Global Agave Spirits Market

Marktgröße in Milliarden USD

CAGR :

%

USD

11.00 Billion

USD

17.28 Billion

2024

2032

USD

11.00 Billion

USD

17.28 Billion

2024

2032

| 2025 –2032 | |

| USD 11.00 Billion | |

| USD 17.28 Billion | |

|

|

|

|

Globale Marktsegmentierung für Agavenspirituosen nach Typ (Tequila, Mezcal , Raicilla, Bacanora, Sotol, Pulque und andere), Anwendung (Getränke, Lebensmittelindustrie, Kosmetik und Pharmazeutik), Endverbraucher (Einzelhandel, HoReCa (Hotel/Restaurant/Café), Duty-Free und Online-Verkauf), Verkaufsstelle (vor Ort und außer Haus) – Branchentrends und Prognose bis 2032

Marktanalyse für Agavenspirituosen

Der Markt für Agavenspirituosen hat ein deutliches Wachstum erlebt, das durch das zunehmende Interesse der Verbraucher an hochwertigen und handwerklich hergestellten alkoholischen Getränken angetrieben wurde. Dieser Trend wurde durch eine größere Wertschätzung für authentische, qualitativ hochwertige Produkte und die steigende Beliebtheit von Tequila und Mezcal auf den globalen Märkten vorangetrieben. Innovationen und Fortschritte in Produktions- und Marketingstrategien, wie nachhaltige Beschaffung und umweltfreundliche Destillationsmethoden, prägen die Branche weiter. Beispielsweise konzentrieren sich Unternehmen jetzt auf Bio-Agaven und Produktionstechniken ohne Zusatzstoffe, um die Nachfrage der Verbraucher nach natürlichen Produkten zu erfüllen. Darüber hinaus haben Kooperationen mit prominenten Werbeträgern und strategische Partnerschaften die Reichweite und Attraktivität der Marke für die Verbraucher erhöht. Die Einführung alkoholfreier Spirituosen auf Agavenbasis hat den Markt ebenfalls diversifiziert und ein neues Segment von Verbrauchern erschlossen, die nach einzigartigen Alternativen suchen. Trotz Herausforderungen wie Umweltbedenken im Zusammenhang mit dem Agavenanbau und den Produktionskosten wird erwartet, dass der Markt seinen Aufwärtstrend fortsetzt, da sich die Verbraucherpräferenzen in Richtung hochwertiger, handwerklich hergestellter und nachhaltiger Optionen verschieben.

Agavenspirituosen Marktgröße

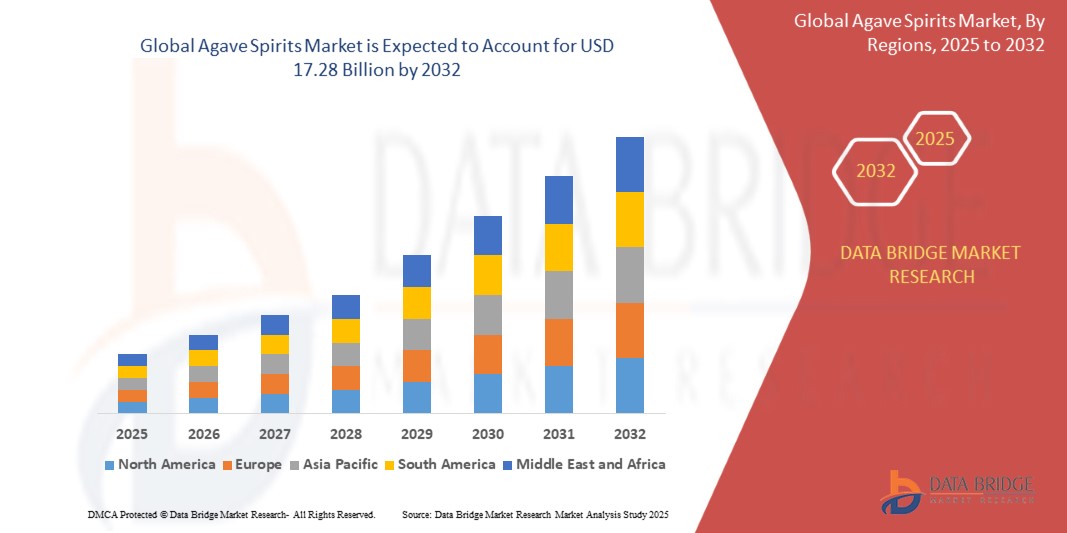

Der globale Markt für Agavenspirituosen wurde im Jahr 2024 auf 11,00 Milliarden US-Dollar geschätzt und soll bis 2032 17,28 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 5,80 % während des Prognosezeitraums 2025 bis 2032. Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen.

Markttrends für Agavenspirituosen

„Aufstieg nachhaltiger und ökologischer Produktionsmethoden“

Ein bedeutender Trend auf dem Markt für Agavenspirituosen ist der Anstieg nachhaltiger und biologischer Produktionsmethoden, der durch die wachsende Nachfrage der Verbraucher nach umweltfreundlichen und verantwortungsvoll hergestellten Getränken vorangetrieben wird. Dieser Trend ist deutlich erkennbar, da Unternehmen Praktiken anwenden, die die Umweltbelastung minimieren, wie die Verwendung von Bio-Agaven und den Einsatz von Destillationsverfahren ohne Zusatzstoffe. Beispielsweise sind Marken wie Tequila Fortaleza und Clase Azul für ihr Engagement für traditionelle und nachhaltige Produktionstechniken bekannt. Darüber hinaus kommt die Einführung alkoholfreier Spirituosen auf Agavenbasis gesundheitsbewussten Verbrauchern entgegen, die nach innovativen Alternativen suchen. Dieses Segment gewinnt an Zugkraft, da es einzigartige Aromen und das Erlebnis von Agavenspirituosen ohne Alkoholgehalt bietet. Solche Bemühungen stehen im Einklang mit dem breiteren globalen Wandel hin zu Nachhaltigkeit und Transparenz und positionieren Agavenspirituosen als zukunftsweisende Wahl in der Kategorie der Premiumspirituosen. Dieser Trend spricht umweltbewusste Verbraucher an und stärkt die Attraktivität des Marktes in der wettbewerbsintensiven Getränkebranche.

Berichtsumfang und Marktsegmentierung für Agavenspirituosen

|

Eigenschaften |

Wichtige Markteinblicke zu Agavenspirituosen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Wichtige Marktteilnehmer |

Brown-Forman (USA), Clase Azul México (Mexiko), Fielding & Jones Ltd. (Großbritannien), DIAGEO (Großbritannien), CAZADORES (Mexiko), Volcan de Mi Tierra Tequila (Mexiko), Tequila Fortaleza (Mexiko), El Silencio Holdings, INC (USA), Ilegal Mezcal (USA), Tanteo Tequila (Mexiko), Bacardi (Bermuda), Heaven Hill Brands (USA), Suntory Global Spirits Inc. (Japan), Davide Campari-Milano NV (Italien), Casa Lumbre (Mexiko), JOSE CUERVO (Mexiko), Tequila Ocho (Mexiko), SAZERAC CO, INC. (USA), Davide Campari-Milano NV (Italien) und Constellation Brands, Inc. (USA) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen. |

Marktdefinition für Agavenspirituosen

Agavenspirituosen sind destillierte alkoholische Getränke, die hauptsächlich aus der blauen Agave hergestellt werden, die in Regionen Mexikos heimisch ist. Die gängigsten Sorten sind Tequila und Mezcal, wobei Tequila ausschließlich aus der blauen Agave hergestellt und in bestimmten Gebieten Mexikos, hauptsächlich in Jalisco, produziert wird. Mezcal hingegen kann aus verschiedenen Agavenarten hergestellt werden und wird in Regionen wie Oaxaca produziert. Der Produktionsprozess umfasst das Ernten und Kochen von Agavenpiñas, das Extrahieren des Safts, das Fermentieren und das Destillieren, um den endgültigen Spiritus herzustellen.

Marktdynamik für Agavenspirituosen

Treiber

- Steigende Verbraucherpräferenz für Premium- und Craft-Spirituosen

Die steigende Vorliebe der Verbraucher für Premium- und Craft-Spirituosen hat die Nachfrage nach Agavengetränken wie Tequila und Mezcal deutlich gesteigert. Dieser Trend wird durch das wachsende Interesse der Verbraucher an hochwertigen, handwerklich hergestellten Produkten vorangetrieben, die einzigartige, komplexe Aromen und ein Gefühl von Tradition bieten. So erfreuen sich Agavenspirituosen in kleinen Mengen und nachhaltiger Produktion eines Popularitätsschubs, da die Verbraucher Wert auf Transparenz und Umweltverantwortung legen. Tequila- und Mezcal-Marken wie Clase Azul und Del Maguey veranschaulichen diesen Wandel, indem sie handwerkliche Methoden und lokale Beschaffung betonen. Diese Verbrauchernachfrage steht im Einklang mit breiteren Premiumisierungstrends in der Alkoholindustrie, wo hochwertige Spirituosen höhere Preise erzielen und eine anspruchsvollere Kundschaft ansprechen. Die Bewegung unterstützt auch das Wachstum regionaler und handwerklicher Destillerien und steigert die Vielfalt und den kulturellen Reichtum von Agavenspirituosen. Infolgedessen wächst der Markt für Agavenspirituosen, angetrieben sowohl von den Verbraucherpräferenzen als auch vom zunehmenden Wunsch nach authentischen, hochwertigen Erlebnissen.

- Wachsende Popularität von Agavenspirituosen in Cocktails und Mixologie

Die wachsende Beliebtheit von Agavenspirituosen in Cocktails und Mixologie war ein wichtiger Treiber für die Expansion des Marktes. Barkeeper und Verbraucher suchen zunehmend nach einzigartigen und kräftigen Aromen, und Tequila und Mezcal bieten unverwechselbare Geschmacksprofile, die sie von anderen Spirituosen abheben. Diese Getränke auf Agavenbasis sind in klassischen Cocktails wie der Margarita enthalten und werden in innovativen neuen Rezepten verwendet, die ihre Vielseitigkeit unter Beweis stellen. So haben beispielsweise Cocktails wie der Mezcal Mule und der Tequila Sunrise an Popularität gewonnen, was das Interesse der Verbraucher an diesen Spirituosen steigert. Die Einbeziehung hochwertiger und handwerklich hergestellter Agavenspirituosen in die Cocktailkultur hat zu einer erhöhten Nachfrage geführt und zum Wachstum des Marktes für Agavenspirituosen beigetragen. Dieser Trend wird durch eine Zunahme von auf Mixologie ausgerichteten Bars und Cocktail-Spezialitätenlokalen, die einzigartige und hochwertige Zutaten bevorzugen, weiter unterstützt. Der Einfluss der Cocktailkultur treibt die Ausbreitung von Agavenspirituosen als Grundnahrungsmittel in der Getränkeindustrie voran.

Gelegenheiten

- Steigendes Gesundheitsbewusstsein bei Verbrauchern

Das zunehmende Gesundheitsbewusstsein der Verbraucher schafft eine bedeutende Marktchance für Agavenspirituosen. Da sich die Menschen der Auswirkungen ihrer Entscheidungen auf Gesundheit und Wohlbefinden immer bewusster werden, entscheiden sich viele für Getränke mit geringerem Zuckergehalt, weniger Zusatzstoffen und potenziellen gesundheitlichen Vorteilen. Agavenspirituosen, insbesondere solche, die mit biologischen und nachhaltigen Verfahren hergestellt werden, folgen diesem Trend aufgrund ihrer natürlichen Produktionsmethoden und ihres niedrigeren glykämischen Index im Vergleich zu anderen Spirituosen. Beispielsweise greifen Verbraucher, die nach gesünderen Alkoholalternativen suchen, zu hochwertigem, reinem Tequila und Mezcal, die für ihre komplexen Aromen und potenziellen verdauungsfördernden Vorteile bei maßvollem Konsum bekannt sind. Diese wachsende Vorliebe für wellnessorientierte Produkte steigert die Nachfrage nach hochwertigen Agavenspirituosen. Marken, die Wert auf ihre biologischen Zutaten und nachhaltigen Verfahren legen, wie z. B. Bio-Tequila-Linien, verzeichnen ein erhöhtes Verbraucherinteresse und Marktwachstum, was eine Chance zur Expansion in diesem Sektor schafft.

- Zunehmende Vorliebe für Spirituosen zum Nippen

Die zunehmende Vorliebe für das Nippen von Spirituosen im Gegensatz zum traditionellen Shot-Konsum bietet eine wachsende Marktchance für Agavenspirituosen. Verbraucher genießen und schätzen zunehmend die nuancierten Aromen von Premiumspirituosen, was dem Trend zum langsamen und bewussten Trinken entspricht. Dies zeigt sich insbesondere am Anstieg des Konsums von Tequila und Mezcal, die pur oder in Verkostungsformaten konsumiert werden, wobei Kenner auf die Qualität, die Herstellungsmethode und die einzigartigen Geschmacksnoten jeder Spirituose achten. Beispielsweise nutzen handwerkliche und Kleinserienproduzenten diesen Trend, indem sie gereifte Tequilas und hochwertige Mezcals anbieten, die sich ideal zum Nippen eignen und Aromen bieten, die sich am Gaumen entwickeln und entfalten. Dieser Wandel wird durch die zunehmende Zahl von Spirituosen-Verkostungsveranstaltungen und Cocktailbars unterstützt, die Nippen fördern. Marken, die die Komplexität und Handwerkskunst ihrer Produkte betonen, verzeichnen Wachstum, da Verbraucher das Erlebnis über die Menge stellen, was die Chance für Premium- und High-End-Agavenspirituosenproduzenten verstärkt.

Einschränkungen/Herausforderungen

- Hohe Produktionskosten

Hohe Produktionskosten stellen eine große Herausforderung für den Markt für Agavenspirituosen dar, da der Anbau von Agavenpflanzen und der Destillationsprozess erhebliche Investitionen in Zeit, Ressourcen und Infrastruktur erfordern. Agavenpflanzen brauchen 7 bis 12 Jahre, um auszureifen, was zu langen Produktionszyklen und höheren Betriebskosten für die Anbauer führt. Dies ist insbesondere für Schwellenmärkte eine Herausforderung, in denen der Zugang zu fortschrittlichen Anbautechniken und Infrastruktur möglicherweise begrenzt ist. So sind Tequila-Produzenten in Mexiko oft mit steigenden Kosten aufgrund von Arbeitskosten, Wasserknappheit und der Notwendigkeit nachhaltiger Anbaumethoden konfrontiert, um die wachsende Nachfrage der Verbraucher nach umweltfreundlichen Produkten zu decken. Diese erhöhten Produktionskosten können sich letztendlich auf Preisgestaltung und Rentabilität auswirken und es kleineren Produzenten schwer machen, gegen größere, etablierte Marken zu konkurrieren. Infolgedessen bleiben hohe Produktionskosten eine zentrale Marktherausforderung, die möglicherweise das Wachstum und die Zugänglichkeit des Marktes in Entwicklungsregionen einschränkt.

- Konkurrenz durch andere Spirituosen

Die Konkurrenz durch andere Spirituosen stellt für den Markt für Agavenspirituosen eine große Herausforderung dar, da er in einer äußerst wettbewerbsintensiven alkoholischen Getränkebranche agiert. Etablierte Kategorien wie Whisky , Wodka und Rum dominieren den Weltmarkt mit größeren Marktanteilen, ausgedehnten Vertriebsnetzen und höherer Markenbekanntheit. Whisky beispielsweise, insbesondere Scotch und Bourbon, hat eine lange Geschichte und eine treue Konsumentenbasis, sodass es für neuere oder Nischenprodukte wie Tequila und Mezcal schwer ist, Aufmerksamkeit zu erregen. Diese traditionellen Spirituosen profitieren häufig von größeren Marketingbudgets und einer größeren Verfügbarkeit sowohl im Einzelhandel als auch im Außendienst. Trotz ihrer wachsenden Beliebtheit haben Agavenspirituosen außerhalb der traditionellen Märkte immer noch einen harten Kampf um Markentreue und Verbraucherbekanntheit zu kämpfen. Dieser intensive Wettbewerb kann das Wachstumspotenzial für Spirituosen auf Agavenbasis einschränken und stellt somit eine erhebliche Marktherausforderung dar, da die Hersteller bestrebt sind, ihr Angebot zu differenzieren und die Verbraucherbindung zu erhöhen.

Auswirkungen von Rohstoffknappheit und Lieferverzögerungen und aktuelles Marktszenario

Data Bridge Market Research bietet eine umfassende Marktanalyse und liefert Informationen, indem es die Auswirkungen und das aktuelle Marktumfeld von Rohstoffknappheit und Lieferverzögerungen berücksichtigt. Dies bedeutet, dass strategische Möglichkeiten bewertet, wirksame Aktionspläne erstellt und Unternehmen bei wichtigen Entscheidungen unterstützt werden. Neben dem Standardbericht bieten wir auch eine eingehende Analyse des Beschaffungsniveaus anhand prognostizierter Lieferverzögerungen, Händlerzuordnung nach Regionen, Rohstoffanalyse, Produktionsanalyse, Preiszuordnungstrends, Beschaffung, Kategorieleistungsanalyse, Lösungen zum Risikomanagement der Lieferkette, erweitertes Benchmarking und andere Dienstleistungen für Beschaffung und strategische Unterstützung.

Erwartete Auswirkungen der Konjunkturabschwächung auf die Preisgestaltung und Verfügbarkeit von Produkten

Wenn die Wirtschaftstätigkeit nachlässt, leiden auch die Branchen darunter. Die prognostizierten Auswirkungen des Konjunkturabschwungs auf die Preisgestaltung und Verfügbarkeit der Produkte werden in den von DBMR bereitgestellten Markteinblickberichten und Informationsdiensten berücksichtigt. Damit sind unsere Kunden ihren Konkurrenten in der Regel immer einen Schritt voraus, können ihre Umsätze und Erträge prognostizieren und ihre Gewinn- und Verlustaufwendungen abschätzen.

Agavenspirituosen Marktumfang

Der Markt ist nach Typ, Anwendung, Endbenutzer und Verkaufsstelle segmentiert . Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Tequila

- Mezcal

- Raicilla

- Bacanora

- Sotol

- Pulque

- Sonstiges

Anwendung

- Getränke

- Lebensmittelindustrie

- Kosmetika

- Pharmazeutische

Endbenutzer

- Einzelhandel

- HoReCa (Hotel/Restaurant/Café)

- Zollfrei

- Online-Verkäufe

Verkaufsstelle

- Vor Ort

- Außerhalb des Geschäftsgeländes

Agave Spirits Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, end-user, and point of sale as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the agave spirits Market, driven primarily by the strong demand for products such as tequila and mezcal, which have deep cultural and historical significance in the region. The popularity of agave-based spirits has been bolstered by their integration into social and culinary traditions, as well as the growing trend of premium and craft beverages. The region benefits from well-established production facilities and a mature distribution network that supports both local and international consumption. In addition, consumer interest in unique and artisanal spirits has further strengthened North America's leadership in this market.

Asia-Pacific is experiencing the fastest growth in the agave spirits market, driven by an increasing interest in international and exotic beverages among consumers. The region’s expanding middle class and higher disposable income have fueled the demand for premium and unique alcoholic drinks. The rising influence of global trends and a growing cocktail culture have introduced agave spirits such as tequila and mezcal to new markets. In addition, the region’s younger demographic, known for embracing novel experiences, contributes to the rapid expansion and popularity of agave-based beverages.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Agave Spirits Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Agave Spirits Market Leaders Operating in the Market Are:

- Brown-Forman (U.S.)

- Clase Azul México (Mexico)

- Fielding & Jones Ltd. (U.K.)

- DIAGEO (U.K.)

- CAZADORES (Mexico)

- Volcan de Mi Tierra Tequila (Mexico)

- Tequila Fortaleza (Mexico)

- El Silencio Holdings, INC (U.S.)

- Ilegal Mezcal (U.S.)

- Tanteo Tequila (Mexico)

- Bacardi (Bermuda)

- Heaven Hill Brands (U.S.)

- Suntory Global Spirits Inc. (Japan)

- Davide Campari-Milano N.V. (Italy)

- Casa Lumbre (Mexico)

- JOSE CUERVO (Mexico)

- Tequila Ocho (Mexico)

- SAZERAC CO, INC. (U.S.)

- Davide Campari-Milano N.V. (Italy)

- Constellation Brands, Inc. (U.S.)

Latest Developments in Agave Spirits Market

- In July 2024, Don Arte launched a new agave spirits distribution network across Europe, enhancing the availability of Mexican agave-based products in six key markets, Germany, Austria, France, Belgium, the Netherlands, and Denmark. In addition, the network, known as Artesario, was established to celebrate traditional distilling practices, offering small-batch Tequila and mezcal free from additives and making previously hard-to-find brands more accessible to consumers

- In May 2024, Maya Pistola Agavepura, Asia’s first premium 100% Agave spirit, introduced its Añejo and Extra Añejo variants in Mumbai. In these exceptional expressions, the brand offers an elevated tasting experience, embodying the craftsmanship and tradition of agave distillation. In addition, each variant is carefully aged, enhancing the rich flavors and complexities that appeal to discerning drinkers, showcasing the brand's dedication to quality and authenticity

- In October 2023, Almave debuted a non-alcoholic blue agave spirit, collaborating with seven-time Formula One champion Lewis Hamilton and agave expert Iván Saldaña. In this product launch, the brand introduced two unique expressions, Almave Ámbar, designed for sipping, and Almave Blanco, intended for mixing. In addition, this innovative product emphasizes the brand's commitment to offering a sophisticated and alcohol-free alternative in the agave spirits market

- In July 2023, Beam Suntory expanded into the mezcal market through a distribution partnership with Mezcal Amarás. In this strategic move, the company enabled the import and distribution of Mezcal Amarás in several U.S. states, reinforcing Beam Suntory's position in the rapidly growing agave-based spirits sector

- In May 2023, Campari Group unveiled Mayenda, a luxury tequila brand featuring Mayenda Tequila Blanco. In addition, this product stands out with labels made from 100% reclaimed agave byproducts. In this way, the tequila is now available in select retailers in Mexico and the United States, highlighting the brand's commitment to sustainability and innovation within the premium spirits segment

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.