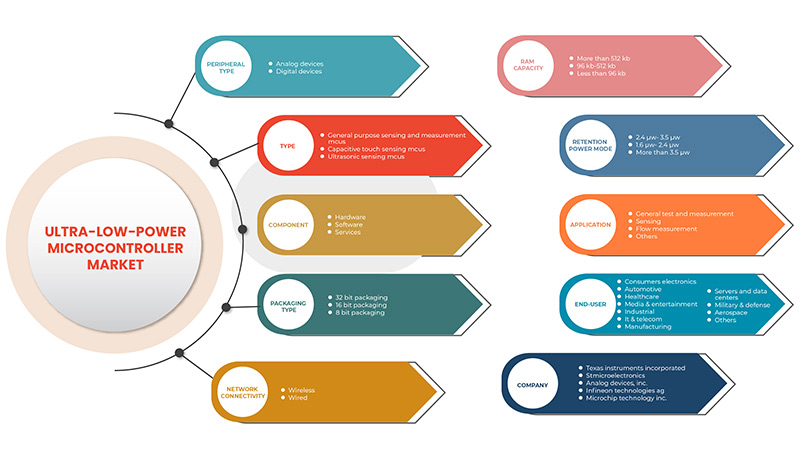

Asia-Pacific Ultra-Low-Power Microcontroller Market, By Peripheral Type (Analog Devices and Digital Devices), Type (General Purpose Sensing and Measurement MCUs, Capacitive Touch Sensing MCUs and Ultrasonic Sensing MCUs), Component (Hardware, Software and Services), Packaging Type (8 Bit Packaging, 16 Bit Packaging and 32 Bit Packaging), Network Connectivity (Wireless and Wired), RAM Capacity (Less Than 96 kb, 96 kb-512 kb and More Than 512 kb), retention power mode (1.6 μW- 2.4 μW, 2.4 μW- 3.5 μW and More Than 3.5 μW), Application (General Test & Measurement, Sensing, Flow Measurement and Others), End-User (Healthcare, Industrial, Manufacturing, It & Telecom, Military & Defence, Aerospace, Media & Entertainment, Automotive, Servers & Data Centers, Consumer Electronics and Others) Industry Trends and Forecast to 2029

Asia-Pacific Ultra-Low-Power Microcontroller Market Analysis and Size

Ultra-low-power microcontroller is the type of semiconductor manufactured to have computing power with the lowest energy consumption for applications such as smart devices, autonomous vehicles, robots, industrial processes, edge AI devices, and others.

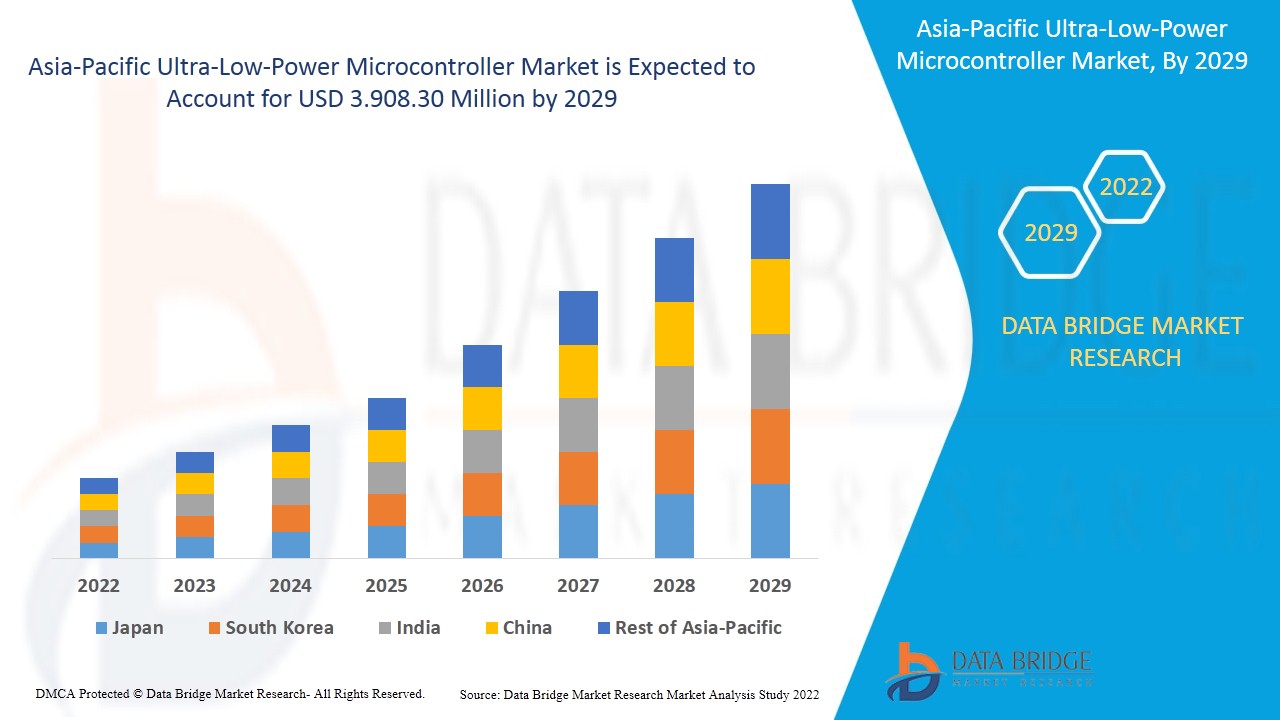

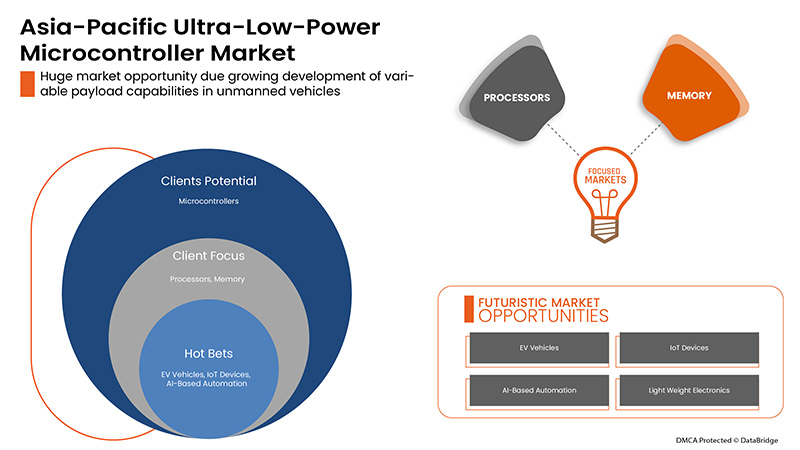

With increasing digitalization, the demand for power electronics worldwide is increasing, thus driving the demand for these ultra-low-power microcontrollers. Data Bridge Market Research analyses that the Asia-Pacific ultra-low-power microcontroller market is expected to reach the value of USD 3.908.30 million by the year 2029, at a CAGR of 11.5% during the forecast period. MCUs have wide applications and are utilized in almost all the industrial, commercial or residential sectors. Growing emphasis on energy conservation in electronic devices is driving the world towards using more efficient and power-conserving equipment, this has been driving the demand of ultra-low-power microcontrollers in the market.

The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Typ (Analoggeräte und Digitalgeräte), Typ (MCUs für allgemeine Sensor- und Messanwendungen, MCUs für kapazitive Berührungssensoren und MCUs für Ultraschallsensoren), Komponente (Hardware, Software und Dienste), Verpackungstyp (8-Bit-Verpackung, 16-Bit-Verpackung und 32-Bit-Verpackung), Netzwerkkonnektivität (drahtlos und kabelgebunden), RAM-Kapazität (weniger als 96 kb, 96 kb-512 kb und mehr als 512 kb), Speicherleistungsmodus (1,6 μW- 2,4 μW, 2,4 μW- 3,5 μW und mehr als 3,5 μW), Anwendung (Allgemeine Tests und Messungen, Sensorik, Durchflussmessung und andere), Endbenutzer (Gesundheitswesen, Industrie, Fertigung, IT und Telekommunikation, Militär und Verteidigung, Luft- und Raumfahrt, Medien und Unterhaltung, Automobilindustrie, Server und Rechenzentren, Unterhaltungselektronik und andere), |

|

Abgedeckte Länder |

China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Rest des asiatisch-pazifischen Raums (APAC) im asiatisch-pazifischen Raum (APAC) |

|

Abgedeckte Marktteilnehmer |

Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Zilog, Inc. |

Marktdefinition

Mit einem Mikrocontroller mit ultraniedrigem Stromverbrauch (ULP) können Edge-Knoten lokalisierte Daten mit minimalem Systemstromverbrauch intelligent verarbeiten. Dadurch können Kunden die Batterielebensdauer und die Zeit zwischen den Ladevorgängen verlängern und so eine längere Nutzung ermöglichen. Kleinere Batteriegrößen und längere Zeiträume zwischen Produktwechseln vor Ort bedeuten Kosteneinsparungen für Endbenutzer. Ein extrem niedriger Stromverbrauch ist eine sehr wichtige Voraussetzung, um mit kleinen Energiequellen zu arbeiten (um die Größe zu reduzieren) und keine lokalen Erwärmungsprobleme zu verursachen.

Die Marktdynamik des Marktes für Mikrocontroller mit ultraniedrigem Stromverbrauch umfasst:

- Bedarf an energieeffizienten Leistungselektronikkomponenten steigt

Entwicklungen in der eingebetteten Technologie führten zur Entwicklung hocheffizienter MCUs. Der Strombedarf dieser MCUs stieg proportional zu ihren Funktionen und Fähigkeiten. Um energieeffiziente und kompakte Anwendungen mit eingebetteten Systemen zu entwickeln, muss daher der Stromverbrauch von Mikrocontrollern reduziert werden. Ein niedriger Stromverbrauch trägt auch dazu bei, das Gerät kompakter zu machen, da er weniger Strom benötigt. Ein Gerät mit extrem niedrigem Stromverbrauch kann lange Zeit funktionieren, sogar mit einer kleineren Batterie. Dies hat viele Unternehmen dazu ermutigt, ultra-stromsparende und energieeffiziente MCUs herzustellen, ohne Kompromisse bei der Leistung einzugehen, was voraussichtlich das Marktwachstum vorantreiben wird.

- Wachsende Popularität von IoT-Geräten mit geringem Batteriebetrieb

Es besteht eine wachsende Nachfrage nach MCUs mit ultraniedrigem Stromverbrauch in IoT-Anwendungen, um Energie zu sparen und das Gerät kompakter zu machen. Dies dürfte das Wachstum auf dem Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch im asiatisch-pazifischen Raum vorantreiben.

- Steigende Nachfrage nach MCUs mit geringem Stromverbrauch in intelligenten Geräten

Der Markt für tragbare Anwendungen für persönliches Wohlbefinden und medizinische Anwendungen wächst schnell. Neue technologische Fortschritte und veränderte Lebensstile haben zu einer zunehmenden Verbreitung intelligenter Geräte auf der ganzen Welt geführt, was die Nachfrage nach Mikrocontrollern mit ultraniedrigem Stromverbrauch auf dem Markt erhöht.

- Steigende Nachfrage nach Mikrocontrollern in Edge-KI

Die Nachfrage nach Mikrocontrollern mit ultraniedrigem Stromverbrauch für die Durchführung von ML am Rande ist zu einem sehr heißen Entwicklungsgebiet geworden. Hersteller arbeiten an der Entwicklung von Mikrocontrollern mit ultraniedrigem Stromverbrauch, mit denen Inferenzen und letztendlich Training auf kleinen, ressourcenbeschränkten Geräten mit niedrigem Stromverbrauch, insbesondere Mikrocontrollern, ausgeführt werden können.

- Steigende Nachfrage nach Smart-Home- und Gebäudemanagement-Anwendungen

Mit der Entwicklung und Verbreitung des Smart-Home-Marktes steigt die Nachfrage nach immer schlankeren Geräten mit kleinerem Formfaktor und höherer Energieeffizienz. Dies hat die Nachfrage nach Mikrocontrollern mit extrem niedrigem Stromverbrauch erhöht.

Einschränkungen/Herausforderungen für den Markt für Ultra-Low-Power-Mikrocontroller

- Riesiges CO2-Problem im Halbleiterfertigungssektor

Chiphersteller tragen maßgeblich zur Klimakrise bei. Sie benötigen enorme Mengen an Energie und Wasser. Daher könnte der ressourcenintensive Herstellungsprozess eines ULP-Mikrocontrollers das Wachstum des Marktes bremsen.

- Engpässe bei der Chipversorgung

Die Führungskräfte und Manager multinationaler Konzerne im asiatisch-pazifischen Raum sind besorgt über den Halbleitermangel, der in zahlreichen Ländern die Produktion und den Verkauf beeinträchtigt hat, und eine baldige Lösung ist nicht in Sicht. Dies stellt eine erhebliche Herausforderung für das Wachstum des Marktes dar.

Dieser Marktbericht für Mikrocontroller mit ultraniedrigem Stromverbrauch enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, dem Einfluss inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Jüngste Entwicklungen

- Im Juni 2021 gab Texas Instruments Incorporated Pläne bekannt, die 300-mm-Halbleiterfabrik (oder „Fab“) von Micron Technology in Lehi, Utah, für 900 Millionen USD zu übernehmen. Damit wollte das Unternehmen seinen Wettbewerbsvorteil in Fertigung und Technologie stärken. Dies ermöglichte es dem Unternehmen, eine größere Kontrolle über seine Lieferkette auszuweiten.

- Im Februar 2021 kündigte STMicroelectronics die Einführung einer neuen Generation extrem stromsparender Mikrocontroller (MCUs) an. Die extrem stromsparenden MCUs der STM32U5-Serie wurden entwickelt, um die anspruchsvollsten Strom-/Leistungsanforderungen intelligenter Anwendungen zu erfüllen, darunter Wearables, persönliche medizinische Geräte, Heimautomatisierung und industrielle Sensoren. Die neue STM32U5-Serie kombiniert den effizienten Arm Cortex-M33-Kern mit den innovativen proprietären Stromsparfunktionen und On-Chip-IP von ST, wodurch der Energiebedarf gesenkt und die Leistung gesteigert wird.

Marktumfang für Ultra-Low-Power-Mikrocontroller im asiatisch-pazifischen Raum

Der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch ist segmentiert nach Peripherietyp, Typ, Komponente, Verpackungstyp, Netzwerkkonnektivität, RAM-Kapazität, Speicherleistungsmodus, Anwendung und Endbenutzer. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Peripheriegerättyp

- Analoge Geräte

- Digitale Geräte

Auf der Grundlage des Peripherietyps ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in analoge und digitale Geräte segmentiert.

Typ

- Allgemeine Sensor- und Mess-MCUs

- Kapazitive Berührungssensor-MCUs

- Ultraschallsensor MCUS

Auf der Grundlage des Typs ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in MCUS für allgemeine Sensor- und Messzwecke, MCUS für kapazitive Berührungssensoren und MCUS für Ultraschallsensoren segmentiert.

Komponente

- Hardware

- Software

- Dienstleistungen

Auf der Grundlage der Komponenten ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in Hardware, Software und Dienstleistungen segmentiert.

Verpackungsart

- 8-Bit-Verpackung

- 16-Bit-Verpackung

- 32-Bit-Verpackung

Auf der Grundlage des Verpackungstyps ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in 8-Bit-Verpackungen, 16-Bit-Verpackungen und 32-Bit-Verpackungen segmentiert.

Netzwerkkonnektivität

- Verdrahtet

- Kabellos

Auf der Grundlage der Netzwerkkonnektivität ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in drahtlos und kabelgebunden unterteilt.

RAM-Kapazität

- Weniger als 96 kb,

- 96 kb-512 kb

- Mehr als 512 kb

Auf Grundlage der RAM-Kapazität ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in weniger als 96 KB, 96 KB–512 KB und mehr als 512 KB segmentiert.

Retention-Power-Modus

- 1,6 μW – 2,4 μW,

- 2,4 μW – 3,5 μW

- Mehr als 3,5 μW

Auf der Grundlage des Energiesparmodus ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in 1,6 μW – 2,4 μW, 2,4 μW – 3,5 μW und mehr als 3,5 μW segmentiert.

Anwendung

- Allgemeine Test- und Messtechnik

- Sensorik

- Durchflussmessung

- Sonstiges

Auf Grundlage der Anwendung ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in allgemeine Test- und Messtechnik, Sensorik, Durchflussmessung und Sonstiges segmentiert.

Endbenutzer

- Gesundheitspflege

- Industrie

- Herstellung

- IT und Telekommunikation

- Militär & Verteidigung

- Luft- und Raumfahrt

- Medien & Unterhaltung

- Automobilindustrie

- Server und Rechenzentren

- Unterhaltungselektronik

- Sonstiges

Auf der Grundlage des Endbenutzers ist der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch in die Bereiche Gesundheitswesen, Industrie, Fertigung, IT und Telekommunikation, Militär und Verteidigung, Luft- und Raumfahrt, Medien und Unterhaltung, Automobil, Server und Rechenzentren, Unterhaltungselektronik und andere unterteilt.

Regionale Analyse/Einblicke zum Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch

Der Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Peripheriegerättyp, Typ, Komponente, Verpackungstyp, Netzwerkkonnektivität, RAM-Kapazität, Energiesparmodus, Anwendung und Endbenutzer wie oben angegeben bereitgestellt.

Die im Marktbericht für Mikrocontroller mit ultraniedrigem Stromverbrauch abgedeckten Länder sind China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, die Philippinen und der Rest der Region Asien-Pazifik (APAC).

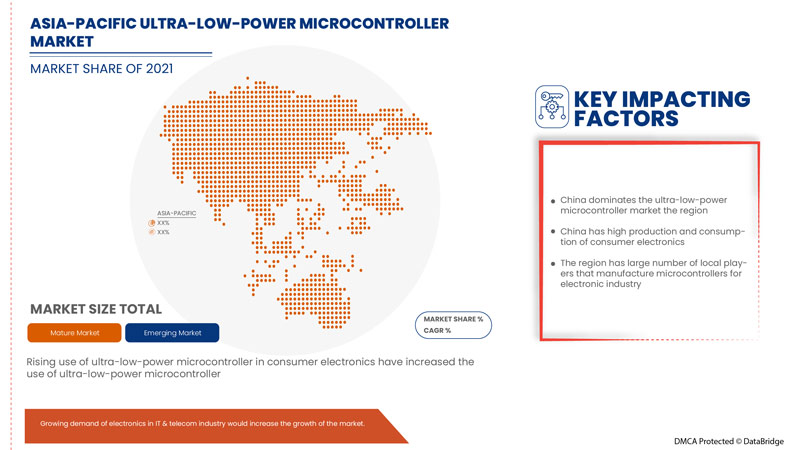

China dominiert den Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch, da es in der Region eine große Anzahl von Herstellern und Fertigungsbetrieben gibt. Die heimische MCU-Industrie Chinas versucht auch, auf den Weltmarkt vorzudringen, indem sie chinesische Automobilhersteller beliefert und Joint Ventures zwischen inländischen und internationalen Automobilherstellern beliefert.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalyse, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Mikrocontrollern mit ultraniedrigem Stromverbrauch

Die Wettbewerbslandschaft auf dem Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch.

Zu den wichtigsten Akteuren auf dem Markt für Mikrocontroller mit ultraniedrigem Stromverbrauch zählen unter anderem Texas Instruments Incorporated, STMicroelectronics, Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., Ambiq Micro, Inc., Broadcom, EM Microelectronics, ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD., Holtek Semiconductor Inc., LAPIS Semiconductor, Co., Ltd., Nuvoton Technology Corporation, NXP Semiconductors, Renesas Electonics Corporation, Seiko Epson Corporation, Semiconductor Components Industries, LLC, Silicon Laboratories, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION und Zilog, Inc.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 APPLICATION COVERAGE GRID

2.9 CHALLENGE MATRIX

2.1 MULTIVARIATE MODELING

2.11 PERIPHERAL TYPE TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS

5.1.2 GROWING POPULARITY OF LOW-BATTERY-POWERED IOT DEVICES

5.1.3 INCREASING DEMAND FOR LOW POWER CONSUMING MCU IN SMART DEVICES

5.1.4 RISING DEMAND FOR MICROCONTROLLERS IN EDGE AI

5.1.5 INCREASING DEMAND FOR SMART HOME AND BUILDING MANAGEMENT APPLICATIONS

5.2 RESTRAINTS

5.2.1 DESIGN COMPLEXITIES IN ULTRA-LOW-POWER MICROCONTROLLER

5.2.1 HUGE CARBON FOOTPRINT ISSUES IN SEMICONDUCTOR MANUFACTURING SECTOR

5.3 OPPORTUNITIES

5.3.1 INCREASING ADOPTION OF POWER ELECTRONICS IN AUTOMOTIVE TECHNOLOGIES

5.3.2 SURGE IN GOVERNMENT INVESTMENTS TO SUPPORT IOT GROWTH ACROSS THE GLOBE

5.3.3 INCREASING FOCUS ON ENERGY CONSERVATION AND ENVIRONMENTAL RESPONSIBILITY

5.4 CHALLENGES

5.4.1 CHIP SUPPLY SHORTAGES

5.4.2 LOWER ADOPTION OF ULTRA-LOW-POWER MICROCONTROLLERS THAN LOW AND HIGH-POWER MICROCONTROLLERS

6 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE

6.1 OVERVIEW

6.2 ANALOG DEVICES

6.3 DIGITAL DEVICES

7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE

7.1 OVERVIEW

7.2 GENERAL PURPOSE SENSING AND MEASUREMENT MCUS

7.3 CAPACITIVE TOUCH SENSING MCUS

7.4 ULTRASONIC SENSING MCUS

8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 PROCESSORS

8.2.2 MEMORY

8.2.3 POWER SUPPLY UNIT

8.2.4 SENSORS

8.2.5 CONTROLLER

8.2.6 OTHERS

8.3 SOFTWARE

8.4 SERVICES

8.4.1 IMPLEMENTATION & INTEGRATION

8.4.2 TRAINING & CONSULTING

8.4.3 SUPPORT & MAINTENANCE

9 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 32 BIT PACKAGING

9.3 16 BIT PACKAGING

9.4 8 BIT PACKAGING

10 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY

10.1 OVERVIEW

10.2 WIRELESS

10.3 WIRED

11 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY

11.1 OVERVIEW

11.2 MORE THAN 512 KB

11.3 96 KB-512 KB

11.4 LESS THAN 96 KB

12 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE

12.1 OVERVIEW

12.2 2.4 ΜW- 3.5 ΜW

12.3 1.6 ΜW- 2.4 ΜW

12.4 MORE THAN 3.5 ΜW

13 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 GENERAL TEST AND MEASUREMENT

13.3 SENSING

13.4 FLOW MEASUREMENT

13.5 OTHERS

14 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER

14.1 OVERVIEW

14.2 CONSUMERS ELECTRONICS

14.2.1 SMARTPHONES

14.2.2 DESKTOP

14.2.3 TABLETS

14.2.4 LAPTOPS

14.2.5 SMART WATCHES

14.3 AUTOMOTIVE

14.3.1 INFOTAINMENT

14.3.2 ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

14.4 HEALTHCARE

14.4.1 PORTABLE MEDICAL DEVICES

14.4.2 WEARABLE MEDICAL PATCHES

14.5 MEDIA & ENTERTAINMENT

14.6 INDUSTRIAL

14.6.1 BUILDING AUTOMATION

14.6.2 ROBOTICS

14.6.3 MACHINE VISION

14.6.4 AUTOMATED GUIDED VEHICLES

14.6.5 HUMAN–MACHINE INTERFACE (HMI)

14.7 IT & TELECOM

14.8 MANUFACTURING

14.9 SERVERS AND DATA CENTERS

14.1 MILITARY & DEFENSE

14.11 AEROSPACE

14.11.1 AVIONICS AND DEFENSE SYSTEMS

14.11.2 UNMANNED AERIAL VEHICLES

14.12 OTHERS

15 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION

15.1 ASIA-PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 SOUTH KOREA

15.1.4 INDIA

15.1.5 AUSTRALIA

15.1.6 INDONESIA

15.1.7 MALAYSIA

15.1.8 SINGAPORE

15.1.9 THAILAND

15.1.10 PHILIPPINES

15.1.11 REST OF ASIA-PACIFIC

16 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 TEXAS INSTRUMENTS INCORPORATED

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 STMICROELECTRONICS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 ANALOG DEVICES, INC.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 INFINEON TECHNOLOGIES AG

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MICROCHIP TECHNOLOGY INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 RENESAS ELECTRONICS CORPORATION

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 NXP SEMICONDUCTORS

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AMBIQ MICRO, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BROADCOM

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EM MICROELECTRONIC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 E-PEAS

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 ESPRESSIF SYSTEMS (SHANGHAI) CO., LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 HOLTEK SEMICONDUCTOR INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 LAPIS SEMICONDUCTOR CO., LTD.

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 NUVOTON TECHNOLOGY CORPORATION

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PROFICHIP USA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 SEIKO EPSON CORPORATION

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENTS

18.18 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SILICON LABORATORIES

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 ZILOG, INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 3 ASIA PACIFIC ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC ANALOG DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 5 ASIA PACIFIC DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DIGITAL DEVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 9 ASIA PACIFIC GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC GENERAL PURPOSE SENSING AND MEASUREMENT MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 11 ASIA PACIFIC CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CAPACITIVE TOUCH SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 13 ASIA PACIFIC ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ULTRASONIC SENSING MCUS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 15 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 17 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 19 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 ASIA PACIFIC SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC SOFTWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 23 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 25 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 27 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 29 ASIA PACIFIC 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC 32 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 31 ASIA PACIFIC 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC 16 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 33 ASIA PACIFIC 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC 8 BIT PACKAGING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 35 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 37 ASIA PACIFIC WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC WIRELESS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 39 ASIA PACIFIC WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC WIRED IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 41 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 43 ASIA PACIFIC MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC MORE THAN 512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 45 ASIA PACIFIC 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC 96 KB-512 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 47 ASIA PACIFIC LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC LESS THAN 96 KB IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 49 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 51 ASIA PACIFIC 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC 2.4 ΜW- 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 53 ASIA PACIFIC 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC 1.6 ΜW- 2.4 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 55 ASIA PACIFIC MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 ASIA PACIFIC MORE THAN 3.5 ΜW IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 57 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 59 ASIA PACIFIC GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 ASIA PACIFIC GENERAL TEST AND MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 61 ASIA PACIFIC SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 ASIA PACIFIC SENSING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 63 ASIA PACIFIC FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 ASIA PACIFIC FLOW MEASUREMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 65 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 67 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 69 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 70 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 71 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ASIA PACIFIC CONSUMER ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 73 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 75 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ASIA PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 77 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 79 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 ASIA PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 81 ASIA PACIFIC MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 ASIA PACIFIC MEDIA & ENTERTAINMENT IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 83 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 85 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ASIA PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 87 ASIA PACIFIC IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 88 ASIA PACIFIC IT & TELECOM IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 89 ASIA PACIFIC MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 90 ASIA PACIFIC MANUFACTURING IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 91 ASIA PACIFIC SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 92 ASIA PACIFIC SERVERS AND DATA CENTERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 93 ASIA PACIFIC MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 94 ASIA PACIFIC MILITARY & DEFENSE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 95 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 96 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 97 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 ASIA PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 99 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 100 ASIA PACIFIC OTHERS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY REGION, 2020-2029 (UNITS)

TABLE 101 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 102 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 103 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 104 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 105 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 107 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 108 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 109 ASIA-PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ASIA-PACIFIC HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 111 ASIA-PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ASIA-PACIFIC SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 113 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 114 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 115 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 116 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 117 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 118 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 119 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 120 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 121 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 123 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 124 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 125 ASIA-PACIFIC CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ASIA-PACIFIC CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 ASIA-PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 ASIA-PACIFIC AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 129 ASIA-PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ASIA-PACIFIC HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 131 ASIA-PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ASIA-PACIFIC INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 133 ASIA-PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ASIA-PACIFIC AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 135 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 137 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 139 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 140 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 141 CHINA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 CHINA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 143 CHINA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 CHINA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 145 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 146 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 147 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 148 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 149 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 150 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 151 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 152 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 153 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 155 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 156 CHINA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 157 CHINA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 CHINA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 CHINA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 CHINA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 161 CHINA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 CHINA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 163 CHINA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 CHINA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 165 CHINA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 CHINA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 167 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 168 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 169 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 171 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 172 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 173 JAPAN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 JAPAN HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 175 JAPAN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 JAPAN SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 177 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 178 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 179 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 180 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 181 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 182 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 183 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 184 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 185 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 187 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 188 JAPAN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 189 JAPAN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 JAPAN CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 191 JAPAN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 JAPAN AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 193 JAPAN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 JAPAN HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 195 JAPAN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 JAPAN INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 197 JAPAN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 JAPAN AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 199 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 201 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 203 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 204 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 205 SOUTH KOREA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 SOUTH KOREA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 207 SOUTH KOREA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 SOUTH KOREA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 209 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 210 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 211 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 212 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 213 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 214 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 215 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 216 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 217 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 219 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 220 SOUTH KOREA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 221 SOUTH KOREA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 222 SOUTH KOREA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 223 SOUTH KOREA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 SOUTH KOREA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 225 SOUTH KOREA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SOUTH KOREA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 227 SOUTH KOREA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SOUTH KOREA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 229 SOUTH KOREA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SOUTH KOREA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 231 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 232 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 233 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 235 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 236 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 237 INDIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 INDIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 239 INDIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 INDIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 241 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 242 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 243 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 244 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 245 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 246 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 247 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 248 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 249 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 251 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 252 INDIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 253 INDIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 INDIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 255 INDIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 INDIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 257 INDIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 INDIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 259 INDIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 INDIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 261 INDIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 INDIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 263 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 264 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 265 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 266 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 267 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 268 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 269 AUSTRALIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 270 AUSTRALIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 271 AUSTRALIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 272 AUSTRALIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 273 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 274 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 275 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 276 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 277 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 278 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 279 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 280 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 281 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 282 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 283 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 284 AUSTRALIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 285 AUSTRALIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 286 AUSTRALIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 287 AUSTRALIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 288 AUSTRALIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 289 AUSTRALIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 290 AUSTRALIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 291 AUSTRALIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 292 AUSTRALIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 293 AUSTRALIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 294 AUSTRALIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 295 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 296 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 297 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 299 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 300 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 301 INDONESIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 INDONESIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 303 INDONESIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 INDONESIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 305 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 306 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 307 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 308 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 309 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 310 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 311 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 312 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 313 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 315 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 316 INDONESIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 317 INDONESIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 318 INDONESIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 319 INDONESIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 320 INDONESIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 321 INDONESIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 322 INDONESIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 323 INDONESIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 INDONESIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 325 INDONESIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 326 INDONESIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 327 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 328 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 329 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 330 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 331 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 332 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 333 MALAYSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 334 MALAYSIA HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 335 MALAYSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 336 MALAYSIA SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 337 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 338 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 339 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 340 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 341 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 342 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 343 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 344 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 345 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 346 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 347 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 348 MALAYSIA ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 349 MALAYSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 350 MALAYSIA CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 351 MALAYSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 352 MALAYSIA AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 353 MALAYSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 354 MALAYSIA HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 355 MALAYSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 356 MALAYSIA INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 357 MALAYSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 358 MALAYSIA AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 359 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 360 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 361 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 362 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 363 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 364 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 365 SINGAPORE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 366 SINGAPORE HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 367 SINGAPORE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 368 SINGAPORE SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 369 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 370 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 371 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 372 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 373 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 374 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 375 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 376 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 377 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 378 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 379 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 380 SINGAPORE ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 381 SINGAPORE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 382 SINGAPORE CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 383 SINGAPORE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 384 SINGAPORE AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 385 SINGAPORE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 386 SINGAPORE HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 387 SINGAPORE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 388 SINGAPORE INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 389 SINGAPORE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 390 SINGAPORE AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 391 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 392 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 393 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 394 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 395 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 396 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 397 THAILAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 398 THAILAND HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 399 THAILAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 400 THAILAND SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 401 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 402 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 403 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 404 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 405 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 406 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 407 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 408 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 409 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 410 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 411 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 412 THAILAND ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 413 THAILAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 414 THAILAND CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 415 THAILAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 416 THAILAND AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 417 THAILAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 418 THAILAND HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 419 THAILAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 420 THAILAND INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 421 THAILAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 422 THAILAND AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 423 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 424 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

TABLE 425 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 426 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 427 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 428 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2020-2029 (UNITS)

TABLE 429 PHILIPPINES HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 430 PHILIPPINES HARDWARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 431 PHILIPPINES SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 432 PHILIPPINES SERVICES IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 433 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 434 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2020-2029 (UNITS)

TABLE 435 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 436 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2020-2029 (UNITS)

TABLE 437 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (USD MILLION)

TABLE 438 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2020-2029 (UNITS)

TABLE 439 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (USD MILLION)

TABLE 440 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2020-2029 (UNITS)

TABLE 441 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 442 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 443 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 444 PHILIPPINES ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2020-2029 (UNITS)

TABLE 445 PHILIPPINES CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 446 PHILIPPINES CONSUMERS ELECTRONICS IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 447 PHILIPPINES AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 448 PHILIPPINES AUTOMOTIVE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 449 PHILIPPINES HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 450 PHILIPPINES HEALTHCARE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 451 PHILIPPINES INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 452 PHILIPPINES INDUSTRIAL IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 453 PHILIPPINES AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 454 PHILIPPINES AEROSPACE IN ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 455 REST OF ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (USD MILLION)

TABLE 456 REST OF ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2020-2029 (UNITS)

Abbildungsverzeichnis

FIGURE 1 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SEGMENTATION

FIGURE 12 SURGE IN NEED OF ENERGY-EFFICIENT POWER ELECTRONIC COMPONENTS IS EXPECTED TO DRIVE THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN THE FORECAST PERIOD

FIGURE 13 ANALOG DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET IN FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET

FIGURE 16 SHARE OF ELECTRICITY FLOW THROUGH POWER ELECTRONICS IN THE U.S. (2005–2030) (IN %)

FIGURE 17 NUMBER OF WEARABLE DEVICES IN U.S. FROM 2014 TO 2019 (IN MILLIONS)

FIGURE 18 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PERIPHERAL TYPE, 2021

FIGURE 19 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY TYPE, 2021

FIGURE 20 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY COMPONENT, 2021

FIGURE 21 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY PACKAGING TYPE, 2021

FIGURE 22 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY NETWORK CONNECTIVITY, 2021

FIGURE 23 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RAM CAPACITY, 2021

FIGURE 24 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY RETENTION POWER MODE, 2021

FIGURE 25 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY APPLICATION, 2021

FIGURE 26 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET, BY END-USER, 2021

FIGURE 27 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: SNAPSHOT (2021)

FIGURE 28 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021)

FIGURE 29 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 ASIA-PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: BY PERIPHERAL TYPE (2022-2029)

FIGURE 32 ASIA PACIFIC ULTRA-LOW-POWER MICROCONTROLLER MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich