Global Critical Illness Insurance Market

Marktgröße in Milliarden USD

CAGR :

%

USD

216.50 Billion

USD

369.97 Billion

2022

2030

USD

216.50 Billion

USD

369.97 Billion

2022

2030

| 2023 –2030 | |

| USD 216.50 Billion | |

| USD 369.97 Billion | |

|

|

|

|

Globaler Markt für Versicherungen gegen schwere Krankheiten, nach Produkttyp (Krankheitsversicherung, Krankenversicherung und Einkommensschutzversicherung), Anwendung (Krebs, Herzinfarkt und Schlaganfall) – Branchentrends und Prognose bis 2030

Marktanalyse und Größe der Schwere-Krankheiten-Versicherung

Der Markt für Versicherungen gegen schwere Krankheiten wird voraussichtlich ein lukratives Wachstum verzeichnen. Die zunehmende Zahl schwerer Erkrankungen wie Schlaganfall, Krebs, Nierenversagen und Herzinfarkt hat sich als Hauptursache für das Bewusstsein der Bevölkerung erwiesen. Die zunehmende Zahl schwerer Erkrankungen und die höheren Ausgaben für Versicherer und Nichtversicherte dürften das Wachstum des Marktes für Versicherungen gegen schwere Krankheiten vorantreiben. Steigende medizinische Kosten dürften den Markt für Versicherungen gegen schwere Krankheiten antreiben.

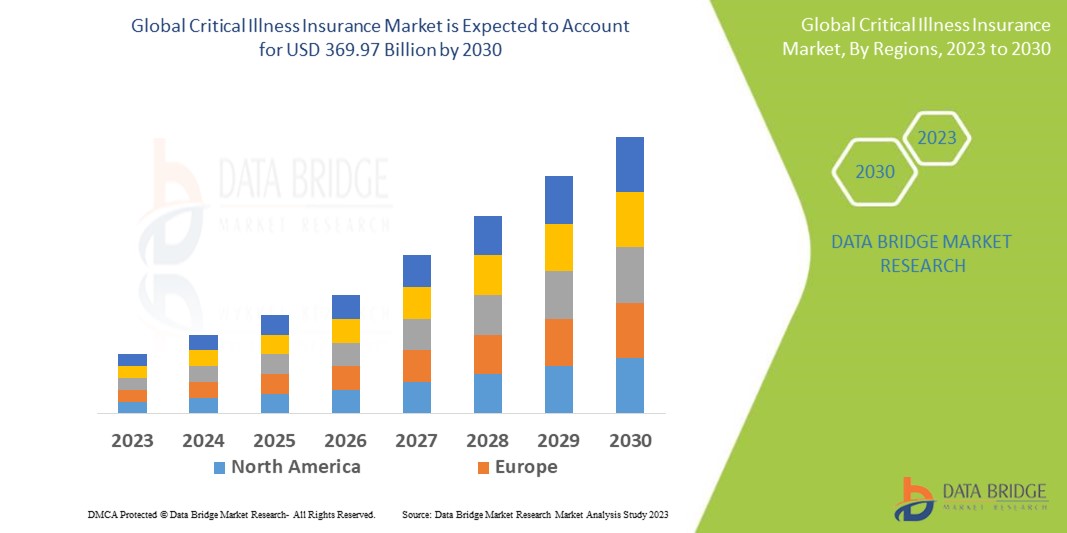

Data Bridge Market Research prognostiziert, dass der Markt für Versicherungen gegen schwere Krankheiten, der im Jahr 2022 216,5 Milliarden US-Dollar betrug, bis 2030 auf 369,97 Milliarden US-Dollar anwachsen und im Prognosezeitraum eine durchschnittliche jährliche Wachstumsrate (CAGR) von 10,40 % verzeichnen wird. „Krankenversicherungen“ dominieren das Produktsegment des Marktes für Versicherungen gegen schwere Krankheiten aufgrund des zunehmenden Bewusstseins und Verständnisses für schwere Krankheiten. Neben Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch umfassende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und Analysen des regulatorischen Rahmens.

Umfang und Segmentierung des Marktes für Versicherungen gegen schwere Krankheiten

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Millionen USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Nach Produkttyp (Krankheitsversicherung, Krankenversicherung und Einkommensschutzversicherung), Anwendung (Krebs, Herzinfarkt und Schlaganfall), |

|

Abgedeckte Länder |

USA, Kanada, Mexiko, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, Restliches Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum, Brasilien, Argentinien, Restliches Südamerika, Südafrika, Saudi-Arabien, Vereinigte Arabische Emirate, Ägypten, Israel, Restlicher Naher Osten und Afrika) |

|

Abgedeckte Marktteilnehmer |

AEGON Life Insurance Company Ltd (Niederlande), AXA Hong Kong (Hongkong), Legal & General Group plc (Großbritannien), Generali China Life Insurance Co. Ltd. (China), Prudential Hong Kong Limited (Hongkong), Bajaj Allianz General Insurance Co. Ltd. (Indien), Tata AIG General Insurance Company Limited (Indien), United Healthcare Services Inc. (USA), Zurich American Insurance Company (USA), AmMetLife Insurance Berhad (Malaysia), Star Union Dai-ichi Life Insurance Company Limited (Indien), Sun Life Assurance Company of Canada (Kanada), AFLAC INCORPORATED (USA), Liberty General Insurance Ltd. (Indien), HCF (Australien), Star Union Dai-ichi Life Insurance Company Limited (Indien), Future Generali India Insurance Company Ltd. (Indien), Religare Health Insurance Company Limited (Indien), Cigna (USA), Manulife Financial Corporation (Kanada), Prudential Financial, Inc. (USA) |

|

Marktchancen |

|

Marktdefinition

Schwere Krankheiten sind im Allgemeinen Krankheiten oder Gesundheitszustände, die eine potenzielle oder unmittelbare Lebensbedrohung darstellen und eine umfassende Pflege und kontinuierliche Überwachung, häufig auf der Intensivstation, erfordern. Eine Schwere-Krankheiten-Versicherung ist ein Versicherungsprodukt, das Ihnen hilft zu prüfen, ob ein Versicherer vertraglich verpflichtet ist, Zahlungen zu leisten, wenn beim Versicherungsnehmer eine bestimmte Krankheit diagnostiziert wird, die im Rahmen einer Versicherungspolice auf einer festgelegten Liste steht.

Globale Marktdynamik für Schwere-Krankheiten-Versicherungen

Treiber

- Zunehmende Prävalenz schwerer Erkrankungen

Die steigende Zahl schwerer Erkrankungen wie Krebs, Herzkrankheiten und Schlaganfällen ist ein wichtiger Treiber für den Markt für Schwere-Krankheiten-Versicherungen. Da sich die Menschen der finanziellen Belastungen dieser Krankheiten zunehmend bewusst werden, steigt die Nachfrage nach Versicherungsschutz zur Abfederung der Behandlungs- und Genesungskosten.

- Steigende Gesundheitsausgaben

Die steigenden Kosten für medizinische Behandlungen und Gesundheitsdienstleistungen haben die Nachfrage nach Versicherungen gegen schwere Krankheiten erhöht. Viele Menschen suchen nach einer Absicherung, die ihnen finanzielle Unterstützung bei teuren medizinischen Behandlungen, Krankenhausaufenthalten, Medikamenten und der Nachsorge bietet.

- Fortschritte in der Medizintechnik und verbesserte Überlebensraten

Fortschritte in der Medizintechnik und Behandlungsprotokollen haben zu verbesserten Überlebensraten bei schweren Erkrankungen geführt. Da immer mehr Menschen schwere Krankheiten überleben, wird der Bedarf an finanzieller Absicherung und Unterstützung während der Genesung immer größer, was die Nachfrage nach einer Versicherung gegen schwere Krankheiten steigert.

Gelegenheiten

- Unerschlossene Märkte und Schwellenländer

In unerschlossenen Märkten und Schwellenländern bieten sich erhebliche Wachstumschancen, da dort die Bekanntheit und Akzeptanz von Versicherungen gegen schwere Krankheiten vergleichsweise gering ist. Mit der Entwicklung dieser Märkte und dem zunehmenden Bewusstsein für das Gesundheitswesen dürfte die Nachfrage nach Versicherungen gegen schwere Krankheiten steigen.

- Produktinnovation und -anpassung:

Versicherer haben die Möglichkeit, innovative und maßgeschneiderte Produkte für die Versicherung schwerer Krankheiten zu entwickeln. Durch flexible Deckungsoptionen, maßgeschneiderte Pakete und zusätzliche Leistungen können Versicherer auf die unterschiedlichen Bedürfnisse und Präferenzen von Personen eingehen, die eine Absicherung gegen schwere Krankheiten suchen.

Einschränkungen/Herausforderungen

- Erschwinglichkeit und Zugänglichkeit

Die Erschwinglichkeit und Zugänglichkeit einer Versicherung gegen schwere Krankheiten kann eine erhebliche Hürde darstellen. Die Prämien können für manche Menschen, insbesondere für einkommensschwache Bevölkerungsgruppen, unerschwinglich sein. Zudem kann der Versicherungsschutz für Personen mit Vorerkrankungen oder einem höheren Risikoprofil eingeschränkt oder gar nicht verfügbar sein.

- Mangelndes Bewusstsein und Verständnis

Mangelndes Bewusstsein und Verständnis für die Schwere-Krankheiten-Versicherung in der Bevölkerung können das Marktwachstum behindern. Viele Menschen verstehen die Vorteile und den Schutz solcher Policen nicht vollständig, was zu einer geringeren Nachfrage und Akzeptanz führt.

- Komplexes Underwriting und Risikobewertung

Die Versicherung schwerer Krankheiten erfordert komplexe Risikoprüfungs- und Risikobewertungsprozesse. Die Bewertung des individuellen Risikoprofils und die Festlegung des geeigneten Versicherungsschutzes können eine Herausforderung sein, insbesondere bei Erkrankungen mit unterschiedlichem Schweregrad und unterschiedlicher Prognose.

- Regulierungs- und Compliance-Probleme

Der Markt für Dread-Disease-Versicherungen unterliegt regionalen, regulatorischen Rahmenbedingungen und Compliance-Anforderungen. Versicherer müssen diese Vorschriften einhalten und die Einhaltung sicherstellen, was Herausforderungen mit sich bringen und die operative Komplexität erhöhen kann.

Dieser Marktbericht zur Dread-Disease-Versicherung enthält Details zu aktuellen Entwicklungen, Handelsbestimmungen, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, dem Einfluss inländischer und lokaler Marktteilnehmer, analysiert Chancen hinsichtlich neuer Einnahmequellen, Änderungen der Marktregulierung, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und Marktdominanz, Produktzulassungen, Produkteinführungen, geografischer Expansion und technologischen Innovationen. Um weitere Informationen zum Markt für Dread-Disease-Versicherungen zu erhalten, kontaktieren Sie Data Bridge Market Research für ein Analysten-Briefing. Unser Team unterstützt Sie bei fundierten Marktentscheidungen und unterstützt Sie bei Ihrem Marktwachstum.

Jüngste Entwicklung

- Im Juli 2020 führte Liberty General Insurance „Critical Connect“ ein. Hier können Kunden zwischen zwei Programmen mit einer Versicherungssumme von 100.000 Rupien bis zu 100.000 Rupien wählen. Wählt der Kunde Plan A, kann er zwischen Paketen für schwere Krankheiten wählen, die 9, 25 oder 43 schwere Krankheiten abdecken. Plan B hingegen bietet krankheitsspezifische Pakete wie Heart Protect, Cancer Protect, Renoliv Protect und Brain Protect. Mit dieser Einführung erweitert das Unternehmen sein Angebot an Versicherungen für schwere Krankheiten.

- Im November 2022 gab die Nassau Financial Group bekannt, dass sie mit der Delaware Life Insurance Company eine verbindliche Vereinbarung zum Kauf der Delaware Life Insurance Company of New York getroffen hat.

Globaler Marktumfang für Versicherungen gegen schwere Krankheiten

Der Markt für Schwere-Krankheiten-Versicherungen ist nach Produkttyp und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen, schwache Wachstumssegmente in den Branchen zu analysieren und bietet Ihnen einen wertvollen Marktüberblick und Markteinblicke, die Ihnen bei strategischen Entscheidungen zur Identifizierung wichtiger Marktanwendungen helfen.

Produkttyp

- Krankheitsversicherung

- Krankenversicherung

- Einkommensschutzversicherung.

Anwendung

- Krebs

- Herzinfarkt

- Schlaganfall.

Regionale Analyse/Einblicke des Marktes für Versicherungen gegen schwere Krankheiten

Der Markt für Versicherungen gegen schwere Krankheiten wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Energiequelle, Produkt und Anwendung bereitgestellt, wie oben angegeben.

Die im Marktbericht für Versicherungen gegen schwere Krankheiten abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, die Niederlande, die Schweiz, Belgien, Russland, Italien, Spanien, die Türkei, das übrige Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, die Philippinen, der übrige asiatisch-pazifische Raum (APAC) in der Region Asien-Pazifik (APAC), Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Israel, der übrige Nahe Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und der übrige Südamerika als Teil Südamerikas.

Nordamerika dürfte den globalen Markt für Versicherungen gegen schwere Krankheiten anführen. Die steigende Zahl chronischer Erkrankungen wie Krebs und die gestiegenen medizinischen Kosten in der Region haben den regionalen Markt vorangetrieben. Der plötzliche Boom bei Krebsdiagnosen und die steigende Sterberate sind jedoch die Hauptfaktoren für das Wachstum des regionalen Marktes.

Im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2023 bis 2030 aufgrund der steigenden Nachfrage nach Krankenversicherungspolicen in bevölkerungsreichen Ländern wie Indien und China ein deutliches Wachstum erwartet.

Der Länderteil des Berichts enthält zudem Informationen zu einzelnen marktbeeinflussenden Faktoren und regulatorischen Veränderungen im Inland, die die aktuellen und zukünftigen Markttrends beeinflussen. Datenpunkte wie die Analyse der vor- und nachgelagerten Wertschöpfungskette, technische Trends, die Fünf-Kräfte-Analyse nach Porter und Fallstudien dienen unter anderem der Prognose des Marktszenarios für einzelne Länder. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund starker oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Prognoseanalyse der Länderdaten berücksichtigt.

Wachstum der installierten Basis der Gesundheitsinfrastruktur und Durchdringung neuer Technologien

Der Markt für Dread-Disease-Versicherungen bietet Ihnen außerdem eine detaillierte Marktanalyse zum Wachstum der Gesundheitsausgaben für Investitionsgüter in jedem Land, zur installierten Basis verschiedener Produkte für den Dread-Disease-Versicherungsmarkt, zum Einfluss der Technologie auf Lebenskurven sowie zu Änderungen der Gesundheitsregulierung und deren Auswirkungen auf den Dread-Disease-Versicherungsmarkt. Die Daten sind für den Zeitraum 2015–2020 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile im Bereich Schwere-Krankheiten-Versicherung

Die Wettbewerbslandschaft im Markt für Dread-Disease-Versicherungen liefert Informationen zu den Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Finanzzahlen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf den Fokus der Unternehmen im Markt für Dread-Disease-Versicherungen.

Zu den wichtigsten Akteuren auf dem Markt für Schwere-Krankheiten-Versicherungen zählen:

- AEGON Life Insurance Company Ltd. – Niederlande

- AXA Hong Kong - Hong Kong

- Legal & General Group plc – Vereinigtes Königreich

- Generali China Life Insurance Co. Ltd. - China

- Prudential Hong Kong Limited - Hongkong

- Bajaj Allianz General Insurance Co. Ltd. – Indien

- Tata AIG General Insurance Company Limited – Indien

- United Healthcare Services Inc. - Vereinigte Staaten

- Zurich American Insurance Company - Vereinigte Staaten

- AmMetLife Insurance Berhad – Malaysia

- Star Union Dai-ichi Life Insurance Company Limited – Indien

- Sun Life Assurance Company of Canada – Kanada

- AFLAC INCORPORATED - Vereinigte Staaten

- Liberty General Insurance Ltd. - Indien

- HCF - Australien

- Zukünftige Generali India Insurance Company Ltd. – Indien

- Religare Health Insurance Company Limited – Indien

- Cigna - Vereinigte Staaten

- Manulife Financial Corporation - Kanada

- Prudential Financial, Inc. – Vereinigte Staaten

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CRITICAL ILLNESS INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE KINESIO TAPE SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CRITICAL ILLNESS INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL CRITICAL ILLNESS INSURANCE MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY TYPE OF INSURANCE

16.1 OVERVIEW

16.2 INDIVIDUAL CRITICAL ILLNESS INSURANCE

16.3 GROUP CRITICAL ILLNESS INSURANCE

16.4 FAMILY FLOATER CRITICAL ILLNESS INSURANCE

16.5 STANDALONE CRITICAL ILLNESS INSURANCE

16.6 RIDER (ADD-ON) CRITICAL ILLNESS INSURANCE

17 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY DISEASE

17.1 OVERVIEW

17.2 CANCER

17.2.1 BREAST CANCER

17.2.2 LUNG CANCER

17.2.3 COLORECTAL CANCER

17.2.4 PROSTATE CANCER

17.2.5 OTHERS

17.3 CARDIOVASCULAR DISEASES

17.3.1 MYOCARDIAL INFARCTION (HEART ATTACK)

17.3.2 STROKE

17.3.3 CORONARY ARTERY BYPASS SURGERY

17.3.4 ANGIOPLASTY

17.3.5 OTHERS

17.4 NEUROLOGICAL DISORDERS

17.4.1 MULTIPLE SCLEROSIS

17.4.2 PARKINSON'S DISEASE

17.4.3 ALZHEIMER'S DISEASE

17.4.4 MOTOR NEURON DISEASE

17.4.5 OTHERS

17.5 ORGAN TRANSPLANTS

17.5.1 KIDNEY TRANSPLANT

17.5.2 LIVER TRANSPLANT

17.5.3 HEART TRANSPLANT

17.5.4 LUNG TRANSPLANT

17.5.5 OTHERS

17.6 OTHERS

18 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY AGE GROUP

18.1 OVERVIEW

18.2 CHILDREN (BELOW 18 YEARS)

18.3 YOUNG ADULTS (18-35 YEARS)

18.4 MIDDLE-AGED ADULTS (36-55 YEARS)

18.5 SENIOR CITIZENS (ABOVE 55 YEARS)

19 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY POLICY TERM

19.1 OVERVIEW

19.2 STANDARD SHORT-TERM POLICIES (LESS THAN 5 YEARS)

19.3 MEDIUM-TERM POLICIES (5-10 YEARS)

19.4 LONG-TERM POLICIES (MORE THAN 10 YEARS)

20 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY PREMIUM TYPE

20.1 OVERVIEW

20.2 REGULAR PREMIUM

20.3 SINGLE PREMIUM

20.4 LIMITED PREMIUM

21 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY END USER

21.1 OVERVIEW

21.2 INDIVIDUALS

21.3 CORPORATE EMPLOYEES

21.4 SELF-EMPLOYED INDIVIDUALS

21.5 FAMILIES

22 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT SALES

22.3 INSURANCE BROKERS/AGENTS

22.4 BANKS (BANCASSURANCE)

22.5 ONLINE PLATFORMS

22.6 CORPORATE SALES

23 GLOBAL CRITICAL ILLNESS INSURANCE MARKET BY COVERAGE AMOUNT

23.1 OVERVIEW

23.2 UP TO USD 50,000

23.3 USD 50,001 - USD 100,000

23.4 USD 100,001 - USD 500,000

23.5 ABOVE USD 500,000

24 GLOBAL CRITICAL ILLNESS INSURANCE MARKET, BY GEOGRAPHY

GLOBAL CRITICAL ILLNESS INSURANCE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1 NORTH AMERICA

24.1.1 U.S.

24.1.2 CANADA

24.1.3 MEXICO

24.2 EUROPE

24.2.1 GERMANY

24.2.2 FRANCE

24.2.3 U.K.

24.2.4 ITALY

24.2.5 SPAIN

24.2.6 RUSSIA

24.2.7 TURKEY

24.2.8 BELGIUM

24.2.9 NETHERLANDS

24.2.10 SWITZERLAND

24.2.11 REST OF EUROPE

24.3 ASIA-PACIFIC

24.3.1 JAPAN

24.3.2 CHINA

24.3.3 SOUTH KOREA

24.3.4 INDIA

24.3.5 AUSTRALIA

24.3.6 SINGAPORE

24.3.7 THAILAND

24.3.8 MALAYSIA

24.3.9 INDONESIA

24.3.10 PHILIPPINES

24.3.11 REST OF ASIA-PACIFIC

24.4 SOUTH AMERICA

24.4.1 BRAZIL

24.4.2 ARGENTINA

24.4.3 PERU

24.4.4 CHILE

24.4.5 COLOMBIA

24.4.6 VENEZUELA

24.4.7 REST OF SOUTH AMERICA

24.5 MIDDLE EAST AND AFRICA

24.5.1 SOUTH AFRICA

24.5.2 SAUDI ARABIA

24.5.3 UAE

24.5.4 EGYPT

24.5.5 ISRAEL

24.5.6 REST OF MIDDLE EAST AND AFRICA

24.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL CRITICAL ILLNESS INSURANCE MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL CRITICAL ILLNESS INSURANCE MARKET, SWOT AND DBMR ANALYSIS

27 GLOBAL CRITICAL ILLNESS INSURANCE MARKET, COMPANY PROFILE

27.1 ALLIANZ

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPEMENTS

27.2 CHINA LIFE INSURANCE COMPANY

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPEMENTS

27.3 SPIDERTECH INC. AFLAC INCORPORATED

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPEMENTS

27.4 AEGON

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPEMENTS

27.5 AIG

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPEMENTS

27.6 AMERICAN FIDELITY

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPEMENTS

27.7 AVIVA

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPEMENTS

27.8 UNITEDHEALTHCARE

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPEMENTS

27.9 DESJARDINS GROUP

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPEMENTS

27.1 LEGAL & GENERAL GROUP PLC

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPEMENTS

27.11 GENERALI CHINA LIFE INSURANCE CO. LTD.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPEMENTS

27.12 PRUDENTIAL HONG KONG LIMITED

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPEMENTS

27.13 AMMETLIFE INSURANCE BERHAD

27.13.1 COMPANY OVERVIEW

27.13.2 REVENUE ANALYSIS

27.13.3 GEOGRAPHIC PRESENCE

27.13.4 PRODUCT PORTFOLIO

27.13.5 RECENT DEVELOPEMENTS

27.14 STAR UNION DAI-ICHI LIFE INSURANCE COMPANY LIMITED

27.14.1 COMPANY OVERVIEW

27.14.2 REVENUE ANALYSIS

27.14.3 GEOGRAPHIC PRESENCE

27.14.4 PRODUCT PORTFOLIO

27.14.5 RECENT DEVELOPEMENTS

27.15 SUN LIFE ASSURANCE COMPANY OF CANADA

27.15.1 COMPANY OVERVIEW

27.15.2 REVENUE ANALYSIS

27.15.3 GEOGRAPHIC PRESENCE

27.15.4 PRODUCT PORTFOLIO

27.15.5 RECENT DEVELOPEMENTS

27.16 LIBERTY GENERAL INSURANCE LTD.

27.16.1 COMPANY OVERVIEW

27.16.2 REVENUE ANALYSIS

27.16.3 GEOGRAPHIC PRESENCE

27.16.4 PRODUCT PORTFOLIO

27.16.5 RECENT DEVELOPEMENTS

27.17 HCF

27.17.1 COMPANY OVERVIEW

27.17.2 REVENUE ANALYSIS

27.17.3 GEOGRAPHIC PRESENCE

27.17.4 PRODUCT PORTFOLIO

27.17.5 RECENT DEVELOPEMENTS

27.18 FUTURE GENERALI INDIA INSURANCE COMPANY LTD.

27.18.1 COMPANY OVERVIEW

27.18.2 REVENUE ANALYSIS

27.18.3 GEOGRAPHIC PRESENCE

27.18.4 PRODUCT PORTFOLIO

27.18.5 RECENT DEVELOPMENTS.

27.19 RELIGARE HEALTH INSURANCE COMPANY LIMITED

27.19.1 COMPANY OVERVIEW

27.19.2 REVENUE ANALYSIS

27.19.3 GEOGRAPHIC PRESENCE

27.19.4 PRODUCT PORTFOLIO

27.19.5 RECENT DEVELOPEMENTS

27.2 CIGNA

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPEMENTS

27.21 MANULIFE FINANCIAL CORPORATION -

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPEMENTS

27.22 PRUDENTIAL FINANCIAL, INC.

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPEMENTS

27.23 AXA HONG KONG

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 ICICI PRUDENTIAL LIFE INSURANCE COMPANY LIMITED

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPEMENTS

27.25 GUARDIAN LIFE INSURANCE COMPANY OF AMERICA

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

27.26 OLD MUTUAL LIMITED

27.26.1 COMPANY OVERVIEW

27.26.2 REVENUE ANALYSIS

27.26.3 GEOGRAPHIC PRESENCE

27.26.4 PRODUCT PORTFOLIO

27.26.5 RECENT DEVELOPEMENTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.