Global Brake Pad Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.33 Billion

USD

6.45 Billion

2024

2032

USD

3.33 Billion

USD

6.45 Billion

2024

2032

| 2025 –2032 | |

| USD 3.33 Billion | |

| USD 6.45 Billion | |

|

|

|

|

Globale Marktsegmentierung für Bremsbeläge nach Fahrzeugtyp (PCV, LCV, HCV und Zweiräder), Material (halbmetallisch, asbestfrei (NAO), niedrigmetallisch (NAO) und Keramik), Position (vorne und hinten), Vertriebskanal (OEM und Aftermarket) – Branchentrends und Prognose bis 2032

Bremsbelag Marktgröße

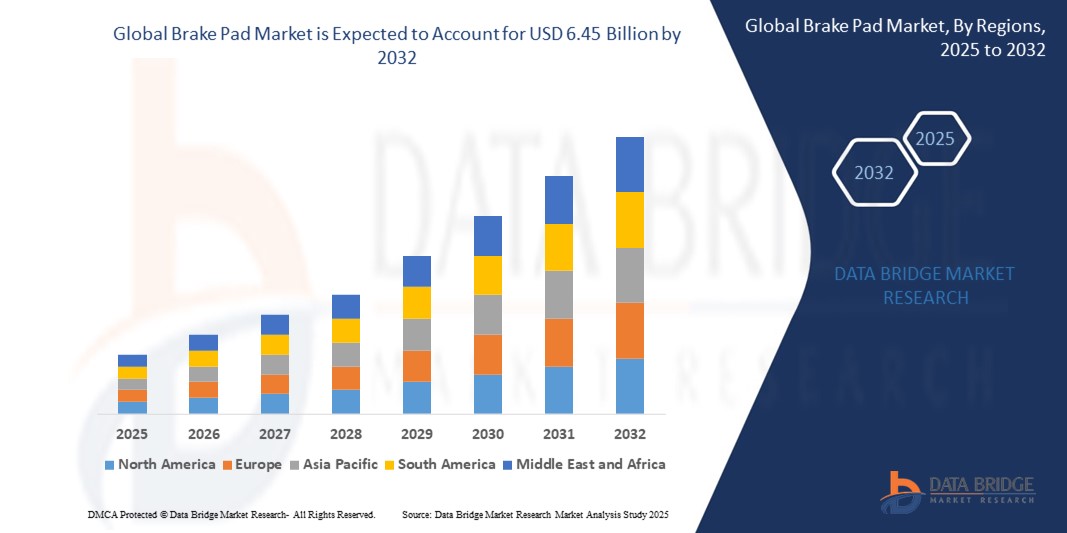

- Der globale Markt für Bremsbeläge wurde im Jahr 2024 auf 3,33 Milliarden US-Dollar geschätzt und dürfte bis 2032 einen Wert von 6,45 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 8,60 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende weltweite Fahrzeugproduktion, die zunehmende Zahl an Fahrzeugbesitzern und das wachsende Bewusstsein für Verkehrssicherheit und regelmäßige Wartung vorangetrieben, was zu einer konstanten Nachfrage nach Bremsbelagersatz sowohl im OEM- als auch im Aftermarket-Bereich führt.

- Darüber hinaus fördert die Umsetzung strenger Sicherheitsvorschriften und Emissionsnormen den Einsatz moderner Bremsbelagmaterialien wie Keramik und asbestfreiem organischem Material (NAO), die eine verbesserte Leistung, weniger Lärm und eine geringere Umweltbelastung bieten. Diese Faktoren beschleunigen die Verbreitung hochwertiger Bremsbeläge und fördern damit das Branchenwachstum erheblich.

Bremsbelag-Marktanalyse

- Bremsbeläge sind ein wichtiger Bestandteil von Scheibenbremssystemen. Sie wandeln kinetische Energie durch Reibung in Wärmeenergie um und sorgen so für effektive Verzögerung und Fahrzeugkontrolle. Sie werden häufig in Pkw, Nutzfahrzeugen und Zweirädern sowohl an Vorder- als auch an Hinterrädern eingesetzt.

- Die Nachfrage nach Bremsbelägen wird durch die Expansion des globalen Automobilsektors, das steigende Durchschnittsalter der Fahrzeuge und die Zunahme von Elektro- und Hybridfahrzeugen angetrieben, die spezielle Bremslösungen erfordern, die mit regenerativen Systemen kompatibel sind.

- Nordamerika dominierte den Bremsbelagmarkt mit einem Anteil von 36,1 % im Jahr 2024 aufgrund eines ausgereiften Automobilsektors, hoher Fahrzeugbesitzraten und strenger Sicherheitsvorschriften

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der steigenden Fahrzeugproduktion, der Urbanisierung und der gestiegenen verfügbaren Einkommen die am schnellsten wachsende Region auf dem Bremsbelagmarkt sein.

- Das Vorderradsegment dominierte den Markt mit einem Marktanteil von 56,8 % im Jahr 2024. Dies liegt daran, dass die Vorderräder bei den meisten Fahrzeugen den Großteil der Bremskraft übernehmen, was zu höherem Verschleiß und häufigerem Austausch führt. Vorderradbremsbeläge sind für die Fahrzeugsicherheit unerlässlich und unterliegen sowohl bei Personen- als auch bei Nutzfahrzeugen strengen Qualitätsstandards.

Berichtsumfang und Marktsegmentierung für Bremsbeläge

|

Eigenschaften |

Wichtige Markteinblicke für Bremsbeläge |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Bremsbelagmarkttrends

„Steigerung der Fahrzeugproduktion“

- Der Markt für Bremsbeläge verzeichnet ein robustes Wachstum, das mit der stetigen Zunahme der weltweiten Fahrzeugproduktion sowohl im Personen- als auch im Nutzfahrzeugbereich einhergeht und die Grundnachfrage nach Hochleistungsbremskomponenten antreibt.

- Da beispielsweise die weltweiten Verkäufe von Pkw und Nutzfahrzeugen in den letzten Jahren stark anstiegen, führten Unternehmen wie Continental neue Designs wie die Green Caliper-Bremse für Elektrofahrzeuge ein und unterstützten damit die Bedürfnisse von Automobilherstellern, die sowohl auf Volumen als auch auf Innovation setzen.

- Wachsende Nutzfahrzeugflotten, insbesondere in Sektoren wie Logistik und Lieferung, treiben den Bedarf an langlebigen, zuverlässigen Bremsbelägen, die starker und häufiger Beanspruchung standhalten, weiter voran

- Die zunehmende Verbreitung von Elektro- und Hybridfahrzeugen beeinflusst die Bremsbelagtechnologie, wobei der Schwerpunkt auf geräuscharmen, langlebigen und speziellen Formulierungen liegt, die mit regenerativen Bremssystemen kompatibel sind.

- Der regulatorische Druck und die Verbraucherforderungen nach Sicherheit veranlassen Automobilhersteller und Zulieferer dazu, in die Weiterentwicklung von Materialien und Leistungsverbesserungen zu investieren, wobei der Schwerpunkt auf der Übererfüllung globaler Sicherheitsstandards liegt.

- Der Ersatzteilmarkt für Bremsbeläge wächst aufgrund des steigenden Verbraucherbewusstseins hinsichtlich der regelmäßigen Bremsenwartung, des einfacheren Einkaufs über E-Commerce-Kanäle und der Langlebigkeitsvorteile neuer Materialinnovationen.

Bremsbelagmarktdynamik

Treiber

„Steigende Nachfrage nach Leichtbaumaterialien“

- Fahrzeughersteller und Bremssystemlieferanten konzentrieren sich zunehmend auf die Reduzierung des Fahrzeuggewichts, um Kraftstoffeffizienz und Leistung zu verbessern. Dies führt zu einer höheren Nachfrage nach leichten Bremsbelagmaterialien wie Hochleistungskeramik und Verbundwerkstoffen.

- So investieren führende Hersteller wie Brembo und SGL Carbon in die Entwicklung und großflächige Einführung von leichten und umweltfreundlichen Bremsbelägen der nächsten Generation, um sowohl den OEM- als auch den Aftermarket-Bereich zu bedienen.

- Umweltvorschriften gegen die Verwendung von Schwermetallen und Asbest haben den Übergang zu innovativen, umweltfreundlichen und leichteren Materialformulierungen beschleunigt, die eine hohe Reibung und längere Haltbarkeit bieten.

- Leichte Bremsbeläge tragen zu verbessertem Handling, reduzierten Emissionen und einer effizienteren Integration in die Architektur von Elektro- und Hybridfahrzeugen bei und unterstützen so die Nachhaltigkeitsziele des Automobilsektors.

- Dank kontinuierlicher Forschung und Entwicklung im Bereich der Materialwissenschaft können Bremsbelaghersteller wichtige Sicherheits- und Leistungsstandards einhalten und gleichzeitig das Gewicht weiter reduzieren – eine immer wichtigere Priorität für Fahrzeughersteller weltweit.

Einschränkung/Herausforderung

„Hohe Preisvolatilität bei Rohstoffen“

- Die Rentabilität und Kostenstruktur der Bremsbelaghersteller werden durch erhebliche Preisschwankungen bei wichtigen Rohstoffen wie Metallen, Spezialharzen und Hochleistungskeramiken beeinträchtigt.

- Da beispielsweise die Nachfrage nach kupferfreien und umweltfreundlichen Bremsbelägen steigt, sehen sich die Unternehmen mit erhöhten und unvorhersehbaren Kosten für Ersatzreibungsmaterialien und Hochleistungsverbundwerkstoffe konfrontiert, was sich auf die Preisgestaltung und die Lieferzuverlässigkeit auswirken kann.

- Die Beschaffung umweltfreundlicher oder gesetzeskonformer Rohstoffe ist oft mit höheren Kosten verbunden und birgt die Gefahr von Lieferkettenunterbrechungen, die durch geopolitische oder logistische Ereignisse noch verschärft werden können.

- Preisinstabilität kann kleinere Hersteller davon abhalten, notwendige Technologie-Upgrades oder Produktinnovationen umzusetzen, was möglicherweise zu einem weniger wettbewerbsintensiven Markt für fortschrittliche, nachhaltige Bremsbeläge führt.

- Der kontinuierliche Zugang zu hochwertigen Rohstoffen zu angemessenen Preisen wird zunehmend schwieriger, da sowohl das Produktionsvolumen der Automobilindustrie als auch die regulatorischen Standards weiter steigen und so die gesamte Wertschöpfungskette unter Druck setzen.

Bremsbelag-Marktumfang

Der Markt ist nach Fahrzeugtyp, Material, Position und Vertriebskanal segmentiert.

- Nach Fahrzeugtyp

Der Bremsbelagmarkt ist nach Fahrzeugtyp in Pkw (PCV), leichte Nutzfahrzeuge (LCV), schwere Nutzfahrzeuge (HCV) und Zweiräder segmentiert. Das PCV-Segment hatte 2024 den größten Umsatzanteil, was auf das hohe weltweite Produktionsvolumen von Pkw und die gestiegene Nachfrage nach individuellen Mobilitätslösungen zurückzuführen ist. Urbanisierung, verbesserte Straßeninfrastruktur und das wachsende Verbraucherbewusstsein für Fahrzeugsicherheit haben den Bedarf an effizienten Bremssystemen weiter erhöht, wodurch PCVs einen großen Beitrag zum Bremsbelagverbrauch leisten.

Das Zweiradsegment wird voraussichtlich von 2025 bis 2032 die höchste jährliche Wachstumsrate verzeichnen, unterstützt durch die zunehmende Verbreitung von Motorrädern und Motorrollern in bevölkerungsreichen Ländern. Die Kosteneffizienz von Zweirädern, insbesondere im asiatisch-pazifischen Raum und Lateinamerika, sowie die zunehmenden Sicherheitsvorschriften hinsichtlich der Bremsleistung führen zu einer steigenden Nachfrage nach fortschrittlichen und langlebigen Bremsbelägen in diesem Segment.

- Nach Material

Der Markt wird nach Material in halbmetallische, asbestfreie organische (NAO), niedrigmetallische NAO- und Keramikbeläge unterteilt. Das halbmetallische Segment hatte 2024 aufgrund seiner ausgewogenen Leistung hinsichtlich Wärmeableitung, Bremsleistung und Wirtschaftlichkeit den größten Marktanteil. Diese Beläge werden in verschiedenen Fahrzeugtypen eingesetzt, insbesondere in Regionen, in denen Wirtschaftlichkeit und Leistung gleichermaßen wichtig sind. Ihre Langlebigkeit unter Hochlastbedingungen macht sie zur bevorzugten Wahl für schwerere Fahrzeuge und Hochgeschwindigkeitsfahrten.

Das Keramiksegment wird voraussichtlich zwischen 2025 und 2032 das stärkste Wachstum verzeichnen, angetrieben von der steigenden Nachfrage nach Geräuschreduzierung, saubereren Felgen und verbessertem Bremskomfort. Keramikbeläge gewinnen im Premium-Automobilsegment an Bedeutung, da sie weniger Staub produzieren und eine längere Lebensdauer bieten. Das spricht Verbraucher an, denen Qualität und Leistung wichtiger sind als die Kosten.

- Nach Position

Der Markt für Bremsbeläge ist nach Position in Vorderachse und Vorder- und Hinterachse unterteilt. Das Vorderachsensegment dominierte den Markt mit einem Anteil von 56,8 % im Jahr 2024, vor allem weil die Vorderräder bei den meisten Fahrzeugen den Großteil der Bremskraft tragen, was zu höherem Verschleiß und häufigerem Austausch führt. Vordere Bremsbeläge sind für die Fahrzeugsicherheit unerlässlich und unterliegen sowohl bei Personen- als auch bei Nutzfahrzeugen strengen Qualitätsstandards.

Das Segment für Vorder- und Hinterräder dürfte im Prognosezeitraum deutlich wachsen. Dies spiegelt die zunehmende Nachfrage nach einem kompletten Bremsbelagwechsel wider, um eine ausgewogene Leistung und gleichmäßigen Verschleiß zu gewährleisten. Dieser Trend ist insbesondere bei Elektrofahrzeugen und Hochleistungsautos spürbar, da die Hersteller zunehmend Systeme entwickeln, die eine gleichmäßig verteilte Bremsleistung erfordern.

- Nach Vertriebskanal

Der Bremsbelagmarkt unterteilt sich nach Vertriebskanälen in OEM und Aftermarket. Das OEM-Segment erwirtschaftete 2024 den größten Umsatzanteil, gestützt durch langfristige Verträge zwischen Automobilherstellern und Zulieferern sowie die weltweit steigende Fahrzeugproduktion. OEM-Bremsbeläge werden aufgrund ihrer garantierten Passform, Leistungskonsistenz und Einhaltung der Originalfahrzeugspezifikationen bevorzugt.

Das Aftermarket-Segment wird voraussichtlich von 2025 bis 2032 das schnellste Wachstum verzeichnen, getrieben durch den wachsenden, alternden Fahrzeugbestand und das steigende Verbraucherbewusstsein hinsichtlich der routinemäßigen Bremsenwartung. Aftermarket-Beläge bieten eine breite Auswahl an Material, Preis und Leistung und sind daher sowohl für Einzelfahrzeugbesitzer als auch für Flottenbetreiber attraktiv, die kostengünstige Ersatzlösungen suchen.

Regionale Analyse des Bremsbelagmarktes

- Nordamerika dominierte den Bremsbelagmarkt mit dem größten Umsatzanteil von 36,1 % im Jahr 2024, angetrieben durch einen reifen Automobilsektor, hohe Fahrzeugbesitzraten und strenge Sicherheitsvorschriften

- Die Verbraucher in der Region legen Wert auf Leistung, Zuverlässigkeit und die Einhaltung von Sicherheitsstandards, was zu einer stetigen Nachfrage nach hochwertigen Bremsbelägen sowohl für Personen- als auch für Nutzfahrzeuge geführt hat.

- Die Präsenz großer Automobilhersteller, die weitverbreitete Einführung fortschrittlicher Bremstechnologien und die zunehmende Hinwendung zu Elektrofahrzeugen stärken die Marktführerschaft der Region weiter.

Einblicke in den US-Bremsbelagmarkt

Der US-Bremsbelagmarkt erzielte 2024 den größten Umsatzanteil in Nordamerika, unterstützt durch einen großen Fahrzeugbestand, regelmäßige Austauschzyklen und die Einhaltung gesetzlicher Vorschriften zur Fahrzeugsicherheit. Der US-Markt profitiert von einer starken Dynamik im OEM- und Aftermarket-Bereich. Verbraucher bevorzugen Bremsbelagmaterialien, die ein ausgewogenes Verhältnis zwischen Leistung und Haltbarkeit bieten. Das Wachstum von Elektro- und Hybridfahrzeugen trägt ebenfalls zur steigenden Nachfrage nach regenerativen Bremsbelägen bei.

Einblicke in den europäischen Bremsbelagmarkt

Der europäische Bremsbelagmarkt wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen. Dies wird durch strenge Umweltvorschriften, die steigende Nachfrage nach geräusch- und staubarmen Lösungen sowie die starke Automobilproduktionsbasis der Region unterstützt. Europäische Automobilhersteller und Verbraucher entscheiden sich zunehmend für fortschrittliche Materialien wie Keramik und NAO, um Leistungs- und Nachhaltigkeitsziele zu erreichen. Die Region profitiert zudem von einem gut etablierten Aftermarket-Netzwerk, insbesondere in Ländern mit alternden Fahrzeugflotten.

Einblicke in den britischen Bremsbelagmarkt

Der britische Bremsbelagmarkt wird voraussichtlich stetig wachsen, angetrieben durch den wachsenden Fahrzeugbestand, regelmäßige Inspektionen (TÜV) und ein wachsendes Bewusstsein für die Fahrzeugwartung. Der Übergang zu Elektro- und Hybridfahrzeugen beeinflusst die Materialauswahl, wobei Keramik- und Low-Metallic-Optionen immer beliebter werden. Die hohe Fahrzeugnutzung in der Stadt und die Verkehrsdichte tragen ebenfalls dazu bei, dass Bremsbeläge häufig ausgetauscht werden müssen.

Einblicke in den Bremsbelagmarkt in Deutschland

Der deutsche Bremsbelagmarkt wächst stetig, unterstützt durch die führende Position Deutschlands im Automobilbau und ein starkes inländisches Fertigungs-Ökosystem. Deutsche Verbraucher und OEMs verlangen leistungsstarke und langlebige Bremslösungen, insbesondere für Premiumfahrzeuge. Auch die Einführung umweltfreundlicher Bremsbeläge nimmt zu, im Einklang mit dem Nachhaltigkeitsfokus Deutschlands und der Einhaltung der Euro-Emissionsnormen.

Einblicke in den Bremsbelagmarkt im Asien-Pazifik-Raum

Der Bremsbelagmarkt im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 die höchste jährliche Wachstumsrate (CAGR) aufweisen. Dies ist auf die steigende Fahrzeugproduktion, die Urbanisierung und steigende verfügbare Einkommen in Ländern wie China, Indien und Japan zurückzuführen. Die boomenden Zweirad- und Kleinwagensegmente der Region generieren eine erhebliche Nachfrage nach Bremsbelägen, insbesondere im Aftermarket. Staatliche Sicherheitsvorschriften und das wachsende Bewusstsein für regelmäßige Bremsenwartung kurbeln das Marktwachstum zusätzlich an.

Einblicke in den japanischen Bremsbelagmarkt

Der japanische Bremsbelagmarkt wächst weiterhin dank einer starken heimischen Automobilindustrie, technologischer Innovationen und der Vorliebe der Verbraucher für präzisionsgefertigte, geräuscharme Bremssysteme. Die alternde Bevölkerung und der Fokus auf Verkehrssicherheit haben den Einsatz hochwertiger Bremsbeläge, insbesondere im Stadtverkehr, erhöht. Japans frühzeitiger Umstieg auf Hybrid- und Elektrofahrzeugtechnologie beeinflusst auch die Nachfrage nach spezialisierten Bremssystemen.

Einblicke in den Bremsbelagmarkt in China

Der chinesische Bremsbelagmarkt hatte 2024 den größten Marktanteil im asiatisch-pazifischen Raum, angetrieben durch die massive Automobilproduktion, die steigende urbane Mobilität und das rasante Wachstum des Aftermarket-Sektors. Mit zunehmendem Sicherheitsbewusstsein und sich entwickelnden Emissionsstandards steigt die Nachfrage nach fortschrittlichen, kupferarmen und umweltfreundlichen Materialien. Die Präsenz großer inländischer Hersteller und der Vorstoß in die Elektromobilität dürften das Marktwachstum weiter ankurbeln.

Marktanteil von Bremsbelägen

Die Bremsbelagindustrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Wilwood Engineering, Inc. (USA)

- Brembo SpA (Italien)

- EBC Brakes (Großbritannien)

- ICER BRAKES SA (Spanien)

- Nisshinbo (Japan)

- Hawk Performance (USA)

- Hunan BoYun Automobile Brake Materials Co., Ltd. (China)

- Sangsin Brake Co., Ltd. (Südkorea)

- KFE Brake Systems (USA)

- Brakewel Automotive Components India Private Limited (Indien)

- TMD FRICTION HOLDINGS GMBH (Deutschland)

- GUD Holdings (Pty) Ltd. (Australien)

- Sundaram Brake Linings Ltd (Indien)

- CENTRIC PARTS. (USA)

- Ford Motor Company (USA)

- Allied Nippon (Indien)

- Tenneco Inc. (USA)

- ZF Friedrichshafen AG (Deutschland)

- MAT Holding, Inc. (USA)

- Rane Holdings Limited (Indien)

- Akebono Brake Corporation (Japan)

Neueste Entwicklungen auf dem globalen Bremsbelagmarkt

- Im Januar 2025 führte Uno Minda Hochleistungs-Bremsbeläge mit Unterlegscheibe für den indischen Ersatzteilmarkt ein und stärkte damit seine Position im inländischen Bremsbelagsegment. Diese Markteinführung steigert das Wertversprechen der Marke durch verbesserte Sicherheit, Bremsleistung und Langlebigkeit und trägt der wachsenden Nachfrage nach leistungsstarken Ersatzteilen in Indiens wachsender Fahrzeugflotte Rechnung.

- Im November 2024 stärkte die Akebono Brake Corporation ihre Position im Premium-Bremsbelagmarkt durch die Einführung von sieben neuen Teilenummern für ihre EURO- und Severe Duty Ultra-Premium-Scheibenbremsbeläge. Diese Erweiterung ermöglicht es Akebono, seine Produktabdeckung auf neuere Fahrzeugmodelle auszuweiten und seinen Marktanteil in Nordamerika und Europa zu stärken. Die Integration hochwertiger Edelstahl-Ankerteile und elektrischer Verschleißsensoren erhöht die Produktdifferenzierung weiter und untermauert den Ruf der Marke für Qualität und Zuverlässigkeit in kritischen Bremsanwendungen.

- Im Oktober 2023 eröffnen Brembo und SGL Carbon gemeinsam zwei hochmoderne Produktionsanlagen mit einer Gesamtfläche von 8.500 Quadratmetern für Brembo SGL Carbon Ceramic Brakes (BSCCB). Die Fertigstellung ist für Oktober 2024 geplant, der Produktionsstart ist für Januar 2025 geplant. Dies schafft rund 80 neue Arbeitsplätze und stärkt die Automobilindustrie.

- Im September 2023 kündigte Brembo SpA eine strategische Initiative an, um der steigenden Nachfrage nach Carbon-Keramik-Bremsscheiben in Pkw und Nutzfahrzeugen gerecht zu werden. Das Joint Venture Brembo SGL Carbon Ceramic Brakes (BSCCB) investierte bis 2027 150 Millionen Euro und ermöglichte damit eine bemerkenswerte Erweiterung der Produktionskapazitäten um 70 % an den Standorten Meitingen (Deutschland) und Stezzano (Italien).

- Im Mai 2023 brachte die Robert Bosch GmbH Elite-Bremsbeläge speziell für die TVS Apache auf den Markt. Sie verfügen über eine Streifenbeschichtung mit der proprietären ABRACOAT-Technologie. Diese Innovation zielt darauf ab, die Bremsleistung und Haltbarkeit von TVS Apache-Motorrädern zu verbessern, die spezifischen Bedürfnisse von Enthusiasten zu erfüllen und die Sicherheit auf der Straße zu erhöhen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.