Global Biodegradable Paper Plastic Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

13.51 Billion

USD

28.27 Billion

2024

2032

USD

13.51 Billion

USD

28.27 Billion

2024

2032

| 2025 –2032 | |

| USD 13.51 Billion | |

| USD 28.27 Billion | |

|

|

|

|

Globale Marktsegmentierung für biologisch abbaubare Papier- und Kunststoffverpackungen nach Typ (Stärkebasierter Kunststoff, Zellulosebasierter Kunststoff, Polymilchsäure (PLA), Polyhydroxyalkanoate (PHA)), Material (Kunststoff, Papier), Endverbraucher (Lebensmittel und Getränke, Catering-Service-Waren, Kosmetik, Körper- und Haushaltspflege, Gesundheitswesen, Elektro- und Elektronik, Pharmazeutika und andere), – Branchentrends und Prognose bis 2032

Marktgröße für biologisch abbaubare Papier- und Kunststoffverpackungen

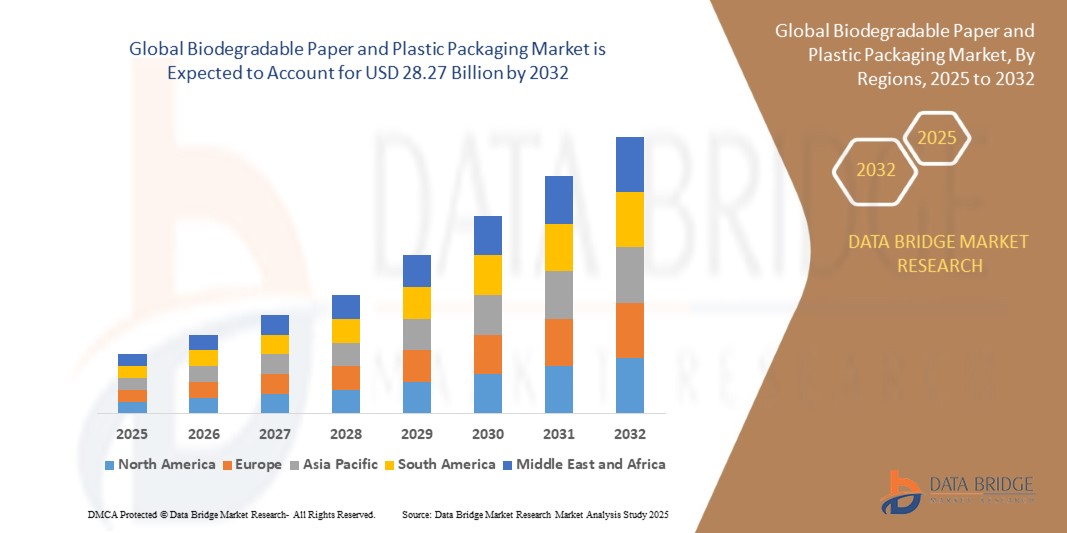

- Der globale Markt für biologisch abbaubare Papier- und Kunststoffverpackungen wurde im Jahr 2024 auf 13,51 Milliarden US-Dollar geschätzt und soll bis 2032 28,27 Milliarden US-Dollar erreichen.

- Im Prognosezeitraum von 2025 bis 2032 wird der Markt voraussichtlich mit einer jährlichen Wachstumsrate von 9,67 % wachsen, vor allem aufgrund zunehmender Umweltbedenken und staatlicher Anreize.

- Dieses Wachstum wird durch Faktoren wie die steigende Nachfrage nach nachhaltigen Verpackungslösungen, Fortschritte in der Materialtechnologie und die Dominanz der Region Asien-Pazifik vorangetrieben, die über ein Drittel des Marktanteils ausmacht.

Marktanalyse für biologisch abbaubare Papier- und Kunststoffverpackungen

- Biologisch abbaubare Papier- und Kunststoffverpackungen spielen eine entscheidende Rolle bei nachhaltigen Verpackungslösungen. Sie reduzieren die Umweltbelastung und erfüllen gleichzeitig die Anforderungen der Verbraucher und der gesetzlichen Bestimmungen. Diese Materialien zersetzen sich auf natürliche Weise, wodurch Umweltverschmutzung und Abfallansammlung minimiert werden.

- Die Nachfrage nach biologisch abbaubaren Verpackungen wird maßgeblich durch zunehmendes Umweltbewusstsein, staatliche Vorschriften für Einwegkunststoffe und den Wandel hin zu nachhaltigen Geschäftspraktiken vorangetrieben. Die Lebensmittel- und Getränkeindustrie leistet einen wichtigen Beitrag mit maßgeschneiderten Verpackungslösungen für Einwegbesteck, Lebensmittelbehälter und Verpackungsmaterialien.

- Die Region Europa ist eine der dominierenden Regionen für biologisch abbaubare Papier- und Kunststoffverpackungen, angetrieben durch strenge Umweltrichtlinien und Verbraucherbewusstsein.

- So hat die Europäische Union beispielsweise strikte Verbote für Einwegkunststoffe erlassen und fördert umweltfreundliche Alternativen, was die Nachfrage nach biologisch abbaubaren Verpackungslösungen steigert. Führende Hersteller in der Region entwickeln weiterhin Innovationen mit kompostierbaren Materialien und verbesserten Abbautechnologien.

- Globally, biodegradable paper and plastic packaging ranks among the fastest-growing segments in the packaging industry, following recyclable packaging materials. It plays a pivotal role in driving sustainability efforts across industries, ensuring compliance with evolving regulations while catering to environmentally conscious consumers

Report Scope and Biodegradable Paper and Plastic Packaging Market Segmentation

|

Attributes |

Biodegradable Paper and Plastic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Biodegradable Paper and Plastic Packaging Market Trends

“Rising Demand for Sustainable Packaging Solutions”

- One prominent trend in the global biodegradable paper and plastic packaging market is the increasing demand for eco-friendly and sustainable packaging alternatives

- These solutions address environmental concerns by reducing plastic waste and promoting the use of biodegradable materials like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics

- For instance, biodegradable plastics derived from cornstarch, sugarcane, and polylactic acid (PLA) are gaining traction as they offer similar durability to conventional plastics while being compostable and less harmful to the environment

- Governments worldwide are introducing incentives and regulations to encourage the adoption of biodegradable packaging, further driving market growth

- This trend is transforming the packaging industry, fostering innovation in material technology, and meeting consumer preferences for environmentally responsible products

Biodegradable Paper and Plastic Packaging Market Dynamics

Driver

“Growing Need for Sustainable Packaging Solutions”

- The increasing environmental concerns and the harmful effects of traditional plastic packaging are driving the demand for biodegradable paper and plastic packaging

- Governments and organizations worldwide are implementing stringent regulations to reduce plastic waste, further boosting the adoption of biodegradable alternatives

- Consumers are becoming more eco-conscious, preferring products with sustainable packaging, which is encouraging manufacturers to shift towards biodegradable materials

- Biodegradable packaging materials, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and cellulose-based plastics, are gaining popularity due to their ability to decompose naturally without harming the environment

- The food and beverage industry, in particular, is a significant contributor to the growth of this market, as it seeks sustainable solutions to maintain product freshness and safety while reducing environmental impact

For instance,

- In 2022, the Asia-Pacific region dominated the biodegradable paper and plastic packaging market, capturing over one-third of the market share. This growth is attributed to government incentives, advancements in material technology, and increasing environmental awareness

- As a result of these factors, the global biodegradable paper and plastic packaging market is experiencing significant growth, driven by the need for sustainable and eco-friendly packaging solutions

Opportunity

“Revolutionizing Sustainable Packaging with Biodegradable Material Innovations”

- AI-driven material innovation can enhance the development of biodegradable paper and plastic packaging by optimizing material compositions, improving durability, and ensuring faster decomposition while maintaining product integrity

- AI algorithms can analyze environmental impact and optimize supply chains, helping manufacturers reduce waste, improve recyclability, and create more efficient, cost-effective biodegradable packaging solutions

- AI-powered quality control systems can assist in detecting defects, monitoring production efficiency, and ensuring consistency in biodegradable packaging materials, leading to higher consumer confidence and industry adoption

For instance,

- In February 2025, according to an article published in the Journal of Sustainable Materials, AI-driven biodegradable material testing has enabled researchers to develop new plant-based polymers that decompose 30% faster than traditional biodegradable plastics. These advancements are accelerating the adoption of eco-friendly packaging in the food and beverage industry

- In September 2023, according to an article published in the Environmental Packaging Journal, AI was instrumental in improving the performance of biodegradable coatings for paper packaging. By analyzing degradation rates and environmental interactions, AI-assisted research has led to coatings that enhance moisture resistance without compromising biodegradability

- The integration of AI in biodegradable packaging production can also lead to reduced manufacturing waste, enhanced efficiency, and a lower carbon footprint. By leveraging AI-driven material analysis, companies can develop stronger, more sustainable packaging while ensuring compliance with evolving global regulations

Restraint/Challenge

“High Production Costs Hindering Market Expansion”

- The high cost of producing biodegradable paper and plastic packaging poses a significant challenge for the market, particularly affecting the pricing and adoption rates among businesses, especially in price-sensitive regions

- Biodegradable packaging materials, while environmentally friendly, often require advanced manufacturing processes and raw materials that are more expensive than conventional plastics, leading to higher production costs

- This substantial financial barrier can deter small and medium-sized enterprises (SMEs) from adopting biodegradable alternatives, as the higher costs may not be feasible for businesses operating on tight margins

For instance,

- In October 2024, according to an article published by the Sustainable Packaging Research Institute, one of the main concerns surrounding the high cost of biodegradable packaging is its impact on market competitiveness. The higher price point compared to traditional plastic packaging limits widespread adoption, particularly in industries with tight cost constraints, such as food and beverage and e-commerce

- Solche Einschränkungen können zu einer langsameren Einführung biologisch abbaubarer Verpackungslösungen führen und die Kluft zwischen Nachhaltigkeitszielen und praktischer Umsetzung vergrößern . Diese Herausforderung behindert letztlich das Marktwachstum , da viele Unternehmen die Umstellung auf biologisch abbaubare Alternativen ohne ausreichende Kostensenkungen oder staatliche Anreize kaum rechtfertigen können.

Marktumfang für biologisch abbaubare Papier- und Kunststoffverpackungen

Der Markt ist nach Typ, Material und Endbenutzer segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Typ |

|

|

Nach Material |

|

|

Nach Endbenutzer |

|

Regionale Analyse des Marktes für biologisch abbaubare Papier- und Kunststoffverpackungen

„Europa ist die dominierende Region auf dem Markt für biologisch abbaubare Papier- und Kunststoffverpackungen“

- Es wird erwartet, dass Europa den Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren wird. Grund dafür sind strenge Umweltvorschriften, eine starke Nachfrage der Verbraucher nach nachhaltigen Verpackungen und staatliche Initiativen zur Förderung umweltfreundlicher Alternativen.

- Die Europäische Union hat einen erheblichen Anteil daran, da Einwegkunststoffe streng verboten sind, das Bewusstsein für die Umweltverschmutzung durch Kunststoffe steigt und in der Lebensmittel-, Getränke- und Einzelhandelsbranche zunehmend kompostierbare und biologisch abbaubare Materialien zum Einsatz kommen.

- Die Präsenz etablierter Nachhaltigkeitsrichtlinien und erhebliche Investitionen in Forschung und Entwicklung durch führende Verpackungshersteller stärken den Markt zusätzlich

- Darüber hinaus treibt die wachsende Nachfrage nach umweltfreundlichen Verpackungslösungen, kombiniert mit dem Engagement der Unternehmen für Nachhaltigkeit und Fortschritten in der Technologie biologisch abbaubarer Materialien, die Marktexpansion in der gesamten Region voran.

„Asien-Pazifik wird voraussichtlich die höchste Wachstumsrate verzeichnen“

- Im asiatisch-pazifischen Raum wird voraussichtlich die höchste Wachstumsrate im Markt für biologisch abbaubare Papier- und Kunststoffverpackungen zu verzeichnen sein, angetrieben durch ein steigendes Umweltbewusstsein, staatliche Vorschriften zur Reduzierung von Kunststoffabfällen und eine steigende Nachfrage nach nachhaltigen Verpackungslösungen.

- Länder wie China, Indien und Japan entwickeln sich aufgrund der schnellen Industrialisierung, des wachsenden E-Commerce-Sektors und der wachsenden Präferenz der Verbraucher für umweltfreundliche Verpackungsalternativen zu Schlüsselmärkten.

- Japan bleibt mit seiner fortschrittlichen Verpackungstechnologie und seinem starken Engagement für Nachhaltigkeit ein wichtiger Markt für biologisch abbaubare Verpackungen. Das Land ist weiterhin führend in der Entwicklung und Einführung leistungsstarker biologisch abbaubarer Materialien, um seine Umweltziele zu erreichen.

- China und Indien mit ihren großen Bevölkerungen und der wachsenden Sorge um die Plastikverschmutzung erleben zunehmende staatliche und private Investitionen in biologisch abbaubare Verpackungslösungen. Die wachsende Präsenz globaler Hersteller nachhaltiger Verpackungen und die verbesserte Verfügbarkeit umweltfreundlicher Alternativen tragen zusätzlich zum Marktwachstum bei.

Marktanteil biologisch abbaubarer Papier- und Kunststoffverpackungen

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Riverside Paper Co. Inc. (USA)

- SmartSolve Industries (USA)

- Özsoy Plastik (Türkei)

- Ultragrüne, nachhaltige Verpackungen (USA)

- Hosgör Plastik (Türkei)

- Eurocell Srl (Großbritannien)

- Tetra Pak International SA (Schweiz)

- Kruger Inc. (Kanada)

- Amcor PLC (Schweiz)

- Mondi (Großbritannien)

- International Paper Company (USA)

- Smurfit Kappa (USA)

- DS Smith (Großbritannien)

- Klabin SA (Brasilien)

- Rengo Co. Ltd (Japan)

- WestRock Company (USA)

- Stora Enso (Schweden)

- Bemis Manufacturing Company (USA)

- Rocktenn (USA)

- BASF SE (Deutschland)

- Clearwater Paper Corporation (USA)

Neueste Entwicklungen auf dem globalen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen

- Im November 2024 stellte BASF SE ihre CircleCELL-Zwischensohlentechnologie vor, die gemeinsam mit Mount to Coast für Ultralaufschuhe entwickelt wurde. Diese innovative Zwischensohle verwendet das biomassenbilanzierte Ecoflex BMB-Biopolymer der BASF und gewährleistet durch die Verwendung nachwachsender Rohstoffe sowohl Leistungssteigerung als auch Nachhaltigkeit. Sie soll 90 % haltbarer sein als herkömmliche Materialien wie PEBA und gleichzeitig die gleiche Energierückgabe bieten, die für Hochleistungsläufe unerlässlich ist. Dies stellt einen bemerkenswerten Fortschritt in der umweltbewussten Haltbarkeit dar.

- Im November 2024 unterzeichnete Toray Industries, Inc. eine Absichtserklärung mit PTT Global Chemical Public Company Limited (GC), um die Massenproduktionstechnologie für Adipinsäure aus nicht essbarer Biomasse zu erforschen. Ziel der Zusammenarbeit war es, die Machbarkeit dieser Technologie und ihre Kommerzialisierung in Thailand und Japan zu prüfen. Das ehrgeizige Ziel besteht darin, bis 2030 jährlich mehrere tausend Tonnen biobasierter Muconsäure und Adipinsäure zu produzieren. Diese Initiative stellt einen bedeutenden Schritt in Richtung einer nachhaltigen Chemieproduktion dar.

- Im September 2024 gaben Danimer Scientific und Ningbo Homelink Eco-iTech die Markteinführung von Nodax bekannt, einem heimkompostierbaren Biopolymer für Extrusionsbeschichtungen auf Basis von Polyhydroxyalkanoat (PHA). Dieses innovative Material dient als Flüssigkeitsbarriere für Pappbecher und bietet eine nachhaltige Alternative zu herkömmlichen Polyethylenbeschichtungen.

- Im April 2024 kooperierte NatureWorks LLC mit IMA Coffee, um eine schlüsselfertige, kompostierbare Kaffeepadlösung für Keurig-Kaffeemaschinen auf dem nordamerikanischen Markt einzuführen. Diese im April 2021 initiierte Zusammenarbeit vereint die Expertise von NatureWorks im Bereich Ingeo PLA-Biopolymer mit der Kompetenz von IMA Coffee in der Kaffeeverarbeitung und Verpackungstechnologie. Ziel der Partnerschaft ist es, die Lieferkette für Kaffeemarken zu vereinfachen und nachhaltige Verpackungslösungen anzubieten, die Geschmack und Aroma des Kaffees bewahren.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.