Europäischer Tankkartenmarkt für gewerbliche Flotten, nach Kartentyp (universelle Tankkarten, Markentankkarten, Händlertankkarten), Funktionen (Fahrzeugberichte, EMV-konform, Tokenisierung, Echtzeit-Updates, mobile Zahlung und kartenlose Transaktionen, Sonstiges), Abonnementtyp (registrierte Karte, Inhaberkarte), Versorgungsunternehmen (Parkgebühren für Fahrzeuge, Zahlung von Ölgebühren, Flottenwartung, Zahlung von Mautgebühren, Sonstiges), Endnutzer (Lieferflotten, Taxiflotten, Autovermietungsflotten, Flotten öffentlicher Versorgungsunternehmen, Sonstiges), Land (Großbritannien, Deutschland, Frankreich, Italien, Spanien, Russland, Niederlande, Belgien, Schweiz, Türkei und übriges Europa) Branchentrends und Prognose bis 2029

Marktanalyse und Einblicke: Europäischer Tankkartenmarkt für gewerbliche Flotten

Marktanalyse und Einblicke: Europäischer Tankkartenmarkt für gewerbliche Flotten

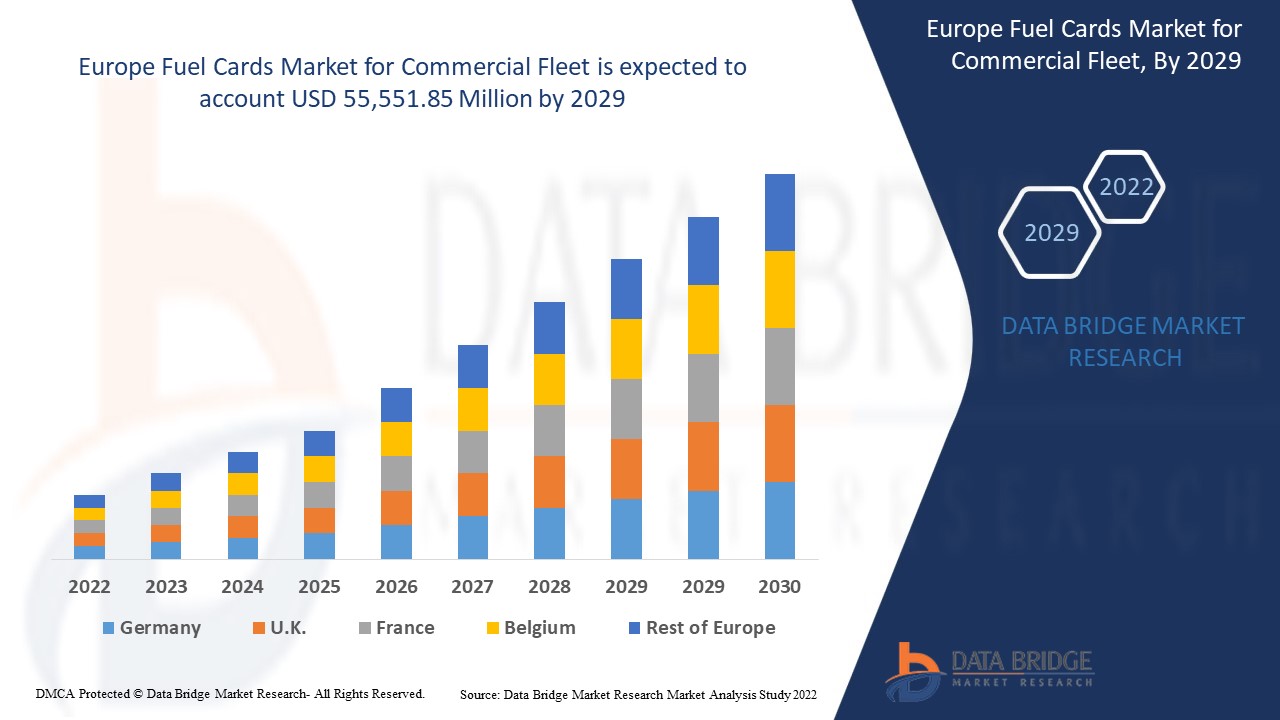

Der europäische Markt für Tankkarten für gewerbliche Flotten dürfte im Prognosezeitraum 2022 bis 2029 ein Marktwachstum verzeichnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,3 % wächst und bis 2029 voraussichtlich 55.551,85 Millionen USD erreichen wird. Die steigende Nachfrage nach Geräten für die intelligente Hausautomation beflügelt den Markt.

Eine Tankkarte ist eine bequeme Möglichkeit, an Tankstellen Benzin, Diesel und andere Kraftstoffe zu bezahlen. Anstatt mit Bargeld, Kreditkarte oder Scheck zu bezahlen, überreicht der Fahrer stattdessen die Tankkarte . Sie bieten Flottenanbietern verschiedene Vorteile, indem sie grundlegende Daten über den Kilometerstand der Fahrzeuge, die getankten Liter Kraftstoff und den Wartungsbedarf des Fahrzeugs erfassen. Darüber hinaus haben ihre Dienstanbieter damit begonnen, Telematikschnittstellen und robuste Berichtsfunktionen als Standardproduktangebote zu integrieren, um die Produktivität des Flottenmanagements zu verbessern. Darüber hinaus unterstützen eine zunehmende Präferenz für die Digitalisierung von Zahlungen und der Einfluss des Internets der Dinge (IoT) das Wachstum des Tankkartenmarktes erheblich.

Die steigende Nachfrage nach Überwachung von Fahrzeugkäufen und Kraftstoffverbrauch ist der wichtigste Antriebsfaktor auf dem Markt. Der zunehmende Einsatz von Skimmern zur Verschleierung von Käufen und zum Diebstahl von Kraftstoff kann sich als Herausforderung erweisen, die Verfügbarkeit lukrativer Rabatte auf Tankkarten kann sich jedoch als Chance erweisen. Höhere Zinsen für die Karte beim Kraftstoffkauf können ein Hindernis für die Einführung von Außenjalousien darstellen.

Der Bericht zum Markt für Tankkarten für gewerbliche Flotten enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Szenario des Marktes für Tankkarten für gewerbliche Flotten zu verstehen, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine Umsatzlösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Europäischer Markt für Tankkarten für gewerbliche Flotten – Umfang und Marktgröße

Europäischer Markt für Tankkarten für gewerbliche Flotten – Umfang und Marktgröße

Der europäische Markt für Tankkarten für gewerbliche Flotten ist in die fünf wichtigen Segmente Kartentyp, Funktionen, Abonnementtyp, Nutzen und Endbenutzer unterteilt.

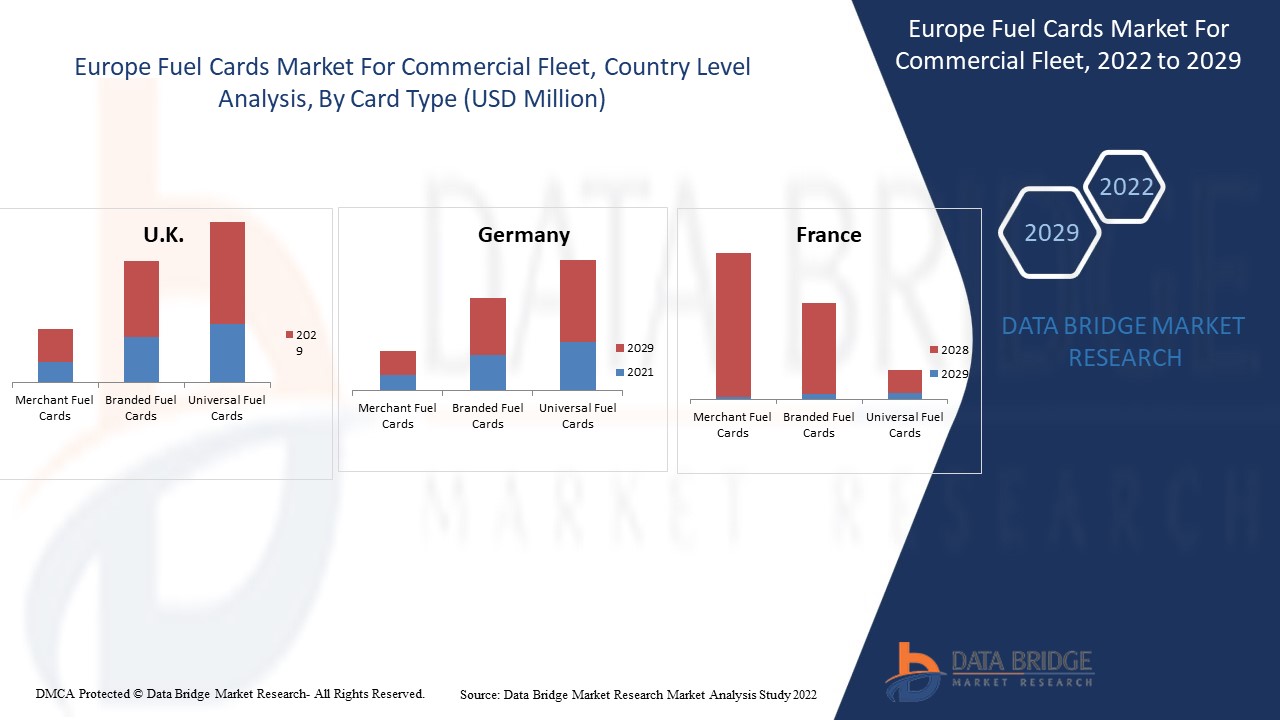

- Auf der Grundlage des Kartentyps ist der europäische Tankkartenmarkt für gewerbliche Flotten in Universaltankkarten, Markenkarten und Händlerkarten unterteilt. Im Jahr 2022 halten Universaltankkarten das höchste Segment, da sie Flexibilität, Kontrolle und Komfort für alle geschäftlichen Einkaufsbedürfnisse bieten und somit eine bessere Kontrolle der Geschäftsausgaben ermöglichen.

- Auf der Grundlage der Funktionen ist der europäische Tankkartenmarkt für gewerbliche Flotten in Fahrzeugberichterstattung, EMV-Konformität, Tokenisierung, Echtzeit-Updates, mobiles Bezahlen und kartenlose Transaktionen sowie andere unterteilt. Im Jahr 2022 sind mobiles Bezahlen und kartenlose Transaktionen das wichtigste Segment, da sie eine zusätzliche Sicherheitsebene für alle Geschäftstypen bieten.

- Auf der Grundlage der Abonnementart ist der europäische Tankkartenmarkt für gewerbliche Flotten in registrierte Karten und Inhaberkarten unterteilt. Im Jahr 2022 halten registrierte Karten das höchste Segment, da sie den Geschäftsinhabern helfen, alle Ausgaben im Auge zu behalten und mehr Flexibilität bei der Überwachung von Fahrzeugen bieten.

- Auf der Grundlage des Nutzens ist der europäische Tankkartenmarkt für gewerbliche Flotten in Fahrzeugparkgebühren, Ölgebührenzahlung, Flottenwartung, Mautgebührenzahlung und andere unterteilt. Im Jahr 2022 hält die Ölgebührenzahlung das höchste Segment, da die Verwendung von Tankkarten an Tankstellen weiter verbreitet ist und die Benutzer eine Reihe von Vorteilen wie Cashbacks, Punkteprämien und

- Auf der Grundlage des Endnutzers ist der europäische Tankkartenmarkt für gewerbliche Flotten in Lieferflotten, Mietwagenflotten, Flotten öffentlicher Versorgungsunternehmen, Taxiflotten und andere unterteilt. Im Jahr 2022 halten Lieferflotten das größte Segment, da sie dazu beitragen, den Kundenservice mit einer Telematikschnittstelle für ein ordnungsgemäßes Flottenmanagement zu verbessern.

Europa: Tankkartenmarkt für gewerbliche Flotten – Länderebeneanalyse

Europa: Tankkartenmarkt für gewerbliche Flotten – Länderebeneanalyse

Der Tankkartenmarkt für gewerbliche Flotten wird analysiert und Informationen zur Marktgröße werden wie oben angegeben nach Land, Kartentyp, Funktionen, Abonnementtyp, Dienstprogramm und Endbenutzer bereitgestellt.

Die im Bericht zum europäischen Tankkartenmarkt für gewerbliche Flotten abgedeckten Länder sind Deutschland, Frankreich, Italien, Großbritannien, Spanien, Russland, die Niederlande, die Schweiz, Belgien, die Türkei und das übrige Europa.

Großbritannien dominiert den Markt aufgrund von Fortschritten in Forschung und Entwicklung in Bezug auf Qualität und Design von Außenjalousien. Deutschland steht aufgrund der steigenden Nachfrage nach energieeffizienten Häusern im Land an zweiter Stelle. Frankreich steht aufgrund des steigenden Bewusstseins für den Schutz vor schädlichen UV-Strahlen in Wohn- und Geschäftsräumen an dritter Stelle.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit europäischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Die zunehmende Neigung zum digitalen Banking fördert das Marktwachstum des europäischen Tankkartenmarktes für gewerbliche Flotten.

Der europäische Tankkartenmarkt für gewerbliche Flotten bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das in einem bestimmten Markt wächst. Darüber hinaus bietet er detaillierte Informationen zur Strategie der Marktteilnehmer und ihrer geografischen Präsenz. Die Daten sind für den historischen Zeitraum von 2012 bis 2020 verfügbar.

Wettbewerbsumfeld und Analyse des europäischen Marktes für Tankkarten für gewerbliche Flottenanteile

Der Wettbewerbsmarkt für Tankkarten für gewerbliche Flotten liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den Tankkartenmarkt für gewerbliche Flotten.

Zu den wichtigsten Akteuren auf dem europäischen Tankkartenmarkt für gewerbliche Flotten zählen unter anderem Exxon Mobil Corporation, Shell, UK Fuels Limited, WAG Payment Solutions, as, bp plc, DKV EURO SERVICE Gmbh + Co. KG, Wex Europe Services, UTA (ein Unternehmen von Edenred), OMV Aktiengesellschaft und TotalEnergies.

Darüber hinaus werden von den Unternehmen weltweit zahlreiche Entwicklungen, Verträge, Vereinbarungen und Erweiterungen initiiert, die den Tankkartenmarkt für gewerbliche Flotten zusätzlich ankurbeln.

Zum Beispiel,

- Im Juli 2021 hat UK Fuels Limited sein Geschäft ausgeweitet, indem es sein Netzwerk auf über 3.500 Tankstellen vergrößert hat. Diese Expansion hat dem Unternehmen geholfen, seinen Kundenstamm zu vergrößern, indem es 97 % des europäischen Marktes erobert hat, was zu einem Wachstum des Umsatzes und des Gewinns des Unternehmens führt.

- Im September 2021 hat WAG Payment Solutions, as sein Geschäft in Deutschland ausgeweitet. Diese Expansion wird es den Kunden des Unternehmens ermöglichen, ihre Eurowag-Karten an TANKPOOL24-Tankstellen in ganz Deutschland zu nutzen. Dies wird dem Unternehmen helfen, neue gewerbliche Kunden in sein Kundenportfolio aufzunehmen und trägt auch dazu bei, das Produktportfolio des Unternehmens zu diversifizieren.

Zusammenarbeit, Produkteinführungen, Geschäftsausweitung, Auszeichnungen und Anerkennungen, Joint Ventures und andere Strategien der Marktteilnehmer verstärken die Präsenz des Unternehmens auf dem Tankkartenmarkt für gewerbliche Flotten, was sich auch positiv auf das Gewinnwachstum des Unternehmens auswirkt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FUEL CARDS FOR COMMERCIAL FLEET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CARD TYPE TIMELINE CURVE

2.1 MARKET UTILITY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 INTEGRAL

4.1.1.1 IDENTIFYING THE PROBLEM

4.1.1.2 SOLUTION

4.1.2 TOTAL PRODUCE

4.1.2.1 IDENTIFYING THE PROBLEM

4.1.2.2 SOLUTION

4.2 REGULATORY FRAMEWORK

4.2.1 PSD (PAYMENT SERVICE DIRECTIVE)

4.2.2 DIRECTIVE (EU) 2015/2366

4.3 TECHNOLOGICAL TRENDS

4.3.1 MOBILE & CONNECTED PAYMENTS

4.3.2 TELEMATICS INTERFACE

4.3.3 HOST CARD EMULATION

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 TOP FLEET LEASING COMPANIES IN EUROPE

4.6.1 TOTAL COST OF OWNERSHIP (TCO) FOR A HEAVY DUTY FLEET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND OF MONITORING VEHICLE PURCHASE & FUEL ECONOMY

5.1.2 THE GROWTH IN INCLINATION TOWARDS THE DIGITAL BANKING

5.1.3 INCREASE IN DEMAND FOR SECURE CASHLESS FUEL TRANSACTIONS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 HIGHER FUEL SURCHARGE (FSC) FEE BY A CARRIER

5.2.2 FUEL CARD ACCOUNTS CAN ONLY BE SET UP FOR BUSINESSES PURPOSES

5.3 OPPORTUNITIES

5.3.1 RISING IN THE STRATEGIC ACQUISITIONS AND PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 AVAILABILITY OF LUCRATIVE DISCOUNTS OVER THE FUEL CARDS

5.3.3 EFFICIENT FLEET ADMINISTRATION WITH THE HELP OF ENHANCED DATA CAPTURE

5.4 CHALLENGES

5.4.1 RISE IN NUMBER OF SKIMMERS TO DISGUISE PURCHASES TO STEAL FUEL

5.4.2 INCREASE IN CONCERN OF THE SECURITY ISSUES WITH THE FUEL CARD PAYMENT

6 ANALYSIS ON IMPACT OF COVID 19 ON THE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

6.1 AFTERMATH OF THE EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE

7.1 OVERVIEW

7.2 UNIVERSAL FUEL CARDS

7.2.1 FUEL CREDIT CARDS

7.2.2 OVER THE ROAD FUEL CARD

7.2.3 NETWORK CARDS

7.3 BRANDED FUEL CARDS

7.4 MERCHANT FUEL CARDS

8 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES

8.1 OVERVIEW

8.2 MOBILE PAYMENT & CARDLESS TRANSACTIONS

8.3 VEHICLE REPORTING

8.4 REAL TIME UPDATES

8.5 EMV COMPLIANT

8.6 TOKENIZATION

8.7 OTHERS

9 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE

9.1 OVERVIEW

9.2 REGISTERED CARD

9.3 BEARER CARD

10 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY

10.1 OVERVIEW

10.2 OIL FEE PAYMENT

10.3 FLEET MAINTENANCE

10.4 VEHICLE PARKING FEES

10.5 TOLL FEE PAYMENT

10.6 OTHERS

11 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER

11.1 OVERVIEW

11.2 DELIVERY FLEETS

11.2.1 MEDIUM/HEAVY DUTY FLEET

11.2.2 LIGHT DUTY FLEET

11.2.3 UNIVERSAL FUEL CARDS

11.2.4 BRANDED FUEL CARDS

11.2.5 MERCHANT FUEL CARDS

11.3 TAXI CAB FLEETS

11.3.1 UNIVERSAL FUEL CARDS

11.3.2 BRANDED FUEL CARDS

11.3.3 MERCHANT FUEL CARDS

11.4 CAR RENTAL FLEETS

11.4.1 UNIVERSAL FUEL CARDS

11.4.2 BRANDED FUEL CARDS

11.4.3 MERCHANT FUEL CARDS

11.5 PUBLIC UTILITY FLEETS

11.5.1 UNIVERSAL FUEL CARDS

11.5.2 BRANDED FUEL CARDS

11.5.3 MERCHANT FUEL CARDS

11.6 OTHERS

11.6.1 UNIVERSAL FUEL CARDS

11.6.2 BRANDED FUEL CARDS

11.6.3 MERCHANT FUEL CARDS

12 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY

12.1 EUROPE

12.1.1 U.K.

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILE

14.1 BP P.L.C.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.6 DBMR ANALYSIS

14.2 OMV AKTIENGESELLSCHAFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.6 DBMR ANALYSIS

14.3 EXXON MOBIL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SWOT ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 DBMR ANALYSIS

14.4 VALERO MARKETING AND SUPPLY COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.4.6 DBMR ANALYSIS

14.5 UK FUELS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.5.5 DBMR ANALYSIS

14.6 DKV EURO SERVICE GMBH + CO. KG

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 MORGAN FUELS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 TOTALENERGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 SHELL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 UTA (AN EDENRED COMPANY)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 W.A.G. PAYMENT SOLUTIONS, A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 WEX EUROPE SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 LIST OF TOP LEASING COMPANIES AND THE FUEL CARDS USED BY THEM

TABLE 2 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TAXI CAB FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CAR RENTAL FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 16 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 18 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 26 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 28 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 30 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 32 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 38 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 40 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 43 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 45 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 46 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 48 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 50 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 51 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 52 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 60 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 62 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 64 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 65 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 68 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 70 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 72 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 73 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 74 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 75 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 78 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 80 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 82 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 87 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 89 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 90 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 92 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 94 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 95 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 98 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 100 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 101 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 102 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 104 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 108 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 109 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 111 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 112 TALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 114 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 117 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 118 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 120 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 122 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 124 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 127 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 128 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 129 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 130 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 131 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 133 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 134 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 135 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 136 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 138 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 139 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 140 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 141 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 142 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 144 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 148 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 150 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 152 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 158 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 160 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 162 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 164 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 168 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 170 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 172 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 174 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 177 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 180 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 182 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 183 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 184 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 186 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 188 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 190 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 192 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 194 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 196 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 199 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 202 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 204 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 205 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 206 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 208 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 210 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 212 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 214 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 216 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 218 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 219 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 221 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 224 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 226 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 227 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 228 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 230 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 232 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 234 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 236 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 238 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 239 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 240 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 241 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 243 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 244 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 245 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 246 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 248 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 249 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 250 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 251 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 252 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 253 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 254 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 255 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 256 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 257 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 258 REST OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: SEGMENTATION

FIGURE 2 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DATA TRIANGULATION

FIGURE 3 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 10 INCREASING IN DEMAND FOR MONITORING VEHICLE PURCHASE & FUEL ECONOMY IS EXPECTED TO DRIVE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 11 CARD TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN 2022 & 2029

FIGURE 12 ANNUAL CHARGES ON FUEL CARDS OFFERED BY VARIOUS COMPANIES

FIGURE 13 AVERAGE COST OF OWNERSHIP FOR HEAVY DUTY FLEET (IN %)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

FIGURE 15 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY CARD TYPE, 2021

FIGURE 16 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY FEATURES, 2021

FIGURE 17 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY SUBSCRIPTION TYPE, 2021

FIGURE 18 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY UTILITY, 2021

FIGURE 19 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY END-USER, 2021

FIGURE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SNAPSHOT (2021)

FIGURE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021)

FIGURE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY CARD TYPE (2022-2029)

FIGURE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.