Global Ready To Drink High Strength Premixes Market

Marktgröße in Milliarden USD

CAGR :

%

USD

39.85 Billion

USD

54.12 Billion

2024

2032

USD

39.85 Billion

USD

54.12 Billion

2024

2032

| 2025 –2032 | |

| USD 39.85 Billion | |

| USD 54.12 Billion | |

|

|

|

Globaler Markt für trinkfertige/hochwirksame Vormischungen, Segmentierung nach Typ (RTDs auf Malzbasis, RTDs auf Spirituosenbasis, RTDs auf Weinbasis, andere), Verarbeitungsart (Einzelverbindung und Mischung), Geschlecht (männlich und weiblich), Verpackungsart (Flasche, Dose und andere), Handel (Off-Trade, On-Trade) – Branchentrends und Prognose bis 2032

Marktanalyse für trinkfertige/hochwirksame Vormischungen

Die Kategorie der Ready-to-drinks (RTDs) hat als Reaktion auf die sich ändernde Dynamik der Trinkvorlieben und -gewohnheiten der weltweiten Verbraucher mehrere kritische Veränderungen erfahren. Trotz erheblicher Kritik haben die großen Fortschritte bei der Nachfrage nach und Vermarktung von alkoholischen Getränken der Kategorie RTDs einen respektablen Platz eingebracht. Die Nachfragedynamik hat aufgrund des hohen Komforts für die Verbraucher, der maßgeblich zur Popularität leicht zuzubereitender alkoholischer Getränke beigetragen hat, nicht viel an Glanz verloren.

Marktgröße für trinkfertige/hochwirksame Vormischungen

Der weltweite Markt für trinkfertige/hochwirksame Vormischungen hatte im Jahr 2024 einen Wert von 39,85 Milliarden US-Dollar und soll bis 2032 einen Wert von 54,12 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 3,90 % während des Prognosezeitraums von 2025 bis 2032.

Berichtsumfang und Marktsegmentierung

|

Eigenschaften |

Wichtige Markteinblicke zu trinkfertigen/hochwirksamen Vormischungen |

|

Segmentierung |

|

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Schweden, Polen, Dänemark, Italien, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Wichtige Marktteilnehmer |

Davide Campari-Milano NV (Niederlande), Diageo PLC (Großbritannien), Halewood International Limited (Großbritannien), Asahi Group Holdings, Ltd. (Japan), Accolade Wines (Australien), Bacardi Limited (Bermuda), Mike's Hard Lemonade Co. (USA), Castel Group (Frankreich), Suntory Holdings Limited (Japan), Anheuser-Busch InBev SA/NV (Belgien), The Brown-Forman Corporation (USA), United Brands Company, Inc. (USA), PernodRicard SA (Frankreich), The Miller Brewing Company (USA) |

|

Marktchancen |

|

Marktdefinition für trinkfertige/hochwirksame Vormischungen

Ready-to-drink (RTD) Premixes sind Getränke, die vorgemischt wurden und jederzeit trinkfertig sind. Es gibt zwei Arten von Ready-to-drink Premixes: RTDs und hochprozentige Premixes. RTD-Getränke bestehen hauptsächlich aus alkoholischen Getränken auf Spirituosen-, Wein- oder Malzbasis . Hochprozentige Premixes umfassen vorgemischte alkoholische Getränke.

Marktdynamik für trinkfertige/hochwirksame Vormischungen

Treiber

- Wachsende Beliebtheit von Getränken mit geringem Alkoholgehalt

Die steigende Beliebtheit von alkoholarmen und aromatisierten Getränken bei einer wachsenden Zahl junger Erwachsener ist ein wichtiger Treiber des Marktes für alkoholische RTDs/hochprozentige Vormischungen. Die wachsende Beliebtheit gesunder alkoholischer Getränke, insbesondere unter den Millennials, treibt die Nachfrage nach alkoholischen RTDs/hochprozentigen Vormischungen in die Höhe. Die wachsende Vorliebe der Verbraucher für hochprozentige Getränke als Ersatz für Spirituosen hat die Nachfrage erheblich angekurbelt.

- Innovative Marketingstrategien für die Zielkonsumenten

Der veränderte Lebensstil der Kunden, die gestiegene Nachfrage junger Leute nach trinkfertigen Premixen, die wachsende Bedeutung neuer und ethnischer Geschmacksrichtungen sowie innovative Fortschritte bei Marketing- und Werbeaktivitäten tragen alle zum Wachstum des globalen Marktes für trinkfertige Premixe bei. Die Verbreitung des E-Commerce, niedrige Preise, einfacher Zugang, die Einführung natürlicher und gesundheitsfördernder Cocktailzutaten in trinkfertigen Premixen, wachsende Investitionen in Pubs und Bars sowie eine Vielzahl von Geschmacksrichtungen in trinkfertigen Premixen treiben das globale Marktwachstum für dieses Produkt voran.

Gelegenheit

Schwellenländer bieten Herstellern von Fertiggetränkemischungen zahlreiche Möglichkeiten, ihre Geschäftstätigkeiten auszuweiten. Im Prognosezeitraum wird der Markt für Fertiggetränkemischungen voraussichtlich exponentiell wachsen. In der Produktkategorie des Marktes für Fertiggetränkemischungen werden jedoch die RTDs auf Wein- und Spirituosenbasis das stärkste Wachstum aufweisen. Der Wunsch der Verbraucher nach Bequemlichkeit treibt Unternehmen dazu, ihr Geschäft mit Fertiggetränken auszuweiten.

Beschränkungen

Allerdings können Faktoren wie religiöse oder kulturelle Überzeugungen in einigen Ländern, hohe Steuern und Abgaben sowie die negativen gesundheitlichen Auswirkungen von Alkohol das Marktwachstum behindern. Darüber hinaus wirken sich strenge Regeln und Vorschriften für die Werbung für alkoholische Produkte sowie eine zunehmende Zahl von Anti-Alkohol-Kampagnen negativ auf das Wachstum des Marktes für hochwirksame Vormischungen aus.

Dieser Marktbericht für trinkfertige/hochprozentige Vormischungen enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen, technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für trinkfertige/hochprozentige Vormischungen zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für trinkfertige/hochwirksame Vormischungen

Der Markt für trinkfertige/hochwirksame Vormischungen ist nach Typ, Verarbeitungsart, Geschlecht, Verpackungsart und Handel segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- RTDS auf Malzbasis

- Bier

- Aromatisierte Malzgetränke (FMB)

- Spiritusbasiertes RTDS

- Wodka

- Whiskey

- Rum

- Tequila

- Sonstiges

- Weinbasiertes RTDS

- Sonstiges

Verarbeitungsart

- Einzelverbindung

- Vermischt

Geschlecht

- Männlich

- Weiblich

Verpackungsart

- Flasche

- Kann

- Sonstiges

Handel

- Im Handel

- Außerhalb des Handels

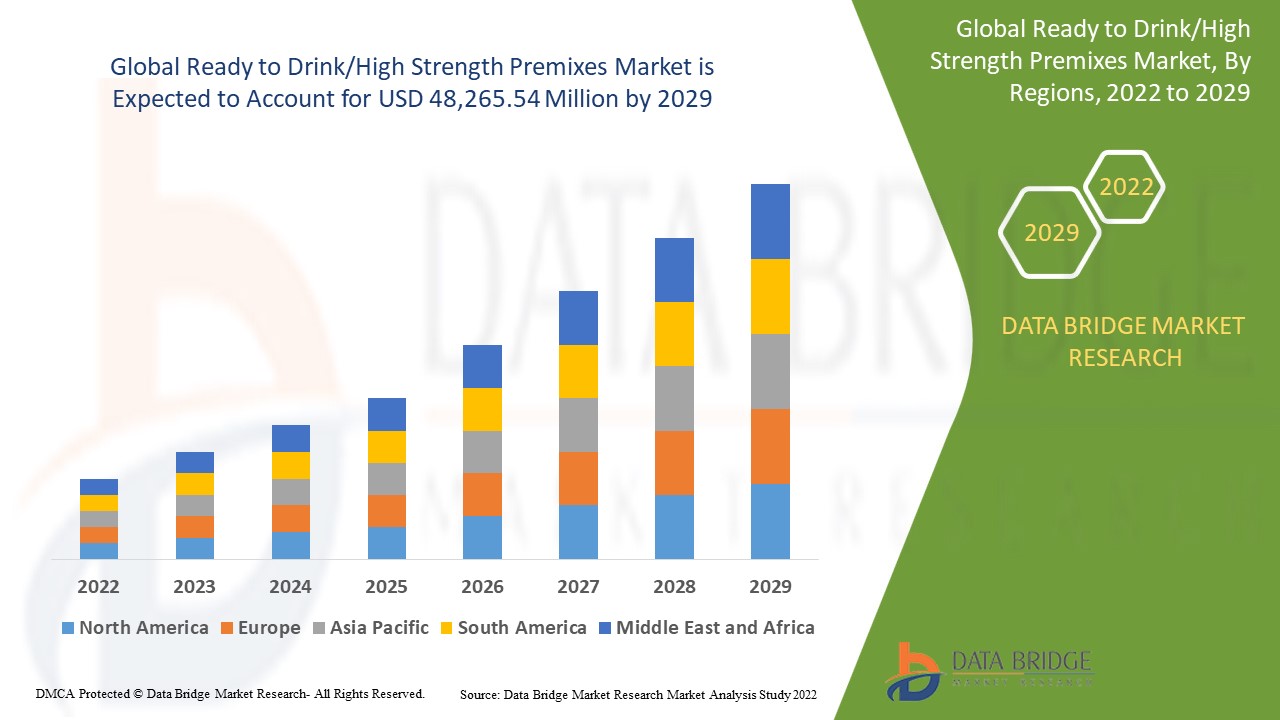

Regionale Analyse des Marktes für trinkfertige/hochwirksame Vormischungen

Der Markt für trinkfertige/hochwirksame Vormischungen wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ, Verarbeitungsart, Geschlecht, Verpackungsart und Handel wie oben angegeben bereitgestellt.

Die im Marktbericht für trinkfertige/hochwirksame Vormischungen abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Schweden, Polen, Dänemark, Italien, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher asiatisch-pazifischer Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

China ist aufgrund seiner großen Bevölkerung und seines hohen Konsums alkoholischer Getränke das dominierende Land im asiatisch-pazifischen Raum. Da es weniger gesundheitsschädlich ist, werden die Menschen bzw. Verbraucher in China von diesem Getränk angezogen, was zu hohen Umsätzen mit dem Produkt führt. Da die Menschen in den Vereinigten Staaten sich der gesundheitlichen Vorteile alkoholarmer Getränke bewusst sind, haben Hersteller begonnen, ihre Produkte in diesem Land zu verkaufen. Darüber hinaus dominiert das Vereinigte Königreich den europäischen Raum aufgrund des hohen Konsums alkoholarmer Produkte in der Region.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Bereitstellung von Prognoseanalysen der Länderdaten berücksichtigt.

Marktanteil trinkfertiger/hochwirksamer Vormischungen

Die Wettbewerbslandschaft auf dem Markt für trinkfertige/hochprozentige Vormischungen liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für trinkfertige/hochprozentige Vormischungen.

Die Marktführer für trinkfertige/hochwirksame Vormischungen sind:

- Davide Campari-Milano NV (Italien)

- Diageo PLC (Großbritannien)

- Halewood International Limited (Großbritannien)

- Asahi Group Holdings, Ltd. (Japan)

- Accolade Wines (Australien)

- Bacardi Limited (Bermuda)

- Mike's Hard Lemonade Co. (USA)

- Castel-Gruppe (Frankreich)

- Suntory Holdings Limited (Japan)

- Anheuser-Busch InBev SA/NV (Belgien)

- Die Brown-Forman Corporation (USA)

- United Brands Company, Inc. (USA)

- PernodRicard SA (Frankreich)

- The Miller Brewing Company (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.