Global Infection Control Market

Marktgröße in Milliarden USD

CAGR :

%

USD

51.45 Million

USD

74.87 Million

2024

2032

USD

51.45 Million

USD

74.87 Million

2024

2032

| 2025 –2032 | |

| USD 51.45 Million | |

| USD 74.87 Million | |

|

|

|

|

Globale Marktsegmentierung für Infektionskontrolle nach Produkt (Sterilisationsprodukte, Reinigungs- und Desinfektionsprodukte, persönliche Schutzbarrieren, Produkte zur Endoskopaufbereitung, antimikrobielle Oberflächen und andere Produkte zur Infektionskontrolle), Anwendung (Chirurgische Instrumente, Endoskope, Ultraschallsonden und andere), Vertriebskanal (Direktausschreibung, Einzelhandel und Drittanbieter), Endverbraucher (Krankenhäuser, Kliniken, Medizintechnikunternehmen, Pharma- und Biotechnologieunternehmen, Labore und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Infektionskontrolle

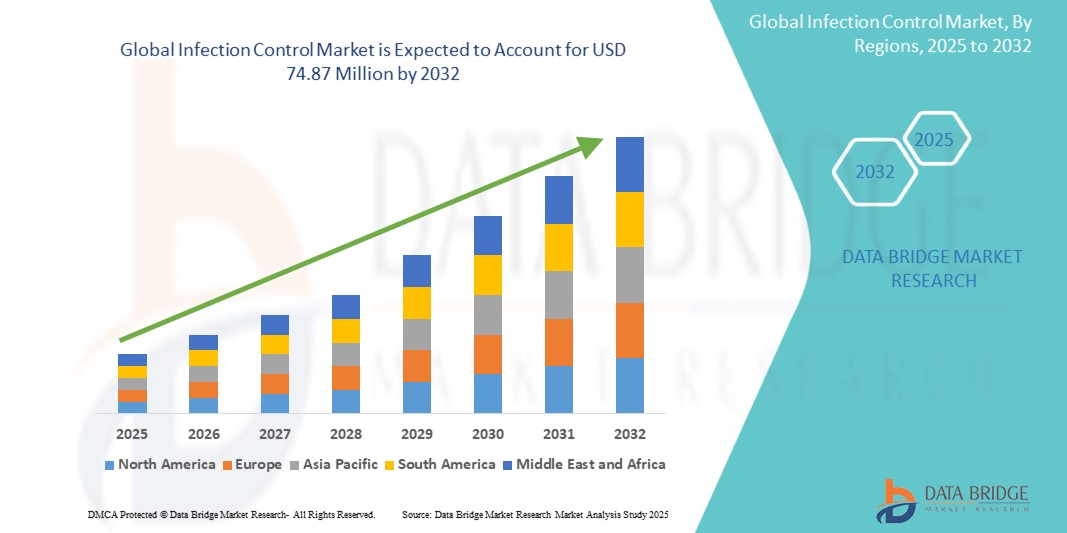

- Der globale Markt für Infektionskontrolle wurde im Jahr 2024 auf 51,45 Millionen US-Dollar geschätzt und soll bis 2032 74,87 Millionen US-Dollar erreichen, bei einer CAGR von 4,80 % im Prognosezeitraum.

- Dieses Wachstum ist auf die Zunahme der Fälle von Krankenhausinfektionen (HAIS) zurückzuführen.

Marktanalyse zur Infektionskontrolle

- Lösungen zur Infektionskontrolle sind im gesamten Gesundheitswesen unerlässlich, um im Gesundheitswesen auftretende Infektionen (HAIs) durch Sterilisation, Desinfektion und Eindämmungsmaßnahmen zu verhindern und zu reduzieren.

- Der wachsende Bedarf an Infektionskontrolle wird durch die zunehmende Verbreitung von Krankenhausinfektionen, die steigende Zahl von chirurgischen Eingriffen und Krankenhauseinweisungen sowie strenge gesetzliche Vorschriften zu Hygiene- und Desinfektionsprotokollen verstärkt.

- Nordamerika wird voraussichtlich den Markt für Infektionskontrolle mit dem größten Marktanteil von 33,85 % dominieren. Dies ist auf die starke Präsenz führender Unternehmen im Bereich Infektionskontrolle, das hohe Bewusstsein für im Gesundheitswesen erworbene Infektionen (HAIs) und die strengen gesetzlichen Vorschriften für Sterilisations- und Desinfektionspraktiken zurückzuführen.

- Der asiatisch-pazifische Raum wird im Prognosezeitraum voraussichtlich die höchste Wachstumsrate im Markt für Infektionskontrolle verzeichnen, was auf die schnelle Urbanisierung, erhöhte Gesundheitsausgaben und die steigende Zahl von HAIs in dicht besiedelten Ländern zurückzuführen ist.

- Das Segment Sterilisationsprodukte wird voraussichtlich den Markt für Infektionskontrolle mit dem größten Marktanteil von 47,22 % dominieren, da die Notwendigkeit zur Reduzierung von Infektionen an Operationsstellen, strenge Sterilisationsvorschriften und der umfassende Einsatz von Sterilisatoren in verschiedenen Anwendungen zunimmt.

Berichtsumfang und Marktsegmentierung für Infektionskontrolle

|

Eigenschaften |

Wichtige Markteinblicke zur Infektionskontrolle |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends im Bereich Infektionskontrolle

„Steigende Akzeptanz von UV-C-Desinfektion und berührungslosen Technologien“

- Ein bemerkenswerter Trend auf dem Markt für Infektionskontrolle ist die schnelle Einführung von UV-C-Desinfektionssystemen und berührungslosen Technologien, die eine schnelle, effiziente und chemikalienfreie Sterilisation von Gesundheitsumgebungen ermöglichen.

- Diese Systeme werden zunehmend in Operationssälen, Intensivstationen und Diagnoselaboren eingesetzt, um den menschlichen Kontakt zu reduzieren und die Sterilisationskonsistenz auf häufig berührten Oberflächen zu verbessern.

- Der Einsatz automatisierter Desinfektionsroboter und fest installierter UV-Anlagen nimmt zu, da sie Krankheitserreger, einschließlich medikamentenresistenter Stämme, innerhalb von Minuten eliminieren können.

- So erweiterte beispielsweise Xenex Disinfection Services im Jahr 2023 seinen Kundenstamm in US-Krankenhäusern mit seinem UV-Roboter LightStrike, der in klinischen Studien eine signifikante Reduzierung der HAI-Inzidenz zeigte

- Dieser Trend verändert die Strategien zur Infektionsprävention und ermöglicht es Gesundheitseinrichtungen, die Sicherheit zu verbessern und gleichzeitig manuelle Desinfektionsfehler zu minimieren.

Marktdynamik im Bereich Infektionskontrolle

Treiber

„Steigende Operationszahlen und Bewusstsein für Krankenhausinfektionen“

- Einer der wichtigsten Treiber für den Markt für Infektionskontrolle ist die steigende Zahl chirurgischer Eingriffe weltweit, begleitet von einem wachsenden Bewusstsein für im Krankenhaus erworbene Infektionen (HAIs).

- Regierungen und Gesundheitsbehörden fördern aktiv Infektionskontrollmaßnahmen, um die HAI-Raten zu senken, die für eine erhebliche Morbidität der Patienten und erhöhte Gesundheitskosten verantwortlich sind.

- In chirurgischen Umgebungen mit hohem Volumen wie Traumazentren und Transplantationseinheiten sind heute umfassende Infektionskontrollsysteme erforderlich, um die Patientensicherheit zu gewährleisten.

- So startete die Weltgesundheitsorganisation (WHO) im Jahr 2023 eine neue globale Initiative, die Krankenhäuser dazu ermutigt, die Häufigkeit von HAI zu melden und zu verfolgen, was die Nachfrage nach Sterilisations- und Desinfektionsmitteln beschleunigte.

- Diese Betonung der Verfahrenshygiene und der öffentlichen Berichterstattung veranlasst die Gesundheitsdienstleister dazu, massiv in Infektionspräventionssysteme zu investieren

Gelegenheit

„Ausbau der Infektionskontrolle im außerklinischen Bereich“

- Eine wachsende Chance liegt in der Ausweitung der Technologien zur Infektionskontrolle über Krankenhäuser hinaus – in ambulanten chirurgischen Zentren , Langzeitpflegeeinrichtungen, Zahnkliniken und der häuslichen Krankenpflege

- Mit der Zunahme ambulanter Eingriffe und häuslicher Pflege steigt der Bedarf an kompakten, einfach zu bedienenden Sterilisations- und Desinfektionsgeräten deutlich an.

- Hersteller von Produkten zur Infektionskontrolle entwickeln tragbare Sterilisatoren, Desinfektionstücher und Oberflächenreiniger, um den Bedarf der dezentralen Gesundheitsversorgung zu decken

- So führte Metrex Research im Jahr 2023 eine neue Linie kompakter Desinfektionstücher ein, die speziell für den Einsatz in Zahnarztpraxen und Ambulanzen entwickelt wurden und sich an kleine Praxen mit begrenzter Sterilisationsinfrastruktur richten.

- Dieser Trend bietet ungenutztes Marktpotenzial, insbesondere in Entwicklungsregionen, in denen der Zugang zur Gesundheitsversorgung schnell zunimmt.

Einschränkung/Herausforderung

„Hohe Kosten für fortschrittliche Infektionskontrollsysteme“

- Ein großes Hindernis für das Marktwachstum sind die hohen Anschaffungs- und Wartungskosten für moderne Infektionskontrollsysteme wie automatische Sterilisatoren, Endoskop-Aufbereiter und UV-C-Roboter.

- Kleineren Krankenhäusern und Kliniken, insbesondere in Ländern mit niedrigem und mittlerem Einkommen, fehlt oft das Kapital, um in High-End-Systeme zu investieren, was die Marktdurchdringung einschränkt.

- Darüber hinaus erhöhen Schulungsanforderungen und Infrastrukturänderungen die Gesamtbetriebskosten, was die Einführung in Umgebungen mit begrenztem Budget zusätzlich erschwert.

- So berichteten beispielsweise im Jahr 2023 mehrere ländliche Krankenhäuser in Lateinamerika, dass sie den Kauf hochwertiger Desinfektionssysteme aufgrund von Budgetumverteilungen während der wirtschaftlichen Erholung nach COVID verschoben hätten.

- Die finanzielle Hürde für die Einführung bleibt eine erhebliche Herausforderung für die weltweite Umsetzung universeller Infektionskontrollstandards

Marktumfang für Infektionskontrolle

Der Markt ist nach Produkt, Anwendung, Vertriebskanal und Endbenutzer segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Produkt |

|

|

Nach Anwendung |

|

|

Nach Vertriebskanal |

|

|

Nach Endbenutzer |

|

Im Jahr 2025 werden die Sterilisationsprodukte voraussichtlich den Markt mit dem größten Anteil im Produktsegment dominieren

Das Segment Sterilisationsprodukte wird voraussichtlich im Jahr 2025 den Markt für Infektionskontrolle mit dem größten Marktanteil von 47,22 % dominieren. Grund dafür sind der zunehmende Bedarf an der Reduzierung von Wundinfektionen, strenge Sterilisationsvorschriften und die umfassende Verwendung von Sterilisatoren in verschiedenen Bereichen wie der Sterilisation von medizinischen Geräten, Lebensmitteln und Getränken, pharmazeutischen Sterilisationen und Sterilisationen in der Biowissenschaftsbranche.

Die chirurgischen Instrumente werden voraussichtlich den größten Anteil im Prognosezeitraum im Anwendungssegment ausmachen

Im Jahr 2025 wird das Segment der chirurgischen Instrumente voraussichtlich den Markt mit dem größten Marktanteil von 56,14 % dominieren, da die weltweit steigende Zahl chirurgischer Eingriffe strenge Maßnahmen zur Infektionskontrolle bei chirurgischen Instrumenten erfordert.

Regionale Analyse des Marktes für Infektionskontrolle

„Nordamerika hält den größten Anteil am Markt für Infektionskontrolle“

- Nordamerika wird voraussichtlich den globalen Markt für Infektionskontrolle mit dem größten Marktanteil von 33,85 % dominieren. Dies ist auf die starke Präsenz führender Unternehmen im Bereich Infektionskontrolle, das hohe Bewusstsein für nosokomial bedingte Infektionen (HAI) und die strengen gesetzlichen Vorschriften für Sterilisations- und Desinfektionsverfahren zurückzuführen.

- Die USA halten den größten Anteil innerhalb der Region aufgrund ausgedehnter Krankenhausnetzwerke, der weit verbreiteten Einführung fortschrittlicher Sterilisationstechnologien und erheblicher Gesundheitsausgaben, die sich auf Patientensicherheit und Infektionsprävention konzentrieren.

- Kontinuierliche Investitionen in die Krankenhausinfrastruktur, der Ausbau ambulanter chirurgischer Zentren und eine günstige Regierungspolitik zur Förderung der Infektionsprävention dürften die Dominanz Nordamerikas in den kommenden Jahren festigen.

„Der asiatisch-pazifische Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate im Markt für Infektionskontrolle verzeichnen“

- Im asiatisch-pazifischen Raum wird aufgrund der raschen Urbanisierung, der gestiegenen Gesundheitsausgaben und der steigenden Zahl von nosokomialen Infektionen in dicht besiedelten Ländern die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im Markt für Infektionskontrolle erwartet.

- Schlüsselmärkte wie China, Indien und Japan beschleunigen ihr Wachstum durch staatlich geförderte Gesundheitsreformen, den Ausbau des Krankenhausbaus und die Einführung moderner Sterilisations- und Desinfektionslösungen.

- Japan legt großen Wert auf Hygiene und fortschrittliche Medizintechnik und setzt aktiv modernste Protokolle zur Infektionskontrolle ein, während China und Indien durch verstärkte Initiativen im Bereich der öffentlichen Gesundheit, die lokale Produktion von Sterilisationsgeräten und einen stärkeren Fokus auf Schulungen zur Infektionsprävention in medizinischen Einrichtungen ein Wachstum verzeichnen.

Marktanteile im Bereich Infektionskontrolle

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- 3M (USA)

- STERIS (USA)

- Getinge (Schweden)

- MATACHANA GROUP (Spanien)

- Ecolab (USA)

- BELIMED, INC. (Schweiz)

- Cardinal Health (USA)

- Steelco SpA (Italien)

- Reckitt Benckiser Group plc (Großbritannien)

- Stryker (USA)

- B. Braun SE (Deutschland)

- Covalon Technologies Ltd. (Kanada)

- SKYTRON, LLC (USA)

- Olympus Corporation (Japan)

- COLTENE Gruppe (Schweiz)

- Pal International (Großbritannien)

- MELAG Medizintechnik GmbH & Co. KG (Deutschland)

- Terragene (Großbritannien)

- The Clorox Company (USA)

Neueste Entwicklungen auf dem globalen Markt für Infektionskontrolle

- Im Oktober 2023 übernahm Getinge AB (Schweden) Healthmark Industries Co. Inc., einen führenden US-amerikanischen Anbieter von Verbrauchsmaterialien für Instrumentenpflege und Infektionskontrolle, um seine Präsenz in der Sterilgutaufbereitung auf dem US-Markt zu stärken. Diese Übernahme unterstreicht Getinges strategisches Engagement für den Ausbau seines Infektionskontrollportfolios in Nordamerika.

- Im Februar 2023 brachte Ecolab Inc. (USA) die neue Produktlinie Ecolab Scientific Clean auf den Markt, die Reinigungslösungen für den gewerblichen, industriellen und privaten Gebrauch bietet. Diese Markteinführung markiert Ecolabs Expansion in den Markt für verbraucherorientierte Hygienelösungen.

- Im Oktober 2021 ging 3M (USA) eine Partnerschaft mit Thermo Fisher Scientific ein, um die Einführung des 3M Harvest RC Chromatographic Clarifier für biopharmazeutische Kunden zu vereinfachen. Ziel dieser Zusammenarbeit ist es, die Betriebseffizienz in biopharmazeutischen Filtrationsprozessen zu steigern.

- Im Februar 2022 stellte Lumalier EDU-C vor, eine tragbare Notfalldesinfektionseinheit für den universellen Einsatz in Einrichtungen und Institutionen. Mit diesem Debüt erweitert Lumalier seine Rolle als Anbieter flexibler Lösungen zur Infektionsprävention.

- Im Januar 2021 gab Steris plc die Übernahme von Cantel Medical bekannt, mit der strategischen Absicht, sein Produktangebot zur Infektionskontrolle zu erweitern. Diese Akquisition ermöglicht Steris, weltweit umfassendere Lösungen zur Infektionsprävention anzubieten.

- Im November 2020 brachte Applicon Biotechnology, eine Tochtergesellschaft von Getinge, den AppliFlex ST auf den Markt, einen anpassbaren Einweg-Bioreaktor, der Laborprozesse rationalisiert und den manuellen Arbeitsaufwand reduziert. Diese Innovation unterstreicht Getinges Engagement für Automatisierung und Effizienz in der Bioprozesstechnik.

- Im September 2020 brachte Midmark Corp., ein führender Anbieter von Dentallösungen, den Sterilizer Data Logger und den M3 Steam Sterilizer auf den Markt. Ziel ist es, die Instrumentenaufbereitung schneller, konformer und einfacher zu gestalten. Diese Markteinführung unterstreicht Midmarks Engagement für die Weiterentwicklung der Sterilisationstechnologie in Zahnarztpraxen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.