Global Automated Material Handling Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

61.40 Billion

USD

114.30 Billion

2024

2032

USD

61.40 Billion

USD

114.30 Billion

2024

2032

| 2025 –2032 | |

| USD 61.40 Billion | |

| USD 114.30 Billion | |

|

|

|

|

Globale Marktsegmentierung für automatisierte Materialhandhabungsgeräte nach Produkt (Roboter, automatisierte Lager- und Bereitstellungssysteme (ASRS), Förder- und Sortiersysteme, Kräne, autonome mobile Roboter (AMR), fahrerlose Transportfahrzeuge (AGV) , Schlepper, Stückgutträger, Palettenwagen, Gabelstapler, Hybridfahrzeuge, sonstige und fahrerlose Transportfahrzeuge (AGV)), Systemtyp (Stückgut- und Schüttgut-Materialhandhabungssysteme), Software und Services (Software und Services), Funktion (Montage, Verpackung, Transport, Vertrieb, Lagerung und Abfallbehandlung), Branche (Automobilindustrie, Metall- und Schwermaschinenbau, Lebensmittel und Getränke, Chemie, Halbleiter und Elektronik, Gesundheitswesen, Luftfahrt, E-Commerce und sonstige) – Branchentrends und Prognose bis 2032

Marktgröße für automatisierte Materialhandhabungsgeräte

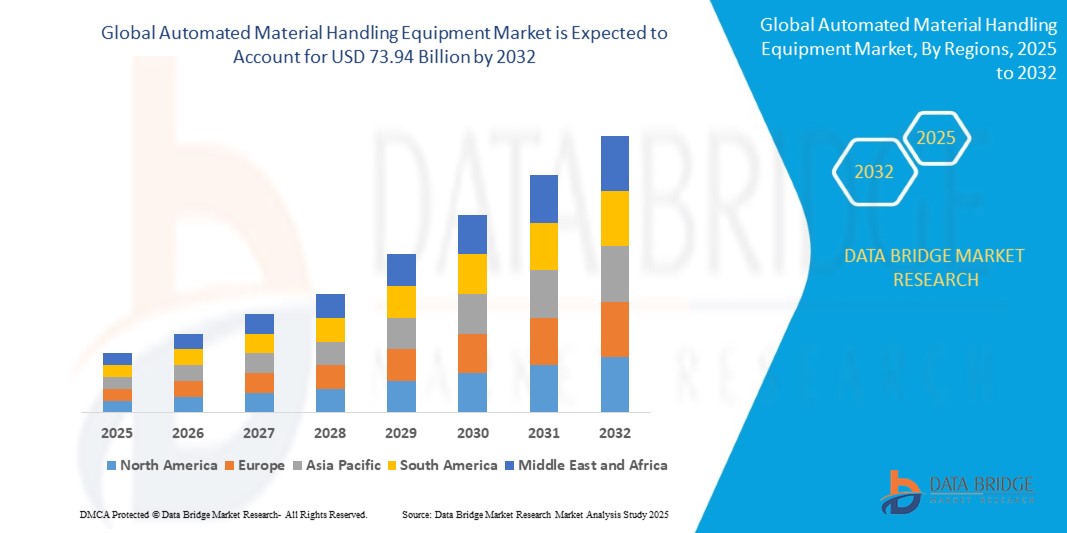

- Der globale Markt für automatisierte Materialtransportgeräte wurde im Jahr 2024 auf 34,77 Milliarden US-Dollar geschätzt und soll bis 2032 73,94 Milliarden US-Dollar erreichen , bei einer CAGR von 9,89 % im Prognosezeitraum.

- Dieses Wachstum wird durch Faktoren wie die steigende Nachfrage nach Automatisierung in der Fertigung, die schnelle Expansion des E-Commerce und den zunehmenden Fokus auf Arbeitssicherheit und Betriebseffizienz vorangetrieben.

Marktanalyse für automatisierte Materialtransportgeräte

- Automatisierte Materialtransportgeräte (AMHE) spielen eine entscheidende Rolle bei der Steigerung der Produktivität, der Senkung der Arbeitskosten und der Verbesserung der Sicherheit in Branchen wie Fertigung, Logistik, Automobil und E-Commerce

- Die Nachfrage nach AMHE wird maßgeblich durch den Anstieg des E-Commerce, den Bedarf an effizienten Lagerlösungen und die zunehmende Einführung von Industrie 4.0-Technologien getrieben.

- Der asiatisch-pazifische Raum wird voraussichtlich den Markt für automatisierte Materialtransportgeräte mit einem Marktanteil von 39,4 % dominieren, was auf die steigende Nachfrage nach Kränen und Hebezeugen im Bergbausektor zurückzuführen ist. Diese Nachfrage wird durch die zunehmende Industrialisierung in der Region, insbesondere im Bergbau und in der Bauindustrie, zusätzlich angekurbelt.

- Nordamerika dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für automatisierte Materialhandhabungsgeräte sein, da technologische Innovationen die Entwicklung neuer und fortschrittlicherer automatisierter Materialhandhabungsgeräte (AMH) vorantreiben.

- Robots segment is expected to dominate the market with largest market share of 22.01% due to the increasing demand for flexible, precise, and efficient handling solutions across various industries. Robots offer significant advantages in terms of speed, accuracy, and ability to operate continuously with minimal human intervention, making them ideal for applications in automotive, electronics, food and beverage, and e-commerce sectors

Report Scope and Automated Material Handling Equipment Market Segmentation

|

Attributes |

Automated Material Handling Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automated Material Handling Equipment Market Trends

“Integration of AI, IoT, and Robotics in Material Handling Systems”

- One prominent trend in the automated material handling equipment market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and robotics to create smart, adaptive handling systems

- These technologies enable real-time data analysis, predictive maintenance, and autonomous decision-making, significantly enhancing efficiency, throughput, and system reliability in warehouses and manufacturing environments

- For instance, AI-powered robotic systems can dynamically optimize picking routes and adapt to variable product flows, while IoT-enabled conveyors and storage systems provide continuous operational feedback to streamline supply chain operations

- This digital transformation is revolutionizing material handling processes, reducing downtime, improving resource utilization, and fueling the shift toward fully automated and intelligent logistics ecosystems

Automated Material Handling Equipment Market Dynamics

Driver

“Surging Demand for Automation Across Warehousing and Manufacturing”

- The growing need for operational efficiency, labor cost reduction, and enhanced productivity is driving the widespread adoption of automated material handling equipment across industries such as e-commerce, automotive, food & beverage, and pharmaceuticals

- As global supply chains become increasingly complex and demand for fast, accurate order fulfillment rises, companies are turning to automation to streamline processes, reduce errors, and improve safety in their operations

- The surge in e-commerce activities, especially post-pandemic, has placed immense pressure on warehouses and distribution centers to handle large volumes of inventory efficiently, further accelerating the adoption of automation

For instance,

- According to the International Federation of Robotics (IFR), the global installation of industrial robots reached 553,052 units in 2022, marking a 5% increase from the previous year—underscoring the rising reliance on automation in material handling and logistics

- As a result, the push for operational excellence and faster throughput is significantly increasing the demand for automated material handling equipment, making it a critical enabler of next-generation industrial and logistics infrastructure

Opportunity

“Growth in E-Commerce and Online Retailing Driving Demand for Automation”

- Das rasante Wachstum des E-Commerce und des Online-Einzelhandels treibt die Nachfrage nach automatisierten Materialflusslösungen erheblich an, da Unternehmen nach schnelleren und effizienteren Möglichkeiten suchen, große Warenmengen zu verwalten und eine schnelle Auftragsabwicklung zu gewährleisten.

- Automatisierte Systeme wie Kommissionierroboter, Förderbänder und automatisierte Lager- und Bereitstellungssysteme (AS/RS) werden immer wichtiger, um hohe Auftragsvolumina abzuwickeln, die Genauigkeit zu verbessern und die Bearbeitungszeiten in Vertriebszentren und Lagern zu beschleunigen.

- Die Nachfrage nach Echtzeit-Bestandsverwaltung, schnellerem Versand und fehlerfreier Auftragskommissionierung treibt den Bedarf an hochentwickelten Automatisierungstechnologien voran

Zum Beispiel,

- Laut einem Bericht von Statista vom Februar 2024 wurde prognostiziert, dass der weltweite E-Commerce-Umsatz im Jahr 2025 die Marke von 5 Billionen US-Dollar überschreiten wird, wobei mehr als 50 % dieser Umsätze über automatisierte Lager und Fulfillment-Center abgewickelt werden. Dieses Wachstum im Online-Handel eröffnet AMHE-Anbietern erhebliche Marktchancen, innovative Lösungen zu entwickeln, die komplexe Logistik bewältigen und die Kundenerwartungen an eine schnelle Lieferung erfüllen.

- Die anhaltende Expansion des E-Commerce-Sektors schafft erhebliche Chancen für automatisierte Materialflusssysteme, insbesondere in der Zustellung auf der letzten Meile und der Lagerautomatisierung, und positioniert den Markt für nachhaltiges Wachstum in den kommenden Jahren

Einschränkung/Herausforderung

„Hohe Anfangsinvestitionen und Wartungskosten behindern das Marktwachstum“

- Die hohen Anschaffungskosten für automatisierte Materialtransportgeräte sowie die laufenden Wartungs- und Betriebskosten stellen eine erhebliche Herausforderung für Unternehmen dar, insbesondere in Schwellenländern und für kleine und mittlere Unternehmen (KMU).

- Automatisierte Systeme, die oft erhebliche Investitionen in Infrastruktur, Software und Integration erfordern, können je nach Komplexität und Umfang der Lösung zwischen Zehntausenden und Millionen von Dollar kosten.

- Diese finanzielle Belastung kann kleinere Unternehmen davon abhalten, Automatisierung einzuführen, und sie zwingen, auf manuelle Arbeit oder veraltete Geräte zurückzugreifen, was die Produktivität und Effizienz beeinträchtigt.

Zum Beispiel,

- Laut einem Bericht der International Federation of Robotics (IFR) vom Oktober 2024 zählen die hohen Anschaffungskosten und langen Amortisationszeiten automatisierter Systeme zu den größten Hindernissen für Unternehmen in Entwicklungsregionen bei der Einführung fortschrittlicher Materialhandhabungslösungen. Die Zurückhaltung bei Investitionen in diese Systeme führt zu einer langsameren Einführung, insbesondere bei Unternehmen mit begrenztem Budget und kleineren Betrieben.

- Infolgedessen können solche Einschränkungen die breite Einführung der Automatisierung, insbesondere in preissensiblen Sektoren, behindern und letztlich das Gesamtwachstum des AMHE-Marktes einschränken.

Marktumfang für automatisierte Materialhandhabungsgeräte

Der Markt ist nach Produkt, Systemtyp, Software und Dienstleistungen, Funktion und Branche segmentiert

|

Segmentierung |

Untersegmentierung |

|

Nach Produkt |

|

|

Nach Systemtyp |

|

|

Nach Software und Diensten |

|

|

Nach Funktion |

|

|

Nach Branche |

|

Im Jahr 2025 werden die Roboter voraussichtlich den Markt mit dem größten Anteil im Produktsegment dominieren

Das Robotersegment wird voraussichtlich den Markt für automatisierte Materialhandhabungsgeräte mit einem Anteil von 22,01 % dominieren, da die Nachfrage nach flexiblen, präzisen und effizienten Handhabungslösungen in verschiedenen Branchen steigt. Roboter bieten erhebliche Vorteile hinsichtlich Geschwindigkeit, Genauigkeit und der Fähigkeit, kontinuierlich mit minimalem menschlichen Eingriff zu arbeiten. Dies macht sie ideal für Anwendungen in der Automobil-, Elektronik-, Lebensmittel- und Getränkebranche sowie im E-Commerce.

Der E-Commerce wird voraussichtlich im Prognosezeitraum den größten Anteil im Industriesegment ausmachen

Im Jahr 2025 wird das E-Commerce-Segment voraussichtlich den Markt mit einem Marktanteil von 20,01 % dominieren. Die zunehmende Verbreitung von Online-Shopping-Plattformen, die Existenz großer Online-Händler und die wachsende Logistikinfrastruktur dürften die Nachfrage nach diesem Produkt in der E-Commerce-Branche ankurbeln. Mehrere Lebensmittelgeschäfte haben sich zu Convenience Stores entwickelt, die Fast-Food-ähnliche Dienstleistungen anbieten, darunter Tiefkühlkost, Fertiggerichte und frische Produkte, was zum Aufstieg der Lebensmittelindustrie geführt hat.

Regionale Analyse des Marktes für automatisierte Materialhandhabungsgeräte

„Der asiatisch-pazifische Raum hält den größten Anteil am Markt für automatisierte Materialtransportgeräte“

- Der asiatisch-pazifische Raum ist die dominierende Region auf dem globalen AMHE-Markt mit dem größten Marktanteil von 35 % im Jahr 2023.

- China trägt mit einem Marktanteil von 23,3 % maßgeblich zu diesem Wachstum bei. Der Grund dafür sind der robuste Fertigungssektor, der groß angelegte E-Commerce und staatliche Initiativen zur Förderung der Automatisierung.

- Indien und südostasiatische Länder wie Thailand, Vietnam und Indonesien setzen schnell auf Automatisierungstechnologien, um die Produktivität zu steigern und den Anforderungen expandierender Branchen wie der Automobil-, Elektronik- und Logistikbranche gerecht zu werden.

„Nordamerika wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate im Markt für automatisierte Materialhandhabungsgeräte verzeichnen“

- North America, particularly the U.S., is experiencing significant growth in the AMHE market, with the U.S. projected to grow at a CAGR of 10.5% from 2025 to 2032

- The region's growth is fueled by advancements in AI, robotics, and IoT technologies, leading to the development of more efficient and intelligent material handling systems

- The automotive and e-commerce sectors in the U.S. are major drivers of this growth, with companies investing heavily in automation to improve efficiency and reduce labor costs

Automated Material Handling Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Daifuku Co., Ltd. (Japan)

- Dematic (KION Group) (Germany)

- SSI Schaefer Group (Germany)

- Honeywell Intelligrated (U.S.)

- Vanderlande (Toyota Advanced Logistics Group) (Netherlands)

- Knapp AG (Austria)

- Murata Machinery Ltd. (Japan)

- Material Handling Systems (MHS) (U.S.)

- WITRON Integrated Logistics (Germany)

- Interlake Mecalux (Mecalux) (Spain)

- Beumer Group GmbH (Germany)

- Siemens Logistics (Germany)

- TGW Logistics Group GmbH (Austria)

- Swisslog AG (KUKA Robotics) (Switzerland)

- Fives Intralogistics (Fives Group) (France)

- Kardex AG (Switzerland)

- Bastian Solutions (Toyota Advanced Logistics Group) (U.S.)

- Elettric 80 (Italy)

- AutoStore AS (Norway)

- System Logistics SpA (Italy)

Latest Developments in Global Automated Material Handling Equipment Market

- In March 2023, THiRARobotics Co., Ltd. unveiled its next-generation autonomous mobile robots, marking a major advancement in logistics, warehousing, manufacturing, and healthcare operations. These cutting-edge robots represent a significant technological leap, offering improved efficiency, adaptability, and versatility across multiple sectors. This development underscores the increasing demand for intelligent, autonomous solutions to streamline material handling processes and enhance operational productivity

- Im März 2022 stärkte die Toyota Industries Corporation ihr Logistikportfolio durch die Übernahme von Viastore, einem führenden Anbieter von Materialflusssystemen. Diese strategische Akquisition erweitert die Möglichkeiten von Toyota Industries, fortschrittliche Automatisierungslösungen anzubieten, die speziell für Distributionszentren kleiner und mittlerer Unternehmen entwickelt wurden, und festigt so seine Branchenführerschaft. Dieser Schritt unterstreicht den wachsenden Trend zur Branchenkonsolidierung und die steigende Nachfrage nach skalierbaren, effizienten Automatisierungslösungen für Unternehmen unterschiedlicher Größe.

- Im September 2020 kooperierte Bohus mit Jungheinrich, um ein hochmodernes Zentrallager in der Nähe von Oslo, Lillestrøm, zu errichten. Das Projekt umfasst umfassende Automatisierungslösungen, darunter Miniload-Systeme, Fördertechnik und Hochregallager. Diese Initiative spiegelt das Engagement von Bohus wider, seine Logistikabläufe zu optimieren und die Effizienz seiner Warenumschlagprozesse deutlich zu steigern. Diese Entwicklung verdeutlicht die wachsende Nachfrage nach fortschrittlichen Automatisierungstechnologien im Lager- und Logistikbetrieb. Die Integration solch innovativer Lösungen unterstreicht das Streben der Branche nach verbesserter Betriebseffizienz, schnellerem Durchsatz und höherer Kosteneffizienz und trägt zur weiteren Expansion und Entwicklung des AMHE-Marktes weltweit bei.

- Im März 2025 fusionierte Bastian Solutions mit Viastore North America und integrierte deren Aktivitäten in die Toyota Automated Logistics Group. Diese strategische Zusammenarbeit vereint die Expertise von Bastian Solutions in der Systemintegration mit der Spezialisierung von Viastore auf automatisierte Palettenhandhabungstechnologien und erweitert so die gemeinsamen Kompetenzen in den Bereichen Lagerautomatisierung und Lagerlösungen. Die Fusion unterstreicht den wachsenden Konsolidierungstrend in der Branche, um umfassendere und fortschrittlichere Automatisierungslösungen anzubieten.

- Im März 2024 wurde OTTO Motors, ein führender Anbieter autonomer mobiler Roboter (AMRs), zu einem wichtigen Akteur in der autonomen Produktionslogistik, einem bahnbrechenden Sektor der Fertigungsinnovation. Mit der Übernahme von OTTO Motors in sein Portfolio erweiterte Rockwell Automation seine Materialhandhabungskompetenz deutlich und bot eine umfassende Lösung zur Optimierung der Betriebsabläufe in gesamten Anlagen. Diese Übernahme unterstreicht den wachsenden Trend, autonome Roboter in Materialhandhabungssysteme zu integrieren, um Effizienz, Flexibilität und Skalierbarkeit zu steigern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.