Asia Pacific Pvc Compound Market

Marktgröße in Milliarden USD

CAGR :

%

USD

79.19 Billion

USD

116.11 Billion

2024

2032

USD

79.19 Billion

USD

116.11 Billion

2024

2032

| 2025 –2032 | |

| USD 79.19 Billion | |

| USD 116.11 Billion | |

|

|

|

|

Marktsegmentierung für PVC-Compounds im asiatisch-pazifischen Raum nach Produkttyp (Hartschaum, Weichschaum), Typ (unweichgemachtes PVC, weichgemachtes PVC), Compound (trockenes PVC-Compound, nasses PVC-Compound), Herstellungsverfahren (Spritzgießen, Extrusion, Sonstige), Rohstoffe (PVC-Harz, Weichmacher, Stabilisatoren, Gleitmittel, Füllstoffe, funktionelle Additive, Legierungspolymere), Endverbraucher (Medizin, Bauwesen, Verpackung, Automobilindustrie, Konsumgüter, Elektrotechnik und Elektronik, Sonstige) – Branchentrends und Prognose bis 2032

Marktgröße für PVC-Compounds im asiatisch-pazifischen Raum

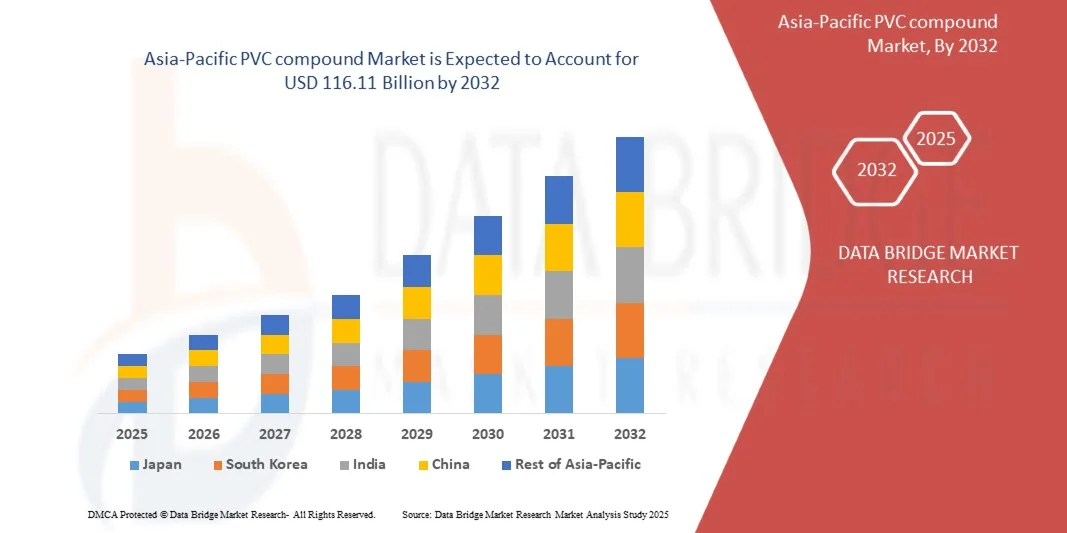

- Der Markt für PVC-Compounds im asiatisch-pazifischen Raum hatte im Jahr 2024 einen Wert von 79,19 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 116,11 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,90 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird primär durch die steigende Nachfrage aus den Bereichen Bauwesen, Automobilindustrie sowie Elektrotechnik und Elektronik angetrieben, verbunden mit der fortschreitenden Urbanisierung und Industrialisierung in der gesamten Region.

- Darüber hinaus tragen Fortschritte in der PVC-Compoundierungstechnologie, wie z. B. verbesserte Haltbarkeit, Flammschutz und Nachhaltigkeit, zu einer breiteren Anwendung bei und treiben so die Marktexpansion in den kommenden Jahren voran.

Analyse des PVC-Compound-Marktes im asiatisch-pazifischen Raum

- PVC-Compounds, die in Anwendungen wie dem Bauwesen, der Automobilindustrie sowie der Elektro- und Elektronikindustrie eingesetzt werden, gewinnen in der Asien-Pazifik-Region aufgrund ihrer Langlebigkeit, Vielseitigkeit und Kosteneffizienz zunehmend an Bedeutung und unterstützen die Entwicklung von Infrastruktur und Industrieprodukten.

- Die steigende Nachfrage nach PVC-Compounds wird in erster Linie durch die rasche Urbanisierung, das industrielle Wachstum und die zunehmende Vorliebe der Verbraucher für leichte, wartungsarme und nachhaltige Materialien angetrieben.

- China dominierte den asiatisch-pazifischen Markt für PVC-Compounds mit dem größten Umsatzanteil von 38,5 % im Jahr 2024. Charakteristisch hierfür waren die massive Bautätigkeit, die starke Automobilproduktion und die Präsenz führender Chemiehersteller. Zusätzlich trugen heimische Innovationen bei leistungsstarken und umweltfreundlichen PVC-Compounds zur Marktakzeptanz bei.

- Indien dürfte im Prognosezeitraum aufgrund beschleunigter Infrastrukturprojekte, steigender verfügbarer Einkommen und wachsender Nachfrage aus dem Automobil- und Elektrosektor das am schnellsten wachsende Land auf dem asiatisch-pazifischen Markt für PVC-Compounds sein.

- Das Segment der starren Produkte dominierte den Markt mit dem größten Umsatzanteil von 55,8 % im Jahr 2024, was auf dessen weitverbreitete Verwendung in Bauanwendungen wie Rohren, Fensterprofilen und Kabelisolierungen zurückzuführen ist, wo strukturelle Festigkeit und Haltbarkeit von entscheidender Bedeutung sind.

Berichtsgegenstand und Marktsegmentierung für PVC-Compounds im asiatisch-pazifischen Raum

|

Attribute |

Wichtige Markteinblicke in PVC-Mischungen im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem asiatisch-pazifischen Markt für PVC-Compounds

„Verbesserte Leistung durch fortschrittliche PVC-Compoundierungstechnologien“

- Ein bedeutender und sich beschleunigender Trend auf dem asiatisch-pazifischen Markt für PVC-Compounds ist die Anwendung fortschrittlicher Compoundiertechnologien, die die Materialeigenschaften, Haltbarkeit und Nachhaltigkeit verbessern. Diese Innovationen ermöglichen ein breiteres Anwendungsspektrum in den Bereichen Bauwesen, Automobilindustrie, Elektrotechnik und Elektronik sowie Verpackung.

- Beispielsweise werden Spezial-PVC-Mischungen mit überlegener Flammwidrigkeit, Schlagfestigkeit und chemischer Stabilität zunehmend in Elektrokabeln, Fahrzeuginnenausstattungen, Rohrleitungssystemen und Verpackungsmaterialien eingesetzt, um sowohl gesetzliche Normen als auch anspruchsvolle Leistungsanforderungen zu erfüllen. Auch biobasierte und recycelte PVC-Mischungen gewinnen an Bedeutung, da Hersteller verstärkt auf Nachhaltigkeit und die Reduzierung der Umweltbelastung setzen.

- Moderne Compoundiertechniken ermöglichen zudem die Anpassung an spezifische Anwendungsanforderungen, wie z. B. verbesserte Witterungsbeständigkeit, Flexibilität, UV-Stabilität oder thermische Beständigkeit. Bestimmte moderne PVC-Formulierungen sind so konzipiert, dass sie extremen Klimabedingungen oder längerer Sonneneinstrahlung standhalten und so eine längere Lebensdauer und geringere Wartungskosten gewährleisten.

- Die Integration dieser Hochleistungsmaterialien in industrielle und bauliche Anwendungen ermöglicht Herstellern höhere Effizienz, niedrigere Lebenszykluskosten und die Einhaltung strenger Sicherheitsvorschriften. Durch maßgeschneiderte Lösungen können Unternehmen vielfältige Branchenanforderungen erfüllen und gleichzeitig Nachhaltigkeitsinitiativen unterstützen.

- Dieser Trend hin zu leistungsstarken, anpassbaren und umweltfreundlichen PVC-Mischungen verändert die Markterwartungen und ermutigt Anbieter wie Shin-Etsu und Formosa Plastics, mit Mischungen zu innovieren, die überlegene Haltbarkeit, Flammschutz und anwendungsspezifische Eigenschaften bieten.

- Die Nachfrage nach hochentwickelten PVC-Compounds wächst rasant in den Bereichen Bauwesen, Automobilindustrie, Elektrotechnik und Verpackung, da die Hersteller zunehmend Wert auf Materialleistung, Sicherheit und Nachhaltigkeit legen.

Marktdynamik von PVC-Compounds im asiatisch-pazifischen Raum

Treiber

„Wachsende Nachfrage aufgrund rasanter Urbanisierung und industrieller Expansion“

- Die zunehmende Urbanisierung und Industrialisierung im asiatisch-pazifischen Raum, gepaart mit der steigenden Nachfrage nach leistungsstarken Bau-, Automobil- und Elektrokomponenten, ist ein wichtiger Treiber für den expandierenden Markt für PVC-Compounds.

- Beispielsweise kündigten führende Hersteller wie Shin-Etsu und Formosa Plastics im Jahr 2024 den Ausbau ihrer Produktionsanlagen für PVC-Compounds an, um die steigende Nachfrage aus den Bereichen Infrastrukturprojekte, Immobilienentwicklung und Automobilzulieferer zu decken. Diese strategischen Investitionen dürften das Marktwachstum im Prognosezeitraum deutlich ankurbeln.

- Die Industrie benötigt zunehmend Materialien mit verbesserter Haltbarkeit, Flammschutz, Chemikalienbeständigkeit und thermischer Stabilität. PVC-Compounds bieten eine effektive Lösung für Anwendungen wie Rohre, Kabel, Bodenbeläge, Automobilteile und Gehäuse für elektrische Anlagen und bieten im Vergleich zu herkömmlichen Materialien überlegene Leistung.

- Darüber hinaus treibt die zunehmende Anwendung nachhaltiger Baupraktiken und umweltfreundlicher Technologien die Nachfrage nach PVC-Mischungen an, die recycelbar sind oder mit geringeren Umweltauswirkungen formuliert wurden, im Einklang mit regionalen Regulierungsstandards und Verbraucherpräferenzen.

- Die Vielseitigkeit, Kosteneffizienz, einfache Verarbeitung und die Fähigkeit, spezifische Anwendungsanforderungen zu erfüllen, machen PVC-Compounds zu einer bevorzugten Wahl in den Bereichen Bauwesen, Automobil und Elektrotechnik sowohl in aufstrebenden als auch in entwickelten Märkten des asiatisch-pazifischen Raums.

Zurückhaltung/Herausforderung

„Umweltbedenken und Rohstoffpreisschwankungen“

- Umweltbedenken im Zusammenhang mit der Herstellung und Entsorgung von PVC, insbesondere die Freisetzung schädlicher Zusatzstoffe und Weichmacher, stellen eine erhebliche Herausforderung für den Markt dar. Strengere Vorschriften und ein wachsendes Verbraucherbewusstsein für Nachhaltigkeit können den Einsatz herkömmlicher PVC-Mischungen in bestimmten Anwendungsbereichen einschränken.

- Beispielsweise haben regulatorische Beschränkungen in Ländern wie Japan und Australien hinsichtlich bestimmter PVC-Zusatzstoffe die Hersteller dazu ermutigt, nachhaltige Alternativen zu entwickeln, was höhere Kosten oder neu formulierte Produktionsprozesse mit sich bringen kann.

- Die Bewältigung dieser Umweltprobleme durch biobasierte PVC-Verbindungen, phthalatfreie Rezepturen und fortschrittliche Recyclingverfahren ist entscheidend für nachhaltiges Marktwachstum. Unternehmen wie Formosa Plastics und LG Chem investieren aktiv in umweltfreundliche PVC-Technologien, um gesetzliche Vorgaben zu erfüllen und den sich wandelnden Verbrauchererwartungen gerecht zu werden.

- Darüber hinaus können Schwankungen bei den Rohstoffpreisen, insbesondere bei Chlor und Ethylen, die Produktionskosten von PVC-Mischungen beeinflussen und sich somit auf die Preisgestaltung und die Rentabilität der Hersteller auswirken.

- Während technologische Innovationen die Herausforderungen in Bezug auf Umwelt und Kosten allmählich abmildern, bleibt die Bewältigung von regulatorischen Anforderungen, der Wahrnehmung durch die Verbraucher und der Schwankungen der Rohstoffpreise entscheidend für das langfristige Wachstum des PVC-Compound-Marktes im asiatisch-pazifischen Raum.

Umfang des PVC-Compound-Marktes im asiatisch-pazifischen Raum

Der Markt für PVC-Compounds im asiatisch-pazifischen Raum ist segmentiert nach Produkttyp, Art, Compound, Herstellungsverfahren, Rohmaterial und Endverbraucher.

• Nach Produkttyp

Der Markt für PVC-Compounds im asiatisch-pazifischen Raum ist nach Produkttyp in starre und flexible Produkte unterteilt und zusätzlich nach PVC-Typ in weichmacherfreies und weichmacherhaltiges PVC klassifiziert. Das Segment der starren Produkte dominierte den Markt mit einem Umsatzanteil von 55,8 % im Jahr 2024. Dies ist auf die breite Anwendung im Bauwesen zurückzuführen, beispielsweise für Rohre, Fensterprofile und Kabelisolierungen, wo strukturelle Festigkeit und Langlebigkeit entscheidend sind. Weichmacherfreies PVC wird insbesondere für Anwendungen bevorzugt, die eine hohe Steifigkeit und Langzeitstabilität erfordern.

Das Segment der flexiblen Produkte wird voraussichtlich von 2025 bis 2032 mit einer Wachstumsrate von 22,1 % das schnellste Wachstum verzeichnen. Grund dafür ist die steigende Nachfrage nach biegsamen, leichten und kostengünstigen Materialien in den Bereichen Fahrzeuginnenausstattung, elektrische Isolierung und Konsumgüter. Weichmacherhaltiges PVC zeichnet sich durch seine verbesserte Flexibilität aus.

- Nach Typ

Der Markt für PVC-Compounds im asiatisch-pazifischen Raum ist nach Produkttyp in weichmacherfreies und weichmacherhaltiges PVC unterteilt. Weichmacherfreies PVC dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024. Gründe hierfür sind seine überlegene Steifigkeit, chemische Beständigkeit und die weitverbreitete Verwendung in Bauanwendungen wie Rohren, Fensterprofilen und Formstücken. Hersteller und Endverbraucher bevorzugen weichmacherfreies PVC häufig für Infrastrukturprojekte aufgrund seiner langen Lebensdauer, strukturellen Festigkeit und Wirtschaftlichkeit.

Für das Segment der weichmacherhaltigen PVC-Produkte wird von 2025 bis 2032 das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach flexiblen Anwendungen wie Bodenbelägen, Kabelisolierungen, Fahrzeuginnenausstattungen und Verpackungen. Weichmacherhaltiges PVC bietet verbesserte Flexibilität, Haltbarkeit und einfache Verarbeitung und eignet sich daher ideal für Anwendungen, die Biegsamkeit ohne Leistungseinbußen erfordern. Die zunehmende Verwendung kundenspezifischer Rezepturen und umweltfreundlicher Weichmacher trägt ebenfalls zum rasanten Wachstum dieses Segments in verschiedenen Endverbraucherbranchen der Region bei. Die gute Verarbeitbarkeit fördert darüber hinaus die Anwendung in neuen industriellen und privaten Bereichen.

• Durch Verbindung

Basierend auf der Zusammensetzung wird der Markt in trockene und nasse PVC-Compounds unterteilt. Das Segment der trockenen PVC-Compounds erzielte 2024 mit 61,5 % den größten Marktanteil, vor allem aufgrund seiner Stabilität, einfachen Lagerung und vielseitigen Einsatzmöglichkeiten in verschiedenen Fertigungsprozessen, darunter Extrusion und Spritzguss. Trockene Compounds werden häufig für industrielle Anwendungen mit hohem Durchsatz, wie z. B. Rohre, Bodenbeläge und Kabel, verwendet.

Für das Segment der Nass-PVC-Compounds wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach Spezialformulierungen für Beschichtungen, Folien und flexible Platten. Nass-Compounds bieten Vorteile bei der Mischung mit Additiven und der Erzielung maßgeschneiderter Eigenschaften, wodurch sie für Anwendungen in der Automobil-, Verpackungs- und Medizintechnik zunehmend attraktiv werden.

• Durch den Herstellungsprozess

Basierend auf dem Herstellungsverfahren ist der Markt in Spritzguss, Extrusion und Sonstige unterteilt. Das Extrusionssegment dominierte den Markt mit dem größten Umsatzanteil von 57,3 % im Jahr 2024. Dies ist auf die Eignung des Verfahrens zur Herstellung von Rohren, Profilen und Blechen mit gleichbleibender Qualität und Kosteneffizienz zurückzuführen. Extrusion wird in der Bau- und Elektroindustrie aufgrund der hohen Produktionsvolumina bevorzugt eingesetzt.

Für den Spritzgusssektor wird von 2025 bis 2032 mit einer Wachstumsrate von 21,8 % das schnellste Wachstum erwartet. Grund dafür ist die steigende Nachfrage nach komplexen Automobilkomponenten, Konsumgütern und Medizinprodukten, die präzise Formen, hohe Maßgenauigkeit und eine erstklassige Oberflächengüte erfordern. Fortschrittliche Spritzgusstechniken in Verbindung mit leistungssteigernden PVC-Compounds beschleunigen die Marktdurchdringung zusätzlich.

• Nach Rohmaterial

Auf Basis der Rohstoffe ist der Markt in PVC-Harz, Weichmacher, Stabilisatoren, Gleitmittel, Füllstoffe, funktionelle Additive und Legierungspolymere unterteilt. PVC-Harz dominierte den Markt mit einem Umsatzanteil von 63,7 % im Jahr 2024, da es den Kernstoff für nahezu alle PVC-Compound-Formulierungen bildet und für Anwendungen im Bauwesen, der Automobilindustrie und der Elektroindustrie unerlässlich ist.

Weichmacher und Stabilisatoren werden voraussichtlich von 2025 bis 2032 mit einer Wachstumsrate von 23,0 % den höchsten Zuwachs verzeichnen. Grund dafür ist die steigende Nachfrage nach flexiblen PVC-Produkten mit verbesserter Haltbarkeit und Flammschutz. Funktionelle Additive, Füllstoffe und Legierungspolymere werden zunehmend eingesetzt, um anwendungsspezifische Anforderungen wie chemische Beständigkeit, thermische Stabilität und Nachhaltigkeit zu erfüllen, was den Rohstoffverbrauch branchenübergreifend weiter ankurbelt.

• Vom Endbenutzer

Basierend auf den Endverbrauchern ist der Markt für PVC-Compounds im asiatisch-pazifischen Raum in die Segmente Medizin, Bauwesen, Verpackung, Automobilindustrie, Konsumgüter, Elektrotechnik und Elektronik sowie Sonstige unterteilt. Das Segment Bauwesen dominierte den Markt mit einem Umsatzanteil von 52,4 % im Jahr 2024. Treiber dieses Wachstums waren der weitverbreitete Einsatz von PVC-Compounds in Rohren, Fensterprofilen, Bodenbelägen und Dämmstoffen, unterstützt durch die rasante Urbanisierung und den Infrastrukturausbau.

Im Automobilsektor wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 24,2 % das schnellste Wachstum erwartet. Grund dafür ist die steigende Nachfrage nach leichten, flexiblen und langlebigen Innen- und Außenkomponenten, die mit der zunehmenden Fahrzeugproduktion und strengeren Kraftstoffeffizienzvorschriften einhergeht. Die Vielseitigkeit und Kosteneffizienz von PVC-Compounds fördern zudem deren Einsatz in anderen Branchen wie der Elektro-, Verpackungs- und Medizintechnik.

Regionale Analyse des PVC-Compound-Marktes im asiatisch-pazifischen Raum

- China dominierte den Markt für PVC-Compounds mit dem größten Umsatzanteil von 38,5 % im Jahr 2024. Treiber dieser Entwicklung waren die rasche Urbanisierung, die Industrialisierung und die wachsende Nachfrage aus den Bereichen Bauwesen, Automobilindustrie sowie Elektrotechnik und Elektronik.

- Verbraucher und Unternehmen in der Region legen zunehmend Wert auf Hochleistungsmaterialien, die Langlebigkeit, Flammschutz und Kosteneffizienz bieten. Daher sind PVC-Verbindungen eine bevorzugte Wahl für Rohre, Bodenbeläge, Kabel und Automobilkomponenten.

- Diese breite Akzeptanz wird zusätzlich unterstützt durch den Ausbau der Produktionsinfrastruktur, steigende verfügbare Einkommen in Schwellenländern und günstige Regierungsinitiativen, die das industrielle Wachstum und die Entwicklung moderner Infrastruktur fördern und PVC-Verbindungen zu einem wichtigen Material für Anwendungen im Wohn-, Gewerbe- und Industriebereich machen.

Einblick in den chinesischen Markt für PVC-Compounds

Der chinesische Markt für PVC-Compounds erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum, angetrieben von der starken Nachfrage aus der Bau-, Automobil- und Elektroindustrie. Chinas robuste Infrastrukturentwicklung, die rasante Urbanisierung und die wachsenden Produktionskapazitäten beflügeln weiterhin den Verbrauch von PVC-Compounds. Steigende Investitionen in Bauvorhaben, insbesondere in Wohn- und Industrieprojekte, beschleunigen das Marktwachstum zusätzlich. Chinas führende Position als bedeutender Exporteur von PVC-Produkten und die Anwendung fortschrittlicher Compoundierungstechnologien verbessern zudem die Produktqualität und -leistung. Der zunehmende Fokus auf Nachhaltigkeit und Recyclingfähigkeit veranlasst die Hersteller außerdem, umweltfreundliche PVC-Rezepturen zu entwickeln, um nationale und internationale Standards zu erfüllen.

Einblick in den japanischen Markt für PVC-Compounds

Der japanische Markt für PVC-Compounds verzeichnet ein stetiges Wachstum, gestützt durch steigende Anwendungsbereiche in der Automobil-, Elektronik- und Medizintechnik. Japanische Hersteller konzentrieren sich auf leistungsstarke, präzisionsgefertigte PVC-Compounds, die strengen Sicherheits- und Qualitätsvorschriften entsprechen. Die Nachfrage nach leichten, langlebigen und hitzebeständigen Materialien für Fahrzeuginnenausstattungen und Kabelbäume ist ein wesentlicher Wachstumstreiber. Japans starker Fokus auf ökologische Nachhaltigkeit und Recyclinginitiativen fördert zudem den Einsatz phthalatfreier und biobasierter Weichmacher in der PVC-Compoundierung. Die hochentwickelte technologische Infrastruktur und die innovationsgetriebene Chemieindustrie des Landes tragen kontinuierlich zur Verbesserung der Produktion von Spezial-PVC-Compounds mit überlegenen Leistungseigenschaften bei.

Einblick in den indischen Markt für PVC-Compounds

Der indische Markt für PVC-Compounds wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die rasche Industrialisierung, die Stadterweiterung und die staatlichen Bemühungen um bezahlbaren Wohnraum und Infrastrukturentwicklung. Die boomenden Bau- und Elektrobranchen sind Hauptabnehmer von PVC-Compounds für Rohre, Kabel und Profile. Zusätzlich trägt die steigende Nachfrage nach kostengünstigen und langlebigen Materialien in der Automobil- und Verpackungsindustrie zum Marktwachstum bei. Zunehmende ausländische Investitionen in die Polymerproduktion und die Errichtung neuer Compoundieranlagen stärken die lokale Versorgungskapazität. Der wachsende Fokus auf nachhaltige Materialien und die Umstellung auf ungiftige PVC-Compounds dürften den Markt in Indien weiter ankurbeln.

Einblick in den südkoreanischen Markt für PVC-Compounds

Der südkoreanische Markt für PVC-Compounds verzeichnet ein kontinuierliches Wachstum, angetrieben durch die steigende Nachfrage aus der Bau-, Elektronik- und Konsumgüterindustrie. Südkoreas technologisch fortschrittlicher Polymersektor und der Fokus auf die Herstellung hochwertiger, leistungsstarker Compounds stärken die Wettbewerbsfähigkeit des Marktes. Südkoreanische Unternehmen investieren in die Entwicklung spezieller PVC-Formulierungen, insbesondere solcher mit verbesserter Flexibilität, Witterungsbeständigkeit und thermischer Stabilität, um anspruchsvolle industrielle Anwendungen zu bedienen. Darüber hinaus fördern Nachhaltigkeitsinitiativen und regulatorische Standards, die den Einsatz umweltfreundlicher und recycelbarer Materialien unterstützen, die Innovation in der PVC-Compoundierungsindustrie zusätzlich.

Marktanteil von PVC-Compounds im asiatisch-pazifischen Raum

Die PVC-Compound-Industrie wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Shin-Etsu Chemical Co., Ltd. (Japan)

- LG Chem (Südkorea)

- Formosa Plastics Corporation (Taiwan)

- Reliance Industries Limited (Indien)

- Solvay SA (Belgien)

- BASF SE (Deutschland)

- Occidental Petroleum Corporation – OxyChem (USA)

- Kem One (Frankreich)

- SABIC (Saudi-Arabien)

- Dow Inc. (USA)

- INOVYN (UK)

- Vinnolit GmbH & Co. KG (Deutschland)

- Axiall Corporation (USA)

- Thai Plastic and Chemicals PLC (Thailand)

- China National Chemical Corporation – ChemChina (China)

- Tianjin Dagu Chemical Co., Ltd. (China)

- China Petroleum & Chemical Corporation – Sinopec (China)

- Nan Ya Plastics Corporation (Taiwan)

- Mitsui Chemicals, Inc. (Japan)

- LG Polymers India Pvt. Ltd. (Indien)

Welche aktuellen Entwicklungen gibt es auf dem Markt für PVC-Compounds im asiatisch-pazifischen Raum?

- Im April 2023 startete Shin-Etsu Chemical Co., Ltd., ein weltweit führender Hersteller von PVC und Spezialchemikalien, eine strategische Initiative in Indien. Ziel ist die Erweiterung des Portfolios an Hochleistungs-PVC-Compounds für Bau- und Automobilanwendungen. Diese Initiative unterstreicht das Engagement des Unternehmens für die Bereitstellung langlebiger, flammhemmender und umweltverträglicher Materialien, die auf die wachsenden Infrastruktur- und Industrieanforderungen der Region zugeschnitten sind. Durch die Nutzung seiner globalen Expertise und fortschrittlichen Compoundiertechnologien stärkt Shin-Etsu seine Präsenz im schnell wachsenden asiatisch-pazifischen Markt für PVC-Compounds.

- Im März 2023 stellte LG Chem in Südkorea eine neue Produktlinie flexibler PVC-Compounds vor, die speziell für den Einsatz in Fahrzeuginnenräumen und Kabelverkabelungen entwickelt wurden. Diese Entwicklung unterstreicht den Fokus von LG Chem auf die Verbesserung der Materialeigenschaften, insbesondere hinsichtlich Hitzebeständigkeit, Langlebigkeit und Nachhaltigkeit. Die Innovation bekräftigt das Engagement des Unternehmens, den sich wandelnden Anforderungen der Automobilindustrie gerecht zu werden und die Bestrebungen der Region hin zu hochwertigen, umweltfreundlichen PVC-Lösungen zu unterstützen.

- Im März 2023 nahm Reliance Industries Limited in Gujarat, Indien, erfolgreich eine modernisierte PVC-Compoundieranlage in Betrieb, die auf die Bedürfnisse des boomenden Bau- und Elektrosektors zugeschnitten ist. Die Anlage nutzt fortschrittliche Extrusions- und Mischtechnologien zur Herstellung hochwertiger PVC-Compounds mit verbesserten mechanischen Eigenschaften und Umweltverträglichkeit. Dieses Projekt unterstreicht die Rolle von Reliance als Motor für industrielles Wachstum und unterstützt die Urbanisierung durch zuverlässige und kostengünstige PVC-Materialien.

- Im Februar 2023 gab die Formosa Plastics Corporation eine strategische Partnerschaft mit führenden Baustofflieferanten in Südostasien bekannt. Ziel der Partnerschaft ist es, die Verwendung von trockenen und nassen PVC-Compounds für Rohre, Bodenbeläge und elektrische Isolierungen zu fördern. Die Zusammenarbeit soll die Effizienz der Lieferkette verbessern und eine gleichbleibende Materialqualität gewährleisten. Damit unterstreicht Formosa Plastics ihr Engagement für die regionale Industrie- und Infrastrukturentwicklung.

- Im Januar 2023 präsentierte Solvay SA auf der Asia-Pacific Polymer Expo 2023 in Singapur seine neueste Produktreihe weichmacherfreier PVC-Compounds. Die Compounds zeichnen sich durch verbesserte thermische Stabilität, Flammschutz und Recyclingfähigkeit aus und eignen sich daher ideal für Anwendungen im Bauwesen, der Automobilindustrie und der Elektrotechnik. Mit dieser Produkteinführung unterstreicht Solvay sein Engagement für die Integration fortschrittlicher Materialtechnologien, um der steigenden Nachfrage der Region nach leistungsstarken und nachhaltigen PVC-Lösungen gerecht zu werden.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.