Global Cocoa Butter Equivalent Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.23 Billion

USD

1.70 Billion

2024

2032

USD

1.23 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.70 Billion | |

|

|

|

|

Globale Marktsegmentierung für Kakaobutteräquivalente nach Produkttyp (Kokumbutter, Mangobutter, Palm- und Palmkernöl, Salfett und Sheabutter), Anwendung (Süßwaren, Kosmetik, Lebensmittel und Getränke usw.) – Branchentrends und Prognose bis 2032

Marktgröße für Kakaobutteräquivalente

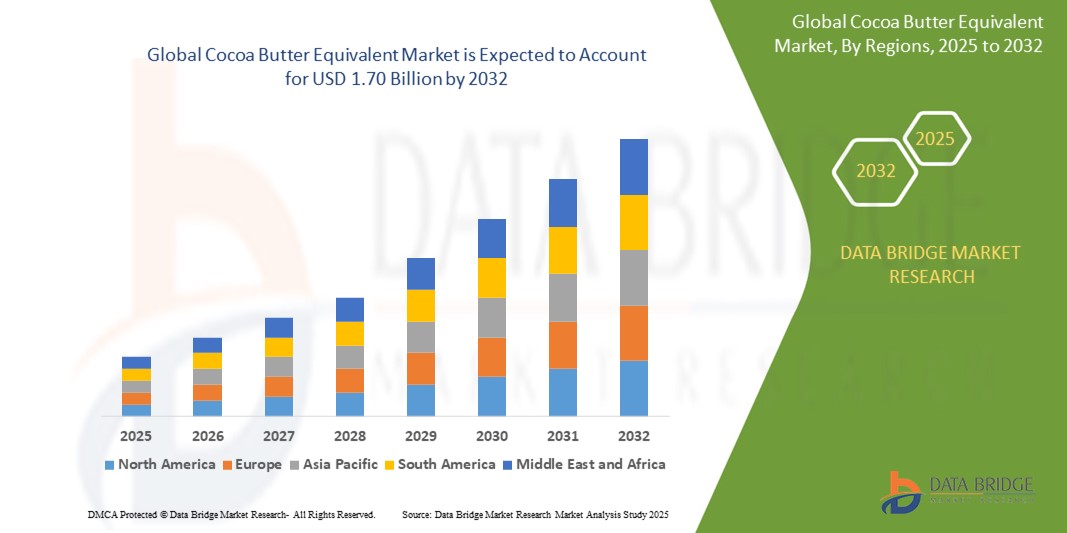

- Der globale Markt für Kakaobutteräquivalente wurde im Jahr 2024 auf 1,23 Milliarden US-Dollar geschätzt und dürfte bis 2032 1,70 Milliarden US-Dollar erreichen , bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,06 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach kostengünstigen und nachhaltigen Alternativen zu Kakaobutter, insbesondere in der Schokoladen- und Süßwarenproduktion, vorangetrieben.

- Die steigende Vorliebe der Verbraucher für pflanzliche und allergenfreie Produkte treibt auch die Nachfrage nach Kakaobutter-Äquivalenten aus Shea-, Palm-, Sal- und Kokumbutter an.

Marktanalyse für Kakaobutteräquivalente

- Der Markt wird durch die starke Nachfrage der Lebensmittel- und Getränkeindustrie angetrieben, insbesondere für den Einsatz in Schokoladenrezepturen, wo CBE Kakaobutter ersetzen kann, ohne die Textur oder den Geschmack zu beeinträchtigen.

- Hersteller investieren zunehmend in Forschung und Entwicklung, um die Funktionalität und Kompatibilität von Kakaobutteräquivalenten zu verbessern und so eine bessere Wärmebeständigkeit und längere Haltbarkeit zu gewährleisten.

- Europa dominierte den Markt für Kakaobutteräquivalente mit dem größten Umsatzanteil von 38,9 % im Jahr 2024, angetrieben durch die starke Nachfrage aus der Süßwaren- und Kosmetikindustrie, insbesondere in Ländern wie Deutschland, Frankreich und Großbritannien.

- Der asiatisch-pazifische Raum wird voraussichtlich die höchste Wachstumsrate im globalen Markt für Kakaobutteräquivalente verzeichnen. Diese Entwicklung wird durch schnell wachsende Volkswirtschaften, einen steigenden Konsum von Süßwaren und eine steigende Nachfrage aus Schwellenländern wie China, Indien und Indonesien vorangetrieben. Auch die wachsende Mittelschicht und veränderte Ernährungsgewohnheiten spielen eine wichtige Rolle bei der Marktexpansion.

- Das Segment Palm- und Palmkernöl dominierte den Markt mit dem größten Umsatzanteil von 39,6 % im Jahr 2024, vor allem aufgrund ihrer breiten Verfügbarkeit, Kosteneffizienz und einfachen Verarbeitung. Diese Öle ähneln in ihrem Schmelzprofil stark dem von Kakaobutter und werden häufig in der großtechnischen Schokoladen- und Süßwarenherstellung verwendet. Ihre Skalierbarkeit und gleichbleibende Qualität machen sie zu einer attraktiven Wahl für multinationale Lebensmittelunternehmen, die ihre Produktionskosten optimieren möchten.

Berichtsumfang und Marktsegmentierung für Kakaobutteräquivalente

|

Eigenschaften |

Wichtige Markteinblicke zu Kakaobutteräquivalenten |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

• Erweiterung der Anwendungen für Süßwaren auf pflanzlicher Basis • Steigende Nachfrage nach kostengünstigen Kakaoalternativen |

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Kakaobutteräquivalente

„Steigende Präferenz für nachhaltige und ethisch gewonnene Zutaten“

- Verbraucher verlangen aufgrund des steigenden Bewusstseins für Umwelt- und Arbeitsprobleme zunehmend nach nachhaltig und ethisch gewonnenen Kakaobutteräquivalenten

- Marken formulieren Produkte mit RSPO-zertifiziertem Palmöl und anderen rückverfolgbaren Pflanzenfetten neu, um die Transparenz zu erhöhen und das Vertrauen der Verbraucher zu stärken

- Clean-Label-Trends und umweltbewusstes Kaufverhalten der Millennials und der Generation Z beschleunigen den Wandel hin zu nachhaltigen CBEs

- Einzelhändler üben Druck auf Lieferanten aus, Nachhaltigkeitsstandards einzuhalten, und beeinflussen CBE-Produzenten, ethische Beschaffungspraktiken einzuführen

- So hat sich beispielsweise Barry Callebaut verpflichtet, bis 2025 ausschließlich nachhaltige Zutaten zu beschaffen, darunter auch verantwortungsvoll beschaffte CBEs für seine Schokoladenproduktion.

Marktdynamik für Kakaobutteräquivalente

Treiber

„Kosteneffizienz und funktionelle Vielseitigkeit von Kakaobutteräquivalenten“

- CBEs sind deutlich kostengünstiger als Kakaobutter und helfen Herstellern, die Produktionskosten zu senken, ohne die Produktqualität zu beeinträchtigen.

- Diese Alternativen imitieren das Schmelzverhalten und die Textur von Kakaobutter und sind daher ideal für verschiedene Süßwaren- und Backanwendungen.

- CBEs verbessern die Produktstabilität und Haltbarkeit, was besonders in tropischen Regionen wertvoll ist, in denen Kakaobutter schneller zerfallen kann.

- Ihre Kompatibilität mit bestehenden Kakaobuttermischungen bietet Herstellern Flexibilität bei der Formulierung und Skalierbarkeit in der Produktion

- So hat Nestlé beispielsweise palmbasierte CBEs in mehreren Produktlinien in ganz Asien verwendet, um die Produktionskosten zu optimieren und gleichzeitig den für den Verbraucher akzeptablen Geschmack und die Textur beizubehalten.

Einschränkung/Herausforderung

„Regulatorische Einschränkungen und Probleme mit der Verbraucherwahrnehmung“

- In vielen Regionen gelten strenge Vorschriften für den maximal zulässigen Anteil an CBEs in Schokolade. Oft liegt dieser bei 5 %, was die Formulierungsfreiheit einschränkt.

- Die obligatorische Offenlegung und Kennzeichnung von CBEs kann das Produktimage beeinträchtigen und die Qualitätswahrnehmung der Verbraucher negativ beeinflussen.

- Einige Verbraucher betrachten CBEs als künstlichen oder minderwertigen Ersatz für Kakaobutter, insbesondere in den Kategorien Premium- und Bio-Produkte

- Technische Herausforderungen ergeben sich aus der Aufrechterhaltung der Konsistenz von Geschmack und Textur über verschiedene CBEs-Typen und Anwendungen hinweg

- In der Europäischen Union beispielsweise müssen Schokoladenprodukte, die CBEs verwenden, strenge Zusammensetzungsregeln und Kennzeichnungsstandards einhalten, was die Einführung von CBEs in Premium-Schokoladensegmenten verlangsamt hat.

Marktumfang für Kakaobutteräquivalente

Der Markt ist nach Produkttyp und Anwendung segmentiert.

- Nach Produkttyp

Der Markt für Kakaobutteräquivalente ist nach Produkttyp in Kokumbutter, Mangobutter, Palm- und Palmkernöl, Salfett und Sheabutter unterteilt. Das Segment Palm- und Palmkernöl dominierte den Markt mit dem größten Umsatzanteil von 39,6 % im Jahr 2024, vor allem aufgrund der breiten Verfügbarkeit, Kosteneffizienz und einfachen Verarbeitung. Diese Öle ähneln stark dem Schmelzprofil von Kakaobutter und werden häufig in der großtechnischen Schokoladen- und Süßwarenherstellung verwendet. Ihre Skalierbarkeit und gleichbleibende Qualität machen sie zu einer attraktiven Wahl für multinationale Lebensmittelunternehmen, die ihre Produktionskosten optimieren möchten.

Das Segment Sheabutter wird voraussichtlich von 2025 bis 2032 das stärkste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage sowohl in der Süßwaren- als auch in der Kosmetikindustrie. Sheabutter wird wegen ihrer feuchtigkeitsspendenden Eigenschaften und ihrer funktionellen Ähnlichkeit mit Kakaobutter geschätzt und ist daher eine beliebte Alternative in Hautpflegeprodukten und Gourmet-Schokolade. Die wachsende Verbraucherpräferenz für natürliche und ethisch einwandfreie Inhaltsstoffe fördert zudem die Akzeptanz von Sheabutter als nachhaltigem Kakaobutterersatz.

- Nach Anwendung

Der Markt für Kakaobutteräquivalente ist nach Anwendungsgebieten in Süßwaren, Kosmetika, Lebensmittel und Getränke sowie weitere Segmente unterteilt. Das Süßwarensegment hatte 2024 den größten Marktanteil, was auf die weit verbreitete Verwendung von Kakaobutteräquivalenten in Schokolade, Füllungen und Überzügen zurückzuführen ist. Kakaobutteräquivalente verbessern die Produktkonsistenz und Haltbarkeit, insbesondere in warmen Klimazonen, wo Kakaobutter allein die Textur beeinträchtigen kann.

Das Kosmetiksegment wird voraussichtlich von 2025 bis 2032 das höchste Wachstum verzeichnen, unterstützt durch die steigende Beliebtheit natürlicher Weichmacher und pflanzlicher Alternativen in Hautpflegeprodukten. Kosmetikhersteller bevorzugen zunehmend CBD-Produkte wie Mango- und Kokumbutter aufgrund ihrer pflegenden Eigenschaften und ihrer Kompatibilität mit Bio-Produktlinien und entsprechen damit den sich entwickelnden Verbraucherpräferenzen für saubere Schönheitslösungen.

Regionale Analyse des Kakaobutteräquivalentmarktes

- Europa dominierte den Markt für Kakaobutteräquivalente mit dem größten Umsatzanteil von 38,9 % im Jahr 2024, angetrieben durch die starke Nachfrage aus der Süßwaren- und Kosmetikindustrie, insbesondere in Ländern wie Deutschland, Frankreich und Großbritannien.

- Die Region profitiert von einem ausgereiften Schokoladensektor und einem steigenden Trend zu nachhaltigen und kostengünstigen Zutaten, wodurch Kakaobutteräquivalente als praktikable Lösung positioniert werden.

- Das gestiegene Gesundheitsbewusstsein und die Nachfrage nach pflanzlichen Inhaltsstoffen fördern die Verwendung natürlicher und alternativer Fette in Lebensmitteln und Körperpflegeprodukten in ganz Europa.

Markteinblick in Kakaobutteräquivalente in Deutschland

Der deutsche Markt für Kakaobutteräquivalente dominierte 2024 den Markt mit dem größten Umsatzanteil. Dies ist auf die groß angelegte Schokoladenproduktion des Landes und die steigende Nachfrage nach Clean-Label-Zutaten zurückzuführen. Die Präsenz globaler Süßwarenmarken, gepaart mit Deutschlands Fokus auf Lebensmittelqualität und Innovation, beschleunigt den Trend zu Kakaobutterersatzstoffen aus Palmkernöl, Sheabutter und anderen natürlichen Quellen. Die robuste Lieferketteninfrastruktur des Landes und das wachsende Bewusstsein für die Nachhaltigkeit von Zutaten sorgen weiterhin für günstige Marktbedingungen.

Markteinblick in das britische Kakaobutteräquivalent

Der britische Markt für Kakaobutteräquivalente wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach pflanzlichen Inhaltsstoffen in Lebensmitteln und Körperpflegeprodukten. Die starke Süßwarentradition Großbritanniens und die zunehmende Vorliebe der Verbraucher für nachhaltige und ethische Beschaffung ermutigen Hersteller, auf Kakaobutteralternativen wie Sheabutter und Mangobutter zurückzugreifen. Der regulatorische Schwerpunkt des Landes auf Clean Labelling und natürliche Rezepturen unterstützt die Wachstumskurve des Marktes zusätzlich.

Markteinblick in den Kakaobutteräquivalentmarkt Nordamerika

Der nordamerikanische Markt für Kakaobutteräquivalente wird voraussichtlich zwischen 2025 und 2032 das höchste Wachstum verzeichnen, unterstützt durch die zunehmende Anwendung in den Bereichen Körperpflege und Kosmetik. Verbraucher bevorzugen zunehmend Hautpflege- und Schönheitsprodukte mit natürlichen und pflegenden Alternativen wie Mangobutter und Sheabutter. Die USA sind regional führend in der Nachfrage, angetrieben von einem florierenden Wellnessmarkt und kontinuierlicher Produktinnovation lokaler und multinationaler Hersteller, die auf Nachhaltigkeit und hautfreundliche Inhaltsstoffe setzen.

Markteinblick in Kakaobutteräquivalente in den USA

Der US-Markt für Kakaobutteräquivalente wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, unterstützt durch die zunehmende Verwendung von Kakaobutteralternativen in Lebensmitteln und Körperpflegeprodukten. US-Unternehmen investieren in die Forschung und Entwicklung gentechnikfreier und biologischer Fettmischungen, um den sich wandelnden Verbraucherpräferenzen gerecht zu werden. Da die Nachfrage nach veganen, allergenfreien und erschwinglichen Schokoladenprodukten steigt, wird der US-Markt voraussichtlich weiterhin eine Vorreiterrolle bei der Innovation im Bereich Kakaobutteräquivalente einnehmen.

Markteinblick in Kakaobutteräquivalente im asiatisch-pazifischen Raum

Der Markt für Kakaobutteräquivalente im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 5,6 % wachsen. Dies ist auf den steigenden Schokoladenkonsum, steigende Kosmetikexporte und die expandierende Lebensmittelindustrie in Ländern wie China, Indien und Indonesien zurückzuführen. Die Erschwinglichkeit und lokale Verfügbarkeit von Palm- und Salfetten machen sie zur bevorzugten Wahl für regionale Hersteller. Staatliche Unterstützung der industriellen Entwicklung und ausländische Investitionen im Lebensmittelsektor tragen zusätzlich zum Marktwachstum in der gesamten Region bei.

Markteinblick in China für Kakaobutteräquivalente

China entwickelt sich zu einem wichtigen Akteur im Markt für Kakaobutteräquivalente, unterstützt durch die steigende Nachfrage nach Schokoladensnacks und Hautpflegeprodukten. Mit dem Wachstum der chinesischen Mittelschicht wächst auch die Nachfrage nach hochwertigen und dennoch kostengünstigen Produkten. Hersteller setzen verstärkt auf Sheabutter und andere pflanzliche Öle, um ihre Rezepturen zu diversifizieren, die Abhängigkeit von Kakaobutter zu reduzieren und den sich entwickelnden gesetzlichen und Verbraucherstandards des Landes gerecht zu werden. Chinas dynamische Einzelhandelslandschaft und die rasante Produktinnovation dürften das Marktwachstum weiter vorantreiben.

Markteinblick in japanisches Kakaobutteräquivalent

Der japanische Markt für Kakaobutteräquivalente wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 5,6 % wachsen. Dies wird durch den Schwerpunkt des Landes auf hochwertige Inhaltsstoffe in Süßwaren und Hautpflegeprodukten unterstützt. Japanische Verbraucher legen Wert auf Reinheit und Funktionalität, was zu einer zunehmenden Nutzung hochwertiger Kakaobutteralternativen wie Kokumbutter und Salfett geführt hat. Der japanische Kosmetiksektor trägt insbesondere zum Marktwachstum bei, da Marken diese natürlichen Ersatzstoffe verwenden, um die Nachfrage nach wirksamen, hautfreundlichen Rezepturen zu decken.

Marktanteil Kakaobutteräquivalent

Die Kakaobutteräquivalent-Industrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- 3F GROUP (Indien)

- AAK AB (Schweden)

- Cargill, Incorporated (USA)

- FUJI OIL ASIA PTE. LTD. (Singapur)

- Bunge Loders Croklaan (Niederlande)

- Manorama Industries Limited (Indien)

- Mewah Group (Singapur)

- INTERCONTINENTAL SPECIALTY FATS SDN. BHD. (Malaysia)

- Olam International (Singapur)

- Wilmar International Ltd (Singapur)

- Musim Mas (Indonesien)

- FGV IFFCO SDN BHD (Malaysia)

- ADM (USA)

- Makendi WorldWide (USA)

- EFKO-Gruppe (Russland)

- Mallinath Group (Indien)

- USHA INTERNATIONAL (Indien)

- Wild Oils (Australien)

- GEF Indien (Indien)

- PT. WILMAR CAHAYA INDONESIA (Indonesien)

Neueste Entwicklungen auf dem globalen Markt für Kakaobutteräquivalente

- Im Februar 2024 brachte SheaMoisture seine erste Deodorant-Kollektion auf den Markt. Sie umfasst sechs Antitranspirantien und zwei Ganzkörperdeodorants, die speziell auf Personen mit erhöhtem Melaninspiegel in der Haut abgestimmt sind. Die in Zusammenarbeit mit schwarzen Dermatologen entwickelten Produkte gehen auf spezifische Bedürfnisse ein, darunter die Verbesserung des Hauttons, die Feuchtigkeitsversorgung und die Förderung einer glatten Hautstruktur. Darüber hinaus bieten sie wirksamen Schutz vor Körpergeruch und Schweiß und gehen auf die besonderen Bedürfnisse ihrer Zielgruppe ein.

- Im Februar 2022 kündigte AAK AB eine bedeutende Investition von rund 54,7 Millionen US-Dollar in die Installation von Biomassekesseln an seinem Produktionsstandort in Aarhus an. Diese Initiative soll die CO2-Emissionen um bis zu 90 % senken. Die Biomassekessel werden Sheamehl, ein Nebenprodukt der Shea-basierten Lebensmittelproduktion, verwenden und tragen so zu AAKs Engagement für Nachhaltigkeit und Umweltverantwortung in der Lebensmittelindustrie bei.

- Im Juni 2021 erweiterte AAK sein Produktangebot um Kakaobutterersatz aus Sheabutter für Mars zur Verwendung in Schokolade und Süßwaren. Diese Innovation erfüllt nicht nur den Bedarf der Branche an hochwertigen Alternativen, sondern unterstreicht auch die Vielseitigkeit von Sheabutter. Sie bietet Herstellern eine nachhaltige Option, die ihre Produkte verbessern und gleichzeitig den Verbraucherwünschen nach gesundheitsbewussten Zutaten gerecht werden möchten.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.