Global Medical Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

12.56 Billion

USD

18.98 Billion

2024

2032

USD

12.56 Billion

USD

18.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.56 Billion | |

| USD 18.98 Billion | |

|

|

|

|

Globale Marktsegmentierung für medizinische Geräte nach Produkt (Beatmungsgerät, Spirometer, Sauerstoffkonzentratoren, Anästhesiegeräte und CPAP/BIPAP), Modus (tragbar, Tischgerät und Standalone), Anwendung (Diagnostik und Therapie), Einrichtung (groß, klein und mittel), Endbenutzer (Krankenhaus, ambulante chirurgische Zentren, Fachkliniken, Langzeitpflegezentren, Rehabilitationszentren und Einrichtungen für die häusliche Pflege), Vertriebskanal (Direktvertrieb und Drittanbieter) – Branchentrends und Prognose bis 2032

Marktgröße für medizinische Geräte

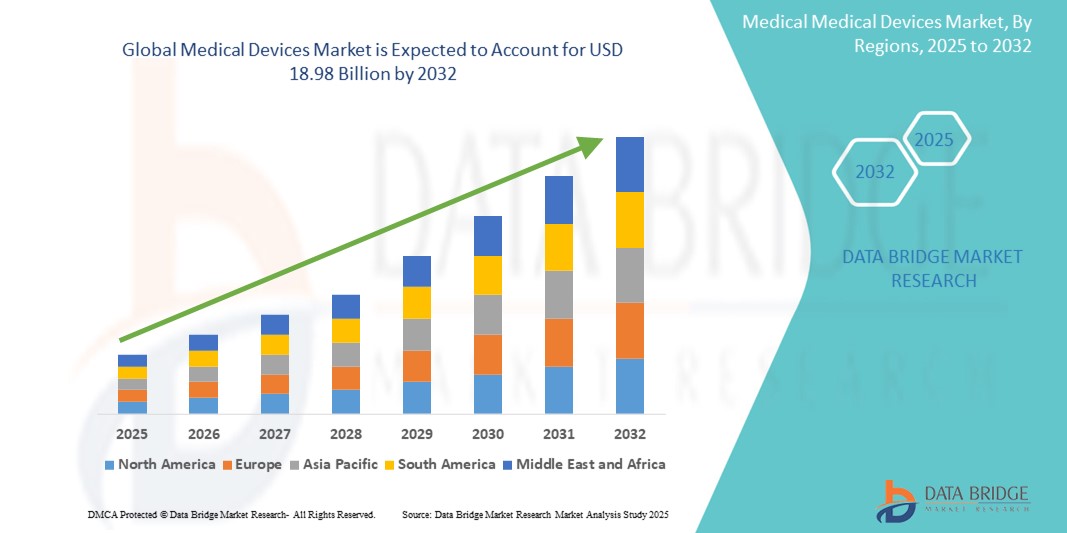

- Der globale Markt für Medizinprodukte wurde im Jahr 2024 auf 12,56 Milliarden US-Dollar geschätzt und dürfte bis 2032 18,98 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 5,30 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung chronischer Krankheiten, die steigende Zahl geriatrischer Menschen und den technologischen Fortschritt bei Diagnose- und Therapiegeräten vorangetrieben, die eine breite Akzeptanz in den globalen Gesundheitssystemen vorantreiben.

- Darüber hinaus etablieren die steigende Nachfrage nach minimalinvasiven Eingriffen, die Integration von KI und Robotik in die Medizintechnik sowie der Ausbau von Lösungen für die häusliche Gesundheitsversorgung Medizinprodukte als unverzichtbare Instrumente der modernen Gesundheitsversorgung. Diese zusammenlaufenden Faktoren beschleunigen die Einführung innovativer Medizinprodukte und fördern damit das Wachstum der Branche erheblich.

Marktanalyse für medizinische Geräte

- Medizinische Geräte, darunter Diagnose-, Therapie- und Überwachungsinstrumente, sind aufgrund ihrer verbesserten Präzision, Fernüberwachungsmöglichkeiten und nahtlosen Integration in digitale Gesundheitsökosysteme zunehmend wichtige Bestandteile moderner Gesundheitssysteme sowohl im Krankenhaus als auch in der häuslichen Pflege.

- Die steigende Nachfrage nach medizinischen Geräten wird vor allem durch die zunehmende Verbreitung chronischer Krankheiten, die alternde Bevölkerung, erhöhte Gesundheitsausgaben und eine zunehmende Präferenz für minimalinvasive Verfahren und häusliche Pflegelösungen angetrieben.

- Nordamerika dominierte den Markt für Medizinprodukte mit dem größten Umsatzanteil von 40,05 % im Jahr 2024. Der Markt zeichnete sich durch eine fortschrittliche Gesundheitsinfrastruktur, hohe Gesundheitsausgaben und eine starke Präsenz wichtiger Branchenakteure aus. Die USA verzeichneten ein starkes Wachstum bei der Installation medizinischer Geräte, insbesondere in den Bereichen Fernüberwachung und roboterassistierte Chirurgie, angetrieben von Innovationen sowohl etablierter Medizintechnikunternehmen als auch digitaler Gesundheits-Startups.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der zunehmenden Urbanisierung, der wachsenden Gesundheitsinfrastruktur und der steigenden verfügbaren Einkommen in Ländern wie China und Indien die am schnellsten wachsende Region im Markt für Medizinprodukte sein.

- Das Segment der Beatmungsgeräte dominierte den Markt für medizinische Geräte mit einem Marktanteil von 29,6 % im Jahr 2024, getrieben durch die gestiegene Nachfrage in der Intensivpflege, insbesondere als Reaktion auf Ausbrüche von Atemwegserkrankungen und die wachsende geriatrische Bevölkerung, die eine erweiterte Atemunterstützung benötigt.

Berichtsumfang und Marktsegmentierung für Medizinprodukte

|

Eigenschaften |

Wichtige Markteinblicke für Medizinprodukte |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für medizinische Geräte

„ Wachsende Akzeptanz vernetzter und benutzerzentrierter Lösungen im Gesundheitswesen “

- Ein bedeutender und sich beschleunigender Trend auf dem globalen Markt für Medizinprodukte ist die zunehmende Integration intelligenter Technologien und Konnektivitätsfunktionen, die sowohl das Benutzererlebnis als auch die betriebliche Effizienz im Gesundheitswesen verbessern. Diese Fortschritte helfen Anbietern, die Gesundheitsversorgung zu optimieren und ermöglichen Patienten gleichzeitig, ihre Gesundheit aktiv zu gestalten.

- Tragbare medizinische Geräte der nächsten Generation bieten beispielsweise Echtzeitüberwachung und mobiles Gesundheitstracking, sodass Patienten wichtige Daten direkt mit Ärzten teilen können. Ferndiagnosetools und app-basierte Gesundheitsüberwachungslösungen gewinnen zunehmend an Bedeutung, insbesondere bei Patienten mit chronischen Erkrankungen und älteren Menschen.

- Die Integration medizinischer Geräte mit mobilen Plattformen und Cloud-Systemen ermöglicht Funktionen wie personalisierte Datenanalyse, Fernwarnungen bei auffälligen Messwerten und kontinuierliches Gesundheits-Tracking. Dies gewährleistet ein rechtzeitiges Eingreifen und fördert einen proaktiven Behandlungsansatz, reduziert Krankenhauswiederaufnahmen und verbessert die Behandlungsergebnisse.

- Die nahtlose Synchronisierung vernetzter medizinischer Geräte mit Telemedizin-Plattformen, elektronischen Gesundheitsakten (EHRs) und mobilen Anwendungen schafft ein integriertes Ökosystem, in dem Patienten und Anbieter in Echtzeit zusammenarbeiten können. Dies ist besonders nach der Pandemie wichtig geworden, da Fernversorgung und häusliche medizinische Lösungen zur Norm werden.

- Dieser Wandel hin zu benutzerfreundlicheren, interoperablen und datengesteuerten Medizingeräten verändert die Erwartungen der Patienten und setzt neue Maßstäbe in puncto Komfort und Personalisierung der Versorgung. Führende Unternehmen wie Medtronic, Philips und GE Healthcare konzentrieren sich daher auf die Entwicklung von Geräten, die Fernüberwachung, Selbstmanagement und die Interoperabilität mit umfassenderen IT-Systemen im Gesundheitswesen unterstützen.

- Die Nachfrage nach vernetzten, intelligenten und benutzerorientierten medizinischen Geräten wächst sowohl im Krankenhaus- als auch im häuslichen Pflegebereich rasant, da Patienten nach zugänglichen, personalisierten und technologiegestützten Gesundheitslösungen suchen.

Marktdynamik für Medizinprodukte

Treiber

„Steigender Bedarf aufgrund steigender Krankheitslast und technologischer Fortschritte“

- Die zunehmende Verbreitung chronischer Krankheiten, die alternde Bevölkerung und die steigende Nachfrage nach frühzeitiger und genauer Diagnose sind wichtige Treiber für das Wachstum des Marktes für medizinische Geräte weltweit.

- So kündigte Medtronic im April 2024 eine strategische Weiterentwicklung seiner Fernüberwachungsplattformen für das Management chronischer Krankheiten an. Diese ermöglicht eine präzisere Echtzeit-Datenerfassung und Patienteneinbindung. Es wird erwartet, dass solche Initiativen führender Unternehmen das Wachstum der Medizintechnikbranche im Prognosezeitraum vorantreiben werden.

- Da Patienten und Anbieter nach effizienteren, weniger invasiven und kostengünstigeren Lösungen im Gesundheitswesen suchen, erfreuen sich medizinische Geräte wie Fernmonitore, tragbare Diagnosegeräte und minimalinvasive chirurgische Instrumente zunehmender Beliebtheit und bieten überzeugende Alternativen zu herkömmlichen Methoden.

- Darüber hinaus macht die zunehmende Verbreitung vernetzter Gesundheitssysteme und digitaler Gesundheitsplattformen medizinische Geräte zu einem integralen Bestandteil moderner Gesundheitsinfrastruktur. Diese Geräte bieten eine nahtlose Integration mit elektronischen Patientenakten (EHRs), Cloud-Speichern und Telemedizin-Plattformen.

- Der Komfort von Echtzeit-Gesundheitsüberwachung, Fernkonsultationen und Früherkennungsmöglichkeiten sind Schlüsselfaktoren für die Akzeptanz sowohl im Krankenhaus als auch in der häuslichen Pflege. Der Trend zur personalisierten Medizin sowie die zunehmende Verfügbarkeit benutzerfreundlicher, tragbarer und vernetzter medizinischer Geräte treiben das Marktwachstum weiter voran.

Einschränkung/Herausforderung

„ Bedenken hinsichtlich der Datensicherheit und hohe Anschaffungskosten “

- Bedenken hinsichtlich Datenschutz und Cybersicherheit vernetzter medizinischer Geräte stellen eine erhebliche Herausforderung für eine breitere Marktdurchdringung dar. Da diese Geräte oft sensible Patientendaten über Netzwerke übertragen, sind sie anfällig für Hackerangriffe und unbefugten Zugriff, was Bedenken hinsichtlich Vertraulichkeit und Compliance aufwirft.

- So haben beispielsweise mehrere Aufsichtsbehörden, darunter die FDA und die EMA, Richtlinien zu Cybersicherheitsrisiken bei medizinischen Geräten herausgegeben, was die wachsende Dringlichkeit der Sicherung der IoT-Infrastruktur im Gesundheitswesen widerspiegelt.

- Die Bewältigung dieser Sicherheitsherausforderungen durch End-to-End-Verschlüsselung, sichere Softwarearchitektur, regelmäßige Firmware-Updates und die Einhaltung internationaler Datenschutzstandards ist entscheidend für den Aufbau von Vertrauen bei Gesundheitsdienstleistern und Patienten.

- Darüber hinaus können die relativ hohen Anschaffungskosten moderner Medizinprodukte – insbesondere solcher mit Robotik, Bildgebung oder Echtzeitüberwachung – die Akzeptanz insbesondere in kostensensiblen oder ressourcenbeschränkten Gesundheitseinrichtungen einschränken. Während Skaleneffekte und zunehmender Wettbewerb die Preise senken, bleibt die Erschwinglichkeit in bestimmten Regionen ein Hindernis.

- Die Bewältigung dieser Herausforderungen durch regulatorische Anpassungen, höhere Investitionen in Innovationen im Bereich der Cybersicherheit, die Aufklärung von Anbietern und Patienten sowie die Entwicklung kostengünstiger Alternativen für medizinische Geräte wird für ein nachhaltiges Marktwachstum in allen Regionen der Welt von entscheidender Bedeutung sein.

Marktumfang für Medizinprodukte

Der Markt ist nach Produkt, Modus, Anwendung, Einrichtung, Endbenutzer und Vertriebskanal segmentiert.

• Nach Produkt

Der Markt für Medizinprodukte ist produktbezogen in Beatmungsgeräte, Spirometer, Sauerstoffkonzentratoren, Anästhesiegeräte und CPAP/BIPAP-Geräte unterteilt. Das Beatmungssegment hielt im Jahr 2024 mit 29,6 % den größten Marktanteil, getrieben durch die gestiegene Nachfrage in der Intensivmedizin, insbesondere aufgrund von Atemwegserkrankungen und der wachsenden geriatrischen Bevölkerung.

Für das CPAP/BIPAP-Segment wird von 2025 bis 2032 mit 8,9 % die höchste durchschnittliche jährliche Wachstumsrate erwartet. Grund dafür sind die steigende Zahl an Fällen von Schlafapnoe, das gestiegene Bewusstsein und die zunehmende Präferenz für Atemtherapien zu Hause.

• Nach Modus

Der Markt ist nach Modell in tragbare, Tisch- und Standalone-Geräte unterteilt. Das tragbare Segment dominierte den Markt mit einem Umsatzanteil von 41,2 % im Jahr 2024, da sich das Gesundheitswesen zunehmend in Richtung häuslicher Pflege und Fernüberwachung von Patienten verlagert. Die Tragbarkeit verbessert die Patientencompliance und unterstützt die Langzeittherapie außerhalb klinischer Einrichtungen.

Aufgrund seiner Vielseitigkeit und zunehmenden Verbreitung in kleinen Kliniken und Diagnoselaboren wird das Tischsegment im Prognosezeitraum voraussichtlich mit 9,3 % die höchste Wachstumsrate verzeichnen.

• Nach Anwendung

Der Markt für Medizinprodukte ist je nach Anwendung in diagnostische und therapeutische Anwendungen unterteilt. Das diagnostische Segment erzielte im Jahr 2024 mit 54,1 % den größten Umsatzanteil, was auf die steigende Krankheitslast und die zunehmende Bedeutung einer frühen und genauen Diagnose zurückzuführen ist.

Für das therapeutische Segment wird von 2025 bis 2032 mit 10,1 % die höchste durchschnittliche jährliche Wachstumsrate prognostiziert, angetrieben durch den technologischen Fortschritt bei Behandlungsgeräten und die steigende Nachfrage nach nicht-invasiven therapeutischen Lösungen.

• Nach Einrichtung

Der Markt wird nach Einrichtungen in große, kleine und mittlere Einrichtungen unterteilt. Das Segment der großen Einrichtungen hatte im Jahr 2024 mit 48,7 % den höchsten Anteil, was auf höhere Budgetzuweisungen, hohe Patientenzahlen und Investitionen in moderne Geräte zurückzuführen ist.

Im Segment der kleinen und mittleren Einrichtungen wird aufgrund der Dezentralisierung der Gesundheitsdienste und steigender Investitionen in Diagnosekapazitäten in den Regionen der Stufe 2 und 3 zwischen 2025 und 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) zu verzeichnen sein.

• Durch Endbenutzer

Der Markt für Medizinprodukte ist nach Endverbrauchern in Krankenhäuser, ambulante Operationszentren, Fachkliniken, Langzeitpflegezentren, Rehabilitationszentren und häusliche Pflege unterteilt. Das Krankenhaussegment hielt im Jahr 2024 mit 37,4 % den größten Anteil, was auf eine hohe Patientenaufnahme, chirurgische Eingriffe und umfassende Diagnosemöglichkeiten zurückzuführen ist.

Das Segment der häuslichen Pflege wird im Zeitraum 2025–2032 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate von 11,6 % am schnellsten wachsen, unterstützt durch den steigenden Trend zur häuslichen Gesundheitsfürsorge und die Nachfrage nach tragbaren, benutzerfreundlichen Geräten zur Behandlung chronischer Krankheiten.

• Nach Vertriebskanal

Basierend auf den Vertriebskanälen ist der Markt in Direktvertrieb und Drittanbieter segmentiert. Das Direktvertriebssegment dominierte mit einem Anteil von 63,9 % im Jahr 2024, da große Hersteller zunehmend Direktvertrieb an Gesundheitsdienstleister und -einrichtungen betreiben, um langfristige Beziehungen aufzubauen und Serviceleistungen sicherzustellen.

Das Segment der Drittanbieter dürfte zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen, da es auch ländliche und unterversorgte Märkte erreicht und so dazu beiträgt, den Zugang zu medizinischen Geräten weltweit zu erweitern.

Regionale Analyse des Marktes für medizinische Geräte

- Nordamerika dominierte den Markt für Medizinprodukte mit dem größten Umsatzanteil von 40,05 % im Jahr 2024, angetrieben durch eine starke Gesundheitsinfrastruktur, hohe Gesundheitsausgaben und die schnelle Einführung fortschrittlicher Medizintechnologien

- Die Region profitiert von der Präsenz wichtiger Branchenakteure, der zunehmenden Verbreitung chronischer Krankheiten und günstigen Erstattungsrichtlinien

- Erhöhte Investitionen in digitale Gesundheitslösungen, Homecare-Lösungen und Fernüberwachungssysteme für Patienten unterstützen das Marktwachstum zusätzlich. Der Trend zu personalisierter und präventiver Versorgung trägt zudem zu einer starken Nachfrage nach diagnostischen und therapeutischen Medizinprodukten in der gesamten Region bei.

Einblicke in den US-amerikanischen Markt für medizinische Geräte

Der US-Markt für Medizinprodukte erzielte 2024 mit 81 % den größten Umsatzanteil innerhalb Nordamerikas. Dies ist auf die hohe Akzeptanz innovativer Technologien, einen breiten Versicherungsschutz und ein robustes regulatorisches Umfeld zurückzuführen, das Forschung und Entwicklung fördert. Die zunehmende Belastung durch Krankheiten wie Diabetes, Herz-Kreislauf-Erkrankungen und Atemwegserkrankungen hat zu einem weit verbreiteten Einsatz von Überwachungs-, Bildgebungs- und Therapiegeräten geführt. Darüber hinaus sind die USA ein wichtiger Knotenpunkt für klinische Studien und FDA-Zulassungen, was die Verfügbarkeit von Geräten der nächsten Generation auf dem heimischen Markt beschleunigt.

Einblicke in den europäischen Markt für Medizinprodukte

Der europäische Markt für Medizinprodukte wird im Prognosezeitraum voraussichtlich um durchschnittlich 7,2 % wachsen. Dies wird durch die alternde Bevölkerung, staatliche Initiativen zur Digitalisierung des Gesundheitswesens und strenge Vorschriften für Medizinprodukte, die Qualität und Innovation fördern, unterstützt. Hohe öffentliche Gesundheitsausgaben, insbesondere in Ländern wie Deutschland, Frankreich und Großbritannien, erleichtern den Zugang zu fortschrittlicher Medizintechnik. Darüber hinaus gibt es einen steigenden Trend zur Nutzung tragbarer Geräte und Heimdiagnostik, insbesondere bei chronisch Kranken und älteren Menschen.

Einblicke in den britischen Markt für medizinische Geräte

Der britische Markt für Medizinprodukte wird zwischen 2025 und 2032 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate von 7,8 % wachsen. Dies ist auf den starken Fokus auf Gesundheitstechnologie, öffentlich-private Partnerschaften und NHS-Initiativen zur Modernisierung der Gesundheitsinfrastruktur zurückzuführen. Steigendes Gesundheitsbewusstsein und Bemühungen um Frühdiagnose fördern die Nachfrage nach Bildgebungs-, Diagnose- und Überwachungsinstrumenten. Das wachsende britische Ökosystem für Medizintechnik-Innovationen und der Zugang zu KI-integrierten Lösungen beschleunigen die Marktentwicklung zusätzlich.

Markteinblick in Medizinprodukte in Deutschland

Der deutsche Markt für Medizinprodukte wird im Prognosezeitraum voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,5 % wachsen. Dies ist auf ein gut etabliertes Gesundheitssystem und ein hohes Vertrauen in fortschrittliche, präzise und effiziente Medizintechnik zurückzuführen. Deutschland ist führend bei der Einführung von chirurgischen Geräten, Beatmungsgeräten und krankenhausbasierten Diagnoseinstrumenten. Eine starke Produktionsbasis und die Unterstützung der Digitalisierung des Gesundheitswesens stärken die Marktposition in Europa zusätzlich.

Markteinblicke für Medizinprodukte im asiatisch-pazifischen Raum

Der Markt für Medizinprodukte im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 9,6 % wachsen. Begünstigt werden dies durch die rasante Urbanisierung, die wachsende Mittelschicht und steigende Investitionen im Gesundheitswesen in China, Indien und Japan. Die zunehmende Verbreitung lebensstilbedingter Krankheiten, die Verbesserung der Gesundheitsinfrastruktur und unterstützende staatliche Programme (wie Indiens Ayushman Bharat und Chinas Healthy China 2030) sind wichtige Wachstumstreiber. Die Region entwickelt sich zudem zu einem wichtigen Produktions- und Forschungszentrum für Medizinprodukte und bietet kostengünstige Lösungen für den nationalen und internationalen Markt.

Einblicke in den japanischen Markt für Medizinprodukte

Der japanische Markt für Medizinprodukte wächst weiterhin stetig, unterstützt durch die alternde Bevölkerung des Landes und seine führende Position in der Roboterchirurgie, der diagnostischen Bildgebung und minimalinvasiven Technologien. Der verstärkte Fokus auf Altenpflege und Heimüberwachungslösungen treibt die Nachfrage nach kompakten, intelligenten und benutzerfreundlichen Geräten an. Die regulatorische Unterstützung von Innovationen und die Integration von KI und IoT in das Gesundheitswesen beschleunigen die Entwicklung und Einführung fortschrittlicher Medizintechnologien zusätzlich.

Markteinblick in China für medizinische Geräte

Der chinesische Markt für Medizinprodukte erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf den sich schnell entwickelnden Gesundheitssektor und die Bemühungen der Regierung zurückzuführen, die inländische Produktion und Innovation zu stärken. Das Land verzeichnet aufgrund der steigenden Prävalenz chronischer Krankheiten und der verbesserten Gesundheitsversorgung ein starkes Wachstum in Bereichen wie diagnostischer Bildgebung, Beatmungstherapie und Medizinprodukten für den Heimgebrauch. Chinas „Made in China 2025“-Strategie hat die Lokalisierung der Herstellung hochwertiger Medizinprodukte weiter beschleunigt und das Land zu einem wichtigen globalen Lieferanten gemacht.

Marktanteil medizinischer Geräte

Die Medizingerätebranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- GE Healthcare (USA)

- Koninklijke Philips NV (Niederlande)

- Medtronic (USA)

- Drägerwerk AG & Co. KGaA (Deutschland)

- VYAIRE (USA)

- Getinge AB (Schweden)

- ndd Medical Technologies (Schweiz)

- ResMed (USA)

- Invacare Corporation (USA)

- NIDEK MEDICAL PRODUCTS, INC. (Japan)

- O2 CONCEPTS, LLC (USA)

- Teijin Limited (Japan)

- GCE Group (Großbritannien)

- Inogen, Inc. (USA)

- Teleflex Incorporated (USA)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- MGC Diagnostics Corporation (USA)

- Hill-Rom Holdings, Inc. (USA)

- Drive DeVilbiss Healthcare Inc. (USA)

- Midmark Corporation (USA)

- CAIRE Inc. (USA)

- GCE Group (Großbritannien)

- Fisher & Paykel Healthcare Limited (Neuseeland)

- Schiller (Schweiz)

Neueste Entwicklungen auf dem globalen Markt für Medizinprodukte

- Im März 2025 erhielt CMR Surgical, ein in Großbritannien ansässiger globaler Innovator im Bereich chirurgischer Robotik, die FDA-Zulassung für sein Versius Surgical System, das für minimalinvasive Gallenblasenoperationen entwickelt wurde. Dieser Meilenstein markiert den offiziellen Markteintritt von CMR in den USA und stärkt seine Position als wichtiger Akteur in der roboterassistierten Chirurgie. Mit seinem kompakten Design und seiner modularen Nutzbarkeit begegnet CMR Surgical der wachsenden Nachfrage nach skalierbaren und effizienten chirurgischen Lösungen auf dem globalen Markt für Medizinprodukte.

- Im März 2025 gab Zydus Lifesciences, ein führendes Pharma- und Gesundheitsunternehmen mit Sitz in Indien, die Übernahme von 85,6 % der Anteile an der französischen Amplitude Surgical für 256,8 Millionen Euro bekannt. Dieser strategische Schritt erweitert Zydus‘ Präsenz im globalen Markt für orthopädische Chirurgiegeräte und unterstreicht sein Engagement für Innovation und internationale Marktexpansion in der Medizintechnikbranche.

- Im April 2025 startete die britische Arzneimittelbehörde MHRA (Medicines and Healthcare products Regulatory Agency) ihr zweites KI-Regulierungs-Sandbox-Pilotprojekt und lud Unternehmen mit KI-gestützten Medizintechnologien – insbesondere in der Atemwegstherapie und Krebsdiagnostik – zur Teilnahme ein. Diese Initiative unterstreicht die wachsende Bedeutung künstlicher Intelligenz für die Weiterentwicklung medizinischer Geräte und die Sicherstellung der regulatorischen Bereitschaft für Gesundheitslösungen der nächsten Generation.

- Im Juni 2025 führte die Europäische Union neue Beschränkungen für chinesische Hersteller von Medizinprodukten ein. Diese beschränken deren Zugang zu öffentlichen Aufträgen über 5 Millionen Euro, sofern sie nicht bestimmte lokale Produktionskriterien erfüllen. Dieser Politikwechsel zielt darauf ab, den gegenseitigen Zugang zu gewährleisten und die Wettbewerbsfähigkeit europäischer Hersteller zu stärken. Dies hat Auswirkungen auf die globale Marktdynamik und die Lieferketten im Medizinproduktesektor.

- Im Februar 2025 stellte die Bruker Corporation, ein führender Anbieter von Life-Science-Instrumenten, Pläne für die Markteinführung des CosMx Human Whole Transcriptome Panel vor, das räumliche Multiomik mit hochauflösender Gewebebildgebung kombiniert. Diese Entwicklung unterstreicht den Fokus des Unternehmens auf Präzisionsdiagnostik und personalisierte Medizin und stärkt seine Position im globalen Markt für Medizinprodukte.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.