Asia Pacific Digital Twin Financial Services And Insurance Market

Marktgröße in Milliarden USD

CAGR :

%

USD

195.91 Million

USD

726.47 Million

2022

2030

USD

195.91 Million

USD

726.47 Million

2022

2030

| 2023 –2030 | |

| USD 195.91 Million | |

| USD 726.47 Million | |

|

|

|

|

Markt für digitale Finanzdienstleistungen und Versicherungen im asiatisch-pazifischen Raum nach Typ (System, Prozess, Produkt), Technologie (Internet der Dinge (IoT) und industrielles Internet der Dinge (IIoT), künstliche Intelligenz und maschinelles Lernen, 5G, Big Data Analytics, Blockchain und Augmented Reality, virtuelle Realität, gemischte Realität), Bereitstellung (Cloud, vor Ort), Anwendung (Überprüfung der Kontostände von Bankkonten, Überprüfung digitaler Überweisungen, Richtlinienerstellung, andere Anwendungen) – Branchentrends und Prognose bis 2030.

Analyse und Größe des asiatisch-pazifischen Digital Twin-Marktes für Finanzdienstleistungen und Versicherungen

Anfangs waren digitale Zwillingsmodelle in ihrer Komplexität und Größe begrenzt, doch ihr Umfang nimmt jetzt durch die Hinzufügung fortschrittlicher Technologien wie künstlicher Intelligenz (KI), Big Data, dem Internet der Dinge (IoT) und Rechenleistung rapide zu. Mit diesen fortschrittlichen Technologien ermöglichen digitale Zwillinge die Verwendung von Daten zur Simulation und Vorhersage zukünftiger Anlagebedingungen und -leistungen im Finanzdienstleistungs- und Versicherungssektor. Infolgedessen steigt die Nachfrage nach digitalen Zwillingen im Finanzdienstleistungs- und Versicherungssektor, was das Marktwachstum fördert.

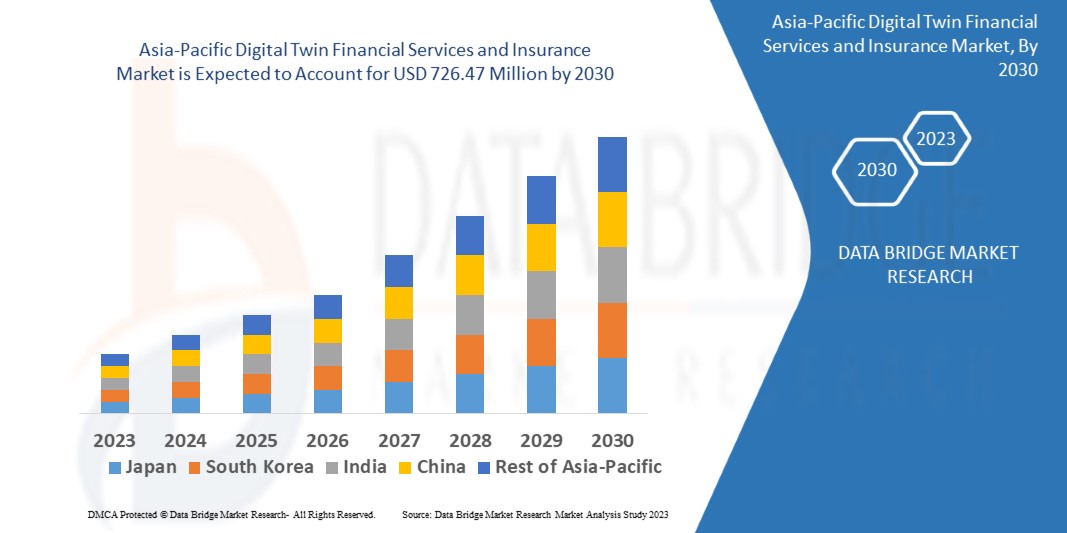

Data Bridge Market Research analysiert, dass der Markt für digitale Finanzdienstleistungen und Versicherungen bis 2030 voraussichtlich 726,47 Millionen USD erreichen wird, was im Jahr 2022 195,91 Millionen USD entspricht, was einer durchschnittlichen jährlichen Wachstumsrate von 17,80 % während des Prognosezeitraums entspricht. Neben Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

Umfang und Segmentierung des Marktes für Finanzdienstleistungen und Versicherungen im asiatisch-pazifischen Digital Twin

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2015 – 2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Typ (System, Prozess, Produkt), Technologie (Internet der Dinge (IoT) und Industrielles Internet der Dinge (IIoT), Künstliche Intelligenz und Maschinelles Lernen, 5G, Big Data Analytics, Blockchain und Augmented Reality, Virtual Reality, Mixed Reality), Bereitstellung (Cloud, Vor Ort), Anwendung (Überprüfung der Kontodeckung, Überprüfung digitaler Überweisungen, Richtlinienerstellung, andere Anwendungen) |

|

Abgedeckte Länder |

China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Rest des Asien-Pazifik-Raums (APAC) im Asien-Pazifik-Raum (APAC). |

|

Abgedeckte Marktteilnehmer |

Microsoft (USA), IBM (USA), SAP (Deutschland), Siemens (Deutschland), General Electric (USA), Atos SE (Frankreich), ABB (Schweiz), TIBCO Software Inc. (USA), Oracle (USA), Robert Bosch GmbH (Deutschland), DXC Technology Company (USA), Hexaware Technologies Limited (Indien), Tata Consultancy Services Limited (Indien), Infosys Limited (Indien), AVEVA Group plc (Großbritannien), Altair Engineering Inc. (USA), NTT DATA, Inc. (Japan), KELLTON TECH (Indien), AVEVA Group plc (Großbritannien), ANSYS, Inc. (USA) |

|

Marktchancen |

|

Marktdefinition

Der digitale Zwilling im Finanz- und Versicherungswesen ist eine Technologie, die Kunden beim Kauf und Management von Policen, bei der Kreditverwaltung, bei der Risikominderung und vielem mehr unterstützt. Digitale Zwillinge sind digitale Kopien physischer Produkte. Die Daten werden visualisiert und auf einer digitalen Plattform gespeichert, um das Unternehmenswachstum zu verbessern. Der digitale Zwilling im Finanz- und Versicherungswesen bietet Kunden optimiertere Lösungen.

Asiatisch-pazifischer Markt für digitale Finanzdienstleistungen und Versicherungen

Treiber

- Zunehmende Urbanisierung und steigendes verfügbares Einkommen werden den Wachstumsspielraum erweitern

Die zunehmende Urbanisierung in dieser Region wird im Prognosezeitraum voraussichtlich das Wachstum des Marktes für digitale Finanzdienstleistungen und Versicherungen vorantreiben. Aufgrund der zunehmenden Urbanisierung und des steigenden Nettoeinkommens können es sich die Menschen problemlos leisten, für digitale Dienste zu bezahlen, anstatt physisch zur Bank zu gehen. Daher werden die zunehmende Urbanisierung und das steigende verfügbare Einkommen den Wachstumsspielraum erweitern.

- Zunehmende Nutzung von Cloud-Technologien

Cloud-Technologien werden auf der Cloud-Plattform gehostet und über den Webbrowser über das Internet aufgerufen. Der Einsatz von Cloud-Technologien in digitalen Versicherungs- und Finanzdienstleistungen bietet mehr Sicherheit und schnellere Bearbeitungszeiten bei geringeren Preisen. Daher wird erwartet, dass die zunehmende Einführung von Cloud-Technologien das Wachstum des Marktes für digitale Finanzdienstleistungen und Versicherungen vorantreiben wird.

Gelegenheiten

- Zunehmende Nutzung digitaler Zwillinge von Finanzdienstleistungen und Versicherungen zur Identifizierung von Cross-Selling-Upselling-Möglichkeiten

Vorhandene Daten in der Versicherungslandschaft können genutzt werden, um Cross-Selling-Upselling-Gelegenheiten zu finden. Digitale Technologie wird den Umsatz der Versicherer durch Upselling und Cross-Selling steigern. Modelle für maschinelles Lernen können die vorhandenen Kundendatensätze wie deren Kaufverhalten und andere Faktoren nutzen, um Cross-Selling-Upselling-Gelegenheiten zu identifizieren. Die zunehmende Nutzung digitaler Zwillinge von Finanzdienstleistungen und Versicherungen zur Identifizierung von Cross-Selling-Upselling-Gelegenheiten wird daher reichlich Möglichkeiten für das Marktwachstum schaffen.

- Zunehmende Integration fortschrittlicher Technologie in digitale Zwillinge

Finanzdienstleistungen mit digitalen Zwillingen und versicherungsbezogene Technologien wie IoT, Sensoren und Echtzeit-Datenüberwachungssysteme helfen Versicherern, neue Policen oder Pakete zu definieren, Verwaltungskosten zu senken, Risiken zu mindern und zentrale Versicherungsvorgänge wie Betrugserkennung, Bewertung von Kundenvermögen, Underwriting, Schadensabwicklung, Erstellung neuer Policen und mehr zu verbessern. Die zunehmende Integration fortschrittlicher Technologien in digitale Zwillinge wird daher lukrative Möglichkeiten für das Marktwachstum schaffen.

Beschränkungen

- Zunehmende Sorge um Datensicherheit

Die zunehmende Besorgnis hinsichtlich der Datensicherheit im Finanzdienstleistungs- und Versicherungssektor aufgrund der Verwendung von Cloud-Plattformen und des Internets der Dinge (IoT) wird das Wachstum des Marktes für digitale Finanzdienstleistungen und Versicherungen behindern.

- Problem im Zusammenhang mit der Erschwinglichkeit der Digital-Twin-Technologie für kleine Unternehmen

Digitale Zwillingstechnologien werden in allen Branchen immer häufiger eingesetzt, aber die Kosten für Installation und Einführung sind sehr hoch. Daher können sich kleine Unternehmen die digitale Zwillingstechnologie nicht leisten . Die Kosten der digitalen Zwillingstechnologie sind auch aufgrund der teuren integrierten Software und der digitalen Zwillingssoftware hoch, was das Marktwachstum behindern wird.

Dieser Bericht zum Markt für Finanzdienstleistungen und Versicherungen mit digitalen Zwillingen enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Finanzdienstleistungen und Versicherungen mit digitalen Zwillingen zu erhalten, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Jüngste Entwicklung

- Im Jahr 2021 erwarb Siemens Smart Infrastructure die digitale Zwillingssoftwareplattform von EcoDomus für einen nicht genannten Betrag. Mit dieser Übernahme wird Siemens sein digitales Gebäudeangebot mithilfe einer cloudbasierten Zwillingssoftware für den Gebäudebetrieb erweitern.

- Im Jahr 2020 wurde HBF von Oracle Health Insurance als Kernplattform für seine Krankenversicherungsprodukte ausgewählt. Diese Plattform wird es HBF ermöglichen, die Betriebseffizienz zu steigern. Oracle unterstützt Krankenversicherer dabei, die Betriebsleistung zu verbessern, die Verwaltungskosten zu senken, die Schadensabwicklung zu optimieren, die Rechnungsgenauigkeit zu verbessern und die Zufriedenheit der Mitglieder zu steigern.

Umfang des Finanzdienstleistungs- und Versicherungsmarkts für digitale Zwillinge im asiatisch-pazifischen Raum

Der Markt für digitale Finanzdienstleistungen und Versicherungen ist nach Typ, Technologie, Einsatz und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- System

- Verfahren

- Produkt

Technologie

- Internet der Dinge (IoT) und industrielles Internet der Dinge (IIoT)

- Künstliche Intelligenz und maschinelles Lernen

- 5G

- Big Data-Analyse

- Blockchain und Augmented Reality

- Virtuelle Realität

- Gemischte Realität

Einsatz

- Wolke

- Vor Ort

Anwendung

- Überprüfung der Bankguthaben

- Schecks für digitale Überweisungen

- Richtliniengenerierung

- Andere Anwendungen

Regionale Analyse/Einblicke zum Digital Twin-Finanzdienstleistungs- und Versicherungsmarkt

Der Markt für digitale Zwillinge im Finanzdienstleistungs- und Versicherungsbereich wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Typ, Technologie, Einsatz und Anwendung wie oben angegeben bereitgestellt.

Die im Bericht zum digitalen Zwillingsmarkt für Finanzdienstleistungen und Versicherungen abgedeckten Länder sind China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, die Philippinen und der Rest des asiatisch-pazifischen Raums (APAC).

China dominiert den Markt für digitale Finanzdienstleistungen und Versicherungen aufgrund der zunehmenden Fokussierung auf die Nutzung von 5G und der hohen Nutzung von Cloud-Datenbanken in dieser Region. Darüber hinaus werden die zunehmende Einführung fortschrittlicher Technologien und eine verbesserte Infrastrukturentwicklung das Marktwachstum weiter ankurbeln.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Digital Twin Finanzdienstleistungen und Versicherungen Marktanteilsanalyse

Die Wettbewerbslandschaft des Marktes für Finanzdienstleistungen und Versicherungen mit digitalen Zwillingen liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Finanzdienstleistungen und Versicherungen mit digitalen Zwillingen.

Zu den wichtigsten Akteuren auf dem Markt für digitale Finanzdienstleistungen und Versicherungen zählen:

- Microsoft (US)

- IBM (USA)

- SAP (Deutschland)

- Siemens (Deutschland)

- General Electric (USA)

- Atos SE (Frankreich)

- ABB (Schweiz)

- TIBCO Software Inc. (USA)

- Oracle (USA)

- Robert Bosch GmbH (Deutschland)

- DXC Technology Company (USA)

- Hexaware Technologies Limited (Indien)

- Tata Consultancy Services Limited (Indien)

- Infosys Limited (Indien)

- AVEVA Group plc (Großbritannien)

- Altair Engineering Inc. (USA)

- NTT DATA, Inc. (Japan)

- KELLTON TECH (Indien)

- AVEVA Group plc (Großbritannien)

- ANSYS, Inc. (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.