Global Clinical Laboratory Services Market

Marktgröße in Milliarden USD

CAGR :

%

USD

319.13 Billion

USD

569.17 Billion

2024

2032

USD

319.13 Billion

USD

569.17 Billion

2024

2032

| 2025 –2032 | |

| USD 319.13 Billion | |

| USD 569.17 Billion | |

|

|

|

|

Globale Marktsegmentierung für klinische Labordienstleistungen nach Fachgebiet (klinische Chemietests, Hämatologietests, mikrobiologische Tests, immunologische Tests, Drogentests, Zytologietests und genetische Tests), Anbieter (unabhängige und Referenzlabore, eigenständige, Krankenhauslabore und Labore in Pflegeheimen und Arztpraxen), Anwendung (Dienstleistungen im Zusammenhang mit der Arzneimittelentdeckung, Arzneimittelentwicklung, bioanalytische und laborchemische Dienstleistungen, toxikologische Testdienstleistungen, Dienstleistungen im Zusammenhang mit Zell- und Gentherapie, Dienstleistungen im Zusammenhang mit präklinischen und klinischen Studien und Sonstiges), Dienstleistungstyp (Routinetestdienstleistungen, esoterische Dienstleistungen und anatomische Pathologiedienstleistungen) – Branchentrends und Prognose bis 2032

Globale Marktgröße für klinische Labordienstleistungen

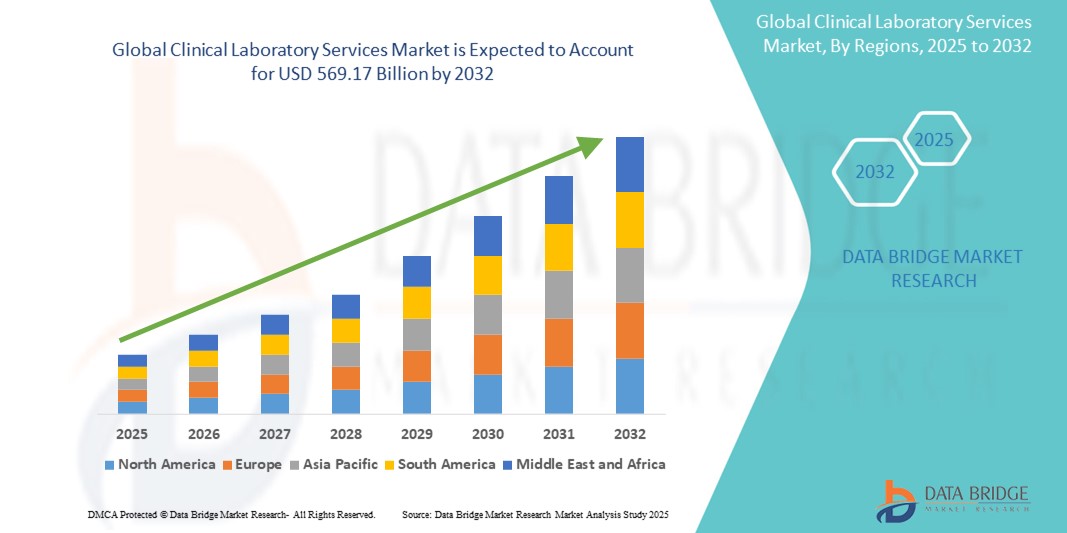

- Der globale Markt für klinische Labordienstleistungen wurde im Jahr 2024 auf 319,13 Milliarden US-Dollar geschätzt und dürfte bis 2032 einen Wert von 569,17 Milliarden US-Dollar erreichen , bei einer jährlichen Wachstumsrate von 7,5 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie die zunehmende Verbreitung chronischer Krankheiten, die alternde Bevölkerung und den technologischen Fortschritt vorangetrieben.

Globaler Markt für klinische Labordienstleistungen

- Klinische Labordienstleistungen sind für die Erkennung, Diagnose und Überwachung von Krankheiten unerlässlich und liefern präzise und zeitnahe Testergebnisse für die Patientenversorgung. Zu diesen Dienstleistungen gehören Routine-Blutuntersuchungen, Molekulardiagnostik, Mikrobiologie, Pathologie und genetische Tests, die eine entscheidende Rolle im Krankheitsmanagement und der Behandlungsplanung spielen .

- Die Nachfrage nach klinischen Labordienstleistungen wird maßgeblich durch die zunehmende Verbreitung chronischer Krankheiten, die alternde Bevölkerung und die zunehmende Betonung der präventiven Gesundheitsfürsorge und der Früherkennung von Krankheiten getrieben.

- Es wird erwartet, dass Nordamerika den globalen Markt für klinische Labordienstleistungen mit 44,5 % dominieren wird. Dies ist auf die fortschrittliche Gesundheitsinfrastruktur, die hohen Gesundheitsausgaben und die frühzeitige Einführung fortschrittlicher Diagnosetechnologien zurückzuführen.

- Der asiatisch-pazifische Raum dürfte mit einem CGR von 8,10 % die am schnellsten wachsende Region im globalen Markt für klinische Labordienstleistungen sein, angetrieben durch die schnelle Entwicklung der Gesundheitsinfrastruktur, das steigende Gesundheitsbewusstsein und die steigende Nachfrage nach diagnostischen Tests in Schwellenländern.

- Routinediagnostikdienste werden voraussichtlich den Markt dominieren und einen Marktanteil von 57,6 % erreichen, da sie eine entscheidende Rolle im Gesundheitswesen spielen. Diese Tests, darunter Blutuntersuchungen, Urinanalysen und grundlegende Stoffwechseluntersuchungen, bilden das Rückgrat der klinischen Diagnostik und unterstützen routinemäßige Gesundheitsuntersuchungen, die Krankheitsüberwachung und die Früherkennung von Krankheiten.

Berichtsumfang und globale Marktsegmentierung für klinische Labordienstleistungen

|

Eigenschaften |

Globaler Markt für klinische Labordienstleistungen – Wichtige Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Globale Markttrends für klinische Labordienstleistungen

„Fortschritte in der Automatisierung und digitalen Technologien für klinische Labordienstleistungen“

- Ein wichtiger Trend in der Entwicklung klinischer Labordienstleistungen ist die zunehmende Integration von Automatisierung, künstlicher Intelligenz (KI) und digitalen Technologien

- Diese Innovationen verbessern die Effizienz, Genauigkeit und Geschwindigkeit diagnostischer Tests, reduzieren menschliche Fehler und ermöglichen schnellere Bearbeitungszeiten für wichtige medizinische Entscheidungen.

- Moderne Laborautomatisierungssysteme können beispielsweise große Probenmengen verarbeiten, Routineuntersuchungen automatisieren und das Datenmanagement integrieren, wodurch der manuelle Arbeitsaufwand und die Betriebskosten deutlich reduziert werden. KI-gesteuerte Plattformen werden zudem zur Analyse komplexer Datensätze eingesetzt, liefern präzisere diagnostische Erkenntnisse und unterstützen die personalisierte Medizin.

- Diese Fortschritte verändern die klinische Diagnostik, verbessern die Behandlungsergebnisse und treiben die Nachfrage nach Labordienstleistungen der nächsten Generation voran, die höhere Präzision und Zuverlässigkeit bieten.

Globale Marktdynamik für klinische Labordienstleistungen

Treiber

„Steigende Nachfrage aufgrund der zunehmenden Verbreitung chronischer Krankheiten“

- Die zunehmende Verbreitung chronischer Krankheiten wie Krebs, Herz-Kreislauf-Erkrankungen, Diabetes und Infektionskrankheiten trägt erheblich zur steigenden Nachfrage nach klinischen Labordienstleistungen bei

- Mit der Alterung der Weltbevölkerung steigt die Zahl dieser Erkrankungen weiter an, was zu einer höheren Nachfrage nach diagnostischen Tests zur Früherkennung, Behandlungsplanung und Krankheitsüberwachung führt.

- Da immer mehr Menschen regelmäßige Gesundheitschecks und Diagnosedienste in Anspruch nehmen, steigt die Nachfrage nach klinischen Labortests, einschließlich Blutuntersuchungen, molekularer Diagnostik und genetischer Tests, weiter an und trägt so zu besseren Behandlungsergebnissen bei.

Zum Beispiel,

- Laut der Weltgesundheitsorganisation (WHO) waren im Dezember 2021 nichtübertragbare Krankheiten (NCDs) für fast 71 % aller weltweiten Todesfälle verantwortlich, wobei Herz-Kreislauf-Erkrankungen, Krebs, Atemwegserkrankungen und Diabetes die Hauptursachen waren. Dieser Trend treibt die Nachfrage nach fortschrittlichen klinischen Labordienstleistungen zur Früherkennung und Behandlung von Krankheiten voran.

- Aufgrund der zunehmenden Verbreitung chronischer Krankheiten steigt die Nachfrage nach klinischen Labortests erheblich an. Diese spielen eine entscheidende Rolle bei der Verbesserung der Gesundheitsergebnisse und der Verringerung der Gesamtbelastung des Gesundheitswesens.

Gelegenheit

„Integration von Künstlicher Intelligenz und Automatisierung in klinischen Laboren“

- KI-gestützte Diagnoseplattformen und automatisierte Laborsysteme können die Geschwindigkeit, Genauigkeit und Effizienz diagnostischer Tests verbessern und es Laboren ermöglichen, große Probenmengen mit minimalem menschlichen Eingriff zu verarbeiten.

- KI-Algorithmen können komplexe Datensätze analysieren, Muster erkennen und schnellere, genauere Diagnoseergebnisse liefern und so die personalisierte Medizin und Präzisionsdiagnostik unterstützen.

- Darüber hinaus kann die Automatisierung die Arbeitsabläufe im Labor rationalisieren, die Durchlaufzeiten verkürzen und die Betriebskosten senken, wodurch Labore effizienter und skalierbarer werden.

Zum Beispiel ,

- Laut einem im Januar 2025 im JAMA Network veröffentlichten Artikel haben KI-gesteuerte Diagnosesysteme eine hohe Genauigkeit bei der Erkennung von Krankheiten wie Krebs, Herz-Kreislauf-Erkrankungen und neurologischen Störungen bewiesen. Diese Systeme können große Mengen an Patientendaten schnell verarbeiten, was die diagnostische Präzision verbessert und frühzeitige Interventionen ermöglicht.

- Die Integration von KI und Automatisierung in klinischen Laboren kann zu verbesserten Diagnoseergebnissen, weniger Fehlern und einer verbesserten Patientenversorgung führen und Labore für zukünftiges Wachstum positionieren.

Einschränkung/Herausforderung

„Hohe Ausrüstungs- und Betriebskosten behindern die Marktdurchdringung“

- Die hohen Kosten für moderne Laborgeräte und Automatisierungssysteme stellen eine erhebliche Herausforderung für den Markt für klinische Labordienstleistungen dar und betreffen insbesondere kleinere Labore und Gesundheitseinrichtungen in Entwicklungsregionen.

- Diese Systeme, die für eine präzise Diagnostik mit hohem Durchsatz unerlässlich sind, können erhebliche Anfangsinvestitionen und laufende Wartungskosten erfordern, was für kleinere Einrichtungen finanzielle Hürden darstellt.

- Diese erhebliche finanzielle Belastung kann Labore davon abhalten, die neuesten Technologien einzuführen, was dazu führt, dass sie auf veraltete Geräte und langsamere Diagnoseprozesse angewiesen sind.

Zum Beispiel,

- Laut einem Artikel von Labcompare vom November 2024 können die Kosten für die Einrichtung eines automatisierten klinischen Labors je nach Automatisierungsgrad und diagnostischen Möglichkeiten zwischen Hunderttausenden und mehreren Millionen Dollar liegen. Dies kann die Wettbewerbsfähigkeit kleinerer Labore in einem sich schnell entwickelnden Markt einschränken.

- Folglich können diese finanziellen Herausforderungen zu Unterschieden in der diagnostischen Qualität und dem Zugang führen und letztlich das Gesamtwachstum des Marktes für klinische Labordienstleistungen behindern.

Globaler Markt für klinische Labordienstleistungen

Der Markt ist nach Fachgebiet, Anbieter, Anwendung und Servicetyp segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Spezialgebiet |

|

|

Nach Anbieter |

|

|

Nach Anwendung |

|

|

Nach Servicetyp

|

|

Im Jahr 2025 werden die Routine-Testdienste voraussichtlich den Markt dominieren und den größten Anteil im Dienstleistungssegment haben.

Aufgrund seiner zentralen Bedeutung im Gesundheitswesen wird das Segment Routinediagnostik voraussichtlich bis 2025 den globalen Markt für klinische Labordienstleistungen mit einem Marktanteil von 57,6 % dominieren. Routinediagnostik, darunter Blutuntersuchungen, Urinanalysen und Stoffwechselanalysen, bildet das Rückgrat der klinischen Diagnostik und unterstützt routinemäßige Gesundheitschecks, Krankheitsüberwachung und Früherkennung. Die hohe Nachfrage nach diesen Tests, die durch ein steigendes Gesundheitsbewusstsein, Präventionsinitiativen und die weltweit wachsende Krankheitslast angetrieben wird, trägt maßgeblich zur Marktdominanz dieses Segments bei.

Es wird erwartet, dass die klinisch-chemischen Tests im Prognosezeitraum den größten Anteil am Spezialmarkt ausmachen werden

Im Jahr 2025 wird das Segment der klinisch-chemischen Tests voraussichtlich mit einem Marktanteil von 31,35 % den Markt dominieren. Dies ist auf seine entscheidende Rolle bei der Diagnose und Überwachung einer Vielzahl von Krankheiten, darunter Diabetes, Herz-Kreislauf-Erkrankungen und Nierenerkrankungen, zurückzuführen. Als eines der größten Segmente im Markt für Spezialtests stützt die hohe Nachfrage nach Stoffwechsel-, Elektrolyt- und Organfunktionstests, gepaart mit Fortschritten in der Diagnosetechnologie, seine Marktdominanz. Die zunehmende Verbreitung chronischer Erkrankungen treibt den Bedarf an präzisen und zeitnahen klinisch-chemischen Tests weiter voran und festigt seine führende Position.

Globale regionale Analyse des Marktes für klinische Labordienstleistungen

„Nordamerika hält den größten Anteil am globalen Markt für klinische Labordienstleistungen“

- Nordamerika dominiert den globalen Markt für klinische Labordienstleistungen und hält mit rund 44,5 % den größten regionalen Marktanteil. Dies ist auf die fortschrittliche Gesundheitsinfrastruktur, die hohe Akzeptanz modernster Diagnosetechnologien und die starke Präsenz wichtiger Marktteilnehmer zurückzuführen.

- Die USA machen mit rund 36,40 % einen erheblichen Anteil dieses Marktanteils aus. Dies ist auf das hohe Volumen diagnostischer Tests, die zunehmende Verbreitung chronischer Krankheiten und die Präsenz gut etablierter klinischer Labore zurückzuführen. Der US-Markt profitiert zudem von günstigen Erstattungsrichtlinien und erheblichen Investitionen in Forschung und Entwicklung, was seine Position weiter stärkt.

- Darüber hinaus trägt die steigende Nachfrage nach Früherkennung und personalisierter Medizin, gepaart mit einem gut etablierten Gesundheitssystem, maßgeblich zur Marktdominanz in der Region bei. Die zunehmende Verbreitung automatisierter Diagnosesysteme und die weit verbreitete Nutzung fortschrittlicher Molekulardiagnostik treiben das Marktwachstum in Nordamerika ebenfalls voran.

„Der asiatisch-pazifische Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem globalen Markt für klinische Labordienstleistungen verzeichnen“

- Der asiatisch-pazifische Raum wird voraussichtlich die höchste Wachstumsrate im globalen Markt für klinische Labordienstleistungen verzeichnen, mit einer prognostizierten jährlichen Wachstumsrate von 8,10 % im Prognosezeitraum. Dieses Wachstum ist auf den rasanten Ausbau der Gesundheitsinfrastruktur, das zunehmende Bewusstsein für präventive Gesundheitsfürsorge und die zunehmende Belastung durch chronische Krankheiten zurückzuführen.

- Länder wie China, Indien und Japan entwickeln sich aufgrund ihrer großen und alternden Bevölkerung zu Schlüsselmärkten. Diese ist anfälliger für Krankheiten wie Diabetes, Herz-Kreislauf-Erkrankungen und Krebs, was die Nachfrage nach klinischen Tests antreibt.

- Japan, bekannt für seine fortschrittliche Medizintechnik und sein hochentwickeltes Gesundheitssystem, bleibt ein wichtiger Markt für klinische Labordienstleistungen. Das Land ist weiterhin führend bei der Einführung von Präzisionsdiagnostik und molekularen Tests zur Verbesserung der Patientenergebnisse.

- Indien wird voraussichtlich mit einem Marktanteil von 3,3 % die höchste durchschnittliche jährliche Wachstumsrate (CAGR) in der Region verzeichnen. Grund hierfür sind der Ausbau der Gesundheitsinfrastruktur, steigende Gesundheitsausgaben und eine steigende Nachfrage nach präzisen Diagnosetests sowohl in ländlichen als auch in städtischen Gebieten.

Globaler Marktanteil klinischer Labordienstleistungen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Abbott (USA)

- ARUP Laboratories (USA)

- OPKO Health, Inc. (USA)

- Bioscientia Healthcare GmbH (Deutschland)

- Charles River Laboratories (USA)

- NeoGenomics Laboratories (USA)

- Healthscope (Australien)

- Labcorp (USA)

- Quest Diagnostics Incorporated (USA)

- Siemens Healthineers AG (Deutschland)

- Tulip Diagnostics (P) Ltd (Indien)

- Sonic Healthcare Limited (Australien)

- Agilent Technologies, Inc. (USA)

- Thermo Fisher Scientific Inc. (USA)

- IQVIA (USA)

- SYNLAB International (Deutschland)

Neueste Entwicklungen auf dem globalen Markt für klinische Labordienstleistungen

- Im Januar 2025 kündigte Abbott die Einführung seines Immunoassay-Analysegeräts der nächsten Generation, des Alinity M, an. Das System wurde entwickelt, um die Laboreffizienz und die Testgeschwindigkeit zu verbessern. Es zeichnet sich durch erweiterte Automatisierungsfunktionen, hohen Durchsatz und ein breites Testmenü aus und unterstützt ein breites Spektrum an diagnostischen Tests, darunter Tests für Infektionskrankheiten, Onkologie und Gentests. Damit ist es ein unverzichtbares Werkzeug für moderne klinische Labore.

- Im Oktober 2024 stellte ARUP Laboratories seine KI-gestützte molekulardiagnostische Plattform vor, die die Genauigkeit und Geschwindigkeit komplexer genetischer Tests verbessern soll. Diese Plattform integriert Deep-Learning-Algorithmen und fortschrittliche molekulare Techniken und ermöglicht so schnellere Durchlaufzeiten und hochpräzise Diagnoseergebnisse für die personalisierte Medizin.

- Im September 2024 gab OPKO Health, Inc. die Erweiterung seines BioReference Laboratories-Netzwerks bekannt und erweiterte damit seine diagnostischen Kapazitäten mit Schwerpunkt auf Krebsgenomik und personalisierter Medizin. Die Erweiterung umfasst erweiterte genetische Tests und präzise onkologische Dienstleistungen, die bessere Patientenergebnisse und gezielte Behandlungsstrategien ermöglichen.

- Im September 2024 brachte die Bioscientia Healthcare GmbH, ein führender Anbieter klinischer Labordienstleistungen in Europa, ihre innovative Mikrobiom-Analyseplattform auf den Markt. Sie soll umfassende Einblicke in die Darmgesundheit und Krankheitsprävention ermöglichen. Die Plattform nutzt Next-Generation-Sequencing (NGS) und fortschrittliche Bioinformatik, um personalisierte Gesundheitseinblicke zu liefern.

- Im September 2024 stellte Charles River Laboratories, ein führender Anbieter präklinischer und klinischer Labordienstleistungen, seine neuen bioanalytischen Testdienstleistungen für Zell- und Gentherapien vor. Diese sollen biopharmazeutische Unternehmen bei der Entwicklung von Therapien der nächsten Generation unterstützen. Diese Erweiterung soll die Entwicklung personalisierter Medikamente und fortschrittlicher Biologika beschleunigen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.