Global Perimeter Intrusion Detection Systems Market

Marktgröße in Milliarden USD

CAGR :

%

USD

62.30 Billion

USD

195.30 Billion

2024

2032

USD

62.30 Billion

USD

195.30 Billion

2024

2032

| 2025 –2032 | |

| USD 62.30 Billion | |

| USD 195.30 Billion | |

|

|

|

|

Global Perimeter Intrusion Detection Systems Market, By Component (Solutions, Sensors, Hardware, Software and Services), Organization Size (Small and Medium Sized Enterprises, Large Enterprises), Deployment Type (Open Area, Fence Mounted, Buried and Others), End User (Critical Infrastructure, Military and Defense, Government, Transportation, Industrial, Correctional Facilities, Commercial and Others) Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) - Industry Trends and Forecast to 2032

Perimeter Intrusion Detection Systems Market Size

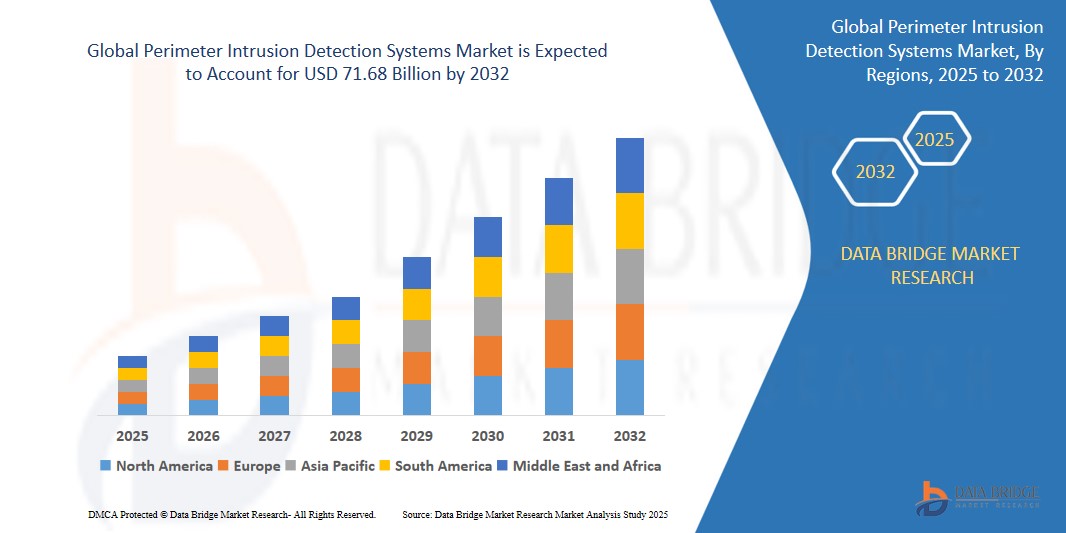

- The Global Perimeter Intrusion Detection Systems Market size was valued atUSD 22.76 billion in 2024 and is expected to reachUSD 71.68 billion by 2032, at aCAGR of 15.42%during the forecast period

- This growth is driven by factors such as increasing need for effective surveillance systems

Perimeter Intrusion Detection Systems Market Analysis

- Perimeter Intrusion Detection Systems are becoming increasingly vital for securing critical infrastructure, industrial assets, military installations, and commercial buildings. These systems are designed to detect unauthorized intrusions at the perimeter of a facility using technologies such as infrared sensors, radar, fiber optics, and video analytics, enabling rapid response to potential threats.

- The market is primarily driven by the rising incidence of security breaches, growing need for border surveillance, and the increasing adoption of automation and smart security solutions across government, transportation, energy, and defense sectors.

- North America is expected to dominate the global PIDS market, supported by substantial investments in national security, critical infrastructure protection, and technological innovation in threat detection solutions. The U.S. government’s continued investments in border security and airport infrastructure further accelerate market demand.

- The Asia Pacific region is projected to witness the fastest growth, driven by rapid industrialization, growing geopolitical tensions, and increased infrastructure development. Countries like China, India, and Japan are deploying perimeter surveillance and detection systems across data centers, ports, and defense sites.

- The sensors segment holds the largest market share of 52.80%. The growth of this segment increasing demand for advanced detection technologies, such as seismic, infrared, fiber optic, and radar based sensors, which provide real-time alerts and accurate perimeter breach detection

Report Scope and Perimeter Intrusion Detection Systems Market Segmentation

|

Attributes |

Pipeline Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Perimeter Intrusion Detection Systems Market Trends

“Integration of AI-Powered Video Analytics and Sensor Fusion in PIDS”

- A key trend transforming the perimeter intrusion detection market is the rapid integration of artificial intelligence (AI), deep learning based video analytics, and sensor fusion technologies to improve accuracy, reduce false alarms, and deliver real-time threat detection.

- These smart systems can distinguish between actual intrusions and non threatening movements like wildlife or environmental conditions, enhancing the reliability of security operations.

- For instance, in February 2025, Johnson Controls unveiled a new AI powered perimeter security suite that integrates thermal cameras, fiber optics, and radar sensors. The system uses AI based object classification and behavior recognition to detect threats with over 95% accuracy, dramatically reducing false alarms in critical infrastructure.

- Sensor fusion combining radar, microwave, and seismic data with AI analytics also allows for more contextual decision-making and timely threat mitigation.

Perimeter Intrusion Detection Systems Market Dynamics

Driver

“Rising Security Concerns Across Critical Infrastructure and Public Spaces”

- Increasing incidents of perimeter breaches, terrorism, and theft have significantly raised demand for advanced intrusion detection systems across airports, data centers, utilities, defense bases, and commercial buildings.

- Governments and private players are investing heavily in perimeter security solutions to ensure public safety, protect assets, and meet regulatory mandates.

- For Instance, In July 2024, India’s Ministry of Civil Aviation mandated perimeter intrusion detection systems at all major airports following multiple runway breaches, pushing vendors to deploy smart fence detection and thermal imaging systems for 24/7 monitoring.

- The need for automated, real time, and tamper-proof intrusion alerts is a strong driver behind the global expansion of PIDS technology.

Opportunity

“Growing Deployment of Cloud-Based and Managed Perimeter Security Platforms”

- The shift toward cloud-based perimeter intrusion systems offers a major opportunity for vendors to provide scalable, flexible, and subscription based security solutions.

- These platforms allow for centralized monitoring, AI analytics, remote updates, and data storage across multiple sites without heavy upfront infrastructure costs.

- For instance, In January 2025, Axis Communications partnered with Microsoft Azure to offer cloud-integrated perimeter monitoring solutions for logistics parks and smart cities in Europe. The collaboration enabled end users to manage multiple sites through a unified dashboard, with real time data synchronization and AI-based threat detection.

- This model is increasingly preferred by enterprises and government agencies that require scalable security across geographically dispersed assets, opening new revenue streams for solution providers.

Restraint/Challenge

“High Installation Costs and Integration Complexity in Legacy Systems”

- One of the significant challenges in the PIDS market is the high upfront cost of installation and integration, particularly when combining new AI-based systems with older surveillance or access control setups.

- Legacy infrastructure may lack compatibility with modern sensors, networks, or analytics tools, requiring extensive customization or overhaul.

- For Instance, In November 2024, a petrochemical facility in the Middle East faced project delays and cost overruns when integrating radar-based PIDS with its decades-old analog CCTV system. The mismatch in data protocols and lack of IP compatibility led to a 3-month project extension and 20% cost escalation.

- These complexities increase implementation time and require skilled technical expertise, which can be a hurdle for adoption in budget-constrained sectors or remote locations.

Perimeter Intrusion Detection Systems Market Scope

The market is segmented on the basis component, Organization Size, Deployment Type, End User

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Organization Size |

|

|

By Deployment Type

|

|

|

By End User

|

|

In 2025, The sensors segment is expected to hold the largest market share and dominate the market

This sensor segment is driven by the increasing demand for advanced detection technologies, such as seismic, infrared, fiber optic, and radar-based sensors, which provide real time alerts and accurate perimeter breach detection. The growing need to enhance situational awareness and minimize false alarms in critical infrastructure, defense, and commercial sectors is further propelling sensor adoption across perimeter security systems.

The Fence Mounted segment is expected to account for the largest share in the Deployment segment during the forecast period.

The fence mounted segment is expected to account for the largest market share. Fence mounted systems are widely used across industrial, government, and military facilities for their ease of installation, cost effectiveness, and ability to cover large boundary areas. Technological advancements in fence sensors that can differentiate between environmental disturbances and actual threats are enhancing their appeal across high-security zones.

Perimeter Intrusion Detection Systems Market Regional Analysis

“North America Holds the Largest Share in the Perimeter Intrusion Detection Systems Market”

- North America dominates the global perimeter intrusion detection systems market due to its robust investments in critical infrastructure security, increasing adoption of smart surveillance technologies, and heightened awareness around perimeter-based threats across military, industrial, and commercial sectors.

- The U.S. leads the region, supported by stringent homeland security regulations and rising demand for intelligent security systems to protect government facilities, data centers, and utilities.

“Asia Pacific is Projected to Register the Highest CAGR in the Perimeter Intrusion Detection Systems Market

- Asia-Pacific is expected to record the fastest growth rate in the global perimeter intrusion detection systems market during the forecast period. Rapid urbanization, increased spending on smart city initiatives, and growing concerns over terrorism, theft, and critical infrastructure protection are key growth factors.

- Countries such as China, India, Japan, and South Korea are heavily investing in perimeter security technologies to safeguard transportation networks, industrial complexes, airports, and defense bases.

Perimeter Intrusion Detection Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell (US)

- FLIR Systems (US)

- Johnson Controls (US)

- Anixter (US)

- Axis Communications (Sweden)

- Schneider Electric (France)

- Senstar Corporation (Canada)

- RBtec Perimeter Security Systems (US)

- Southwest Microwave (US)

- Advanced Perimeter Systems (UK)

- Fiber SenSys (US)

- CIAS Elettronica (Italy)

- UTC Climate, Controls & Security (US)

- Future Fibre Technologies (Australia)

- SORHEA (France)

- DeTekion Security Systems (US

- Jacksons Fencing (UK)

- Harper Chalice Group (UK)

Latest Developments in Global Perimeter Intrusion Detection Systems Market

- In March 2025, Honeywell introduced its latest AI driven perimeter intrusion detection system, designed to enhance real time threat detection capabilities. This advanced system integrates machine learning algorithms with high resolution thermal imaging to accurately identify and classify potential intrusions, reducing false alarms and improving response times. The launch underscores Honeywell's commitment to leveraging cutting edge technology to bolster perimeter security solutions.

- In February 2025, Schneider Electric announced a strategic partnership with Senstar Corporation to develop integrated perimeter security solutions. This collaboration aims to combine Schneider Electric's expertise in energy management and automation with Senstar's advanced intrusion detection technologies. The joint solutions are expected to offer enhanced protection for critical infrastructure and industrial facilities by providing comprehensive, scalable security systems.

- In January 2025, FLIR Systems unveiled significant upgrades to its thermal imaging cameras used in perimeter intrusion detection. The enhancements include improved image resolution and advanced analytics capabilities, enabling more precise detection of intrusions under various environmental conditions. These improvements are part of FLIR's ongoing efforts to provide robust security solutions for challenging perimeter environments.

- In December 2024, Anixter International Inc. completed the acquisition of Advanced Perimeter Systems, a UK based provider of electronic perimeter security systems. This acquisition is set to broaden Anixter's product offerings in the perimeter security market, allowing the company to deliver more comprehensive solutions to its global customer base. The move reflects Anixter's strategy to strengthen its position in the growing perimeter intrusion detection market.

- In November 2024, Axis Communications launched its next-generation radar detection technology, aimed at enhancing perimeter security applications. The new radar system offers improved detection accuracy and range, capable of identifying and tracking multiple objects simultaneously. This innovation is designed to complement existing video surveillance systems, providing an additional layer of security for various perimeter protection scenarios.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.