Europäischer Torque-Vectoring-Markt, nach Komponente (Hardware, Dienstleistungen), Technologie (Aktives Torque-Vectoring-System (ATVS), Passives Torque-Vectoring-System (PTVS)), Kupplungsbetätigungsart (elektrisch, hydraulisch), Antriebsradart (Hinterradantrieb (RWD), Frontantrieb (FWD)), Fahrzeugtyp ( PkwNutzfahrzeuge , Geländewagen), Antriebsart (Diesel/Benzin/CNG, Elektrofahrzeug ) Branchentrends und Prognose bis 2029

Marktanalyse und Einblicke

Torque-Vectoring-Lösungen sind die wichtigsten und entscheidendsten Systeme, die für Sicherheit sorgen und zur Verbesserung der Leistung des Fahrzeugs beitragen. Diese Systeme liefern oder verteilen grundsätzlich Drehmoment zwischen den Rädern, wodurch das Fahrzeug eine Kurve oder Biegung effektiv bewältigen kann. Torque-Vectoring ist ein ganzheitlicher, vorausschauender Ansatz für die Fahrzeugdynamik unter Verwendung einer Kombination aus Hardware und elektronischen Systemen. Der globale Torque-Vectoring-Markt wächst aufgrund der Entstehung von EVS und seines Torque-Vectoring-Systems rasant. Die Unternehmen bringen sogar neue Produkte auf den Markt, um einen größeren Marktanteil zu gewinnen.

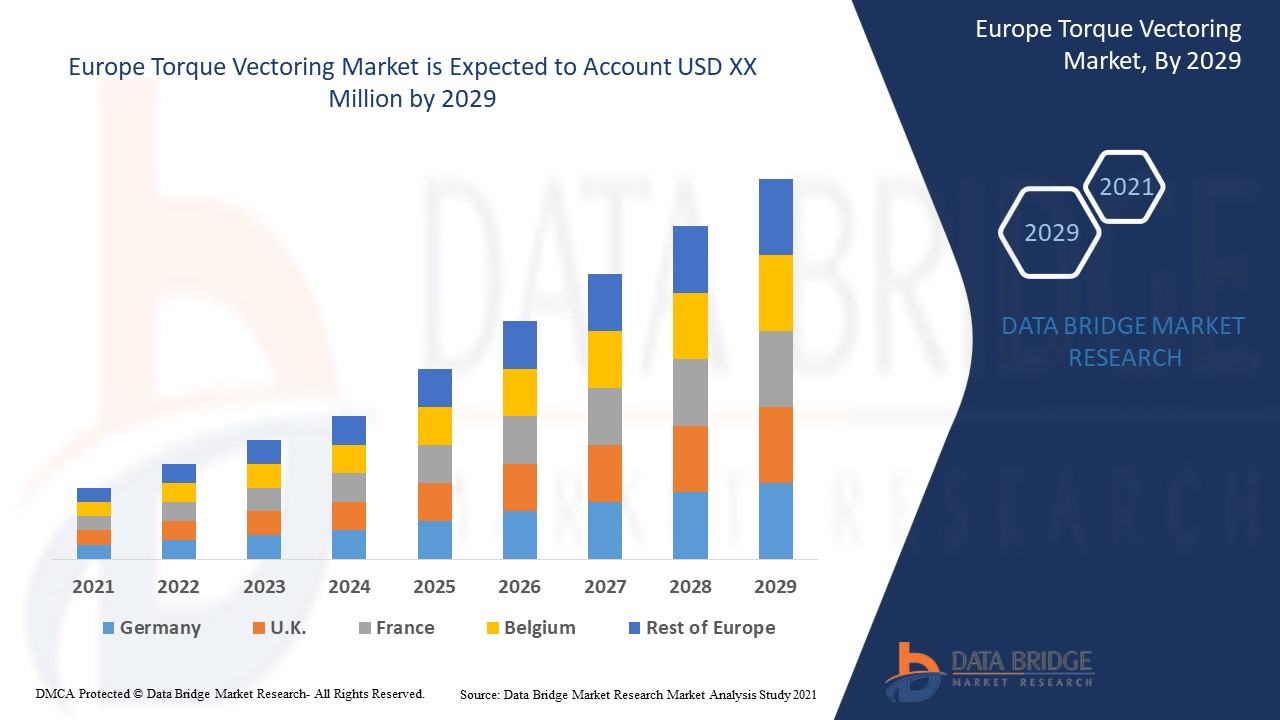

Bevölkerungswachstum, schnelle Urbanisierung und Industrialisierung haben einen propositionalen Einfluss auf das Wachstum und die Einführung von Torque Vectoring, da Torque Vectoring-Systeme in letzter Zeit häufig zur Verbesserung der Fahrzeugdynamik und der Sicherheit eingesetzt werden. Data Bridge Market Research analysiert, dass der Torque Vectoring-Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 17,4 % wachsen wird.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historisches Jahr |

2020 (Anpassbar auf 2019 – 2014) |

|

Quantitative Einheiten |

Umsatz in Mio. USD |

|

Abgedeckte Segmente |

Nach Komponente (Hardware, Services), Technologie (Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS)), Kupplungsbetätigungsart (elektrisch, hydraulisch), Antriebsradtyp (Hinterradantrieb (RWD), Frontantrieb (FWD)), Fahrzeugtyp (Pkw, Nutzfahrzeuge, Geländewagen), Antriebsart (Diesel/Benzin/CNG, Elektrofahrzeug) |

|

Abgedeckte Länder |

Deutschland, Spanien, Frankreich, Russland, Türkei, Tschechische Republik, Großbritannien, Italien, Polen, Rumänien, Ungarn, Belgien, Schweden, Niederlande, Finnland, Weißrussland, Schweiz und Rest von Europa |

|

Abgedeckte Marktteilnehmer |

BorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean, Hewland Engineering Ltd, Continental AG, Modelon, GKN Automotive Limited, Inc., Prodrive Holdings Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG und andere. |

Marktdefinition

Torque-Vectoring-Lösungen sind die wichtigsten und entscheidendsten Systeme, die die Sicherheit gewährleisten und zur Verbesserung der Leistung des Fahrzeugs beitragen. Diese Systeme liefern oder verteilen grundsätzlich Drehmoment zwischen den Rädern, wodurch das Fahrzeug eine Kurve oder Biegung effektiv bewältigen kann. Torque Vectoring ist ein ganzheitlicher, vorausschauender Ansatz für die Fahrzeugdynamik unter Verwendung einer Kombination aus Hardware und elektronischen Systemen. Es sorgt für die am besten geeignete Drehmomentverteilung auf ein Rad zu jedem Zeitpunkt, basierend auf den Absichten des Fahrers und den Fahrbedingungen. Grundsätzlich werden zwei Arten von Torque-Vectoring-Techniken häufig verwendet: bremsbasiertes Torque Vectoring und elektrisch basiertes Torque Vectoring.

Torque Vectoring Marktdynamik

Treiber

- Bevölkerungswachstum und rasche Urbanisierung

Die schnelle Urbanisierung, Bevölkerungszunahme, die Entstehung von Mobility-as-a-Service-Technologien (MaaS) und Veränderungen im Verbraucherverhalten zwingen die großen Akteure dazu, abonnementbasierte Dienste anzubieten, damit sich die Verbraucher einen Marktvorteil verschaffen können.

- Aufkommen von Elektrofahrzeugen und deren Torque-Vectoring-System

In jüngster Zeit verzeichnet die Automobilindustrie aufgrund der steigenden Nachfrage nach luxuriösen Elektrofahrzeugen im Laufe der Jahre ein enormes Wachstum. Vollelektrische Fahrzeuge (EVs) werden als batteriebetriebene Elektrofahrzeuge bezeichnet, die eine Batterie verwenden, um die elektrische Energie zu speichern, die die Fahrzeuge antreibt.

- Intelligenter Torque-Vectoring-Ansatz für ADAS-Fahrzeuge

Bei fortschrittlichen Fahrerassistenzsystemen (ADAS) handelt es sich um elektronische Systeme, die in Autos eingebaut werden, um das Fahren von Fahrzeugen oder selbstfahrenden Autos zu unterstützen. Dieses System verwendet Sensoren wie Radare und Kameras zur Analyse und ergreift automatisch Maßnahmen basierend auf der Umgebung des Fahrzeugs.

- Steigende Nachfrage nach Luxus- und Hochleistungsfahrzeugen

Das Konzept vernetzter Fahrzeuge mit fortschrittlichen Sicherheitsfunktionen und Telematik ist dank des technologischen Fortschritts möglich. Technologien wie KI, Big Data, fortschrittliche Netzwerkkonnektivität und IoT. Darüber hinaus ist Torque Vectoring ein computergesteuertes Steuersystem, das die Leistung des Motors oder der Motoren des Autos steuert und basierend auf den verfügbaren Leistungsdaten an jedes einzelne Rad sendet.

Gelegenheit

-

Starke Einführung des Torque-Vectoring-Systems in Geländefahrzeugen

Ein Geländewagen (OHV) oder Offroad-Fahrzeug ist ein Fahrzeugtyp, der speziell für den Offroad-Einsatz in unwegsamem Gelände konzipiert ist. Diese Fahrzeuge wurden speziell für Verbraucher entwickelt, die Geländefahrzeuge für die Erreichbarkeit in ihrem Wohngebiet oder für Freizeitzwecke bevorzugen.

Einschränkung/Herausforderung

Der hohe CO2-Fußabdruck des Automobilsektors wird die Regierungen jedoch dazu zwingen, strenge Maßnahmen und Vorschriften zur Kontrolle des Emissionsniveaus zu ergreifen, was die Einführung von Torque-Vectoring-Lösungen verringern könnte. Darüber hinaus steht das begrenzte Angebot für Fahrzeuge aufgrund des Mangels an Halbleiterchips und Controllern in direktem Zusammenhang mit dem Verkauf und der Verfügbarkeit neuer Torque-Vectoring-Systeme.

Auswirkungen von Covid-19 auf den Torque Vectoring-Markt

COVID-19 hat sich negativ auf den Markt ausgewirkt. Da Torque-Vectoring-Systeme stark nachgefragt waren, haben Unternehmen wie JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean und andere in Europa große Schwierigkeiten, fortschrittliche Systeme für neue und alte Fahrzeuge bereitzustellen, da es an Halbleiter-Steuerchips und -Controllern mangelt. Grund dafür sind strenge Vorschriften der Regierung. Darüber hinaus hat das begrenzte Angebot an Halbleiterchips und -geräten die Fahrzeugversorgung auf dem Markt erheblich beeinträchtigt.

Jüngste Entwicklung

- Im März 2022 brachte Prodrive Holdings Limited das weltweit erste geländegängige Hypercar auf den Markt. Das Highlight dieser Fahrzeugeinführung war das 600 PS starke, geländegängige Abenteuerfahrzeug mit Allradantrieb und unübertroffener Leistungsfähigkeit und Leistung in jedem Gelände. Dadurch erweiterte das Unternehmen seinen Markt, indem es seinen Verbrauchern innovative Lösungen anbot.

Torque Vectoring Marktumfang in Europa

Der Torque-Vectoring-Markt ist segmentiert nach Komponenten, Technologie, Kupplungsbetätigungsart, Antriebsradtyp, Fahrzeugtyp und Antriebsart. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Komponente

- Hardware

- Dienstleistungen

Auf der Grundlage der Komponenten wurde der europäische Torque-Vectoring-Markt in Hardware und Dienstleistungen segmentiert.

Technologie

- Aktives Torque-Vectoring-System (ATVS)

- Passives Torque-Vectoring-System (PTVS)

Auf technologischer Grundlage wurde der europäische Torque Vectoring-Markt in aktive Torque Vectoring-Systeme (ATVS) und passive Torque Vectoring-Systeme (PTVS) segmentiert.

Kupplungsbetätigungstyp

- Elektrisch

- Hydraulisch

Auf Grundlage der Art der Kupplungsbetätigung wurde der europäische Torque-Vectoring-Markt in elektrisch und hydraulisch segmentiert.

Antriebsradtyp

- Hinterradantrieb (RWD)

- Frontantrieb (FWD)

- Allradantrieb/Vierradantrieb (AWD/4WD)

Auf der Grundlage des Antriebsradtyps wurde der europäische Torque Vectoring-Markt in Hinterradantrieb (RWD), Frontantrieb (FWD) und Allradantrieb/Vierradantrieb (AWD/4WD) segmentiert.

Fahrzeugtyp

- Pkw

- Nutzfahrzeuge

- Geländewagen

Auf der Grundlage des Fahrzeugtyps wurde der europäische Torque Vectoring-Markt in Personenkraftwagen, Nutzfahrzeuge und Geländefahrzeuge segmentiert.

Antriebsart

- Diesel/Benzin/CNG

- Elektrofahrzeug

Auf Grundlage der Antriebsart wurde der europäische Torque-Vectoring-Markt in Diesel-/Benzin-/CNG- und Elektrofahrzeuge segmentiert.

Europa Torque Vectoring Markt – Regionale Analyse/Einblicke

Der Torque-Vectoring-Markt wird analysiert und Einblicke in die Marktgröße und Trends werden nach Land, Komponente, Technologie, Kupplungsbetätigungstyp, Antriebsradtyp, Fahrzeugtyp und Antriebstyp wie oben angegeben bereitgestellt. Der europäische Markt ist weiter segmentiert in Deutschland, Spanien, Frankreich, Russland, Türkei, Tschechische Republik, Großbritannien, Italien, Polen, Rumänien, Ungarn, Belgien, Schweden, Niederlande, Finnland, Weißrussland, Schweiz und Restliches Europa.

Aufgrund der Bedeutung des Torque-Vectoring-Marktes, in dem es große Hersteller und eine hohe Nachfrage gibt, wird Deutschland voraussichtlich den europäischen Markt dominieren.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierungen auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, Länderdemografie, Krankheitsepidemiologie und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wettbewerbsumfeld und Torque Vectoring Marktanteilsanalyse

Die Wettbewerbslandschaft des Torque Vectoring-Marktes liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Lösungseinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Torque Vectoring-Markt.

Zu den wichtigsten Akteuren auf dem Torque Vectoring-Markt zählen unter anderem Continental AG, Schaeffler AG, Robert Bosch GmbH, GKN Automotive Limited, ZF Friedrichshafen AG, BorgWarner Inc., Eaton, Magna International Inc. und Dana Limited.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TORQUE VECTORING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF EVS & AND ITS TORQUE VECTORING SYSTEM

5.1.3 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH IMPLEMENTING TORQUE VECTORING/AWD/4WD SYSTEMS

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 HEAVING ADOPTION OF TORQUE VECTORING SYSTEM IN OFF-ROAD VEHICLES

5.3.2 GROWING AWARENESS ABOUT ENHANCED SAFETY AND VEHICLE DYNAMICS

5.4 CHALLENGES

5.4.1 HAMPERED SUPPLY OF SEMICONDUCTOR EQUIPMENT LIMITS TORQUE VECTORING SYSTEM

5.4.2 CHANGING AUTOMOTIVE PRODUCT LIFE CYCLE AND LONG PRODUCTION CYCLE OF AUTOMOTIVE VEHICLES

6 EUROPE TORQUE VECTORING MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DRIVE CONTROL UNIT (DCU)

6.2.2 MOTOR CONTROLLERS

6.2.3 SENSORS

6.2.4 MOTOR

6.2.5 CAN BUS

6.2.6 OTHERS

6.3 SERVICES

7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

7.3 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

8 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE

8.1 OVERVIEW

8.2 ELECTRIC

8.3 HYDRAULIC

9 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE

9.1 OVERVIEW

9.2 FRONT-WHEEL DRIVE (FWD)

9.3 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

9.4 REAR-WHEEL DRIVE (RWD)

10 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 BY TYPE

10.2.1.1 SEDAN

10.2.1.2 HATCHBACK

10.2.1.3 CROSSOVERS

10.2.1.4 SUV

10.2.1.5 OTHERS

10.2.2 BY TECHNOLOGY

10.2.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.2.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.3 COMMERCIAL VEHICLES

10.3.1 BY TYPE

10.3.1.1 LIGHT COMMERCIAL VEHICLE

10.3.1.2 HEAVY COMMERCIAL VEHICLE

10.3.1.2.1 BUS

10.3.1.2.2 TRUCKS

10.3.2 BY TECHNOLOGY

10.3.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.3.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.4 OFF ROAD VEHICLE

10.4.1 BY TECHNOLOGY

10.4.1.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.4.1.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

11 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE

11.1 OVERVIEW

11.2 DIESEL/PETROL/CNG

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 HYBRID ELECTRIC VEHICLE (HEV)

12 EUROPE TORQUE VECTORING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY (LEFT HAND DRIVE)

12.1.2 SPAIN (LEFT HAND DRIVE)

12.1.3 FRANCE (LEFT HAND DRIVE)

12.1.4 RUSSIA (LEFT HAND DRIVE)

12.1.5 TURKEY (LEFT HAND DRIVE)

12.1.6 CZECH REPUBLIC (LEFT HAND DRIVE)

12.1.7 U.K. (RIGHT HAND DRIVE)

12.1.8 ITALY (LEFT HAND DRIVE)

12.1.9 POLAND (LEFT HAND DRIVE)

12.1.10 ROMANIA (LEFT HAND DRIVE)

12.1.11 HUNGARY (LEFT HAND DRIVE)

12.1.12 BELGIUM (LEFT HAND DRIVE)

12.1.13 SWEDEN (LEFT HAND DRIVE)

12.1.14 NETHERLANDS (LEFT HAND DRIVE)

12.1.15 FINLAND (LEFT HAND DRIVE)

12.1.16 BELARUS (LEFT HAND DRIVE)

12.1.17 SWITZERLAND (LEFT HAND DRIVE)

12.1.18 REST OF EUROPE

13 EUROPE TORQUE VECTORING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMERICAN AXLE & MANUFACTURING, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY PROFILE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CONTINENTAL AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EATON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SCHAEFFLER AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JTEKT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BORGWARNER INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DRAKO MOTORS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCTS PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GKN AUTOMOTIVE LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCTS PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HALDEX

15.10.1 COMPANY SNPASHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HEWLAND ENGINEERING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LINAMAR CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MAGNA INTERNATIONAL INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MITSUBISHI MOTORS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCTS PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MODELON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PRODRIVE HOLDINGS LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCTS PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTEAN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICARDO

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 ROBERT BOSCH GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 THE TIMKEN COMPANY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 UNIVANCE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 ZF FRIEDRICHSHAFEN AG

15.22.1 COMPANY SNAPSHOT

15.22.2 SOLUTION PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 PERFORMANCE TABLE

TABLE 2 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS & SUVS

TABLE 3 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ACTIVE TORQUE VECTORING SYSTEMS (ATVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PASSIVE TORQUE VECTORING SYSTEMS (PTVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ELECTRIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE HYDRAULIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRONT-WHEEL DRIVE (FWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE REAR-WHEEL DRIVE (RWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE COMMERCIAL VEHICLES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIESEL/PETROL/CNG IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 EUROPE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 49 GERMANY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 GERMANY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 SPAIN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SPAIN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 SPAIN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 FRANCE (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 FRANCE (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 105 TURKEY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 TURKEY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 119 CZECH REPUBLIC (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 123 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 124 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CZECH REPUBLIC (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 CZECH REPUBLIC (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 CZECH REPUBLIC (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 U.K. (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.K. (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 U.K. (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 ITALY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 ITALY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 161 POLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 164 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 165 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 166 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 POLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 POLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 175 ROMANIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 178 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 180 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ROMANIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ROMANIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 187 ROMANIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 189 HUNGARY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 192 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 193 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 HUNGARY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 HUNGARY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 200 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 HUNGARY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 217 SWEDEN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 221 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 222 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 224 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWEDEN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 227 SWEDEN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 228 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWEDEN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 230 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 231 NETHERLANDS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 238 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 241 NETHERLANDS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 244 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 245 FINLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 247 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 248 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 249 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 250 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 FINLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 255 FINLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 256 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 257 FINLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 258 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 259 BELARUS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 262 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 263 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 264 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 266 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 BELARUS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 269 BELARUS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 271 BELARUS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 272 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 275 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 276 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 277 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 280 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 SWITZERLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 SWITZERLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 285 SWITZERLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 286 REST OF EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 2 EUROPE TORQUE VECTORING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TORQUE VECTORING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TORQUE VECTORING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE TORQUE VECTORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TORQUE VECTORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE TORQUE VECTORING MARKET: DBMRMARKET POSITION GRID

FIGURE 8 EUROPE TORQUE VECTORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 10 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES IS EXPECTED TO DRIVE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE TORQUE VECTORING MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TORQUE VECTORING MARKET

FIGURE 14 PERCENTAGE OF URABANIZATION ACROSS THE GLOBE

FIGURE 15 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 16 ROAD TRANSPORT EMISSIONS

FIGURE 17 EUROPE TORQUE VECTORING MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE TORQUE VECTORING MARKET: BY TECHNOLOGY, 2021

FIGURE 19 EUROPE TORQUE VECTORING MARKET: BY CLUTCH ACTUATION TYPE, 2021

FIGURE 20 EUROPE TORQUE VECTORING MARKET: BY DRIVING WHEEL TYPE, 2021

FIGURE 21 EUROPE TORQUE VECTORING MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 EUROPE TORQUE VECTORING MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 EUROPE TORQUE VECTORING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE TORQUE VECTORING MARKET: BY COMPONENT (2022-2029)

FIGURE 28 EUROPE TORQUE VECTORING MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.