Global Cleanroom Technology Market

Marktgröße in Milliarden USD

CAGR :

%

USD

33.85 Billion

USD

57.25 Billion

2024

2032

USD

33.85 Billion

USD

57.25 Billion

2024

2032

| 2025 –2032 | |

| USD 33.85 Billion | |

| USD 57.25 Billion | |

|

|

|

|

Globale Marktsegmentierung für Reinraumtechnologie nach Typ (Geräte und Verbrauchsmaterialien), Bauart (Material und Design, Standard-/Trockenbau-Reinräume, Hartbau-Reinräume, Weichbau-Reinräume und Klemmenkästen/Durchreicheschränke), Branche (Pharmaindustrie, Halbleiter- und Elektronikindustrie, Biotechnologieindustrie Lebensmittel- und Getränkeindustrie, Hersteller medizinischer Geräte, Krankenhaus- und Gesundheitsindustrie, Automobilindustrie, Kunststoffindustrie, optische Industrie und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Reinraumtechnologie

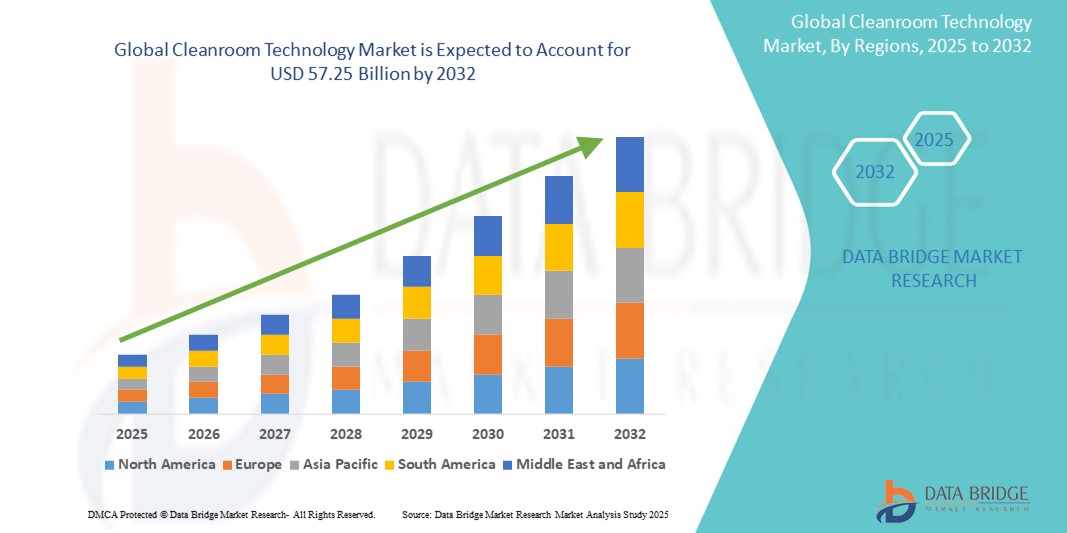

- Der globale Markt für Reinraumtechnologie wurde im Jahr 2024 auf 33,85 Milliarden US-Dollar geschätzt und soll bis 2032 57,25 Milliarden US-Dollar erreichen , bei einer CAGR von 6,79 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie die strengen regulatorischen Standards und die Expansion des Gesundheits- und Biopharmasektors vorangetrieben .

Marktanalyse für Reinraumtechnologie

- Reinraumtechnologie ist eine entscheidende Komponente in verschiedenen Branchen. Sie bietet kontrollierte Umgebungen mit geringen Schadstoffkonzentrationen, die für Herstellungsprozesse in Sektoren wie Pharma, Biotechnologie, Elektronik und Medizintechnik unerlässlich sind.

- Die Nachfrage nach Reinraumtechnologie wird maßgeblich durch den steigenden Bedarf an Kontaminationskontrolle, strenge gesetzliche Anforderungen und den zunehmenden Fokus auf Produktqualität und -sicherheit in hochpräzisen Fertigungsumgebungen getrieben.

- Nordamerika wird voraussichtlich mit einem Marktanteil von 39,40 % den Markt für Reinraumtechnologie dominieren. Diese Führungsposition wird durch eine fortschrittliche Gesundheitsinfrastruktur, strenge regulatorische Anforderungen und die Präsenz großer Pharma- und Biotechnologieunternehmen vorangetrieben.

- Der asiatisch-pazifische Raum dürfte mit einer prognostizierten jährlichen Wachstumsrate (CAGR) von 6,10 % die am schnellsten wachsende Region im Markt für Reinraumtechnologie sein. Dies ist auf die schnelle Industrialisierung, steigende Investitionen in die Gesundheitsinfrastruktur und die Expansion der Elektronik- und Pharmaindustrie zurückzuführen.

- Das Verbrauchsgütersegment wird voraussichtlich mit einem Marktanteil von 55,16 % den Markt dominieren, angetrieben durch die anhaltende Nachfrage nach Einwegartikeln wie Handschuhen, Tüchern, Desinfektionsmitteln und Kleidung.

Berichtsumfang und Marktsegmentierung für Reinraumtechnologie

|

Eigenschaften |

Wichtige Markteinblicke in die Reinraumtechnologie |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Reinraumtechnologie

„Zunehmende Akzeptanz modularer Reinraumsysteme“

- Ein wichtiger Trend in der Reinraumtechnologie ist die zunehmende Nutzung modularer Reinraumsysteme. Diese vorgefertigten, skalierbaren Strukturen bieten Flexibilität und Kosteneffizienz und ermöglichen Branchen wie der Pharma-, Biotechnologie- und Elektronikbranche die schnelle Bereitstellung und Anpassung von Reinraumumgebungen an spezifische Betriebsanforderungen.

- Die Integration intelligenter Technologien, darunter IoT-Sensoren und künstliche Intelligenz (KI), verbessert die Echtzeitüberwachung und -steuerung kritischer Reinraumparameter wie Temperatur, Luftfeuchtigkeit und Partikelgehalt. Diese Fortschritte verbessern die Kontaminationskontrolle, die Betriebseffizienz und die vorausschauende Wartung.

- So ist beispielsweise Genentechs Werk im kalifornischen Vacaville ein Beispiel für die erfolgreiche Integration fortschrittlicher Reinraumtechnologie in die pharmazeutische Produktion. Durch Investitionen in hochmoderne Luftfiltersysteme, rigoroses Umweltmonitoring und umfassende Mitarbeiterschulungen schuf das Unternehmen eine streng kontrollierte Umgebung, die das Kontaminationsrisiko deutlich reduzierte. Dieses Engagement verbesserte nicht nur die Produktqualität und sicherte die Prozesskonsistenz, sondern erleichterte auch die Einhaltung strenger gesetzlicher Vorschriften und untermauerte Genentechs Ruf für exzellente Produktion.

- Innovationen bei Baumaterialien, wie der Einsatz antimikrobieller Oberflächen und energieeffizienter Systeme, tragen zur Entwicklung nachhaltiger Reinraumlösungen bei. Diese Materialien tragen dazu bei, Kontaminationsrisiken und Betriebskosten zu reduzieren und stehen im Einklang mit globalen Nachhaltigkeitszielen.

Marktdynamik für Reinraumtechnologie

Treiber

„Strenge gesetzliche Vorschriften fördern die Einführung von Reinräumen“

- Die Durchsetzung strenger regulatorischer Standards durch Behörden wie die US-amerikanische Food and Drug Administration (FDA) und die Europäische Arzneimittel-Agentur (EMA) schreibt die Verwendung von Reinraumumgebungen in der pharmazeutischen und biotechnologischen Produktion vor.

- Die Einhaltung von Richtlinien wie Good Manufacturing Practices (GMP) und ISO 14644 ist für die Gewährleistung von Produktsicherheit und -qualität unerlässlich und treibt die Nachfrage nach fortschrittlichen Reinraumtechnologien voran.

Zum Beispiel ,

- Im August 2023 hat die Europäische Union die überarbeiteten GMP-Richtlinien (Anhang 1) umgesetzt. Diese legen den Schwerpunkt auf das Qualitätsrisikomanagement und fordern eine Kontaminationskontrollstrategie für die Herstellung steriler Arzneimittel. Diese Aktualisierung hat zu einer erhöhten Nachfrage nach fortschrittlichen Reinraumlösungen geführt, um die neuen Compliance-Standards zu erfüllen.

- Die Notwendigkeit, Kontaminationen bei der Herstellung empfindlicher Produkte wie Biologika und Medizinprodukte zu verhindern, treibt die Einführung von Reinraumlösungen in verschiedenen Branchen weiter voran. Forschung und Märkte

Gelegenheit

„Integration intelligenter Technologien zur Steigerung der Reinraumeffizienz“

- Die Integration von Industrie 4.0-Technologien, einschließlich des Internets der Dinge (IoT), künstlicher Intelligenz (KI) und Automatisierung, revolutioniert den Reinraumbetrieb, indem sie eine Echtzeitüberwachung und -kontrolle von Umgebungsparametern ermöglicht.

- Intelligente Reinraumsysteme können den Wartungsbedarf vorhersagen, den Energieverbrauch optimieren und menschliche Fehler reduzieren, was zu einer verbesserten Betriebseffizienz und Kosteneinsparungen führt.

- Die Entwicklung modularer und anpassbarer Reinraumdesigns ermöglicht skalierbare Lösungen, die auf spezifische Branchenanforderungen zugeschnitten werden können und Flexibilität und schnelle Bereitstellung bieten.

Zum Beispiel,

- Mecart, ein kanadischer Reinraumhersteller, lieferte während der COVID-19-Pandemie wichtige modulare Isolationsräume an Krankenhäuser und Gesundheitseinrichtungen. Diese vorgefertigten Reinräume wurden schnell einsatzbereit gemacht und demonstrierten die Flexibilität und Effizienz moderner Reinraumlösungen. MECART Reinräume

- Die Integration intelligenter und modularer Technologien bietet erhebliche Möglichkeiten zur Verbesserung der Effizienz und Anpassungsfähigkeit von Reinraumumgebungen

Einschränkung/Herausforderung

„Hohe Implementierungs- und Wartungskosten begrenzen die Marktexpansion“

- Die erheblichen Kapitalinvestitionen, die für die Planung, den Bau und die Wartung von Reinraumanlagen erforderlich sind, stellen insbesondere für kleine und mittlere Unternehmen (KMU) eine erhebliche Hürde dar.

- Laufende Betriebskosten, einschließlich Energieverbrauch, Spezialausrüstung und Einhaltung sich entwickelnder regulatorischer Standards, erhöhen die finanzielle Belastung und können die Einführung behindern.

- Die Komplexität der Reinraumanpassung an spezifische Branchenanforderungen erhöht die Kosten zusätzlich und kann eine rechtzeitige Umsetzung behindern.

Zum Beispiel,

- Laut Workstation Industries lagen die durchschnittlichen Kosten für die Einrichtung eines modularen Reinraums im Mai 2019 zwischen 100 und 150 US-Dollar pro Quadratfuß. Diese hohen Kosten können für kleinere Unternehmen oder Unternehmen in Entwicklungsregionen unerschwinglich sein und den Einsatz von Reinraumtechnologien einschränken. Ressourcen

- Die hohen Kosten für die Implementierung und Wartung von Reinräumen stellen weiterhin eine erhebliche Herausforderung dar, insbesondere für kleinere Unternehmen und in Umgebungen mit eingeschränkten Ressourcen.

Marktumfang für Reinraumtechnologie

Der Markt ist nach Typ, Bauart und Branche segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Typ |

|

|

Nach Bautyp |

|

|

Nach Branche |

|

Im Jahr 2025 werden die Verbrauchsmaterialien voraussichtlich den Markt dominieren, mit dem größten Anteil im Typsegment

Das Verbrauchsmaterialsegment wird voraussichtlich den Markt für Reinraumtechnologie mit einem Marktanteil von 55,16 % im Jahr 2025 dominieren, angetrieben durch die anhaltende Nachfrage nach Einwegartikeln wie Handschuhen, Tüchern, Desinfektionsmitteln und Bekleidung. Diese Produkte sind für die Einhaltung der Hygiene und die Vermeidung von Kontaminationen in Reinraumumgebungen in verschiedenen Branchen unerlässlich. Der wiederkehrende Charakter von Verbrauchsmaterialkäufen und strenge regulatorische Anforderungen, insbesondere in der Pharma- und Halbleiterproduktion, tragen zusätzlich zur Dominanz des Segments bei.

Die Pharmaindustrie wird voraussichtlich im Prognosezeitraum den größten Anteil am Industriemarkt ausmachen

Im Jahr 2025 wird die Pharmaindustrie voraussichtlich mit einem Marktanteil von rund 43,9 % den Markt dominieren . Diese Dominanz ist auf strenge regulatorische Anforderungen an die Herstellung und Prüfung von Arzneimitteln zurückzuführen, für deren Sicherheit und Wirksamkeit Reinräume unerlässlich sind. Die steigende Nachfrage nach neuen Medikamenten und Medizinprodukten, die durch die zunehmende Zahl von Krankheiten befeuert wird, beschleunigt den Einsatz von Reinraumtechnologien in dieser Branche zusätzlich.

Regionale Analyse des Marktes für Reinraumtechnologie

„Nordamerika hält den größten Anteil am Markt für Reinraumtechnologie“

- Nordamerika dominiert den Markt für Reinraumtechnologie mit einem Anteil von 39,40 % am Weltmarkt. Diese Führungsposition ist auf eine fortschrittliche Gesundheitsinfrastruktur, strenge regulatorische Anforderungen und die Präsenz großer Pharma- und Biotechnologieunternehmen zurückzuführen.

- Die USA tragen maßgeblich zum Marktanteil der Region bei und halten rund 81,6 % des nordamerikanischen Marktes für Reinraumtechnologie. Die starke Halbleiterfertigung, die Pharmaproduktion sowie die Luft- und Raumfahrtindustrie des Landes sowie die strengen FDA-Richtlinien treiben die Nachfrage nach fortschrittlichen Reinraumsystemen an.

- Die Verfügbarkeit etablierter Erstattungsrichtlinien und wachsende Investitionen in Forschung und Entwicklung durch führende Medizintechnikunternehmen stärken den Markt weiter

- Darüber hinaus treiben die zunehmende Anzahl hochpräziser Fertigungsprozesse und die Einführung modularer und flexibler Reinräume die Marktexpansion in der gesamten Region voran.

„Im asiatisch-pazifischen Raum wird voraussichtlich die höchste jährliche Wachstumsrate im Markt für Reinraumtechnologie verzeichnet“

- Im asiatisch-pazifischen Raum wird mit einer prognostizierten jährlichen Wachstumsrate von 6,10 % das höchste Wachstum im Markt für Reinraumtechnologie erwartet. Dieses Wachstum wird durch die schnelle Industrialisierung, steigende Investitionen in die Gesundheitsinfrastruktur und die Expansion der Elektronik- und Pharmaindustrie vorangetrieben.

- Aufgrund der zunehmenden Alterung der Bevölkerung und der Notwendigkeit strenger Sauberkeitsstandards in den Produktionsprozessen entwickeln sich Länder wie China, Indien und Japan zu Schlüsselmärkten.

- Japan bleibt mit seiner fortschrittlichen Medizintechnik und seinem starken Fokus auf Forschung und Entwicklung ein wichtiger Markt für Reinraumtechnologie, insbesondere in der Halbleiterfertigung und Feinmechanik.

- Indien wird voraussichtlich mit 8,4 % die höchste jährliche Wachstumsrate in der Region verzeichnen. Dies wird durch den aufstrebenden Fertigungssektor, insbesondere in den Bereichen Elektronik und Pharma, sowie durch staatliche Initiativen zur Förderung der inländischen Produktion vorangetrieben.

Marktanteile der Reinraumtechnologie

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- AES Clean Technology (USA)

- DuPont (USA)

- Clean Air Products (USA)

- Reinraumdepot (USA)

- Integrated Cleanroom Technologies Pvt. Ltd. (Indien)

- Hemair (Indien)

- AIRTECH JAPAN, Ltd. (Japan)

- Lennox (Indien)

- Colandis (Deutschland

- ABN Cleanroom Technology (Belgien)

- Nicos Group, Inc. (USA)

- GALVANI SRL (Italien)

- ANSELL LTD. (Australien)

- Ardmac (Irland)

- Azbil Corporation (Japan)

- Helapet Ltd. (Großbritannien)

- KCWW (USA)

- Camfil (Schweden)

- Labconco (USA)

- Taikisha Ltd. (Japan)

- Terra Universal, Inc. (USA)

- Lindner SE (Deutschland)

Neueste Entwicklungen auf dem globalen Markt für Reinraumtechnologie

- Im April 2025 stellte AES Clean Technology das CleanLock-Modul vor, eine modulare Schleusenlösung zur Verbesserung von Sauberkeit und Effizienz in Reinraumumgebungen. Das CleanLock-Modul integriert die proprietären Reinraumoberflächen von AES, patentierte Beleuchtung, vorhersehbare Luftströmungsmuster und fortschrittliche Türsteuerungen und schafft so eine hochkontrollierte Umgebung, die sich nahtlos und ohne Verzögerung in jede Einrichtung integrieren lässt.

- Im Oktober 2024 entwickelten EAZER Maintenance, ABN Cleanroom Technology und die Universität Hasselt gemeinsam CleanAR, ein digitales Tool, das Augmented Reality zur Steuerung der Reinraumreinigung nutzt. Diese innovative Lösung verbessert die Reinigungspräzision, gewährleistet die Einhaltung von Sauberkeitsstandards und steigert so die Effizienz und Effektivität der Reinraumwartungsprozesse.

- Im April 2024 kündigte Micron den Bau von vier Halbleiterfertigungsanlagen (Fabs) in Clay, New York, an. Jede Fabrik verfügt über 55.000 Quadratmeter Reinraumfläche, was einer Gesamtfläche von 220.000 Quadratmetern entspricht. Dies entspricht der größten Reinraumfläche, die jemals in den USA angekündigt wurde, und unterstreicht die wachsende Nachfrage nach Reinraumtechnologien in der Halbleiterfertigung.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.