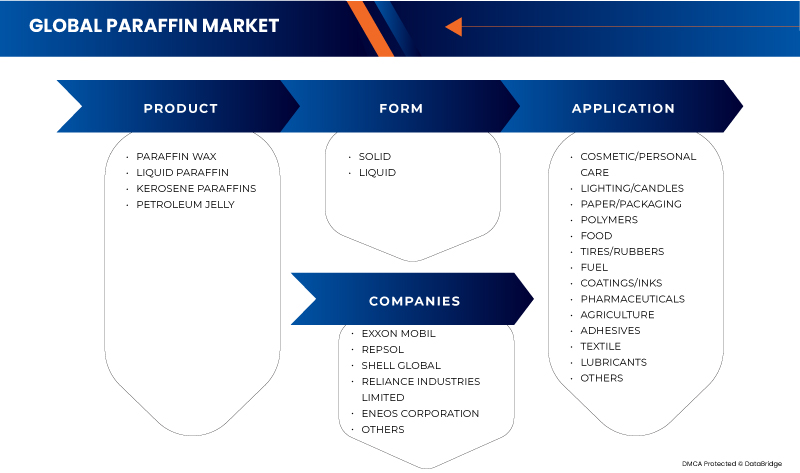

Globaler Paraffinmarkt, nach Produkt (Paraffinwachs , flüssiges Paraffin, Kerosinparaffine und Vaseline), Form (fest und flüssig), Anwendung (Kosmetik/Körperpflege, Beleuchtung/Kerzen, Papier/Verpackung, Polymere, Lebensmittel, Reifen/Gummi, Kraftstoff, Beschichtungen/Tinten, Pharmazeutika, Landwirtschaft, Klebstoffe, Textilien, Schmiermittel und andere) – Branchentrends und Prognose bis 2030.

Paraffinmarktanalyse und -größe

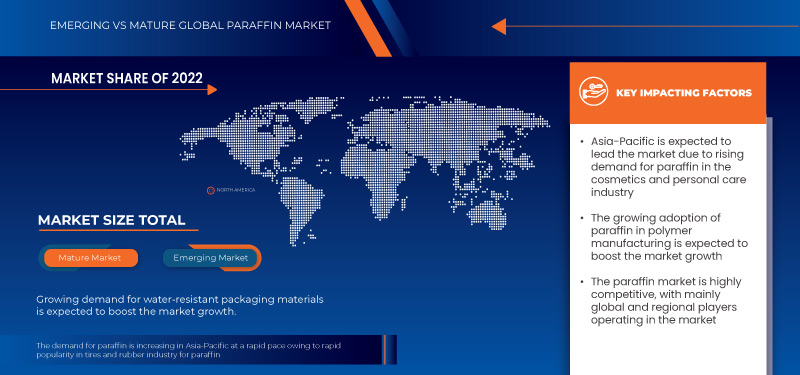

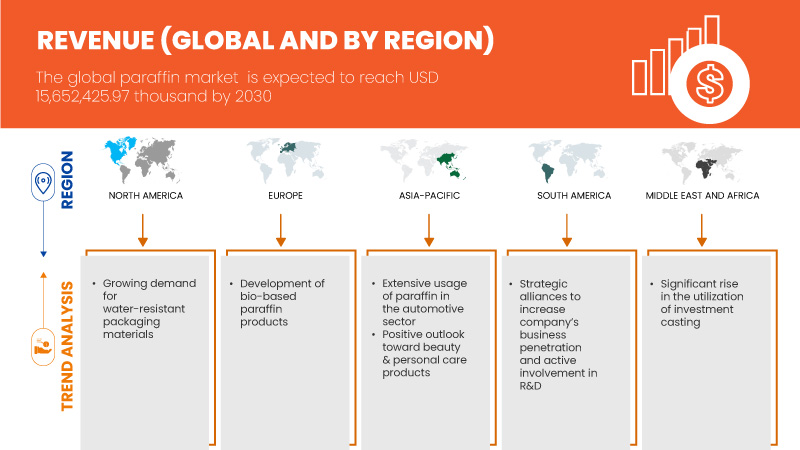

Der globale Paraffinmarkt wird durch die umfangreiche Verwendung von Paraffin im Automobilsektor angetrieben, ein wichtiger Treiber für den globalen Paraffinmarkt. Darüber hinaus wird erwartet, dass die wachsende Nachfrage nach wasserfesten Verpackungsmaterialien das Marktwachstum ankurbelt. Es wird jedoch erwartet, dass die Verlagerung der Präferenz hin zu erneuerbaren und nachhaltigen Alternativen das Marktwachstum bremst.

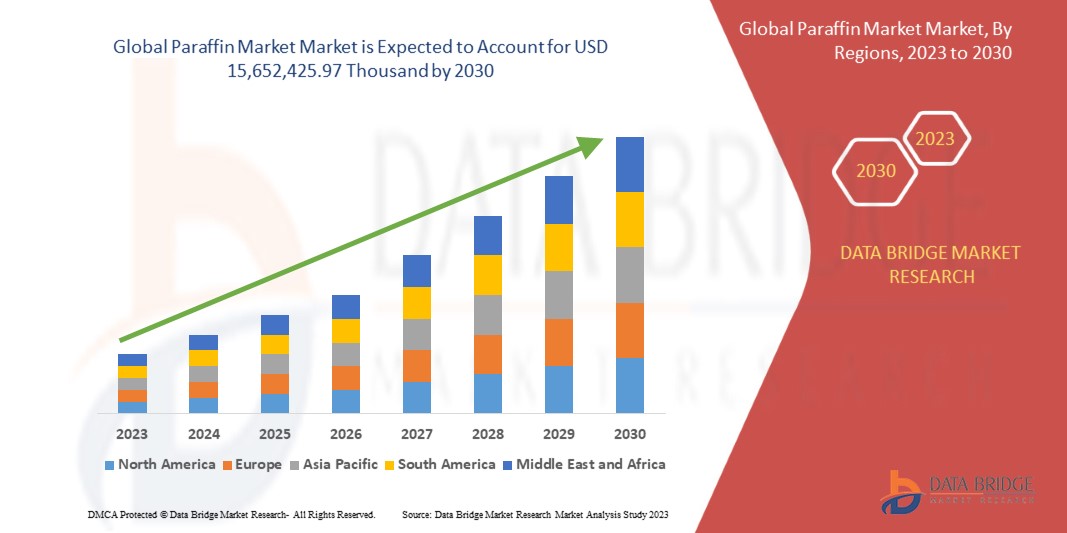

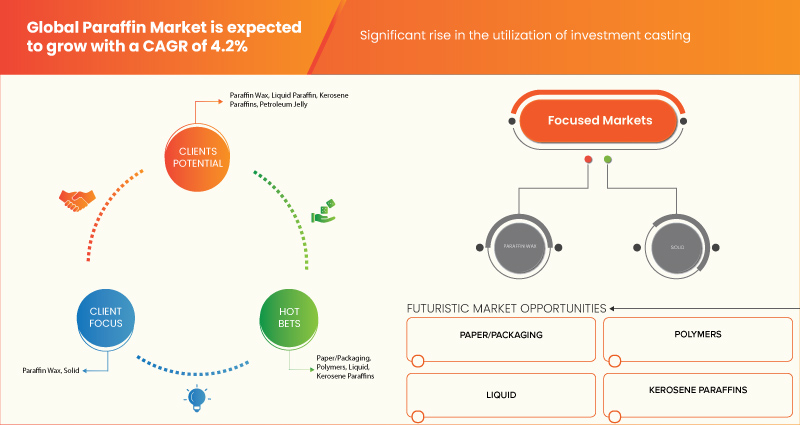

Laut einer Analyse von Data Bridge Market Research dürfte der globale Paraffinmarkt bis 2030 einen Wert von 15.652.425,97 Tausend US-Dollar erreichen, was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,2 % während des Prognosezeitraums entspricht.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historisches Jahr |

2021 (Anpassbar 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Tausend USD |

|

Abgedeckte Segmente |

Produkt (Paraffinwachs, flüssiges Paraffin, Kerosinparaffine und Vaseline), Form (fest und flüssig), Anwendung (Kosmetik/Körperpflege, Beleuchtung/Kerzen, Papier/Verpackung, Polymere, Lebensmittel, Reifen/Gummi, Kraftstoff, Beschichtungen/Tinten, Pharmazeutika, Landwirtschaft, Klebstoffe, Textilien, Schmiermittel und andere) |

|

Abgedeckte Länder |

USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Westeuropa, Nordeuropa, Südeuropa, Osteuropa, China, Indien, Japan, Südkorea, Australien und Neuseeland, Indonesien, Philippinen, Thailand, Singapur, Malaysia, Restlicher Asien-Pazifik-Raum, Vereinigte Arabische Emirate, Saudi-Arabien, Ägypten, Südafrika, Israel und Restlicher Naher Osten und Afrika |

|

Abgedeckte Marktteilnehmer |

Exxon Mobil Corporation, Repsol, Shell Global, Reliance Industries Limited, ENEOS Corporation, Indian Oil Corporation Ltd, Cepsa, Bharat Petroleum Corporation Limited, Sasol Limited., ENI SpA, Calumet Specialty Products Partners, LP, H&R GROUP, The International Group, Inc., Farabi Petrochemicals Co., Adinath Chemicals, FUCHS, LANXESS, Unicorn und Industrial Raw Materials LLC. unter anderem |

Marktdefinition

Paraffin ist eine wachsartige Substanz, die durch Raffination aus Erdöl oder Rohöl gewonnen wird. Es wird häufig in verschiedenen Industrien und Anwendungen verwendet und ist bei Raumtemperatur geruchlos, farblos und fest. Aufgrund seines niedrigen Schmelzpunkts kann Paraffin zur Herstellung von Kerzen, zum Überziehen von Gegenständen mit Wachs und zum Schmieren von Geräten verwendet werden. Als Bestandteil von Kosmetik- und Hautpflegeprodukten wird es auch in der Medizinbranche für Verfahren wie Paraffinwachsbäder verwendet. Aufgrund seiner Eigenschaften ist Paraffin eine Substanz mit vielen Anwendungen. Die zunehmende Verwendung von Paraffin für Schönheits- und Körperpflegeprodukte dürfte das Marktwachstum vorantreiben.

Globale Paraffinmarktdynamik

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Umfangreicher Einsatz von Paraffin im Automobilsektor

Paraffin wird hauptsächlich in der Automobilindustrie aufgrund seiner verschiedenen Eigenschaften verwendet, wie z. B. seiner Unlöslichkeit in Wasser, seiner Inertheit gegenüber Feuchtigkeit und Luft und seiner Eigenschaft, die Viskosität und Schmierfähigkeit zu erhöhen. Paraffinwachse können beispielsweise als Rostschutz für metallische Autoteile verwendet werden, indem sie eine Schutzschicht auf Metalloberflächen bilden und die Korrosionsgefahr verringern. Dies ist wichtig, um die Leistung und Langlebigkeit von Fahrzeugkomponenten zu erhalten, die Feuchtigkeit und anderen äußeren Einflüssen ausgesetzt sind.

Darüber hinaus wird Paraffinwachs bei der Reifenherstellung verwendet, um die Flexibilität und Zähigkeit der Gummimischungen zu erhöhen. Es verlängert die Lebensdauer der Reifen, indem es die Traktion verbessert, den Verschleiß verringert und Reifenrissen vorbeugt. Diese Anwendung ist unerlässlich, um Spitzenleistung, Sicherheit und Kosteneffizienz zu gewährleisten, da sie den Verschleiß der Reifen verhindert und ihre Lebensdauer über ihre übliche Lebensdauer hinaus verlängert.

- Positive Einstellung gegenüber Schönheits- und Körperpflegeprodukten

Da Paraffinwachs als Weichmacher wirkt und die Haut weich macht und befeuchtet, wird es häufig in Kosmetik- und Körperpflegeprodukten wie Cremes, Lotionen und Balsamen verwendet. Es bildet einen Schutzschild auf der Hautoberfläche, der Feuchtigkeit speichert und Austrocknung verhindert. Diese Eigenschaft macht es vorteilhaft für trockene oder raue Haut, da es die Hautstruktur nährt und verbessert. Die schmierenden Eigenschaften von Paraffinwachs erleichtern auch das Kämmen und Entwirren der Haare, verbessern die Handhabbarkeit und das Aussehen der Haare insgesamt. Paraffinwachs wird in verschiedenen Kosmetikprodukten verwendet, darunter Lippenbalsam, Lippenstift und Mascara. Darüber hinaus hilft Paraffinwachs, das ein Bestandteil von Lippenbalsam ist, dabei, eine Barriere auf den Lippen zu bilden, um Feuchtigkeit zu speichern und sie mit Feuchtigkeit zu versorgen. Außerdem verleiht es Lippenstiften eine glatte Textur und lässt sich leichter auftragen. Paraffinwachs verleiht Mascara Textur und Stabilität, um klumpenfreie, voluminöse Wimpern zu erzeugen.

- Steigende Nachfrage nach wasserfesten Verpackungsmaterialien

Die Nachfrage nach wasserfesten Verpackungsmaterialien, insbesondere solchen mit einer Innenbeschichtung aus Paraffinwachs, wächst. Paraffinwachs bietet wünschenswerte Eigenschaften, die es für wasserfeste Verpackungen geeignet machen. Paraffinwachs weist in erster Linie eine inhärente Wasserabweisung auf, wirkt als Barriere gegen Feuchtigkeit und verhindert, dass Wasser in die verpackten Produkte eindringt. Diese Eigenschaft ist entscheidend für den Schutz von Waren, die bei Kontakt mit Wasser beschädigt oder abgebaut werden können, wie etwa Lebensmittel, Getränke und bestimmte Industrieprodukte. Darüber hinaus verfügt Paraffinwachs über hervorragende Versiegelungseigenschaften. Als Beschichtung oder Schicht auf Verpackungsmaterialien aus Papier oder Karton bildet es eine dichte Versiegelung, die die Wasserbeständigkeit erhöht. Diese Versiegelungsfähigkeit trägt dazu bei, die Integrität und Qualität der verpackten Produkte zu erhalten, insbesondere in feuchten oder nassen Umgebungen.

Gelegenheiten

- Entwicklung biobasierter Paraffinprodukte

Die zunehmende Verwendung von Paraffin und biobasierten Paraffinprodukten schafft Chancen für den Paraffinmarkt, da in verschiedenen Branchen eine wachsende Nachfrage nach nachhaltigen Alternativen besteht. Biobasiertes Paraffin bietet eine umweltfreundlichere Alternative als herkömmliches Paraffin auf Erdölbasis. Es wird aus erneuerbaren Ressourcen wie pflanzlichen oder tierischen Ölen und Biomasse oder Abfallstoffen durch Bioraffinerien und Biomasseumwandlungstechnologien hergestellt. Branchen, die die Kundennachfrage nach umweltfreundlichen Produkten erfüllen und Nachhaltigkeitsziele einhalten möchten, finden es aufgrund seiner erneuerbaren Natur und seines geringen CO2-Fußabdrucks attraktiv. Darüber hinaus haben Durchbrüche in Forschung und Entwicklung die Herstellung und Eigenschaften von biobasiertem Paraffin verbessert. Das Ziel der laufenden Forschung und Entwicklung besteht darin, die Leistung und Benutzerfreundlichkeit von biobasiertem Paraffin zu verbessern, sodass es dem von Paraffin auf Erdölbasis ebenbürtig oder besser ist. Dies umfasst Eigenschaften wie Schmelzpunkt, Stabilität, Kompatibilität mit anderen Materialien und allgemeine Wirksamkeit in verschiedenen Anwendungen.

- Deutlicher Anstieg der Nutzung von Feinguss

Aufgrund seiner zahlreichen Vorteile nimmt die Verwendung des Feingussverfahrens in der Fertigungsindustrie zu. Das Feingussverfahren ermöglicht die Herstellung komplexer und komplizierter Metallteile mit hoher Präzision und Maßgenauigkeit. Es findet Anwendung in verschiedenen Branchen, darunter der Luft- und Raumfahrt, der Automobilindustrie, der Medizin und mehr, in denen komplizierte und maßgeschneiderte Metallkomponenten benötigt werden. Beim Feingussverfahren werden Wachsmodelle verwendet, um Formen für die fertigen Metallkomponenten herzustellen. Diese Wachsmodelle werden häufig aus Paraffinwachs hergestellt, da es über hervorragende Form- und Ausbrenneigenschaften verfügt. Paraffinwachs lässt sich leicht in komplizierte Modelle formen, wodurch es möglich wird, äußerst komplizierte Modelle herzustellen, die das benötigte Metallstück präzise nachbilden.

Beschränkungen

- Verschiebung der Präferenz hin zu erneuerbaren und nachhaltigen Alternativen

Traditionelles Paraffin wird aus Erdöl gewonnen, einem nicht erneuerbaren Rohstoff. Die Gewinnung und Verarbeitung von Erdöl kann schädliche Auswirkungen auf die Umwelt haben, darunter Luftverschmutzung, Zerstörung von Lebensräumen und Umweltverschmutzung, Zerstörung von Lebensräumen und Umweltverschmutzung, Zerstörung von Lebensräumen und Umweltverschmutzung, Zerstörung von Lebensräumen und Umweltverschmutzung, Zerstörung von Lebensräumen und Umweltverschmutzung, Zerstörung von Lebensräumen und Treibhausgasemissionen. Der Übergang zu erneuerbaren und nachhaltigen Paraffinalternativen wird durch das zunehmende Umweltbewusstsein und den Wunsch vorangetrieben, die Abhängigkeit von Materialien aus fossilen Brennstoffen zu verringern.

Der Übergang zu erneuerbaren und nachhaltigen Alternativen ist unerlässlich, um den Klimawandel zu mildern, die Umwelt zu schützen und Ressourcen zu schonen, die den Markt voraussichtlich einschränken werden. Die Nutzung erneuerbarer und nachhaltiger Alternativen steht im Einklang mit dem Prinzip der langfristigen Geschäftsnachhaltigkeit. Unternehmen, die Nachhaltigkeit priorisieren und ihren ökologischen Fußabdruck reduzieren, haben einen Wettbewerbsvorteil auf dem Markt.

- Schwankungen der Rohstoffpreise

Der Rohölpreis beeinflusst den Paraffinmarkt, da Paraffin aus Erdöl gewonnen wird. Rohöl ist der wichtigste Rohstoff für die Paraffinproduktion. Steigende Rohölpreise führen zu höheren Kosten für den Erwerb von Erdölrohstoffen, was wiederum zu höheren Produktionskosten für Paraffinhersteller und höheren Produktionskosten für Paraffinhersteller führt, was wiederum zu höheren Preisen für Paraffin auf dem Markt führt. Die OPEC (Organisation erdölexportierender Länder) ist der größte Einflussfaktor für Ölpreisschwankungen. Das Hauptziel der OPEC besteht darin, die Ölmärkte durch die Steuerung der Rohölversorgung zu koordinieren und zu stabilisieren. Die OPEC kann die Ölpreise durch Anpassung der Produktionsmengen beeinflussen. Die Organisation hält regelmäßige Treffen ab, um Produktionsziele als Reaktion auf Marktbedingungen und globale Nachfrage zu diskutieren und festzulegen.

Herausforderung

- Strenge Regeln und Vorschriften

Die gesetzlichen Beschränkungen auf dem Paraffinmarkt können je nach Land oder Region unterschiedlich sein. Diese Beschränkungen werden in der Regel eingeführt, um Umweltbedenken, Verbrauchersicherheit und Produktqualität Rechnung zu tragen. Regulierungsbehörden beschränken häufig die Produktion, Verwendung und Entsorgung von Paraffin, um dessen Umweltauswirkungen zu mildern. Die Einhaltung dieser Vorschriften kann von Paraffinherstellern verlangen, in Maßnahmen zur Schadstoffbekämpfung zu investieren und nachhaltigere Produktionspraktiken einzuführen. Regulierungsbehörden legen häufig Sicherheitsstandards und Kennzeichnungsanforderungen für Paraffinprodukte fest, um die Verbrauchersicherheit zu gewährleisten. Vorschriften zur Verpackung und zum Transport von Paraffin zielen darauf ab, die sichere Handhabung, Lagerung und den Transport der Produkte zu gewährleisten.

Jüngste Entwicklungen

- Im November 2020 bot Impro Precision Industries Limited Feinguss für verschiedene Anwendungen an, darunter Automobil-, Medizin-, Luft- und Raumfahrt- und Industrieausrüstung. Bei diesen Verfahren werden Wachse verwendet, um komplizierte und präzise Muster zu erstellen, die später in Metallkomponenten umgewandelt werden.

- Im Oktober 2021 unterzeichnete Shell Plc eine Vereinbarung mit Shell und Pryme über eine strategische Zusammenarbeit bei der Verarbeitung von Kunststoffabfällen zu Chemikalien. Die Vereinbarung basiert auf Shells Ziel, bis 2025 jährlich eine Million Tonnen Kunststoffabfälle in globalen Chemieanlagen zu recyceln. Diese Vereinbarung wird dazu beitragen, das Image des Unternehmens auf dem Markt zu verbessern. Feinguss und Paraffinwachs werden auch durch Entwicklungen in additiven Fertigungstechniken vorangetrieben, wie z. B. den 3D-Druck von Wachsmodellen und Verbesserungen in der Feingusstechnologie. Diese Entwicklungen erweitern die Einsatzmöglichkeiten des Feingusses und erhöhen die Nachfrage nach Paraffinwachs, einem entscheidenden Bestandteil des Verfahrens, der die Herstellung immer filigranerer und anspruchsvollerer Metallteile ermöglicht.

Globaler Paraffinmarktumfang

Der globale Paraffinmarkt ist in drei wichtige Segmente unterteilt: Produkt, Form und Anwendung. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Paraffinwachs

- Flüssiges Paraffin

- Kerosin Paraffin

- Vaseline

Auf der Grundlage des Produkts ist der Markt in Paraffinwachs, flüssiges Paraffin, Kerosinparaffin und Vaseline segmentiert.

Bilden

- Solide

- Flüssig

Auf Grundlage der Form wird der Markt in fest und flüssig segmentiert.

Anwendung

- Kosmetik/Körperpflege

- Beleuchtung/Kerzen

- Papier/Verpackung

- Polymere

- Essen

- Reifen/Gummi

- Kraftstoff

- Beschichtung/Tinten

- Pharmazeutika

- Landwirtschaft

- Klebstoffe

- Textil

- Schmierstoffe

- Sonstiges

Auf der Grundlage der Anwendung ist der Markt in Kosmetik/Körperpflege, Beleuchtung/Kerzen, Papier/Verpackung, Polymere, Lebensmittel, Reifen/Gummi, Kraftstoff, Beschichtungen/Tinten, Pharmazeutika, Landwirtschaft, Klebstoffe, Textilien, Schmiermittel und Sonstiges segmentiert.

Globaler Paraffinmarkt – Regionale Analyse/Einblicke

Der globale Paraffinmarkt wird analysiert und Einblicke in die Marktgröße und Trends werden wie oben angegeben nach Produkt, Form und Anwendung bereitgestellt.

Die im globalen Paraffinmarktbericht abgedeckten Länder sind die USA, Kanada, Mexiko, Brasilien, Argentinien, der Rest von Südamerika, Westeuropa, Nordeuropa, Südeuropa, Osteuropa, China, Indien, Japan, Südkorea, Australien und Neuseeland, Indonesien, Philippinen, Thailand, Singapur, Malaysia, der Rest des asiatisch-pazifischen Raums, die Vereinigten Arabischen Emirate, Saudi-Arabien, Ägypten, Südafrika, Israel sowie der Rest des Nahen Ostens und Afrikas.

Der asiatisch-pazifische Raum wird voraussichtlich dominieren, da dort wichtige Marktteilnehmer auf dem größten Verbrauchermarkt mit hohem BIP vertreten sind. China wird voraussichtlich aufgrund der steigenden Nachfrage nach Paraffin in der Kosmetik- und Pharmaindustrie wachsen. Westeuropa dominiert die Region Europa aufgrund der starken Präsenz wichtiger Akteure. Die USA dominieren Nordamerika aufgrund der steigenden Nachfrage aus den Schwellenmärkten und der Expansion.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken aus dem asiatisch-pazifischen Raum und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und globale Paraffin-Marktanteilsanalyse

Die Wettbewerbslandschaft des globalen Paraffinmarkts liefert Details nach Wettbewerbern. Die enthaltenen Details umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im asiatisch-pazifischen Raum, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen auf dem globalen Paraffinmarkt.

Zu den wichtigsten Akteuren auf dem globalen Paraffinmarkt zählen unter anderem Exxon Mobil Corporation, Repsol, Shell Global, Reliance Industries Limited, ENEOS Corporation, Indian Oil Corporation Ltd, Cepsa, Bharat Petroleum Corporation Limited, Sasol Limited, ENI SpA, Calumet Specialty Products Partners, LP, H&R GROUP, The International Group, Inc., Farabi Petrochemicals Co., Adinath Chemicals, FUCHS, LANXESS, Unicorn und Industrial Raw Materials LLC.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS

4.2.2 THE THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 CONSUMER BUYING FACTORS ANALYSIS

4.4.1 OVERVIEW

4.4.2 APPLICATION AND INTENDED USE

4.4.3 BRAND REPUTATION

4.4.4 AVAILABILITY AND CONVENIENCE OF SHIPMENT

4.5 CONSUMER PREFERENCE AND BEHAVIOUR

4.5.1 QUALITY AND PERFORMANCE

4.5.2 APPLICATION-SPECIFIC CHARACTERISTICS

4.5.3 PRICE AND VALUE

4.5.4 SUSTAINABILITY AND ENVIRONMENTAL CONSIDERATIONS

4.5.5 SUPPLIER RELIABILITY AND TRUST

4.5.6 TECHNICAL SUPPORT AND EXPERTISE

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 RAW MATERIAL COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9.1 ADVANCED REFINING TECHNIQUES

4.9.2 MOLECULAR MODIFICATION

4.9.3 MICROENCAPSULATION AND NANOENCAPSULATION

4.9.4 PHASE CHANGE MATERIALS (PCMS)

4.9.5 BIODEGRADABLE AND SUSTAINABLE PARAFFIN ALTERNATIVES

4.9.6 QUALITY CONTROL AND ANALYTICAL TECHNIQUES

4.1 VENDOR SELECTION CRITERIA

5 REGULATORY FRAMEWORK AND GUIDELINES

5.1 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXTENSIVE USAGE OF PARAFFIN IN THE AUTOMOTIVE SECTOR

6.1.2 POSITIVE OUTLOOK TOWARD BEAUTY & PERSONAL CARE PRODUCTS

6.1.3 GROWING DEMAND FOR WATER-RESISTANT PACKAGING MATERIALS

6.2 RESTRAINTS

6.2.1 SHIFTING PREFERENCE TOWARDS RENEWABLE AND SUSTAINABLE ALTERNATIVES

6.2.2 FLUCTUATION IN RAW MATERIAL PRICES

6.3 OPPORTUNITIES

6.3.1 DEVELOPMENT OF BIO-BASED PARAFFIN PRODUCTS

6.3.2 SIGNIFICANT RISE IN THE UTILIZATION OF INVESTMENT CASTING

6.4 CHALLENGE

6.4.1 STRINGENT RULES AND REGULATIONS

7 GLOBAL PARAFFIN MARKET, BY REGION

7.1 OVERVIEW

7.2 ASIA-PACIFIC

7.3 EUROPE

7.4 NORTH AMERICA

7.5 MIDDLE EAST AND AFRICA

7.6 SOUTH AMERICA

8 GLOBAL PARAFFIN MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: EUROPE

8.3 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 EXXON MOBIL CORPORATION

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 REPSOL

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENT

10.3 SHELL GLOBAL

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 RELIANCE INDUSTRIES LIMITED

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT DEVELOPMENT

10.5 ENEOS CORPORATION

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 ADINATH CHEMICALS

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 BHARAT PETROLEUM CORPORATION LIMITED

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT DEVELOPMENT

10.9 CEPSA

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENT

10.1 ENI S.P.A.

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENTS

10.11 FARABI PETROCHEMICALS CO.

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENT

10.12 FUCHS

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENT

10.13 H&R GROUP

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT UPDATES

10.14 INDIAN OIL CORPORATION LTD

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENT

10.15 INDUSTRIAL RAW MATERIALS LLC.

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENT

10.16 LANXESS

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 REVENUE ANALYSIS

10.16.4 RECENT DEVELOPMENT

10.17 SASOL LIMITED.

10.17.1 COMPANY SNAPSHOT

10.17.2 REVENUE ANALYSIS

10.17.3 PRODUCT PORTFOLIO

10.17.4 RECENT DEVELOPMENTS

10.18 THE INTERNATIONAL GROUP, INC.

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCT PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 UNICORN.

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

Abbildungsverzeichnis

FIGURE 1 GLOBAL PARAFFIN MARKET

FIGURE 2 GLOBAL PARAFFIN MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL PARAFFIN MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL PARAFFIN MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL PARAFFIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL PARAFFIN MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 GLOBAL PARAFFIN MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL PARAFFIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL PARAFFIN MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL PARAFFIN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL PARAFFIN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL PARAFFIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL PARAFFIN MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL PARAFFIN MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 GROWING DEMAND FOR PARAFFIN IN COSMETICS INDUSTRY IS EXPECTED TO DRIVE THE GLOBAL PARAFFIN MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PARAFFIN WAX IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL PARAFFIN MARKET IN 2023 AND 2030

FIGURE 17 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR PARAFFIN MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL PARAFFIN MARKET

FIGURE 20 FLUCTUATION IN PRICES OF CRUDE OIL ( 2018- 2022)

FIGURE 21 GLOBAL PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 22 GLOBAL SOLVENTS MARKET: BY REGION (2022)

FIGURE 23 GLOBAL SOLVENTS MARKET: BY REGION (2023 & 2030)

FIGURE 24 GLOBAL SOLVENTS MARKET: BY REGION (2022 & 2030)

FIGURE 25 GLOBAL SOLVENTS MARKET: BY CATEGORY (2023-2030)

FIGURE 26 ASIA-PACIFIC PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 27 ASIA-PACIFIC PARAFFIN MARKET: BY COUNTRY (2022)

FIGURE 28 ASIA-PACIFIC PARAFFIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 ASIA-PACIFIC PARAFFIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 ASIA-PACIFIC PARAFFIN MARKET: BY CATEGORY (2023 - 2030)

FIGURE 31 EUROPE PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 32 EUROPE PARAFFIN MARKET: BY COUNTRY (2022)

FIGURE 33 EUROPE PARAFFIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 EUROPE PARAFFIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 EUROPE PARAFFIN MARKET: BY CATEGORY (2023 - 2030)

FIGURE 36 NORTH AMERICA PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 37 NORTH AMERICA PARAFFIN MARKET: BY COUNTRY (2022)

FIGURE 38 NORTH AMERICA PARAFFIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 NORTH AMERICA PARAFFIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 40 NORTH AMERICA PARAFFIN MARKET: BY CATEGORY (2023 - 2030)

FIGURE 41 MIDDLE EAST AND AFRICA PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 42 MIDDLE EAST AND AFRICA PARAFFIN MARKET: BY COUNTRY (2022)

FIGURE 43 MIDDLE EAST AND AFRICA PARAFFIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 44 MIDDLE EAST AND AFRICA PARAFFIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 MIDDLE EAST AND AFRICA PARAFFIN MARKET: BY CATEGORY (2023 - 2030)

FIGURE 46 SOUTH AMERICA PARAFFIN MARKET: SNAPSHOT (2022)

FIGURE 47 SOUTH AMERICA PARAFFIN MARKET: BY COUNTRY (2022)

FIGURE 48 SOUTH AMERICA PARAFFIN MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 SOUTH AMERICA PARAFFIN MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 SOUTH AMERICA PARAFFIN MARKET: BY CATEGORY (2023 - 2030)

FIGURE 51 GLOBAL PARAFFIN MARKET: COMPANY SHARE 2022 (%)

FIGURE 52 EUROPE PARAFFIN MARKET: COMPANY SHARE 2022 (%)

FIGURE 53 NORTH AMERICA PARAFFIN MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 ASIA PACIFIC PARAFFIN MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.