Europäischer Markt für biologisch abbaubare Verpackungen aus Papier und Kunststoff, nach Verpackungstyp (Kunststoff und Papier), Produkt (Tüten, Backbleche, Pappteller, Sandwichbehälter, Portionsbecher, Tabletts, Besteck, Schüsseln, Beutel und Sachets, mit Deckel und andere), Verwendung (Einweg und Mehrweg), Vertriebskanal (E-Commerce, Supermärkte/Hypermärkte, Convenience Stores, Fachgeschäfte und andere), Anwendung (Lebensmittelverpackungen, Getränkeverpackungen, Pharmaverpackungen, Körper- und Haushaltspflegeverpackungen, Verpackungen für elektronische Geräte und andere), Verpackungsschicht (Primärverpackungen, Sekundärverpackungen und Tertiärverpackungen), Endverbraucher (Restaurants, Hotels, Tee- und Kaffeehäuser, Süßwaren- und Snackläden, Cafeterias und andere), Land (Deutschland, Großbritannien, Italien, Frankreich, Spanien, Schweiz, Russland, Türkei, Belgien, Niederlande und übriges Europa), Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke : Europäischer Markt für biologisch abbaubare Papier- und Kunststoffverpackungen

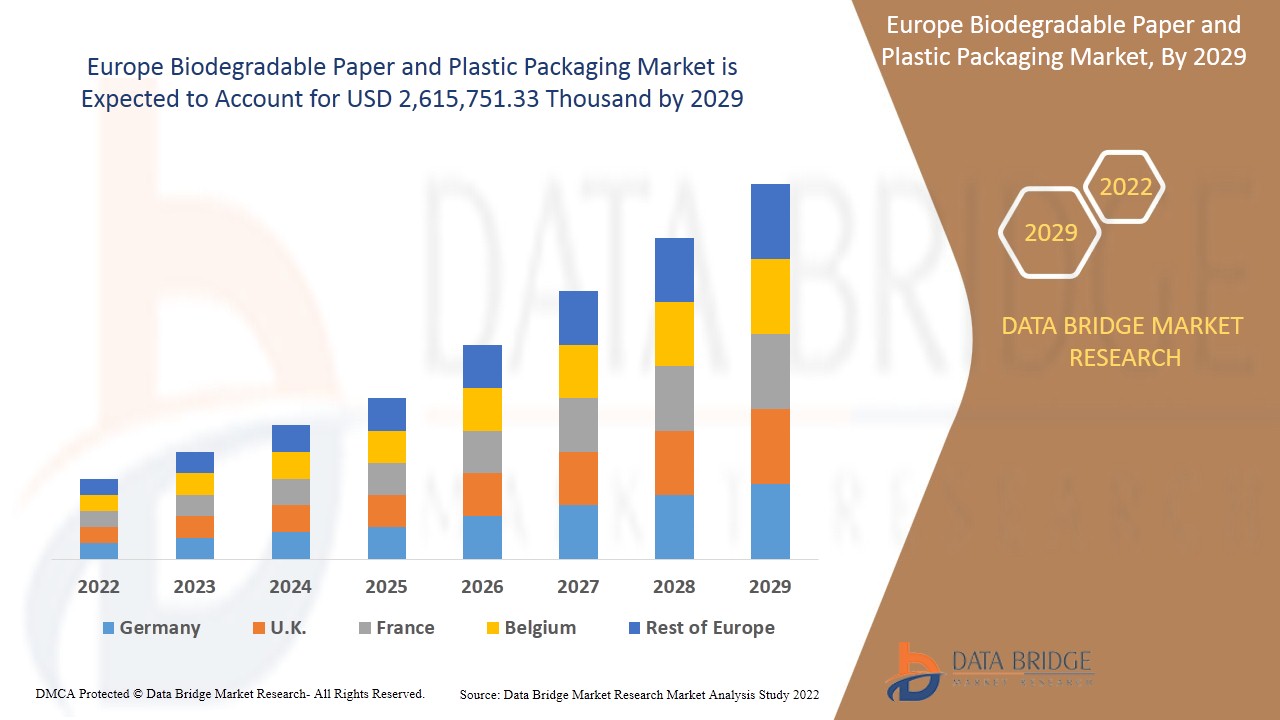

Der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen wird im Prognosezeitraum 2022 bis 2029 voraussichtlich ein Marktwachstum verzeichnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 7,8 % wächst und bis 2029 voraussichtlich 2.615.751,33 Tausend USD erreichen wird. Einer der wichtigsten Treiber des europäischen Marktes für biologisch abbaubare Papier- und Kunststoffverpackungen könnten strengere staatliche Vorschriften in Bezug auf Verpackungen sein.

Biologisch abbaubare Papier- und Kunststoffverpackungen sind umweltfreundliche Rohstoffe, bei deren Herstellung kein Kohlenstoff freigesetzt wird. Aufgrund des steigenden Bewusstseins der Bevölkerung für umweltfreundliche Verpackungen ist die Nachfrage nach biologisch abbaubaren Papier- und Kunststoffverpackungen gestiegen. Dies gilt für verschiedene Branchen wie die Pharma-, Lebensmittel-, Gesundheits- und Umweltindustrie. Die Lebensmittel- und Getränkeindustrie ist aufgrund der verschiedenen Kunststoffarten in hohem Maße auf Verpackungsmaterialien angewiesen.

Das wachsende Bewusstsein der Verbraucher für umweltfreundliche Verpackungen dürfte das Marktwachstum ankurbeln. Der Bedarf an Materialien mit geringerem CO2-Fußabdruck könnte ein potenzieller Markttreiber für den Markt sein. Auch der Ausstieg aus Einwegkunststoffen steigert den Umsatz und Gewinn der auf dem Markt tätigen Akteure.

Die größte Einschränkung für den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen sind die begrenzten Investitionen in die Produktion biologisch abbaubarer Kunststoffe. Darüber hinaus kann ein starker Fokus auf die Produktion von recycelbaren und nicht biologisch abbaubaren Kunststoffen auf biologischer Basis das Marktwachstum bremsen. Die Produktion von Polymilchsäure (PLA) aus Zuckerrohr und Mais dürfte Chancen für den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen schaffen. Die begrenzte Verfügbarkeit von Maschinen und Geräten für biologisch abbaubare Materialien dürfte das Marktwachstum behindern.

Dieser europäische Marktbericht zu biologisch abbaubaren Papier- und Kunststoffverpackungen liefert Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Biologisch abbaubare Papier- und Kunststoffverpackungen in Europa – Marktumfang und Marktgröße

Der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen ist nach Verpackungsart, Produkt, Verwendung, Vertriebskanal, Anwendung, Verpackungsschicht und Endverbraucher segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer Hauptanwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

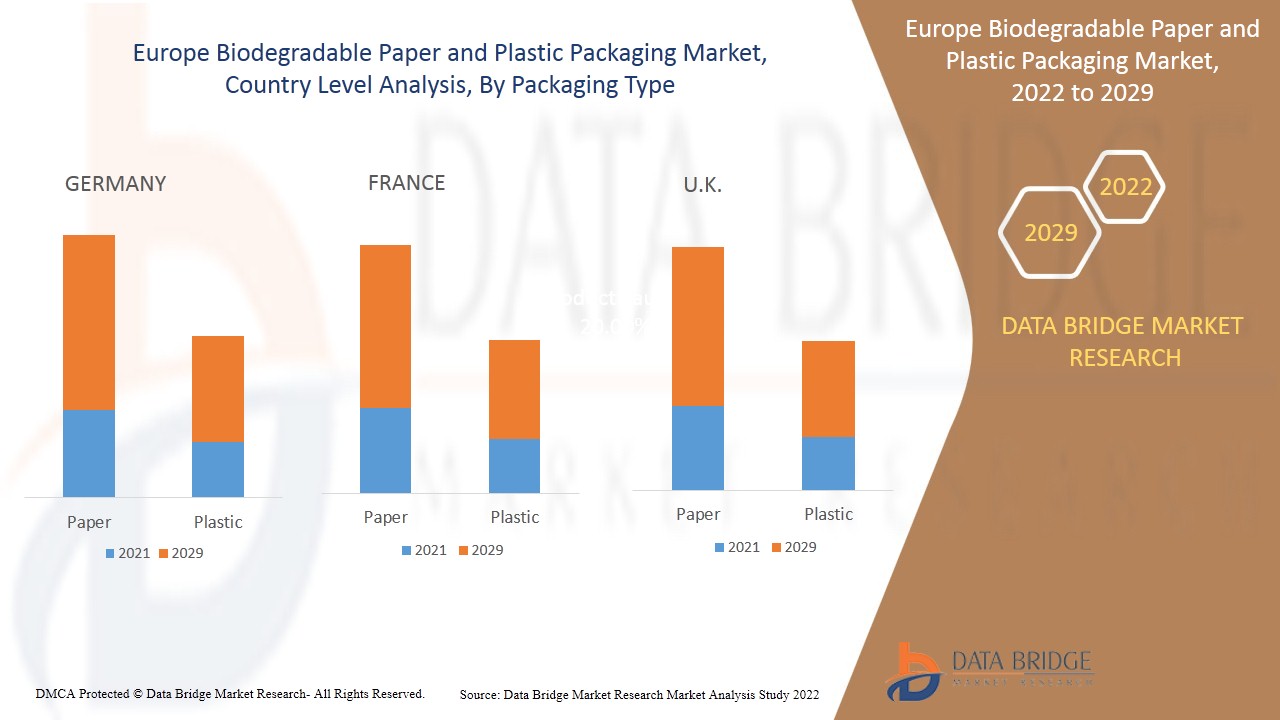

- Auf der Grundlage der Verpackungsart ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Papier und Kunststoff segmentiert. Im Jahr 2022 wird das Papiersegment voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da der Herstellungsprozess von Papier weniger Facharbeiter erfordert und Ressourcen oder Rohstoffe leicht verfügbar sind, was die Nachfrage erhöht.

- Auf der Grundlage des Produkts ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Strohhalme, Beutel, Backbleche, Pappteller, Sandwichbehälter, Portionsbecher, Tabletts, Besteck, Schüsseln, Beutel und Tüten, Deckel und andere unterteilt. Im Jahr 2022 wird das Beutelsegment voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da es langlebig und vielseitig einsetzbar ist, was die Nachfrage erhöht.

- Auf der Grundlage der Verwendung ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Einweg- und Mehrwegverpackungen unterteilt. Im Jahr 2022 wird das Mehrwegsegment voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da es eine unnötige Ausbeutung von Ressourcen und die Vermeidung von Vermüllung verhindert und somit die Nachfrage im Prognosezeitraum erhöht.

- Auf der Grundlage der Vertriebskanäle ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in E-Commerce , Supermärkte/Hypermärkte, Convenience Stores, Fachgeschäfte und andere segmentiert. Im Jahr 2022 wird das Segment Supermärkte/Hypermärkte voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da die Kunden volle Auswahlfreiheit genießen können, was die Nachfrage im Prognosezeitraum erhöht.

- Auf der Grundlage der Anwendung ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Lebensmittelverpackungen, Getränkeverpackungen, Arzneimittelverpackungen, Körper- und Haushaltspflegeverpackungen, Verpackungen für elektronische Geräte und andere unterteilt. Im Jahr 2022 wird das Segment Lebensmittelverpackungen voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da es Lebensmittel sicherer und weniger anfällig für Verunreinigungen macht, was die Nachfrage erhöht.

- Auf der Grundlage der Verpackungsschicht ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Primärverpackungen, Sekundärverpackungen und Tertiärverpackungen unterteilt. Im Jahr 2022 wird das Segment der Primärverpackungen voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da es kostengünstig ist und für Endverbraucher konzipiert ist, die gedruckte Informationen zum Produkt haben, wodurch die Nachfrage im Prognosezeitraum steigt.

- Auf der Grundlage des Endverbrauchers ist der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen in Restaurants, Hotels, Tee- und Kaffeehäuser, Süßwaren- und Snackläden, Cafeterias und andere unterteilt. Im Jahr 2022 wird das Restaurantsegment voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren, da es den Gästen durch Lebensmittel und deren Verpackung verschiedene Kulturen nahebringt, was die Nachfrage im Prognosezeitraum erhöht.

Europa: Markt für biologisch abbaubare Papier- und Kunststoffverpackungen – Länderanalyse

Der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen ist nach Verpackungsart, Produkt, Verwendung, Vertriebskanal, Anwendung, Verpackungsschicht und Endbenutzer segmentiert.

Die im europäischen Marktbericht für biologisch abbaubare Papier- und Kunststoffverpackungen abgedeckten Länder sind Deutschland, Großbritannien, Italien, Frankreich, Spanien, die Schweiz, Russland, die Türkei, Belgien, die Niederlande und das übrige Europa.

Aufgrund des steigenden Bedarfs an Materialien mit geringerem CO2-Fußabdruck wird Deutschland voraussichtlich den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen dominieren. In Frankreich steigert das wachsende Bewusstsein der Verbraucher für umweltfreundliche Verpackungen nachweislich die Nachfrage nach biologisch abbaubaren Papier- und Kunststoffverpackungen in allen Sektoren. In Großbritannien dürften strengere staatliche Vorschriften für Verpackungen die Nachfrage nach biologisch abbaubaren Papier- und Kunststoffverpackungen bei den Endverbrauchern steigern.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit europäischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wachstum in der Branche für biologisch abbaubare Papier- und Kunststoffverpackungen

Der europäische Markt für biologisch abbaubare Papier- und Kunststoffverpackungen bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das in Bezug auf die installierte Basis verschiedener Produktarten für den Markt für biologisch abbaubare Papier- und Kunststoffverpackungen wächst, die Auswirkungen der Technologie anhand von Lebenskurven sowie Änderungen der Regulierungsszenarien für Säuglingsanfangsnahrung und deren Auswirkungen auf den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen. Die Daten sind für den historischen Zeitraum von 2012 bis 2020 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile biologisch abbaubarer Papier- und Kunststoffverpackungen in Europa

Die Wettbewerbslandschaft des europäischen Marktes für biologisch abbaubare Papier- und Kunststoffverpackungen liefert Einzelheiten nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben genannten Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf den europäischen Markt für biologisch abbaubare Papier- und Kunststoffverpackungen.

Zu den wichtigsten Akteuren, die im Bericht behandelt werden, gehören unter anderem Smurfit Kappa, DS Smith, Tetra Pak, Mondi, International Paper, VPK Group, Sonoco Products Company, STOROPACK HANS REICHENECKER GMBH, WestRock Company, Stora Enso, Eurocell srl, Novamont SpA, OSQ, BIO-LUTIONS International AG, TIPA LTD, Robert Cullen Ltd., BioApply, CPS Paper Products, The Biodegradable Bag Company Ltd. und Hosgör Plastik. DBMR-Analysten kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Zum Beispiel,

- Im Oktober 2021 hat die VPK Group den Industriestandort DA Alizay in der Normandie zu einem Zentrum für nachhaltige Entwicklung in der Kreislaufwirtschaft gemacht. Die VPK Group kündigt an, den Umbau der Papiermaschine gemeinsam mit Valmet Oyj durchzuführen.

- Im November 2021 investierte Mondi 20 Millionen Euro, um die Nachhaltigkeit seiner Zellstoffproduktion im Werk Frantschach in Österreich zu verbessern. Diese neue Anlagenausrüstung wird die Zellstoffproduktion von Mondi noch effizienter und nachhaltiger machen. Dies wird weiter dazu beitragen, einen Kundenstamm aufzubauen

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 USAGE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 NEED FOR LOWER CARBON FOOTPRINT MATERIALS

5.1.2 GROWING CONSUMER AWARENESS RELATED TO ECO-FRIENDLY PACKAGING

5.1.3 STRENGHTHENING OF GOVERNMENT REGULATIONS RELATED TO PACKAGING

5.1.4 PHASE OUT OF SINGLE USE PLASTICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF BIODEGRADABLE PACKAGING PRODUCTS

5.2.2 LOW PRODUCTION OF POLYHYDROXYBUTYRATE ACID (PHB)

5.2.3 LIMITED INVESTMENT IN BIODEGRADABLE PLASTIC PRODUCTION

5.2.4 HIGH FOCUS ON RECYCLABLE AND BIO-BASED NON-BIODEGRADABLE PLASTIC PRODUCTION

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF COST-EFFECTIVE BIODEGRADABLE PACKAGING PRODUCTS

5.3.2 PRODUCTION OF POLYLACTIC ACID (PLA) FROM SUGARCANE AND CORN

5.3.3 BIODEGRADABLE PACKAGING PRODUCTION FOR HEALTHCARE INDUSTRY

5.4 CHALLENGES

5.4.1 HIGH FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 LIMITED AVAILABILITY OF MACHINES AND EQUIPMENT FOR PRODUCTION OF BIO-BASED MATERIALS

5.4.3 LOW YIELD IN PRODUCTION OF BIO-BASED PLASTIC RESINS

6 IMPACT OF COVID-19 ON EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE BIODEGRADABLE PLASTIC & PAPER PACKAGING MARKET

6.2 STRATERGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 PRICE IMPACT

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BAGS

7.2.1 STANDARD CARRY BAGS

7.2.2 STAND UP BAGS

7.2.2.1 ROUND BOTTOM GUSSET TYPE

7.2.2.2 SEAL BOTTOM TYPE

7.2.2.3 PLOW BOTTOM TYPE

7.2.2.4 SIDE GUSSET TYPE

7.2.2.5 THREE SIDE SEALED

7.2.2.6 FOUR SIDE SEALED

7.2.2.7 OTHERS

7.2.3 T-SHIRT PLASTIC BAGS

7.2.4 SELF-OPENING STYLE BAGS

7.2.5 ZIPPER BAGS

7.2.6 FOOD SAFE BARRIER BAGS

7.2.7 SMELL PROOF BAGS

7.2.8 PINCH BOTTOM BAGS

7.2.9 OTHERS

7.3 TRAYS

7.4 PAPER PLATES

7.5 BOWLS

7.6 CLAMSHELL SANDWICH CONTAINERS

7.7 POUCHES AND SACHETS

7.8 PORTION CUPS

7.9 STRAWS

7.1 CUTLERY

7.11 LIDDED

7.12 BAKING SHEETS

7.13 OTHERS

8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 PAPER

8.2.1 CORRUGATED BOARD

8.2.2 BOXBOARD

8.2.3 FLEXIBLE PAPER

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 PLA

8.3.2 STARCH BASED PLASTIC

8.3.3 PBS

8.3.4 PHA

8.3.5 PCL

8.3.6 OTHERS

9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE

9.1 OVERVIEW

9.2 REUSABLE

9.3 SINGLE-USE

10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 CONVENIENCE STORES

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PACKAGING

12.2.1 FOOD PACKAGING, BY APPLICATION

12.2.1.1 FRUITS

12.2.1.2 VEGETABLE

12.2.1.3 BAKERY PRODUCTS

12.2.1.3.1 CAKES

12.2.1.3.2 PASTRIES

12.2.1.3.3 BISCUITS

12.2.1.3.4 BREAD

12.2.1.3.5 OTHERS

12.2.1.4 COOKED FOOD

12.2.1.4.1 PIZZA

12.2.1.4.2 SANDWICH

12.2.1.4.3 BURGER

12.2.1.4.4 OTHERS

12.2.1.5 MEAT, SEAFOOD AND POULTRY

12.2.1.6 DAIRY PRODUCTS

12.2.1.6.1 EGGS

12.2.1.6.2 CHEESE

12.2.1.6.3 OTHERS

12.2.1.7 OTHERS

12.3 BEVERAGE PACKAGING

12.4 ELECTRONIC APPLIANCE PACKAGING

12.5 PERSONAL & HOME CARE PACKAGING

12.6 PHARMACEUTICALS PACKAGING

12.7 OTHERS

13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESTAURANTS

13.2.1 RESTAURANTS, BY PRODUCT

13.2.1.1 BAGS

13.2.1.2 TRAYS

13.2.1.3 PAPER PLATES

13.2.1.4 BOWLS

13.2.1.5 CLAMSHELL SANDWICH CONTAINERS

13.2.1.6 POUCHES AND SACHETS

13.2.1.7 PORTION CUPS

13.2.1.8 STRAWS

13.2.1.9 CUTLERY

13.2.1.10 LIDDED

13.2.1.11 BAKING SHEETS

13.2.1.12 OTHERS

13.3 SWEETS & SNACKS STORES

13.3.1 SWEETS & SNACKS STORES, BY PRODUCT

13.3.1.1 BAGS

13.3.1.2 TRAYS

13.3.1.3 PAPER PLATES

13.3.1.4 BOWLS

13.3.1.5 CLAMSHELL SANDWICH CONTAINERS

13.3.1.6 POUCHES AND SACHETS

13.3.1.7 PORTION CUPS

13.3.1.8 STRAWS

13.3.1.9 CUTLERY

13.3.1.10 LIDDED

13.3.1.11 BAKING SHEETS

13.3.1.12 OTHERS

13.4 CAFETERIA

13.4.1 CAFETERIA, BY PRODUCT

13.4.1.1 BAGS

13.4.1.2 TRAYS

13.4.1.3 PAPER PLATES

13.4.1.4 BOWLS

13.4.1.5 CLAMSHELL SANDWICH CONTAINERS

13.4.1.6 POUCHES AND SACHETS

13.4.1.7 PORTION CUPS

13.4.1.8 STRAWS

13.4.1.9 CUTLERY

13.4.1.10 LIDDED

13.4.1.11 BAKING SHEETS

13.4.1.12 OTHERS

13.5 TEA AND COFFEE SHOPS

13.5.1 TEA AND COFFEE SHOPS, BY PRODUCT

13.5.1.1 BAGS

13.5.1.2 TRAYS

13.5.1.3 PAPER PLATES

13.5.1.4 BOWLS

13.5.1.5 CLAMSHELL SANDWICH CONTAINERS

13.5.1.6 POUCHES AND SACHETS

13.5.1.7 PORTION CUPS

13.5.1.8 STRAWS

13.5.1.9 CUTLERY

13.5.1.10 LIDDED

13.5.1.11 BAKING SHEETS

13.5.1.12 OTHERS

13.6 HOTELS

13.6.1 HOTELS, BY PRODUCT

13.6.1.1 BAGS

13.6.1.2 TRAYS

13.6.1.3 PAPER PLATES

13.6.1.4 BOWLS

13.6.1.5 CLAMSHELL SANDWICH CONTAINERS

13.6.1.6 POUCHES AND SACHETS

13.6.1.7 PORTION CUPS

13.6.1.8 STRAWS

13.6.1.9 CUTLERY

13.6.1.10 LIDDED

13.6.1.11 BAKING SHEETS

13.6.1.12 OTHERS

13.7 OTHERS

13.7.1 OTHERS, BY PRODUCT

13.7.1.1 BAGS

13.7.1.2 TRAYS

13.7.1.3 PAPER PLATES

13.7.1.4 BOWLS

13.7.1.5 CLAMSHELL SANDWICH CONTAINERS

13.7.1.6 POUCHES AND SACHETS

13.7.1.7 PORTION CUPS

13.7.1.8 STRAWS

13.7.1.9 CUTLERY

13.7.1.10 LIDDED

13.7.1.11 BAKING SHEETS

13.7.1.12 OTHERS

14 EUROPE

14.1 GERMANY

14.2 FRANCE

14.3 U.K.

14.4 ITALY

14.5 SPAIN

14.6 RUSSIA

14.7 BELGIUM

14.8 NETHERLANDS

14.9 SWITZERLAND

14.1 TURKEY

14.11 REST OF EUROPE

15 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 EXPANSIONS

15.4 NEW PRODUCT DEVELOPMENT

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SMURFIT KAPPA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 DS SMITH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 TETRA PAK

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT UPDATES

17.4 MONDI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 INTERNATIONAL PAPER

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 VPK GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATE

17.8 STOROPACK HANS REICHENECKER GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOAPPLY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 BIO-LUTIONS INTERNATIONAL AG

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 CPS PAPER PRODUCTS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 EUROCELL SRL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATE

17.13 HOŞGÖR PLASTIK

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 NOVAMONT S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 OSQ

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ROBERT CULLEN LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 STORA ENZO

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATE

17.18 THE BIODEGRADABLE BAG COMPANY LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 TIPA LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 WEST ROCK COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

18 QUESTIONNAIRES

19 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 IMPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS.; HS CODE - 3923 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS .; HS CODE - 3923 (USD THOUSAND)

TABLE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND )

TABLE 13 EUROPE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DAIRY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 26 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 28 GERMANY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 50 FRANCE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 FRANCE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 58 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 FRANCE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 U.K. BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.K. FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 U.K. COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 94 ITALY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 ITALY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 ITALY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 108 ITALY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ITALY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 ITALY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ITALY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 ITALY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ITALY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 116 SPAIN BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SPAIN PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 122 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 124 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SPAIN SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 SPAIN CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SPAIN TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 SPAIN HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 SPAIN OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 RUSSIA BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 160 BELGIUM BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 BELGIUM PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 166 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 168 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 BELGIUM DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 174 BELGIUM RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 176 BELGIUM CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 180 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 182 NETHERLANDS BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 NETHERLANDS PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 189 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 196 NETHERLANDS RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 NETHERLANDS SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 198 NETHERLANDS CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 NETHERLANDS TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 NETHERLANDS HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 NETHERLANDS OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 204 SWITZERLAND BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 226 TURKEY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 TURKEY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 228 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 TURKEY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 TURKEY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 232 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 233 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 234 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 TURKEY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 236 TURKEY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 TURKEY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 TURKEY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 240 TURKEY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 TURKEY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 242 TURKEY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 TURKEY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 TURKEY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 TURKEY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 246 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

Abbildungsverzeichnis

FIGURE 1 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE USAGE LIFE LINE CURVE

FIGURE 7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING CONSUMER AWARENESS RELATED TO ECOFRIENDLY PACKAGING IS DRIVING THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

FIGURE 17 VOLUME OF PLASTIC POLYMERS USE IN THE EUROPEAN UNION (MILLION TONS), 2018

FIGURE 18 EUROPE BIOPLASTICS MARKET, BY TYPE (IN EUROPE), 2018

FIGURE 19 PRODUCTION CAPACITY OF BIOPLASTICS, BY MATERIAL TYPE, 2019

FIGURE 20 TYPES OF NATIONAL RESTRICTIONS OR BANS IN THE WORLD (%)

FIGURE 21 BANS ON SPECIFIC PRODUCTS (N) ASSOCIATED WITH FOOD SERVICE AND DELIVERY

FIGURE 22 PRODUCTION COST OF PLA, BY OPERATING EXPENDITURE (%)

FIGURE 23 FEEDSTOCK EFFICIENCY SCORE, 2016

FIGURE 24 LAND USE PER TON OF BIOBASED PLA, BIOBASED PE AND BIOETHANOL

FIGURE 25 PRODUCER PRICE INDEX BY INDUSTRY: PLASTICS MATERIAL AND RESINS MANUFACTURING

FIGURE 26 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 27 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2021

FIGURE 28 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2021

FIGURE 29 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2021

FIGURE 31 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 32 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2021

FIGURE 33 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 38 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY SHARE 2021(%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.