Europäischer Markt für Schrumpfschläuche für die Automobilindustrie, nach Anwendung (Schläuche, Steckverbinder, Ringkabelschuhe, Inline-Verbindungsstücke, Bremsleitungen Dieseleinspritzgruppen, Kabelschutz unter der Motorhaube, Gasleitungen, Miniaturverbindungen), Material (Polyolefin, Polyvinylchlorid, Polytetrafluorethylen, fluoriertes Ethylenpropylen, Perfluoralkoxyalkan, Ethylentetrafluorethylen und andere), Farbe (Rot, Gelb und andere), Typ (einwandige Schrumpfschläuche und doppelwandige Schrumpfschläuche), Spannung (niedrig, mittel und hoch), Kraftstoffart (Benzin, Diesel/CNG und Elektro ), Vertriebskanal (OEM und Aftermarket), Fahrzeugtyp (Pkw, leichte Nutzfahrzeuge, schwere Nutzfahrzeuge und Elektrofahrzeuge), Land (Deutschland, Frankreich, Großbritannien, Italien, Spanien, Schweiz, Niederlande, Russland, Türkei, Belgien, übriges Europa) Branchentrends und Prognose bis 2028

Marktanalyse und Einblicke: Europäischer Markt für Schrumpfschläuche für die Automobilindustrie

Marktanalyse und Einblicke: Europäischer Markt für Schrumpfschläuche für die Automobilindustrie

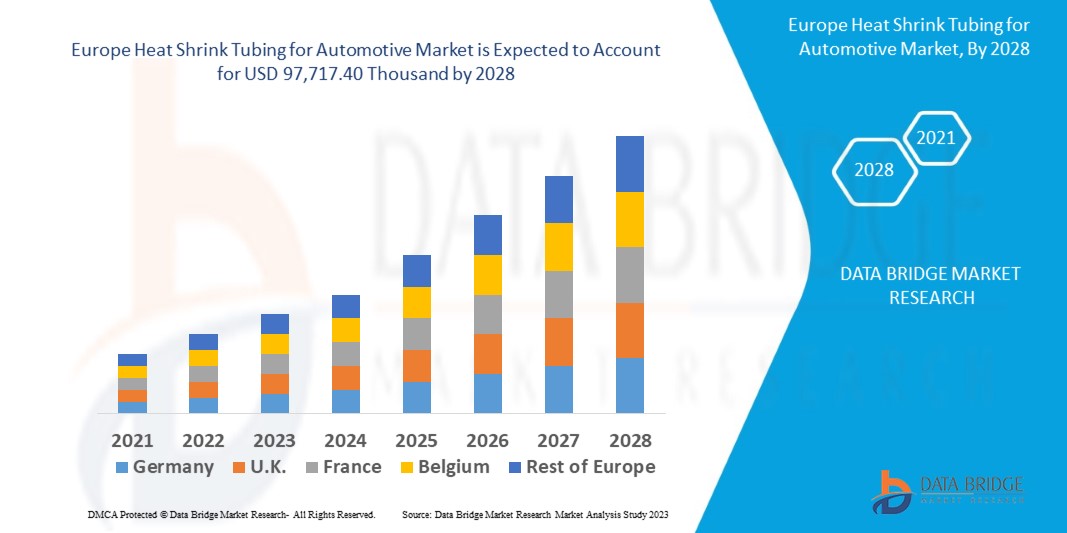

Der europäische Markt für Schrumpfschläuche für die Automobilindustrie dürfte im Prognosezeitraum 2021 bis 2028 ein Marktwachstum verzeichnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2021 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,1 % wächst und bis 2028 voraussichtlich 97.717,40 Tausend US-Dollar erreichen wird. Die steigende Nachfrage nach Fahrzeugkabelbäumen für Fahrzeugsicherheitssysteme dürfte das Marktwachstum erheblich vorantreiben.

Schrumpfschläuche werden zur Isolierung von Drähten verwendet und bieten Abriebfestigkeit und Umweltschutz für Litzenleiter aus massivem Draht mit Verbindungen, Verbindungen und Klemmen in Elektroinstallationen . Im Allgemeinen schrumpft ein Schlauch mit einer niedrigeren Schrumpftemperatur schneller. Wenn Schrumpfschläuche um Kabelanordnungen und elektrische Komponenten gewickelt werden, kollabieren sie radial, um sich den Konturen der Geräte anzupassen, und bilden eine Schutzschicht. Sie können vor Abrieb, leichten Stößen, Schnitten, Feuchtigkeit und Staub schützen, indem sie einzelne Drähte bedecken oder ganze Anordnungen umhüllen. Kunststoffhersteller beginnen mit der Extrusion eines thermoplastischen Schlauchs, um Schrumpfschläuche herzustellen. Die Materialien für Schrumpfschläuche variieren je nach beabsichtigter Anwendung.

Der Hauptantriebsfaktor für den europäischen Markt für Schrumpfschläuche für die Automobilindustrie ist die steigende Nachfrage nach einer breiten Palette von Isoliermaterialien für die vorbeugende Wartung. Mangelndes Fachwissen der Bediener hinsichtlich der Installation von Schrumpfschläuchen kann sich als Herausforderung erweisen. Die Automatisierung des Schrumpfschlauchprozesses kann jedoch eine Chance für den Markt sein. Die strengen staatlichen Vorschriften zur Emission giftiger Gase schränken den europäischen Markt für Schrumpfschläuche für die Automobilindustrie ein.

Der Bericht zum europäischen Markt für Schrumpfschläuche für die Automobilindustrie enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Szenario des europäischen Marktes für Schrumpfschläuche für die Automobilindustrie zu verstehen, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine Umsatzlösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Europa: Schrumpfschläuche für die Automobilindustrie – Marktumfang und Marktgröße

Europa: Schrumpfschläuche für die Automobilindustrie – Marktumfang und Marktgröße

Der europäische Markt für Schrumpfschläuche für die Automobilindustrie ist in acht wichtige Segmente unterteilt, basierend auf Anwendung, Material, Typ, Vertriebskanal, Farbe, Spannung, Kraftstoffart und Fahrzeugtyp. Das Wachstum zwischen den Segmenten hilft Ihnen dabei, Nischenwachstumsbereiche und Strategien zur Marktbearbeitung zu analysieren und Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten zu bestimmen.

- Auf der Grundlage der Anwendung ist der Markt für Schrumpfschläuche für die Automobilindustrie in Schläuche, Verbindungsstücke, Ringkabelschuhe, Inline-Verbindungsstücke, Bremsleitungen, Dieseleinspritzgruppen, Kabelschutz unter der Motorhaube, Gasleitungen und Miniaturverbindungen unterteilt. Im Jahr 2021 wird das Schlauchsegment voraussichtlich den Markt dominieren, da für Schläuche bessere Isolierungs- und Sicherheitsmaßnahmen erforderlich sind.

- Auf der Grundlage des Materials ist der Markt für Schrumpfschläuche für die Automobilindustrie in Polyolefin, Polyvinylchlorid, Polytetrafluorethylen, fluoriertes Ethylenpropylen, Perfluoralkoxyalkan, Ethylentetrafluorethylen und andere unterteilt. Im Jahr 2021 wird das Polyolefinsegment aufgrund seiner korrosionsbeständigen Eigenschaften voraussichtlich den Markt dominieren.

- Auf der Grundlage der Farbe wird der Markt für Schrumpfschläuche für die Automobilindustrie in Rot, Gelb und andere unterteilt. Im Jahr 2021 wird das rote Segment voraussichtlich den Markt dominieren, da es in wichtigen Anwendungen wie der Hauptstromkreisverkabelung stark genutzt wird.

- Der Markt für Schrumpfschläuche für die Automobilindustrie ist nach Typ in einwandige und doppelwandige Schrumpfschläuche unterteilt. Im Jahr 2021 wird das Segment der einwandigen Schrumpfschläuche voraussichtlich den Markt dominieren, da es billiger ist und die gleiche Leistung wie doppelwandige Schrumpfschläuche bietet.

- Auf der Grundlage der Spannung wird der Markt für Schrumpfschläuche für die Automobilindustrie in Nieder-, Mittel- und Hochspannung unterteilt. Im Jahr 2021 wird das Niederspannungssegment voraussichtlich den Markt dominieren, da aufgrund staatlicher Vorschriften derzeit eine größere Anzahl von Niederspannungsfahrzeugen verfügbar ist.

- Auf der Grundlage der Kraftstoffart wird der Markt für Schrumpfschläuche für die Automobilindustrie in Benzin, Diesel/CNG und Elektro unterteilt. Im Jahr 2021 wird das Benzinsegment voraussichtlich den Markt dominieren, da es einer der ältesten Kraftstoffe für Automobile mit hervorragenden Verbrennungseigenschaften ist.

- Auf der Grundlage des Vertriebskanals ist der Markt für Schrumpfschläuche für die Automobilindustrie in OEM und Aftermarket unterteilt. Im Jahr 2021 wird das OEM-Segment voraussichtlich den Markt dominieren, da die Verbraucher die beste Qualität und genaue Passform bevorzugen.

- Auf der Grundlage des Fahrzeugtyps wird der Markt für Schrumpfschläuche für die Automobilindustrie in Pkw, leichte Nutzfahrzeuge, schwere Nutzfahrzeuge und Elektrofahrzeuge unterteilt. Im Jahr 2021 wird das Pkw-Segment voraussichtlich den Markt dominieren, da die Nachfrage nach privaten Pkw aufgrund der wachsenden Bevölkerung steigt.

Europa Schrumpfschläuche für die Automobilindustrie Markt – Länderebene Analyse

Der europäische Markt für Schrumpfschläuche für die Automobilindustrie wird analysiert und Informationen zur Marktgröße werden nach Land, Anwendung, Material, Typ, Vertriebskanal, Farbe, Spannung, Kraftstoffart und Fahrzeugtyp bereitgestellt, wie oben angegeben.

Die im europäischen Marktbericht für Schrumpfschläuche für die Automobilindustrie abgedeckten Länder sind Deutschland, Frankreich, Großbritannien, Italien, Spanien, die Schweiz, die Niederlande, Russland, die Türkei, Belgien und das übrige Europa. Deutschland dominiert die europäische Region aufgrund des Anstiegs des technologischen Fortschritts und der Kabelbaumtechnologie für Fahrzeugsicherheitszwecke.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit europäischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Der Anstieg des technologischen Fortschritts zur Steigerung der Fahrzeugleistung fördert das Marktwachstum des europäischen Schrumpfschlauchmarktes für den Automobilmarkt

Der europäische Markt für Schrumpfschläuche für die Automobilindustrie bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das in einem bestimmten Markt wächst. Darüber hinaus bietet er detaillierte Informationen zur Strategie der Marktteilnehmer und ihrer geografischen Präsenz. Die Daten sind für den historischen Zeitraum von 2010 bis 2019 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile von Schrumpfschläuchen für die Automobilindustrie in Europa

Die Wettbewerbslandschaft des europäischen Marktes für Schrumpfschläuche für die Automobilindustrie liefert Einzelheiten zu den Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den europäischen Markt für Schrumpfschläuche für die Automobilindustrie.

Zu den wichtigsten Akteuren auf dem europäischen Markt für Schrumpfschläuche für die Automobilindustrie zählen unter anderem ABB, IS-Rayfast Ltd, SHAWCOR, Sumitomo Electric Industries, Ltd., Zeus Industrial Products, Inc., HellermannTyton, Autosparks, 3M, Dasengh, Inc., Huizhou Guanghai Electronic Insulation Materials Co.,Ltd., Alpha Wire, GREMCO GmbH, The Zippertubing Company, RADPOL SA, Molex, TE Connectivity und Panduit.

Darüber hinaus werden von den Unternehmen weltweit zahlreiche Verträge und Vereinbarungen initiiert, die ebenfalls zum Wachstum des europäischen Marktes für Schrumpfschläuche für die Automobilindustrie beitragen.

Zum Beispiel,

- Im Juli 2021 beschleunigt Molex den Weg zur Industrie 4.0 mit erweiterten Industrieautomatisierungslösungen (IAS4.0) und neuen flexiblen Automatisierungsmodulen (FAMs). Diese Erweiterung hilft den Beteiligten in der Lieferkette, softwaredefinierte Maschinen, Roboter und Produktionslinien zu bauen, die den steigenden Anforderungen an vernetzte, sichere, skalierbare und effiziente Abläufe gerecht werden. Diese Erweiterung trug zur Entwicklung des Produktportfolios bei und steigerte den Umsatz des Unternehmens

- Im Januar 2021 gab Panduit bekannt, dass es eine Partnerschaft mit Cailabs, einem französischen Deep-Tech-Unternehmen und weltweit führenden Anbieter von Lichtstrahlformung, für die weltweiten Rechte zur Integration der Cailabs-Technologie in Panduits innovatives One-Mode-Produktportfolio unterzeichnet hat, was zur Verbesserung des Produktportfolios des Unternehmens beiträgt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 APPLICATION TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS

5.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

5.1.3 INCREASING VEHICLE SALES AND DEMAND FOR PREMIUM VEHICLES

5.1.4 INCREASING DEMAND FOR WIDE RANGE OF INSULATING MATERIAL FOR PREVENTIVE MAINTENANCE

5.2 RESTARINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

5.2.2 TRADE BARRIERS IN LEAST DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC ACQUISITIONS & PARTNERSHIPS BETWEEN ORGANIZATIONS

5.3.2 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

5.3.3 INCREASE IN PENETRATION OF ELECTRIC VEHICLE ACROSS THE GLOBE

5.3.4 EASY PRODUCTION OF HEAT SHRINK TUBING PRODUCTS

5.4 CHALLENGES

5.4.1 INCREASE IN PRICES OF RAW MATERIALS FOR TUBING

5.4.2 AVAILABILITY OF DUPLICATE & INEXPENSIVE PRODUCTS IN THE MARKET

5.4.3 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE

6 IMPACT ANALYSIS OF COVID-19 ON EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.1 AFTERMATH OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.2 OPPORTUNITIES FOR THE MARKET POST-COVID-19 PANDEMIC

6.3 IMPACT ON SUPPLY, DEMAND, AND PRICES

6.4 CONCLUSION

7 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 FUEL DELIVERY SYSTEM HOSES

7.2.3 BRAKING SYSTEM HOSES

7.2.4 TURBOCHARGER HOSES

7.2.5 POWER STEERING SYSTEM HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.3.3 BY APPLICATION

7.3.3.1 HTAT

7.3.3.2 ATUM

7.3.3.3 CGPT

7.3.3.4 LSTT<150 C

7.3.3.5 OTHERS

7.4 RING TERMINAL

7.4.1 12-10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 BRAKE PIPES

7.7 DIESEL INJECTION CLUSTERS

7.8 UNDER BONNET CABLE PROTECTION

7.9 GAS PIPES

7.1 MINIATURE SPLICES

8 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYVINYL CHLORIDE

8.4 POLYTETRAFLUOROETHYLENE

8.5 FLOURINATED ETHYLENE PROPYLENE

8.6 PERFLUOROALKOXY ALKANES

8.7 ETHYLENE TETRAFLUORO ETHYLENE

8.8 OTHERS

9 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE

10.1 OVERVIEW

10.2 SINGLE WALL SHRINK TUBING

10.3 DUAL WALL SHRINK TUBING

11 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE

11.1 OVERVIEW

11.2 LOW VOLTAGE

11.3 MEDIUM VOLTAGE

11.4 HIGH VOLTAGE

12 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE

12.1 OVERVIEW

12.2 PETROL

12.3 DIESEL/CNG

12.4 ELECTRIC

13 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 PASSENGER CARS

14.2.1 BY TYPE

14.2.1.1 SUV

14.2.1.2 SEDAN

14.2.1.3 CROSSOVER

14.2.1.4 COUPE

14.2.1.5 HATCHBACK

14.2.1.6 MPV

14.2.1.7 CONVERTIBLE

14.2.1.8 OTHERS

14.2.2 BY APPLICATION

14.2.2.1 HOSES

14.2.2.2 CONNECTORS

14.2.2.3 RING TERMINALS

14.2.2.4 IN-LINE SPLICES

14.2.2.5 BRAKING PIPES

14.2.2.6 DIESEL INJECTION CLUSTERS

14.2.2.7 UNDER BONNET CABLE PROTECTION

14.2.2.8 GAS PIPES

14.2.2.9 MINIATURE SPLICES

14.3 LCV

14.3.1 BY TYPE

14.3.1.1 PICKUP TRUCKS

14.3.1.2 VANS

14.3.1.2.1 CARGO VANS

14.3.1.2.2 PASSENGER VANS

14.3.1.3 MINI BUS

14.3.1.4 COACHES

14.3.1.5 OTHERS

14.3.2 BY APPLICATION

14.3.2.1 HOSES

14.3.2.2 CONNECTORS

14.3.2.3 RING TERMINALS

14.3.2.4 IN-LINE SPLICES

14.3.2.5 BRAKE PIPES

14.3.2.6 DIESEL INJECTION CLUSTERS

14.3.2.7 UNDER BONNET CABLE PROTECTION

14.3.2.8 GAS PIPES

14.3.2.9 MINIATURE SPLICES

14.4 ELECTRIC VEHICLE

14.4.1 BY TYPE

14.4.1.1 BATTERY OPERATED VEHICLES

14.4.1.2 PLUGIN VEHICLES

14.4.1.3 HYBRID VEHICLES

14.4.1.4 FUEL CELL ELECTRIC VEHICLES

14.4.2 BY APPLICATION

14.4.2.1 HOSES

14.4.2.2 CONNECTORS

14.4.2.3 RING TERMINALS

14.4.2.4 IN-LINE SPLICES

14.4.2.5 BRAKING PIPES

14.4.2.6 DIESEL INJECTION CLUSTERS

14.4.2.7 UNDER BONNET CABLE PROTECTION

14.4.2.8 GAS PIPES

14.4.2.9 MINIATURE SPLICES

14.5 HCV

14.5.1 BY TYPE

14.5.1.1 TRUCKS

14.5.1.1.1 DUMP TRUCKS

14.5.1.1.2 TOW TRUCKS

14.5.1.1.3 CEMENT TRUCKS

14.5.1.2 BUSES

14.5.2 BY APPLICATION

14.5.2.1 HOSES

14.5.2.2 CONNECTORS

14.5.2.3 RING TERMINALS

14.5.2.4 IN-LINE SPLICES

14.5.2.5 BRAKING PIPES

14.5.2.6 DIESEL INJECTION CLUSTERS

14.5.2.7 UNDER BONNET CABLE PROTECTION

14.5.2.8 GAS PIPES

14.5.2.9 MINIATURE SPLICES

15 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 FRANCE

15.1.3 U.K.

15.1.4 ITALY

15.1.5 RUSSIA

15.1.6 SPAIN

15.1.7 NETHERLANDS

15.1.8 BELGIUM

15.1.9 TURKEY

15.1.10 SWITZERLAND

15.1.11 REST OF EUROPE

16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TE CONNECTIVITY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SHAWCOR

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE AANLYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HELLERMANNTYTON

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOILIO

18.5.4 RECENT DEVELOPMENT

18.6 AUTOSPARKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ALPHA WIRE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE SHRINK INSULATION PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 DASENGH, INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FLEX WIRES INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GREMCO GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVLOPMENT

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 3M

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MOLEX

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RADPOL S.A.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

8.22 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SUZHOU FEIBO COLD AND HEAT SHRINKING CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TECHFLEX, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 THE ZIPPERTUBING COMPANY

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 TEXCAN

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 2 EUROPE HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 EUROPE HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 6 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 EUROPE CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 8 EUROPE RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 EUROPE RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 EUROPE IN-LINE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 EUROPE BRAKE PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 EUROPE DIESEL INJECTION CLUSTERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 EUROPE UNDER BONNET CABLE PROTECTION IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 EUROPE GAS PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 EUROPE MINIATURE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 17 EUROPE POLYOLEFIN IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 EUROPE POLYVINYL CHLORIDE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 EUROPE POLYTETRAFLUOROETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 EUROPE FLUORINATED ETHYLENE PROPYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 EUROPE PERFLUOROALKOXY ALKANES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 EUROPE ETHYLENE TETRAFLUORO ETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 25 EUROPE RED IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 EUROPE YELLOW IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 EUROPE OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 29 EUROPE SINGLE WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 EUROPE DUAL WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 32 EUROPE LOW VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 EUROPE MEDIUM VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 EUROPE HIGH VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 EUROPE PETROL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 EUROPE DIESEL/CNG IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 EUROPE ELECTRIC IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 40 EUROPE OEM IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 EUROPE AFTERMARKET IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 44 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 EUROPE PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 46 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 EUROPE VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 49 EUROPE LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 50 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 EUROPE ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 54 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 EUROPE TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 EUROPE HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 57 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 58 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 59 EUROPE HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 60 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 61 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 62 EUROPE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 EUROPE RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 64 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 65 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 66 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 68 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 70 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 EUROPE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 EUROPE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 73 EUROPE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 74 EUROPE VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 EUROPE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 76 EUROPE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 EUROPE TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 EUROPE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 79 EUROPE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 EUROPE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 81 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 82 GERMANY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 GERMANY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 86 GERMANY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 88 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 89 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 90 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 91 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 92 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 93 GERMANY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 GERMANY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 GERMANY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 96 GERMANY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 GERMANY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 GERMANY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 99 GERMANY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 GERMANY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 GERMANY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 102 GERMANY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 GERMANY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 104 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 105 FRANCE HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 FRANCE CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 109 FRANCE RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 110 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 111 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 112 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 114 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 116 FRANCE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 FRANCE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 FRANCE PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 119 FRANCE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 FRANCE VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 FRANCE LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 122 FRANCE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 FRANCE TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 124 FRANCE HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 125 FRANCE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 FRANCE ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 127 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 128 U.K. HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 129 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 130 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 131 U.K. CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 132 U.K. RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 134 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 135 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 137 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 139 U.K. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 U.K. PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 U.K. PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 142 U.K. LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 U.K. VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 144 U.K. LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 145 U.K. HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 U.K. TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 U.K. HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 148 U.K. ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 149 U.K. ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 150 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 151 ITALY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 152 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 154 ITALY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 155 ITALY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 156 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 157 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 158 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 159 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 160 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 161 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 162 ITALY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 163 ITALY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 164 ITALY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 165 ITALY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 166 ITALY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 167 ITALY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 168 ITALY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 169 ITALY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 170 ITALY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 171 ITALY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 172 ITALY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 173 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 174 RUSSIA HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 175 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 176 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 177 RUSSIA CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 178 RUSSIA RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 179 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 180 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 181 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 182 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 183 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 184 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 185 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 186 RUSSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 187 RUSSIA PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 188 RUSSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 189 RUSSIA VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 190 RUSSIA LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 191 RUSSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 192 RUSSIA TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 193 RUSSIA HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 194 RUSSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 195 RUSSIA ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 196 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 197 SPAIN HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 198 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 199 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 200 SPAIN CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 201 SPAIN RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 202 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 203 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 204 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 205 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 206 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 207 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 208 SPAIN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 209 SPAIN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 210 SPAIN PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 211 SPAIN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 212 SPAIN VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 213 SPAIN LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 214 SPAIN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 215 SPAIN TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 216 SPAIN HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 217 SPAIN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 218 SPAIN ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 219 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 220 NETHERLANDS HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 221 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 222 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 223 NETHERLANDS CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 224 NETHERLANDS RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 225 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 226 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 227 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 228 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 229 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 230 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 231 NETHERLANDS HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 232 NETHERLANDS PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 233 NETHERLANDS PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 234 NETHERLANDS LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 235 NETHERLANDS VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 236 NETHERLANDS LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 237 NETHERLANDS HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 238 NETHERLANDS TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 239 NETHERLANDS HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 240 NETHERLANDS ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 241 NETHERLANDS ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 242 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 243 BELGIUM HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 244 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 245 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 246 BELGIUM CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 247 BELGIUM RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 248 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 249 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 250 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 251 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 252 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 253 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 254 BELGIUM HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 255 BELGIUM PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 256 BELGIUM PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 257 BELGIUM LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 258 BELGIUM VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 259 BELGIUM LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 260 BELGIUM HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 261 BELGIUM TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 262 BELGIUM HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 263 BELGIUM ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 264 BELGIUM ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 265 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 266 TURKEY HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 267 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 268 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 269 TURKEY CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 270 TURKEY RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 271 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 272 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 273 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 274 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 275 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 276 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 277 TURKEY HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 278 TURKEY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 279 TURKEY PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 280 TURKEY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 281 TURKEY VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 282 TURKEY LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 283 TURKEY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 284 TURKEY TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 285 TURKEY HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 286 TURKEY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 287 TURKEY ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 288 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 289 SWITZERLAND HOSES FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 290 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 291 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 292 SWITZERLAND CONNECTORS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 293 SWITZERLAND RING TERMINAL FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 294 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 295 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 296 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 297 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 298 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 299 RUSSIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 300 SWITZERLAND HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 301 SWITZERLAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 302 SWITZERLAND PASSENGER CARS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 303 SWITZERLAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 304 SWITZERLAND VANS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 305 SWITZERLAND LCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 306 SWITZERLAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 307 SWITZERLAND TRUCKS FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 308 SWITZERLAND HCV FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 309 SWITZERLAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 310 SWITZERLAND ELECTRIC VEHICLE FOR HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 311 REST OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS & RISE IN TECHNOLOGICAL ADVANCEMENTS TO IMPROVE VEHICLE PERFORMANCE IS EXPECTED TO DRIVE EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN 2021 & 2028

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

FIGURE 14 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION, 2020

FIGURE 15 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY MATERIAL, 2020

FIGURE 16 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COLOUR, 2020

FIGURE 17 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY TYPE, 2020

FIGURE 18 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VOLTAGE, 2020

FIGURE 19 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY FUEL TYPE, 2020

FIGURE 20 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY SALES CHANNEL, 2020

FIGURE 21 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2020

FIGURE 22 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SNAPSHOT (2020)

FIGURE 23 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020)

FIGURE 24 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION (2021-2028)

FIGURE 27 EUROPE HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2020 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.