Global Medical Device Connectivity Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.20 Billion

USD

25.84 Billion

2025

2033

USD

4.20 Billion

USD

25.84 Billion

2025

2033

| 2026 –2033 | |

| USD 4.20 Billion | |

| USD 25.84 Billion | |

|

|

|

|

Segmentierung des globalen Marktes für die Vernetzung medizinischer Geräte nach Produkt und Dienstleistung (Lösungen und Services für die Vernetzung medizinischer Geräte), Technologie (kabelgebundene, drahtlose und hybride Technologien), Anwendung (Vitalparameter- und Patientenmonitore, Anästhesiegeräte und Beatmungsgeräte, Infusionspumpen und Sonstiges) und Endnutzer (Krankenhäuser, ambulante Pflegedienste, Diagnosezentren und ambulante Versorgungszentren) – Branchentrends und Prognose bis 2033

Marktgröße für Konnektivität medizinischer Geräte

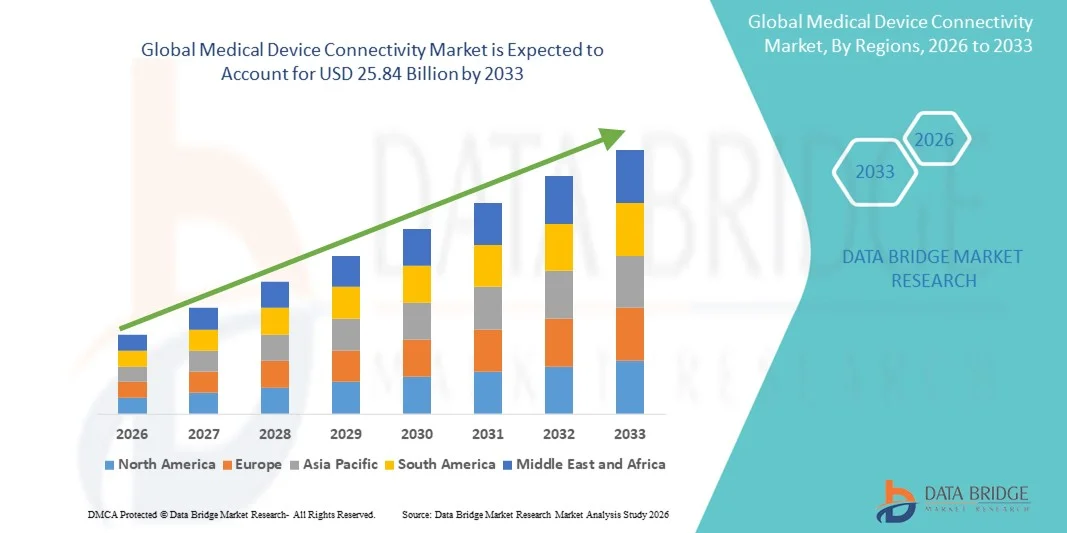

- Der globale Markt für die Vernetzung medizinischer Geräte hatte im Jahr 2025 einen Wert von 4,20 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 25,84 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 25,50 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung fortschrittlicher Gesundheitstechnologien und den wachsenden Bedarf an nahtloser Integration medizinischer Geräte in Krankenhäusern, Kliniken und Diagnosezentren angetrieben.

- Darüber hinaus treibt die steigende Nachfrage nach Echtzeit-Patientenüberwachung, effizientem Datenmanagement und optimierten klinischen Arbeitsabläufen die Einführung vernetzter Gesundheitslösungen voran. Diese Faktoren beschleunigen die Verbreitung von Konnektivitätslösungen für Medizinprodukte und fördern so das Wachstum der Branche erheblich.

Marktanalyse für die Konnektivität medizinischer Geräte

- Lösungen zur Vernetzung medizinischer Geräte, die eine nahtlose Integration und Kommunikation zwischen medizinischen Geräten, Krankenhausinformationssystemen und IT-Plattformen im Gesundheitswesen ermöglichen, werden aufgrund ihrer gesteigerten Effizienz, Echtzeit-Überwachungsmöglichkeiten und datengestützten Entscheidungsunterstützung zunehmend zu unverzichtbaren Bestandteilen der modernen Gesundheitsinfrastruktur in Krankenhäusern und ambulanten Einrichtungen.

- Die steigende Nachfrage nach der Vernetzung medizinischer Geräte wird vor allem durch die weitverbreitete Einführung elektronischer Patientenakten (EHRs), den zunehmenden Fokus auf Patientensicherheit und Workflow-Optimierung sowie die wachsende Beliebtheit von Fernüberwachung und vernetzten Gesundheitslösungen angetrieben.

- Nordamerika dominierte 2025 mit einem Umsatzanteil von 42 % den Markt für die Vernetzung medizinischer Geräte. Treiber dieses Erfolgs waren die gut ausgebaute Gesundheitsinfrastruktur, hohe Investitionen in Forschung und Entwicklung sowie die Präsenz wichtiger Branchenakteure. In den USA verzeichneten Krankenhäuser, Kliniken und Diagnosezentren ein deutliches Wachstum bei der Installation von Systemen zur Vernetzung medizinischer Geräte. Unterstützt wurde dies durch Innovationen in der drahtlosen Geräteintegration, cloudbasierten Plattformen und KI-gestützten Überwachungslösungen.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für die Vernetzung medizinischer Geräte sein. Gründe hierfür sind der Ausbau der Gesundheitsinfrastruktur, die zunehmende Nutzung digitaler Gesundheitslösungen, die steigende Nachfrage nach Fernüberwachung von Patienten und die wachsenden verfügbaren Einkommen in Ländern wie China, Indien und Japan. Technologische Fortschritte und staatliche Initiativen zur Förderung vernetzter Gesundheitsversorgung tragen zusätzlich zur Marktakzeptanz in der Region bei.

- Das Segment der Konnektivitätslösungen für Medizinprodukte dominierte 2025 mit einem Marktanteil von 55,6 %, angetrieben durch den steigenden Bedarf an integrierten Plattformen, die einen nahtlosen Datenaustausch zwischen Medizinprodukten und Krankenhaus-IT-Systemen ermöglichen.

Berichtsumfang und Marktsegmentierung für die Konnektivität medizinischer Geräte

|

Attribute |

Wichtige Markteinblicke in die Vernetzung medizinischer Geräte |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

• Oracle (USA) |

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Markttrends für die Konnektivität medizinischer Geräte

Verbesserte Konnektivität und Interoperabilität medizinischer Geräte

- Ein wichtiger und sich beschleunigender Trend im globalen Markt für die Vernetzung medizinischer Geräte ist der zunehmende Fokus auf Interoperabilität zwischen verschiedenen medizinischen Geräten. Dies ermöglicht einen nahtlosen Datenaustausch zwischen Krankenhausnetzwerken, Laboren und Diagnosezentren. Dieser Trend unterstützt die integrierte Patientenüberwachung, Echtzeitanalysen und eine verbesserte klinische Entscheidungsfindung.

- So kündigte Philips Healthcare beispielsweise im Jahr 2024 Verbesserungen an seiner IntelliBridge Enterprise-Plattform an, die die Echtzeitintegration von Vitalparameter-Monitoren, Infusionspumpen und Laborgeräten in die elektronischen Patientenaktensysteme von Krankenhäusern ermöglichen. Solche Entwicklungen erlauben es Ärzten, über eine einzige Schnittstelle auf umfassende Patientendaten zuzugreifen, wodurch manuelle Eingabefehler reduziert und die betriebliche Effizienz gesteigert werden.

- Die Integration medizinischer Geräte in die IT-Systeme von Krankenhäusern ermöglicht automatisierte Warnmeldungen, Fernüberwachung und datengestützte Patientenversorgung. Krankenhäuser verlassen sich zunehmend auf diese Systeme, um Patientendaten zu verwalten, Telemedizin zu unterstützen und die Einhaltung von Behandlungsprotokollen sicherzustellen.

- Der Trend hin zu standardisierten Kommunikationsprotokollen wie HL7 und FHIR erleichtert die Interoperabilität von Geräten zusätzlich und vereinfacht die Integration neuer Geräte in die bestehende Krankenhausinfrastruktur.

- Gesundheitseinrichtungen investieren in Plattformen, die Umgebungen mit mehreren Anbietern unterstützen und eine nahtlose Koordination zwischen älteren Geräten und vernetzten Geräten der neuen Generation ermöglichen.

- Dieser Trend prägt die IT-Strategien von Krankenhäusern und ermutigt Anbieter, anpassungsfähigere und skalierbarere Konnektivitätslösungen bereitzustellen. Unternehmen wie GE Healthcare und Cerner konzentrieren sich auf Lösungen, die Patientenüberwachung, Bildgebung und Laborergebnisse auf einer einzigen Plattform vereinen.

Marktdynamik der Konnektivität medizinischer Geräte

Treiber

Wachsender Bedarf an Echtzeitdaten und Workflow-Optimierung

- Die steigende Nachfrage nach Patientendaten in Echtzeit in Krankenhäusern und Diagnosezentren ist ein wesentlicher Wachstumstreiber des Marktes. Der Zugriff auf sofortige und verlässliche Informationen hilft Ärzten, schnellere und präzisere Entscheidungen zu treffen.

- So implementierte beispielsweise Hillrom (ein Unternehmen von Baxter) im Jahr 2023 seine vernetzten Lösungen für die Patientenversorgung in mehreren US-Krankenhäusern, um die Überwachung zu optimieren und die manuelle Dokumentation zu reduzieren und so die Effizienz des Personals zu steigern.

- Gesundheitsdienstleister konzentrieren sich zunehmend auf datengestützte Entscheidungsfindung und benötigen daher integrierte Konnektivitätslösungen, die umfassende Einblicke über verschiedene Geräte hinweg ermöglichen.

- Die Echtzeit-Geräteüberwachung verringert zudem das Fehlerrisiko, verbessert die Patientensicherheit und unterstützt eine bessere Einhaltung der Behandlungsprotokolle.

- Die durch vernetzte Medizingeräte erzielten betrieblichen Effizienzgewinne helfen Krankenhäusern, Kosten zu senken, Arbeitsabläufe zu verbessern und die Ressourcenzuweisung zu optimieren.

Zurückhaltung/Herausforderung

Bedenken hinsichtlich der Datensicherheit und hoher Anfangskosten

- Bedenken hinsichtlich Cybersicherheit und Datenschutz stellen weiterhin ein großes Hindernis für den Markt für vernetzte Medizinprodukte dar. Vernetzte Geräte sind anfällig für Cyberangriffe, Datenlecks und unbefugten Zugriff, was bei Gesundheitsdienstleistern Besorgnis auslöst.

- Beispielsweise meldeten im Jahr 2022 mehrere Krankenhäuser in den USA kleinere Sicherheitslücken in vernetzten Infusionspumpen, was die Notwendigkeit robuster Verschlüsselung und sicherer Authentifizierung unterstreicht.

- Hohe Anfangskosten für die Implementierung von krankenhausweiten Vernetzungslösungen können ebenfalls ein Hindernis darstellen, insbesondere für kleinere Krankenhäuser oder Kliniken in Entwicklungsländern.

- Die Wartung und Aktualisierung vernetzter Systeme erfordert fortlaufende Investitionen in die IT-Infrastruktur und die Mitarbeiterschulung, was die Betriebskosten erhöht.

- Die Bewältigung dieser Herausforderungen durch verbesserte Sicherheitsmaßnahmen, standardisierte Protokolle und kosteneffiziente Lösungen ist entscheidend für langfristiges Marktwachstum.

Marktumfang für Konnektivität medizinischer Geräte

Der Markt ist segmentiert nach Produkt und Dienstleistung, Technologie, Anwendung und Endnutzer.

- Nach Produkt und Dienstleistung

Basierend auf Produkten und Dienstleistungen ist der Markt in „Lösungen für die Vernetzung medizinischer Geräte“ und „Dienstleistungen für die Vernetzung medizinischer Geräte“ unterteilt. Das Segment „Lösungen für die Vernetzung medizinischer Geräte“ dominierte 2025 mit einem Marktanteil von 55,6 %. Treiber dieser Entwicklung ist der steigende Bedarf an integrierten Plattformen, die einen nahtlosen Datenaustausch zwischen medizinischen Geräten und Krankenhaus-IT-Systemen ermöglichen. Krankenhäuser und Diagnosezentren bevorzugen zunehmend Lösungen, die die Echtzeitüberwachung des Patientenzustands, automatisierte Warnmeldungen und eine sichere Datenspeicherung gewährleisten. Die führende Position dieses Segments wird durch die weitverbreitete Einführung elektronischer Patientenakten (EPA) und Initiativen zur Modernisierung der Gesundheitsinfrastruktur gestützt. Diese Lösungen ermöglichen die Interoperabilität zwischen älteren und neuen medizinischen Geräten, unterstützen klinische Arbeitsabläufe und steigern die betriebliche Effizienz. Die Integrationsmöglichkeiten von Vitalparameter-Monitoren, Infusionspumpen, Beatmungsgeräten und Anästhesiegeräten machen dieses Segment besonders attraktiv. Führende Anbieter konzentrieren sich auf die Entwicklung umfassender Lösungen mit standardisierten Kommunikationsprotokollen, um die Kompatibilität verschiedener Gerätetypen sicherzustellen. Krankenhäuser profitieren zudem von weniger manueller Dokumentation, erhöhter Patientensicherheit und besserer Einhaltung von Behandlungsprotokollen. Forschungs- und akademische Einrichtungen nutzen diese Lösungen zur Echtzeit-Datenerfassung in klinischen Studien und experimentellen Untersuchungen. Die Bedeutung dieses Segments wird durch weltweit steigende Investitionen in digitale Gesundheitsinitiativen und vernetzte Krankenhäuser weiter gestärkt. Kontinuierliche technologische Fortschritte, darunter Cloud-basierte Lösungen und die Skalierbarkeit von Plattformen, festigen die führende Position des Segments „Konnektivitätslösungen für Medizinprodukte“ kontinuierlich.

Das Segment der Konnektivitätsdienste für Medizinprodukte wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen und von 2026 bis 2033 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 12,4 % erreichen. Treiber dieses Wachstums sind die steigende Nachfrage nach Managed Services, Systemwartung und Integrationsunterstützung. Gesundheitsdienstleister suchen nach Dienstleistungen, die den kontinuierlichen Betrieb vernetzter Geräte gewährleisten, Software-Updates vereinfachen und Echtzeit-Fehlerbehebung ermöglichen. Dienstleister bieten Fernüberwachung, Installationsunterstützung und Beratung zur Optimierung der Gerätekonnektivität in Krankenhäusern, Kliniken und Diagnoselaboren. Da Krankenhäuser zunehmend komplexere und heterogene Netzwerke für Medizinprodukte einsetzen, steigt die Nachfrage nach Dienstleistungen, die Interoperabilität und Compliance gewährleisten. Das Serviceangebot umfasst auch Schulungen für Krankenhauspersonal, Cybersicherheitsunterstützung und Datenanalyse, um eine sichere und effiziente Nutzung vernetzter Geräte zu gewährleisten. Der Ausbau von Telemedizin und häuslicher Patientenüberwachung fördert die Nutzung dieser Dienstleistungen zusätzlich. Anbieter bieten abonnementbasierte Modelle an, wodurch fortschrittliche Konnektivitätslösungen auch für kleinere Kliniken und ambulante Pflegedienste zugänglicher werden. Der Fokus auf die Reduzierung von Ausfallzeiten und die Verbesserung des Gerätelebenszyklusmanagements erhöht die Attraktivität serviceorientierter Lösungen. Zudem veranlassen regulatorische Anforderungen wie HIPAA und MDR Gesundheitsdienstleister dazu, bei der Implementierung von Konnektivität auf Expertendienstleistungen zurückzugreifen. Das Wachstum dieses Segments wird durch das zunehmende Bewusstsein für die Vorteile professioneller Unterstützung bei der Verwaltung komplexer Gerätenetzwerke verstärkt.

- Durch Technologie

Basierend auf der Technologie ist der Markt in kabelgebundene, drahtlose und hybride Technologien unterteilt. Das Segment der drahtlosen Technologien dominierte 2025 mit einem Marktanteil von 48,9 %. Dies ist auf die Flexibilität, die einfache Installation und die Möglichkeit der Echtzeit-Fernüberwachung zurückzuführen. Krankenhäuser und ambulante Pflegedienste bevorzugen drahtlose Verbindungen, um Infrastrukturkosten zu senken, die Integration mobiler Geräte zu ermöglichen und die Mobilität der Patienten zu verbessern. Drahtlose Systeme ermöglichen die nahtlose Integration mehrerer Geräte ohne aufwendige Verkabelung und somit eine schnellere Implementierung in allen Krankenhausbereichen. Sie unterstützen die Konnektivität für Vitalparameter-Monitore, Infusionspumpen, Beatmungsgeräte und Anästhesiegeräte und ermöglichen Klinikern den sofortigen Zugriff auf Patientendaten. Das Wachstum dieses Segments wird durch die Einführung standardisierter Kommunikationsprotokolle verstärkt, die die Interoperabilität zwischen verschiedenen Geräteherstellern gewährleisten. Drahtlose Technologien verbessern zudem die Skalierbarkeit, sodass Krankenhäuser Geräte ohne größere Aufrüstungen in das Netzwerk integrieren können. Die Technologie ermöglicht fortschrittliche Analysen, automatisierte Benachrichtigungen und die Integration mit elektronischen Patientenakten (EMR), wodurch die betriebliche Effizienz und die Patientenversorgung verbessert werden. Krankenhäuser profitieren vom geringeren Risiko kabelbedingter Ausfälle und der schnelleren Fehlerbehebung. Das Segment unterstützt zudem Initiativen zur Telemedizin und Fernüberwachung von Patienten, die zunehmend an Bedeutung gewinnen. Die weitverbreitete Nutzung von IoT-fähigen Medizinprodukten festigt die Vormachtstellung der drahtlosen Technologie weiter. Hersteller verbessern kontinuierlich die drahtlosen Protokolle, um Sicherheit, Zuverlässigkeit und Datengenauigkeit zu erhöhen.

Das Segment der Hybridtechnologien wird voraussichtlich das schnellste Wachstum verzeichnen und von 2026 bis 2033 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 13,1 % erreichen. Diese Technologien vereinen die Stabilität kabelgebundener Netzwerke mit der Flexibilität drahtloser Systeme. Hybridsysteme werden bevorzugt in großen Krankenhausnetzwerken eingesetzt, wo kritische Geräte für eine hohe Zuverlässigkeit kabelgebundene Verbindungen benötigen, während mobile und patientennahe Geräte von der drahtlosen Integration profitieren. Diese Technologien ermöglichen es Gesundheitsdienstleistern, eine hohe Verfügbarkeit zu gewährleisten, eine sichere Datenübertragung sicherzustellen und die Überwachungsmöglichkeiten zu erweitern, ohne die bestehende Infrastruktur grundlegend zu modernisieren. Hybridsysteme ermöglichen den Echtzeit-Datenzugriff für stationäre und mobile Geräte. Das Wachstum von Hybridlösungen wird von Krankenhäusern und Diagnosezentren vorangetrieben, die Kosten optimieren, die Installationskomplexität reduzieren und die Patientenergebnisse verbessern möchten. Anbieter stellen maßgeschneiderte Hybridplattformen bereit, die Interoperabilität, die Einhaltung gesetzlicher Bestimmungen und einen sicheren Datenaustausch unterstützen. Die Flexibilität, kabelgebundene und drahtlose Verbindungen zu kombinieren, ermöglicht es Gesundheitseinrichtungen, Konnektivitätslösungen schrittweise einzuführen. Hybridtechnologien unterstützen zudem Fernüberwachung und Telemedizin und tragen so dem steigenden Bedarf an dezentraler Patientenversorgung Rechnung. Durch die Kombination von Zuverlässigkeit, Skalierbarkeit und Flexibilität positionieren sich Hybrid-Konnektivitätslösungen als bevorzugte Wahl für komplexe Krankenhausökosysteme.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt in Vitalparameter- und Patientenmonitore, Anästhesiegeräte und Beatmungsgeräte, Infusionspumpen und Sonstiges unterteilt. Das Segment Vitalparameter- und Patientenmonitore dominierte 2025 mit einem Marktanteil von 46,5 %, was auf den dringenden Bedarf an kontinuierlicher Patientenüberwachung in Krankenhäusern und der häuslichen Pflege zurückzuführen ist. Diese Geräte liefern Echtzeitdaten zu Herzfrequenz, Blutdruck, Sauerstoffsättigung und anderen Vitalparametern, die für zeitnahe klinische Interventionen unerlässlich sind. Die Integration in die IT-Systeme von Krankenhäusern gewährleistet die automatisierte Datenerfassung und reduziert Fehler, die mit manueller Dokumentation verbunden sind. Krankenhäuser und Diagnosezentren nutzen vernetzte Monitore, um die Behandlungsergebnisse zu verbessern, die Arbeitsabläufe effizienter zu gestalten und Fernkonsultationen zu ermöglichen. Die führende Position dieses Segments wird auch durch die zunehmende Verbreitung chronischer Krankheiten und die alternde Bevölkerung gestützt, die den Bedarf an ständiger Patientenüberwachung erhöhen. Programme zur Fernüberwachung von Patienten und Telemedizininitiativen unterstreichen die Bedeutung dieses Segments zusätzlich. Anbieter konzentrieren sich auf Geräte, die interoperabel, skalierbar und mit EMR-Systemen kompatibel sind und eine nahtlose Integration in die verschiedenen Gesundheitseinrichtungen ermöglichen. Erweiterte Analysen, automatisierte Benachrichtigungen und prädiktive Erkenntnisse sind weitere Funktionen, die die Akzeptanz in Krankenhäusern und der häuslichen Pflege fördern. Auch Forschungseinrichtungen nutzen vernetzte Vitalparameter-Monitore für klinische Studien und Gesundheitsforschung. Die Bedeutung dieses Segments wird durch technologische Fortschritte, darunter tragbare und am Körper tragbare Überwachungslösungen, weiter gestärkt.

Das Segment der Infusionspumpen wird voraussichtlich das schnellste Wachstum verzeichnen und von 2026 bis 2033 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 12,9 % erreichen. Treiber dieses Wachstums ist der zunehmende Einsatz vernetzter Pumpen in Krankenhäusern, ambulanten Versorgungszentren und der häuslichen Pflege. Vernetzte Infusionspumpen ermöglichen die präzise Steuerung der Medikamentenverabreichung, automatische Warnmeldungen bei Verstopfungen oder Dosierungsfehlern sowie die Integration in die elektronische Patientenakte (EPA) zur Echtzeitüberwachung. Krankenhäuser bevorzugen vernetzte Pumpen, um Medikationsfehler zu reduzieren, die Arbeitsabläufe effizienter zu gestalten und die Patientensicherheit zu erhöhen. Die zunehmende Nutzung intelligenter Infusionspumpen wird durch regulatorische Anforderungen, den Trend zur automatisierten Medikamentenverwaltung und die steigende Prävalenz chronischer Erkrankungen begünstigt. Dienstleister bieten vermehrt Fernüberwachung, Wartung und Software-Updates für Infusionspumpennetzwerke an. Das Wachstum der Telemedizin und der häuslichen Pflege treibt die Nachfrage zusätzlich an, da Patienten eine automatisierte Behandlung mit minimaler klinischer Überwachung erhalten können. Anbieter konzentrieren sich auf Konnektivitätslösungen, die Interoperabilität, sichere Datenübertragung und prädiktive Analysen für das Management der Infusionstherapie ermöglichen.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Krankenhäuser, ambulante Pflegedienste, Diagnosezentren und ambulante Versorgungszentren unterteilt. Das Segment der Krankenhäuser dominierte 2025 mit einem Marktanteil von 52,8 %, da große Krankenhausnetzwerke fortschrittliche Gerätevernetzung für die Patientenüberwachung, die Optimierung klinischer Arbeitsabläufe und die Einhaltung gesetzlicher Bestimmungen benötigen. Krankenhäuser implementieren zunehmend zentralisierte Systeme zur Verwaltung mehrerer Geräte, darunter Monitore, Beatmungsgeräte, Infusionspumpen und Anästhesiegeräte, über eine einzige Schnittstelle. Dies ermöglicht die Echtzeit-Patientenverfolgung, automatisierte Warnmeldungen und eine verbesserte Entscheidungsfindung. Das Segment wird durch die Einführung von elektronischen Patientenakten (EPA), Telemedizinprogrammen und Initiativen im Bereich der digitalen Gesundheit gestärkt. Führende Krankenhäuser konzentrieren sich auf Interoperabilität, Cybersicherheit und skalierbare Vernetzungslösungen, um die Patientenversorgung und die betriebliche Effizienz zu verbessern. Investitionen in die IT-Infrastruktur von Krankenhäusern, Programme zur digitalen Transformation und die Fernüberwachung von Patienten treiben die Marktführerschaft voran. Krankenhäuser profitieren zudem von prädiktiven Analysen, Workflow-Optimierung und verbesserten klinischen Ergebnissen, die durch vernetzte Geräte ermöglicht werden.

Das Segment der häuslichen Pflegezentren wird voraussichtlich das schnellste Wachstum verzeichnen und von 2026 bis 2033 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 13,3 % erreichen. Treiber dieses Wachstums sind die steigende Nachfrage nach Fernüberwachung, dem Management chronischer Erkrankungen und telemedizinischen Leistungen. Vernetzte Geräte in der häuslichen Pflege ermöglichen es Patienten, Vitalparameter zu überwachen, Medikamente über vernetzte Infusionssysteme zu erhalten und Daten in Echtzeit an Ärzte zu übermitteln. Dieser Trend wird durch die alternde Bevölkerung, die zunehmende Verbreitung chronischer Erkrankungen und die wachsende Nutzung der Telemedizin begünstigt. Häusliche Pflegezentren nutzen die Vernetzung von Geräten, um Wiedereinweisungen ins Krankenhaus zu reduzieren, die Therapietreue der Patienten zu verbessern und die Gesamtqualität der Versorgung zu steigern. Anbieter entwickeln speziell für den Heimgebrauch entwickelte Lösungen mit Fokus auf einfache Installation, Zuverlässigkeit und sichere Datenübertragung. Der Ausbau der häuslichen Pflege, staatliche Initiativen und die Kostenerstattung durch die Krankenkassen für die Fernüberwachung fördern die Verbreitung vernetzter Medizinprodukte in diesem Segment zusätzlich.

Regionale Analyse des Marktes für Konnektivität medizinischer Geräte

- Nordamerika dominierte 2025 mit einem Umsatzanteil von 42 % den Markt für die Vernetzung medizinischer Geräte. Treiber dieser Entwicklung waren die gut ausgebaute Gesundheitsinfrastruktur, hohe Ausgaben für Forschung und Entwicklung sowie die Präsenz wichtiger Branchenakteure. Das fortschrittliche medizinische Ökosystem der Region, gepaart mit der starken Akzeptanz vernetzter Gesundheitslösungen, schuf ein günstiges Umfeld für das Marktwachstum.

- Verbraucher und Gesundheitsdienstleister in Nordamerika schätzen den Komfort, die Echtzeit-Überwachungsmöglichkeiten und die nahtlose Integration vernetzter medizinischer Geräte in Krankenhausinformationssysteme, elektronische Patientenakten und Cloud-basierte Plattformen sehr.

- Diese weitverbreitete Akzeptanz wird zusätzlich durch die steigende Nachfrage nach Fernüberwachung von Patienten, Telemedizin und KI-gestützten Diagnosetools unterstützt, wodurch die Vernetzung medizinischer Geräte zu einem entscheidenden Bestandteil der modernen Gesundheitsversorgung wird.

Markteinblicke für die Vernetzung medizinischer Geräte in den USA:

Der US-amerikanische Markt für die Vernetzung medizinischer Geräte erzielte 2025 den größten Umsatzanteil in Nordamerika. Treiber dieses Wachstums waren die zahlreichen Installationen in Krankenhäusern, Kliniken und Diagnosezentren. Innovationen in der drahtlosen Geräteintegration, cloudbasierte Plattformen und KI-gestützte Überwachungslösungen treiben die Akzeptanz dieser Technologien voran. Gesundheitsdienstleister priorisieren zunehmend vernetzte Systeme, die die Behandlungsergebnisse verbessern, effiziente Arbeitsabläufe ermöglichen und den Echtzeitzugriff auf wichtige Daten gewährleisten. Darüber hinaus beschleunigen staatliche Initiativen zur Förderung digitaler Gesundheitslösungen und der Integration von Geräten des Internets der medizinischen Dinge (IoMT) die Marktexpansion.

Markteinblicke für die Vernetzung medizinischer Geräte in Europa:

Der europäische Markt für die Vernetzung medizinischer Geräte wird im Prognosezeitraum voraussichtlich ein signifikantes jährliches Wachstum verzeichnen. Treiber dieser Entwicklung sind die zunehmende Nutzung vernetzter Gesundheitstechnologien, strenge regulatorische Standards und ein steigendes Bewusstsein für Patientensicherheit und betriebliche Effizienz. Europäische Krankenhäuser und Diagnosezentren integrieren medizinische Geräte in elektronische Patientenakten und Telemedizinplattformen und verbessern so die Patientenversorgung und die Effizienz der Arbeitsabläufe.

Markteinblicke für die Vernetzung medizinischer Geräte in Großbritannien

: Der britische Markt für die Vernetzung medizinischer Geräte wird im Prognosezeitraum voraussichtlich stetig wachsen. Unterstützt wird dies durch Investitionen in die digitale Gesundheitsinfrastruktur, die zunehmende Nutzung von Lösungen zur Fernüberwachung von Patienten und den wachsenden Fokus auf Prävention. Gesundheitseinrichtungen in Großbritannien setzen vermehrt interoperable Medizinprodukte ein, um die Datengenauigkeit, die Patientensicherheit und die klinische Entscheidungsfindung zu verbessern.

Markteinblicke für die Vernetzung medizinischer Geräte in Deutschland:

Der deutsche Markt für die Vernetzung medizinischer Geräte dürfte ein deutliches Wachstum verzeichnen. Treiber dieser Entwicklung sind die hohe Akzeptanz digitaler Gesundheitslösungen, die gut ausgebaute Gesundheitsinfrastruktur und die zunehmende Integration von IoMT-Geräten. Deutsche Krankenhäuser und Forschungsinstitute nutzen vernetzte Lösungen, um Arbeitsabläufe zu optimieren, Fehler zu reduzieren und fortschrittliche klinische Forschungsprojekte zu unterstützen.

Markteinblicke für die Vernetzung medizinischer Geräte im asiatisch-pazifischen Raum:

Der Markt für die Vernetzung medizinischer Geräte im asiatisch-pazifischen Raum wird im Prognosezeitraum voraussichtlich die am schnellsten wachsende Region sein. Treiber dieses Wachstums sind der Ausbau der Gesundheitsinfrastruktur, die zunehmende Nutzung digitaler Gesundheitslösungen, die steigende Nachfrage nach Fernüberwachung von Patienten und die wachsenden verfügbaren Einkommen in Ländern wie China, Indien und Japan. Staatliche Initiativen zur Förderung vernetzter Gesundheitsversorgung, kombiniert mit technologischen Fortschritten und der Erschwinglichkeit moderner Geräte, treiben die Akzeptanz in Krankenhäusern, Kliniken und der häuslichen Pflege voran.

Einblick in den japanischen Markt für die Vernetzung medizinischer Geräte:

Der japanische Markt für die Vernetzung medizinischer Geräte gewinnt aufgrund des starken Fokus auf Hightech-Lösungen im Gesundheitswesen, der alternden Bevölkerung und der steigenden Nachfrage nach Fernüberwachung und häuslicher Pflege an Dynamik. Die Integration von IoMT-Geräten in Krankenhausmanagementsysteme und mobile Gesundheitsanwendungen ermöglicht ein effizientes Patientenmanagement und eine proaktive Gesundheitsversorgung.

Markteinblicke für vernetzte Medizingeräte in China:

Der chinesische Markt für vernetzte Medizingeräte wird im Jahr 2025 den größten Marktanteil im asiatisch-pazifischen Raum erzielen. Das Wachstum wird durch die rasante Urbanisierung, den Ausbau der Gesundheitsinfrastruktur, staatliche Initiativen im Bereich der digitalen Gesundheit und die zunehmende Nutzung vernetzter Medizingeräte in Krankenhäusern und Kliniken angetrieben. Die Bestrebungen hin zu intelligenten Krankenhäusern und die Verfügbarkeit kostengünstiger vernetzter Medizingeräte sind wesentliche Wachstumsfaktoren.

Marktanteil im Bereich Konnektivität medizinischer Geräte

Die Branche für Konnektivität medizinischer Geräte wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

• Oracle (USA)

• Philips Healthcare (Niederlande)

• GE Healthcare (USA)

• Siemens Healthineers (Deutschland)

• Medtronic (Irland)

• BD (USA)

• Tyler Technologies (USA)

• Cardinal Health (USA)

• Drägerwerk (Deutschland)

• Spacelabs Healthcare (USA)

• Carestream Health (USA)

• Hill-Rom Holdings (USA)

• Welch Allyn (USA)

• Connexall (Frankreich)

• McKesson Corporation (USA)

• Haemonetics (USA)

• Stryker Corporation (USA)

• Teladoc Health (USA)

• Medicomp Systems (USA)

Neueste Entwicklungen auf dem globalen Markt für Konnektivität medizinischer Geräte

- Im Juli 2025 ging Philips eine strategische Partnerschaft mit führenden Medizintechnikunternehmen wie Dräger, Hamilton Medical, Getinge und B. Braun ein, um die Interoperabilität serviceorientierter Gerätekonnektivität (SDC) in der Intensivmedizin voranzutreiben. Diese Initiative zielt darauf ab, eine einheitliche Gesundheitsumgebung zu schaffen, in der Geräte nahtlos Daten austauschen können. Dies ermöglicht Echtzeitüberwachung, effizientere Arbeitsabläufe und eine erhöhte Patientensicherheit in Krankenhausnetzwerken.

- Im Mai 2025 veröffentlichte die IEEE Standards Association die Normenreihe „IEEE 2621“ für die Cybersicherheit medizinischer Geräte. Diese Normen bieten Herstellern einen Rahmen für die Entwicklung sicherer und interoperabler Geräte, die Patientendaten sicher zwischen den IT-Systemen von Krankenhäusern übertragen. Ziel der Initiative ist es, Cyberrisiken zu reduzieren und die Integration vernetzter medizinischer Geräte in Krankenhäusern zu verbessern.

- Im März 2023 startete die US-amerikanische Arzneimittelbehörde FDA im Rahmen ihrer SHIELD-Initiative das „Diagnostic Data Program“. Ziel dieses Programms ist die Standardisierung und Verbesserung der Erfassung, Harmonisierung und Interoperabilität von Daten medizinischer Geräte und diagnostischer Labore. Es unterstützt den Datenaustausch in Echtzeit, die Früherkennung klinischer Probleme und die effizientere Integration medizinischer Geräte in Krankenhausnetzwerke.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.