Europe Resting Electrocardiograph Ecg Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.19 Billion

USD

2.07 Billion

2024

2032

USD

1.19 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 2.07 Billion | |

|

|

|

|

Marktsegmentierung für Ruhe-Elektrokardiographen (EKG) in Europa nach Produkt (EKG-Geräte, Monitore, Software und Dienste, implantierbare Loop-Recorder und mobiles Herztelemetriegerät ), Anzahl der Ableitungen (12 Ableitungen, 15 Ableitungen, 18 Ableitungen und andere), Technologie (digital und analog), Modalität (fest und mobil), Gerätegröße (groß, mittel und klein), Konnektivität (kabelgebunden und drahtlos), Betriebsmodus (automatisch, halbautomatisch und manuell), Endbenutzer (Krankenhäuser, Fachkliniken, ambulante chirurgische Zentren, häusliche Pflegeeinrichtungen und andere) – Branchentrends und Prognose bis 2032

Ruhe-Elektrokardiograph (EKG) Marktgröße in Europa

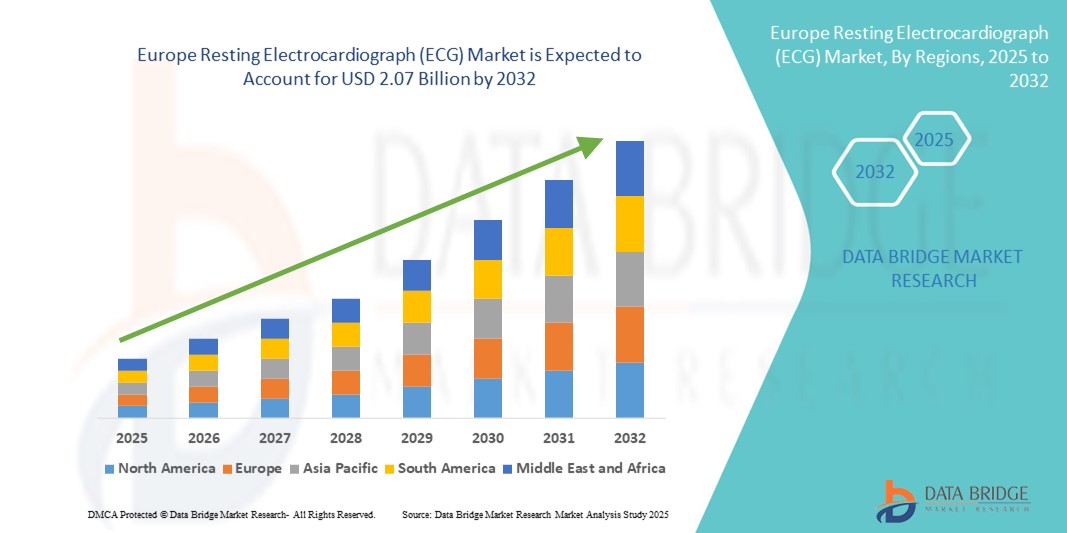

- Der europäische Markt für Ruhe-Elektrokardiographen (EKG) hatte im Jahr 2024 einen Wert von 1,19 Milliarden US-Dollar und wird bis 2032 voraussichtlich 2,07 Milliarden US-Dollar erreichen , bei einer CAGR von 7,10 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Akzeptanz und den technologischen Fortschritt in der medizinischen Diagnostik, insbesondere in der Herzmedizin, vorangetrieben, was zu einer zunehmenden Digitalisierung und Integration der Gesundheitsinfrastruktur in Krankenhäusern und ambulanten Einrichtungen in Europa führt.

- Darüber hinaus etabliert die steigende Nachfrage nach präziser, nicht-invasiver Echtzeit-Herzüberwachung Ruhe-EKG-Geräte als unverzichtbares Diagnoseinstrument. Diese konvergierenden Faktoren beschleunigen die Verbreitung von Ruhe-EKG-Lösungen in Europa und fördern damit das Wachstum der Branche erheblich.

Ruhe-Elektrokardiograph (EKG) Marktanalyse für Europa

- Ruhe-Elektrokardiographen (EKG) erfassen die elektrische Aktivität des Herzens im Ruhezustand des Patienten und sind aufgrund ihrer Zuverlässigkeit, ihres nicht-invasiven Designs und ihrer Wirksamkeit bei der Erkennung von Herz-Kreislauf-Erkrankungen wie Herzrhythmusstörungen, Herzinfarkt und Herzinsuffizienz wichtige Diagnoseinstrumente in europäischen Gesundheitssystemen.

- Die Nachfrage nach Ruhe-EKGs steigt in ganz Europa aufgrund der wachsenden älteren Bevölkerung, der zunehmenden Zahl von Herzerkrankungen und des steigenden Bewusstseins für präventive Herzbehandlungen weiter an. Darüber hinaus verbessert die Integration digitaler EKG-Systeme in elektronische Patientenakten (EHRs), KI-gestützte Analysetools und mobile Plattformen die Diagnosegeschwindigkeit und -genauigkeit erheblich.

- Deutschland dominierte den europäischen Markt für Ruhe-EKGs mit dem größten Umsatzanteil von 33,3 % im Jahr 2024. Dies ist auf die fortschrittliche Gesundheitsinfrastruktur, den starken Fokus auf frühzeitige kardiovaskuläre Diagnostik und die weit verbreitete Einführung von 12-Kanal-EKG-Systemen in öffentlichen und privaten Krankenhäusern zurückzuführen. Die führende Rolle Deutschlands in der Medizintechnikproduktion und Investitionen in Telekardiologiedienste fördern die EKG-Einführung weiter.

- Großbritannien wird voraussichtlich der am schnellsten wachsende Markt im europäischen Ruhe-EKG-Markt sein und im Prognosezeitraum (2025–2032) eine jährliche Wachstumsrate (CAGR) von 10,1 % verzeichnen. Das Wachstum wird durch die steigende Belastung durch Herz-Kreislauf-Erkrankungen, die zunehmende Nutzung von EKG-Überwachungen zu Hause bei älteren Patienten und staatliche Initiativen zur Modernisierung der Diagnosedienste im gesamten NHS mit KI-gestützten EKG-Plattformen und mobilen Diagnosegeräten vorangetrieben.

- Das 12-Kanal-EKG-Segment dominierte 2024 den europäischen Markt für Ruhe-Elektrokardiographen (EKG) mit einem Umsatzanteil von 51,3 %, da es in Krankenhäusern standardmäßig für umfassende Herzuntersuchungen eingesetzt wird. Es bietet eine detaillierte Ansicht der elektrischen Aktivität des Herzens und unterstützt so eine genaue Diagnose.

Berichtsumfang und Marktsegmentierung für Ruhe-Elektrokardiographen (EKG) in Europa

|

Eigenschaften |

Wichtige Markteinblicke zum Ruhe-Elektrokardiographen (EKG) in Europa |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Ruhe-Elektrokardiographen (EKG) in Europa

„ Fortschritte bei der digitalen Integration und diagnostischen Präzision “

- Ein bedeutender und sich beschleunigender Trend auf dem europäischen Markt für Ruhe-EKGs ist die zunehmende Integration von künstlicher Intelligenz (KI), Cloud-Konnektivität und mobilen Gesundheitsplattformen in EKG-Systeme. Diese technologischen Verbesserungen verbessern die Diagnosegeschwindigkeit, Genauigkeit und Zugänglichkeit sowohl im klinischen als auch im Fernversorgungsbereich erheblich.

- Beispielsweise können KI-gestützte EKG-Systeme heute subtile Herzanomalien früher erkennen als herkömmliche Methoden, indem sie große Mengen an Patientendaten analysieren und komplexe Muster erkennen. Geräte von Unternehmen wie GE HealthCare und Philips integrieren Algorithmen für maschinelles Lernen, um Ärzte bei der Echtzeit-Interpretation von EKG-Daten zu unterstützen.

- Mobile und drahtlose EKG-Geräte, wie tragbare Einkanal-EKG-Monitore und Patch-basierte Systeme, erfreuen sich bei Patienten und Gesundheitsdienstleistern zunehmender Beliebtheit. Diese Geräte ermöglichen eine kontinuierliche Überwachung außerhalb klinischer Umgebungen und können Daten per Bluetooth oder Cloud-Plattformen an medizinisches Fachpersonal zur sofortigen Analyse und Intervention übertragen.

- Die Integration von EKG-Systemen in Telemedizin -Plattformen ermöglicht Ferndiagnosen, reduziert den Bedarf an persönlichen Besuchen und erweitert den Zugang zur Herzversorgung, insbesondere in ländlichen und alternden Bevölkerungsgruppen. Dieser Wandel steht im Einklang mit nationalen Gesundheitsstrategien in Ländern wie Großbritannien und Deutschland, die das Management chronischer Krankheiten durch digitale Gesundheitsinfrastrukturen modernisieren wollen.

- Tragbare EKG-Geräte und mit Smartphones verbundene EKG-Apps verändern das Segment der Herzgesundheit für Verbraucher. Sie bieten Echtzeit-Arrhythmie-Erkennung, Herzfrequenzmessung und Datensynchronisierung mit elektronischen Gesundheitsakten (EHRs). Unternehmen wie AliveCor und Withings sind in Europa führend mit CE-gekennzeichneten Geräten, die für den Heimgebrauch zugelassen sind.

- Da Patienten zunehmend Wert auf Echtzeitüberwachung legen und Ärzte umfassendere diagnostische Unterstützung benötigen, steigt die Nachfrage nach intelligenten, vernetzten und benutzerfreundlichen Ruhe-EKG-Lösungen auf dem europäischen Markt weiter an. Diese Innovationen verbessern nicht nur die Gesundheitsergebnisse, sondern optimieren auch die Arbeitsabläufe und erhöhen die Kontinuität der Versorgung.

Marktdynamik für Ruhe-Elektrokardiographen (EKG) in Europa

Treiber

„Steigender Bedarf aufgrund der zunehmenden Belastung durch Herz-Kreislauf-Erkrankungen und der Einführung digitaler Gesundheitsdienste “

- Die zunehmende Verbreitung von Herz-Kreislauf-Erkrankungen (CVDs) wie Arrhythmien, ischämischer Herzkrankheit und Herzinsuffizienz sowie die zunehmende Bedeutung von Frühdiagnose und Vorsorge treiben die Nachfrage nach Ruhe-EKG-Systemen in ganz Europa deutlich an.

- So brachte Koninklijke Philips NV im März 2024 eine KI-gestützte EKG-Softwareplattform auf den Markt, die Kliniker dabei unterstützen soll, Herzanomalien am Point of Care genauer zu erkennen. Dies signalisiert einen wachsenden Trend zur intelligenten Diagnostik. Solche Strategien dürften das Wachstum des europäischen Marktes für Ruhe-EKGs im Prognosezeitraum fördern.

- Da Gesundheitssysteme Wert auf Kosteneffizienz und ambulante Versorgung legen, werden Ruhe-EKG-Geräte aufgrund ihrer Einfachheit und ihres diagnostischen Nutzens zunehmend in Primärkliniken, ambulanten Einrichtungen und sogar zu Hause eingesetzt.

- Darüber hinaus macht die zunehmende Integration digitaler Gesundheitsplattformen, elektronischer Gesundheitsakten (EHR) und Fernüberwachung des Herzens Ruhe-EKG-Systeme zu einem wichtigen Bestandteil moderner diagnostischer Arbeitsabläufe und unterstützt die klinische Entscheidungsfindung mit Echtzeit-Dateneinblicken

- Der Trend zu kompakten, kabellosen und tragbaren EKG-Geräten – die benutzerfreundliche Bedienung, schnellere Diagnose und Telemedizin-Kompatibilität bieten – beschleunigt die Marktakzeptanz in öffentlichen und privaten Gesundheitseinrichtungen weiter. Die zunehmende Nutzung tragbarer EKG-Überwachungsgeräte und vernetzter Geräte verändert auch die kardiovaskuläre Versorgung.

Einschränkung/Herausforderung

„ Datenschutzbedenken und hohe Systemintegrationskosten “

- Trotz der Vorteile digitaler EKG-Lösungen stellen Bedenken hinsichtlich Datenschutz, Interoperabilität und Speichersicherheit erhebliche Herausforderungen dar, insbesondere bei grenzüberschreitenden Telekardiologiediensten innerhalb Europas

- Beispielsweise haben Verstöße gegen die Cybersicherheit und Bedenken hinsichtlich der Einhaltung der Datenschutz-Grundverordnung (DSGVO) viele Gesundheitsdienstleister bei der Einführung cloudbasierter EKG-Datenspeicherung und KI-Analyse zurückhaltend gemacht.

- Um diese Bedenken auszuräumen, müssen Hersteller eine Ende-zu-Ende-Verschlüsselung, eine DSGVO-konforme Datenverarbeitung und robuste Authentifizierungsprotokolle sicherstellen. Unternehmen wie die Schiller AG und GE Healthcare legen in ihren Marketingkampagnen Wert auf sichere Konnektivität und konforme Datenplattformen.

- Darüber hinaus können die relativ hohen Kosten für die Integration von Ruhe-EKG-Systemen in die IT-Infrastruktur des Krankenhauses, PACS (Picture Archiving and Communication System) und EHR-Software kleinere Kliniken und öffentliche Krankenhäuser mit begrenztem Budget davon abhalten, vollständig auf digitale EKG-Plattformen umzusteigen.

- Zwar wird erwartet, dass die Kosten mit zunehmender Innovation und Wettbewerb sinken werden, doch die anfänglichen Investitionen in hochwertige Mehrkanal-EKG-Systeme stellen weiterhin ein Hindernis für die breite Einführung dar, insbesondere in Osteuropa und unterfinanzierten Gesundheitssegmenten.

- Die Bewältigung dieser Herausforderungen durch skalierbare Preismodelle, Cloud-basierte Diagnostik und modulare EKG-Plattformen wird für eine tiefere Marktdurchdringung und langfristiges Wachstum von entscheidender Bedeutung sein.

Europa Ruhe-Elektrokardiograph (EKG) Marktumfang

Der Markt ist nach Produkt, Anzahl der Leads, Technologie, Modalität, Gerätegröße, Konnektivität, Betriebsart und Endbenutzer segmentiert.

- Nach Produkt

Der europäische Markt für Ruhe-Elektrokardiographen (EKG) ist produktbezogen in EKG-Geräte, Monitore, Software und Dienstleistungen, implantierbare Loop-Recorder und mobile Herztelemetriegeräte unterteilt. Das Segment der EKG-Geräte hatte im Jahr 2024 mit 38,6 % den größten Marktanteil, was auf ihre weit verbreitete Verwendung in der routinemäßigen Herzdiagnostik in Krankenhäusern und Kliniken zurückzuführen ist. Diese Geräte sind unerlässlich für die Erkennung von Arrhythmien, ischämischen Herzerkrankungen und anderen kardiovaskulären Anomalien.

Im Segment der mobilen Herztelemetriegeräte wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) von 20,9 % verzeichnet werden. Grund hierfür ist die wachsende Nachfrage nach Herzüberwachung in Echtzeit und die steigende Zahl chronischer Herzerkrankungen in der alternden Bevölkerung.

- Nach Anzahl der Leads

Basierend auf der Anzahl der Ableitungen ist der europäische Markt für Ruhe-Elektrokardiographen (EKG) in 12-, 15- und 18-Kanal-EKGs sowie weitere Geräte unterteilt. Das 12-Kanal-EKG dominierte den Markt im Jahr 2024 mit einem Umsatzanteil von 51,3 %, da es in Krankenhäusern standardmäßig für umfassende Herzuntersuchungen eingesetzt wird. Es bietet eine detaillierte Darstellung der elektrischen Aktivität des Herzens und unterstützt so eine präzise Diagnose.

Das Segment mit 15 Ableitungen wird im Prognosezeitraum voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate von 18,7 % das höchste Wachstum verzeichnen, da es eine verbesserte Erkennung von Hinterkammer- und Rechtsherzinfarkten ermöglicht, insbesondere in der fortgeschrittenen Pflege und in der Kardiologie.

- Nach Technologie

Auf Basis der Technologie wird der Markt in digital und analog segmentiert. Das digitale Segment hatte im Jahr 2024 mit 72,4 % den größten Umsatzanteil, was auf seine höhere Genauigkeit, die Möglichkeit zur elektronischen Speicherung und Weitergabe von Daten sowie die Kompatibilität mit Telemedizin-Plattformen zurückzuführen ist.

Das analoge Segment ist zwar rückläufig, bleibt aber in ressourcenarmen Umgebungen relevant und dürfte aufgrund seiner Erschwinglichkeit und Einfachheit leicht wachsen.

- Nach Modalität

Der europäische Markt für Ruhe-Elektrokardiographen (EKG) ist nach Modalität in stationäre und mobile EKG-Systeme unterteilt. Das stationäre Segment hatte im Jahr 2024 mit 61,1 % den größten Anteil, was auf die hohe Installationsrate in Krankenhäusern und Diagnosezentren für den Langzeiteinsatz zurückzuführen ist.

Das Mobilsegment wird zwischen 2025 und 2032 voraussichtlich mit einer CAGR von 22,3 % wachsen, unterstützt durch die steigende Nachfrage nach Mobilität, Heimdiagnostik und telemedizingestützter Gesundheitsversorgung.

- Nach Gerätegröße

Der europäische Markt für Ruhe-EKGs (Ruheelektrokardiographen) wird nach der Gerätegröße in große, mittlere und kleine Geräte unterteilt. Das Segment der mittelgroßen EKG-Geräte erreichte 2024 mit 44,5 % den größten Marktanteil, da sie Mobilität und Funktionalität in Einklang bringen und sich daher ideal für Kliniken und ambulante Einrichtungen eignen.

Das Segment der Kleingeräte dürfte mit einer durchschnittlichen jährlichen Wachstumsrate von 21,1 % die höchste Wachstumsrate aufweisen, angetrieben durch das gestiegene Interesse der Verbraucher an tragbaren EKG-Monitoren und Smartphone-kompatiblen Gesundheitsgeräten.

- Nach Konnektivität

Auf der Grundlage der Konnektivität ist der europäische Markt für Ruhe-Elektrokardiographen (EKG) in kabelgebundene und kabellose Geräte unterteilt. Das kabelgebundene Segment hatte im Jahr 2024 mit 58,6 % den größten Marktanteil, insbesondere in Krankenhäusern, wo eine sichere und kontinuierliche EKG-Übertragung von entscheidender Bedeutung ist.

Das drahtlose Segment dürfte zwischen 2025 und 2032 mit 23,6 % die höchste Wachstumsrate verzeichnen. Grund hierfür ist die schnelle Verbreitung von Bluetooth und Cloud-basierten EKG-Systemen, die eine Fernüberwachung und den Datenaustausch in Echtzeit ermöglichen.

- Nach Betriebsart

Der europäische Markt für Ruhe-Elektrokardiographen (EKG) ist nach Betriebsart in automatische, halbautomatische und manuelle Geräte unterteilt. Das automatische Segment hatte im Jahr 2024 mit 49,3 % den größten Marktanteil. Grund dafür ist die Bevorzugung von Systemen, die Bedienereingriffe reduzieren und die diagnostische Konsistenz verbessern.

Das halbautomatische Segment dürfte mit 19,8 % die höchste durchschnittliche jährliche Wachstumsrate aufweisen, da es insbesondere im klinischen Bereich der mittleren Preisklasse ein kostengünstiges Gleichgewicht zwischen manueller Steuerung und Automatisierung bietet.

- Nach Endbenutzer

Der europäische Markt für Ruhe-EKGs ist nach Endverbrauchern in Krankenhäuser, Fachkliniken, ambulante Operationszentren, häusliche Pflegeeinrichtungen und andere Bereiche unterteilt. Das Krankenhaussegment dominierte mit einem Marktanteil von 46,2 % im Jahr 2024 aufgrund des hohen Patientenaufkommens, der Verfügbarkeit moderner Diagnosegeräte und qualifizierter Fachkräfte.

Das Segment der häuslichen Pflege dürfte zwischen 2025 und 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 24,7 % die höchste Wachstumsrate aufweisen. Dies ist auf die Verlagerung hin zu einer patientenzentrierten Pflege, die zunehmende Behandlung chronischer Krankheiten zu Hause und die zunehmende Verwendung tragbarer EKG-Lösungen zurückzuführen.

Europa Ruhe-Elektrokardiograph (EKG) Markt Regionalanalyse

- Europa dominierte den globalen Markt für Ruhe-Elektrokardiographen (EKG) mit dem größten Umsatzanteil von 36,7 % im Jahr 2024, bedingt durch die zunehmende Belastung durch Herz-Kreislauf-Erkrankungen (CVDs), die steigende Nachfrage nach Lösungen zur Frühdiagnose und staatlich geförderte Gesundheitsscreening-Initiativen

- Die wachsende geriatrische Bevölkerung, die hohe Prävalenz lebensstilbedingter Herzerkrankungen und die starke Betonung der präventiven Gesundheitsfürsorge sind Schlüsselfaktoren für die Einführung von Ruhe-EKG-Systemen in Krankenhäusern, Kliniken und Einrichtungen der Primärversorgung in der Region.

- Darüber hinaus unterstützt die Integration digitaler Technologien wie KI-gestützte EKG-Interpretation, Cloud-Konnektivität und Interoperabilität mit elektronischen Patientenakten das Marktwachstum weiter, indem sie die diagnostische Genauigkeit und die Effizienz klinischer Arbeitsabläufe verbessert.

Markteinblick in Ruhe-Elektrokardiographen (EKG) in Großbritannien

Der globale Markt für Ruhe-Elektrokardiographen (EKG) in Großbritannien verzeichnet ein starkes Wachstum, das durch die steigende Zahl von Herzrhythmusstörungen und Bluthochdruck sowie den Fokus des britischen Gesundheitsdienstes auf die frühzeitige Herzdiagnose in der Primärversorgung getrieben wird. Staatlich geförderte Kampagnen zur Herzgesundheit und die zunehmende Verfügbarkeit von EKG-Geräten in kommunalen Gesundheitseinrichtungen fördern die breite Nutzung. Die zunehmende Integration von KI-gestützter EKG-Analyse und mobilen EKG-Lösungen trägt zudem zu schnelleren und präziseren klinischen Entscheidungen bei.

Markteinblick in Ruhe-Elektrokardiographen (EKG) in Deutschland

Der deutsche globale Markt für Ruhe-EKGs (Ruheelektrokardiographen) hält mit 33,3 % einen führenden Anteil am europäischen Ruhe-EKG-Markt. Dies ist auf die fortschrittliche kardiologische Infrastruktur, die breite Nutzung digitaler Gesundheitslösungen und die hohen Gesundheitsausgaben zurückzuführen. Die starke regulatorische Unterstützung des Landes für medizintechnische Innovationen und die steigende Nachfrage nach nicht-invasiver Herzdiagnostik bei älteren Patienten fördern die Einführung tragbarer Mehrkanal-EKG-Systeme sowohl in städtischen Krankenhäusern als auch in ländlichen Kliniken.

Markteinblick in Ruhe-Elektrokardiographen (EKG) in Frankreich

Der globale Markt für Ruhe-EKGs (Ruheelektrokardiogramm) in Frankreich wächst stetig, unterstützt durch staatliche Vorgaben zu routinemäßigen Herzuntersuchungen und die Betonung der Schlaganfallprävention. Die Einführung cloudbasierter EKG-Plattformen, insbesondere in öffentlichen Krankenhäusern, verbessert den Zugang zu kardiologischer Diagnostik in unterversorgten Regionen. Darüber hinaus verbessert die Zusammenarbeit zwischen Gesundheitseinrichtungen und EKG-Geräteherstellern die Schulung und Implementierung digitaler EKG-Tools.

Markteinblick in Italien für Ruhe-Elektrokardiographen (EKG)

Der globale Markt für Ruhe-EKGs in Italien wird durch die steigende Zahl koronarer Herzkrankheiten und staatliche Programme zur Förderung der kardiovaskulären Risikobewertung in der alternden Bevölkerung vorangetrieben. Die zunehmende Verlagerung des italienischen Gesundheitssystems hin zu häuslicher Pflege und ambulanter Überwachung schafft eine Nachfrage nach kompakten, benutzerfreundlichen EKG-Systemen. Auch die Integration der EKG-Diagnostik in Telekardiologie-Plattformen gewinnt an Dynamik.

Markteinblick in Spanien für Ruhe-Elektrokardiographen (EKG)

Der spanische globale Markt für Ruhe-EKGs verzeichnet einen deutlichen Anstieg der Nutzung von Ruhe-EKG-Geräten, vor allem aufgrund der wachsenden Infrastruktur in der Herzmedizin und öffentlich-privater Partnerschaften zur Modernisierung der Diagnostik. Das gestiegene Bewusstsein für plötzlichen Herzstillstand (SCA) und die Bedeutung von EKG-Screenings im Sport und in der Arbeitsmedizin fördern die Marktdurchdringung, insbesondere in Gemeindekliniken und Wellnesszentren.

Marktanteil von Ruhe-Elektrokardiographen (EKG) in Europa

Die europäische Ruhe-Elektrokardiographen-Branche (EKG) wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- GE Healthcare (USA)

- Koninklijke Philips NV (Niederlande)

- Baxter (USA)

- SCHILLER AG (Schweiz)

- Cardioline SPA (Italien)

- EDAN Instruments, Inc. (China)

- FUKUDA DENSHI (Japan)

- Personal MedSystems GmbH (Deutschland)

- VYAIRE MEDICAL, INC. (USA)

- Innomed Medical Inc. (Ungarn)

- Norav Medical (USA)

- OSI Systems, Inc. (Spacelabs Healthcare) (USA)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- Dawei Medical (China)

- Gima SPA (Italien)

- Zimmer Benelux BV (Deutschland)

- AMEDTEC Medizintechnik Aue GmbH (Deutschland)

- BTL (Indien)

- Contec Medical Systems Co., Ltd (China)

Neueste Entwicklungen auf dem europäischen Markt für Ruhe-Elektrokardiographen (EKG)

- Im März 2022 trat Cardioline SPA, ein führender Hersteller von EKG-Technologie mit Sitz in Italien, der Initiative PariSanté Campus bei, um digitale Innovationen im Gesundheitswesen in Europa zu fördern. Durch diese Partnerschaft will das Unternehmen die Entwicklung der EKG-Diagnostik beschleunigen und KI-basierte Analysen für eine bessere kardiovaskuläre Risikobewertung integrieren.

- Im April 2023 brachte Philips seine neueste 12-Kanal-Ruhe-EKG-Lösung mit integrierter KI auf den Markt, die sich an Krankenhäuser und Fachkliniken in ganz Europa richtet. Dieses System verbessert die diagnostische Genauigkeit durch fortschrittliche Signalverarbeitung und unterstützt die Fern-EKG-Interpretation – und erleichtert so die Versorgung in städtischen und ländlichen Gebieten.

- Im Februar 2023 führte GE HealthCare das MAC VU360 EKG-System in Deutschland, Frankreich und Großbritannien ein. Dieses Premium-EKG-Gerät unterstützt automatisierte Arbeitsabläufe in großen Krankenhäusern und Diagnoselaboren. Die Deep-Learning-Algorithmen des Systems ermöglichen eine verbesserte Arrhythmie-Erkennung und eine schnellere Berichterstattung für Kardiologieteams.

- Im Januar 2023 gab die Schiller AG, ein Schweizer EKG-Technologieunternehmen, eine Partnerschaft mit mehreren osteuropäischen Krankenhäusern bekannt, um den Zugang zu ihrem EKG-System CARDIOVIT AT-102 G2 zu erweitern. Dieses mit USB- und Wireless-Funktionen ausgestattete Gerät trägt zur Modernisierung kardiologischer Abteilungen in mittelgroßen Kliniken in der gesamten EU bei.

- Im Dezember 2022 stellte die Nihon Kohden Europe GmbH ihr verbessertes Cardiofax S EKG-System vor, das für den Einsatz in Hochdurchsatz-Kardiologiezentren in Großbritannien und Deutschland optimiert ist. Es bietet eine erweiterte Ableitungserkennung, schnellere Ausdruckfunktionen und eine nahtlose Integration in Krankenhausinformationssysteme (KIS).

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.