Globaler Markt für OE-Reifen und -Felgen für Kraftfahrzeuge, nach Felgenmaterial (Leichtmetall, Kohlefaser, Stahl, Sonstiges), Fahrzeugtyp (Nutzfahrzeuge, Personenkraftwagen), Reifenmaterial (Naturkautschuk, synthetischer Kautschuk), Reifenprofil (70), Reifenbreite (230 mm), Fahrzeugklasse (Luxusfahrzeuge, Economy-Fahrzeuge, Fahrzeuge der mittleren Preisklasse), Felgengröße (13-15 Zoll, 16-18 Zoll, 19-21 Zoll, größer als 21 Zoll), Land (USA, Kanada, Mexiko, Brasilien, Argentinien, übriges Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, übriges Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, übriger asiatisch-pazifischer Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, übriger Naher Osten und Afrika) Branchentrends und Prognosen für 2028.

Marktanalyse und Einblicke für Erstausrüsterreifen und -räder für Kraftfahrzeuge: Globaler Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge

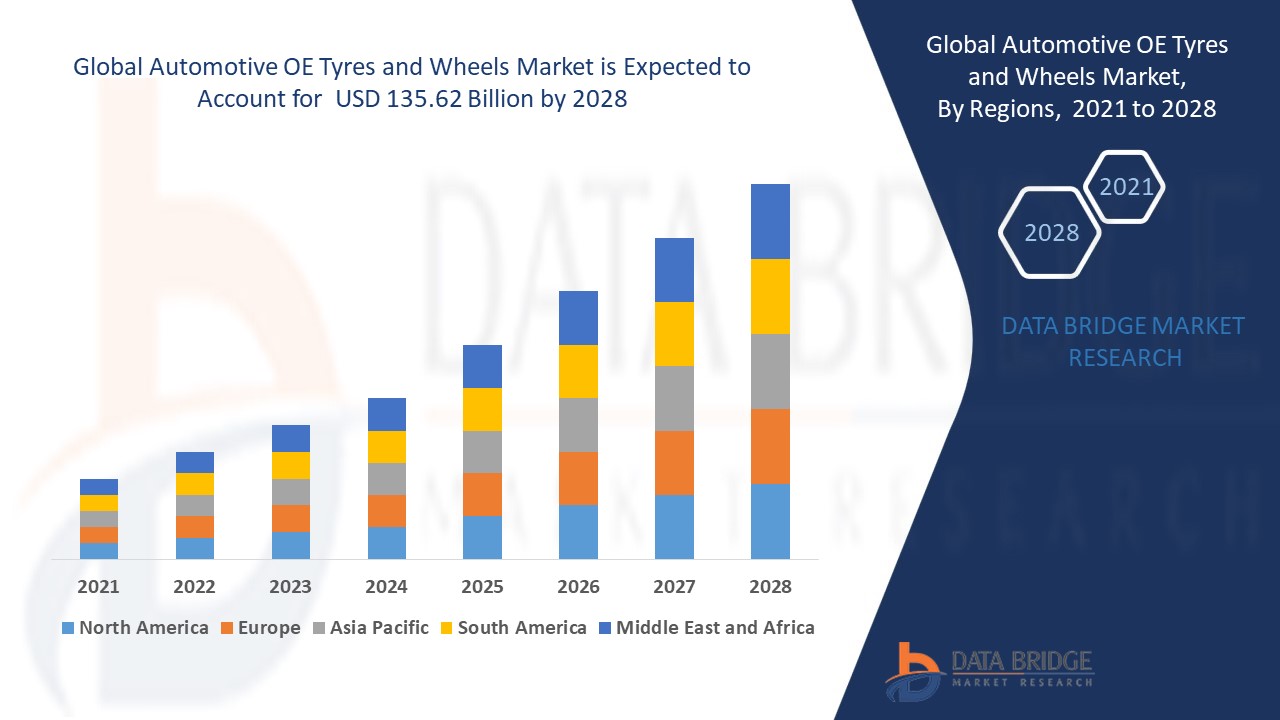

Der Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge wird im Prognosezeitraum von 2021 bis 2028 einen geschätzten Wert von 135,62 Milliarden US-Dollar erreichen und mit einer durchschnittlichen jährlichen Wachstumsrate von 3,25 % wachsen. Der zunehmende Fokus auf Innovationen und Fortschritte auf dem Markt, die leichte Materialien erfordern, ist ein wesentlicher Faktor für den Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge.

Reifen sind ringförmige Gummikonstruktionen, die die Räder des Fahrzeugs umgeben. Diese Reifen sind für die Mobilität des Fahrzeugs verantwortlich und helfen auch dabei, das Gewicht des Fahrzeugs von den Achsen auf den Boden zu verteilen.

Die Steigerung der Automobilproduktion und des Automobilabsatzes in verschiedenen Fahrzeugsegmenten ist ein entscheidender Faktor, der das Marktwachstum beschleunigt. Auch der zunehmende Wettbewerb zwischen Reifenherstellern, die zunehmende Einführung fortschrittlicher Technologien im Herstellungsprozess, die steigenden niedrigen Produktionskosten, die zunehmende Verfügbarkeit wirtschaftlicher Arbeitskräfte, nachsichtige Emissions- und Sicherheitsnormen und die zunehmenden staatlichen Initiativen für ausländische Direktinvestitionen sind die Hauptfaktoren, die den Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge ankurbeln. Darüber hinaus werden steigende Bedenken hinsichtlich Kraftstoffeffizienz und Sicherheit, zunehmende technologische Fortschritte und zunehmende Modernisierung der Produktionstechniken sowie zunehmende Forschungs- und Entwicklungsaktivitäten auf dem Markt im oben genannten Prognosezeitraum weitere neue Möglichkeiten für den Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge schaffen.

Allerdings sind die volatilen Rohstoffpreise und die zunehmende Entwicklung im Markt für Runderneuerungsreifen die Hauptfaktoren, die das Marktwachstum bremsen und den Markt für Erstausrüstungsreifen und -felgen für Kraftfahrzeuge im oben genannten Prognosezeitraum vor weitere Herausforderungen stellen.

Dieser Marktbericht für Erstausrüstungsreifen und -räder für Kraftfahrzeuge enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-/Exportanalysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Erstausrüstungsreifen und -räder für Kraftfahrzeuge zu erhalten, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang und Marktgröße für Erstausrüstungsreifen und -räder für Kraftfahrzeuge

Der Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge ist nach Radmaterial, Fahrzeugtyp, Reifenmaterial, Querschnittsverhältnis, Auswahlbreite, Fahrzeugklasse und Radgröße segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer Hauptanwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage des Radmaterials ist der Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge in Legierung, Kohlefaser , Stahl und andere unterteilt.

- Basierend auf dem Fahrzeugtyp ist der Markt für Erstausrüsterreifen und -felgen in Nutzfahrzeuge und Personenkraftwagen segmentiert.

- Basierend auf dem Reifenmaterial ist der Markt für Erstausrüsterreifen und -felgen für Kraftfahrzeuge in Naturkautschuk und Synthesekautschuk segmentiert.

- Basierend auf dem Höhen-/Breitenverhältnis ist der Markt für Erstausrüsterreifen und -felgen für Kraftfahrzeuge in <60, 60-70 und >70 segmentiert.

- Basierend auf der Auswahlbreite ist der Markt für Erstausrüsterreifen und -felgen für Kraftfahrzeuge in 200, 200–230 und > 230 mm segmentiert.

- Basierend auf der Fahrzeugklasse ist der Markt für Erstausrüsterreifen und -felgen in Luxusfahrzeuge, Fahrzeuge der unteren Preisklasse und Fahrzeuge der mittleren Preisklasse segmentiert.

- Der Markt für Erstausrüsterreifen und -felgen für Kraftfahrzeuge ist außerdem nach der Felgengröße segmentiert: in 13–15 Zoll, 16–18 Zoll, 19–21 Zoll und über 21 Zoll.

Automobil-OE-Reifen und -Felgen Marktumfang Länderebene Analyse

Der Markt für Erstausrüsterreifen und -felgen für Kraftfahrzeuge wird analysiert. Informationen zu Marktgröße und Volumen werden nach Land, Felgenmaterial, Fahrzeugtyp, Reifenmaterial, Querschnittsverhältnis, Auswahlbreite, Fahrzeugklasse und Felgengröße wie oben angegeben bereitgestellt.

Die im Marktbericht für Erstausrüsterreifen und -felgen für Kraftfahrzeuge abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Brasilien, Argentinien und der Rest von Südamerika als Teil von Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Niederlande, Belgien, Schweiz, Türkei, Russland, der Rest von Europa in Europa, Japan, China, Indien, Südkorea, Australien, Singapur, Malaysia, Thailand, Indonesien, Philippinen, der Rest von Asien-Pazifik (APAC) in der Region Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, der Rest von Nahem Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA).

Der asiatisch-pazifische Raum dominiert den Markt für Erstausrüsterreifen und -räder aufgrund des steigenden Inlandsverbrauchs, des zunehmenden Wettbewerbs unter den Reifenherstellern und der zunehmenden Einführung fortschrittlicher Technologien im Herstellungsprozess in dieser Region. In Bezug auf den Markt für Erstausrüsterreifen und -räder ist Europa die erwartete Region aufgrund der steigenden Automobilproduktion und -verkäufe in verschiedenen Fahrzeugsegmenten dieser Region.

Der Länderabschnitt des Marktberichts für Erstausrüsterreifen und -räder für Kraftfahrzeuge enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Erstausrüsterreifen und -felgen für Kraftfahrzeuge

Die Wettbewerbslandschaft auf dem Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge bietet Einzelheiten nach Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, regionale Präsenz, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Erstausrüsterreifen und -räder für Kraftfahrzeuge.

Die wichtigsten Akteure, die im Marktbericht für Erstausrüsterreifen und -räder für Kraftfahrzeuge behandelt werden, sind IOCHPE, Bridgestone Corporation, Superior Industries International, Inc., Apollo Tyres, MICHELIN, CITIC LIMITED, Steel Strips Wheels Limited, Hitachi Metals, Ltd., The Goodyear Tire & Rubber Company, Wanfeng Group Co., Ltd., MANGELS, Accuride Wheels, Continental AG, RONAL GROUP, thyssenkrupp AG, TOPY INDUSTRIES LIMITED, Sumitomo Rubber Industries, Ltd., Pirelli & CSpA, ZC-RUBBER, THE YOKOHAMA RUBBER CO., LTD., CST, MRF, TOYO TIRE & RUBBER CO., LTD. und Nokian Tyres plc sowie weitere nationale und internationale Akteure. Marktanteilsdaten sind für die Regionen weltweit, Nordamerika, Europa, Asien-Pazifik (APAC), Naher Osten und Afrika (MEA) und Südamerika separat verfügbar. Die Analysten von DBMR verstehen die Stärken der Wettbewerber und erstellen für jeden Wettbewerber separat eine Wettbewerbsanalyse.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.