Global Audit Software Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.06 Billion

USD

5.97 Billion

2024

2032

USD

2.06 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 5.97 Billion | |

|

|

|

|

Globale Marktsegmentierung für Audit-Software nach Komponenten (Lösungen und Services), Bereitstellungsmodus (On-Premise und Cloud), Unternehmensgröße (Großunternehmen und kleine und mittlere Unternehmen), Branchenvertikale (BFSI, Einzelhandel und E-Commerce, Fertigung, Regierung und Verteidigung, Energie und Versorgung, IT und Telekommunikation, Bildung, Gesundheitswesen und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Auditsoftware

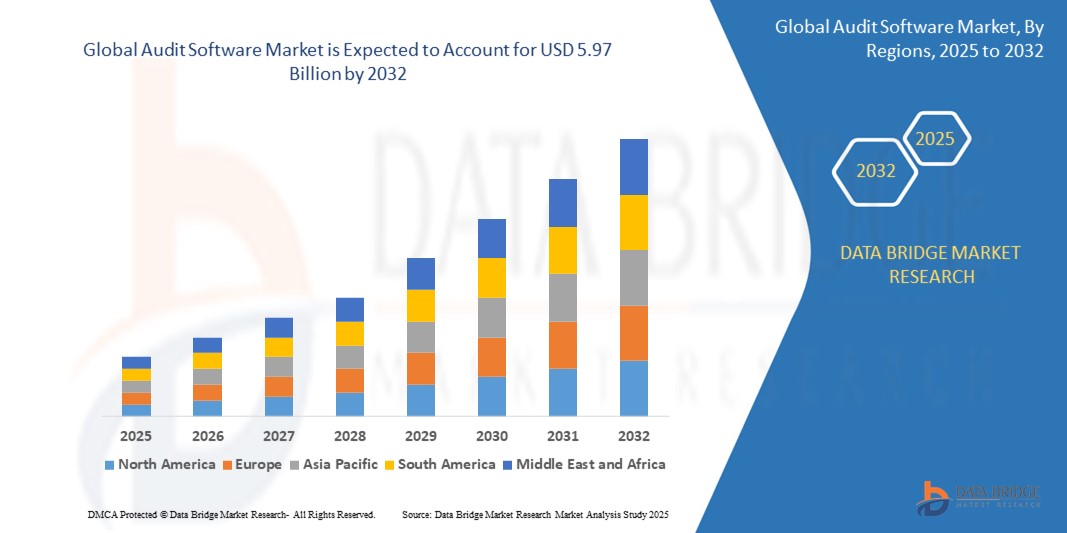

- Der globale Markt für Auditsoftware wurde im Jahr 2024 auf 2,06 Milliarden US-Dollar geschätzt und soll bis 2032 5,97 Milliarden US-Dollar erreichen , bei einer CAGR von 14,20 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch den steigenden Bedarf an automatisierten und präzisen Auditprozessen in allen Branchen vorangetrieben, der durch die steigenden Anforderungen an die Einhaltung gesetzlicher Vorschriften und die Initiativen zur digitalen Transformation innerhalb von Unternehmen bedingt ist.

- Darüber hinaus veranlasst die wachsende Nachfrage nach cloudbasierten Audit-Tools mit Echtzeitanalysen, verbessertem Risikomanagement und optimiertem Reporting Unternehmen dazu, integrierte Audit-Softwarelösungen einzusetzen. Diese konvergierenden Faktoren beschleunigen die Umstellung von manuellen Audits auf digitale Plattformen und kurbeln damit das Wachstum des Audit-Softwaremarktes deutlich an.

Marktanalyse für Audit-Software

- Auditsoftware umfasst Technologielösungen, die interne Auditprozesse optimieren, Compliance-Anforderungen verwalten und die Transparenz und Genauigkeit der Finanz- und Betriebsberichterstattung verbessern. Diese Tools automatisieren wichtige Aufgaben wie Risikobewertung, Workflow-Tracking, Kontrolltests und Dokumentation in verschiedenen Unternehmensfunktionen.

- Die zunehmende Nutzung von Audit-Software ist auf einen verstärkten Fokus auf Corporate Governance, regulatorischen Druck in Sektoren wie BFSI und Gesundheitswesen sowie die wachsende Präferenz für Echtzeitüberwachung und Cloud-basierte Auditsysteme zurückzuführen.

- Nordamerika dominierte den Markt für Auditsoftware mit einem Anteil von 47,5 % im Jahr 2024 aufgrund strenger regulatorischer Compliance-Standards, der weit verbreiteten Digitalisierung in Unternehmen und der starken Präsenz wichtiger Anbieter von Auditsoftware.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum die am schnellsten wachsende Region im Markt für Audit-Software sein, da der digitale Wandel in allen Branchen schnell voranschreitet und das Bewusstsein für die Verantwortung von Unternehmen wächst.

- Das Lösungssegment dominierte den Markt mit einem Marktanteil von 64,8 % im Jahr 2024. Dies ist auf die steigende Nachfrage nach automatisierten Audit-Tools zurückzuführen, die die Genauigkeit erhöhen, die Einhaltung gesetzlicher Vorschriften gewährleisten und manuelle Eingriffe reduzieren. Unternehmen setzen zunehmend umfassende Audit-Softwarelösungen ein, um interne Audit-Workflows zu optimieren, finanzielle und operative Risiken zu minimieren und Auditdaten für eine bessere Übersicht und Berichterstattung zu zentralisieren. Die Skalierbarkeit und Integrationsfähigkeit dieser Lösungen mit Unternehmensystemen wie ERP- und GRC-Plattformen stärken ihre Dominanz weiter.

Berichtsumfang und Marktsegmentierung für Auditsoftware

|

Eigenschaften |

Wichtige Markteinblicke in die Audit-Software |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für Audit-Software

„Integration mit Unternehmensanwendungen“

- Der Markt für Audit-Software entwickelt sich rasant, da Unternehmen zunehmend Lösungen benötigen, die sich nahtlos in zentrale Unternehmensanwendungen wie ERP-, CRM- und HR-Management-Systeme integrieren lassen. Diese Integration optimiert Audit-Workflows, ermöglicht den Datenaustausch in Echtzeit und verbessert die Transparenz komplexer Geschäftsprozesse.

- Branchenführer wie SAP, Oracle und Microsoft integrieren beispielsweise Audit-Funktionalitäten direkt in ihre Unternehmenssoftware-Suiten und ermöglichen es ihren Kunden, Compliance, Risikomanagement und Finanzkontrollen in einem einzigen Ökosystem zu vereinen.

- Der Trend zu plattformbasierten, interoperablen Lösungen wird durch die zunehmende Komplexität der Berichtspflichten und den Bedarf an flexibleren, datengesteuerten Audits in Branchen wie BFSI, Gesundheitswesen, Fertigung und Energie vorangetrieben.

- Die Integration mit Unternehmensanwendungen wird durch die Verwendung offener APIs weiter vorangetrieben. Dadurch können Anbieter von Audit-Software die Zusammenarbeit mit einer breiten Palette von Business Intelligence- und Analysetools fördern und so den Umfang der automatisierten Erfassung von Audit-Beweisen und der Risikoeinsichten erweitern.

- Da Remote- und Hybrid-Arbeitsmodelle immer häufiger eingesetzt werden, stellen integrierte Systeme sicher, dass alle Audit-Beteiligten unabhängig vom Standort in Echtzeit auf die Audit-Ergebnisse zugreifen, diese überprüfen und darauf reagieren können – ein entscheidender Vorteil für globale Teams und Betriebe mit mehreren Standorten.

- Der Fokus auf die End-to-End-Integration beschleunigt auch die Einführung von KI, Datenanalyse und Prozessautomatisierung in Audit-Software, was zu schnelleren, intelligenteren und genaueren Audit-Funktionen führt.

Marktdynamik von Audit-Software

Treiber

„Wachsende Nachfrage nach Cloud-basierten Lösungen“

- Der Anstieg der Nachfrage nach Cloud-basierter Audit-Software ist ein wichtiger Treiber, da Unternehmen jeder Größe Skalierbarkeit, Flexibilität und schnelle Bereitstellung ohne die Infrastrukturanforderungen von On-Premise-Lösungen suchen.

- Beispielsweise erweitern führende Anbieter wie IBM, SAP und Oracle ihre Cloud-Audit-Angebote erheblich, um kontinuierliche Überwachung, automatisierte Updates und nahtlosen Zugriff von jedem Gerät und Standort aus zu ermöglichen – Funktionen, die besonders von global verteilten Teams und regulierten Branchen geschätzt werden.

- Cloudbasierte Plattformen bieten Kosteneffizienz durch Abonnementmodelle und reduzierten Wartungsaufwand und sind daher sowohl für große Unternehmen als auch für KMU attraktiv, die ihre Prüfungsfunktionen modernisieren möchten.

- Verbesserte Sicherheit, Echtzeit-Zusammenarbeit und die Integration mit anderen Cloud-Diensten tragen zu optimierten Audit-Prozessen, proaktivem Compliance-Management und schnellerer Reaktion auf regulatorische Änderungen bei

- Der wachsende Bedarf an Remote- und Hybrid-Audit-Prozessen sowie zunehmende Initiativen zur digitalen Transformation in allen Branchen machen Cloud-basierte Audit-Software zur bevorzugten Wahl für Unternehmen, die Resilienz und operative Agilität anstreben.

Einschränkung/Herausforderung

„Hohe Implementierungskosten“

- Trotz ihrer Vorteile können Audit-Softwarelösungen – insbesondere solche mit erweiterten Integrations- und Cloud-Funktionen – erhebliche Vorlaufkosten für Anpassung, Bereitstellung und Schulung verursachen, was kleinere Unternehmen mit begrenzten IT-Budgets vor Herausforderungen stellt.

- Beispielsweise müssen Unternehmen, die Unternehmenslösungen von Anbietern wie SAP oder Oracle einführen, häufig hohe Kosten für die Datenmigration, Benutzerschulung und den laufenden Support aufbringen, was die Einführung in kostensensiblen Segmenten verlangsamt.

- Die Integration von Audit-Plattformen in bestehende Geschäftsanwendungen und die Gewährleistung der vollständigen Interoperabilität können zusätzliche Entwicklungs- und Beratungsressourcen erfordern, was die Gesamtbetriebskosten erhöht.

- Komplexe regulatorische Rahmenbedingungen und häufige Änderungen der Compliance-Standards können zu weiteren Investitionen in Software-Updates und Mitarbeiterschulungen führen, sodass ein robustes Kostenmanagement für eine nachhaltige Nutzung unerlässlich ist.

- Kleinere Unternehmen und gemeinnützige Organisationen suchen möglicherweise nach alternativen kostengünstigen oder modularen Lösungen. Diese bieten jedoch in der Regel weniger Funktionen und eine eingeschränkte Skalierbarkeit, wodurch sie im Vergleich zu vollständig integrierten Unternehmensangeboten im Nachteil sind.

Marktumfang für Auditsoftware

Der Markt ist nach Komponenten, Bereitstellungsmodus, Unternehmensgröße und Branche segmentiert.

- Nach Komponente

Der Markt für Auditsoftware ist nach Komponenten in Lösungen und Dienstleistungen unterteilt. Das Lösungssegment erzielte 2024 mit 64,8 % den größten Marktanteil, angetrieben durch die steigende Nachfrage nach automatisierten Audittools, die die Genauigkeit erhöhen, die Einhaltung gesetzlicher Vorschriften gewährleisten und manuelle Eingriffe reduzieren. Unternehmen setzen zunehmend umfassende Auditsoftwarelösungen ein, um interne Auditabläufe zu optimieren, finanzielle und operative Risiken zu minimieren und Auditdaten für eine bessere Übersicht und Berichterstattung zu zentralisieren. Die Skalierbarkeit und Integrationsfähigkeit dieser Lösungen mit Unternehmensystemen wie ERP- und GRC-Plattformen untermauern ihre Dominanz zusätzlich.

Das Dienstleistungssegment wird voraussichtlich von 2025 bis 2032 das höchste Wachstum verzeichnen, da der Bedarf an Implementierungs-, Schulungs- und Supportleistungen im Zusammenhang mit komplexen Auditumgebungen steigt. Da Unternehmen immer anspruchsvollere Audit-Tools einsetzen, spielen Dienstleister eine entscheidende Rolle bei der Gewährleistung nahtloser Integration, Anpassung und kontinuierlicher technischer Unterstützung, insbesondere in stark regulierten Branchen, in denen Auditpräzision unerlässlich ist.

- Nach Bereitstellungsmodus

Der Markt für Auditsoftware wird anhand der Bereitstellungsmethode in On-Premise und Cloud unterteilt. Das On-Premise-Segment hatte 2024 den größten Marktanteil, vor allem aufgrund seiner Attraktivität für große Unternehmen mit strengen Datensicherheitsrichtlinien und Infrastrukturinvestitionen. On-Premise-Bereitstellungen bieten direkte Kontrolle über sensible Auditdaten und -systeme, was für Finanzinstitute, Behörden und Gesundheitsdienstleister, die mit vertraulichen Daten arbeiten, ein wichtiger Aspekt ist.

Das Cloud-Segment wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen, was auf Skalierbarkeit, geringere Vorlaufkosten und Fernzugriff zurückzuführen ist. Cloudbasierte Audit-Software ermöglicht Echtzeit-Zusammenarbeit, einfachere Updates und die Integration in Cloud-basierte Business-Suiten. Dies ist insbesondere für Unternehmen von Vorteil, die agile und kosteneffiziente Auditprozesse anstreben. Der zunehmende Trend zur digitalen Transformation und das wachsende Vertrauen in Cloud-Sicherheitsrahmen tragen zur zunehmenden Präferenz für die Cloud-Bereitstellung bei.

- Nach Organisationsgröße

Der Markt für Auditsoftware ist nach Unternehmensgröße in Großunternehmen sowie kleine und mittlere Unternehmen (KMU) segmentiert. Das Segment der Großunternehmen dominierte den Markt im Jahr 2024 aufgrund ihrer komplexen Auditanforderungen, der hohen regulatorischen Anforderungen und ihrer umfangreichen Aktivitäten in verschiedenen Regionen. Diese Unternehmen investieren häufig in Audit-Tools auf Unternehmensebene, um Prozesse zu standardisieren, Compliance sicherzustellen und umfassende interne Audits mit erhöhter Transparenz durchzuführen.

Das Segment der kleinen und mittleren Unternehmen (KMU) wird voraussichtlich zwischen 2025 und 2032 am stärksten wachsen, was auf das zunehmende Bewusstsein für Compliance- und Risikomanagementanforderungen bei kleineren Unternehmen zurückzuführen ist. Cloudbasierte und modulare Audit-Softwareangebote, die auf KMU-Budgets zugeschnitten sind, haben die Einführung erleichtert. Darüber hinaus veranlassen die zunehmende regulatorische Kontrolle und der Bedarf an einem optimierten Finanzmanagement KMU dazu, in kostengünstige und dennoch effektive Audit-Lösungen zu investieren.

- Nach Branchenvertikale

Der Markt für Audit-Software ist branchenbezogen in die Bereiche Finanz- und Sicherheitsdienstleistungen (BFSI), Einzelhandel & E-Commerce, Fertigung, öffentliche Verwaltung & Verteidigung, Energie & Versorgung, IT & Telekommunikation, Bildung, Gesundheitswesen und weitere segmentiert. Das BFSI-Segment erzielte 2024 den größten Umsatzanteil, unterstützt durch strenge regulatorische Vorgaben, häufige interne Audits und hohe Mengen an Transaktionsdaten, die einer genauen Prüfung bedürfen. Finanzinstitute setzen frühzeitig auf fortschrittliche Audit-Lösungen zur Risikominderung, Betrugserkennung und Compliance-Berichterstattung.

Der Gesundheitssektor dürfte von 2025 bis 2032 aufgrund zunehmender Datenschutzbestimmungen wie HIPAA und der Notwendigkeit einer sicheren Prüfung von Patientenakten, Abrechnungen und Versicherungsansprüchen die höchsten Wachstumsraten verzeichnen. Die zunehmende Verbreitung elektronischer Patientenakten (EHRs) und medizinischer Softwaresysteme erfordert robuste Prüfpfade und Compliance-Tools. Prüfsoftware im Gesundheitswesen erhöht die Transparenz, senkt die Compliance-Kosten und unterstützt eine sichere Betriebsführung.

Regionale Analyse des Marktes für Audit-Software

- Nordamerika dominierte den Markt für Audit-Software mit dem größten Umsatzanteil von 47,5 % im Jahr 2024, was auf strenge regulatorische Compliance-Standards, eine weit verbreitete Digitalisierung in Unternehmen und eine starke Präsenz wichtiger Anbieter von Audit-Software zurückzuführen ist.

- Unternehmen in der Region legen Wert auf Risikomanagement und Einhaltung gesetzlicher Vorschriften, was zu einer großflächigen Einführung fortschrittlicher Audit-Lösungen für finanzielle und betriebliche Transparenz führt.

- Die Region profitiert von einer ausgereiften IT-Infrastruktur, einem hohen Bewusstsein für Cybersicherheitsbedrohungen und einer verstärkten Integration von Cloud-basierten Tools, wodurch Audit-Software zu einer wichtigen Komponente in den Unternehmens-Governance-Frameworks wird.

Einblicke in den US-Audit-Softwaremarkt

Der US-Markt für Auditsoftware erwirtschaftete 2024 einen dominanten Anteil am Gesamtumsatz Nordamerikas. Dies ist auf die fortschrittliche IT-Infrastruktur des Landes und die proaktive Durchsetzung von Vorschriften zurückzuführen. Große Unternehmen sind Vorreiter bei der Einführung von Auditsoftware und setzen Lösungen ein, die interne Kontrolltests optimieren, das Reporting automatisieren und die Auditgenauigkeit verbessern. Ein wachsender Trend zu Echtzeit-Audits, gepaart mit der Integration von KI und Analytik zur Betrugserkennung und Leistungsüberwachung, verändert den Markt. Die Nachfrage nach SaaS-basierten Modellen und Remote-Auditing-Funktionen steigt weiter, insbesondere in Branchen wie Banken, Versicherungen und der Pharmaindustrie.

Einblicke in den europäischen Audit-Softwaremarkt

Der europäische Markt für Auditsoftware wird im Prognosezeitraum voraussichtlich stetig wachsen, unterstützt durch strenge Compliance-Anforderungen wie DSGVO, IFRS und Nachhaltigkeitsvorschriften. Unternehmen in der gesamten Region setzen digitale Auditplattformen ein, um wachsende Mengen an Finanz- und Betriebsdaten zu verwalten und gleichzeitig Genauigkeit, Transparenz und Einhaltung gesetzlicher Vorschriften zu gewährleisten. Besonders stark ist die Nachfrage bei staatlichen Institutionen, Energieversorgern und großen Fertigungsunternehmen, die sowohl branchenspezifische als auch grenzüberschreitende regulatorische Anforderungen erfüllen müssen. Der Schwerpunkt auf ESG-Audits und digitalen Assurance-Services beschleunigt die Marktexpansion in Europa zusätzlich.

Einblicke in den britischen Audit-Softwaremarkt

Der britische Markt für Auditsoftware wird voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen, angetrieben durch die steigende Nachfrage nach Automatisierung von Audit Trails, Finanzkontrolle und Steuerberichterstattung. Unternehmen suchen nach effizienten und skalierbaren Lösungen, um die sich nach dem Brexit entwickelnden Finanzvorschriften und internen Governance-Standards einzuhalten. Der robuste Finanzsektor des Landes, das wachsende Fintech-Ökosystem und die frühzeitige Einführung von Cloud- und Analysetechnologien fördern die breite Nutzung von Auditsoftware sowohl bei Großunternehmen als auch bei KMU. Der Trend zu Remote-Arbeit und digitalen Compliance-Strategien verstärkt auch den Softwareeinsatz in den Bereichen professionelle Dienstleistungen und E-Commerce.

Markteinblick in Audit-Software in Deutschland

Der deutsche Markt für Auditsoftware dürfte im Prognosezeitraum stetig wachsen. Dies wird durch die industrielle Stärke, das Engagement für Compliance und hohe Standards für operative Transparenz vorangetrieben. Deutsche Unternehmen aus der Fertigungsindustrie, der Automobilindustrie und der Versorgungswirtschaft setzen zunehmend Auditsoftware ein, um komplexe interne Kontrollsysteme zu verwalten und sowohl nationale als auch EU-Vorschriften zu erfüllen. Die zunehmende Präferenz für lokalisierte, mehrsprachige Plattformen und der Bedarf an durchgängiger Transparenz der Auditprozesse führen zu einer starken Nachfrage nach fortschrittlichen digitalen Lösungen. Die Integration in ERP-Systeme und die Unterstützung nachhaltigkeitsbezogener Auditmodule steigern die Akzeptanz im Land zusätzlich.

Markteinblicke für Audit-Software im asiatisch-pazifischen Raum

Der Markt für Auditsoftware im asiatisch-pazifischen Raum wird voraussichtlich von 2025 bis 2032 aufgrund des rasanten digitalen Wandels in allen Branchen und des wachsenden Bewusstseins für unternehmerische Verantwortung das höchste jährliche Wachstum verzeichnen. Länder wie China, Indien und Japan verzeichnen steigende Investitionen in Governance-, Risiko- und Compliance-Tools, da die regulatorische Kontrolle zunimmt und Unternehmen ihre Aktivitäten regional ausweiten. Die Nutzung cloudbasierter Plattformen ist insbesondere bei mittelständischen Unternehmen, die nach kostengünstigen, sicheren und skalierbaren Lösungen suchen, hoch. Staatliche Digitalisierungsinitiativen und der wachsende Bedarf an transparenten Geschäftspraktiken treiben die Verbreitung von Auditsoftware in dieser dynamischen Region weiter voran.

Einblicke in den japanischen Audit-Softwaremarkt

Der japanische Markt für Auditsoftware gewinnt an Dynamik. Dies ist auf den technologieorientierten Ansatz, strenge Corporate-Governance-Vorgaben und die steigende Nachfrage nach operativer Effizienz zurückzuführen. Unternehmen aus Branchen wie Elektronik, Gesundheitswesen und Finanzdienstleistungen setzen verstärkt auf digitale Auditlösungen, um Compliance in Echtzeit sicherzustellen, Risiken zu minimieren und die Prozessintegrität zu optimieren. Die Integration von Auditsoftware mit IoT- und Business-Analytics-Tools wird immer üblicher, insbesondere da japanische Unternehmen in die digitale Transformation investieren, um global wettbewerbsfähig zu bleiben. Die alternde Belegschaft des Landes fördert zudem die Einführung intuitiver, automatisierter Systeme, die die Abhängigkeit von manuellen Auditaufgaben reduzieren.

Einblicke in den chinesischen Audit-Softwaremarkt

China hatte 2024 den größten Anteil am Markt für Auditsoftware im asiatisch-pazifischen Raum, unterstützt durch die rasante Industrialisierung, verschärfte Regulierungen und staatliche Bemühungen zur Förderung der digitalen Governance. Chinesische Unternehmen setzen Audit-Plattformen ein, um komplexe Finanzsysteme zu verwalten, nationale Compliance-Anforderungen zu erfüllen und die Datenrückverfolgbarkeit in dezentralen Betrieben sicherzustellen. Ein wachsendes Ökosystem inländischer Softwareanbieter, gepaart mit der zunehmenden Akzeptanz in Branchen wie Einzelhandel, Immobilien und Logistik, erweitert die Marktreichweite. Der Vorstoß in Richtung Smart City-Entwicklung und Datensicherheit fördert zudem die Integration fortschrittlicher, Cloud-nativer Audit-Tools.

Marktanteil von Audit-Software

Die Audit-Softwarebranche wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- IBM (USA)

- SAP SE (Deutschland)

- Protiviti Inc. (USA)

- ACL Services Ltd (Kanada)

- Ideagen Plc (Großbritannien)

- NAVEX Global, Inc. (USA)

- Wolters Kluwer Corporate & Financial Services (Niederlande)

- Workiva (USA)

- MasterControl, Inc. (USA)

- Xactium Limited (Großbritannien)

Neueste Entwicklungen auf dem globalen Markt für Audit-Software

- Im Mai 2025 sicherte sich Workiva Inc. eine Finanzierung in Höhe von 120 Millionen US-Dollar, angeführt von BlackRock, um sein Angebot an Audit-Software zu erweitern und seine Cloud-basierte Plattform zu stärken. Diese beträchtliche Investition soll Workivas Innovation und Marktexpansion beschleunigen und seine Position als wichtiger Akteur im wachsenden Audit-Software-Markt stärken.

- Im März 2025 gaben SAP SE und Deloitte eine strategische Partnerschaft zur Integration des SAP GRC Audit Center in die Prüfungsdienstleistungen von Deloitte bekannt. Diese Zusammenarbeit soll die Wettbewerbsfähigkeit des Marktes deutlich steigern, indem sie die Prüfungstechnologie von SAP mit der Fachkompetenz von Deloitte verbindet und so die Prüfungsgenauigkeit, Effizienz und Wertschöpfung in allen Kundenorganisationen verbessert.

- Im Januar 2024 brachte Intuit Inc. Intuit Audit auf den Markt, eine neue Audit-Softwarelösung speziell für kleine und mittlere Wirtschaftsprüfungsgesellschaften. Durch die Automatisierung von Routineaufgaben und die Bereitstellung von Echtzeitanalysen soll die Lösung manuelle Fehler und operative Reibungsverluste reduzieren und Intuit so helfen, im Segment der Audit-Software für KMU Fuß zu fassen.

- Im Januar 2024 übernahm MetricStream, ein bedeutender Akteur im Markt für Auditsoftware, Intelex Technologies, bekannt für seine Umwelt-, Gesundheits- und Sicherheitsmanagementsysteme (EHS). Ziel dieser Übernahme ist es, das Produktangebot von MetricStream im Bereich Auditmanagement zu erweitern und die Marktpräsenz zu erweitern.

- Im Januar 2024 stellte die Netwrix Corporation, ein führender Anbieter von Auditsoftware, ihre neueste Auditmanagement-Lösung Netwrix Auditor 11.5 vor. Diese aktualisierte Version bietet erweiterte Datenanalysefunktionen, eine überarbeitete Benutzeroberfläche und eine nahtlose Integration in gängige Unternehmensanwendungen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.