Asia Pacific Cooling System For Edge Computing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

361.33 Million

USD

814.87 Million

2024

2032

USD

361.33 Million

USD

814.87 Million

2024

2032

| 2025 –2032 | |

| USD 361.33 Million | |

| USD 814.87 Million | |

|

|

|

|

Marktsegmentierung für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum nach Kühlsystemtyp (luftbasiert, flüssigkeitsbasiert und Hybrid), Kühlleistung (mittelgroße Kühlsysteme, kleine Kühlsysteme und große Kühlsysteme (über 200 kW)), Bereitstellungstyp (raumbasierte Kühleinheiten, In-Rack-Kühleinheiten, Außenkühleinheiten, Direct-to-Chip-Flüssigkeitskühleinheiten, tragbare Kühleinheiten und Tauchkühleinheiten), Kühlmanagementsystem (integrierte Kühlmanagementsysteme und eigenständige Kühlmanagementsysteme), Kühlmethode (Kaltwasserkühlung, Direktverdampfung (DX)-Kühlung, Flüssigkeitskühlung und andere), Vertikal (IT und Telekommunikation, Fertigung, Behörden und öffentliche Sektoren, Gesundheitswesen, Transport und Logistik, Einzelhandel und Konsumgüter und andere) – Branchentrends und Prognose bis 2032

Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum – Marktgröße

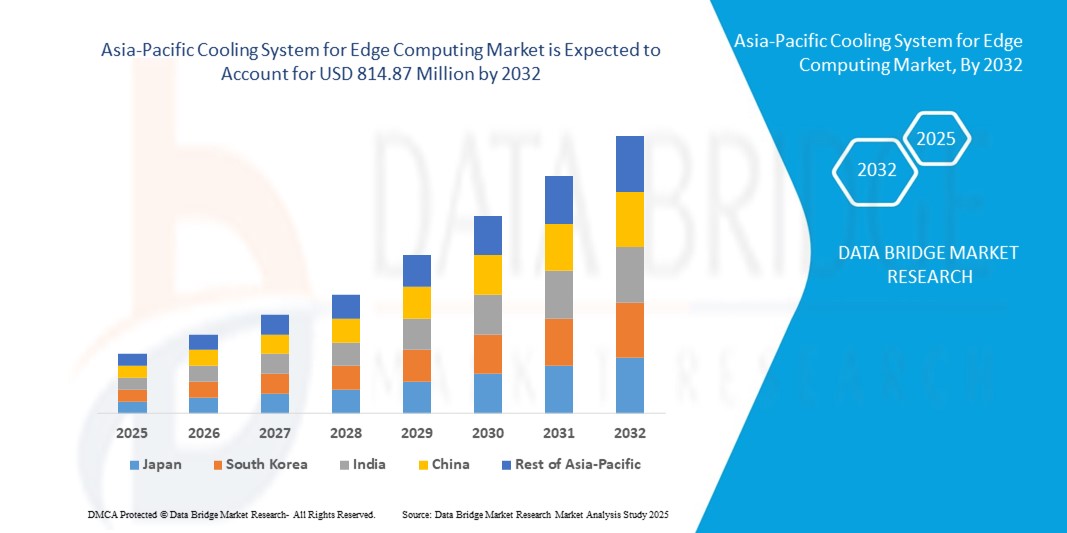

- Der Markt für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum hatte im Jahr 2024 einen Wert von 361,33 Millionen US-Dollar und wird bis 2032 voraussichtlich 814,87 Millionen US-Dollar erreichen , bei einer CAGR von 10,70 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung von Edge Computing in allen Branchen, die steigende Nachfrage nach effizienten und nachhaltigen Kühltechnologien und den wachsenden Bedarf an Wärmemanagement in hochdichten Computerumgebungen vorangetrieben.

- Fortschritte bei Flüssigkeitskühlungs- und Immersionskühlungslösungen sowie steigende Investitionen in Rechenzentren näher an den Endverbrauchern tragen weiter zur Marktexpansion bei

Marktanalyse für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum

- Der Markt für Kühlsysteme für Edge-Computing im asiatisch-pazifischen Raum erlebt eine erhebliche Dynamik, da Unternehmen die digitale Transformation beschleunigen und Edge-Infrastrukturen für eine schnellere Datenverarbeitung einsetzen.

- Der zunehmende Fokus auf die Reduzierung der Latenz und die Gewährleistung einer unterbrechungsfreien Systemleistung hat den Bedarf an innovativen Kühltechnologien erhöht, die den Energieverbrauch minimieren und gleichzeitig eine hohe Betriebseffizienz gewährleisten.

- China dominierte den Markt für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum mit dem größten Umsatzanteil im Jahr 2024, unterstützt durch massive Investitionen in den 5G-Ausbau, die Einführung des IoT und Smart-City-Initiativen

- Japan wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im asiatisch-pazifischen Markt für Kühlsysteme für Edge-Computing verzeichnen, aufgrund der steigenden Nachfrage nach Hochleistungs-Computing, der frühen Einführung von Flüssigkeitskühlungstechnologien und steigender Investitionen in KI- und IoT-gesteuerte Edge-Anwendungen.

- Das luftgestützte Segment hatte im Jahr 2024 den größten Marktanteil, was auf seine Kosteneffizienz, die breite Verfügbarkeit und die einfache Integration in die bestehende Infrastruktur zurückzuführen ist. Luftkühlung bleibt eine bevorzugte Option für kleine und mittelgroße Edge-Implementierungen mit moderaten Effizienzanforderungen.

Berichtsumfang und Marktsegmentierung für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum

|

Eigenschaften |

Kühlsystem für Edge Computing im asiatisch-pazifischen Raum – Wichtige Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Kühlsystem für Edge-Computing-Markttrends im asiatisch-pazifischen Raum

Einführung von Flüssigkeitskühlungs- und Immersionskühlungstechnologien

- Der Übergang zu fortschrittlichen Flüssigkeits- und Tauchkühlungssystemen verändert den Kühlsystemmarkt für Edge-Computing, indem er hohe Wärmedichten in kompakten Infrastrukturen berücksichtigt. Diese Technologien ermöglichen ein effizientes Wärmemanagement am Edge und gewährleisten so eine konstante Systemverfügbarkeit und Leistung auch bei hoher Arbeitslast.

- Die wachsende Nachfrage nach nachhaltigen Kühlmethoden beschleunigt die Einführung flüssigkeitsbasierter Systeme, die im Vergleich zur herkömmlichen Luftkühlung weniger Strom und Wasser verbrauchen. Dieser Trend ist besonders stark in Regionen mit strengen CO2-Reduktionszielen, in denen energieeffiziente Betriebsabläufe im Vordergrund stehen.

- Die Skalierbarkeit und der modulare Aufbau von Immersionskühlsystemen machen sie für kleine und mittelgroße Edge-Implementierungen geeignet. Sie tragen dazu bei, die Betriebskosten zu senken und gleichzeitig die Lebensdauer der Geräte zu verlängern. Ihre Anpassungsfähigkeit bietet einen großen Vorteil für Unternehmen, die Edge-Netzwerke in städtischen und abgelegenen Gebieten erweitern.

- So haben beispielsweise mehrere Telekommunikationsbetreiber im Jahr 2023 modulare Flüssigkeitskühleinheiten in Edge-Rechenzentren eingesetzt, was zu einer deutlichen Reduzierung des Energieverbrauchs und einer verbesserten Zuverlässigkeit der Netzwerkdienste führte. Dies steigert nicht nur die Leistung, sondern unterstützt auch langfristige Nachhaltigkeitsziele.

- Flüssigkeits- und Immersionskühlung ermöglichen zwar eine höhere Effizienz und größere Umweltvorteile, ihre weitreichende Wirkung hängt jedoch von der Senkung der Vorlaufkosten, der Entwicklung von Industriestandards und der Schulung der Bediener ab. Anbieter müssen sich auf lokalisierte Bereitstellungsstrategien konzentrieren, um die Akzeptanz in verschiedenen Edge-Umgebungen zu maximieren.

Marktdynamik für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum

Treiber

Steigender Datenverkehr und wachsende Nachfrage nach Verarbeitung mit geringer Latenz

- Der exponentielle Anstieg des Datenverkehrs durch IoT-Geräte, 5G-Netzwerke und Echtzeitanwendungen setzt die Edge-Computing-Infrastruktur enorm unter Druck. Um die Leistung aufrechtzuerhalten und Ausfallzeiten zu vermeiden, ist eine effiziente Kühlung zu einem entscheidenden Faktor für den Edge-Einsatz geworden.

- Unternehmen sind sich zunehmend der finanziellen und betrieblichen Risiken bewusst, die mit Überhitzung verbunden sind, darunter Geräteschäden, Energieineffizienz und Betriebsunterbrechungen. Dieses Bewusstsein hat zu einer verstärkten Nutzung von Kühlsystemen der nächsten Generation geführt, die einen reibungslosen Betrieb gewährleisten.

- Regierungen und Branchenregulierungsbehörden unterstützen die Entwicklung von Edge-Infrastrukturen durch Energieeffizienzinitiativen und Green-IT-Richtlinien. Diese Rahmenbedingungen ermutigen Unternehmen, in moderne Kühllösungen zu investieren, die den CO2-Fußabdruck reduzieren und Nachhaltigkeitsanforderungen erfüllen.

- So setzen beispielsweise im Jahr 2022 mehrere Rechenzentrumsbetreiber zunehmend fortschrittliche Immersionskühlsysteme ein, um die Energieeffizienzrichtlinien einzuhalten, was die Marktnachfrage nach Hochleistungskühltechnologien steigert.

- Während die Nachfrage nach Verarbeitung mit geringer Latenz ein wichtiger Treiber ist, werden die Berücksichtigung des Energieverbrauchs, der Systemintegration und der Betriebsschulung von entscheidender Bedeutung sein, um eine nachhaltige Einführung fortschrittlicher Kühlsysteme am Rande sicherzustellen.

Einschränkung/Herausforderung

Hohe Bereitstellungskosten und technische Barrieren in Edge-Umgebungen

- Die hohen Investitionen für fortschrittliche Kühllösungen wie Flüssigkeitsimmersion und Direct-to-Chip-Kühlung stellen nach wie vor ein großes Hindernis für die Einführung dar, insbesondere für kleine Unternehmen und Schwellenländer. Viele Unternehmen setzen aus Kostengründen immer noch auf konventionelle Systeme.

- Der Mangel an qualifizierten Technikern und die begrenzte Expertise im Umgang mit speziellen Kühltechnologien an abgelegenen oder verteilten Edge-Standorten schränken den Einsatz zusätzlich ein. Diese Herausforderung wird durch das Fehlen standardisierter Verfahren und technischer Richtlinien in der gesamten Branche noch verschärft.

- Die Marktdurchdringung wird auch durch Infrastrukturprobleme behindert, darunter Probleme mit der Stromversorgung und der Wartung in bestimmten Edge-Umgebungen. Diese Einschränkungen können den Einsatz effizienter Kühlsysteme verzögern und zur Abhängigkeit von weniger effektiven Alternativen führen.

- Beispielsweise werden im Jahr 2023 viele kleine Edge-Rechenzentren aufgrund der hohen Kosten und der begrenzten Verfügbarkeit fortschrittlicher Flüssigkeitskühlungstechnologien weiterhin veraltete luftbasierte Kühlsysteme verwenden.

- Während Innovationen die Effizienz von Kühlsystemen weiter verbessern, ist es unerlässlich, Kosten-, Infrastruktur- und Qualifikationsbarrieren zu überwinden. Marktteilnehmer müssen in modulare, kostengünstige und leicht einsetzbare Lösungen investieren, um eine breitere Akzeptanz im gesamten Edge-Ökosystem zu erreichen.

Kühlsystem für Edge Computing im asiatisch-pazifischen Raum – Marktumfang

Der Markt ist nach Kühlsystemtyp, Kühlleistung, Einsatzart, Kühlmanagementsystem, Kühlmethode und Branche segmentiert.

- Nach Art der Kühlsysteme

Der Markt für Edge-Computing-Kühlsysteme im asiatisch-pazifischen Raum wird nach Kühlsystemtypen in luftbasierte, flüssigkeitsbasierte und hybride Systeme unterteilt. Das luftbasierte Segment hatte 2024 den größten Marktanteil, was auf seine Kosteneffizienz, die breite Verfügbarkeit und die einfache Integration in die bestehende Infrastruktur zurückzuführen ist. Luftkühlung bleibt die bevorzugte Option für kleine und mittelgroße Edge-Implementierungen mit moderaten Effizienzanforderungen.

Das Segment der flüssigkeitsbasierten Kühlsysteme wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen. Dies ist auf die überlegene Wärmeableitungsfähigkeit und die zunehmende Verbreitung in hochdichten Edge-Rechenzentren zurückzuführen. Flüssigkeitsbasierte Kühllösungen gewinnen an Bedeutung, da sie den Energieverbrauch senken und Nachhaltigkeitsziele unterstützen. Damit eignen sie sich ideal für Computerumgebungen der nächsten Generation.

- Nach Kühlleistung

Auf der Grundlage der Kühlleistung wird der Markt in mittelgroße, kleine und große Kühlsysteme (über 200 kW) unterteilt. Das Segment der mittelgroßen Kühlsysteme erzielte im Jahr 2024 den größten Umsatzanteil, vor allem aufgrund ihres Einsatzes in regionalen und Randanlagen mit moderatem Kühlbedarf.

Das Segment der Großkühlsysteme wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, da Edge Computing zunehmend auch in großen Telekommunikationszentren und Unternehmenseinrichtungen Einzug hält. Ihre Fähigkeit, intensive Arbeitslasten zu bewältigen und eine hohe Systemzuverlässigkeit aufrechtzuerhalten, macht sie zu einer wichtigen Wahl für große Edge-Netzwerke.

- Nach Bereitstellungstyp

Auf der Grundlage der Bereitstellungsart ist der Markt in raumbasierte Kühleinheiten, Rack-Kühleinheiten, Außenkühleinheiten, Direct-to-Chip-Flüssigkeitskühleinheiten, tragbare Kühleinheiten und Tauchkühleinheiten segmentiert. Das Segment der raumbasierten Kühleinheiten dominierte den Marktanteil im Jahr 2024 aufgrund ihrer etablierten Verwendung in traditionellen Edge-Einrichtungen und Rechenzentren.

Das Segment der Direct-to-Chip-Flüssigkeitskühlungen wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch die steigende Nachfrage nach energieeffizienten und platzsparenden Kühllösungen. Diese Systeme ermöglichen ein gezieltes Wärmemanagement und werden zunehmend in Hochleistungs-Edge-Umgebungen eingesetzt.

- Durch Kühlmanagementsystem

Auf der Grundlage des Kühlmanagementsystems ist der Markt in integrierte Kühlmanagementsysteme und eigenständige Kühlmanagementsysteme unterteilt. Das Segment der integrierten Kühlmanagementsysteme hatte im Jahr 2024 den größten Anteil, da Unternehmen zunehmend zentralisierte Systeme bevorzugen, die die Überwachung, Automatisierung und Energieoptimierung verbessern.

Das Segment der eigenständigen Kühlmanagementsysteme wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate aufweisen, insbesondere bei kleinen Anlagen und kostenbewussten Betreibern, die flexible und unabhängige Systeme bevorzugen.

- Nach Kühlmethode

Auf der Grundlage der Kühlmethode ist der Markt für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum in Kaltwasserkühlung, Direktexpansionskühlung (DX), Flüssigkeitskühlung und andere unterteilt. Das Segment der Kaltwasserkühlung hatte im Jahr 2024 den größten Umsatzanteil, was auf seine Zuverlässigkeit, Skalierbarkeit und weite Verbreitung in mittelgroßen bis großen Edge-Einrichtungen zurückzuführen ist.

Das Segment der Flüssigkeitskühlung wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate aufweisen, was auf die steigende Leistungsdichte am Rand und den Bedarf an hocheffizienten und nachhaltigen Kühltechnologien zurückzuführen ist.

- Nach Vertikal

Auf vertikaler Basis ist der Markt in die Bereiche IT und Telekommunikation, Fertigung, Regierung und öffentlicher Sektor, Gesundheitswesen, Transport und Logistik, Einzelhandel und Konsumgüter usw. unterteilt. Das Segment IT und Telekommunikation dominierte den Markt im Jahr 2024, angetrieben durch den großflächigen Einsatz von 5G-Netzen und die steigende Nachfrage nach Edge-Rechenzentren.

Im Gesundheitssektor wird von 2025 bis 2032 voraussichtlich die höchste Wachstumsrate verzeichnet, da die Einführung von Edge Computing in der Telemedizin, der medizinischen Bildgebung und der Echtzeit-Patientenüberwachung den Bedarf an zuverlässigen und energieeffizienten Kühlsystemen erhöht.

Asien-Pazifik-Kühlsystem für Edge-Computing-Markt – Regionale Analyse

- China dominierte den Markt für Kühlsysteme für Edge Computing im asiatisch-pazifischen Raum mit dem größten Umsatzanteil im Jahr 2024, unterstützt durch massive Investitionen in den 5G-Ausbau, die Einführung des IoT und Smart-City-Initiativen

- Das schnelle Wachstum der digitalen Infrastruktur des Landes treibt die Nachfrage nach fortschrittlichen Kühllösungen voran, die Effizienz und Nachhaltigkeit gewährleisten

- Starke staatliche Unterstützung, eine große Produktionsbasis und eine steigende Nachfrage nach KI-gesteuerten Anwendungen stärken Chinas Führungsposition auf dem Markt weiter.

Japanisches Kühlsystem für den Edge-Computing-Markt

Der japanische Markt für Kühlsysteme für Edge Computing wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch die zunehmende Verbreitung von Edge Computing in der Automobil-, Robotik- und Telekommunikationsbranche. Steigende Energiekosten und der nationale Fokus auf CO2-Neutralität drängen Unternehmen dazu, innovative flüssigkeitsbasierte und Immersionskühlsysteme einzusetzen. Darüber hinaus beschleunigen Kooperationen zwischen globalen Anbietern von Kühltechnologien und lokalen Betreibern die Einführung von Lösungen der nächsten Generation.

Marktanteil von Kühlsystemen für Edge Computing im asiatisch-pazifischen Raum

Die Kühlsystembranche für Edge-Computing im asiatisch-pazifischen Raum wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Huawei Technologies (China)

- Fujitsu Limited (Japan)

- Hitachi Kühlung & Heizung (Japan)

- Johnson Controls-Hitachi Air Conditioning (Japan)

- Delta Electronics (Taiwan)

- NEC Corporation (Japan)

- OMRON Corporation (Japan)

- Sungrow Power Supply Co., Ltd. (China)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.