur einige zu nennen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TRANSIENT TRANSFECTION OF TRANSFECTION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS:

6 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, REGULATIONS

6.1 EUROPEAN UNION REGULATORY SCENARIO

6.2 U.S. REGULATORY SCENARIO

6.3 JAPAN REGULATORY SCENARIO

6.4 CHINA REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISEASES

7.1.2 DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS

7.1.3 GROWING DEMAND FOR CHIMERIC GENES

7.1.4 LARGE-SCALE TRANSFECTIONS USED IN CLINICAL RESEARCH

7.1.5 UTILIZATION OF BIOPHARMACEUTICALS IN THE PRODUCTION OF PROTEINS

7.2 RESTRAINTS

7.2.1 HIGH COST OF TRANSFECTION PRODUCTS

7.2.2 SELECTIVE EFFECTIVENESS OF TRANSFECTION REAGENTS

7.2.3 CELL DAMAGE INDUCED BY TRANSFECTION PROCEDURE

7.3 OPPORTUNITIES

7.3.1 EXPLORATION OF EMERGING MARKET

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 SURGING LEVEL OF INVESTMENT

7.4 CHALLENGES

7.4.1 LONG APPROVAL PROCEDURE

7.4.2 LACK OF SAFETY LEVEL LAB FOR VIRUS-ASSOCIATED TRANSFECTION

7.4.3 LACK OF TRAINED PROFESSIONALS

8 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 REAGENTS & KITS

8.3 INSTRUMENTS

9 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE

9.1 OVERVIEW

9.2 RESEARCH

9.3 PRECLINICAL

9.4 CLINICAL PHASES

9.5 COMMERCIAL

10 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE

10.1 OVERVIEW

10.2 TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT

10.3 STABLE TRANSECTION REAGENTS AND EQUIPMENT

11 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY METHODS

11.1 OVERVIEW

11.2 NON-VIRAL METHODS

11.3 VIRAL METHODS

12 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE

12.1 OVERVIEW

12.2 PLASMID DNA

12.3 SMALL INTERFERING RNA (SIRNA)

12.4 PROTEINS

12.5 DNA OLIGONUCLEOTIDES

12.6 RIBONUCLEOPROTEIN COMPLEXES (RNPS)

12.7 OTHERS

13 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM

13.1 OVERVIEW

13.2 MAMMALIAN CELLS

13.3 PLANTS

13.4 FUNGI

13.5 VIRUS

13.6 BACTERIA

14 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 IN VITRO APPLICATION

14.2.1 IN VIVO APPLICATION

14.2.2 BIOPRODUCTION

14.2.3 OTHERS

14.2.4 SYNTHETIC BIOLOGY

14.2.5 AGRICULTURE

14.2.6 OTHERS

15 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER

15.1 OVERVIEW

15.2 BIOPHARMA

15.3 CROS

15.4 CMOS/CDMOS

15.5 ACADEMIA

15.6 HOSPITALS

15.7 CLINICAL LABS

15.8 OTHERS

16 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION

17.1 OVERVIEW

17.2 NORTH AMERICA

17.2.1 U.S.

17.2.2 CANADA

17.2.3 MEXICO

17.3 EUROPE

17.3.1 GERMANY

17.3.2 U.K.

17.3.3 FRANCE

17.3.4 ITALY

17.3.5 RUSSIA

17.3.6 SPAIN

17.3.7 TURKEY

17.3.8 NETHERLANDS

17.3.9 BELGIUM

17.3.10 SWITZERLAND

17.3.11 REST OF EUROPE

17.4 ASIA-PACIFIC

17.4.1 CHINA

17.4.2 JAPAN

17.4.3 INDIA

17.4.4 AUSTRALIA

17.4.5 SOUTH KOREA

17.4.6 SINGAPORE

17.4.7 THAILAND

17.4.8 MALAYSIA

17.4.9 INDONESIA

17.4.10 PHILIPPINES

17.4.11 REST OF ASIA-PACIFIC

17.5 SOUTH AMERICA

17.5.1 BRAZIL

17.5.2 ARGENTINA

17.5.3 REST OF SOUTH AMERICA

17.6 MIDDLE EAST AND AFRICA

17.6.1 SOUTH AFRICA

17.6.2 SAUDI ARABIA

17.6.3 U.A.E.

17.6.4 EGYPT

17.6.5 ISRAEL

17.6.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THERMO FISHER SCIENTIFIC INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 ROCHE MOLECULAR SYSTEMS, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROMEGA CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 TAKARA BIO INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.5 BIO-RAD LABORATORIES, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANANLYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 ALTOGEN BIOSYSTEMS

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AVANTI POLAR LIPIDS (A SUBSIDIARY OF CRODA INTERNATIONAL PLC)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER)

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CYTIVA

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 FUJIFILM IRVINE SCIENTIFIC (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANANLYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 GENLANTIS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 GENO TECHNOLOGY INC., USA

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 GINKGO BIOWORKS

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 LONZA

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANANLYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 MAXCYTE, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 MERCK KGAA

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 MIRUS BIO LLC.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ORIGENE TECHNOLOGIES, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 PERKINELMER CHEMAGEN TECHNOLOGIE GMBH (A SUBSIDIARY OF PERKINELMER INC.)

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 POLYPLUS TRANSFECTION

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 R&D SYSTEMS, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SBS GENETECH

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 SIGNAGEN LABORATORIES

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL REAGENT AND KITS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 GLOBAL INSTRUMENTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE, 2021-2030 (USD THOUSAND)

TABLE 5 GLOBAL RESEARCH IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL PRECLINICAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 GLOBAL CLINICAL PHASES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL COMMERCIAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL STABLE TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET, BY METHODS, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL NON-VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL PLASMID DNA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL SMALL INTERFERING RNA (SIRNA) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL PROTEINS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL DNA OLIGONUCLEOTIDES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL RIBONUCLEOPROTEIN COMPLEXES (RNPS) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL MAMMALIAN CELLS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL PLANTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL FUNGI IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL VIRUS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL BACTERIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET , BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL IN VITRO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL IN VIVO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL BIOPRODUCTION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 GLOBAL BIOPHARMA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 GLOBAL CROS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 GLOBAL CMOS/CDMOS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 GLOBAL ACADEMIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 GLOBAL HOSPITALS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 GLOBAL CLINICAL LABS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 43 GLOBAL DIRECT TENDER IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 GLOBAL RETAIL SALES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 GLOBAL OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 GLOBAL TRANSFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS GROWING AT THE FASTEST PACE IN THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 13 INCREASING OCCURENCE OF CHRONIC DISEASES AND DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS IS DRIVING THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 14 THE TRANSIENT TRANSFECTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN 2022 & 2030

FIGURE 15 NORTH AMERICA IS THE FASTEST GROWING MARKET IN THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 16 APPROVAL PROCESS FOR GENE THERAPY IN CHINA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET

FIGURE 18 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023

FIGURE 19 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023-2030 (USD THOUSAND)

FIGURE 20 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, CAGR (2023-2030)

FIGURE 21 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 22 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023

FIGURE 23 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023-2030 (USD THOUSAND)

FIGURE 24 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, CAGR (2023-2030)

FIGURE 25 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, LIFELINE CURVE

FIGURE 26 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023

FIGURE 27 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 28 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 29 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 30 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2022

FIGURE 31 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2023-2030 (USD THOUSAND)

FIGURE 32 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, CAGR (2023-2030)

FIGURE 33 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, LIFELINE CURVE

FIGURE 34 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2022

FIGURE 35 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2023-2030 (USD THOUSAND)

FIGURE 36 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, CAGR (2023-2030)

FIGURE 37 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, LIFELINE CURVE

FIGURE 38 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2022

FIGURE 39 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2023-2030 (USD THOUSAND)

FIGURE 40 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, CAGR (2023-2030)

FIGURE 41 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, LIFELINE CURVE

FIGURE 42 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2022

FIGURE 43 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 44 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, CAGR (2023-2030)

FIGURE 45 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, LIFELINE CURVE

FIGURE 46 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY END USER, 2022

FIGURE 47 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 48 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 49 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 50 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 51 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 52 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 53 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 54 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 55 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 56 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 57 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 58 GLOBAL TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 59 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 60 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 61 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 62 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 63 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 64 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 65 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 66 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 67 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (202 & 2030)

FIGURE 68 EUROPE TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 69 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 70 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 71 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 72 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 73 ASIA-PACIFIC TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 74 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 75 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 76 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 77 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 78 SOUTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 79 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 80 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 81 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 82 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 83 MIDDLE EAST AND AFRICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 84 GLOBAL TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 85 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 86 EUROPE TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 87 ASIA-PACIFIC TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.