Rasche technologische Fortschritte, darunter tragbare Geräte, mobile Apps und Telemedizin-Plattformen, haben die Fernüberwachung von Therapien erleichtert. Diese Technologien ermöglichen die Erfassung, Übertragung und Analyse von Daten in Echtzeit und ermöglichen es Gesundheitsdienstleistern, die Vitalfunktionen, die Medikamenteneinnahme und den allgemeinen Gesundheitszustand von Patienten aus der Ferne zu überwachen. Technologische Fortschritte haben zur Entwicklung tragbarer Geräte und Sensoren geführt, die verschiedene MSK-Parameter (Muskel-Skelett-System) wie Bewegung, Haltung, Bewegungsumfang, Muskelaktivität und Gelenkdruck überwachen können. Diese Geräte erfassen Echtzeitdaten und liefern objektive Messwerte, sodass Gesundheitsdienstleister den Zustand von MSK-Patienten überwachen und ihren Fortschritt aus der Ferne verfolgen können. Präzise und zuverlässige tragbare Geräte verbessern die Fernüberwachung von MSK-Erkrankungen.

Zum Beispiel,

- Im Mai 2021 berichtete ScienceDirect, dass die Technologie in den letzten Jahren den Bereich der Bewegungserfassung revolutioniert hat. Tragbare und optische Sensoren ermöglichen die automatische Erfassung zuverlässiger Bewegungsdaten für die biomechanische Analyse. Zudem wurde wissenschaftliche Literatur zu technologiegestützten Ansätzen mit RGB-D-Sensoren zur Überwachung der Gesundheit des Bewegungsapparats entwickelt.

Zugriff auf den vollständigen Bericht unter https://www.databridgemarketresearch.com/reports/us-remote-therapeutic-monitoring-msk-market

Man kann den Schluss ziehen, dass der zunehmende technologische Fortschritt im Bereich der therapeutischen Fernüberwachung (MSK) das Marktwachstum im Prognosezeitraum vorantreibt.

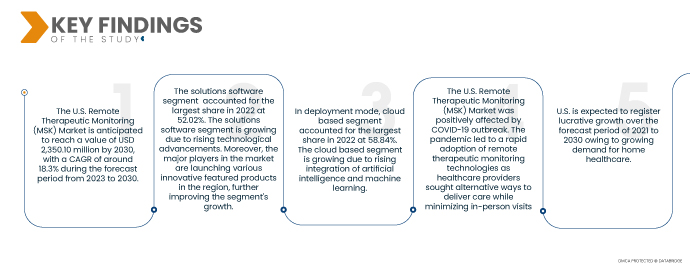

Wichtigste Ergebnisse der Studie

- Der US-Markt für Remote Therapeutic Monitoring (MSK) wird voraussichtlich bis 2030 einen Wert von 2.350,10 Millionen US-Dollar erreichen, mit einer CAGR von rund 18,3 % im Prognosezeitraum von 2023 bis 2030

- Das Segment Lösungssoftware hatte im Jahr 2022 mit 52,02 % den größten Anteil. Das Segment Lösungssoftware wächst aufgrund des technologischen Fortschritts. Darüber hinaus bringen die wichtigsten Marktteilnehmer verschiedene innovative Produkte in der Region auf den Markt, was das Wachstum des Segments weiter fördert.

- Im Bereitstellungsmodus hatte das Cloud-basierte Segment im Jahr 2022 mit 58,84 % den größten Anteil. Das Cloud-basierte Segment wächst aufgrund der zunehmenden Integration von künstlicher Intelligenz und maschinellem Lernen

- Der US-Markt für therapeutische Fernüberwachung (MSK) profitierte vom COVID-19-Ausbruch. Die Pandemie führte zu einer raschen Einführung von Technologien zur therapeutischen Fernüberwachung, da Gesundheitsdienstleister nach alternativen Behandlungsmöglichkeiten suchten und gleichzeitig persönliche Besuche minimierten. Dieser Wandel führte zu einer verstärkten Nutzung von Telemedizinplattformen, tragbaren Geräten, mobilen Anwendungen und anderen Fernüberwachungstools zur Behandlung von MSK-Erkrankungen.

- In den USA wird im Prognosezeitraum von 2021 bis 2030 aufgrund der steigenden Nachfrage nach häuslicher Gesundheitsversorgung ein lukratives Wachstum erwartet.

Steigende Nachfrage nach häuslicher Gesundheitsversorgung

Patienten bevorzugen zunehmend die bequeme Versorgung zu Hause. Therapeutische Fernüberwachung ermöglicht es Patienten, ihren Zustand aus der Ferne zu überwachen und reduziert so die Notwendigkeit häufiger Krankenhausbesuche. Diese Nachfrage nach häuslicher Pflege fördert die Einführung von Fernüberwachungslösungen.

Häusliche Gesundheitsversorgung bietet Patienten den Komfort und die Bequemlichkeit, Gesundheitsleistungen in ihren eigenen vier Wänden zu erhalten. Viele Patienten möchten häufige Krankenhausbesuche oder längere Aufenthalte vermeiden. Die therapeutische Fernüberwachung ermöglicht es Patienten, ihre Beschwerden bequem von zu Hause aus zu behandeln. Dadurch werden persönliche Besuche reduziert, und sie erhalten dennoch die notwendige Pflege und Überwachung.

Aus der obigen Diskussion lässt sich daher der Schluss ziehen, dass die steigende Nachfrage nach häuslicher Gesundheitsversorgung das Marktwachstum im Prognosezeitraum vorantreibt.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015–2020)

|

Quantitative Einheiten

|

Umsatz in Millionen USD, Mengen in Einheiten und Preise in USD

|

Abgedeckte Segmente

|

Nach Produkt (Lösungssoftware, -dienste und -hardware), Bereitstellungsmodus (Cloud-basiert und vor Ort), Zugriffsmodus (mobil und webbasiert), Codes (98975, 98976, 98977, 98980 und 98981), Typ (Kontinuierliche Überwachung, proaktive Überwachung und intermittierende Überwachung), Anwendung (nicht physiologische Daten und therapeutische Daten), Kaufmodus (Gruppenkauf und Einzelkauf), Endbenutzer (Anbieter, Zahler und Patienten), Vertriebskanal (Direktvertrieb und indirekter Vertrieb)

|

Abgedecktes Land

|

LAUS

|

Abgedeckte Marktteilnehmer

|

Zimmer Biomet (USA), Omada Health Inc. (USA), HealthViewX (USA), Propeller Health (USA), Limber Health Inc. (USA), Murata Vios (USA), Owlytics Healthcare (USA), Medistics LLC. (USA), INTELLIH INC. (USA), HealthArc (USA), CIPHER SKIN INC. (USA), Medsien, Inc. (USA), Censon Health (USA) und Exer Labs, Inc. (USA)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der US-Markt für Remote Therapeutic Monitoring (MSK) ist in neun wichtige Segmente unterteilt, wie Produkt, Bereitstellungsmodus, Zugriffsmodus, Codes, Typ, Anwendung, Kaufmodus, Endbenutzer und Vertriebskanal.

- Der US-Markt für Remote Therapeutic Monitoring (MSK) ist auf Produktbasis in Lösungssoftware, Dienstleistungen und Hardware segmentiert.

Im Jahr 2023 wird das Segment der Lösungssoftware aufgrund des zunehmenden technologischen Fortschritts voraussichtlich den Markt dominieren.

Im Jahr 2023 dominiert das Segment der Lösungssoftware den Markt mit einem Marktanteil von 52,02 % und wird Schätzungen zufolge bis 2030 1.234,98 Millionen US-Dollar erreichen, was einer durchschnittlichen jährlichen Wachstumsrate von 18,4 % im Prognosezeitraum von 2023 bis 2030 entspricht. Aufgrund des zunehmenden technologischen Fortschritts wird erwartet, dass das Segment den US-Markt für Remote Therapeutic Monitoring (MSK) dominieren wird.

- Der US-Markt für Remote Therapeutic Monitoring (MSK) ist nach Bereitstellungsmodus in Cloud-basierte und On-Premises-Lösungen unterteilt. Im Jahr 2023 dominiert das Cloud-basierte Segment den Markt mit einem Marktanteil von 58,89 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,4 %.

- Der US-Markt für Remote Therapeutic Monitoring (MSK) ist nach Zugriffsart in mobil und webbasiert segmentiert. Im Jahr 2023 dominiert das mobile Segment den Markt mit einem Marktanteil von 58,81 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,3 %.

- Auf der Grundlage der Codes ist der US-Markt für Remote Therapeutic Monitoring (MSK) in die Segmente 98975, 98976, 98977, 98980 und 98981 unterteilt. Im Jahr 2023 dominiert das Segment 98975 den Markt mit einem Marktanteil von 27,38 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 19,5 %.

- Der US-Markt für therapeutische Fernüberwachung (MSK) ist nach Typen in kontinuierliche Überwachung, proaktive Überwachung und intermittierende Überwachung unterteilt. Im Jahr 2023 dominiert das Segment der kontinuierlichen Überwachung den Markt mit einem Marktanteil von 42,70 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,7 %.

- Der US-Markt für therapeutische Fernüberwachung (MSK) ist nach Anwendung in nicht-physiologische und therapeutische Daten segmentiert. Im Jahr 2023 dominiert das nicht-physiologische Segment den Markt mit einem Marktanteil von 51,47 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,5 %.

- Auf der Grundlage der Kaufart ist der US-Markt für die Fernüberwachung therapeutischer Geräte (MSK) in Gruppenkäufe und Einzelkäufe segmentiert.

Im Jahr 2023 wird das Segment der Gruppenkäufe aufgrund der Ausweitung der Telemedizin voraussichtlich den US-Markt für Remote Therapeutic Monitoring (MSK) dominieren.

Im Jahr 2023 dominiert das Segment der Gruppenkäufe den Markt mit einem Marktanteil von 60,41 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,4 %. Aufgrund der Ausweitung der Telemedizin wird erwartet, dass es den US-Markt für therapeutische Fernüberwachung (MSK) dominieren wird.

- Der US-Markt für Remote Therapeutic Monitoring (MSK) ist nach Endnutzern in Anbieter, Kostenträger und Patienten segmentiert. Im Jahr 2023 dominiert das Anbietersegment den Markt mit einem Marktanteil von 43,36 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,5 %.

- Der US-Markt für Remote Therapeutic Monitoring (MSK) ist nach Vertriebskanälen in Direktvertrieb und indirekten Vertrieb unterteilt. Im Jahr 2023 dominiert der Direktvertrieb den Markt mit einem Marktanteil von 57,56 % und wächst im Prognosezeitraum von 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,4 %.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als Marktteilnehmer auf dem US-Markt für Remote Therapeutic Monitoring (MSK) an: Zimmer Biomet (USA), Omada Health Inc. (USA), HealthViewX (USA), Propeller Health (USA), Limber Health Inc. (USA), Murata Vios (USA), Owlytics Healthcare (USA), Medistics LLC. (USA), INTELLIH INC. (USA), HealthArc (USA), CIPHER SKIN INC. (USA), Medsien, Inc. (USA), Censon Health (USA) und Exer Labs, Inc. (USA).

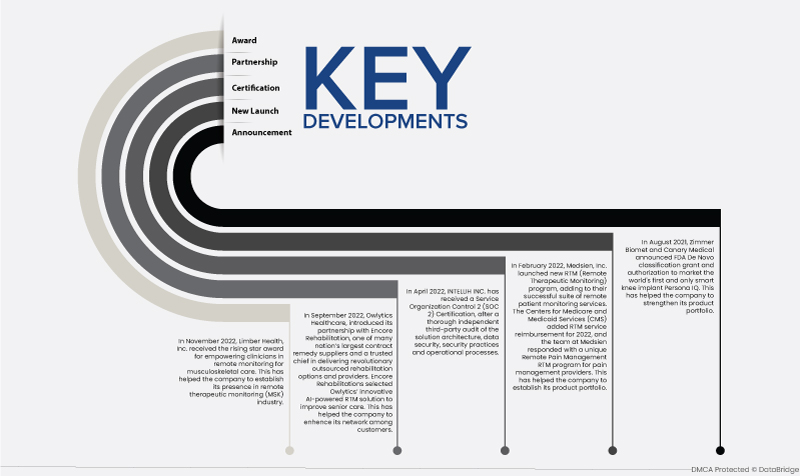

Marktentwicklung

- Im November 2022 erhielt Limber Health, Inc. den Rising Star Award für die Unterstützung von Klinikern bei der Fernüberwachung der muskuloskelettalen Versorgung. Dies hat dem Unternehmen geholfen, seine Präsenz in der Branche der therapeutischen Fernüberwachung (MSK) zu etablieren.

- Im September 2022 gab Owlytics Healthcare seine Partnerschaft mit Encore Rehabilitation bekannt, einem der größten Vertragsbehandlungsanbieter des Landes und führenden Anbieter innovativer ausgelagerter Rehabilitationslösungen und -dienstleistungen. Encore Rehabilitations entschied sich für die innovative KI-gestützte RTM-Lösung von Owlytics, um die Seniorenbetreuung zu verbessern. Dies hat dem Unternehmen geholfen, sein Kundennetzwerk zu erweitern.

- Im April 2022 erhielt INTELLIH INC. nach einer gründlichen unabhängigen Prüfung der Lösungsarchitektur, der Datensicherheit, der Sicherheitspraktiken und der Betriebsabläufe durch Dritte eine Service Organization Control 2 (SOC 2)-Zertifizierung

- Im Februar 2022 startete Medsien, Inc. ein neues RTM-Programm (Remote Therapeutic Monitoring) und ergänzte damit sein erfolgreiches Angebot an Fernüberwachungsdiensten für Patienten. Die Centers for Medicare and Medicaid Services (CMS) führten für 2022 die Kostenerstattung für RTM-Leistungen ein, und das Team von Medsien reagierte darauf mit einem einzigartigen Remote Pain Management (RTM)-Programm für Schmerztherapeuten. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu etablieren.

- Im August 2021 gaben Zimmer Biomet und Canary Medical die Erteilung der FDA-De-Novo-Klassifizierung und die Zulassung zur Vermarktung des weltweit ersten intelligenten Knieimplantats Persona IQ bekannt. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu stärken.

Für detailliertere Informationen zum US-Marktbericht zur therapeutischen Fernüberwachung (MSK) klicken Sie hier – https://www.databridgemarketresearch.com/reports/us-remote-therapeutic-monitoring-msk-market