Asia Pacific Active Pharmaceutical Ingredient Api Market

Marktgröße in Milliarden USD

CAGR :

%

USD

64.56 Billion

USD

115.14 Billion

2024

2032

USD

64.56 Billion

USD

115.14 Billion

2024

2032

| 2025 –2032 | |

| USD 64.56 Billion | |

| USD 115.14 Billion | |

|

|

|

|

Marktsegmentierung für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum nach Molekülgröße (kleine Moleküle, große Moleküle), Typ (innovative pharmazeutische Wirkstoffe , generische innovative pharmazeutische Wirkstoffe), Herstellertyp (eigener Wirkstoffhersteller, externer Wirkstoffhersteller), Synthese (synthetische pharmazeutische Wirkstoffe und biotechnologische pharmazeutische Wirkstoffe), chemische Synthese (Paracetamol, Artemisinin, Saxagliptin, Natriumchlorid, Ibuprofen, Losartan-Kalium, Enoxaparin-Natrium, Rufinamid, Naproxen, Tamoxifen, Sonstige), Arzneimitteltyp ( verschreibungspflichtige Arzneimittel , rezeptfreie Arzneimittel), Anwendung (klinisch, Forschung), Wirkstärke (niedrig- bis mittelstark wirksame pharmazeutische Wirkstoffe, stark bis hochwirksame pharmazeutische Wirkstoffe), therapeutische Anwendung (Kardiologie, ZNS & Neurologie, Onkologie, Orthopädie, Endokrinologie, Pneumologie, Gastroenterologie, Nephrologie). Ophthalmologie, Sonstige therapeutische Anwendungen), - Branchentrends und Prognose bis 2032

Marktgröße für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum

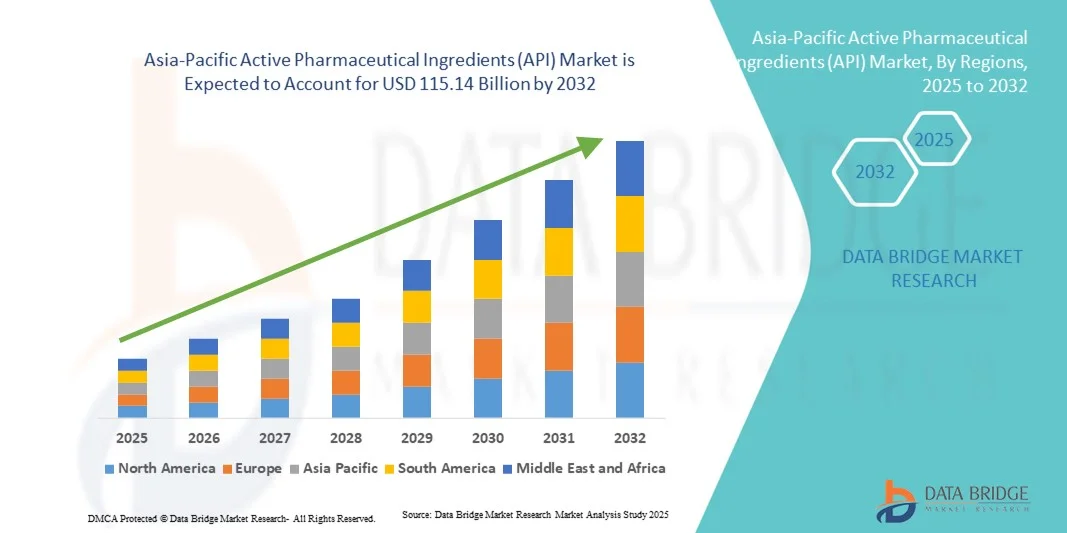

- Der Markt für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum hatte im Jahr 2024 einen Wert von 64,56 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 115,14 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,50 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach wirksamen und qualitativ hochwertigen Medikamenten angetrieben, die durch die zunehmende Verbreitung chronischer und Infektionskrankheiten, die alternde Weltbevölkerung und die wachsende Anwendung fortschrittlicher therapeutischer Formulierungen bedingt ist.

- Darüber hinaus beschleunigen kontinuierliche Fortschritte in der Biotechnologie , gepaart mit wachsenden pharmazeutischen Forschungs- und Entwicklungsaktivitäten und der zunehmenden Auslagerung der Wirkstoffherstellung in kostengünstige Regionen, die Akzeptanz von Wirkstofflösungen und kurbeln damit das Wachstum der Branche erheblich an.

Marktanalyse für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum

- Der Markt für pharmazeutische Wirkstoffe (API) spielt eine entscheidende Rolle in der pharmazeutischen Industrie und ist der Schlüsselfaktor für die therapeutische Wirkung von Arzneimitteln in verschiedenen Therapiebereichen wie Onkologie, Herz-Kreislauf-Erkrankungen und Infektionskrankheiten. Der Markt verzeichnet ein starkes Wachstum aufgrund technologischer Fortschritte in der Synthese, steigender Nachfrage nach Biologika und zunehmendem Fokus auf hochwirksame Wirkstoffe (HPAPIs).

- Die steigende Nachfrage nach pharmazeutischen Wirkstoffen (APIs) wird vor allem durch die zunehmende Verbreitung chronischer und lebensstilbedingter Erkrankungen, die Expansion des Generikamarktes und den Trend von Pharmaunternehmen angetrieben, die API-Produktion aus Kostengründen und zur Qualitätssicherung an spezialisierte Hersteller auszulagern.

- China dominierte den Markt für pharmazeutische Wirkstoffe (API) mit dem größten Umsatzanteil von 41,6 % im Jahr 2024, was auf eine gut etablierte pharmazeutische Produktionsbasis, eine starke F&E-Infrastruktur und die Präsenz wichtiger Marktteilnehmer zurückzuführen ist.

- Indien dürfte im Prognosezeitraum die am schnellsten wachsende Region auf dem Markt für pharmazeutische Wirkstoffe (API) sein, was auf die wachsenden Produktionskapazitäten, günstige Regierungsinitiativen und die steigende Nachfrage nach erschwinglichen Generika zurückzuführen ist.

- Das klinische Segment erzielte 2024 mit 68 % den größten Umsatzanteil, getrieben durch den Einsatz von Wirkstoffen in Krankenhäusern, Fachkliniken und Patientenbehandlungsprogrammen in verschiedenen Therapiebereichen.

Berichtsumfang und Marktsegmentierung für pharmazeutische Wirkstoffe (API)

|

Attribute |

Wichtige Markteinblicke in Wirkstoffe (API) |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Trends auf dem asiatisch-pazifischen Markt für pharmazeutische Wirkstoffe (API)

Erweiterung der Biologika - Wirkstoff- und Spezialwirkstoffherstellung

- Ein klarer und sich beschleunigender Trend auf dem API-Markt ist die Verlagerung weg von traditionellen niedermolekularen APIs hin zu Biologika, Peptiden, Oligonukleotiden und anderen hochwertigen Spezial-APIs.

- Beispielsweise kündigte im Jahr 2023 ein führendes chinesisches API-Unternehmen die Inbetriebnahme einer neuen Produktionslinie für biologische APIs für Onkologie-Medikamente an.

- Das Segment der synthetischen niedermolekularen Wirkstoffe ist zwar immer noch führend in Bezug auf den Marktanteil, aber die Wachstumsdynamik verlagert sich hin zu komplexen biologischen Wirkstoffen.

- Viele API-Hersteller investieren in Produktionsanlagen für die Herstellung biologischer APIs oder anderer hochwirksamer/komplexer APIs oder rüsten diese um. Dies ermöglicht höhere Gewinnmargen und eine bessere Differenzierung im hart umkämpften Generikamarkt.

- Die Outsourcing-Trends entwickeln sich weiter: Globale Pharmaunternehmen suchen zunehmend nicht nur nach Wirkstoffen in großen Mengen, sondern auch nach Partnerschaften zur Herstellung von Spezialwirkstoffen und Biosimilars im asiatisch-pazifischen Raum.

- Technologische Fortschritte – wie kontinuierliche Fertigung, verbesserte Expressionssysteme und die Skalierung von Bioprozessen – erleichtern die Herstellung von Spezialwirkstoffen in der Region.

- Regierungen und regionale Entscheidungsträger unterstützen die Herstellung von Biologika und hochwertigen pharmazeutischen Wirkstoffen (z. B. durch Anreize), was diesen Wandel hin zu Spezialprodukten weiter verstärkt.

- Insgesamt spiegelt dieser Trend eine Transformation des API-Marktes von der kostenorientierten Massenproduktion hin zu komplexeren, differenzierten und wertschöpfungsintensiveren API-Produktionsmodellen wider.

Marktdynamik für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum

Treiber

Steigende Nachfrage nach kosteneffizienter API -Produktion und Outsourcing

- Der globale Markt für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum wird maßgeblich von Pharmaunternehmen und Auftragsherstellern angetrieben, die nach qualitativ hochwertigen und kostengünstigeren API-Lieferungen suchen.

- Beispielsweise erweiterte im Jahr 2023 ein führender indischer API-Hersteller seine Produktionskapazität, um der steigenden Nachfrage globaler Pharmaunternehmen gerecht zu werden.

- Die zunehmende Verbreitung chronischer Krankheiten, die alternde Bevölkerung und die steigenden globalen Gesundheitsausgaben steigern die Nachfrage nach generischen und innovativen Wirkstoffen.

- Regierungsinitiativen in mehreren Ländern des asiatisch-pazifischen Raums stärken die heimische Produktion, verringern die Importabhängigkeit und verbessern die Rolle in den globalen Lieferketten.

- Niedrigere Herstellungskosten, große Mengen an qualifizierten Arbeitskräften und eine etablierte chemische/biotechnologische Infrastruktur in wichtigen asiatisch-pazifischen Ländern veranlassen westliche Pharmaunternehmen vermehrt dazu, die API-Produktion auszulagern.

- Die Expansion im Bereich biologischer und spezieller Wirkstoffe (z. B. für Onkologie und Immunologie) schafft neue Produktions- und Beschaffungsbedürfnisse und treibt damit das Wachstum des Wirkstoffmarktes in der Region weiter an.

- Viele Pharmaunternehmen verlagern Teile ihrer Wirkstofflieferkette in den asiatisch-pazifischen Raum, um Kosteneffizienz, schnellere Markteinführung und regulatorische Vorteile zu erzielen.

- Die oben genannten vielfältigen Faktoren tragen gemeinsam zu einer starken Wachstumsdynamik auf dem API-Markt im asiatisch-pazifischen Raum und weltweit bei.

Zurückhaltung/Herausforderung

Regulatorische Komplexität, Lieferkettenrisiken und Preisdruck

- Strenge regulatorische Anforderungen an die Qualität, Sicherheit und Herstellungsverfahren von Wirkstoffen verursachen erhebliche Kosten- und Compliance-Belastungen.

- So kam es beispielsweise im Jahr 2022 bei einem renommierten europäischen Pharmaunternehmen aufgrund zusätzlicher behördlicher API-Inspektionen zu Verzögerungen.

- Anhaltende Schwachstellen in der Lieferkette – wie die Abhängigkeit von bestimmten Rohstoffen, Produktionszentren in einzelnen Ländern oder Störungen durch geopolitische/logistische Ereignisse – schränken die Zuverlässigkeit ein.

- Der erhebliche Abwärtsdruck auf die Preise für pharmazeutische Wirkstoffe – insbesondere für Generika – verringert die Rentabilität der Hersteller und kann Investitionen in Kapazitäten oder Innovationen hemmen.

- Bedenken hinsichtlich Umwelt, Gesundheit und Sicherheit sowie die Notwendigkeit, die Produktion auf umweltfreundlichere Chemie oder besser kontrollierte biotechnologische Verfahren umzustellen, erhöhen die Investitions- und Betriebskosten.

- Fragmentierte globale Qualitätsstandards und unterschiedliche Inspektionsregime in den einzelnen Ländern erschweren die globale Beschaffung und behindern die Harmonisierung.

- Für kleinere API-Hersteller kann die Kombination aus regulatorischem, Kosten- und Marktpreisdruck die Möglichkeiten zur Skalierung oder zu Investitionen in Spezial-/Biologika-APIs einschränken.

- Diese Herausforderungen müssen bewältigt werden, um ein nachhaltiges Marktwachstum zu gewährleisten; Unternehmen und Regulierungsbehörden müssen sich hinsichtlich Qualität, Resilienz und Kostenstrukturen abstimmen.

Umfang des asiatisch-pazifischen Marktes für pharmazeutische Wirkstoffe (API)

Der Markt ist segmentiert nach Molekül, Typ, Herstellertyp, Synthese, chemischer Synthese, Arzneimitteltyp, Verwendung, Wirkstärke und therapeutischer Anwendung.

- Nach Molekül

Basierend auf der Molekülart ist der API-Markt im asiatisch-pazifischen Raum in niedermolekulare und hochmolekulare Wirkstoffe unterteilt. Das Segment der niedermolekularen Wirkstoffe dominierte 2024 mit einem Marktanteil von 62 % und erzielte damit den größten Umsatz. Dies ist auf ihre etablierte Anwendung in der pharmazeutischen Produktion, die einfache Synthese und die nachgewiesene klinische Wirksamkeit zurückzuführen. Niedermolekulare Wirkstoffe werden in verschreibungspflichtigen und rezeptfreien Medikamenten in verschiedenen Therapiebereichen wie Kardiologie, ZNS, Onkologie und Gastroenterologie eingesetzt. Ihre kosteneffiziente Produktion, Skalierbarkeit und Kompatibilität mit konventionellen Verabreichungsmethoden machen sie bei Herstellern besonders beliebt. Auslaufende Patente und die Entwicklung von Generika verstärken diese Dominanz zusätzlich. Darüber hinaus profitieren niedermolekulare Wirkstoffe von ausgereiften Lieferketten, breiter regulatorischer Akzeptanz und der Verfügbarkeit von Rohstoffen. Das Segment verzeichnet zudem eine starke Nachfrage aufgrund der steigenden Nachfrage nach Therapien für chronische Erkrankungen und der Notwendigkeit einer Produktion in großen Mengen. Wichtige pharmazeutische Zentren im asiatisch-pazifischen Raum, darunter China und Indien, bauen ihre Produktionskapazitäten kontinuierlich aus und erhöhen so ihren Marktanteil. Die Integration in traditionelle Gesundheitssysteme und etablierte klinische Entwicklungspipelines tragen ebenfalls zur Verbreitung niedermolekularer Wirkstoffe bei.

Für das Segment der großmolekularen Wirkstoffe wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach Biologika, monoklonalen Antikörpern und rekombinanten Proteinen. Großmolekulare Wirkstoffe werden zunehmend für komplexe Therapien, darunter in der Onkologie, bei Autoimmunerkrankungen und seltenen Erkrankungen, eingesetzt. Rasante Fortschritte in der Biotechnologie, die Erweiterung der biopharmazeutischen Entwicklungspipeline und staatliche Förderprogramme für Biologika beschleunigen das Wachstum. Verbesserte Herstellungsverfahren, Kostensenkungen in der Biologika-Produktion und die zunehmende Anwendung in Krankenhäusern und Fachkliniken steigern das Marktpotenzial zusätzlich. Der wachsende Fokus auf personalisierte Medizin, Biosimilars und innovative Therapien unterstützt das Wachstum dieses Segments. Strategische Kooperationen zwischen Biotech-Unternehmen und Forschungsinstituten verbessern den Zugang und fördern Innovationen. Das Segment profitiert von der Zunahme klinischer Studien, der Zulassung von Biologika und dem steigenden Bewusstsein für zielgerichtete Therapien im asiatisch-pazifischen Raum. Die Akzeptanz wird zudem durch den Ausbau der Biotech-Infrastruktur in Schwellenländern gefördert.

- Nach Typ

Basierend auf der Art der Wirkstoffe ist der Markt in innovative und generische innovative Wirkstoffe unterteilt. Das Segment der innovativen Wirkstoffe dominierte 2024 mit einem Umsatzanteil von 58 %, bedingt durch die hohe Nachfrage nach neuartigen Therapeutika, patentgeschützten Arzneimitteln und Spezialformulierungen. Pharmaunternehmen investieren massiv in Forschung und Entwicklung, um neue chemische Substanzen und zielgerichtete Therapien zu entwickeln, insbesondere in den Bereichen Onkologie, ZNS und Kardiologie. Zulassungen, klinische Studien in der Pipeline und Partnerschaften mit Forschungseinrichtungen stärken diese Marktführerschaft. Innovative Wirkstoffe profitieren zudem von höheren Margen und einer strategischen Positionierung in wettbewerbsintensiven Therapiegebieten. Das Segment wird durch eine robuste Gesundheitsinfrastruktur, den zunehmenden Fokus der Regierungen auf seltene und komplexe Erkrankungen sowie starke Rahmenbedingungen zum Schutz geistigen Eigentums gestützt. Darüber hinaus festigen die steigende Nachfrage in Schwellenländern und der Ausbau von Krankenhäusern und Fachkliniken die Marktposition weiter. Kontinuierliche Innovationen in der Entwicklung und Verabreichung von Arzneimitteln gewährleisten die nachhaltige Nutzung innovativer Wirkstoffe im gesamten asiatisch-pazifischen Raum.

Das Segment der generischen, innovativen Wirkstoffe (API) wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die zunehmende Nutzung von Generika, kostenbewusste Gesundheitspolitiken und auslaufende Patente. Generische Wirkstoffe bieten erschwingliche Alternativen zu Markenmedikamenten und decken die steigende Nachfrage in Schwellenländern. Hersteller erweitern ihre Kapazitäten, verbessern ihre Vertriebsnetze und setzen auf Auftragsfertigung, um das schnelle Wachstum zu unterstützen. Strategische Kooperationen mit Krankenhäusern, Apotheken und anderen Gesundheitsdienstleistern beschleunigen die Marktdurchdringung zusätzlich. Steigende staatliche Initiativen zur Verbesserung des Zugangs zu Medikamenten tragen in Verbindung mit technologischen Fortschritten in der Herstellung zu einer schnelleren Markteinführung bei. Auch die Ausweitung der Krankenversicherung und öffentlicher Gesundheitsprogramme fördert den Verbrauch generischer Wirkstoffe.

- Nach Herstellertyp

Basierend auf der Herstellerart ist der Markt in Eigenhersteller und externe Wirkstoffhersteller unterteilt. Das Segment der Eigenhersteller dominierte 2024 mit einem Umsatzanteil von 55 %, da die hauseigene Wirkstoffproduktion es Pharmaunternehmen ermöglicht, die Qualitätskontrolle aufrechtzuerhalten, Kosten zu senken und die Einhaltung regulatorischer Vorgaben sicherzustellen. Eigenhersteller profitieren von integrierter Forschung und Entwicklung, etablierten Vertriebsnetzen und firmeneigenen Formulierungen. In diesem Segment besteht eine starke Nachfrage in margenstarken Therapiegebieten wie Onkologie und ZNS. Die Versorgungssicherheit, die vertikale Integration und die strategische Marktpositionierung tragen zur anhaltenden Marktführerschaft bei.

Für das Segment der Auftragshersteller von pharmazeutischen Wirkstoffen (API) wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,8 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind der zunehmende Trend zu Outsourcing, die Möglichkeiten der Auftragsfertigung und die weltweite Nachfrage nach APIs. Auftragshersteller bieten flexible Produktionskapazitäten, kosteneffiziente Lösungen und spezialisierte APIs. Die Expansion in Schwellenländer und die steigende Anzahl klinischer Studien beflügeln das Wachstum dieses Segments. Der zunehmende Fokus kleiner Biotech-Unternehmen und Startups, die die API-Produktion auslagern, beschleunigt die Akzeptanz zusätzlich. Darüber hinaus steigern Fortschritte in den Fertigungstechnologien und die regulatorische Unterstützung für die Auftragsfertigung die Wettbewerbsfähigkeit und Attraktivität dieses Segments für globale Pharmaunternehmen.

- Durch Synthese

Auf Basis der Synthese wird der Markt in synthetische und biotechnologische Wirkstoffe (APIs) unterteilt. Das Segment der synthetischen APIs erzielte 2024 mit 60 % den größten Umsatzanteil. Dies ist auf die etablierten Produktionsprozesse, die niedrigeren Herstellungskosten und die breite Anwendbarkeit in oralen, injizierbaren und topischen Arzneimitteln zurückzuführen. Starke Lieferketten, umfassende Kenntnisse der regulatorischen Rahmenbedingungen und die Kompatibilität mit verschiedenen Therapiegebieten stärken die Marktführerschaft dieses Segments und machen es zur bevorzugten Wahl für Pharmahersteller. Darüber hinaus festigen die ausgereifte Infrastruktur, die stetige Verfügbarkeit von Rohstoffen und die nahtlose Integration in bestehende pharmazeutische Produktionsprozesse die führende Position weiter. Die breite Anwendung synthetischer APIs in Marken- und Generika-Arzneimitteln in Verbindung mit kontinuierlichen technologischen Fortschritten sichert nachhaltiges Wachstum und die fortgesetzte Marktführerschaft.

Das Segment der biotechnologischen Wirkstoffe (API) wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die rasanten Fortschritte bei Biologika, rekombinanten Proteinen und monoklonalen Antikörpern. Steigende Investitionen in die biopharmazeutische Forschung und Entwicklung, die zunehmende Anwendung in Krankenhäusern und staatliche Förderprogramme für biotechnologische Innovationen beschleunigen das Wachstum. Unterstützt wird das Segment durch vermehrte klinische Studien, einen verbesserten Zugang zu fortschrittlichen Therapien und ein wachsendes Bewusstsein für personalisierte Medizin. Strategische Kooperationen zwischen Pharma- und Biotech-Unternehmen stärken die Marktdurchdringung zusätzlich. Neue Biotech-Zentren im asiatisch-pazifischen Raum verbessern die Produktionskapazität und die Erschwinglichkeit biotechnologischer Wirkstoffe.

- Durch chemische Synthese

Auf Basis der chemischen Synthese ist der Markt in Paracetamol, Artemisinin, Saxagliptin, Natriumchlorid, Ibuprofen, Losartan-Kalium, Enoxaparin-Natrium, Rufinamid, Naproxen, Tamoxifen und weitere Wirkstoffe unterteilt. Paracetamol dominierte 2024 mit einem Marktanteil von 44 % den Markt, was auf seine breite Anwendung in Analgetika, Antipyretika und Kombinationspräparaten zurückzuführen ist. Die hohe Nachfrage nach rezeptfreien Medikamenten, in Krankenhäusern und Kliniken stärkt diese Marktführerschaft. Paracetamol profitiert von etablierten Herstellungsverfahren, niedrigen Produktionskosten und einem breiten Vertriebsnetz. Seine Kompatibilität mit Darreichungsformen für Kinder und Erwachsene sowie die Integration in Kombinationstherapien gewährleisten eine kontinuierliche Marktakzeptanz. Die stetige globale Nachfrage, die starke regulatorische Zulassung und die steigenden Gesundheitsausgaben im asiatisch-pazifischen Raum tragen zur anhaltenden Marktführerschaft bei. Darüber hinaus nutzen die Hersteller Skaleneffekte und effiziente Lieferketten, um die Produktion aufrechtzuerhalten.

Für das Artemisinin-Segment wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind die steigende Nachfrage nach Malariamitteln und die zunehmende Forschung an neuen Derivaten. Staatliche Programme zur Förderung der Malariabehandlung und globale Gesundheitsinitiativen tragen ebenfalls zum Wachstum bei. Die Ausweitung der Auftragsfertigung und steigende Investitionen in die Biopharmabranche in Südostasien beschleunigen die Markteinführung zusätzlich. Die Bedeutung von Artemisinin in Kombinationstherapien und die laufende Forschung und Entwicklung zur Verbesserung der Wirksamkeit unterstützen eine rasche Marktdurchdringung. Partnerschaften mit Forschungseinrichtungen, der verbesserte Zugang zu Schwellenländern und technologische Fortschritte bei den Produktionsmethoden stärken das Wachstum dieses Segments zusätzlich.

- Nach Arzneimitteltyp

Basierend auf der Art des Arzneimittels ist der Markt in verschreibungspflichtige und rezeptfreie Medikamente unterteilt. Das Segment der verschreibungspflichtigen Medikamente erzielte 2024 mit 65 % den größten Umsatzanteil. Treiber dieser Entwicklung sind die hohe Prävalenz chronischer Erkrankungen, steigende Gesundheitsausgaben und die zunehmende Anwendung spezialisierter Therapien in der Kardiologie, Onkologie und im Bereich des zentralen Nervensystems. Wirkstoffe für verschreibungspflichtige Medikamente profitieren von hohen regulatorischen Standards, etablierten klinischen Entwicklungspipelines und starken Vertriebsnetzen für Krankenhäuser und Apotheken. Das Segment wird zusätzlich durch einen verstärkten Forschungsschwerpunkt, patentgeschützte innovative Therapien und die wachsende Nachfrage nach personalisierter Medizin gestärkt. Die Integration in Gesundheitssysteme, die Kostenübernahme durch Krankenversicherungen und die Präsenz in Fachkliniken sichern die kontinuierliche Nutzung. Starke Investitionen in Forschung und Entwicklung, die Verfügbarkeit hochwertiger Wirkstoffe und fortschrittliches Formulierungs-Know-how erhalten die Marktführerschaft.

Für den Markt für rezeptfreie Arzneimittel wird von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,8 % das schnellste Wachstum erwartet. Treiber dieses Wachstums sind die zunehmende Selbstmedikation, das steigende Bewusstsein für die Behandlung kleinerer gesundheitlicher Probleme und staatliche Initiativen zur Verbesserung der Verfügbarkeit rezeptfreier Arzneimittel. Verbraucherpräferenzen für Komfort, Kosteneffizienz und gute Verfügbarkeit treiben das Wachstum dieses Segments an. Der Ausbau von Apothekennetzen, Online-Vertriebskanälen und E-Commerce-Plattformen beschleunigt die Akzeptanz zusätzlich. Auch die steigende Nachfrage nach Schmerzmitteln, Erkältungsmitteln und Vitaminen trägt zum schnellen Wachstum bei. Hersteller entwickeln innovative Verpackungen und Rezepturen, um die Attraktivität für Verbraucher zu steigern.

- Nach Verwendung

Basierend auf der Nutzung ist der Markt in klinische Anwendung und Forschung unterteilt. Das klinische Segment erzielte 2024 mit 68 % den größten Umsatzanteil, getrieben durch den Einsatz von Wirkstoffen in Krankenhäusern, Fachkliniken und Behandlungsprogrammen für Patienten in verschiedenen Therapiebereichen. Die klinische Anwendung wird durch eine robuste Gesundheitsinfrastruktur, eine wachsende Patientenzahl und die zunehmende Verbreitung chronischer Erkrankungen begünstigt. Wirkstoffe in klinischen Anwendungen gewährleisten hohe Qualität, die Einhaltung regulatorischer Standards und konsistente Therapieergebnisse. Die Zusammenarbeit zwischen Pharmaunternehmen und Krankenhäusern stärkt die Marktführerschaft zusätzlich. Der Ausbau des Zugangs zur Gesundheitsversorgung in den Ländern des asiatisch-pazifischen Raums, die Integration fortschrittlicher Therapien und die Einführung standardisierter Behandlungsprotokolle fördern die Marktdurchdringung.

Der Forschungssektor dürfte von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,2 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind steigende Investitionen in Forschung und Entwicklung, klinische Studien und staatliche Fördermittel für die Wirkstoffforschung. Akademische Einrichtungen, Auftragsforschungsinstitute und Biotech-Unternehmen setzen zunehmend auf Wirkstoffe (APIs) für experimentelle Therapien. Das wachsende Interesse an personalisierter Medizin, seltenen Erkrankungen und neuartigen Formulierungen fördert die Anwendung zusätzlich. Der Ausbau der Laborinfrastruktur, die Verfügbarkeit hochreiner Wirkstoffe und die gemeinsame Innovationsarbeit treiben das Wachstum dieses Segments voran. Strategische Partnerschaften zwischen Pharmaunternehmen und Forschungseinrichtungen verbessern die Entwicklung neuer Wirkstoffpipelines.

- Nach Wirkstärke

Basierend auf der Wirkstärke wird der Markt in Wirkstoffe mit niedriger bis mittlerer Wirkstärke und Wirkstoffe mit hoher bis hoher Wirkstärke unterteilt. Das Segment der Wirkstoffe mit niedriger bis mittlerer Wirkstärke erzielte 2024 mit 61 % den größten Marktanteil, was auf die breite Anwendung in gängigen Therapiebereichen wie Analgetika, Herz-Kreislauf-Medikamenten und Antiinfektiva zurückzuführen ist. Effiziente Fertigung, Kosteneffektivität und etablierte Lieferketten stärken diese Marktführerschaft. Wirkstoffe mit niedriger bis mittlerer Wirkstärke eignen sich aufgrund ihrer Eignung für die Massenproduktion und ihres breiten therapeutischen Anwendungsspektrums. Vertrautheit mit regulatorischen Vorgaben, skalierbare Produktionsprozesse und die Integration in Kombinationstherapien fördern die Akzeptanz zusätzlich. Das Marktwachstum wird durch die steigende Nachfrage von Krankenhäusern und Apotheken sowie durch starke regionale Produktionszentren begünstigt.

Das Segment der hochpotenten bis hochpotenten Wirkstoffe (API) wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,5 % das schnellste Wachstum verzeichnen. Treiber dieses Wachstums sind die Bereiche Onkologie, ZNS und Spezialtherapeutika, die niedrig dosierte, hochwirksame Medikamente erfordern. Strenge Herstellungsstandards, spezialisierte Produktionsanlagen und zunehmende Partnerschaften mit Auftragsherstellern tragen zum Wachstum dieses Segments bei. Der wachsende Fokus auf die Behandlung seltener Erkrankungen, Biologika und Präzisionsmedizin fördert die Akzeptanz hochpotenter Wirkstoffe. Der Ausbau spezialisierter Produktionsinfrastruktur, fortschrittliche Containment-Technologien und die zunehmende Anzahl behördlicher Zulassungen beschleunigen die Marktdurchdringung dieses Segments. Das starke Marktinteresse an neuartigen zielgerichteten Therapien und die Entwicklung klinischer Projekte verstärken das Wachstum zusätzlich.

- Durch therapeutische Anwendung

Basierend auf der therapeutischen Anwendung ist der Markt in Kardiologie, ZNS & Neurologie, Onkologie, Orthopädie, Endokrinologie, Pneumologie, Gastroenterologie, Nephrologie, Ophthalmologie und weitere therapeutische Anwendungen unterteilt. Das Segment Onkologie dominierte 2024 mit einem Umsatzanteil von 32 %, bedingt durch die steigende Krebsprävalenz, fortschrittliche zielgerichtete Therapien und die hohe Akzeptanz von Biologika. Onkologische Wirkstoffe profitieren von einer starken Forschungs- und Entwicklungspipeline, staatlicher Förderung und der Zusammenarbeit mit spezialisierten Krankenhäusern und Forschungsinstituten. Zulassungen für neuartige Therapien, die hohe Patientennachfrage und die Anwendung von Mehrfachmedikamenten verstärken diese dominante Stellung zusätzlich. Steigende Investitionen in die Krebstherapie, eine rege klinische Studientätigkeit und die Integration der Präzisionsmedizin fördern die Akzeptanz im asiatisch-pazifischen Raum.

Das Segment ZNS & Neurologie wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die steigende Prävalenz neurologischer Erkrankungen, die wachsende Nachfrage nach innovativen Therapien und die zunehmende staatliche Förderung der Behandlung seltener Erkrankungen. Der Ausbau von Forschungszentren, klinischen Studien und die verstärkte Anwendung von ZNS-Wirkstoffen in Krankenhäusern beschleunigen das Segmentwachstum. Die Entwicklung neuartiger niedermolekularer und hochmolekularer Therapeutika, das steigende Bewusstsein für psychische Gesundheit und die Integration digitaler Gesundheitstechnologien fördern die Akzeptanz zusätzlich. Partnerschaften zwischen Pharmaunternehmen und neurologisch spezialisierten Forschungsinstituten stärken die Marktexpansion.

Regionale Analyse des asiatisch-pazifischen Marktes für pharmazeutische Wirkstoffe (API).

- Der Markt für pharmazeutische Wirkstoffe (API) im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen.

- Angetrieben durch die zunehmende Urbanisierung, steigende verfügbare Einkommen und technologische Fortschritte in Ländern wie China, Japan und Indien

- Die wachsende pharmazeutische Produktionsbasis der Region, unterstützende Regierungsinitiativen und der Fokus auf erschwingliche Generika schaffen ein günstiges Umfeld für die Marktexpansion.

Markteinblicke für pharmazeutische Wirkstoffe (API) in China:

Der chinesische Markt für pharmazeutische Wirkstoffe (API) dominierte 2024 mit einem Umsatzanteil von 41,6 % den API-Markt. Dies ist auf eine gut etablierte pharmazeutische Produktionsbasis, eine starke F&E-Infrastruktur und die Präsenz bedeutender Marktteilnehmer zurückzuführen. Die wachsende Mittelschicht, die rasche Urbanisierung und die zunehmende Technologieakzeptanz treiben den API-Markt zusätzlich an. Darüber hinaus sind die starke inländische Produktionskapazität, staatliche Förderprogramme für die pharmazeutische Produktion und die steigende Nachfrage nach Generika Schlüsselfaktoren für die anhaltende Marktführerschaft Chinas.

Markteinblicke für pharmazeutische Wirkstoffe (API) in Indien:

Der indische Markt für pharmazeutische Wirkstoffe (API) wird im Prognosezeitraum voraussichtlich die am schnellsten wachsende Region im API-Markt sein. Gründe hierfür sind die expandierenden Produktionskapazitäten, günstige Regierungsinitiativen und die steigende Nachfrage nach erschwinglichen Generika. Zunehmende ausländische Investitionen, ein starkes Exportpotenzial und wachsende Möglichkeiten der Auftragsfertigung unterstützen ebenfalls Indiens Wachstumskurs. Der Fokus des Landes auf kosteneffiziente Produktion und skalierbare API-Herstellung zieht globale Pharmaunternehmen an, die in Indien produzieren lassen.

Marktanteil von pharmazeutischen Wirkstoffen (API) im asiatisch-pazifischen Raum

Die Wirkstoffindustrie (API) wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Cipla (Indien)

- Dr. Reddy's Laboratories (Indien)

- Sun Pharmaceutical Industries (Indien)

- Aurobindo Pharma (Indien)

- Hanwha Chemical (Südkorea)

- Toyama Chemical (Japan)

- Daiichi Sankyo (Japan)

- Hetero Labs (Indien)

- Lupin Limited (Indien)

Neueste Entwicklungen auf dem asiatisch-pazifischen Markt für pharmazeutische Wirkstoffe (API).

- Im Mai 2025 kündigte Xellia Pharmaceuticals, Europas letzter Hersteller wichtiger Antibiotika-Wirkstoffe, die Schließung seines größten Werks in Kopenhagen an, wodurch 500 Arbeitsplätze verloren gingen. Das Unternehmen nannte als Gründe den nicht tragbaren Wettbewerb und die geplante Verlagerung eines Teils der Produktion nach China. Dieser Schritt verdeutlicht die Herausforderungen, vor denen europäische Pharmahersteller im Kampf gegen asiatische Konkurrenten stehen.

- Im Oktober 2025 startete die US-amerikanische Arzneimittelbehörde FDA ein Pilotprogramm zur Beschleunigung des Zulassungsverfahrens für Generika, die vollständig in den USA hergestellt und getestet werden. Ziel dieser Initiative ist es, die heimische Arzneimittelproduktion zu stärken und die Abhängigkeit von ausländischen Wirkstofflieferanten zu verringern.

- Im September 2025 kündigte Symbiotec Pharmalab, ein weltweit führender Hersteller von Kortikosteroid- und Hormonwirkstoffen, Pläne für einen Börsengang (IPO) innerhalb der nächsten zwölf Monate an. Das Unternehmen strebt eine Bewertung von rund einer Milliarde US-Dollar an, um seine Position im Markt für Spezialpharmazeutika zu stärken.

- Im Juni 2025 sanken die Preise für pharmazeutische Wirkstoffe (APIs) in Indien deutlich, was den Druck auf die indische Pharmaindustrie verringerte. Der Rückgang der API-Kosten dürfte die Produktionskosten der Arzneimittelhersteller senken, die Rentabilität steigern und die Lieferkette innerhalb des Sektors stabilisieren.

- Im Oktober 2025 berichtete Dr. Reddy’s Laboratories, dass die US-amerikanische Arzneimittelbehörde FDA nach einer Inspektion ihrer Produktionsstätte für pharmazeutische Wirkstoffe (API) in Middleburgh, New York, ein Formular 483 mit zwei Beanstandungen ausgestellt hat. Das Unternehmen plant, diese Beanstandungen in Absprache mit der FDA zu beheben, um die Einhaltung der regulatorischen Standards sicherzustellen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.