Global Iot Insurance Market

Marktgröße in Milliarden USD

CAGR :

%

USD

27,500.00 Million

USD

299,813.95 Million

2022

2030

USD

27,500.00 Million

USD

299,813.95 Million

2022

2030

| 2023 –2030 | |

| USD 27,500.00 Million | |

| USD 299,813.95 Million | |

|

|

|

|

Globaler IoT-Versicherungsmarkt nach Typ ( Krankenversicherung , Sach- und Unfallversicherung, Agrarversicherung, Lebensversicherung, Sonstige), Endbenutzer (Automobil und Transport, Reisen, Gesundheitswesen, Wohn- und Geschäftsgebäude, Unternehmen, Landwirtschaft, Unterhaltungselektronik) – Branchentrends und Prognose bis 2030.

IoT-Versicherungsmarktanalyse und -größe

IoT Insurance ist ein spezialisierter Zweig der Versicherungsbranche, der IoT-Geräte und -Daten nutzt, um eine verbesserte Risikobewertung, Policenpreisgestaltung und personalisierten Versicherungsschutz für verschiedene Sektoren wie Automobil, Gesundheitswesen, Landwirtschaft, Wohnen und Gewerbeimmobilien bereitzustellen. Dabei werden die von IoT-Geräten gesammelten Daten genutzt, um Risiken zu überwachen und zu verwalten, Verluste zu verhindern und die Betriebseffizienz zu verbessern.

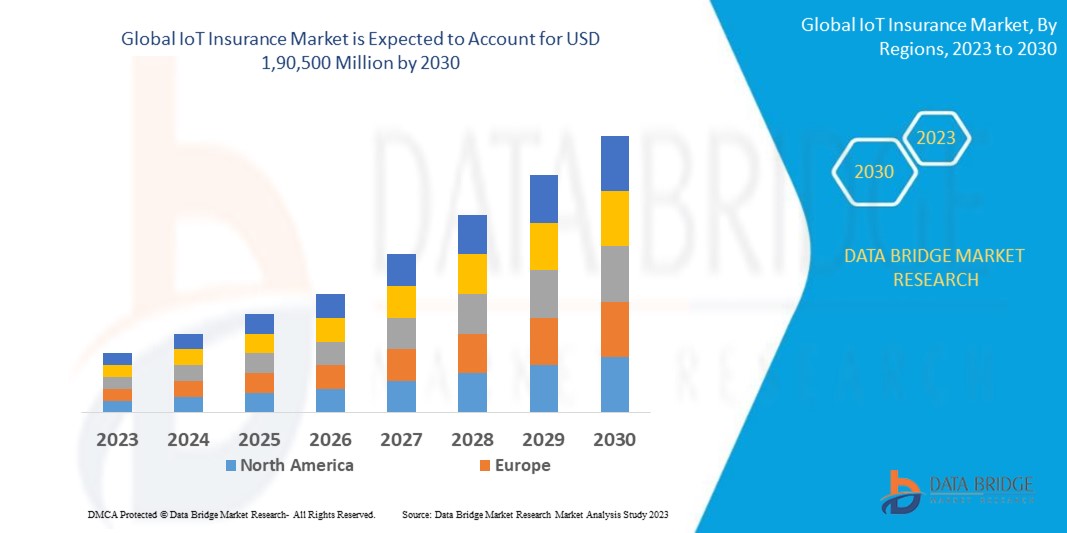

Data Bridge Market Research analysiert, dass der globale IoT-Versicherungsmarkt, der im Jahr 2022 27.500 Millionen USD betrug, bis 2030 voraussichtlich 190.500 Millionen USD erreichen wird und im Prognosezeitraum 2023–2030 eine durchschnittliche jährliche Wachstumsrate von 34,8 % aufweisen wird. Dies zeigt den Marktwert. „Krankenversicherung“ dominiert das Typensegment des globalen IoT-Versicherungsmarktes, da Unternehmen die Notwendigkeit einer automatisierten Qualitätssicherung in Produktionsprozessen erkannt haben und die Nachfrage danach gestiegen ist, was das Wachstum des Marktes für industrielle Bildverarbeitung voraussichtlich weiter vorantreiben wird. Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Vertriebshändlern und Partnern, detaillierte und aktualisierte Preistrendanalysen und Defizitanalysen von Lieferkette und Nachfrage.

Umfang und Segmentierung des IoT-Versicherungsmarktes

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Nach Typ (Krankenversicherung, Sach- und Unfallversicherung, Agrarversicherung, Lebensversicherung, Sonstige), Endnutzer (Automobil und Transport, Reisen, Gesundheitswesen, Wohn- und Geschäftshäuser, Gewerbe, Landwirtschaft, Unterhaltungselektronik ) |

|

Abgedeckte Länder |

(USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Restliches Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika) |

|

Abgedeckte Marktteilnehmer |

Accenture plc (USA), Allerin (USA), Capgemini SE (USA), Cognizant (USA), Concirrus (USA), Intel Corporation (USA), International Business Machines Corporation (USA), Microsoft Corporation (USA), Sas Institute Inc. (USA), Telit (USA), Verisk Analytics Inc. (USA) und Wipro Limited (USA) |

|

Marktchancen |

Die Einführung von Industrie 4.0 wird voraussichtlich positive Auswirkungen haben |

Marktdefinition

Der globale Versicherungsmarkt für das Internet der Dinge (IoT) bezieht sich auf den Markt, der Versicherungsprodukte und -dienstleistungen umfasst, die speziell auf IoT-Geräte und -Technologien zugeschnitten sind. IoT bezieht sich auf das Netzwerk miteinander verbundener physischer Geräte, Fahrzeuge, Gebäude und anderer Objekte, die mit Sensoren, Software und Konnektivität ausgestattet sind, sodass sie Daten sammeln und austauschen können.

Globaler IoT-Versicherungsmarkt

Treiber

- Risikomanagement und Schadensverhütung

IoT-Versicherungen bieten verbesserte Möglichkeiten zur Risikobewertung und Schadensverhütung. Durch die Nutzung von Echtzeitdaten von IoT-Geräten können Versicherer Risiken besser verstehen und bewerten, was eine genauere Risikoprüfung und Preisgestaltung ermöglicht. IoT-gestützte Maßnahmen zur Risikominderung, wie Fernüberwachung und prädiktive Analysen, tragen dazu bei, Verluste zu vermeiden und die Schadenshäufigkeit zu reduzieren.

- Personalisierte Versicherungslösungen

IoT-Versicherungen ermöglichen es Versicherern, personalisierten Versicherungsschutz und Preise basierend auf individuellen Daten und Verhaltensweisen anzubieten. In der Autoversicherung beispielsweise können nutzungsbasierte Policen auf die Fahrgewohnheiten einer Person zugeschnitten werden, was zu faireren Prämien führt. Personalisierte Versicherungslösungen fördern die Kundenzufriedenheit und -bindung.

Gelegenheit

- Markterweiterung und -durchdringung

Der globale IoT-Versicherungsmarkt bietet Versicherern die Möglichkeit, ihren Kundenstamm zu erweitern und in neue Märkte vorzudringen. Da die Verbreitung des IoT branchen- und regionenübergreifend weiter zunimmt, können Versicherer gezielt auf bestimmte Sektoren wie das Gesundheitswesen, die Landwirtschaft und die Fertigung abzielen, in denen IoT-Geräte weit verbreitet sind, und maßgeschneiderte Versicherungslösungen anbieten.

Einschränkungen/Herausforderungen

- Bedenken hinsichtlich Datensicherheit und Datenschutz

Die weitverbreitete Nutzung von IoT-Geräten und die Erfassung großer Mengen persönlicher und sensibler Daten geben Anlass zu Bedenken hinsichtlich Datensicherheit und Datenschutz. Versicherer müssen robuste Datenschutzmaßnahmen sicherstellen, um unbefugten Zugriff, Verstöße und Missbrauch der durch IoT generierten Daten zu verhindern. Die Einhaltung von Datenschutzbestimmungen wie der DSGVO (Datenschutz-Grundverordnung) erhöht die Komplexität und die Kosten des IoT-Versicherungsökosystems.

- Komplexe Infrastruktur und Integration:

IoT-Versicherungen erfordern die Integration verschiedener Technologien und Systeme, darunter IoT-Geräte, Datenanalyseplattformen und Versicherungssoftware. Der Aufbau und die Verwaltung der erforderlichen Infrastruktur können komplex und anspruchsvoll sein. Die Gewährleistung von Kompatibilität, nahtlosem Datenfluss und effektiver Integration über verschiedene Geräte und Plattformen hinweg erfordert erhebliche Investitionen und Fachwissen.

Jüngste Entwicklungen

- Im November 2022 hat die IBM Corporation eine Partnerschaft mit Ablera und Bulgarien angekündigt, um ABACUS zu verbessern, eine Lösung für Versicherungsunternehmen für Preis- und Ratingprozesse auf Basis künstlicher Intelligenz, die diese Prozesse auf ein neues Niveau an Geschwindigkeit und Genauigkeit bringt, den fehleranfälligen, mühsamen manuellen Aufwand minimiert und es einem breiteren Anwenderkreis ermöglicht, mit der Raffinesse der angewandten Mathematik zu arbeiten.

- Im August 2022 gab Telit, ein weltweit führendes Unternehmen im Bereich Internet der Dinge (IoT), die Übernahme der Konzernanlagen von Mobilogix bekannt. Durch die Übernahme kommen umfassende Fachkenntnisse und Ressourcen im Bereich Geräteentwicklung hinzu, die sich auf die Optimierung der Spezifikationen für die Übergabe an elektronische Fertigungsdienste, die Herstellung von Originalgeräten sowie die Erlangung behördlicher Genehmigungen und Carrier-Zertifizierungen konzentrieren.

Globaler IoT-Versicherungsmarktumfang und Marktgröße

Der globale IoT-Versicherungsmarkt ist nach Typ und Endbenutzer segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Krankenversicherung

- Sach- und Unfallversicherung

- Landwirtschaftliche Versicherung

- Lebensversicherung

- Sonstiges

Endbenutzer

- Automobil und Transport

- Reisen, Gesundheitswesen

- Wohn- und Geschäftsgebäude

- Geschäft,

- Landwirtschaft

- Unterhaltungselektronik

Globaler IoT-Versicherungsmarkt – Regionale Analyse/Einblicke

Der globale IoT-Versicherungsmarkt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ und Endbenutzeranwendung wie oben angegeben bereitgestellt.

Die im Marktbericht für industrielle Bildverarbeitung abgedeckten Länder sind die USA, Kanada, Mexiko, Brasilien, Argentinien, das übrige Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, die Niederlande, Belgien, die Schweiz, die Türkei, Russland, das übrige Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, die Philippinen, der übrige asiatisch-pazifische Raum, Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Israel und der übrige Nahe Osten und Afrika

Nordamerika ist aufgrund der Anwendung fortschrittlicher Technologie in mehreren Branchen Marktführer im Bereich industrieller Bildverarbeitung. Darüber hinaus wird das Auftreten wichtiger Schlüsselakteure das Wachstum des Marktes für industrielle Bildverarbeitung in der Region im Prognosezeitraum 2023–2030 weiter ankurbeln.

Im asiatisch-pazifischen Raum wird aufgrund der starken Präsenz wichtiger Produktionsländer ein deutliches Wachstum des Marktes für industrielle Bildverarbeitung erwartet. Darüber hinaus wird erwartet, dass die steigende Zahl neuer Marktteilnehmer das Wachstum des Marktes für industrielle Bildverarbeitung in der Region in den kommenden Jahren weiter vorantreiben wird.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und globale Marktanteilsanalyse für IoT-Versicherungen

Die Wettbewerbslandschaft des globalen IoT- Versicherungsmarktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den globalen IoT-Versicherungsmarkt.

Einige der wichtigsten Akteure auf dem globalen IoT-Versicherungsmarkt sind:

- Accenture plc (USA)

- Allerin (USA)

- Capgemini SE (USA)

- Cognizant (USA)

- Concirrus (USA)

- Intel Corporation (USA)

- International Business Machines Corporation (USA)

- Microsoft Corporation (US)

- Sas Institute Inc. (USA)

- Telit (USA)

- Verisk Analytics Inc. (USA)

- Wipro Limited (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.