Asia Pacific Polybutylene Succinate Pbs Market

Marktgröße in Milliarden USD

CAGR :

%

USD

81.24 Million

USD

148.15 Million

2025

2033

USD

81.24 Million

USD

148.15 Million

2025

2033

| 2026 –2033 | |

| USD 81.24 Million | |

| USD 148.15 Million | |

|

|

|

|

Marktsegmentierung für Polybutylensuccinat (PBS) im asiatisch-pazifischen Raum nach Produkt (konventionelles und biobasiertes PBS), Verfahren (Umesterung und direkte Veresterung), Anwendung (Beutel, Mulchfolie, Verpackungsfolie, Hygieneartikel, Fischernetze, Kaffeekapseln, Holz-Kunststoff-Verbundwerkstoffe u. a.), Verwendung (Einweg und Mehrweg), Verpackungsschicht (Primär-, Sekundär- und Tertiärverpackung) und Endverwendung (Verpackung, Landwirtschaft, Textilien, Konsumgüter, Elektrotechnik und Elektronik, Automobilindustrie u. a.) – Branchentrends und Prognose bis 2033

Wie groß ist der Markt für Polybutylensuccinat (PBS) im asiatisch-pazifischen Raum und wie hoch ist seine Wachstumsrate?

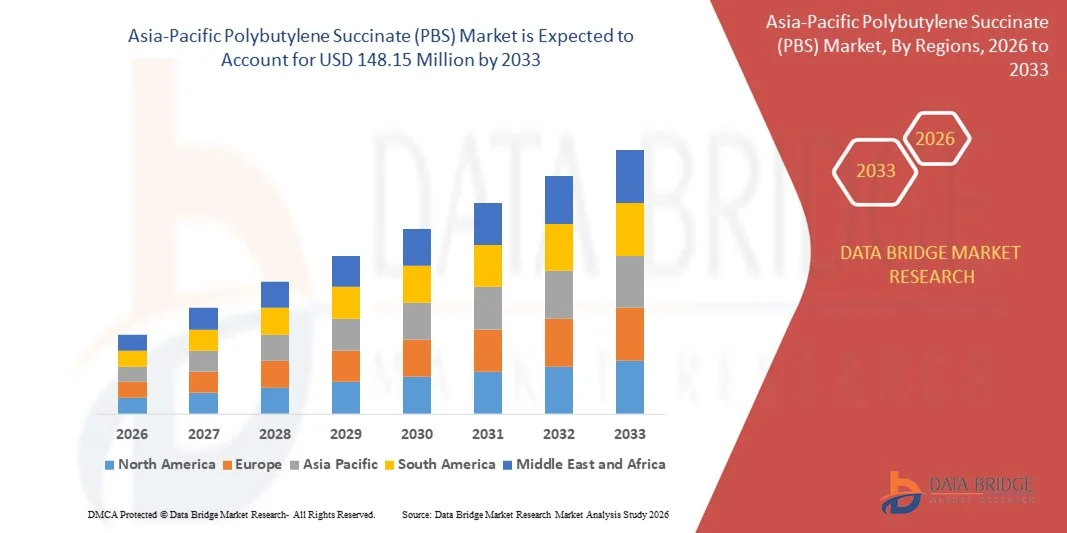

- Der Markt für Polybutylensuccinat (PBS) im asiatisch-pazifischen Raum hatte im Jahr 2025 einen Wert von 81,24 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 148,15 Millionen US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,80 % im Prognosezeitraum entspricht.

- Polybutylensuccinat wird häufig mit Naturfasern wie Rutenhirse (SG) kombiniert. Diese innovativen Verbundwerkstoffe finden breite Anwendung im Automobilsektor, da sie als vielversprechende biobasierte Alternativen zu herkömmlichen erdölbasierten Polymeren gelten.

- Laut OICA stieg die Produktion von leichten Nutzfahrzeugen in Frankreich um 6,5 Prozent von 495.123 im Jahr 2018 auf 527.262 im Jahr 2019, während sie in Spanien um 5,6 Prozent von 496.671 im Jahr 2018 auf 524.504 im Jahr 2019 zunahm. Aufgrund der steigenden Automobilproduktion wird die Nachfrage nach Polybutylensuccinat allmählich steigen und somit als Markttreiber wirken.

Was sind die wichtigsten Erkenntnisse zum Markt für Polybutylensuccinat (PBS)?

- Polybutylensuccinat findet zunehmend Anwendung in der Landwirtschaft, beispielsweise in Mulchfolien. Mulchfolien werden häufig eingesetzt, um die Bodentemperatur zu regulieren, das Unkrautwachstum einzudämmen, den Feuchtigkeitsverlust zu reduzieren und den Ertrag sowie die Reife der Pflanzen zu steigern.

- Regierungen investieren zudem umfangreich in Agrarprojekte und -investitionen, da dies einer der effektivsten Wege zur Verbesserung der ökologischen Nachhaltigkeit ist.

- China dominierte 2024 den asiatisch-pazifischen Markt für Polybutylensuccinat (PBS) mit dem größten Umsatzanteil von 38,2 %. Treiber dieses Wachstums waren die großflächige Produktion biologisch abbaubarer Kunststoffe, die starke Inlandsnachfrage nach Verpackungen sowie die rasche Expansion der nachhaltigen Landwirtschaft und der Konsumgüterindustrie.

- Der japanische Markt für Polybutylensuccinat (PBS) verzeichnet ein stetiges Wachstum mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,9 %, was durch die steigende Nachfrage nach hochwertigen, biologisch abbaubaren Materialien in den Bereichen Verpackung, Textilien und Konsumgüter begünstigt wird.

- Das Segment der konventionellen PBS-Verpackungsmaterialien dominierte den Markt mit einem Umsatzanteil von 58,6 % im Jahr 2024. Dies ist auf die etablierte Produktionsbasis, die Wettbewerbsfähigkeit bei den Kosten und die breite Anwendung in Verpackungsfolien, Agrarprodukten und Konsumgütern zurückzuführen.

Berichtsumfang und Marktsegmentierung für Polybutylensuccinat (PBS)

|

Attribute |

Polybutylensuccinat (PBS) – Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und den regulatorischen Rahmen. |

Was ist der wichtigste Trend auf dem Markt für Polybutylensuccinat (PBS)?

Zunehmende Verwendung biobasierter und kompostierbarer Materialien für nachhaltige Verpackungen und Konsumgüteranwendungen

- Ein wichtiger und sich beschleunigender Trend auf dem Markt für Polybutylensuccinat (PBS) ist die zunehmende Verlagerung hin zu biobasierten, biologisch abbaubaren und kompostierbaren Polymeren als Alternative zu herkömmlichen erdölbasierten Kunststoffen. Dieser Wandel wird durch wachsende Umweltbedenken, regulatorischen Druck in Bezug auf Einwegkunststoffe und die steigende Verbrauchernachfrage nach nachhaltigen Materialien in den Bereichen Verpackung, Landwirtschaft und Konsumgüter vorangetrieben.

- Führende Materialhersteller wie BASF SE, Indorama Ventures, Mitsubishi Chemical und Far Eastern New Century erweitern beispielsweise die Produktion von biobasiertem PBS und entwickeln Hochleistungstypen, die sich für Folien, Formteile und Mischungen mit PLA und PBAT eignen.

- Die zunehmende Verwendung von PBS in Verpackungsfolien, kompostierbaren Beuteln, Einwegbesteck und Materialien mit Lebensmittelkontakt ermöglicht es Herstellern, Nachhaltigkeitsziele zu erreichen und gleichzeitig Flexibilität, Hitzebeständigkeit und Verarbeitbarkeit zu erhalten, die mit herkömmlichen Kunststoffen vergleichbar sind.

- Fortschritte bei der Herstellung von Bio-Bernsteinsäure, Polymermischtechnologien und Kostenoptimierung verbessern die kommerzielle Rentabilität von PBS in großtechnischen Anwendungen weiter.

- Die zunehmende Anwendung von Kreislaufwirtschaftsprinzipien, Standards für kompostierbare Verpackungen und Zertifizierungsprogrammen für biologisch abbaubare Materialien unterstreicht die Bedeutung von PBS als Kernmaterial für nachhaltige Kunststoffalternativen.

- Da die Anforderungen an Nachhaltigkeit weltweit weiter steigen, entwickelt sich Polybutylensuccinat zu einem entscheidenden Werkstoff, der umweltverträgliches Produktdesign ermöglicht, ohne die Funktionalität zu beeinträchtigen.

Was sind die wichtigsten Triebkräfte des Polybutylensuccinat-Marktes (PBS)?

- Ein wesentlicher Wachstumstreiber für den Markt für Polybutylensuccinat (PBS) ist die zunehmende Umsetzung von Maßnahmen zur Reduzierung von Plastikmüll und das Verbot von Einwegkunststoffen in den Bereichen Verpackung, Gastronomie und Landwirtschaft.

- Beispielsweise haben Regierungen in ganz Europa und im asiatisch-pazifischen Raum im Zeitraum 2024–2025 die Vorschriften zur Förderung kompostierbarer Materialien verschärft und so die Verwendung von kompostierbaren Materialien in Verpackungsfolien, Einwegprodukten und landwirtschaftlichen Mulchanwendungen verstärkt.

- Die steigende Nachfrage nach nachhaltigen Lebensmittelverpackungen, kompostierbaren Konsumgütern und biologisch abbaubaren landwirtschaftlichen Betriebsmitteln beschleunigt den Verbrauch von PBS in allen Endverbraucherbranchen.

- Technologische Fortschritte bei biobasierten Rohstoffen, Fermentationsprozessen und Polymermodifizierung verbessern die mechanische Festigkeit, die thermische Stabilität und die Kostenwettbewerbsfähigkeit von PBS.

- Das zunehmende Engagement von Marken für Klimaneutralität, Umweltkennzeichnung und nachhaltige Verpackungsumstellungen ermutigt Hersteller, PBS in ihre Produktportfolios zu integrieren.

- Unterstützt durch Umweltauflagen, Nachhaltigkeitsziele von Unternehmen und ein wachsendes Verbraucherbewusstsein wird erwartet, dass der Markt für Polybutylensuccinat (PBS) ein robustes langfristiges Wachstum auf den globalen Märkten verzeichnen wird.

Welcher Faktor beeinträchtigt das Wachstum des Polybutylensuccinat-Marktes (PBS)?

- Die Grundstoffe für Polybutylensuccinat, insbesondere Bernsteinsäure und 1,4-Butandiole, werden aus Erdölrohstoffen gewonnen.

- Folglich beeinflussen Schwankungen des Rohölpreises den Preis von Polybutylensuccinat-Rohstoffen. Der Preis für Polybutylensuccinat steigt auch aufgrund der Unsicherheit der Rohölpreise.

- Infolgedessen dürften die Hersteller von Polybutylensuccinat mit starken Schwankungen der Rohölpreise konfrontiert sein. Dieser Faktor wird voraussichtlich das Wachstum des globalen Polybutylensuccinat-Marktes (PBS) beeinträchtigen.

Wie ist der Markt für Polybutylensuccinat (PBS) segmentiert?

Der Markt ist segmentiert nach Produkt, Prozess, Anwendung, Verwendung, Verpackungsschicht und Endverwendung .

- Nebenprodukt

Basierend auf dem Produkt wird der Markt für Polybutylensuccinat (PBS) in konventionelles und biobasiertes Polybutylensuccinat unterteilt. Das Segment des konventionellen PBS dominierte den Markt mit einem Umsatzanteil von 58,6 % im Jahr 2024. Gründe hierfür waren die etablierte Produktionsbasis, die Wettbewerbsfähigkeit des Produkts und die breite Anwendung in Verpackungsfolien, Agrarprodukten und Konsumgütern. Konventionelles PBS bietet zuverlässige mechanische Festigkeit, Flexibilität und thermische Stabilität und eignet sich daher für großtechnische Anwendungen.

Das Segment der biobasierten Kunststoff- und Bio-Bernsteinsäure (PBS) dürfte von 2025 bis 2032 das schnellste jährliche Wachstum verzeichnen. Gründe hierfür sind steigende Umweltauflagen, eine wachsende Nachfrage nach kompostierbaren Kunststoffen und die zunehmende Verfügbarkeit von biobasierter Bernsteinsäure. Nachhaltigkeitsverpflichtungen von Marken und Fortschritte in der Verarbeitung von Bio-Rohstoffen beschleunigen die Akzeptanz zusätzlich.

- Durch Prozess

Basierend auf dem Verfahren ist der Markt in Umesterung und Direktveresterung unterteilt. Das Segment der Direktveresterung hielt 2024 mit 54,2 % den größten Marktanteil. Dies ist auf den vereinfachten Prozessablauf, die geringeren Produktionskosten und die Eignung für die großtechnische PBS-Herstellung zurückzuführen. Dieses Verfahren wird von großen Herstellern häufig eingesetzt, um die Ausbeute zu steigern und die Komplexität der Betriebsabläufe zu reduzieren.

Das Segment der Umesterung wird voraussichtlich im Zeitraum 2025–2032 das schnellste jährliche Wachstum verzeichnen, bedingt durch seine Fähigkeit, Polymere mit höherem Molekulargewicht und verbesserter Materialkonsistenz herzustellen. Steigende Investitionen in fortschrittliche Polymerisationstechnologien fördern dessen Anwendung für Hochleistungs- und Spezial-PBS-Typen.

- Durch Bewerbung

Basierend auf den Anwendungsbereichen ist der Markt für Polybutylensuccinat (PBS) in Beutel, Mulchfolie, Verpackungsfolie, spülbare Hygieneprodukte, Fischernetze, Kaffeekapseln, Holz-Kunststoff-Verbundwerkstoffe und Sonstiges unterteilt. Das Segment Verpackungsfolie dominierte den Markt mit einem Anteil von 31,4 % im Jahr 2024, angetrieben durch die steigende Nachfrage nach biologisch abbaubaren Lebensmittelverpackungen, kompostierbaren Folien und nachhaltigen Alternativen zu herkömmlichen Kunststoffen.

Für das Segment Mulchfolie wird von 2025 bis 2032 das schnellste durchschnittliche jährliche Wachstum erwartet, unterstützt durch die zunehmende Verwendung biologisch abbaubarer landwirtschaftlicher Betriebsmittel und staatliche Initiativen zur Förderung nachhaltiger Anbaumethoden.

- Nach Verwendung

Basierend auf der Verwendung wird der Markt in Einweg- und Mehrweganwendungen unterteilt. Das Segment Einwegprodukte erzielte 2024 mit 62,7 % den größten Umsatzanteil, bedingt durch die weitverbreitete Verwendung in Einwegverpackungen, Hygieneprodukten und Agrarfolien. PBS ersetzt aufgrund seiner Kompostierbarkeit und der Einhaltung gesetzlicher Vorschriften zunehmend herkömmliche Kunststoffe in kurzlebigen Anwendungen.

Das Segment der wiederverwendbaren Produkte dürfte im Prognosezeitraum die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Unterstützt wird dies durch Materialverbesserungen, die die Haltbarkeit, die mechanische Festigkeit und die Beständigkeit gegenüber wiederholter Verwendung verbessern, insbesondere bei Konsumgütern und Verpackungsanwendungen.

- Nach Verpackungsschicht

Basierend auf der Verpackungsschicht ist der Markt in Primärverpackung, Sekundärverpackung und Tertiärverpackung unterteilt. Das Segment Primärverpackung dominierte den Markt mit einem Umsatzanteil von 46,9 % im Jahr 2024, getrieben durch Anwendungen mit direktem Lebensmittelkontakt wie Verpackungsfolien, Beutel und Behälter.

Das Segment Sekundärverpackungen dürfte von 2025 bis 2032 die höchste Wachstumsrate verzeichnen, unterstützt durch den zunehmenden Einsatz biologisch abbaubarer Materialien für Verpackungen, Gruppierungen und Schutzverpackungen in Logistik- und Einzelhandelslieferketten.

- Nach Endverwendung

Nach Anwendungsbereich ist der Markt für Polybutylensuccinat (PBS) in die Segmente Verpackung, Landwirtschaft, Textilien, Konsumgüter, Elektrotechnik und Elektronik, Automobilindustrie und Sonstige unterteilt. Das Segment Verpackung hielt 2024 mit 38,5 % den größten Marktanteil, angetrieben durch die steigende Nachfrage nach nachhaltigen Lebensmittelverpackungen und kompostierbaren Konsumgütern.

Es wird erwartet, dass der Agrarsektor im Zeitraum 2025–2032 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen wird, angetrieben durch den zunehmenden Einsatz biologisch abbaubarer Mulchfolien und die staatliche Unterstützung für umweltfreundliche landwirtschaftliche Lösungen.

Welche Region hält den größten Anteil am Markt für Polybutylensuccinat (PBS)?

- China dominierte 2024 den asiatisch-pazifischen Markt für Polybutylensuccinat (PBS) mit dem größten Umsatzanteil von 38,2 %. Treiber dieses Wachstums waren die großflächige Produktion biologisch abbaubarer Kunststoffe, die starke Inlandsnachfrage nach Verpackungen sowie die rasche Expansion der nachhaltigen Landwirtschaft und der Konsumgüterindustrie.

- Die führende Rolle des Landes bei der Herstellung kompostierbarer Verpackungsfolien, landwirtschaftlicher Mulchfolien und biobasierter Materialien beschleunigt die Verbreitung von Polybutylensuccinat (PBS) in Lebensmittelverpackungen, Einwegprodukten und landwirtschaftlichen Anwendungen.

- Strenge staatliche Vorschriften zur Reduzierung von Kunststoffabfällen, die Verfügbarkeit kostengünstiger Rohstoffe und erhebliche Investitionen in die Kapazität biobasierter Polymere positionieren China als wichtigstes Produktions- und Konsumzentrum für Polybutylensuccinat (PBS) im asiatisch-pazifischen Markt.

Einblick in den japanischen Markt für Polybutylensuccinat (PBS).

Der japanische Markt für Polybutylensuccinat (PBS) verzeichnet ein stetiges Wachstum mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,9 %. Dies wird durch die steigende Nachfrage nach hochwertigen, biologisch abbaubaren Materialien für Verpackungen, Textilien und Konsumgüter begünstigt. Japanische Hersteller konzentrieren sich auf leistungsstarke, biobasierte PBS-Typen mit verbesserter thermischer Stabilität und kontrollierter biologischer Abbaubarkeit, um strenge Qualitäts- und Umweltstandards zu erfüllen. Starke Forschungs- und Entwicklungskapazitäten, fortschrittliche Polymerverarbeitungstechnologien und die Zusammenarbeit zwischen Chemieunternehmen und Endverbraucherbranchen stärken Japans Rolle als technologieorientierter Akteur auf dem asiatisch-pazifischen Markt für Polybutylensuccinat (PBS).

Einblick in den südkoreanischen Markt für Polybutylensuccinat (PBS).

Der südkoreanische Markt für Polybutylensuccinat (PBS) wächst stetig, angetrieben durch die zunehmende Verwendung umweltfreundlicher Verpackungen, kompostierbarer Konsumgüter und nachhaltiger Industriematerialien. Steigende Investitionen in biobasierte Polymere, zunehmende Exporte biologisch abbaubarer Verpackungslösungen und die starke staatliche Förderung umweltfreundlicher Produktionsverfahren tragen zum Marktwachstum bei. Kontinuierliche Innovationen bei Polymermischungen, der Verbesserung der Materialeigenschaften und skalierbaren Produktionsprozessen positionieren Südkorea als wichtiges Innovations- und Wertschöpfungszentrum im asiatisch-pazifischen PBS-Markt.

Welche sind die führenden Unternehmen auf dem Markt für Polybutylensuccinat (PBS)?

Die Polybutylensuccinat (PBS)-Industrie wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Indorama Ventures Public Company Limited (Thailand)

- Alpek SAB de CV (Mexiko)

- Jiangsu Sanfangxiang Group Co., Ltd. (China)

- Far Eastern New Century Corporation (Taiwan)

- DAK Americas (USA)

- BASF SE (Deutschland)

- Zhejiang Biodegradable Advanced Material Co. Ltd (China)

- Xinhaibio (China)

- Lubrilog (Frankreich)

- ECCO Gleittechnik GmbH (Deutschland)

- HUSK-ITT Corporation (USA)

- Setral Chemie GmbH (Deutschland)

- IKV Tribology Ltd (Deutschland)

- Hangzhou Ruijiang Chemical Co. (China)

- WILLEAP (Südkorea)

Welche aktuellen Entwicklungen gibt es auf dem globalen Markt für Polybutylensuccinat (PBS)?

- Im September 2022 stärkte Technip Energies, ein französisches Ingenieur- und Technologieunternehmen, sein Portfolio an nachhaltigen Chemikalien durch die Übernahme der Biosuccinium-Technologie von DSM. Damit sicherte sich Technip Energies die exklusiven Lizenzrechte für die Herstellung von biobasierter Bernsteinsäure, einem wichtigen Rohstoff für Polybutylensuccinat (PBS). Die Akquisition umfasst mehrere Patentfamilien und firmeneigene, im kommerziellen Maßstab validierte Hefestämme. Technip Energies kommt zu dem Schluss, dass dieser Schritt die führende Position und langfristige Ausrichtung des Unternehmens in den Wertschöpfungsketten biobasierter Polymere deutlich verbessert.

- Im April 2021 entwickelte die Mitsubishi Chemical Corporation im Rahmen ihrer Bemühungen zur Weiterentwicklung pflanzenbasierter Polybutylensuccinat-Produkte (PBS) und zur Erweiterung ihres Anwendungspotenzials eine marine, biologisch abbaubare Variante von BioPBS. Diese Entwicklung trägt zur Diversifizierung des Produktportfolios und zum Umsatzwachstum bei und erfüllt gleichzeitig die Anforderungen an ökologische Nachhaltigkeit. Das Unternehmen kommt zu dem Schluss, dass diese Innovation seine Wettbewerbsfähigkeit auf den Märkten für biologisch abbaubare und umweltfreundliche Polymere stärkt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.