Global Low Earth Orbit Leo Satellite Payload Market

Marktgröße in Milliarden USD

CAGR :

%

USD

17.49 Billion

USD

27.47 Billion

2024

2032

USD

17.49 Billion

USD

27.47 Billion

2024

2032

| 2025 –2032 | |

| USD 17.49 Billion | |

| USD 27.47 Billion | |

|

|

|

|

Globale Marktsegmentierung für Nutzlastsatelliten in erdnahen Umlaufbahnen (LEO) nach Typ (Kleinsatellit, Mittelsatellit, Großsatellit und Würfelsatellit), Frequenz (L-Band, S-Band, X-Band, C-Band, Ka-Band, Ku-Band und andere), Anwendung (Kommunikation und Navigation, Erdbeobachtung und Fernerkundung, Überwachung, Wissenschaft und andere), Subsystem (Nutzlast, Telekommunikation, Energiesystem, Antriebssystem, Satellitenbus und andere), Endnutzung (kommerziell, staatlich und militärisch, zivil und andere) – Branchentrends und Prognose bis 2032

Wie groß ist der globale Markt für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) und wie hoch ist seine Wachstumsrate?

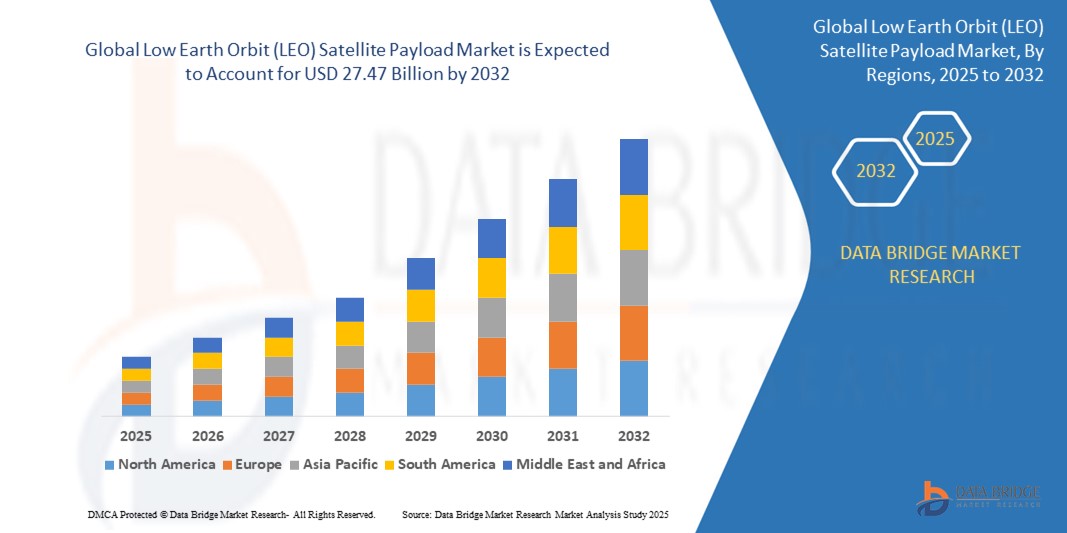

- Der globale Markt für Nutzlasten von Satelliten in erdnahen Umlaufbahnen (LEO) wurde im Jahr 2024 auf 17,49 Milliarden US-Dollar geschätzt und dürfte bis 2032 27,47 Milliarden US-Dollar erreichen , bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,80 % im Prognosezeitraum.

- Der Markt für Nutzlastsatelliten in erdnahen Umlaufbahnen (LEO) verzeichnet ein signifikantes Wachstum, angetrieben durch Fortschritte bei der Miniaturisierung, der KI-Integration und verbesserten Antriebstechnologien.

- Innovationen wie wiederverwendbare Raketen, verbesserte Satellitenkommunikationssysteme und kostengünstige Herstellungsverfahren treiben das Marktwachstum voran. Die steigende Nachfrage nach Hochgeschwindigkeitsinternet, Erdbeobachtung und IoT-Konnektivität treibt die Entwicklung und das Potenzial dieses dynamischen Sektors weiter voran.

Was sind die wichtigsten Erkenntnisse des Marktes für Nutzlastsatelliten im erdnahen Orbit (LEO)?

- Die steigende Nachfrage nach Breitbandverbindungen, insbesondere in abgelegenen und unterversorgten Regionen, treibt den Markt für LEO-Satellitennutzlasten maßgeblich voran. Satellitenkonstellationen wie Starlink und OneWeb veranschaulichen diesen Trend durch den Ausbau globaler Breitbandnetze.

- So zielt beispielsweise der Einsatz von Starlink darauf ab, ländlichen Gebieten weltweit Hochgeschwindigkeitsinternetzugang zu bieten, die digitale Kluft zu schließen und das Marktwachstum anzukurbeln, indem der steigende Konnektivitätsbedarf dieser Bevölkerungsgruppen gedeckt wird.

- Nordamerika dominierte den Markt für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) mit dem größten Umsatzanteil von 32,7 % im Jahr 2024, angetrieben durch wachsende Investitionen in Satelliten-Megakonstellationen, Fortschritte bei der Miniaturisierung der Nutzlast und die steigende Nachfrage nach Hochgeschwindigkeitsverbindungen und Erdbeobachtungsmöglichkeiten.

- Der Markt für LEO-Satellitennutzlasten im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit der höchsten durchschnittlichen jährlichen Wachstumsrate (CAGR) von 9,8 % wachsen. Dies ist auf die Ausweitung der Satellitenprogramme, die steigende Nachfrage nach Hochgeschwindigkeitsverbindungen und die rasante technologische Entwicklung in Ländern wie China, Indien und Japan zurückzuführen.

- Das Segment der Kleinsatelliten dominierte den Markt für Nutzlastsatelliten in erdnahen Umlaufbahnen (LEO) und erzielte im Jahr 2024 mit 46,8 % den größten Umsatzanteil. Dies ist auf die steigende Nachfrage nach kosteneffizienten, leichten und schnell einsetzbaren Lösungen für Erdbeobachtungs-, Kommunikations- und wissenschaftliche Missionen zurückzuführen.

Berichtsumfang und Marktsegmentierung für Satellitennutzlasten im niedrigen Erdorbit (LEO)

|

Eigenschaften |

Wichtige Markteinblicke zu Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Was ist der wichtigste Trend auf dem Markt für Nutzlastsatelliten im erdnahen Orbit (LEO)?

„ Verbesserte Nutzlastleistung durch KI und autonome Systeme “

- Ein bedeutender und sich schnell entwickelnder Trend im globalen Markt für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) ist die zunehmende Integration von künstlicher Intelligenz (KI), autonomer Entscheidungsfindung und intelligenter Bordverarbeitung zur Verbesserung der Satellitenleistung und Missionsflexibilität. Diese Fortschritte verändern die Art und Weise, wie Nutzlasten Echtzeitdaten verarbeiten, die Kommunikation optimieren und kritische Operationen im Weltraum unterstützen.

- Northrop Grumman beispielsweise setzt KI-gestützte Technologien ein, um die Nutzlastdatenverarbeitung im Orbit zu optimieren. Dadurch wird der Bedarf an Bodeneingriffen reduziert und die operative Reaktionsfähigkeit verbessert. Ähnlich integriert die SmartSat™-Plattform von Lockheed Martin autonome Systeme, die es Nutzlasten ermöglichen, sich in Echtzeit an die Missionsanforderungen anzupassen und so die Gesamteffizienz zu verbessern.

- KI-gestützte LEO-Satellitennutzlasten bieten Funktionen wie Echtzeit-Bedrohungserkennung, optimierte Signalverarbeitung und verbesserte Datenkomprimierung, die für Anwendungen in der Verteidigung, Erdbeobachtung und globalen Konnektivität unerlässlich sind. Autonome Technologien ermöglichen es Satelliten zudem, Nutzlastfunktionen dynamisch neu zu konfigurieren und so ein breiteres Aufgabenspektrum mit größerer operativer Flexibilität zu unterstützen.

- Die nahtlose Integration mit Bodenstationen, Cloud-basierter Analytik und sicheren Kommunikationsprotokollen steigert den Nutzen intelligenter Nutzlasten weiter und ermöglicht einen schnelleren, zuverlässigen Datentransfer und eine verbesserte Systemkoordination.

- Unternehmen wie SpaceX und Airbus sind führend in der Entwicklung intelligenter LEO-Nutzlasten, die KI für autonome Operationen, fortschrittliche Bildgebung und effiziente Spektrumnutzung nutzen und so der steigenden Nachfrage nach leistungsstarken, belastbaren Weltraumsystemen gerecht werden.

- Die weitverbreitete Einführung von KI und autonomen Nutzlasttechnologien definiert die Fähigkeiten von LEO-Satelliten neu und beschleunigt Innovationen in den Bereichen Erdbeobachtung, Breitbandinternet, Verteidigungsüberwachung und globale Kommunikation.

Was sind die Haupttreiber des Marktes für Nutzlastsatelliten im erdnahen Orbit (LEO)?

- Die steigende Nachfrage nach globaler Konnektivität, hochauflösender Erdbeobachtung und sicherer Verteidigungskommunikation ist ein Haupttreiber für das Wachstum des Marktes für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO).

- So erweiterte SpaceX im März 2024 seine Starlink-Konstellation um verbesserte LEO-Nutzlasten, um die Breitbandgeschwindigkeit, Latenz und globale Abdeckung zu verbessern und die Konnektivität in abgelegenen Regionen zu unterstützen.

- Steigende Investitionen in LEO-Mega-Konstellationen sowohl privater als auch staatlicher Einrichtungen treiben die Marktexpansion voran, mit Anwendungen in den Bereichen Telekommunikation, Katastrophenüberwachung, Verteidigungsüberwachung und wissenschaftliche Forschung

- Der Übergang zu miniaturisierten, leistungsstarken Nutzlasten, der durch Fortschritte in den Bereichen Elektronik, Materialien und KI ermöglicht wird, verbessert die Erschwinglichkeit, Flexibilität und schnelle Bereitstellung von Satellitenkonstellationen.

- Darüber hinaus treibt die wachsende Nachfrage nach nahezu Echtzeitdaten für die Klimaüberwachung, die Seeüberwachung und das Agrarmanagement die Einführung fortschrittlicher Nutzlastsysteme voran.

- Die Fähigkeit moderner LEO-Satellitennutzlasten, Kommunikation mit geringer Latenz, hochauflösende Bilder und eine kontinuierliche globale Abdeckung zu liefern, macht sie für aufstrebende Sektoren unverzichtbar, darunter autonome Fahrzeuge, IoT-Netzwerke und Smart Cities .

Welcher Faktor behindert das Wachstum des Marktes für Nutzlastsatelliten im erdnahen Orbit (LEO)?

- Bedenken hinsichtlich Weltraumüberlastung, Weltraummüll und regulatorischen Beschränkungen stellen erhebliche Herausforderungen für das langfristige Wachstum und die Nachhaltigkeit des Marktes für LEO-Satellitennutzlasten dar

- Die zunehmende Zahl der gestarteten Satelliten, insbesondere von Mega-Konstellationen, erhöht das Risiko von Kollisionen und Trümmeransammlungen und erfordert eine strengere behördliche Aufsicht und internationale Koordinierungsbemühungen.

- Unternehmen wie OneWeb und Amazons Project Kuiper stehen vor operativen Einschränkungen aufgrund sich entwickelnder Protokolle zur Weltraumverkehrsverwaltung und der Notwendigkeit zuverlässiger De-Orbiting-Lösungen zur Minderung der Risiken durch Weltraummüll.

- Darüber hinaus können die hohen Entwicklungs- und Startkosten für LEO-Nutzlasten der nächsten Generation, insbesondere solcher mit KI und autonomen Funktionen, die Akzeptanz bei kleineren Raumfahrtagenturen oder in Schwellenländern einschränken.

- Geopolitische Spannungen, Exportbeschränkungen für fortschrittliche Satellitentechnologien und Cybersicherheitslücken im Zusammenhang mit der Satellitenkommunikation erschweren die Marktexpansion zusätzlich.

- Die Überwindung dieser Hindernisse durch robuste Strategien zur Eindämmung von Weltraummüll, internationale Zusammenarbeit, technologische Standardisierung und Kostensenkungsinitiativen wird entscheidend sein, um das nachhaltige Wachstum des Marktes für LEO-Satellitennutzlasten in den kommenden Jahren sicherzustellen.

Wie ist der Markt für Nutzlasten von Satelliten in erdnahen Umlaufbahnen (LEO) segmentiert?

Der Markt ist nach Typ, Häufigkeit, Anwendung, Subsystem und Endnutzung segmentiert.

• Nach Typ

Der Markt für Nutzlasten von Satelliten in erdnahen Umlaufbahnen (LEO) ist nach Typ in Kleinsatelliten, Mittelsatelliten, Großsatelliten und Würfelsatelliten unterteilt. Das Kleinsatellitensegment dominierte den Markt für Nutzlasten von Satelliten in erdnahen Umlaufbahnen (LEO) und erzielte 2024 mit 46,8 % den größten Umsatzanteil. Dies ist auf die steigende Nachfrage nach kosteneffizienten, leichten und schnell einsetzbaren Lösungen für Erdbeobachtung, Kommunikation und wissenschaftliche Missionen zurückzuführen. Kleinsatelliten werden aufgrund ihrer Erschwinglichkeit, Vielseitigkeit und Eignung für Megakonstellationen bevorzugt und sind daher ein wichtiger Bestandteil moderner LEO-Satellitenprojekte.

Das Segment der Cube-Satelliten wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen. Grund hierfür sind Fortschritte bei der Miniaturisierung, niedrigere Startkosten und zunehmende akademische, wissenschaftliche und kommerzielle Anwendungen. CubeSats werden zunehmend für Technologiedemonstrationen, Fernerkundung und Kommunikationsmissionen eingesetzt, insbesondere von Start-ups, Universitäten und aufstrebenden Raumfahrtprogrammen.

• Nach Häufigkeit

Der Markt für Nutzlasten erdnaher Satelliten (LEO) ist frequenzmäßig in L-Band, S-Band, X-Band, C-Band, Ka-Band, Ku-Band und weitere Bereiche unterteilt. Das Ku-Band hatte im Jahr 2024 mit 31,4 % den größten Marktanteil, was auf seine weit verbreitete Nutzung für Hochdurchsatz-Satellitenkommunikation, Breitband-Internet und Videoübertragungsdienste zurückzuführen ist. Das Ku-Band bietet ein optimales Gleichgewicht zwischen Bandbreitenkapazität, Abdeckungsbereich und Widerstandsfähigkeit gegen atmosphärische Störungen und eignet sich daher hervorragend für LEO-Satellitenkonstellationen.

Das Ka-Band-Segment dürfte zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, was auf die steigende Nachfrage nach Kommunikationsdiensten mit hoher Kapazität und geringer Latenz und seine Rolle bei der Ermöglichung von Breitband-, 5G-Backhaul- und Verteidigungsanwendungen der nächsten Generation zurückzuführen ist.

• Nach Anwendung

Der Markt für Nutzlasten von Satelliten in erdnahen Umlaufbahnen (LEO) ist nach Anwendung in die Bereiche Kommunikation und Navigation, Erdbeobachtung und Fernerkundung, Überwachung, Wissenschaft und Sonstiges unterteilt. Das Segment Kommunikation und Navigation dominierte den Markt mit dem größten Umsatzanteil von 42,9 % im Jahr 2024. Dies ist auf den steigenden globalen Konnektivitätsbedarf, den Ausbau von LEO-Breitbandkonstellationen und die zunehmende Nutzung satellitengestützter Navigationsdienste zurückzuführen.

Das Segment Erdbeobachtung und Fernerkundung dürfte zwischen 2025 und 2032 die höchste Wachstumsrate aufweisen, angetrieben durch zunehmende Initiativen zur Umweltüberwachung, den Bedarf an Katastrophenmanagement und die zunehmende Nutzung von Satellitenbildern in der Landwirtschaft, Stadtplanung und Ressourcenverwaltung.

• Nach Subsystem

Der Markt für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) ist nach Subsystemen in Nutzlast, Telekommunikation, Energiesystem, Antriebssystem, Satellitenbus und Sonstiges unterteilt. Das Nutzlastsegment erzielte 2024 mit 37,6 % den größten Marktanteil, da Nutzlastsysteme eine entscheidende Rolle für die Satellitenfunktionalität, missionsspezifische Operationen und die Datenübertragung spielen. Die steigende Nachfrage nach leistungsstarken, KI-fähigen und autonomen Nutzlasten führt zu erheblichen Investitionen in diesem Segment.

Das Segment Antriebssysteme dürfte zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen, was auf den Bedarf an präzisen Bahnanpassungen, Deorbitierungsfähigkeiten und effizienter Manövrierfähigkeit in überfüllten LEO-Umgebungen zurückzuführen ist.

• Nach Endverwendung

Der Markt für Nutzlasten erdnaher Satelliten (LEO) ist nach Endnutzung in die Segmente Kommerziell, Staatlich und Militärisch, Zivil und Sonstige unterteilt. Das kommerzielle Segment dominierte den Markt mit dem größten Umsatzanteil von 55,1 % im Jahr 2024. Dies ist auf das schnelle Wachstum privater Satellitenbetreiber, erhöhte Investitionen in Breitbandinternet und die Nachfrage nach Erdbeobachtung und satellitengestützten IoT-Diensten zurückzuführen.

Das Segment Regierung und Militär wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen, was auf die zunehmenden Bemühungen zur Modernisierung der Verteidigung, den erhöhten Überwachungsbedarf und die zunehmende Abhängigkeit von sicherer Satellitenkommunikation und Fernerkundung für die nationale Sicherheit zurückzuführen ist.

Welche Region hält den größten Anteil am Markt für Nutzlastsatelliten in erdnahen Umlaufbahnen (LEO)?

- Nordamerika dominierte den Markt für Satellitennutzlasten in erdnahen Umlaufbahnen (LEO) mit dem größten Umsatzanteil von 32,7 % im Jahr 2024, angetrieben durch wachsende Investitionen in Satelliten-Megakonstellationen, Fortschritte bei der Miniaturisierung der Nutzlast und die steigende Nachfrage nach Hochgeschwindigkeitsverbindungen und Erdbeobachtungsmöglichkeiten.

- Das starke Ökosystem der Region aus Luft- und Raumfahrtunternehmen, Verteidigungsprogrammen und privaten Raumfahrtbetreibern trägt maßgeblich zur Innovation im Bereich der LEO-Nutzlast bei, insbesondere in den USA.

- Günstige Regierungspolitik, hohe Ausgaben für Forschung und Entwicklung sowie ein gut entwickelter kommerzieller Raumfahrtsektor festigen Nordamerikas Position als weltweit führendes Unternehmen im Markt für LEO-Satellitennutzlasten.

Markteinblicke für Satellitennutzlasten in niedrigen Erdumlaufbahnen (LEO) in den USA

Die USA erwirtschafteten 2024 den größten Umsatzanteil innerhalb Nordamerikas, unterstützt durch bedeutende Initiativen führender Akteure wie SpaceX, Lockheed Martin und Northrop Grumman sowie den zunehmenden Einsatz von Verteidigungs- und kommerziellen Satelliten. Der Fokus des Landes auf globale Breitbandversorgung, Erdbeobachtung und sichere militärische Kommunikation treibt die Nachfrage nach fortschrittlichen LEO-Satellitennutzlasten an. Darüber hinaus tragen der Anstieg öffentlich-privater Partnerschaften und die anhaltenden Investitionen der NASA in LEO-Technologien zu einem nachhaltigen Marktwachstum bei.

Einblicke in den europäischen Markt für Satellitennutzlasten im erdnahen Orbit (LEO)

Der europäische Markt für LEO-Satellitennutzlasten wird im Prognosezeitraum voraussichtlich stetig wachsen, angetrieben durch die starke Unterstützung der Weltraumforschung, der Modernisierung der Verteidigung und der Umweltüberwachung. Die gemeinsamen Raumfahrtprogramme der Region unter der Leitung der Europäischen Weltraumorganisation (ESA) und Investitionen in Satelliten-Breitbanddienste beschleunigen die Nutzlastentwicklung. Europa legt zudem großen Wert auf Erdbeobachtung, Katastrophenmanagement und wissenschaftliche Forschung, was die Nachfrage nach leistungsstarken LEO-Nutzlasten steigert.

Einblicke in den britischen Markt für Satellitennutzlasten im erdnahen Orbit (LEO)

Der britische Markt für LEO-Satellitennutzlasten wird voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen. Dies wird durch erhöhte staatliche Mittel für die Weltrauminfrastruktur, einen florierenden Satellitenfertigungssektor und strategische Partnerschaften mit globalen Raumfahrtagenturen unterstützt. Der britische Fokus auf autonome Nutzlasttechnologien, Klimaüberwachung und Satellitenkommunikation entspricht der steigenden globalen Nachfrage nach LEO-Satellitendiensten und erhöht das Marktpotenzial.

Markteinblicke für Satellitennutzlasten im erdnahen Orbit (LEO) in Deutschland

Der deutsche Markt für LEO-Satellitennutzlasten wird voraussichtlich stetig wachsen. Dies wird durch die technologische Expertise des Landes, den Schwerpunkt auf fortschrittliche Luft- und Raumfahrtlösungen sowie steigende Investitionen in Verteidigungs- und Forschungssatellitenmissionen vorangetrieben. Deutschlands führende Rolle in der Herstellung von Satellitenkomponenten sowie die Unterstützung nachhaltiger Weltraumoperationen und des Weltraumverkehrsmanagements treiben die Nachfrage nach zuverlässigen, leistungsstarken LEO-Nutzlasten sowohl im kommerziellen als auch im staatlichen Sektor voran.

Welche Region verzeichnet das schnellste Wachstum im Markt für Nutzlastsatelliten im erdnahen Orbit (LEO)?

Der Markt für LEO-Satellitennutzlasten im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 9,8 % wachsen. Dies ist auf den Ausbau von Satellitenprogrammen, die steigende Nachfrage nach Hochgeschwindigkeitsverbindungen und die rasante technologische Entwicklung in Ländern wie China, Indien und Japan zurückzuführen. Staatliche Initiativen zur Förderung der Weltraumforschung, die Modernisierung der Kommunikationsinfrastruktur und wachsende Investitionen in kommerzielle Satelliten sind wichtige Wachstumsfaktoren in der Region. Der Aufstieg aufstrebender Raumfahrt-Startups und inländischer Satellitenhersteller macht LEO-Nutzlasten in der gesamten Region zugänglicher.

Markteinblicke für Satellitennutzlasten in niedriger Erdumlaufbahn (LEO) in Japan

Der japanische Markt für LEO-Satellitennutzlasten verzeichnet ein starkes Wachstum. Dies wird durch die fortschrittliche Technologielandschaft, staatlich geförderte Raumfahrtprogramme und die steigende Nachfrage nach Katastrophenmanagement, Erdbeobachtung und Konnektivitätsdiensten unterstützt. Japans Fokus auf die Entwicklung autonomer Satellitensysteme, effizienter Nutzlasten und die Integration von KI zur Echtzeit-Datenverarbeitung beschleunigt die Marktakzeptanz, insbesondere für wissenschaftliche und militärische Anwendungen.

Markteinblicke für Satellitennutzlasten in niedriger Erdumlaufbahn (LEO) in China

Der chinesische Markt für LEO-Satellitennutzlasten hatte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum, angetrieben durch den schnellen Satellitenausbau des Landes im Rahmen von Initiativen wie dem Beidou-Navigationssystem und LEO-Breitband-Megakonstellationen. Chinas erhebliche Investitionen in fortschrittliche Nutzlasttechnologien, starke inländische Fertigungskapazitäten und der strategische Fokus auf globale Konnektivität und Verteidigungsüberwachung sind wichtige Faktoren für das Marktwachstum. Die Ambitionen des Landes in den Bereichen Smart Cities, autonome Systeme und Umweltüberwachung unterstützen die steigende Nachfrage nach LEO-Nutzlastlösungen zusätzlich.

Welches sind die Top-Unternehmen auf dem Markt für Satellitennutzlasten im erdnahen Orbit (LEO)?

Die Nutzlastbranche für Satelliten in erdnahen Umlaufbahnen (LEO) wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- AIRBUS (Frankreich)

- RTX (USA)

- Thales (Frankreich)

- Lockheed Martin Corporation (USA)

- Honeywell International Inc. (USA)

- L3Harris Technologies, Inc. (USA)

- Boeing (USA)

- Viasat, Inc. (USA)

- SpaceX (USA)

- MDA (Kanada)

- LUCIX CORPORATION (USA)

- Mitsubishi Electric Corporation (Japan)

- ISRO (Indien)

- General Dynamics Mission Systems, Inc. (USA)

- Northrop Grumman Corporation (USA)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für Nutzlastsatelliten im erdnahen Orbit (LEO)?

- Im Oktober 2024 erhielt Northrop Grumman (USA) von der US Space Development Agency (SDA) den Auftrag zur Entwicklung und Herstellung von 38 Datentransportsatelliten für die Tranche 2 Transport Layer – Alpha (T2TL-Alpha) der Proliferated Warfighter Space Architecture (PWSA). Diese Satelliten, die im niedrigen Erdorbit (LEO) operieren, werden die militärischen Kommunikationsfähigkeiten verbessern. Der Betriebsbeginn ist für Dezember 2026 geplant. Dieser Auftrag im Wert von 732 Millionen US-Dollar stärkt Northrop Grummans Präsenz im Verteidigungsraumsektor.

- Im Oktober 2024 bestellte die Europäische Weltraumorganisation (ESA) bei Thales Alenia Space (Frankreich) sechs weitere Satelliten zur Erweiterung der italienischen Erdbeobachtungskonstellation IRIDE. Ziel der Initiative ist es, Europas Beobachtungs- und Umweltüberwachungskapazitäten durch den Einsatz fortschrittlicher LEO-Satelliten zu verbessern und die Rolle von Thales in europäischen Raumfahrtprogrammen zu stärken.

- Im Januar 2024 erhielt L3Harris Technologies, Inc. (USA) einen Auftrag im Wert von 919 Millionen US-Dollar zur Lieferung von 18 Infrarot-Raumfahrzeugen im Rahmen der Tranche 2 Tracking Layer der US-SDA. Diese Systeme werden die Fähigkeiten des US-Militärs zur Raketenerkennung und zur Verfolgung hypersonischer Bedrohungen verbessern und den Ruf von L3Harris als wichtiger Anbieter von Verteidigungstechnologie festigen.

- Im Oktober 2023 erteilte die US-amerikanische Raumfahrtbehörde (SDA) Northrop Grumman (USA) einen Auftrag im Wert von 732 Millionen US-Dollar zum Bau von 38 LEO-Datentransportsatelliten für das T2TL-Alpha-Netzwerk im Rahmen des PWSA-Programms. Diese Satelliten sollen die sichere militärische Kommunikation verbessern. Der Betrieb soll bis Dezember 2026 beginnen und Northrop Grummans strategische Verteidigungsrolle stärken.

- Im Oktober 2023 vergab die US Space Force über das Space Systems Command einen 70-Millionen-Dollar-Auftrag an SpaceX (USA) zur Bereitstellung von Starlink-Internetdiensten für militärische Operationen. Der Einjahresvertrag, der am 1. September begann, enthält nicht veröffentlichte Spezifikationen des US-Verteidigungsministeriums (DoD), die die wachsende Rolle von SpaceX in der sicheren Verteidigungskommunikation widerspiegeln.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.