Global Glass Substrate Market

Marktgröße in Milliarden USD

CAGR :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Globale Marktsegmentierung für Glassubstrate nach Typ (auf Borosilikatbasis, auf Quarzglas-/Quarzbasis, Silizium und andere), Waferdurchmesser (300 mm, 200 mm, 150 mm, 125 mm, über 300 mm und bis zu 100 mm), Anwendung (Waferverpackung, Substratträger und TGV-Interposer), Endverbrauch (Elektronik, optische Anwendungen, Luft- und Raumfahrt und Verteidigung, Automobil- und Solarindustrie sowie Medizin) – Branchentrends und Prognose bis 2032

Marktgröße für Glassubstrate

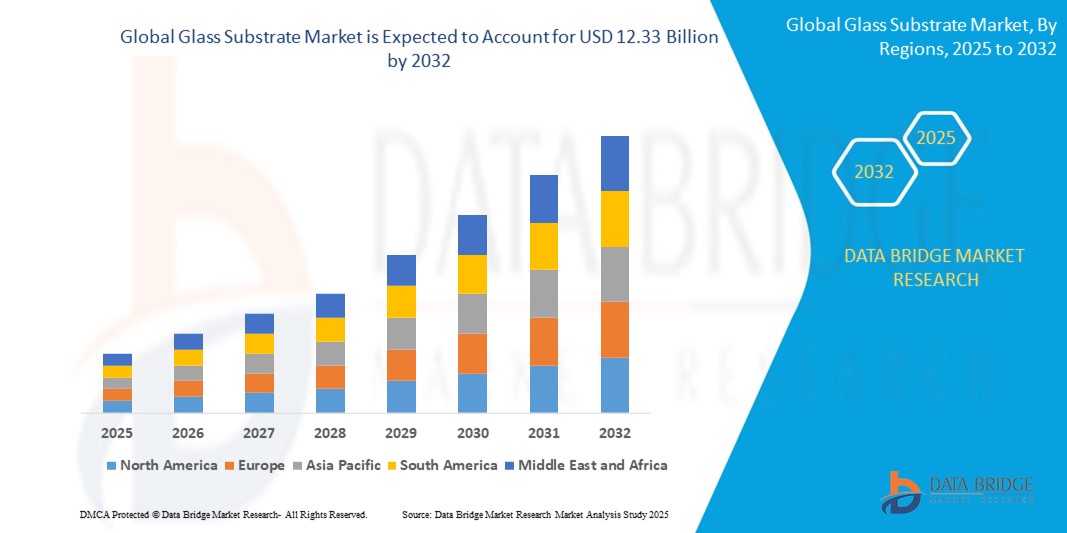

- Der globale Markt für Glassubstrate wurde im Jahr 2024 auf 7,01 Milliarden US-Dollar geschätzt und dürfte bis 2032 12,33 Milliarden US-Dollar erreichen , bei einer CAGR von 7,30 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach fortschrittlichen Displaytechnologien in der Unterhaltungselektronik wie Smartphones, Tablets und Fernsehern sowie durch die zunehmende Anwendung in Solarmodulen und flexibler Elektronik vorangetrieben.

- Darüber hinaus treibt die zunehmende Verbreitung von OLED- und AMOLED-Displays, die hochwertige Glassubstrate für bessere Leistung und Haltbarkeit benötigen, die Marktexpansion weltweit weiter voran.

Marktanalyse für Glassubstrate

- Der Markt für Glassubstrate wächst aufgrund der steigenden Nachfrage nach Hochleistungsdisplays in der Unterhaltungselektronik, die eine verbesserte Haltbarkeit und Klarheit für Geräte wie Smartphones und Fernseher bieten.

- Die Hersteller konzentrieren sich auf die Entwicklung dünnerer und flexiblerer Glassubstrate, um den wachsenden Anforderungen flexibler und faltbarer Displaytechnologien gerecht zu werden.

- Nordamerika dominierte den Markt für Glassubstrate mit dem größten Umsatzanteil im Jahr 2024, angetrieben von einer robusten Elektronikindustrie, einer wachsenden Nachfrage nach fortschrittlichen Displaytechnologien und der Präsenz führender Halbleiterhersteller

- Im asiatisch-pazifischen Raum wird voraussichtlich die höchste Wachstumsrate auf dem globalen Markt für Glassubstrate verzeichnet, angetrieben durch die schnelle Industrialisierung, die wachsende Elektronikfertigung und die steigende Nachfrage nach Halbleitern und Displaypanels in Ländern wie China, Japan, Südkorea und Indien.

- Das Segment auf Borosilikatbasis dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, was auf seine hohe thermische und chemische Beständigkeit zurückzuführen ist, die es für eine Vielzahl von Anwendungen in der Mikroelektronik und Photonik geeignet macht. Die Nachfrage nach Borosilikatsubstraten ist in der Halbleiterverpackung aufgrund ihrer Dimensionsstabilität und Kosteneffizienz stark.

Berichtsumfang und Marktsegmentierung für Glassubstrate

|

Eigenschaften |

Wichtige Markteinblicke zu Glassubstraten |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Markttrends für Glassubstrate

„Aufstieg flexibler und faltbarer Displayglassubstrate“

- Der Markt für Glassubstrate erlebt einen deutlichen Trend zur Entwicklung und Einführung flexibler und faltbarer Glassubstrate, angetrieben durch die zunehmende Beliebtheit faltbarer Smartphones und tragbarer Geräte.

- Hersteller entwickeln innovative ultradünne und biegsame Glasmaterialien, die wiederholtem Falten standhalten, ohne dass die Haltbarkeit oder die Displayklarheit beeinträchtigt werden

- Beispielsweise verwenden die faltbaren Smartphones von Samsung und das Surface Duo von Microsoft flexible Glassubstrate, was die kommerzielle Rentabilität und die Verbrauchernachfrage nach solchen Technologien unterstreicht.

- Dieser Trend drängt Glasproduzenten dazu, die Zähigkeit und Elastizität des Glases durch fortschrittliche chemische Verstärkungs- und Beschichtungstechniken zu verbessern.

- Darüber hinaus unterstützt der Trend das Wachstum neuer Produktkategorien in der Unterhaltungselektronik, wie rollbare Displays und flexible Tablets, und eröffnet neue Möglichkeiten für Glassubstratanwendungen über traditionelle starre Displays hinaus.

Marktdynamik für Glassubstrate

Treiber

„Steigende Nachfrage nach fortschrittlichen Displaytechnologien“

- Die wachsende Nachfrage nach fortschrittlichen Displaytechnologien treibt den Markt für Glassubstrate an, da die Verbraucher hochauflösende, langlebige und benutzerfreundliche Geräte suchen

- Glassubstrate sind für Displays wie Flüssigkristallanzeigen, organische Leuchtdioden und neue flexible und faltbare Bildschirme unerlässlich, da sie eine glatte und flache Oberfläche für gleichmäßige elektronische Schichten bieten.

- Innovationen wie ultradünnes und chemisch gehärtetes Glas ermöglichen leichtere und robustere Bildschirme und erfüllen so den Bedarf der Verbraucher nach schlanken und dennoch langlebigen Geräten.

- Die zunehmende Verbreitung von Smartphones, Tablets, Laptops und Fernsehern mit fortschrittlichen Displays beschleunigt das Marktwachstum. Beispielsweise verwenden große Smartphone-Marken chemisch gehärtetes Glas, um die Kratzfestigkeit und Haltbarkeit zu verbessern.

- Neue Displayformate, darunter flexible und rollbare Bildschirme, sind auf spezielle Glassubstrate angewiesen, die ihre Flexibilität beibehalten, ohne Transparenz oder Festigkeit einzubüßen. Dies führt zu einer zunehmenden Verwendung in Armaturenbrettern von Autos und tragbaren Geräten.

- Beispielsweise verwenden die neuesten faltbaren Smartphones von Samsung ultradünne, chemisch verstärkte Glassubstrate, die eine reibungslose Biegung des Bildschirms ermöglichen und gleichzeitig Haltbarkeit und Klarheit gewährleisten.

Einschränkung/Herausforderung

„Hohe Produktionskosten und Fertigungskomplexität“

- Der Markt für Glassubstrate steht vor Herausforderungen aufgrund der hohen Kosten bei der Herstellung fortschrittlicher Glasmaterialien, insbesondere solcher, die ultradünn oder chemisch behandelt sind.

- Die Herstellung erfordert mehrere präzise Schritte wie Schmelzen, Formen, Glühen und chemisches Verfestigen, die jeweils strenge Qualitätskontrollen und spezielle Geräte erfordern.

- Bei der Herstellung flexibler Glassubstrate müssen Biegsamkeit und optische Klarheit erhalten bleiben, was technisch anspruchsvoll ist und die Betriebskosten erhöht.

- Beispielsweise erfordert die Entwicklung ultradünnen flexiblen Glases für faltbare Displays eine Dickenkontrolle auf Nanoebene, um Brüche zu verhindern und gleichzeitig die visuelle Leistung zu gewährleisten.

- Alternative Materialien wie Kunststoffsubstrate sind zwar weniger haltbar, erfreuen sich aber aufgrund geringerer Produktionskosten und einfacherer Verarbeitung zunehmender Beliebtheit für flexible Displays.

Marktumfang für Glassubstrate

Der Markt ist nach Typ, Waferdurchmesser, Anwendung und Endverbrauch segmentiert.

- Nach Typ

Der Markt für Glassubstrate ist nach Typ in Borosilikat-, Quarzglas-/Quarz- und Siliziumsubstrate sowie weitere Substrate unterteilt. Das Borosilikat-Segment dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024. Dies ist auf seine hohe thermische und chemische Beständigkeit zurückzuführen, die es für eine Vielzahl von Anwendungen in der Mikroelektronik und Photonik geeignet macht. Aufgrund ihrer Dimensionsstabilität und Kosteneffizienz ist die Nachfrage nach Borosilikatsubstraten im Halbleitergehäusebereich stark.

Das Segment Quarzglas/Quarz wird voraussichtlich von 2025 bis 2032 das schnellste Wachstum verzeichnen, was auf die außergewöhnliche optische Transparenz und den niedrigen Wärmeausdehnungskoeffizienten zurückzuführen ist. Diese Eigenschaften machen Quarzglas ideal für Hochfrequenzelektronik, optische Komponenten und fortschrittliche Lithografie, insbesondere in der Halbleiter- und Luft- und Raumfahrtindustrie.

- Nach Waferdurchmesser

Basierend auf dem Waferdurchmesser ist der Markt für Glassubstrate mit hohem Durchmesser in 300 mm, 200 mm, 150 mm, 125 mm, über 300 mm und bis zu 100 mm unterteilt. Das 200-mm-Segment hatte im Jahr 2024 den größten Marktanteil, was auf seine weit verbreitete Verwendung in bestehenden Halbleiterfertigungsanlagen und seine Kosteneffizienz bei der Herstellung von MEMS und analogen Bauelementen zurückzuführen ist.

Das 300-mm-Segment dürfte zwischen 2025 und 2032 das höchste Wachstum verzeichnen, angetrieben durch die fortschreitende Entwicklung in der Halbleiterfertigung, darunter 3D-Packaging und die Großserienproduktion von ICs. Da Gießereien zunehmend größere Wafer verwenden, um die Ausbeute zu steigern und die Kosten pro Chip zu senken, steigt die Nachfrage nach 300-mm-Glassubstraten rasant an.

- Nach Anwendung

Der Markt für Glassubstrate ist anwendungsbezogen in Waferverpackungen, Substratträger und TGV-Interposer unterteilt. Das Segment Waferverpackungen erzielte 2024 den größten Marktanteil, angetrieben durch die steigende Nachfrage nach hochdichten und miniaturisierten Verpackungslösungen in der Unterhaltungselektronik und Kommunikationsgeräten. Glassubstrate bieten hervorragende planare Oberflächen und ein optimales thermisches Verhalten für Wafer-Level-Packaging.

Das TGV-Interposer-Segment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, da die Through-Glass-Via-Technologie zunehmend in der fortschrittlichen Chipintegration und heterogenen Verpackung eingesetzt wird. Die hohe Präzision und die geringen dielektrischen Verluste sind für Hochleistungsrechner und HF-Anwendungen attraktiv.

- Nach Endverwendung

Der Markt für Glassubstrate ist nach Endanwendung in die Bereiche Elektronik, optische Anwendungen, Luft- und Raumfahrt & Verteidigung, Automobil & Solar sowie Medizin unterteilt. Das Elektroniksegment dominierte den Markt im Jahr 2024, angetrieben von der steigenden Nachfrage nach Smartphones, Wearables und Halbleiterbauelementen, die kompakte und effiziente Substratlösungen erfordern.

Im medizinischen Bereich wird von 2025 bis 2032 voraussichtlich die höchste Wachstumsrate erwartet, was auf die zunehmende Verbreitung von Biosensoren, Mikrofluidik-Chips und Lab-on-a-Chip-Technologien zurückzuführen ist, die aufgrund ihrer Biokompatibilität, chemischen Stabilität und Transparenz Glassubstrate verwenden.

Regionale Analyse des Glassubstratmarktes

- Nordamerika dominierte den Markt für Glassubstrate mit dem größten Umsatzanteil im Jahr 2024, angetrieben von einer robusten Elektronikindustrie, einer wachsenden Nachfrage nach fortschrittlichen Displaytechnologien und der Präsenz führender Halbleiterhersteller

- Die Region profitiert von steigenden Investitionen in Forschung und Entwicklung für Mikroelektronik und optoelektronische Anwendungen, was die Nachfrage nach Hochleistungsglassubstraten steigert.

- Darüber hinaus beschleunigen unterstützende Regierungsinitiativen und der Ausbau der Fertigungsanlagen in den USA und Kanada die Marktakzeptanz in Endverbrauchsbranchen wie der Automobilindustrie, der Luft- und Raumfahrt und dem Gesundheitswesen.

Einblicke in den US-Glassubstratmarkt

Der US-amerikanische Markt für Glassubstrate erzielte 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch die starke Präsenz führender Elektronik- und Halbleiterunternehmen. Das fortschrittliche technologische Ökosystem des Landes, gepaart mit der hohen Nachfrage nach miniaturisierten und hochpräzisen Komponenten in der Unterhaltungselektronik, beflügelt den Markt. Zunehmende Anwendungen in medizinischen Bildgebungsgeräten und Photovoltaikmodulen tragen ebenfalls zum Wachstum bei. Kontinuierliche Innovationen in den Bereichen Glasherstellung und Materialwissenschaft verbessern die Marktaussichten zusätzlich.

Einblicke in den europäischen Glassubstratmarkt

Der europäische Markt für Glassubstrate wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch steigende Investitionen in Photonik, MEMS und Displaytechnologien. Die starke Verankerung der Region in der Automobilelektronik sowie die zunehmende Verbreitung intelligenter Displays und optischer Komponenten unterstützen die anhaltende Marktnachfrage. Strenge Umwelt- und Qualitätsvorschriften fördern zudem den Einsatz hochreiner, nachhaltiger Glassubstrate in zahlreichen Anwendungen in Deutschland, Frankreich und Großbritannien.

Einblicke in den britischen Glassubstratmarkt

Der britische Markt für Glassubstrate wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, unterstützt durch die steigende Nachfrage nach fortschrittlichen Materialien in der Medizin-, Luft- und Raumfahrt- und Optoelektronikbranche. Innovationen in den Bereichen flexible Elektronik und optische Sensoren sowie staatliche Förderung der heimischen Fertigung verbessern die Marktaussichten. Darüber hinaus fördert der Fokus des Landes auf Nachhaltigkeit und Präzisionsfertigung die Akzeptanz in aufstrebenden Hightech-Sektoren.

Markteinblick für Glassubstrate in Deutschland

Der deutsche Markt für Glassubstrate wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben von der führenden Rolle Deutschlands in der Automobiltechnologie, Optik und industriellen Automatisierung. Mit einem starken Fokus auf Feinmechanik und Hochleistungsmaterialien investiert Deutschland massiv in Mikrofertigung und fortschrittliche Substratmaterialien. Der Aufstieg von Industrie 4.0 und intelligenten Fabriken erhöht die Nachfrage nach Glassubstraten für die Sensor- und Displayintegration weiter.

Einblicke in den Markt für Glassubstrate im asiatisch-pazifischen Raum

Der Markt für Glassubstrate im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen. Dies ist auf die boomende Produktion von Unterhaltungselektronik, eine günstige Regierungspolitik und die schnelle Industrialisierung zurückzuführen. Länder wie China, Japan, Südkorea und Taiwan sind Vorreiter bei Innovationen im Bereich Displays, Halbleiter und Solartechnologie. Die Verfügbarkeit kostengünstiger Fertigungsmöglichkeiten, qualifizierter Arbeitskräfte und strategischer Investitionen in Reinraumanlagen beschleunigen das regionale Wachstum deutlich.

Einblicke in den japanischen Glassubstratmarkt

Der japanische Markt für Glassubstrate wird aufgrund der tief verwurzelten Expertise in Präzisionsmaterialien, Mikroelektronik und hochwertigen optischen Technologien voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen. Japans etablierte Unterhaltungselektronik- und Displayindustrie ist ein wichtiger Nachfragetreiber. Darüber hinaus fördern Anwendungen in Automobil-HUDs, Fotomasken und fortschrittlichen medizinischen Geräten die Akzeptanz. Der Fokus auf Produktminiaturisierung und Langlebigkeit stärkt die Marktposition bei hochwertigen Anwendungen zusätzlich.

Einblicke in den chinesischen Markt für Glassubstrate

Der chinesische Markt für Glassubstrate erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum, unterstützt durch die Massenproduktion von Smartphones, Tablets und Displays. Chinas aggressives Streben nach Halbleiterautarkie und der Ausbau der Photovoltaikproduktion treiben den Bedarf an hochwertigen Glassubstraten voran. Dank starker inländischer Lieferanten und staatlicher Anreize für die Technologieentwicklung ist China weiterhin führend im regionalen Wachstum, sowohl beim Volumen- als auch beim Kapazitätsausbau.

Marktanteil von Glassubstraten

Die Glassubstratbranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- AGC Inc. (Japan)

- SCHOTT (Deutschland)

- AvanStrate Inc. (Japan)

- Dongxu Group Co., Ltd. (China)

- Irico Group New Energy Company Limited (China)

- TECNISCO, LTD. (Japan)

- Corning Incorporated (USA)

- Nippon Electric Glass Co., Ltd. (Japan)

- HOYA Corporation (Japan)

- Plan Optik AG (Deutschland)

- Ohara Inc. (Japan)

Neueste Entwicklungen auf dem globalen Markt für Glassubstrate

- Im April 2024 erhielt AGC Inc. eine von SuMPO validierte Umweltproduktdeklaration (EPD) für sein Architektur-Floatglas aus dem Werk Kashima. Diese Initiative soll Käufern helfen, Umweltauswirkungen transparenter zu bewerten und die Einhaltung von Standards für nachhaltiges Bauen wie LEED zu unterstützen. Durch die Ausrichtung auf das mittelfristige Ziel, die Umweltbelastung zu reduzieren, stärkt AGC seine Strategie für nachhaltige Beschaffung und verbessert so die Wachstumschancen im Bausektor.

- Im Januar 2024 erweiterte SCHOTT seine Zusammenarbeit mit Lumus, um der steigenden Nachfrage nach Augmented-Reality-Brillen (AR) gerecht zu werden. Die Erweiterung des malaysischen SCHOTT-Werks wird die Produktion der Z-Lens-Wellenleitertechnologie von Lumus unterstützen. Diese Partnerschaft soll die AR-Entwicklung vom Prototyping bis zur Massenproduktion optimieren, AR-Brillen zugänglicher machen und SCHOTTs Präsenz in der Unterhaltungselektronik stärken.

- Im Mai 2023 erhöhte Corning Incorporated weltweit die Preise für Displayglassubstrate um 20 %, um den steigenden Energie- und Rohstoffkosten Rechnung zu tragen. Diese strategische Preisanpassung soll die Profitabilität trotz Inflation sichern und gleichzeitig die steigende Nachfrage nach Displayglas nutzen. Die Anpassung positioniert Corning für eine anhaltende Marktführerschaft und Umsatzwachstum in einer sich erholenden Elektronikindustrie.

- Im April 2023 präsentierte SCHOTT auf der AWE 2023 in Shanghai innovative Küchenlösungen mit Funktionen wie der CleanPlus-Beschichtung für einfache Pflege und CERAN Luminoir für fortschrittliche Kochfelddesigns. Diese branchenweit anerkannten Produkte spiegeln SCHOTTs Engagement für intelligente Kücheninnovationen wider und stärken die Wettbewerbsfähigkeit des Unternehmens im Haushaltsgerätemarkt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.