Europe Bioherbicides Market

Marktgröße in Milliarden USD

CAGR :

%

USD

456.13 Million

USD

675.46 Million

2024

2032

USD

456.13 Million

USD

675.46 Million

2024

2032

| 2025 –2032 | |

| USD 456.13 Million | |

| USD 675.46 Million | |

|

|

|

|

Segmentierung des europäischen Bioherbizide-Marktes nach Typ (mikrobiell, biochemisch und andere), Wirkungsweise (selektive und nichtselektive Bioherbizide), Form (flüssig und trocken), Anwendung (Blattspray, Saatgutbehandlung, Bodenbehandlung, Nachernte, chemische Behandlung und andere), Pflanzenart (Getreide und Körner, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen und andere Pflanzen), Vertriebskanal (direkt und indirekt) – Branchentrends und Prognose bis 2032

Bioherbizide Marktgröße in Europa

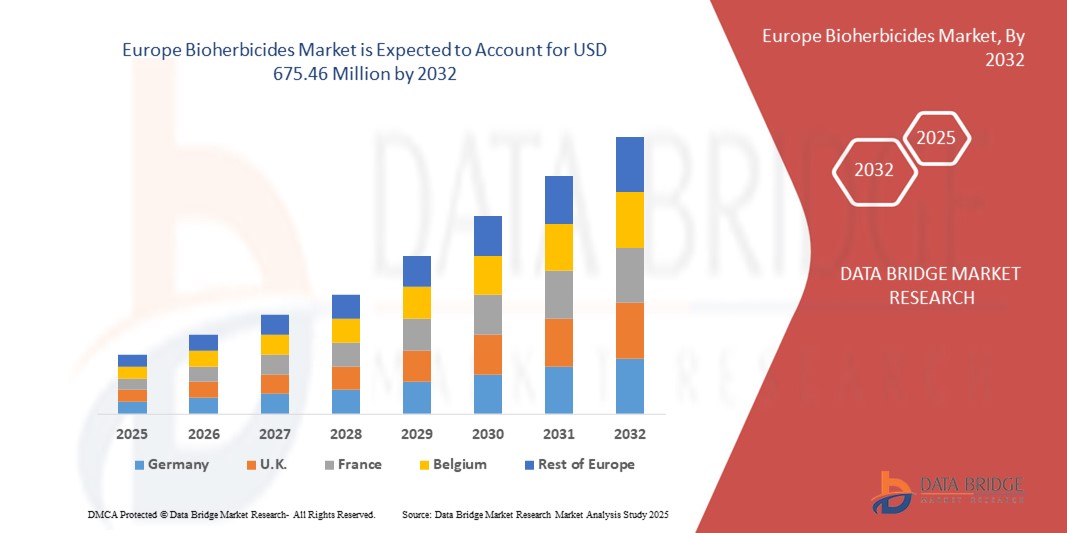

- Der europäische Markt für Bioherbizide hatte im Jahr 2024 einen Wert von 456,13 Millionen US-Dollar und dürfte bis 2032 einen Wert von 675,46 Millionen US-Dollar erreichen , was einer jährlichen Wachstumsrate von 5,03 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Einführung nachhaltiger und umweltfreundlicher landwirtschaftlicher Praktiken sowie das wachsende Bewusstsein für die Umweltauswirkungen synthetischer Herbizide vorangetrieben. Landwirte und Agrarunternehmen setzen zunehmend auf biologische Lösungen zur Unkrautbekämpfung und zur Reduzierung chemischer Rückstände in Pflanzen und Böden.

- Darüber hinaus beschleunigen die zunehmende regulatorische Unterstützung für biologisch basierte Pflanzenschutzmittel und Fortschritte bei mikrobiellen und biochemischen Formulierungen die Entwicklung und Einführung von Bioherbiziden und fördern damit das Wachstum der Branche erheblich.

Bioherbizide Marktanalyse in Europa

- Bioherbizide sind biologische Wirkstoffe, die aus natürlichen Organismen oder deren Metaboliten gewonnen werden und zur Kontrolle oder Unterdrückung des Unkrautwachstums auf landwirtschaftlichen Feldern eingesetzt werden. Sie bieten gezielte, umweltfreundliche Alternativen zu herkömmlichen chemischen Herbiziden und können in verschiedenen Formen, darunter Flüssig-, Trocken- und Saatgutbehandlungen, für verschiedene Kulturarten eingesetzt werden.

- Die steigende Nachfrage nach Bioherbiziden wird vor allem durch den Bedarf an nachhaltigen Lösungen zur Unkrautbekämpfung, die zunehmende Verbreitung herbizidresistenter Unkräuter und den zunehmenden Fokus auf die Reduzierung des Chemikalieneinsatzes in der Landwirtschaft angetrieben. Fortschritte in der Formulierungstechnologie, die einfache Integration in moderne landwirtschaftliche Praktiken und das wachsende Bewusstsein der Landwirte für die langfristige Boden- und Pflanzengesundheit unterstützen das Marktwachstum zusätzlich.

- Deutschland dominierte 2024 den Markt für Bioherbizide aufgrund seines fortschrittlichen Agrarsektors, seines starken Fokus auf nachhaltige Landwirtschaft und der zunehmenden Einführung umweltfreundlicher Pflanzenschutzlösungen.

- Großbritannien dürfte im Prognosezeitraum die am schnellsten wachsende Region auf dem Markt für Bioherbizide sein, da dort zunehmend nachhaltige und biologische Anbaumethoden eingesetzt werden und der Fokus zunehmend auf der Reduzierung des chemischen Einsatzes im Pflanzenbau liegt.

- Das Flüssigsegment dominierte den Markt mit einem Marktanteil von 57,6 % im Jahr 2024 aufgrund seiner einfachen Anwendung, schnellen Absorption und gleichmäßigen Verteilung auf den Zielflächen. Flüssige Virostatika eignen sich besonders für Blattspritzungen und Saatgutbehandlungen und ermöglichen eine effiziente Wirkstoffabgabe. Ihre Formulierungsflexibilität und Kompatibilität mit automatisierten Applikationssystemen machen sie für den kommerziellen Einsatz äußerst attraktiv. Darüber hinaus ermöglichen flüssige Formulierungen eine präzise Dosierung und schnelle Reaktion auf neu auftretende virale Bedrohungen, was ihre Wirksamkeit im großflächigen Pflanzenschutz erhöht. Ihre Anpassungsfähigkeit an verschiedene Kulturarten und Umweltbedingungen stärkt die Marktakzeptanz zusätzlich.

Berichtsumfang und Marktsegmentierung für Bioherbizide

|

Eigenschaften |

Wichtige Markteinblicke zu Bioherbiziden |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für Bioherbizide in Europa

Wachsende Nachfrage nach ökologischer und nachhaltiger Landwirtschaft

- Der beschleunigte Übergang zu biologischen und nachhaltigen Anbaumethoden steigert die Nachfrage nach Bioherbiziden, da sie umweltfreundliche Alternativen zu chemisch-synthetischen Unkrautbekämpfungsmitteln bieten. Landwirte und Produzenten suchen zunehmend nach natürlichen Produkten, die Umweltschäden minimieren und gleichzeitig die Produktivität aufrechterhalten.

- Marrone Bio Innovations hat beispielsweise Bioherbizide entwickelt, die auf die Unkrautbekämpfung mit natürlichen Mikroben und pflanzlichen Wirkstoffen abzielen. Ihr Portfolio zeigt, wie nachhaltige Lösungen Unkrautprobleme effektiv bekämpfen und gleichzeitig das Marktwachstum durch organische Produkte unterstützen können.

- Die zunehmende Vorliebe der Verbraucher für chemiefreie Lebensmittel drängt Landwirte dazu, Produkte zu verwenden, die Nachhaltigkeitszertifikaten entsprechen. Bioherbizide sind rückstandsfrei und biologisch abbaubar und stärken die Einhaltung der Standards des ökologischen Landbaus sowie die Forderungen der Verbraucher nach sichereren landwirtschaftlichen Praktiken.

- Darüber hinaus hat das Bewusstsein für Bodengesundheit und Biodiversität die landwirtschaftlichen Strategien beeinflusst. Bioherbizide unterstützen diese Ziele, indem sie die chemische Ansammlung reduzieren, die mikrobielle Aktivität fördern und im Vergleich zu synthetischen Herbiziden zur langfristigen Nachhaltigkeit landwirtschaftlicher Flächen beitragen.

- Der wachsende Biolandbau bietet günstige Bedingungen für Bioherbizide. Angesichts der zunehmenden Herausforderungen für die Ernährungssicherheit wird die nachhaltige Unkrautbekämpfung durch biobasierte Kontrollen zu einer zentralen Priorität für das landwirtschaftliche Ökosystem.

- Insgesamt unterstreicht der Trend zu ökologischer und nachhaltiger Landwirtschaft die zentrale Rolle von Bioherbiziden. Ihre Fähigkeit, die Erwartungen der Verbraucher zu erfüllen, die Bodenqualität zu verbessern und regulatorische und ökologische Ziele zu erfüllen, macht sie zu einem wichtigen Bestandteil der zukünftigen Landwirtschaft.

Marktdynamik für Bioherbizide in Europa

Treiber

Regulatorische Unterstützung und Regierungsinitiativen

- Globale regulatorische Rahmenbedingungen und Regierungspolitik spielen eine entscheidende Rolle bei der Einführung von Bioherbiziden. Maßnahmen zur Reduzierung der Abhängigkeit von chemischen Herbiziden fördern den Übergang zu nachhaltigen Alternativen in der konventionellen Landwirtschaft.

- So hat die Europäische Union beispielsweise strengere Vorschriften für synthetische Pestizide erlassen und damit Möglichkeiten für den Einsatz von Bioherbiziden geschaffen. Unternehmen wie BioWorks nutzen diese politischen Veränderungen, indem sie die Produktion biologisch gewonnener Lösungen ausweiten, die den gesetzlichen Anforderungen für eine sicherere Landwirtschaft entsprechen.

- Staatlich geförderte Forschungsprogramme und Subventionen fördern die Einführung zusätzlich. Viele Länder investieren in die Entwicklung von Biopestiziden und bieten Landwirten Anreize für die Integration biobasierter Produkte in integrierte Unkrautbekämpfungssysteme.

- Darüber hinaus hat die Betonung der Erreichung der Ziele für nachhaltige Entwicklung der Vereinten Nationen (SDGs) die Unterstützung umweltfreundlicher landwirtschaftlicher Betriebsmittel erhöht. Bioherbizide stehen in engem Zusammenhang mit Klimaschutzmaßnahmen und nachhaltigen landwirtschaftlichen Produktivitätszielen.

- Insgesamt bilden regulatorische Unterstützung, politische Anreize und institutionelle Finanzierung eine solide Grundlage für eine breite Markteinführung von Bioherbiziden. Diese unterstützenden Rahmenbedingungen dürften die Nachfrage stärken und Innovationen in der Branche fördern.

Einschränkung/Herausforderung

Wenig Bewusstsein der Landwirte für die Vorteile von Bioherbiziden

- Eine große Herausforderung auf dem Markt für Bioherbizide ist das geringe Bewusstsein der Landwirte hinsichtlich ihrer Wirksamkeit im Vergleich zu konventionellen Chemikalien. Viele Landwirte zögern weiterhin aufgrund von Bedenken hinsichtlich der Leistung, der Anwendungsverfahren und der begrenzten Produktverfügbarkeit auf den lokalen Märkten.

- So zeigen beispielsweise Umfragen in Schwellenländern, dass Agrarunternehmen wie BASF Biologicals Schwierigkeiten haben, Landwirte davon zu überzeugen, Bioherbizide anstelle herkömmlicher Herbizide einzusetzen, da sie Risiken hinsichtlich der Ertragssicherheit und der Wirksamkeit der Bekämpfung sehen.

- Das Fehlen solider Beratungsdienste und Schulungsprogramme für Landwirte behindert häufig die Verbreitung von Wissen über Bioherbizide. Der Mangel an klaren Richtlinien und Demonstrationen trägt zusätzlich zu niedrigen Akzeptanzraten bei, insbesondere bei kleinen und mittleren Landwirten.

- Darüber hinaus erschweren die höheren Kosten und die eingeschränkte kommerzielle Verfügbarkeit im Vergleich zu synthetischen Herbiziden den Zugang in preissensiblen Märkten. Landwirte mit kleinem Budget bleiben eher bei konventionellen Chemikalien, die schnelle und bekannte Ergebnisse liefern.

- Um diese Herausforderungen zu bewältigen, bedarf es umfassender Aufklärung der Landwirte, Demonstrationsprojekte und staatlich geförderter Sensibilisierungskampagnen. Die Beseitigung dieser Lücken ist entscheidend, um das Vertrauen zu stärken, die Akzeptanz zu erhöhen und das volle Potenzial von Bioherbiziden in der nachhaltigen Landwirtschaft auszuschöpfen.

Europa Bioherbizide Marktumfang

Der Markt ist nach Typ, Wirkungsweise, Form, Anwendung, Pflanzenart und Vertriebskanal segmentiert.

- Nach Typ

Der Markt für antivirale Mittel ist nach Typ in mikrobielle, biochemische und sonstige Mittel unterteilt. Das mikrobielle Segment hatte 2024 den größten Marktanteil, da es sich durch seine nachgewiesene Wirksamkeit bei der Bekämpfung viraler Krankheitserreger und seine Kompatibilität mit landwirtschaftlichen und medizinischen Anwendungen auszeichnet. Mikrobielle Virostatika werden aufgrund ihrer Umweltfreundlichkeit und minimalen Auswirkungen auf Nichtzielorganismen bevorzugt und sind daher die bevorzugte Wahl für ein nachhaltiges Krankheitsmanagement. Intensive Forschung und Entwicklung im Bereich mikrobieller Formulierungen hat deren Stabilität, Wirksamkeit und Anwendungsfreundlichkeit weiter verbessert. Ihre Integrationsfähigkeit in bestehende Pflanzenschutz- und Gesundheitsprotokolle fördert die Akzeptanz zusätzlich.

Das biochemische Segment wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch Fortschritte bei molekularen antiviralen Verbindungen und die steigende Nachfrage nach zielgerichteten Lösungen. Biochemische Virostatika unterbrechen die Virusreplikation hochwirksam und bieten eine Spezifität, die Kollateralschäden an nützlichen Organismen reduziert. Steigende Investitionen in Biotechnologie und das wachsende Bewusstsein für chemiefreie Alternativen in der Landwirtschaft und im Gesundheitswesen treiben das Marktwachstum weiter voran.

- Nach Wirkungsweise

Der Markt für antivirale Mittel wird anhand ihrer Wirkungsweise in selektive und nichtselektive Bioherbizide unterteilt. Das Segment der selektiven Bioherbizide hatte 2024 den größten Marktanteil, da es spezifische virale Krankheitserreger bekämpft, ohne andere Organismen zu beeinträchtigen, und so unbeabsichtigte Schäden an Nutzpflanzen oder mikrobiellen Gemeinschaften reduziert. Diese Spezifität ermöglicht sicherere und vorhersehbarere Ergebnisse sowohl in der Landwirtschaft als auch im Gesundheitswesen. Die regulatorische Unterstützung selektiver Lösungen und die zunehmende Akzeptanz in der Präzisionslandwirtschaft tragen ebenfalls zur Marktführerschaft bei.

Das Segment der nicht-selektiven Bioherbizide wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen. Dies ist auf den steigenden Bedarf an Breitband-Antivirenlösungen in Regionen zurückzuführen, die anfällig für mehrere Virusstämme und häufige Krankheitsausbrüche sind. Diese Antivirenmittel ermöglichen eine schnelle und umfassende Kontrolle, bekämpfen effektiv ein breites Spektrum an Krankheitserregern und reduzieren das Risiko von Ernteausfällen. Ihre Fähigkeit, unter unterschiedlichen Umweltbedingungen einen gleichbleibenden Schutz zu bieten, macht sie besonders geeignet für den großflächigen Pflanzenschutz und das Notfallmanagement von Krankheitsausbrüchen. Die zunehmende Akzeptanz wird auch durch Fortschritte in der Formulierungstechnologie unterstützt, die Stabilität, Wirksamkeit und Anwendungsfreundlichkeit verbessert.

- Nach Formular

Der Markt für antivirale Mittel ist in flüssige und trockene Mittel unterteilt. Das flüssige Segment hatte im Jahr 2024 mit 57,6 % den größten Marktanteil, was auf die einfache Anwendung, die schnelle Absorption und die gleichmäßige Verteilung auf den Zielflächen zurückzuführen ist. Flüssige antivirale Mittel eignen sich besonders für Blattspritzungen und Saatgutbehandlungen und ermöglichen eine effiziente Wirkstoffabgabe. Ihre Formulierungsflexibilität und Kompatibilität mit automatisierten Applikationssystemen machen sie für den gewerblichen Einsatz äußerst attraktiv. Darüber hinaus ermöglichen flüssige Formulierungen eine präzise Dosierung und eine schnelle Reaktion auf neu auftretende virale Bedrohungen, was ihre Wirksamkeit im großflächigen Pflanzenschutz erhöht. Ihre Anpassungsfähigkeit an verschiedene Kulturarten und Umweltbedingungen stärkt die Marktakzeptanz zusätzlich.

Das Trockensegment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, getrieben von Vorteilen wie längerer Haltbarkeit, einfacher Lagerung und kostengünstigem Transport. Trockene Virostatika können bei Bedarf rekonstituiert werden, was Abfall reduziert und nachhaltige Anwendungspraktiken unterstützt. Ihre Stabilität unter unterschiedlichen Umweltbedingungen macht sie für Regionen mit eingeschränkter Kühlketteninfrastruktur geeignet. Die einfache Handhabung und die präzise Dosierung steigern ihre Attraktivität für Landwirte und Agrarbetriebe zusätzlich. Darüber hinaus wird erwartet, dass die steigende Nachfrage in abgelegenen oder ressourcenarmen Regionen, in denen flüssige Formulierungen weniger praktikabel sind, die Einführung trockener Virostatika beschleunigen wird. Das wachsende Bewusstsein für nachhaltige und effiziente Pflanzenschutzpraktiken trägt ebenfalls zum Marktwachstum bei.

- Nach Anwendung

Der Markt für antivirale Mittel ist nach Anwendungsgebieten in Blattspray, Saatgutbehandlung, Bodenbehandlung, Nacherntebehandlung, Chemigation und weitere segmentiert. Das Segment Blattsprays hatte 2024 den größten Marktanteil, da es durch die direkte Anwendung auf Nutzpflanzen eine sofortige Viruskontrolle ermöglicht und die Ausbreitung von Infektionen reduziert. Blattsprays ermöglichen eine präzise Dosierung und gleichmäßige Abdeckung, wodurch die Behandlungseffizienz erhöht und gleichzeitig die Umweltbelastung minimiert wird. Ihre Kompatibilität mit automatisierten Sprühsystemen und Präzisionslandwirtschaftstechniken stärkt ihre Akzeptanz in der kommerziellen Landwirtschaft zusätzlich. Darüber hinaus sind Blattsprays vielseitig einsetzbar und eignen sich für verschiedene Nutzpflanzenarten und klimatische Bedingungen, was sie zur bevorzugten Wahl für großflächige und hochwertige landwirtschaftliche Betriebe macht. Das zunehmende Bewusstsein für ein rechtzeitiges und wirksames Krankheitsmanagement treibt die Marktnachfrage zusätzlich an.

Das Segment Saatgutbehandlung wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen. Dies ist auf seine Rolle beim frühen Schutz vor viralen Krankheitserregern zurückzuführen, wodurch die Widerstandsfähigkeit und der Ertrag von Nutzpflanzen verbessert werden. Saatgutbehandlungen gewinnen aufgrund ihrer Effizienz, des geringeren Chemikalienbedarfs und der Kompatibilität mit modernen landwirtschaftlichen Praktiken an Bedeutung und unterstützen präventive Strategien zur Krankheitsbekämpfung. Ihre Fähigkeit, gezielten Schutz im kritischen Keimstadium zu bieten, reduziert das Risiko von Ernteausfällen und steigert die Gesamtproduktivität. Darüber hinaus dürften Fortschritte bei der Saatgutbeschichtungstechnologie und die zunehmende Einführung nachhaltiger landwirtschaftlicher Praktiken das Wachstum dieses Segments weiter beschleunigen. Die steigende Nachfrage aus Regionen, die Wert auf qualitativ hochwertige und krankheitsfreie Pflanzenproduktion legen, fördert die Akzeptanz ebenfalls.

- Nach Pflanzenart

Der Markt für antivirale Mittel ist nach Anbaupflanzen in Getreide, Obst und Gemüse, Ölsaaten und Hülsenfrüchte, Rasen und Zierpflanzen sowie sonstige Nutzpflanzen unterteilt. Das Segment Obst und Gemüse hatte im Jahr 2024 den größten Marktanteil, was auf die hohe Anfälligkeit dieser Nutzpflanzen für Virusinfektionen und die steigende Nachfrage nach sicheren, qualitativ hochwertigen Produkten zurückzuführen ist. Die Vorliebe der Verbraucher für chemiefreie Lösungen fördert die Einführung antiviraler Behandlungen bei diesen Nutzpflanzen zusätzlich. Fortschrittliche Anwendungstechniken und Präzisionslandwirtschaft erhöhen die Wirksamkeit antiviraler Mittel in diesem Segment zusätzlich.

Der Getreidesektor wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen. Grund dafür sind die steigende Nachfrage nach Grundnahrungsmitteln und die zunehmende Verbreitung viraler Krankheitserreger, die die globale Ernährungssicherheit beeinträchtigen. Antivirale Lösungen für Getreide und Körner tragen dazu bei, Ernteverluste zu vermeiden, die Widerstandsfähigkeit der Nutzpflanzen zu verbessern und die Stabilität der Lebensmittelversorgung zu gewährleisten, was zu einer höheren Akzeptanz führt. Das wachsende Bewusstsein der Landwirte für die wirtschaftlichen Auswirkungen von Virusinfektionen sowie die Integration antiviraler Mittel in moderne landwirtschaftliche Praktiken treiben die Akzeptanz dieser Lösungen weiter voran.

- Nach Vertriebskanal

Der Markt für antivirale Medikamente wird anhand der Vertriebskanäle in direkte und indirekte Vertriebskanäle unterteilt. Der Direktvertrieb hatte 2024 den größten Marktanteil, was auf die engeren Beziehungen zwischen Herstellern und großen Endverbrauchern wie landwirtschaftlichen Genossenschaften, kommerziellen landwirtschaftlichen Betrieben und Gesundheitseinrichtungen zurückzuführen ist. Direktvertriebskanäle ermöglichen eine bessere Kontrolle über die Preisgestaltung, pünktliche Lieferungen und maßgeschneiderte Lösungen, die auf die Bedürfnisse der Endverbraucher zugeschnitten sind. Ein starker Herstellersupport und Kundendienst verstärken die Dominanz des Direktvertriebs zusätzlich.

Das Segment des indirekten Vertriebs wird voraussichtlich von 2025 bis 2032 die schnellste Wachstumsrate verzeichnen, angetrieben durch das wachsende Netzwerk von Distributoren, Einzelhändlern und Online-Plattformen. Indirekte Kanäle verbessern die Produktverfügbarkeit für Kleinbauern und regionale Agrarbetriebe, erhöhen die Marktdurchdringung und fördern eine breite Akzeptanz. Das Wachstum wird zusätzlich durch den Aufstieg von E-Commerce und digitalen Marktplätzen gefördert, die es Herstellern ermöglichen, abgelegene und unterversorgte Regionen zu erreichen. Darüber hinaus fördern Partnerschaften mit lokalen Distributoren und Agrartechnologie-Dienstleistern die Aufklärung und Sensibilisierung für die Vorteile von Bioherbiziden und beschleunigen so die Akzeptanz in verschiedenen Regionen.

Regionale Analyse des europäischen Bioherbizidmarktes

- Deutschland dominierte den Markt für Bioherbizide mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch seinen fortschrittlichen Agrarsektor, den starken Fokus auf nachhaltige Landwirtschaft und die zunehmende Einführung umweltfreundlicher Pflanzenschutzlösungen.

- Die Führungsrolle des Landes wird durch umfangreiche Investitionen in Forschung und Entwicklung, staatliche Unterstützung für die biologische Schädlings- und Unkrautbekämpfung und die Integration von Technologien für die Präzisionslandwirtschaft gestärkt.

- Die steigende Nachfrage nach Getreide, Getreidesorten und Gartenbaukulturen sowie das zunehmende Bewusstsein für herbizidresistente Unkräuter stärken Deutschlands Position weiter. Die Zusammenarbeit zwischen heimischen Bioherbizidherstellern und globalen Unternehmen treibt Innovation und Marktexpansion weiter voran und festigt Deutschlands dominante Stellung in der Region.

Markteinblick in Großbritannien für Bioherbizide

Der britische Markt wird zwischen 2025 und 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate in Europa verzeichnen. Dies ist auf die zunehmende Nutzung nachhaltiger und biologischer Anbaumethoden und die zunehmende Reduzierung des Chemikalieneinsatzes im Pflanzenbau zurückzuführen. Unterstützt wird das Wachstum durch staatliche Initiativen zur Förderung einer umweltfreundlichen Landwirtschaft, den Ausbau des Anbaus hochwertiger Nutzpflanzen und ein wachsendes Bewusstsein der Landwirte für die Vorteile von Bioherbiziden. Investitionen in Forschung, Technologieintegration und die Zusammenarbeit mit globalen Bioherbizidanbietern verbessern die Wirksamkeit und Verfügbarkeit der Produkte. Der Schwerpunkt Großbritanniens auf umweltbewusster Landwirtschaft und Präzisionslandwirtschaft führt zu einer größeren Marktdurchdringung und beschleunigt die Akzeptanz.

Markteinblick in Bioherbizide in Frankreich

Für Frankreich wird zwischen 2025 und 2032 ein stetiges Wachstum erwartet. Unterstützt wird dies durch den etablierten Agrarsektor, die steigende Produktion von Getreide, Obst und Gemüse sowie das wachsende Interesse an biologischen und nachhaltigen Pflanzenschutzlösungen. Der zunehmende Einsatz mikrobieller und biochemischer Bioherbizide sowie staatliche Maßnahmen zur Reduzierung des Chemikalieneinsatzes treiben das Marktwachstum voran. Die Zusammenarbeit zwischen inländischen Herstellern und internationalen Bioherbizidentwicklern verbessert Verfügbarkeit, Wirksamkeit und das Bewusstsein der Landwirte. Der Fokus des Landes auf nachhaltige Anbaumethoden, Umweltschutz und Technologieintegration stärkt Frankreichs Marktaussichten weiter.

Marktanteil von Bioherbiziden in Europa

Die Bioherbizidindustrie wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- BASF (Deutschland)

- FMC Corporation (USA)

- Coromandel International Limited (Indien)

- Certis USA LLC (USA)

- Emery Oleochemicals (Malaysia)

- BioHerbizide Australien (Australien)

- Herbanatur (Spanien)

- Andermatt Biocontrol Suisse (Schweiz)

- Syngenta AG (Schweiz)

- Bayer CropScience AG (Deutschland)

- Novozymes A/S (Dänemark)

- Marrone Bio Innovations Inc. (USA)

- Verdesian Life Sciences (USA)

- Deer Creek Holdings (USA)

- EcoPesticides International, Inc. (USA)

Neueste Entwicklungen auf dem europäischen Bioherbizidmarkt

- Im Juli 2025 gab Seipasa, ein auf Biopestizide spezialisiertes spanisches Unternehmen, seine Bemühungen zur Registrierung eines neuen Bioherbizids mit neuartiger Wirkungsweise bekannt. Diese Entwicklung soll eine Alternative zu bestehenden synthetischen Herbiziden bieten und der wachsenden Nachfrage nach nachhaltigen Pflanzenschutzlösungen gerecht werden. Die Einführung dieses innovativen Produkts soll Seipasas Portfolio erweitern und zur Förderung umweltfreundlicher landwirtschaftlicher Praktiken beitragen.

- Im Dezember 2022 eröffnete Seipasa eine neue, 4.000 m² große Industrieanlage zur Entwicklung und Registrierung seiner Bioherbizidprodukte. Diese Anlage soll das Wachstum des Unternehmens fördern und seine Kapazitäten erweitern, um die steigende Nachfrage nach Biopestizidlösungen zu decken.

- Im Mai 2023 führte BASF zwei neue Herbizide ein, Facet und Duvelon, um indische Reis- und Teebauern bei der Bekämpfung problematischer Unkräuter zu unterstützen. Facet bekämpft das grasartige Unkraut Echinochloa spp. in Reiskulturen, während Duvelon, basierend auf Kixor Active, breitblättrige Unkräuter in Teeplantagen bekämpft. Diese Markteinführung erweitert das Angebot von BASF und adressiert die wichtigsten Herausforderungen für Reis- und Teebauern in Indien. Sie unterstreicht das Engagement des Unternehmens für nachhaltige landwirtschaftliche Praktiken.

- Im Oktober 2024 kündigte die FMC Corporation die Markteinführung des Herbizids Ambriva in Chandigarh, Indien, an. Ziel ist es, Weizenbauern bei der Bekämpfung des resistenten Unkrauts Phalaris minor zu unterstützen. Mit Isoflex active, einem neuartigen Herbizid der Gruppe 13, bietet Ambriva eine wirksame Kontrolle im frühen Nachauflauf und einen langanhaltenden Schutz. Das Herbizid wurde strengen Tests unterzogen und bietet Landwirten in Punjab, Haryana, Uttar Pradesh und Rajasthan eine leistungsstarke neue Lösung zur Bewältigung der erheblichen Herausforderungen, die dieses zerstörerische Unkraut mit sich bringt.

- Im Dezember 2022 gaben FMC Corporation und Micropep Technologies ihre Zusammenarbeit bei der Entwicklung biologischer Lösungen zur Bekämpfung herbizidresistenter Unkräuter bekannt. Diese Partnerschaft kombiniert die landwirtschaftliche Expertise von FMC mit der Mikropeptidtechnologie von Micropep, um die Entwicklung innovativer Bioherbizidlösungen zu beschleunigen. Ziel ist es, die Ernteerträge zu steigern und nachhaltige Anbaumethoden zu fördern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.