Asia Pacific Antibody Drug Conjugates Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.06 Billion

USD

7.10 Billion

2024

2032

USD

2.06 Billion

USD

7.10 Billion

2024

2032

| 2025 –2032 | |

| USD 2.06 Billion | |

| USD 7.10 Billion | |

|

|

|

|

Marktsegmentierung für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum nach Produkt (Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak und andere), Antigenkomponente (HER2-Rezeptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Gewebefaktoren und andere), Antikörperkomponente (ADCs der dritten Generation, der zweiten Generation, der vierten Generation und der ersten Generation), Linkerkomponente (spaltbare Linker und nicht spaltbare Linker), zytotoxische Nutzlasten oder Sprengkopfkomponente (DNA-schädigende Wirkstoffe und Mikrotubuli-störende Wirkstoffe), Linkertechnologie (Peptidlinker, Thioetherlinker, Hydrazonlinker und Disulfidlinker), Konjugationstechnologie (ortsspezifische Konjugation und chemische Konjugation), Indikation (Brustkrebs, Blutkrebs (Leukämie, Lymphom), Lungenkrebs, gynäkologischer Krebs, Magen-Darm-Krebs, Urogenitalkrebs und andere), Endbenutzer (Krankenhäuser, Fachzentren, Kliniken, ambulante Zentren, häusliche Pflege und andere), Vertriebskanal (Direktausschreibungen, Einzelhandel und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

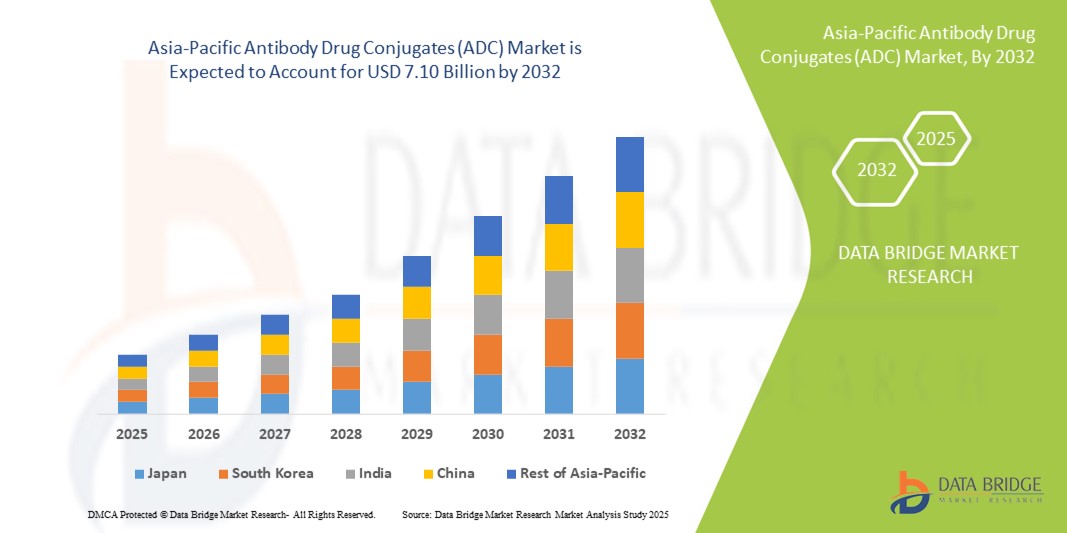

- Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum hatte im Jahr 2024 ein Volumen von 2,06 Milliarden US-Dollar und dürfte bis 2032 einen Wert von 7,10 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate (CAGR) von 16,70 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Krebsbelastung, steigende Investitionen in die onkologische Forschung und eine größere Verfügbarkeit zielgerichteter Therapeutika in Ländern wie China, Japan und Südkorea vorangetrieben.

- Darüber hinaus positioniert die zunehmende Anwendung der Präzisionsmedizin sowie positive staatliche Initiativen zur Förderung biopharmazeutischer Innovationen ADCs als bevorzugte Methode in der Krebsbehandlung. Diese konvergierenden Faktoren treiben die starke Nachfrage nach ADC-Therapien voran und treiben damit die Marktexpansion in der Region deutlich voran.

Marktanalyse für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

- Antikörper-Wirkstoff-Konjugate (ADCs), die die zielgerichteten Fähigkeiten monoklonaler Antikörper mit der starken zelltötenden Wirkung zytotoxischer Medikamente kombinieren, werden aufgrund ihrer verbesserten Wirksamkeit, gezielten Verabreichung und reduzierten systemischen Toxizität zu einer wichtigen Klasse von Therapeutika in der Onkologie im gesamten asiatisch-pazifischen Raum.

- Die steigende Nachfrage nach ADCs ist vor allem auf die zunehmende Krebshäufigkeit, die Verbesserung der Gesundheitsinfrastruktur und den zunehmenden Zugang zu fortschrittlichen Biopharmazeutika in Schwellenländern wie China und Indien zurückzuführen.

- China dominierte den Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum mit dem größten Umsatzanteil von 48,1 % im Jahr 2024, unterstützt durch beschleunigte behördliche Zulassungen, umfangreiche klinische Forschungsaktivitäten und strategische Partnerschaften zwischen inländischen Unternehmen und globalen Biotech-Unternehmen, die sich auf neuartige ADC-Pipelines konzentrieren.

- Japan wird voraussichtlich das schnellste Wachstum im Markt für Antikörper-Wirkstoff-Konjugate (ADC) erleben, angetrieben durch hohe Gesundheitsausgaben, gut etablierte Pharmaindustrien und ein steigendes Bewusstsein der Patienten für gezielte Krebstherapien.

- Das Brustkrebssegment dominierte den Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum mit einem Marktanteil von 40,2 % im Jahr 2024, was auf die hohe Inzidenzrate, steigende Diagnoseraten und das Vorhandensein mehrerer zugelassener ADC-Therapien gegen HER2-positiven Brustkrebs zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

|

Eigenschaften |

Wichtige Markteinblicke zu Antikörper-Wirkstoff-Konjugaten (ADC) im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

„Steigende Zunahme klinischer Studien und lokaler Biotech-Kooperationen“

- Ein bedeutender und sich beschleunigender Trend auf dem ADC-Markt im asiatisch-pazifischen Raum ist der Anstieg regionsspezifischer klinischer Studien und strategischer Kooperationen zwischen lokalen Biotech-Unternehmen und globalen Pharmaunternehmen, die darauf abzielen, die Entwicklung und Vermarktung neuartiger ADC-Therapien zu beschleunigen.

- So schloss beispielsweise das in China ansässige Unternehmen Biokin Pharmaceuticals im Jahr 2024 eine gemeinsame Entwicklungsvereinbarung mit einem US-amerikanischen Biotech-Unternehmen ab, um eine Pipeline von HER2-gerichteten ADCs voranzutreiben. Dies spiegelt ein wachsendes Muster internationaler Partnerschaften wider, das durch die steigenden F&E-Kapazitäten und regulatorischen Reformen in der Region vorangetrieben wird.

- Steigende Investitionen in Onkologie-Pipelines und Verbesserungen der regulatorischen Rahmenbedingungen – insbesondere in China und Südkorea – ermöglichen schnellere Zulassungen und optimierte Verfahren für innovative Therapeutika wie ADCs. Diese Fortschritte ermutigen sowohl lokale als auch multinationale Unternehmen, ihre klinischen Studien auszuweiten und lokale Produktionsstätten aufzubauen.

- Darüber hinaus fördern Regierungen in der gesamten Region, insbesondere in China und Japan, aktiv Krebsforschung und Programme zur Präzisionsmedizin und schaffen so ein günstiges Umfeld für ADC-Innovationen. Zu den bemerkenswerten Initiativen gehören die erweiterte Finanzierung im Rahmen des chinesischen Plans „Healthy China 2030“ und des japanischen „Cancer Control Promotion Act“, die beide darauf abzielen, die Ergebnisse der Onkologie durch fortschrittliche Therapeutika zu verbessern.

- Die Integration fortschrittlicher Linker-Technologien und ortsspezifischer Konjugationstechniken gewinnt auch in regionalen Entwicklungsbemühungen an Bedeutung. Dadurch können ADCs höhere therapeutische Indizes mit verbesserten Sicherheitsprofilen erreichen. Dies verändert den Behandlungsstandard und positioniert ADCs als erste Wahl in der zielgerichteten Krebstherapie.

- Infolgedessen entwickelt sich die Region Asien-Pazifik zu einem attraktiven Zentrum für die ADC-Forschung. Sie profitiert von starker wissenschaftlicher Expertise, einer wachsenden Patientenzahl für onkologische Studien und einem günstigen regulatorischen Umfeld, das beschleunigte Innovationen und Zulassungen unterstützt.

Marktdynamik für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

Treiber

„Wachsende Krebslast und steigende Nachfrage nach zielgerichteter Therapie“

- Die steigende Zahl verschiedener Krebserkrankungen im asiatisch-pazifischen Raum sowie das wachsende Bewusstsein für Präzisionsonkologie sind wichtige Treiber für die steigende Nachfrage nach ADCs in der Region.

- So schätzte die Weltgesundheitsorganisation beispielsweise, dass es im Jahr 2024 in Asien über 9 Millionen neue Krebsfälle geben wird, wobei Brust-, Lungen- und Magenkrebs zu den häufigsten gehören. Dieser alarmierende Anstieg führt zu einer erhöhten Nachfrage nach innovativen Behandlungsmöglichkeiten wie ADCs, die im Vergleich zu herkömmlichen Chemotherapien eine verbesserte Spezifität und geringere Toxizität bieten.

- Darüber hinaus ermöglichen die zunehmende Erschwinglichkeit von Biologika und die wachsende Versicherungsdeckung in Schlüsselmärkten wie China und Japan einen breiteren Zugang zu ADC-Therapien. Günstige Erstattungsrichtlinien und nationale Gesundheitsprogramme fördern zudem die Einführung kostenintensiver Behandlungen, da sie die finanzielle Belastung der Patienten verringern.

- Auch die Investitionen in die Biopharmaindustrie nehmen in der Region stark zu. Unternehmen wie Seagen und Daiichi Sankyo erweitern ihre Präsenz in der ADC-Branche durch lokale Partnerschaften und erweiterte klinische Programme. Diese strategischen Schritte ermöglichen schnellere Entwicklungszyklen und eine verbesserte Verfügbarkeit von ADCs in der gesamten Region.

- Darüber hinaus unterstützen die wachsenden Kapazitäten regionaler CROs und CDMOs die End-to-End-Entwicklung von ADCs, von der frühen Forschungsphase bis zur Produktion im kommerziellen Maßstab, und verbessern so die lokale Marktreife weiter.

Einschränkung/Herausforderung

„Hohe Fertigungskomplexität und regulatorische Variabilität“

- Trotz des Wachstumspotenzials steht der ADC-Markt im asiatisch-pazifischen Raum vor erheblichen Herausforderungen, darunter die hohe Komplexität und die Kosten der Herstellung von ADCs, die die Zugänglichkeit und Skalierbarkeit in einigen Teilen der Region einschränken.

- ADCs erfordern Präzision in der Konjugationschemie, eine Produktion unter strengen Sicherheitsvorkehrungen und eine strenge Qualitätskontrolle, was die Produktionskosten in die Höhe treibt. Diese technischen Hürden können den Markteintritt kleinerer Biotech-Unternehmen erschweren, denen die Infrastruktur oder das Kapital für Investitionen in die Entwicklung und Produktion von ADCs fehlen.

- Darüber hinaus erschweren regulatorische Uneinheitlichkeiten in den asiatisch-pazifischen Ländern eine reibungslose regionale Vermarktung. Während China und Japan die Zulassungsverfahren für Biologika vereinfacht haben, sind andere Länder nach wie vor mit langwierigen Zulassungsverfahren konfrontiert oder es fehlen klare ADC-spezifische Richtlinien.

- Diese Hürden können den Markteintritt verzögern und die grenzüberschreitende Zusammenarbeit, insbesondere für neuere Akteure, einschränken. Darüber hinaus kann der Mangel an erfahrenen Arbeitskräften und technischem Know-how in einigen Schwellenländern die Einführung und Innovation von ADCs weiter verlangsamen.

- Die Überwindung dieser Hindernisse durch harmonisierte regulatorische Rahmenbedingungen, verstärkte öffentlich-private Investitionen in die Bioproduktionskapazitäten und Schulungsprogramme für die ADC-Produktion wird entscheidend sein, um nachhaltiges Wachstum und einen gleichberechtigten Zugang im gesamten asiatisch-pazifischen Raum zu gewährleisten.

Marktumfang für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

Der Markt ist nach Produkt, Antigenkomponente, Antikörperkomponente, Linkerkomponente, zytotoxischen Nutzlasten, Linkertechnologie, Konjugationstechnologie, Indikation, Endbenutzer und Vertriebskanal segmentiert.

- Nach Produkt

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist produktbezogen in Enhertu, Kadcyla, Trodelvy, Polivy, Adcetris, Padcev, Besponsa, Elahere, Zylonta, Mylotarg, Tivdak und weitere segmentiert. Das Segment Enhertu dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, was auf seine breite klinische Anwendung bei HER2-positiven Krebserkrankungen und die starke Akzeptanz in wichtigen asiatisch-pazifischen Ländern wie Japan, China und Südkorea zurückzuführen ist. Die soliden Wirksamkeitsdaten und behördlichen Zulassungen von Enhertu in mehreren soliden Tumorindikationen haben seine führende Position im regionalen ADC-Markt gefestigt.

Das Polivy-Segment wird voraussichtlich von 2025 bis 2032 das stärkste Wachstum verzeichnen, was auf die zunehmende Verbreitung in der Behandlung des diffusen großzelligen B-Zell-Lymphoms (DLBCL) und die Aufnahme in regionale Behandlungsrichtlinien zurückzuführen ist. Die strategische Expansion von Roche und die zunehmende Kostenerstattung in onkologischen Zentren unterstützen das rasante Wachstum in diesem Markt zusätzlich.

- Nach Antigenkomponente

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist anhand der Antigenkomponente in HER2-Rezeptor, Trop-2, CD79B, CD30, Nectin 4, CD22, CD19, CD33, Gewebefaktoren und weitere segmentiert. Das HER2-Rezeptor-Segment erzielte 2024 den größten Umsatzanteil, was auf die hohe Prävalenz HER2-positiver Krebserkrankungen und die Verfügbarkeit fortschrittlicher ADCs gegen dieses Antigen, darunter Kadcyla und Enhertu, zurückzuführen ist.

Das Trop-2-Segment dürfte im Prognosezeitraum die höchste Wachstumsrate verzeichnen, unterstützt durch die zunehmende Verwendung von Trodelvy und das steigende klinische Interesse an Trop-2-Zielwirkstoffen für aggressive Brust- und Urothelkrebserkrankungen in der Region.

- Nach Antikörperkomponente

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist nach der Antikörperentwicklung in ADCs der ersten, zweiten, dritten und vierten Generation unterteilt. Das Segment der ADCs der zweiten Generation dominierte den Markt mit dem größten Anteil im Jahr 2024 aufgrund des klinischen Erfolgs und der kommerziellen Verfügbarkeit von ADCs wie Kadcyla und Adcetris, die eine verbesserte Stabilität und Wirksamkeit bieten.

Das Segment der ADCs der dritten Generation wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum aufweisen, angetrieben durch technologische Fortschritte bei der ortsspezifischen Konjugation und verbesserte Sicherheitsprofile, die von regionalen Entwicklern und globalen Pharma-Kooperationspartnern übernommen werden.

- Nach Linker-Komponente

Basierend auf der Linker-Komponente ist der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum in spaltbare und nicht spaltbare Linker unterteilt. Das Segment der spaltbaren Linker hatte im Jahr 2024 den größten Marktanteil, da sie zytotoxische Wirkstoffe selektiv in Tumorumgebungen freisetzen und so die systemische Toxizität reduzieren und die Therapieergebnisse verbessern können.

Das Segment der nicht spaltbaren Linker dürfte im Prognosezeitraum das schnellste Wachstum verzeichnen, insbesondere bei hämatologischen Malignomen, bei denen intrazelluläre Abbaumechanismen eine wirksame Arzneimittelfreisetzung auch ohne Linkerspaltung ermöglichen.

- Durch zytotoxische Nutzlasten oder Sprengkopfkomponenten

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist auf der Grundlage ihrer zytotoxischen Eigenschaften in DNA-schädigende Wirkstoffe und Mikrotubuli-disruptierende Wirkstoffe segmentiert. Das Segment der Mikrotubuli-disruptierenden Wirkstoffe dominierte den Markt im Jahr 2024, angetrieben durch ihren erfolgreichen Einsatz in etablierten ADCs wie Kadcyla und Adcetris. Diese Wirkstoffe weisen eine starke Antitumoraktivität auf und zeigten positive Ergebnisse sowohl bei soliden Krebserkrankungen als auch bei Blutkrebs.

Das Segment der DNA-schädigenden Wirkstoffe dürfte zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, was auf die einzigartigen Wirkmechanismen dieser Wirkstoffe und ihre zunehmende Verbreitung in ADCs der nächsten Generation zurückzuführen ist, darunter auch in der Entwicklung für solide Tumore mit hoher Mutationslast.

- Von Linker Technology

Basierend auf der Linker-Technologie ist der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum in Peptid-Linker, Thioether-Linker, Hydrazon-Linker und Disulfid-Linker segmentiert. Das Segment Peptid-Linker erzielte 2024 den größten Umsatzanteil, was auf ihre selektive Spaltung in Tumorgewebe und ihre Kompatibilität mit modernen ADC-Designs zurückzuführen ist.

Das Segment der Thioether-Linker dürfte im Prognosezeitraum das schnellste Wachstum aufweisen, da sie chemische Stabilität bieten und häufig in zugelassenen ADCs wie Kadcyla verwendet werden, wo sie eine sichere und wirksame Arzneimittelverabreichung im systemischen Kreislauf unterstützen.

- Von Conjugation Technology

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist anhand der Konjugationsmethode in die Bereiche ortsspezifische Konjugation und chemische Konjugation unterteilt. Das Segment der chemischen Konjugation hatte 2024 den höchsten Marktanteil, da es sich bei den meisten ADCs der ersten und zweiten Generation um die konventionelle Methode handelt.

Das Segment der ortsspezifischen Konjugation dürfte im Prognosezeitraum das schnellste Wachstum verzeichnen, da es die Präzision der Nutzlastabgabe steigert, den therapeutischen Index verbessert und die Entwicklung von ADCs der neuesten Generation für verschiedene Indikationen unterstützt.

- Nach Indikation

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist nach Indikation in Brustkrebs, Blutkrebs (Leukämie, Lymphom), Lungenkrebs, gynäkologischen Krebs, Magen-Darm-Krebs, Urogenitalkrebs und weitere Bereiche unterteilt. Das Segment Brustkrebs dominierte den Markt mit dem größten Marktanteil von 40,2 % im Jahr 2024, was auf die hohe Belastung durch HER2-positive Fälle und die weit verbreitete Verwendung zugelassener ADCs wie Enhertu und Kadcyla zurückzuführen ist.

Das Lungenkrebssegment dürfte zwischen 2025 und 2032 die höchste Wachstumsrate aufweisen, was auf steigende Inzidenzraten, neue klinische ADC-Studien für NSCLC und die zunehmende Einführung von Strategien der Präzisionsmedizin in China und Japan zurückzuführen ist.

- Nach Endbenutzer

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist nach Endverbraucher segmentiert in Krankenhäuser, Fachzentren, Kliniken, ambulante Zentren, häusliche Pflege und Sonstige. Das Segment Krankenhäuser hatte 2024 den größten Marktanteil, da sie die wichtigsten Standorte für Krebsbehandlungen und die Verabreichung von ADCs sind und kontrollierte Umgebungen erfordern.

Das Segment Spezialzentren wird im Prognosezeitraum voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, unterstützt durch steigende Investitionen in onkologisch ausgerichtete Einrichtungen und die Nachfrage der Patienten nach spezialisierter, qualitativ hochwertiger Versorgung in speziellen Krebsbehandlungszentren.

- Nach Vertriebskanal

Der Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum ist nach Vertriebskanälen in Direktausschreibungen, Einzelhandelsverkäufe und Sonstiges unterteilt. Das Segment Direktausschreibungen dominierte den Markt im Jahr 2024, angetrieben durch die zentrale Beschaffung durch staatliche und private Krankenhausnetzwerke, insbesondere für teure onkologische Therapien, die Großabnahmeverträge erfordern.

Das Segment Einzelhandelsumsätze dürfte im Prognosezeitraum das höchste Wachstum verzeichnen. Dies ist auf die schrittweise Umstellung auf ambulante Krebsbehandlungsmodelle, die Ausweitung der Apothekennetze und den zunehmenden Zugang der Patienten zu gezielten Therapien über private Gesundheitssysteme in Ländern wie Japan und Südkorea zurückzuführen.

Regionale Analyse des Marktes für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum

- China dominierte den Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum mit dem größten Umsatzanteil von 48,1 % im Jahr 2024, unterstützt durch beschleunigte behördliche Zulassungen, umfangreiche klinische Forschungsaktivitäten und strategische Partnerschaften zwischen inländischen Unternehmen und globalen Biotech-Unternehmen, die sich auf neuartige ADC-Pipelines konzentrieren.

- Das Wachstum der Region wird durch steigende Investitionen in onkologische Forschung und Entwicklung, intensive klinische Studien und den Ausbau der inländischen Produktionskapazitäten weiter vorangetrieben. Chinas biopharmazeutischer Sektor entwickelt sich rasant und ist damit ein wichtiger Knotenpunkt für die Entwicklung und Vermarktung von ADCs.

- Günstige Erstattungsrichtlinien, steigende Gesundheitsausgaben und ein wachsendes Bewusstsein für Präzisionsonkologie in Ländern wie Japan, Südkorea und Australien tragen ebenfalls zur regionalen Expansion bei und positionieren den asiatisch-pazifischen Raum in den kommenden Jahren als wichtigen Beitragszahler zum globalen ADC-Markt.

Markteinblicke für Antikörper-Wirkstoff-Konjugate (ADC) in China

Der chinesische Markt für Antikörper-Wirkstoff-Konjugate (ADC) erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies wurde durch eine unterstützende Regierungspolitik, eine schnell wachsende Onkologie-Pipeline und eine starke inländische Pharmaproduktionsbasis begünstigt. Regulatorische Reformen wie das „MAH“-System (Marketing Authorization Holder) und beschleunigte Arzneimittelzulassungen haben China zu einem Zentrum der ADC-Entwicklung gemacht. Das zunehmende Bewusstsein für zielgerichtete Therapien und strategische Allianzen zwischen chinesischen Unternehmen und globalen Biotech-Unternehmen treiben das Marktwachstum weiter voran, insbesondere bei HER2-positiven und hämatologischen Krebstherapien.

Markteinblick in Japan für Antikörper-Wirkstoff-Konjugate (ADC)

Der japanische Markt für Antikörper-Wirkstoff-Konjugate (ADC) gewinnt dank seiner fortschrittlichen Gesundheitsinfrastruktur, erheblicher Investitionen in onkologische Forschung und Entwicklung sowie der frühen Einführung innovativer Therapeutika an Dynamik. Japans reife Pharmaindustrie und etablierte Erstattungssysteme begünstigen die Einführung kostenintensiver Biologika wie ADCs. Die steigende Zahl von Brust- und Lungenkrebserkrankungen sowie das Vertrauen der japanischen Bevölkerung in zielgerichtete Behandlungen fördern ein starkes Wachstum, insbesondere bei ADCs der zweiten und dritten Generation mit nachgewiesener Sicherheit und Wirksamkeit.

Markteinblick in Antikörper-Wirkstoff-Konjugate (ADC) in Indien

Der indische Markt für Antikörper-Wirkstoff-Konjugate (ADC) steht vor einem rasanten Wachstum. Treiber hierfür sind die steigende Krebsprävalenz, der verbesserte Zugang zu fachärztlicher Versorgung und die zunehmende Teilnahme an globalen klinischen Studien. Indiens wachsende Mittelschicht und der Fokus auf den Ausbau der Gesundheitsinfrastruktur haben den Zugang zu fortschrittlichen Behandlungen erleichtert. Das Aufkommen lokaler Biotech-Unternehmen, die in die ADC-Forschung investieren, gepaart mit unterstützenden Maßnahmen im Rahmen von Initiativen wie „Make in India“ und „Pharma Vision 2020“, dürfte die inländischen Produktions- und Entwicklungskapazitäten deutlich verbessern und die Position des Landes im asiatisch-pazifischen ADC-Markt stärken.

Markteinblick in Antikörper-Wirkstoff-Konjugate (ADC) in Südkorea

Der südkoreanische Markt für Antikörper-Wirkstoff-Konjugate (ADC) wächst stetig. Grund dafür ist der starke Fokus des Landes auf biotechnologische Innovationen, staatliche Förderung der Krebsforschung und die zunehmende Verbreitung lebensstilbedingter Krebserkrankungen. Südkoreas führende Pharmaunternehmen arbeiten aktiv mit internationalen Biotech-Unternehmen zusammen, um gemeinsam neue ADC-Therapien zu entwickeln und zu vermarkten. Der optimierte regulatorische Rahmen und die hohen Gesundheitsausgaben des Landes unterstützen die Integration von ADC in onkologische Behandlungsprotokolle großer Krankenhäuser und spezialisierter Krebszentren zusätzlich.

Marktanteil von Antikörper-Wirkstoff-Konjugaten (ADC) im asiatisch-pazifischen Raum

Die Branche der Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Daiichi Sankyo Co., Ltd. (Japan)

- Seagen Inc. (USA)

- AstraZeneca (Großbritannien)

- RemeGen Co., Ltd. (China)

- Mycenax Biotech Inc. (Taiwan)

- Mabwell (Shanghai) Bioscience Co., Ltd. (China)

- Mersana Therapeutics, Inc. (USA)

- Biocon Biologics Ltd. (Indien)

- WuXi Biologics (Cayman) Inc. (China)

- Samsung Biologics Co., Ltd. (Südkorea)

- Bio-Thera Solutions, Ltd. (China)

- Zymeworks Inc. (Kanada)

- Prestige Biopharma Ltd. (Singapur)

- SinoMab BioScience Limited (Hongkong)

- Kyowa Kirin Co., Ltd. (Japan)

- AbbVie Inc. (USA)

- Innovent Biologics, Inc. (China)

- Nanjing Leads Biolabs Co., Ltd. (China)

- Tot Biopharm Co., Ltd. (China)

- Amgen Inc. (USA)

Was sind die jüngsten Entwicklungen auf dem globalen Markt für Antikörper-Wirkstoff-Konjugate (ADC) im asiatisch-pazifischen Raum?

- Im April 2024 gab RemeGen Co., Ltd., ein in China ansässiges biopharmazeutisches Unternehmen, die Ausweitung seiner globalen klinischen Studien für Disitamab Vedotin, ein HER2-gerichtetes ADC, auf Südostasien und Australien bekannt. Dieser Schritt zielt darauf ab, die behördlichen Zulassungen im asiatisch-pazifischen Raum zu beschleunigen und spiegelt den strategischen Fokus des Unternehmens auf die Erweiterung des Zugangs zu Krebstherapeutika der nächsten Generation wider. Die Initiative von RemeGen unterstreicht das zunehmende Engagement der Region in der globalen Onkologieentwicklung und ihre wachsende Bedeutung im ADC-Innovationsökosystem.

- Im März 2024 schloss das japanische Unternehmen Daiichi Sankyo eine Forschungs- und Lizenzvereinbarung mit dem in Singapur ansässigen A*STAR Genome Institute ab, um neuartige ADC-Nutzlasten und Linker-Technologien zu erforschen. Die Zusammenarbeit konzentriert sich auf die Erweiterung des therapeutischen Fensters bestehender ADCs und die Entwicklung gezielterer Therapien für solide Tumore. Diese Entwicklung unterstreicht den zunehmenden Trend grenzüberschreitender Kooperationen im asiatisch-pazifischen Raum zur Förderung der onkologischen Forschung und Arzneimittelentwicklung.

- Im Februar 2024 kündigte das südkoreanische Unternehmen Samsung Biologics seine Expansion in die Auftragsentwicklung und -produktion von ADCs an und positionierte sich damit als wichtiger regionaler Akteur in der ADC-Produktion. Angesichts der wachsenden Nachfrage nach ausgelagerter biopharmazeutischer Produktion im asiatisch-pazifischen Raum verbessert diese Expansion die Skalierbarkeit der ADC-Lieferketten und unterstützt regionale Biotech-Unternehmen dabei, neue Therapien schneller und kostengünstiger auf den Markt zu bringen.

- Im Februar 2024 unterzeichnete das indische Unternehmen Biocon Biologics eine exklusive Partnerschaft mit einem US-amerikanischen Biotech-Unternehmen zur gemeinsamen Entwicklung und Vermarktung einer Pipeline von ADCs zur Behandlung gynäkologischer und gastrointestinaler Krebserkrankungen. Die Partnerschaft steht im Einklang mit dem strategischen Ziel von Biocon, sein Onkologie-Portfolio zu erweitern und Indiens wachsende klinische und Produktionsinfrastruktur für fortschrittliche Biologika zu nutzen.

- Im Januar 2024 startete das australische Garvan Institute of Medical Research eine klinische Phase-I-Studie zur Evaluierung eines neuen, auf Trop-2 abzielenden ADC, das in Zusammenarbeit mit einem lokalen Biotech-Startup entwickelt wurde. Die Studie ist eine der ersten ADC-Studien im Frühstadium in Australien und spiegelt die zunehmende Rolle lokaler Forschungsinstitute bei der Weiterentwicklung zielgerichteter, auf regionale Patientengruppen zugeschnittener Krebstherapien wider.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PESTEL ANALYSIS

5 COST STRUCTURE ANALYSIS OF ANTIBODY-DRUG CONJUGATE (ADC) MANUFACTURING

5.1 ANTIBODIES

5.1.1 OVERVIEW OF ANTIBODY PRODUCTION

5.1.1.1 In-house vs. Outsourced:

5.1.2 ANTIBODY PRICING FACTORS

5.2 LINKERS

5.2.1 ROLE AND TYPES OF LINKERS

5.2.1.1 Cost Impact by Linker Type:

5.3 CYTOTOXIC AGENTS

5.3.1 COST CONSIDERATIONS:

5.3.2 BUFFERS AND SOLVENTS

5.4 COST BREAKDOWN BY MANUFACTURING STAGE

5.4.1 PRE-PRODUCTION COSTS

5.4.2 CONJUGATION PROCESS

5.4.3 PURIFICATION AND FILTRATION

5.4.4 QUALITY CONTROL

5.5 COST PROJECTIONS AND PRICING TRENDS (2024–2030)

5.5.1 PROJECTED COST FLUCTUATIONS

5.5.2 COST IMPACT OF SCALABILITY

5.6 SUPPLIER AND GEOGRAPHIC PRICING TRENDS

5.6.1 GEOGRAPHIC COST VARIATIONS

5.6.2 SUPPLIER ANALYSIS

5.6.3 CONCLUSION

6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CANCER

7.1.2 ADVANCES IN ANTIBODY-DRUG CONJUGATE (ADC) TECHNOLOGY

7.1.3 INCREASING DEMAND FOR TARGETED THERAPIES

7.1.4 ADVANCEMENTS IN PROTEOMICS AND GENOMICS RESEARCH

7.2 RESTRAINTS

7.2.1 HIGH DEVELOPMENT COST & MANUFACTURING COMPLEXITIES

7.2.2 SAFETY AND TOXICITY ISSUES OF ANTIBODY DRUG CONJUGATES

7.3 OPPORTUNITIES

7.3.1 GROWING ONCOLOGY PIPELINE FOR ANTIBODY DRUG CONJUGATES (ADCS)

7.3.2 INCREASING INVESTMENT IN CANCER RESEARCH

7.3.3 INCREASING COLLABORATION WITH RESEARCH INSTITUTIONS FOR ANTIBODY DRUG CONJUGATES

7.4 CHALLENGES

7.4.1 CLINICAL TRIAL FAILURES FOR ANTIBODY DRUG CONJUGATES DEVELOPMENT

7.4.2 LENGTHY CLINICAL TRIALS AND DEVELOPMENT PHASES

8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ENHERTU

8.3 KADCYLA

8.4 TRODELVY

8.5 POLIVY

8.6 ADCETRIS

8.7 PADCEV

8.8 BESPONSA

8.9 ELAHERE

8.1 ZYLONTA

8.11 MYLOTARG

8.12 TIVDAK

8.13 OTHERS

9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT

9.1 OVERVIEW

9.2 HER2 RECEPTOR

9.3 TROP-2

9.4 CD79B

9.5 CD30

9.6 NECTIN 4

9.7 CD22

9.8 CD19

9.9 CD33

9.1 TISSUE FACTORS

9.11 OTHERS

10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT

10.1 OVERVIEW

10.2 THIRD GENERATION ADCS

10.3 SECOND GENERATION ADCS

10.4 FOURTH GENERATION ADCS

10.5 FIRST GENERATION ADCS

11 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT

11.1 OVERVIEW

11.2 CLEAVABLE LINKERS

11.2.1 PEPTIDE BASED

11.2.2 ACID SENSITIVE OR ACID LABILE

11.2.3 GLUTATHIONE SENSITIVE DISULFIDE

11.3 NON CLEAVABLE LINKERS

12 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT

12.1 OVERVIEW

12.2 DNA DAMAGING AGENTS

12.2.1 CAMPTOTHECIN

12.2.2 CALICHEAMICIN

12.2.3 PYRROLOBENZODIAZEPINES

12.3 MICROTUBULE DISRUPTING AGENTS

12.3.1 AURISTATIN

12.3.2 MAYTANSINOIDS

13 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY

13.1 OVERVIEW

13.2 PEPTIDE LINKERS

13.3 THIOETHER LINKERS

13.4 HYDRAZONE LINKERS

13.5 DISULFIDE LINKERS

14 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY

14.1 OVERVIEW

14.2 SITE-SPECIFIC CONJUGATION

14.3 CHEMICAL CONJUGATION

15 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION

15.1 OVERVIEW

15.2 BREAST CANCER

15.3 BLOOD CANCER (LEUKEMIA, LYMPHOMA)

15.4 LUNG CANCER

15.5 GYNECOLOGICAL CANCER

15.6 GASTROINTESTINAL CANCER

15.7 GENITOURINARY CANCER

15.8 OTHERS

16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER

16.1 OVERVIEW

16.2 HOSPITALS

16.3 SPECIALTY CENTER

16.4 CLINICS

16.5 AMBULATORY CENTERS

16.6 HOME HEALTHCARE

16.7 OTHERS

17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL

17.1 OVERVIEW

17.2 DIRECT TENDERS

17.3 RETAIL SALES

17.3.1 HOSPITAL PHARMACY

17.3.2 RETAIL PHARMACY

17.3.3 ONLINE PHARMACY

17.4 OTHERS

18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION

18.1 ASIA-PACIFIC

18.1.1 JAPAN

18.1.2 CHINA

18.1.3 INDIA

18.1.4 AUSTRALIA

18.1.5 SINGAPORE

18.1.6 REST OF ASIA-PACIFIC

19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

20 SWOT ANALYSIS

21 COMPANY PROFILES

21.1 DAIICHI SANKYO, INC.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 RECENT DEVELOPMENT

21.2 F. HOFFMANN-LA ROCHE LTD

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENT

21.3 GILEAD SCIENCES, INC.

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE

21.3.3 PRODUCT PORTFOLIO

21.3.4 RECENT DEVELOPMENT

21.4 ASTELLAS PHARMA INC.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 RECENT DEVELOPMENT

21.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 RECENT DEVELOPMENT

21.6 ABBVIE INC.

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENT

21.7 ADC THERAPEUTICS SA

21.7.1 6.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 RECENT DEVELOPMENT

21.8 AMGEN, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENT

21.9 ASTRAZENECA

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENT

21.1 BAYER

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 RECENT DEVELOPMENT

21.11 BYONDIS

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENT

21.12 EISAI INC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENT

21.13 GSK PLC

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 RECENT DEVELOPMENT

21.14 JOHNSON & JOHNSON SERVICES, INC.

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENT

21.15 OXFORD BIOTHERAPEUTICS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 RECENT DEVELOPMENT

21.16 PFIZER INC.

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 RECENT UPDATES

21.17 REMEGEN

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SANOFI

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 RECENT DEVELOPMENT

21.19 SUTRO BIOPHARMA, INC.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 RECENT UPDATES

22 QUESTIONNAIRE

23 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 PROJECTED PRICE CHANGE (2024–2030)

TABLE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 4 ASIA-PACIFIC ENHERTU IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 ASIA-PACIFIC KADCYLA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 ASIA-PACIFIC TRODELVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 ASIA-PACIFIC POLIVY IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 ASIA-PACIFIC ADCETRIS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 ASIA-PACIFIC PADCEV IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 ASIA-PACIFIC BESPONSA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 ASIA-PACIFIC ELAHERE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 ASIA-PACIFIC ZYLONTA IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 ASIA-PACIFIC MYLOTARG IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 14 ASIA-PACIFIC TIVDAK IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 17 ASIA-PACIFIC HER2 RECEPTOR IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 ASIA-PACIFIC TROP-2 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 ASIA-PACIFIC CD79B IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 20 ASIA-PACIFIC CD30 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 ASIA-PACIFIC NECTIN 4 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 22 ASIA-PACIFIC CD22 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 23 ASIA-PACIFIC CD19 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 ASIA-PACIFIC CD33 IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 25 ASIA-PACIFIC TISSUE FACTORS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC THIRD GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC SECOND GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC FOURTH GENERATION ADCS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC FIRST GENERATION ADCS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC NON CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 37 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 38 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 39 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 40 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 42 ASIA-PACIFIC PEPTIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 43 ASIA-PACIFIC THIOETHER LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 44 ASIA-PACIFIC HYDRAZONE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 45 ASIA-PACIFIC DISULFIDE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 47 ASIA-PACIFIC SITE-SPECIFIC CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 48 ASIA-PACIFIC CHEMICAL CONJUGATION IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 50 ASIA-PACIFIC BREAST CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 51 ASIA-PACIFIC BLOOD CANCER (LEUKEMIA, LYMPHOMA) IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 52 ASIA-PACIFIC LUNG CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 53 ASIA-PACIFIC GYNECOLOGICAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 54 ASIA-PACIFIC GASTROINTESTINAL CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENITOURINARY CANCER IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 56 ASIA-PACIFIC OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 58 ASIA-PACIFIC HOSPITALS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 59 ASIA-PACIFIC SPECIALTY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 60 ASIA-PACIFIC CLINICS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 61 ASIA-PACIFIC AMBULATORY CENTERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 62 ASIA-PACIFIC HOME HEALTHCARE IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 63 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 64 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 65 ASIA-PACIFIC DIRECT TENDERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 66 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 67 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 68 ASIA-PACIFIC OTHERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 69 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 70 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 71 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 72 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 73 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 74 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 75 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 76 ASIA-PACIFIC CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 77 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 78 ASIA-PACIFIC DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 79 ASIA-PACIFIC MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 80 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 81 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 82 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 83 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 84 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 85 ASIA-PACIFIC RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 86 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 87 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 88 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 89 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 90 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 91 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 92 JAPAN CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 93 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 94 JAPAN DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 95 JAPAN MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 96 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 97 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 98 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 99 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 100 JAPAN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 JAPAN RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 102 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 103 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 104 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 105 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 106 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 107 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 108 CHINA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 109 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 110 CHINA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 111 CHINA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 112 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 113 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 114 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 115 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 116 CHINA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 117 CHINA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 118 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 119 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 120 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 121 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 122 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 123 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 124 INDIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 125 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 126 INDIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 127 INDIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 128 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 129 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 130 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 131 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 132 INDIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 133 INDIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 134 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 135 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 136 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 137 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 138 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 139 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 140 AUSTRALIA CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 141 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 142 AUSTRALIA DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 143 AUSTRALIA MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 144 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 145 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 146 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 147 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 148 AUSTRALIA ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 149 AUSTRALIA RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 150 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 151 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 152 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

TABLE 153 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIGEN COMPONENT, 2022-2031 (USD MILLION)

TABLE 154 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY ANTIBODY COMPONENT, 2022-2031 (USD MILLION)

TABLE 155 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKERS COMPONENT, 2022-2031 (USD MILLION)

TABLE 156 SINGAPORE CLEAVABLE LINKERS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 157 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2022-2031 (USD MILLION)

TABLE 158 SINGAPORE DNA DAMAGING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 159 SINGAPORE MICROTUBULE DISRUPTING AGENTS IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY COMPONENT, 2022-2031 (USD MILLION)

TABLE 160 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY LINKER TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 161 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY CONJUGATION TECHNOLOGY, 2022-2031 (USD MILLION)

TABLE 162 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY INDICATION, 2022-2031 (USD MILLION)

TABLE 163 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY END USER, 2022-2031 (USD MILLION)

TABLE 164 SINGAPORE ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 165 SINGAPORE RETAIL SALES IN ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 166 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (USD MILLION)

TABLE 167 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (VOLUME IN UNITS)

TABLE 168 REST OF ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET, BY PRODUCT, 2022-2031 (ASP)

Abbildungsverzeichnis

FIGURE 1 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 RISING INCIDENCE OF CANCER IS DRIVING THE GROWTH OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET FROM 2024 TO 2031

FIGURE 14 THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET IN 2024 AND 2031

FIGURE 15 DROC

FIGURE 16 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2023

FIGURE 17 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, 2024-2031 (USD MILLION)

FIGURE 18 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, CAGR (2024-2031)

FIGURE 19 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2023

FIGURE 21 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, 2024-2031 (USD MILLION)

FIGURE 22 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, CAGR (2024-2031)

FIGURE 23 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIGEN COMPONENT, LIFELINE CURVE

FIGURE 24 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2023

FIGURE 25 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, 2024-2031 (USD MILLION)

FIGURE 26 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, CAGR (2024-2031)

FIGURE 27 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY ANTIBODY COMPONENT, LIFELINE CURVE

FIGURE 28 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2023

FIGURE 29 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 30 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, CAGR (2024-2031)

FIGURE 31 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKERS COMPONENT, LIFELINE CURVE

FIGURE 32 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2023

FIGURE 33 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, 2024-2031 (USD MILLION)

FIGURE 34 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, CAGR (2024-2031)

FIGURE 35 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CYTOTOXIC PAYLOADS OR WARHEADS COMPONENT, LIFELINE CURVE

FIGURE 36 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2023

FIGURE 37 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 38 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, CAGR (2024-2031)

FIGURE 39 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY LINKER TECHNOLOGY, LIFELINE CURVE

FIGURE 40 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2023

FIGURE 41 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, 2024-2031 (USD MILLION)

FIGURE 42 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, CAGR (2024-2031)

FIGURE 43 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY CONJUGATION TECHNOLOGY, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2023

FIGURE 45 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, 2024-2031 (USD MILLION)

FIGURE 46 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, CAGR (2024-2031)

FIGURE 47 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 48 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2023

FIGURE 49 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, 2024-2031 (USD MILLION)

FIGURE 50 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 51 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY END USER, LIFELINE CURVE

FIGURE 52 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 53 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 54 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 55 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 56 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC) MARKET: SNAPSHOT (2023)

FIGURE 57 ASIA-PACIFIC ANTIBODY DRUG CONJUGATES (ADC): COMPANY SHARE 2023 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.