Global Automotive Level Sensor Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.03 Billion

USD

1.32 Billion

2024

2032

USD

1.03 Billion

USD

1.32 Billion

2024

2032

| 2025 –2032 | |

| USD 1.03 Billion | |

| USD 1.32 Billion | |

|

|

|

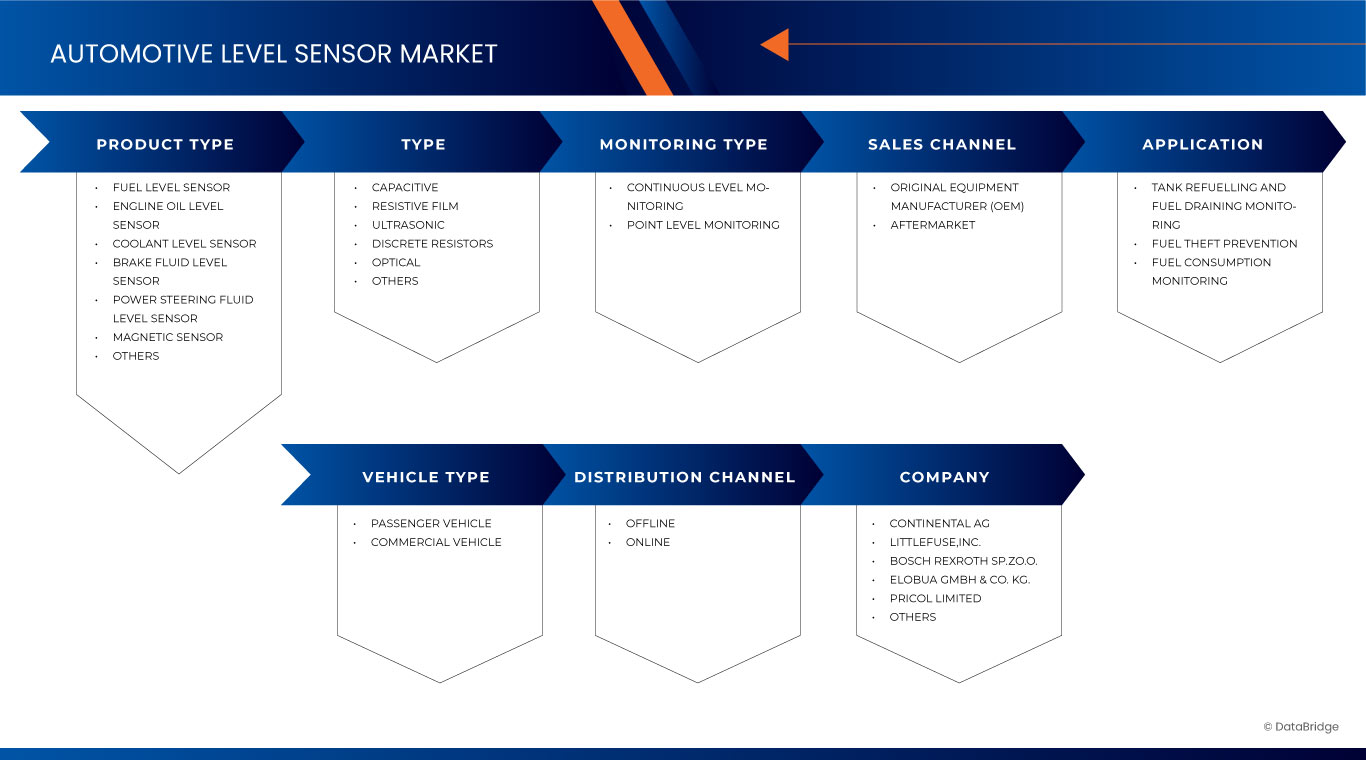

Global Automotive Level Sensor Market Segmentation, By Product Type(Fuel Level Sensor, Engine Oil Level Sensor, Coolant Level Sensor, Brake Fluid Level Sensor, Power Steering Fluid Level Sensor Magnetic Sensor, and Others), Type (Capacitive, Resistive Film, Ultrasonic, Discrete Resistors, Optical, and Others), Monitoring Type (Continuous Level Monitoring and Point Level Monitoring), Application (Tank Refueling and fuel draining monitoring, Fuel Theft Prevention, and Fuel Consumption Monitoring), Vehicle Type (Passenger Vehicle and Commercial Vehicle), Sales Channel (Original Equipment Manufacturer (OEM) and Aftermarket Distribution Channel (Online and Offline) - Industry Trends and Forecast to 2031

Global Automotive Level Sensor Market Analysis

Rapidly expanding automotive industry is driving the market growth. Technological innovations and advancements in sensor technology provides opportunities in the market. Moreover, increasing adoption of Electric Vehicles (EVs) is driving market growth.

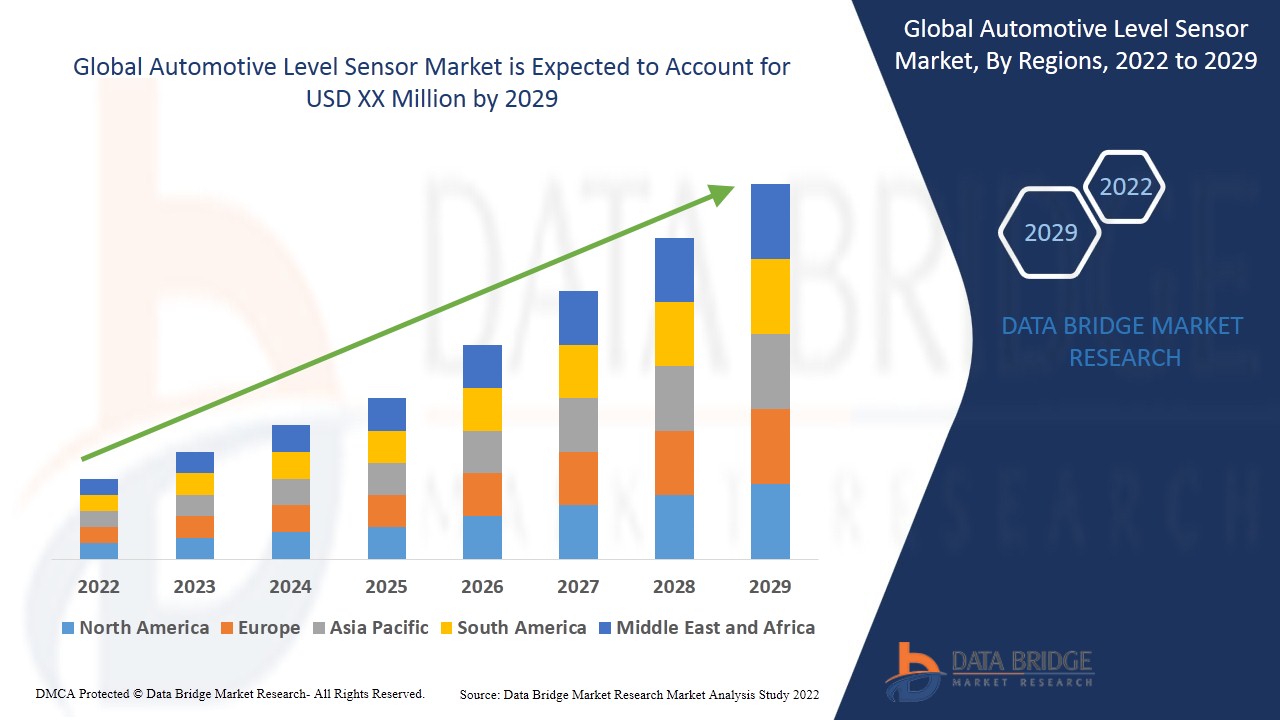

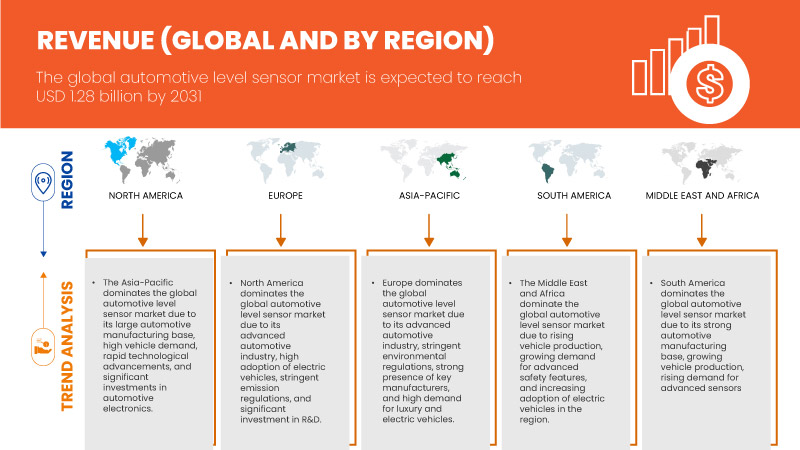

Global Automotive Level Sensor Market Size

The global automotive level sensor market is expected to reach USD 1.28 billion by 2031 from USD 1.01 billion in 2023, growing with a substantial CAGR of 3.06% in the forecast period of 2024 to 2031.

Global Automotive Level Sensor Market Trends

“Rising consumer demand for safety and comfort”

Rising consumer expectations for safety and comfort are significantly boosting the automotive level sensor market. As vehicle drivers place greater emphasis on advanced safety features and enhanced comfort, the demand for sophisticated level sensors is increasing.

Modern vehicles are equipped with numerous safety systems that depend on level sensors. These sensors monitor critical fluid levels such as brake fluid, windshield washer fluid, and engine oil, which are essential for preventing accidents and ensuring smooth vehicle operation. With tighter safety regulations and heightened consumer expectations, automakers are incorporating advanced sensors to improve vehicle safety, thereby driving market growth.

The drive for greater vehicle comfort has led to innovations in climate control systems. Level sensors play a crucial role in managing heating, ventilation, and air conditioning (HVAC) fluids, providing accurate measurements of coolant and refrigerant levels to maintain a pleasant cabin environment. As consumers demand better climate control and overall comfort, the need for high-performance level sensors in these systems continues to rise.

The trend towards more luxurious and feature-rich vehicles also fuels this market growth. High-end vehicles often include advanced systems such as automatic transmission fluid monitoring and adaptive suspension systems, all of which rely on precise level sensors to operate effectively and enhance the driving experience.

As automotive technology progresses, consumers expect vehicles to be more reliable and efficient. Level sensors contribute to these expectations by ensuring optimal fluid levels, which supports vehicle performance and longevity.

Report Scope and Market Segmentation

|

Attributes |

Global Automotive Level Sensor Key Market Insights |

|

Segmentation |

By Product Type - Fuel Level Sensor, Engine Oil Level Sensor, Coolant Level Sensor, Brake Fluid Level Sensor, Power Steering Fluid Level Sensor, Magnetic Sensor, and Others By Type- Capacitive, Resistive Film, Ultrasonic, Discrete Resistors, Optical, and Others By Monitoring Type- Continuous Level Monitoring and Point Level Monitoring By Application- Tank Refuelling and fuel draining monitoring, Fuel Theft Prevention, and Fuel Consumption Monitoring By Vehicle Type- Passenger Vehicle and Commercial Vehicle By Sales Channel- Original Equipment Manufacturer (OEM) and Aftermarket By Distribution Channel- Online and Offline |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Russia, Turkey, Netherlands, Belgium, Sweden, Poland, Switzerland, Denmark, Norway, Finland, Rest of Europe, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Vietnam, Taiwan, Philippines, Singapore, Australia, Rest of Asia-Pacific, U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Kuwait, Qatar, Oman, Bahrain, and Rest of Middle East and Africa |

|

Key Market Players |

Continental AG (Germany), Littelfuse, Inc.(U.S.), Bosch Rexroth Sp. Z O.O. (Poland), Elobau Gmbh & Co. KG.C (Germany), Pricol Limited (India), Bourns Inc (U.S.), Guangdong Zhengyang Sensing Technology Co., Ltd.(China), Misensor Tech Co., Ltd.(China), Omnicomm (Estonia), Soway Tech Limited (China), Spark Minda (India), Standex Electronics, Inc (U.S.), and Technoton (Czech Republic), Wema UK (UK), among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Automotive Level Sensor Market Definition

The global automotive level sensor market includes sensors that measure and monitor fluid levels, such as fuel, oil, and coolant, in vehicles. These sensors enhance vehicle safety and performance by providing real-time data for precise fluid management. They are commonly used in dashboards, engine management systems, and fuel tanks. Market growth is driven by rising vehicle production, technological innovations, and a heightened focus on safety and efficiency in automotive design.

Global Automotive Level Sensor Market Dynamics

Drivers

- Rapidly Expanding Automotive Industry

The rapid growth of the automotive industry is significantly boosting the global market for automotive level sensors. As vehicle technology advances, there is an increasing need for sophisticated components that enhance safety, efficiency, and performance. Automotive level sensors, essential for monitoring fluid levels such as fuel, oil, and coolant, are crucial for ensuring the functionality and reliability of modern vehicles.

The rise of electric and hybrid vehicles necessitates advanced level sensing technologies to manage battery cooling systems and maintain peak performance. As these vehicles become more prevalent, the demand for accurate and reliable level sensors increases.

The shift towards autonomous and semi-autonomous vehicles further amplifies the need for advanced sensor technologies. These vehicles rely on extensive sensor networks for safe operation, with level sensors being vital for maintaining proper fluid levels and ensuring overall system reliability.

Moreover, stringent environmental regulations and consumer demands for better fuel efficiency drive automakers to implement advanced monitoring systems. Level sensors contribute by optimizing fuel consumption and reducing emissions through precise fluid level readings and management.

The growth of the automotive market in emerging economies accelerates the demand for these sensors. As these regions adopt modern automotive technologies, the need for advanced level sensors to meet evolving safety and

performance standards increases.

For Instance,

- In 2024, according to news of Indian Express, India's automotive industry is experiencing high growth, with projections indicating significant expansion in both production and market value. The sector's focus on EVs, innovation, and global competitiveness positions it as a leading player in the global automotive landscape

Zunehmende Verbreitung von Elektrofahrzeugen (EVS)

Die zunehmende Verbreitung von Elektrofahrzeugen (EVs) hat erhebliche positive Auswirkungen auf den Markt für Fahrzeug-Füllstandssensoren. Da sich der Übergang zu Elektrofahrzeugen beschleunigt, tragen mehrere Schlüsselfaktoren zur erhöhten Nachfrage nach Füllstandssensoren bei.

Elektrofahrzeuge benötigen moderne Batteriemanagementsysteme (BMS), um den sicheren und effizienten Betrieb ihrer Hochleistungsbatterien zu gewährleisten. Diese Systeme sind auf präzise Füllstandssensoren angewiesen, um den Kühlmittelstand der Batterie zu überwachen, der für die Temperaturregulierung und Aufrechterhaltung optimaler Leistung unerlässlich ist. Mit dem Wachstum des Elektrofahrzeugmarktes steigt auch der Bedarf an diesen Spezialsensoren.

Elektrofahrzeuge verfügen über hochentwickelte Wärmemanagementsysteme, die die Temperatur verschiedener Komponenten, darunter Elektromotoren und Leistungselektronik, regeln. Füllstandssensoren sind in diesen Systemen von entscheidender Bedeutung, da sie genaue Kühlmittelstandsmessungen ermöglichen, die eine Überhitzung verhindern und die Systemzuverlässigkeit gewährleisten.

Der Umstieg auf Elektrofahrzeuge bringt Fortschritte in Fahrzeugdesign und -technologie mit sich und erhöht die Nachfrage nach präziseren und zuverlässigeren Lösungen zur Füllstandsmessung. Um die Leistung und Sicherheit der Fahrzeuge zu verbessern, integrieren die Hersteller von Elektrofahrzeugen modernste Sensortechnologien und kurbeln so das Marktwachstum weiter an.

Der Wunsch nach längeren Reichweiten und höherer Energieeffizienz bei Elektrofahrzeugen hat die Entwicklung moderner Batteriekühlungslösungen vorangetrieben. Diese Lösungen sind auf leistungsstarke Füllstandssensoren angewiesen, um Kühlflüssigkeiten effektiv zu verwalten und zu überwachen, was den wachsenden Bedarf an solchen Sensoren im Elektrofahrzeugsektor unterstreicht.

Zum Beispiel,

- Laut dem Bericht der IEA stiegen die weltweiten Zulassungen von Elektroautos im Jahr 2023 auf fast 14 Millionen, was einer Gesamtzahl von 40 Millionen Fahrzeugen entspricht. Das Wachstum wurde von China, Europa und den USA angeführt, wobei Elektroautos 18 % des weltweiten Absatzes ausmachten. China exportierte 1,2 Millionen Elektrofahrzeuge, während Europa ein unterschiedliches regionales Wachstum verzeichnete.

Gelegenheiten

- Technologische Innovationen und Fortschritte in der Sensortechnologie

Technologische Innovationen und Fortschritte in der Sensortechnologie beeinflussen den globalen Markt für Füllstandssensoren in der Automobilindustrie erheblich. Mit der zunehmenden Komplexität von Fahrzeugen ist die Nachfrage nach Hightech-Sensoren, die Sicherheit, Effizienz und Leistung verbessern, stark gestiegen.

Die wichtigste Entwicklung ist die Verbesserung der Sensorgenauigkeit und -zuverlässigkeit. Neue Technologien wie kapazitive und optische Sensoren bieten eine verbesserte Präzision bei der Überwachung von Flüssigkeitsständen. Diese fortschrittlichen Sensoren liefern zuverlässigere Daten, die für das effektive Funktionieren moderner Fahrzeugsysteme, einschließlich fortschrittlicher Fahrerassistenzsysteme (ADAS) und Motormanagement, von entscheidender Bedeutung sind.

Zusammenfassend lässt sich sagen, dass technologische Innovationen in den Bereichen Genauigkeit, Konnektivität, Miniaturisierung, Haltbarkeit und Sensorfusion den globalen Markt für Füllstandssensoren für Kraftfahrzeuge erheblich voranbringen. Diese Entwicklungen verbessern die Leistung und Sicherheit von Fahrzeugen, indem sie präzisere und zuverlässigere Überwachungslösungen bieten und das Wachstum und die Entwicklung des Marktes im Einklang mit modernen Fortschritten in der Automobilindustrie vorantreiben.

- Trends bei intelligenten Fahrzeugen steigern die Nachfrage nach fortschrittlichen Sensoren und Technologien

Der wachsende Trend zu intelligenten Fahrzeugen treibt die Nachfrage nach fortschrittlichen Sensoren und Technologien auf dem globalen Markt für Fahrzeug-Füllstandssensoren erheblich an. Da Fahrzeuge immer vernetzter und autonomer werden, ist der Bedarf an hochentwickelten Sensoren zur Unterstützung dieser Innovationen stark gestiegen.

Intelligente Fahrzeugsysteme, darunter fortschrittliche Fahrerassistenzsysteme (ADAS) und autonome Fahrtechnologien, erfordern hochpräzise und zuverlässige Füllstandssensoren. Diese Systeme sind auf genaue Messungen angewiesen, um wichtige Flüssigkeiten wie Kraftstoff, Öl und Kühlmittel zu überwachen und zu verwalten und so sowohl optimale Leistung als auch Sicherheit zu gewährleisten. Folglich steigt die Nachfrage nach Sensoren, die Echtzeit- und präzise Daten liefern.

Intelligente Fahrzeuge verfügen über fortschrittliche Klima- und Infotainmentsysteme, die auf hochmodernen Sensortechnologien basieren. So müssen beispielsweise Sensoren, die Heizungs-, Lüftungs- und Klimaanlagen (HVAC) steuern, hochpräzise sein, um optimale Innenraumbedingungen aufrechtzuerhalten. Ebenso benötigen Sensoren in Fahrzeugkonnektivitätssystemen fortschrittliche Funktionen, um eine nahtlose Kommunikation und Datenübertragung zu ermöglichen.

Der Trend hin zur Elektrifizierung und Hybridisierung erhöht auch den Bedarf an hochentwickelten Sensoren. Elektro- und Hybridfahrzeuge nutzen komplexe Batteriekühlsysteme, die Hochleistungssensoren zur Überwachung des Kühlmittelstands und zur Gewährleistung der Batterieeffizienz erfordern. Da diese Fahrzeugtypen immer häufiger zum Einsatz kommen, steigt die Nachfrage nach hochentwickelten Sensoren weiter an.

Da die Verbesserung der Fahrzeugsicherheit und des Fahrerkomforts bei intelligenten Fahrzeugen im Vordergrund steht, besteht ein Bedarf an Sensoren, die präzise Messungen liefern und sich effektiv in verschiedene Fahrzeugsysteme integrieren lassen. Innovationen wie die Sensorfusionstechnologie, die Daten mehrerer Sensoren für eine umfassende Überwachung kombiniert, werden immer wichtiger.

Zum Beispiel,

- Laut einer Meldung der Economic Times hat die Automobilindustrie im letzten Jahrzehnt rasante Fortschritte gemacht und die Mobilität für das digitale Zeitalter neu definiert. Zu den Innovationen gehören verbesserte Konnektivität, autonome Fahrtechnologie und Elektrifizierung, die zu erheblichen Veränderungen im Fahrzeugdesign und den Erwartungen der Verbraucher führen.

Einschränkungen/Herausforderungen

- Hohe Kosten für fortschrittliche Sensoren

Die hohen Kosten, die mit modernen Sensoren verbunden sind, wirken sich erheblich auf den Markt für Füllstandssensoren in Kraftfahrzeugen aus. Obwohl der technologische Fortschritt hochentwickelte Sensoren hervorgebracht hat, die die Sicherheit und Leistung von Fahrzeugen verbessern, stellt ihr hoher Preis mehrere Herausforderungen für das Marktwachstum dar.

Die hohen Kosten für moderne Sensoren können eine breite Akzeptanz verhindern, insbesondere bei preisbewussten Verbrauchern und auf Kosteneffizienz ausgerichteten Automobilherstellern. Dies kann die Integration dieser Spitzentechnologien in günstigere Fahrzeugsegmente verzögern und so die Marktdurchdringung und Wachstumschancen einschränken.

Die Kosten für moderne Sensoren wirken sich auf die Preisstrategien der Fahrzeuge aus. Die Automobilhersteller haben möglicherweise Schwierigkeiten, die Kosten für den Einbau dieser Sensoren mit der Notwendigkeit, die Fahrzeugpreise wettbewerbsfähig zu halten, in Einklang zu bringen. Dieser Druck kann zu langsameren Einführungsraten führen und die Expansion des Marktes für Fahrzeugfüllstandssensoren verlangsamen.

Hohe Kosten beeinträchtigen die Forschungs- und Entwicklungsanstrengungen (F&E) der Automobilhersteller. Diese Sensoren bieten zwar erhebliche Vorteile, doch die erheblichen Investitionen, die für ihre Entwicklung und Produktion erforderlich sind, können die für andere Innovationen und Verbesserungen verfügbaren Ressourcen einschränken.

Mit der Weiterentwicklung von Technologie und Produktionsverfahren dürften die Kosten dieser Sensoren mit der Zeit sinken. Diese Senkung könnte eine breitere Akzeptanz und ein Marktwachstum ermöglichen. Darüber hinaus können Skaleneffekte und ein erhöhter Wettbewerb zwischen den Sensorherstellern zu niedrigeren Preisen führen, wodurch fortschrittliche Sensoren in verschiedenen Fahrzeugsegmenten leichter zugänglich werden.

Zusammenfassend lässt sich sagen, dass die hohen Kosten für moderne Sensoren zwar eine Herausforderung für den Markt für Füllstandssensoren in Kraftfahrzeugen darstellen, dass jedoch technologische Fortschritte und verstärkter Wettbewerb die Preise voraussichtlich senken werden. Dies wird wahrscheinlich eine breitere Akzeptanz und Markterweiterung ermöglichen, da die niedrigeren Kosten moderne Sensoren in verschiedenen Fahrzeugsegmenten zugänglicher machen und so zukünftiges Wachstum unterstützen.

- Komplexer Integrationsprozess von Füllstandssensoren in bestehende Fahrzeugsysteme

Der komplizierte Prozess der Integration von Füllstandssensoren in bestehende Fahrzeugsysteme stellt auf dem Markt für Füllstandssensoren für Kraftfahrzeuge eine erhebliche Herausforderung dar. Da Fahrzeuge immer ausgefeilter werden, erfordert die Integration von Füllstandssensoren, die zur Überwachung wichtiger Flüssigkeiten wie Kraftstoff, Öl und Kühlmittel verwendet werden, in bestehende Fahrzeugsysteme sorgfältige Planung und technisches Können.

Die Gewährleistung der Kompatibilität mit aktuellen Fahrzeugsystemen ist von entscheidender Bedeutung. Moderne Fahrzeuge sind mit fortschrittlicher Elektronik und Kommunikationsnetzwerken wie Controller Area Network (CAN)-Bussen und Automotive Ethernet ausgestattet. Neue Sensoren müssen nahtlos in diese Systeme integriert werden und sich an vorhandene Protokolle und Schnittstellen anpassen, um eine reibungslose Datenübertragung und Systemfunktionalität zu gewährleisten.

Die physische Installation von Sensoren bringt eine Reihe eigener Herausforderungen mit sich. Sensoren müssen genau positioniert werden, um den Flüssigkeitsstand korrekt zu überwachen. Dies erfordert die Entwicklung und Installation von Sensoren an bestimmten Stellen im Fahrzeug, was aufgrund von Platzbeschränkungen häufig kundenspezifische Montagelösungen und Anpassungen der Fahrzeugstruktur erforderlich macht.

Die Kalibrierung ist auch für die Sensorgenauigkeit von entscheidender Bedeutung. Jeder Sensor muss präzise kalibriert werden, um zuverlässige Messwerte zu gewährleisten. Dazu müssen die Sensorausgaben mit den Steuersystemen des Fahrzeugs abgestimmt und die Leistung unter verschiedenen Betriebsbedingungen validiert werden.

Die Integration von Füllstandssensoren erfordert häufig Software-Updates und Systemanpassungen. Elektronische Steuergeräte (ECUs) im Fahrzeug müssen möglicherweise neu programmiert oder aktualisiert werden, um Daten von neuen Sensoren zu integrieren und so eine ordnungsgemäße Kommunikation und Funktionalität im Gesamtsystem des Fahrzeugs sicherzustellen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden.

Neben dem Standardbericht bieten wir auch detaillierte Analysen des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Warenanalysen, Produktionsanalysen, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalysen, Lösungen zum Lieferkettenrisikomanagement, erweitertes Benchmarking und andere Dienste für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Globaler Marktumfang für Füllstandssensoren für Kraftfahrzeuge

Der Markt ist in sieben bemerkenswerte Segmente unterteilt, basierend auf Produkttyp, Typ, Überwachungstyp, Anwendung, Fahrzeugtyp, Vertriebskanal und Vertriebskanal. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse von dürftigen Wachstumssegmenten in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Produkttyp

- Kraftstoffstandsensor

- Motorölstandsensor

- Kühlmittelstandsensor

- Bremsflüssigkeitsstandsensor

- Servolenkungsflüssigkeitsstandsensor

- Magnetsensor

- Produkttyp

- Reed-Effekt-Schalter

- Hall-Effekt-Schalter

- Sonstiges

- Produkttyp

- Typ

- Kapazitiv

- Widerstandsfilm

- Ultraschall

- Diskrete Widerstände

- Optisch

- Sonstiges

- Überwachungstyp

- Kontinuierliche Füllstandsüberwachung

- Grenzstandüberwachung

- Anwendung

- Überwachung der Tankbefüllung und Kraftstoffentleerung

- Prävention von Kraftstoffdiebstahl

- Überwachung des Kraftstoffverbrauchs

- Fahrzeugtyp

- Personenkraftwagen

- Nutzfahrzeug

- Fahrzeugtyp

- Geländewagen

- Format Mittelgroß

- Kompakt

- Luxus

- Typ

- Kapazitiv

- Widerstandsfolie

- Ultraschall

- Diskrete Widerstände

- Optisch

- Sonstiges

- Typ

- Leichtes Nutzfahrzeug

- Schweres Nutzfahrzeug

- Typ

- Kleintransporter

- Transporter

- Kleinbus

- Trainer

- Sonstiges

- Typ

- LKW

- Busse

- Typ

- Kapazitiv

- Widerstandsfilm

- Ultraschall

- Diskrete Widerstände

- Optisch

- Sonstiges

- Fahrzeugtyp

- VERTRIEBSKANAL

- Originalgerätehersteller (OEM)

- Ersatzteilmarkt

- Vertriebskanal

- Online

- Offline

- Vertriebskanal

- E-Einkauf

- Zur Firma

- Vertriebskanal

- Fachgeschäfte

- Einzelhandelsgeschäfte

- Vertriebskanal

Globale regionale Analyse des Marktes für Füllstandssensoren für Kraftfahrzeuge

Der Markt ist basierend auf Produkttyp, Typ, Überwachungstyp, Anwendung, Fahrzeugtyp, Verkaufskanal und Vertriebskanal in sieben wichtige Segmente unterteilt.

Die vom Markt abgedeckten Länder sind Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, Türkei, Niederlande, Belgien, Schweden, Polen, Schweiz, Dänemark, Norwegen, Finnland, übriges Europa, China, Japan, Südkorea, Indien, Thailand, Malaysia, Indonesien, Vietnam, Taiwan, Philippinen, Singapur, Australien, übriger Asien-Pazifik-Raum, USA, Kanada, Mexiko, Brasilien, Argentinien, übriges Südamerika, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Kuwait, Katar, Oman, Bahrain sowie übriger Naher Osten und Afrika.

Der asiatisch-pazifische Raum wird voraussichtlich das dominierende und am schnellsten wachsende Land auf dem Markt sein, da seine gut ausgebaute Infrastruktur, seine fortschrittliche Verarbeitungstechnologie und das im Vergleich zu anderen Regionen höhere Investitionsniveau in diesem Sektor das Marktwachstum voraussichtlich weiter ankurbeln werden.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Globaler Marktanteil an Füllstandssensoren für Kraftfahrzeuge

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die weltweit auf dem Markt tätigen Marktführer für Füllstandssensoren für Kraftfahrzeuge sind:

- Continental AG (Deutschland)

- Littelfuse, Inc. (USA)

- Bosch Rexroth Sp. Z OO (Polen)

- Elobau GmbH & Co. KG.C (Deutschland),

- Pricol Limited (Indien)

- Bourns Inc (USA)

- Guangdong Zhengyang Sensortechnologie Co., Ltd. (China)

- Misensor Tech Co., Ltd. (China)

- Omnicomm (Estland), Soway Tech Limited (China)

- Spark Minda (Indien)

- Standex Electronics, Inc (USA)

- Technoton (Tschechische Republik)

- Wema UK (Großbritannien)

Neueste Entwicklungen auf dem globalen Markt für Füllstandssensoren für Kraftfahrzeuge

- In July 2024, Continental AG showcased its expanded product range, including new ADAS sensors, sustainable multi V-belts, and the UltracContact NXT tire with up to 65% sustainable materials, at the Automechanika trade fair in Frankfurt. Continental benefited by showcasing its technology and sustainability leadership, boosting market presence, and attracting customers and partners

- In August 2024, Continental AG Executiv Board has decided to evaluate th possibility of spinning off Automotive group sector into an independent company. This mov aims to maximize value and growth potential amid dynamic automotive market conditions. A decision on th spin-off will be made in Q4 2024. I approved by the Executive an Supervisory Boards, and voted on b shareholders on April 25, 2025, th spin-off could be completed by the end of 2025. Meanwhile, the Tires and ContiTech sectors will remain under Continental’s umbrella

- In August 2024, Littelfuse, Inc., unveiled its latest innovation: the SMBLCEHR HRA, SMCLCE-HR/HRA, an SMDLCE-HR/HRA High-Reliability Lo Capacitance TVS Diode Series. This cutting-edge series of TVS diodes I engineered to provide superior protection for avionics equipment against lightning and other overvoltage threats, establishing new benchmark for high-reliability protection in the aviation industry

- In April 2024, Littelfuse, Inc., introduced it latest innovation in the eFus Protection IC lineup: th LS0502SCD33S. This cutting-edg Single Cell Super Capacitor Protectio IC is specifically designed to enhance the safety and efficiency of charging backup power sources under extreme conditions. With this new release Littelfuse sets a new industry standard for protection in demanding environments. View the video to learn more about this groundbreaking development

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.