Asia Pacific Omega 3 For Food Application Market

Marktgröße in Milliarden USD

CAGR :

%

USD

488.34 Million

USD

1,175.00 Million

2025

2033

USD

488.34 Million

USD

1,175.00 Million

2025

2033

| 2026 –2033 | |

| USD 488.34 Million | |

| USD 1,175.00 Million | |

|

|

|

|

Marktsegmentierung des asiatisch-pazifischen Omega-3-Marktes für Lebensmittelanwendungen nach Typ ( Alpha-Linolensäure (ALA), Eicosapentaensäure (EPA), Docosahexaensäure (DHA) und EPA + DHA), Quelle (marin, algenbasiert und pflanzlich), Form (Öl und Pulver), Anwendung ( funktionelle Lebensmittel , Süßwaren und Schokoladenprodukte, Sporternährung, Nahrungsergänzungsmittel , Säuglingsnahrung und Sonstiges) und Funktion (Lebensmittelanreicherung, Knochen- und Gelenkgesundheit, Hautgesundheit, Haargesundheit, Nagelgesundheit und Sonstiges) – Branchentrends und Prognose bis 2033

Wie groß ist der Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen im asiatisch-pazifischen Raum und wie hoch ist seine Wachstumsrate?

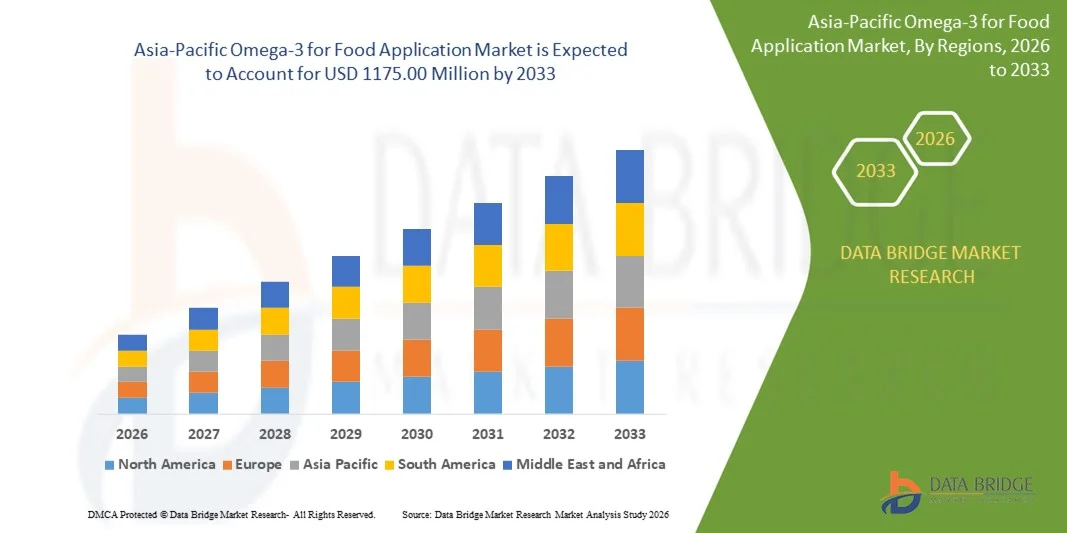

- Der Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen im asiatisch-pazifischen Raum hatte im Jahr 2025 einen Wert von 488,34 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 1175,00 Millionen US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,6 % im Prognosezeitraum entspricht.

- Die steigende Nachfrage der Verbraucher nach funktionalen, angereicherten und gesundheitsorientierten Lebensmitteln treibt das Wachstum des Marktes für Omega-3-Fettsäuren in der Lebensmittelindustrie an. Das zunehmende Bewusstsein für die positiven Auswirkungen von Omega-3-Fettsäuren auf die Herzgesundheit, die kognitive Leistungsfähigkeit und die Entzündungshemmung ermutigt Hersteller, diese Inhaltsstoffe in Backwaren, Milchprodukten, Getränken und Snacks zu verarbeiten.

- Die wachsende Beliebtheit von natürlichen und biologischen Lebensmitteln, verbunden mit Bedenken hinsichtlich Zuckerkonsum, Übergewicht und Diabetes, beschleunigt die Verbreitung von mit Omega-3-Fettsäuren angereicherten Lebensmitteln zusätzlich. Funktionelle Vorteile wie entzündungshemmende, herzschützende und die Gehirngesundheit fördernde Eigenschaften stärken die Marktattraktivität im asiatisch-pazifischen Raum.

Was sind die wichtigsten Erkenntnisse zum Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie?

- Das steigende Gesundheitsbewusstsein der Verbraucher, wachsende verfügbare Einkommen und sich wandelnde Ernährungsgewohnheiten sind Schlüsselfaktoren, die sich positiv auf den Markt für Omega-3-Fettsäuren in Lebensmitteln auswirken. Darüber hinaus bieten Produktinnovationen und neue Formulierungsstrategien lukrative Chancen für die Marktteilnehmer.

- Die hohen Kosten von Omega-3-Zutaten im Vergleich zu herkömmlichen Alternativen sowie die Verfügbarkeit günstigerer künstlicher Anreicherungsmethoden könnten das Wachstum hemmen. Das geringe Bewusstsein der Verbraucher in Schwellenländern für die gesundheitlichen Vorteile von Omega-3 dürfte eine breite Akzeptanz ebenfalls erschweren.

- Trotz Herausforderungen dürften laufende Forschungs- und Entwicklungsaktivitäten, Produktdiversifizierung und Marketinginitiativen das langfristige Wachstum des asiatisch-pazifischen Marktes für Omega-3-Fettsäuren in Lebensmittelanwendungen aufrechterhalten.

- China dominierte den asiatisch-pazifischen Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie mit einem Umsatzanteil von 35,2 % im Jahr 2025, angetrieben durch die hohe Verbrauchernachfrage nach angereicherten Lebensmitteln, Nahrungsergänzungsmitteln und funktionellen Getränken in den USA und Kanada.

- Indien wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,1 % das schnellste Wachstum verzeichnen, angetrieben durch das zunehmende Bewusstsein für Ernährungsmängel, Herz-Kreislauf-Erkrankungen und kognitive Gesundheit.

- Das DHA-Segment dominierte den Markt mit einem Umsatzanteil von 41,6 % im Jahr 2025, was auf die weitverbreitete Verwendung in Säuglingsnahrung, angereicherten Milchprodukten, Getränken zur Förderung der Gehirngesundheit und Nahrungsergänzungsmitteln zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Omega-3-Fettsäuren in der Lebensmittelindustrie

|

Eigenschaften |

Omega-3 für Lebensmittelanwendungen: Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtigste Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und den regulatorischen Rahmen. |

Was ist der wichtigste Trend auf dem Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie?

Steigende Nachfrage nach nährstoffangereicherten und Multi-Omega-3-Lebensmittelzutaten

- Der Markt für Omega-3-Fettsäuren in Lebensmitteln verzeichnet ein signifikantes Wachstum hin zu nährstoffangereicherten, multifunktionalen und Clean-Label-Rezepturen, darunter Mischungen mit pflanzlichen Ölen, Algenextrakten und Ballaststoffen zur Verbesserung des Nährwerts, des Geschmacks und der funktionellen Vorteile.

- Hersteller entwickeln vielseitige Omega-3-Lösungen, die die Herzgesundheit, die kognitive Funktion und entzündungshemmende Eigenschaften unterstützen und in Backwaren, Milchprodukten, Getränken und Säuglingsnahrungsprodukten breitere Anwendung finden.

- Die Verbraucher suchen zunehmend nach natürlichen, sicheren und funktionalen Omega-3-Inhaltsstoffen anstelle von synthetischen Alternativen, was die Akzeptanz in den Bereichen Lebensmittel, Getränke und Nahrungsergänzungsmittel vorantreibt.

- Beispielsweise haben Unternehmen wie DSM, BASF, Croda, ADM und Aker BioMarine ihr Omega-3-Produktportfolio erweitert, indem sie mikroverkapselte, pulverförmige und gemischte Öle eingeführt haben, die für angereicherte Lebensmittel und Getränke geeignet sind.

- Das wachsende Bewusstsein für Herz-Kreislauf-Gesundheit, Säuglingsernährung und den Konsum von Produkten mit transparenten Inhaltsangaben beschleunigt die Akzeptanz im asiatisch-pazifischen Markt.

- Da der Fokus der Verbraucher auf Gesundheit, Funktionalität und natürliche Inhaltsstoffe zunimmt, werden Omega-3-Fettsäuren für Lebensmittelanwendungen voraussichtlich weiterhin eine zentrale Rolle bei Produktinnovationen in der Lebensmittel- und Nahrungsergänzungsindustrie spielen.

Was sind die wichtigsten Treiber des Marktes für Omega-3-Fettsäuren in Lebensmittelanwendungen?

- Die steigende Nachfrage nach funktionellen, pflanzlichen und marinen Omega-3-Inhaltsstoffen treibt die starke Akzeptanz von Omega-3 in Lebensmittelanwendungen im asiatisch-pazifischen Raum voran.

- Beispielsweise haben DSM, BASF und Croda im Jahr 2025 ihr Angebot an mikroverkapselten und pulverförmigen Omega-3-Produkten für angereicherte Milchprodukte, Getränke und Säuglingsnahrung erweitert.

- Das wachsende Bewusstsein für Herzgesundheit, die Entwicklung des kindlichen Gehirns, entzündungshemmende Vorteile und kognitive Unterstützung steigert die Nachfrage in den USA, Europa und im asiatisch-pazifischen Raum.

- Fortschritte bei Mikroverkapselungs-, Extraktions- und Mischtechniken haben die Stabilität, die Geschmacksmaskierung und die Anwendungsvielfalt in einer breiten Palette von Lebensmitteln verbessert.

- Die steigende Nachfrage nach Bio-, gentechnikfreien und Clean-Label-Lebensmitteln unterstützt das Marktwachstum zusätzlich, angetrieben von gesundheits- und umweltbewussten Verbrauchern.

- Dank kontinuierlicher Forschung und Entwicklung, neuer Produkteinführungen, Kooperationen und einer erweiterten Distribution im asiatisch-pazifischen Raum wird erwartet, dass der Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen im Prognosezeitraum ein starkes Wachstum beibehalten wird.

Welcher Faktor beeinträchtigt das Wachstum des Marktes für Omega-3-Fettsäuren in der Lebensmittelindustrie?

- Die hohen Kosten für Extraktion, Reinigung und Stabilisierung von Omega-3-Ölen marinen und pflanzlichen Ursprungs schränken die Bezahlbarkeit in preissensiblen Regionen ein.

- Beispielsweise wirkten sich im Zeitraum 2024–2025 Schwankungen in der Fischöl- und Algenproduktion, der Rohstoffverfügbarkeit und der Energiekosten auf die Produktionsmengen mehrerer Unternehmen aus.

- Strenge regulatorische Anforderungen für die Zulassung neuartiger Lebensmittel, die Lebensmittelsicherheit und die Einhaltung der Kennzeichnungsvorschriften erhöhen die betriebliche Komplexität.

- Das geringe Verbraucherbewusstsein in Schwellenländern hinsichtlich der Vorteile von Omega-3-Fettsäuren, einschließlich der Unterstützung von Herz-Kreislauf-Gesundheit, kognitiven Fähigkeiten und der Säuglingsernährung, schränkt deren Akzeptanz ein.

- Die Konkurrenz durch günstigere Alternativen wie Leinöl, Chiaöl und andere pflanzliche Öle übt Druck auf Preisgestaltung und Differenzierung aus.

- Unternehmen begegnen diesen Herausforderungen mit dem Fokus auf kosteneffiziente Extraktion, stabile Formulierungen, regulatorische Anpassung und Verbraucheraufklärung, um die Verwendung von hochwertigem Omega-3 für Lebensmittelanwendungen im asiatisch-pazifischen Raum auszuweiten.

Wie ist der Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie segmentiert?

Der Markt ist segmentiert nach Art, Quelle, Form, Anwendungen und Funktion .

- Nach Typ

Der Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen ist in Alpha-Linolensäure (ALA), Eicosapentaensäure (EPA), Docosahexaensäure (DHA) und EPA+DHA unterteilt. Das DHA-Segment dominierte den Markt mit einem Umsatzanteil von 41,6 % im Jahr 2025, was auf seine weitverbreitete Verwendung in Säuglingsnahrung, angereicherten Milchprodukten, Getränken zur Förderung der Gehirngesundheit und Nahrungsergänzungsmitteln zurückzuführen ist. DHA wird aufgrund seiner nachgewiesenen Vorteile für die kognitive Entwicklung, die Augengesundheit und die neurologische Unterstützung weithin bevorzugt. Seine hohe Stabilität in mikroverkapselten Formaten und seine Kompatibilität mit Backwaren, Getränken und Pulverformulierungen erweitern die industrielle Anwendung weiter

Das Segment EPA+DHA wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Treiber dieser Entwicklung ist die steigende Nachfrage nach synergistischen Mischungen in funktionellen Lebensmitteln für die Herzgesundheit, in der Sporternährung und in entzündungshemmenden Präparaten. Das zunehmende Bewusstsein für präventive Ernährung, die steigende Zahl von Herz-Kreislauf-Erkrankungen und Produktinnovationen aus marinen und Algenquellen werden die Nachfrage in den asiatisch-pazifischen Märkten weiter ankurbeln.

- Nach Quelle

Der Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen ist in marine, algenbasierte und pflanzliche Produkte unterteilt. Das Segment der marinen Produkte hielt 2025 mit 58,3 % den größten Anteil, was auf die gute Verfügbarkeit von Fischöl, Krillöl und konzentrierten marinen Triglyceriden zurückzuführen ist, die in angereicherten Getränken, Milchprodukten, Brotaufstrichen und Nahrungsergänzungsmitteln verwendet werden. Marine Omega-3-Fettsäuren bleiben aufgrund ihres hohen EPA- und DHA-Gehalts und der breiten regulatorischen Akzeptanz in der Lebensmittelindustrie des asiatisch-pazifischen Raums die etablierteste Quelle

Das Segment der Algenprodukte wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach pflanzlichen, nachhaltigen, gentechnikfreien und veganen Alternativen, die sich für Säuglingsnahrung, funktionelle Getränke, Clean-Label-Lebensmittel und hochwertige Nahrungsergänzungsmittel eignen. Zunehmende Investitionen in die Fermentation von Mikroalgen, kosteneffiziente Produktion und ökologische Nachhaltigkeit stärken die Akzeptanz in den USA, Europa und im asiatisch-pazifischen Raum zusätzlich.

- Nach Formular

Der Markt ist in Öl- und Pulverform unterteilt. Das Ölsegment dominierte den Markt mit einem Umsatzanteil von 67,2 % im Jahr 2025, was auf die häufige Verwendung in angereicherten Getränken, Milchprodukten, Säuglingsnahrung und kulinarischen Anwendungen zurückzuführen ist. Öle bieten eine hervorragende Bioverfügbarkeit, einen hohen Reinheitsgrad und eine breitere Anwendbarkeit in traditionellen Lebensmittelsystemen. Omega-3-Öle auf Meeres- und Algenbasis gelten weiterhin als Industriestandard für die Anreicherung mit EPA und DHA, insbesondere in Premium-Lebensmitteln und Nahrungsergänzungsmitteln.

Das Segment der Pulverprodukte wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen, unterstützt durch die zunehmende Verwendung in Backwaren, Fruchtgummis, Süßwaren, Trockenmischungen, Mahlzeitenersatzprodukten und Getränkepulvern. Omega-3-Pulver bietet eine bessere Stabilität, Geschmacksmaskierung, längere Haltbarkeit und lässt sich leicht einrühren, wodurch es sich ideal für den industriellen Großverbrauch und Hersteller pflanzlicher Lebensmittel eignet.

- Nach Anwendungen

Der Markt für Omega-3-Fettsäuren in Lebensmitteln ist in funktionelle Lebensmittel, Süßwaren und Schokoladenprodukte, Sporternährung, Nahrungsergänzungsmittel, Säuglingsnahrung und Sonstiges unterteilt. Das Segment der funktionellen Lebensmittel führte den Markt mit einem Umsatzanteil von 36,4 % im Jahr 2025 an, angetrieben durch die steigende Nachfrage nach herzgesunden Lebensmitteln, Getränken zur Förderung der Gehirnleistung, angereicherten Milchalternativen, Brotaufstrichen, Müslis und Müsliriegeln. Die zunehmende Präferenz der Verbraucher für präventive und lifestyleorientierte Ernährung unterstützt das kontinuierliche Wachstum

Das Segment Sporternährung wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Grund dafür ist das wachsende Interesse an entzündungshemmenden Eigenschaften, Muskelregeneration, verbesserter Ausdauer und Unterstützung der Gelenkgesundheit. Der steigende Konsum von Omega-3-angereicherten Proteinpulvern, -Gels, -Hydrationsgetränken und -Nahrungsmitteln für Leistungssportler treibt das rasante Wachstum in Nordamerika, Europa und im asiatisch-pazifischen Raum an.

- Nach Funktion

Der Markt ist in Lebensmittelanreicherung, Knochen- und Gelenkgesundheit, Hautgesundheit, Haargesundheit, Nagelgesundheit und Sonstiges unterteilt. Das Segment Lebensmittelanreicherung dominierte den Markt mit einem Umsatzanteil von 44,8 % im Jahr 2025, unterstützt durch die zunehmende Verwendung von Omega-3 in Milchprodukten, Getränken, Backwaren, Säuglingsnahrung, Getreideprodukten und nahrhaften Snacks. Der zunehmende Fokus der Regierungen auf Nährstoffverbesserung, Clean-Label-Rezepturen und präventive Gesundheitsmaßnahmen fördert die breite industrielle Akzeptanz

Das Segment Hautgesundheit wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach Produkten für natürliche Schönheit, Anti-Aging-Lebensmitteln, Kollagenpräparaten und dermatologisch fundierter Ernährung. Die Bedeutung von Omega-3-Fettsäuren für die Hautfeuchtigkeit, die Reduzierung von Entzündungen und die Reparatur der Hautbarriere beschleunigt deren Integration in angereicherte Snacks, Getränke und funktionelle Süßwaren.

Welche Region hält den größten Anteil am Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie?

- China dominierte den asiatisch-pazifischen Markt für Omega-3-Fettsäuren in Lebensmitteln mit einem Umsatzanteil von 35,2 % im Jahr 2025. Treiber dieses Wachstums war die hohe Nachfrage der Verbraucher in den USA und Kanada nach angereicherten Lebensmitteln, Nahrungsergänzungsmitteln und funktionellen Getränken. Das ausgeprägte Bewusstsein für die Bedeutung von Herzgesundheit, Gehirnentwicklung und präventiver Ernährung fördert die weitverbreitete Verwendung von Omega-3 in Milchprodukten, Säuglingsnahrung, Müsliriegeln und Sportnahrung.

- Führende Hersteller erweitern die Integration von Omega-3-Fettsäuren in Getränke, Milchprodukte, Säuglingsnahrung, Backwaren und Sportnahrung durch Innovationen in den Bereichen Mikroverkapselung, Geruchsmaskierung, Stabilisierung und nachhaltige Algenfermentation. Förderliche Regulierungen, die Präferenz für Clean-Label-Produkte und die zunehmende Verwendung pflanzlicher Omega-3-Fettsäuren stärken die regionale Marktführerschaft zusätzlich.

- Steigende verfügbare Einkommen, die rasante Urbanisierung und eine starke Marktdurchdringung im Einzelhandel und E-Commerce beschleunigen weiterhin die Marktexpansion in verschiedenen Lebensmittelkategorien.

Einblick in den japanischen Markt für Omega-3-Fettsäuren in der Lebensmittelanwendung

Japan verzeichnet ein stetiges Marktwachstum, angetrieben durch die hohe Nachfrage nach hochwertigen, geruchsneutralen Omega-3-Zutaten in funktionellen Getränken, Diätprodukten und traditionellen Gerichten. Kontinuierliche Innovationen bei Verkapselung, Geschmacksmaskierung und Reinheitsgrad sprechen gesundheitsbewusste Verbraucher stark an. Ein etabliertes Einzelhandelsnetz, förderliche Regulierungen für gesundheitsbezogene Angaben und die Nachfrage nach hochwertigen angereicherten Lebensmitteln tragen zu einer breiten Marktdurchdringung bei.

Einblick in den indischen Markt für Omega-3-Fettsäuren in Lebensmittelanwendungen

Indien wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,1 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung ist das zunehmende Bewusstsein für Nährstoffmängel, Herz-Kreislauf-Erkrankungen und kognitive Beeinträchtigungen. Die steigende Nachfrage nach Omega-3-angereicherten Getränken, angereicherten Fertigprodukten, Nahrungsergänzungsmitteln und Säuglingsnahrung beschleunigt die Akzeptanz dieser Produkte. Der wachsende E-Commerce, die zunehmende Zahl gesundheitsbewusster Konsumenten in Städten und die Präferenz für Produkte mit transparenten Inhaltsstofflisten und pflanzlichen Zutaten fördern das Marktwachstum zusätzlich.

Einblick in den südkoreanischen Markt für Omega-3-Fettsäuren in der Lebensmittelindustrie

Südkorea trägt maßgeblich zum Wachstum der Region bei, angetrieben durch das starke Interesse an funktionellen Getränken, angereicherten Snacks und leistungssteigernden Lebensmitteln. Wellness-Trends, der Einfluss der koreanischen Gesundheitskultur und das hohe Verbraucherinteresse an ernährungsphysiologisch bewusster Ernährung fördern den vermehrten Einsatz von EPA und DHA in Lebensmitteln. Kontinuierliche Innovationen bei Rezepturen auf Algenbasis, hochwertigen Verpackungen und geschmacksneutralen Formaten steigern die Produktakzeptanz im In- und Ausland.

Welche sind die führenden Unternehmen auf dem Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen?

Die Omega-3-Industrie für Lebensmittelanwendungen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- DSM (Niederlande)

- BASF SE (Deutschland)

- Croda International Plc (Großbritannien)

- Aker BioMarine (Norwegen)

- ADM (Archer Daniels Midland Company) (USA)

- Cellana Inc. (USA)

- HUTAI Biopharm Resource Co. Ltd (China)

- Alaskan Omega (USA)

- KinOmega Biopharm Inc. (USA)

- Pharma Marine AS (Norwegen)

- GC Rieber VivoMega AS (Norwegen)

- Sanmark LLC (USA)

- Arjuna Natural Pvt Ltd (Indien)

- ConnOils LLC (USA)

- Kingdomway Nutrition, Inc. (China)

- Polaris Inc. (USA)

- Biosearch Life (Spanien)

Was sind die jüngsten Entwicklungen auf dem asiatisch-pazifischen Markt für Omega-3-Fettsäuren für Lebensmittelanwendungen?

- Im März 2025 brachte Natac sein Produkt Omega-3 Star auf den Markt, das aus hochwertigem Fischöl hergestellt und für Anwendungen in der Lebensmittel-, Nahrungsergänzungs- und Tiernahrungsindustrie entwickelt wurde. Diese Produkteinführung stärkt die Position des Unternehmens im wachsenden Markt für Omega-3-Lösungen.

- Im Oktober 2023 brachte dsm-firmenich life's OMEGA O3020 auf den nordamerikanischen Markt und präsentierte damit das erste Omega-3-Präparat aus Algen, das aus einer einzigen Quelle gewonnen wird und das natürliche EPA-zu-DHA-Verhältnis von herkömmlichem Fischöl aufweist, gleichzeitig aber eine überlegene Wirksamkeit bietet. Dieses Produkt soll die Verbreitung pflanzlicher Omega-3-Alternativen beschleunigen.

- Im Mai 2023 brachte Nuseed Asia-Pacific sein pflanzenbasiertes Öl Nuseed Nutriterra auf den Markt, das mit Omega-3-Fettsäuren angereichert ist und speziell auf die sich wandelnden Bedürfnisse der Ernährungs- und Nahrungsergänzungsbranche zugeschnitten wurde. Diese Innovation verbessert die Verfügbarkeit nachhaltiger, nicht-mariner Omega-3-Quellen.

- Im März 2023 investierte Epax 40 Millionen US-Dollar in Molekulardestillationstechnologien, um die Produktion und Reinheit hochkonzentrierter Omega-3-Präparate zu verbessern. Diese Investition unterstreicht das Engagement des Unternehmens für die Weiterentwicklung hochwertiger Omega-3-Lösungen.

- Im Oktober 2022 brachte Nature's Bounty ein neues pflanzliches Omega-3-Nahrungsergänzungsmittel mit 1.000 mg vegetarischem Algenöl auf den Markt, das die Gesundheit von Herz, Gelenken und Haut unterstützen soll. Diese Produkteinführung unterstreicht die wachsende Nachfrage der Verbraucher nach Omega-3-Produkten mit natürlichen Inhaltsstoffen und veganen Alternativen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.