Die rasante Entwicklung der LED-Beleuchtungstechnologie ist ein wichtiger Treiber für den Markt für Gewächshaus- und Pflanzenlampen. Die LED-Technologie hat sich in den letzten Jahren deutlich weiterentwickelt und bietet im Vergleich zu herkömmlichen Beleuchtungsoptionen eine verbesserte Energieeffizienz, längere Lebensdauer und bessere Lichtqualität. Moderne LEDs lassen sich feinabstimmen, um spezifische Lichtspektren zu emittieren, die das Pflanzenwachstum optimieren, die Photosynthese fördern und den Ertrag steigern. Diese individuelle Anpassung ermöglicht eine präzisere Kontrolle der Wachstumsbedingungen, was für die Maximierung der Produktivität in kontrollierten Umgebungen entscheidend ist.

Zugriff auf den vollständigen Bericht unter https://www.databridgemarketresearch.com/reports/north-america-greenhouse-and-controlled-environment-grow-lights-for-agricultural-crops-market

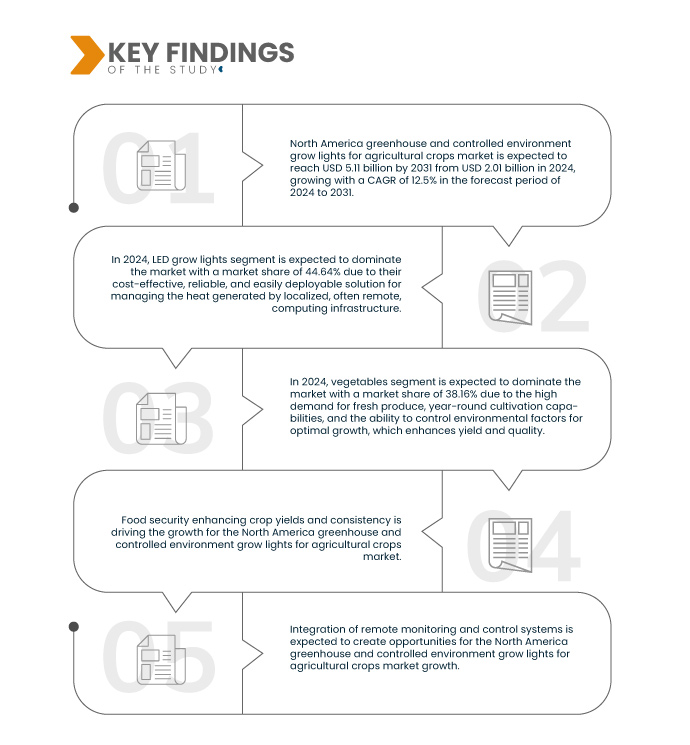

Data Bridge Market Research analysiert, dass der nordamerikanische Markt für Gewächshäuser und Wachstumslampen in kontrollierten Umgebungen für landwirtschaftliche Nutzpflanzen von 2,01 Milliarden US-Dollar im Jahr 2024 auf 5,11 Milliarden US-Dollar im Jahr 2031 anwachsen dürfte, was einem CAGR von 12,5 % im Prognosezeitraum von 2025 bis 2031 entspricht.

Wichtigste Ergebnisse der Studie

Steigende Verbraucherpräferenz für frische Produkte

Die zunehmende Vorliebe der Verbraucher für frische Produkte ist ein wichtiger Wachstumstreiber im nordamerikanischen Markt für Gewächshäuser und Pflanzenlampen für landwirtschaftliche Nutzpflanzen. Da die Verbraucher gesundheitsbewusster werden und das ganze Jahr über hochwertige, regionale und frische Produkte verlangen, müssen die Erzeuger ihre Betriebe anpassen, um diesen Wünschen gerecht zu werden. Gewächshäuser und Pflanzenlampen ermöglichen die Produktion von frischem Gemüse, Obst und Kräutern unabhängig von saisonalen oder geografischen Einschränkungen. Diese wachsende Nachfrage nach hochwertigen, frischen Produkten hat zu erhöhten Investitionen in fortschrittliche Anbautechnologien geführt, darunter spezielle Beleuchtungssysteme für eine kontinuierliche und optimale Pflanzenproduktion.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar von 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Typ (LED-Wachstumslampen, Leuchtstofflampen, Hochdruckentladungslampen (HID) und Glühlampen), Anwendung (Gemüse, Obst, Blumen, Kräuter, Bäume und Sonstiges), Systemtyp (Gewächshäuser und vertikale Farmen ), Installationstyp (Festinstallation und tragbare Installation), Spektrum (breit und schmal), Lichtspektrum (Doppelspektrum: Rotlichtspektrum (600–700 NM), Blaulichtspektrum (400–500 NM), Fernrotlichtspektrum (700–850 NM), Grünlichtspektrum (500–600 NM) und UV-Lichtspektrum (100–400 NM)), Vertriebskanal (Online, E-Commerce , Unternehmenswebsite, Einzelhandel, Großhandel, Offline und Sonstiges), Endbenutzer (Gewächshausgärtner, Lagerhausgärtner, Heimgärtner, Viehzuchtanwendungen, Forschungs- und akademische Einrichtungen und Sonstiges)

|

Abgedeckte Länder

|

USA, Kanada und Mexiko

|

Abgedeckte Marktteilnehmer

|

Signify Holding (Niederlande), Heliospectra (Schweden), AMS-OSRAM AG (Österreich), Cree LED (USA), Hydrofarm (USA), SunPlus LED (China), SAVANT TECHNOLOGIES LLC (USA), Hyperion Grow Lights (Tochtergesellschaft von Midstream Ltd.) (Großbritannien), MechaTronix Horticulture Lighting (Niederlande), GrowPackage.com (Kanada), California Lightworks (USA), Valoya (Finnland) und Grower's Choice (USA) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse

Der nordamerikanische Markt für Wachstumslampen für Gewächshäuser und kontrollierte Umgebungen für landwirtschaftliche Nutzpflanzen ist in acht wichtige Segmente unterteilt, die auf Typ, Anwendung, Systemtyp, Installationstyp, Spektrum, Lichtspektrum, Vertriebskanal und Endbenutzer basieren.

- Der nordamerikanische Markt für Gewächshaus- und kontrollierte Umgebungswachstumslampen für landwirtschaftliche Nutzpflanzen ist nach Typ in LED-Wachstumslampen, Leuchtstofflampen, Hochdruckentladungslampen (HID) und Glühlampen unterteilt.

Im Jahr 2024 wird das Segment der LED-Wachstumsleuchten voraussichtlich den nordamerikanischen Markt für Gewächshaus- und kontrollierte Umgebungswachstumsleuchten für landwirtschaftliche Nutzpflanzen dominieren.

Im Jahr 2024 wird das Segment der LED-Wachstumslampen voraussichtlich mit einem Marktanteil von 44,64 % den Markt dominieren, da sie eine kostengünstige, zuverlässige und leicht zu implementierende Lösung zur Bewältigung der von lokaler, oft entfernter Computerinfrastruktur erzeugten Wärme darstellen.

- Auf der Grundlage der Anwendung ist der nordamerikanische Markt für Gewächshaus- und kontrollierte Umgebungswachstumslampen für landwirtschaftliche Nutzpflanzen in Gemüse, Obst, Blumen, Kräuter, Bäume und andere unterteilt

Im Jahr 2024 wird das Gemüsesegment voraussichtlich den nordamerikanischen Markt für Gewächshäuser und kontrollierte Umgebungswachstumslampen für landwirtschaftliche Nutzpflanzen dominieren

Im Jahr 2024 wird das Gemüsesegment voraussichtlich mit einem Marktanteil von 38,16 % den Markt dominieren. Dies ist auf die hohe Nachfrage nach frischen Produkten, die Möglichkeit des ganzjährigen Anbaus und die Möglichkeit zurückzuführen, Umweltfaktoren für ein optimales Wachstum zu kontrollieren, was Ertrag und Qualität verbessert.

- Der nordamerikanische Markt für Gewächshäuser und Pflanzenlampen für kontrollierte Umgebungen für landwirtschaftliche Nutzpflanzen ist nach Systemtyp in Gewächshäuser und vertikale Farmen unterteilt. Im Jahr 2024 wird das Segment Gewächshäuser voraussichtlich mit einem Marktanteil von 64,02 % den Markt dominieren.

- Der nordamerikanische Markt für Gewächshaus- und kontrollierte Anbauleuchten für landwirtschaftliche Nutzpflanzen ist nach Installationsart in Festinstallationen und mobile Installationen unterteilt. Im Jahr 2024 wird das Segment der Festinstallationen voraussichtlich mit einem Marktanteil von 81,29 % den Markt dominieren.

- Der nordamerikanische Markt für Gewächshaus- und kontrollierte Anbaulampen für landwirtschaftliche Nutzpflanzen ist auf der Grundlage des Spektrums in ein breites und ein schmales Segment unterteilt. Im Jahr 2024 wird das breite Segment voraussichtlich den Markt mit einem Marktanteil von 66,95 % dominieren.

- Der nordamerikanische Markt für Gewächshaus- und kontrollierte Anbaulampen für landwirtschaftliche Nutzpflanzen ist nach dem Lichtspektrum in zwei Lichtspektrum-Varianten unterteilt: Rotlichtspektrum (600–700 NM), Blaulichtspektrum (400–500 NM), Fernrotlichtspektrum (700–850 NM), Grünlichtspektrum (500–600 NM) und UV-Lichtspektrum (100–400 NM). Im Jahr 2024 wird das Rotlichtspektrum-Segment (600–700 NM) voraussichtlich mit einem Marktanteil von 35,02 % dominieren.

- Der nordamerikanische Markt für Gewächshaus- und Pflanzenlampen für landwirtschaftliche Nutzpflanzen ist nach Vertriebskanälen in Online, E-Commerce, Unternehmenswebsite, Einzelhandel, Großhandel, Offline und andere unterteilt. Im Jahr 2024 wird das Online-Segment voraussichtlich mit einem Marktanteil von 33,87 % den Markt dominieren.

- Der nordamerikanische Markt für Gewächshaus- und kontrollierte Anbaulampen für landwirtschaftliche Nutzpflanzen ist nach Endverbraucher segmentiert in Gewächshausanbau, Lagerhausanbau, Heimanbau, Viehzucht, Forschungs- und akademische Einrichtungen und weitere. Im Jahr 2024 wird das Segment der Gewächshausanbaubetriebe voraussichtlich mit einem Marktanteil von 38,70 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert unter anderem Signify Holding (Niederlande), Heliospectra (Schweden), AMS-OSRAM AG (Österreich), Cree LED (USA) und Hydrofarm (USA) als die wichtigsten Unternehmen, die auf dem nordamerikanischen Markt für Wachstumslampen für Gewächshäuser und kontrollierte Umgebungen für landwirtschaftliche Nutzpflanzen tätig sind.

Marktentwicklungen

- Im November 2023 präsentierte die Kubota Corporation auf der Agritechnica den Agri Robo KVT, einen bedeutenden Fortschritt in der autonomen Landwirtschaftstechnologie. Dieser verbesserte Traktor begegnete dem Arbeitskräftemangel, erhöhte die Sicherheit und förderte eine effiziente Landwirtschaft. Damit steigerte Kubota seine Marktwettbewerbsfähigkeit und seine Innovationsführerschaft.

- Im September 2023 haben sich Yara und John Deere zusammengeschlossen, um agronomisches Know-how mit Präzisionstechnologie zu verbinden und so die Produktivität und Nachhaltigkeit landwirtschaftlicher Betriebe zu steigern. Ihre Partnerschaft optimierte die Düngung mithilfe datenbasierter Erkenntnisse und zielte darauf ab, den Ertrag um bis zu 7 % zu steigern und den Stickstoffverbrauch um 14 % zu senken – im Einklang mit den EU-Zielen von „Vom Hof auf den Tisch“.

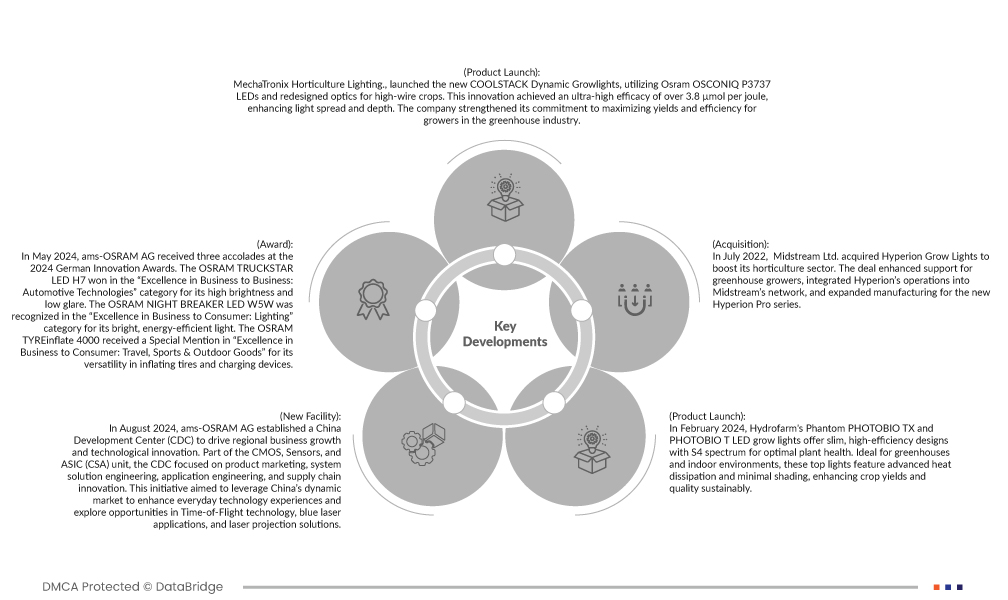

- Im August 2024 gründete die ams-OSRAM AG ein China Development Center (CDC), um das regionale Geschäftswachstum und die technologische Innovation voranzutreiben. Als Teil der CMOS-, Sensor- und ASIC-Einheit (CSA) konzentrierte sich das CDC auf Produktmarketing, Systemlösungsentwicklung, Anwendungsentwicklung und Lieferketteninnovation. Ziel dieser Initiative war es, den dynamischen chinesischen Markt zu nutzen, um alltägliche Technologieerlebnisse zu verbessern und Möglichkeiten in den Bereichen Time-of-Flight-Technologie, Blaulaseranwendungen und Laserprojektionslösungen zu erkunden.

- Im Februar 2023 bieten die Phantom PHOTOBIO TX und PHOTOBIO T LED-Wachstumsleuchten von Hydrofarm schlanke, hocheffiziente Designs mit S4-Spektrum für optimale Pflanzengesundheit. Diese Top-Leuchten sind ideal für Gewächshäuser und Innenräume und zeichnen sich durch fortschrittliche Wärmeableitung und minimale Beschattung aus, wodurch Ernteerträge und -qualität nachhaltig gesteigert werden.

- Im Juli 2022 erwarb Midstream Ltd. Hyperion Grow Lights, um seinen Gartenbausektor zu stärken. Die Übernahme verbesserte die Unterstützung für Gewächshausgärtner, integrierte Hyperions Betrieb in das Midstream-Netzwerk und erweiterte die Produktion für die neue Hyperion Pro-Serie.

Regionale Analyse

Geografisch betrachtet sind dies die USA, Kanada und Mexiko, die im nordamerikanischen Marktbericht über Wachstumslampen für Gewächshäuser und kontrollierte Umgebungen für landwirtschaftliche Nutzpflanzen behandelt werden.

Laut Marktforschungsanalyse von Data Bridge:

Es wird erwartet, dass die USA den nordamerikanischen Markt für Gewächshaus- und kontrollierte Umgebungswachstumslampen für landwirtschaftliche Nutzpflanzen dominieren und die am schnellsten wachsende Region sein werden.

Die USA dominieren aufgrund ihrer fortschrittlichen Agrartechnologie-Infrastruktur und erheblichen Investitionen in innovative Anbaumethoden sowie der Präsenz wichtiger Marktteilnehmer.

Für detailliertere Informationen zum nordamerikanischen Marktbericht über Wachstumslampen für Gewächshäuser und kontrollierte Umgebungen für landwirtschaftliche Nutzpflanzen klicken Sie hier – https://www.databridgemarketresearch.com/reports/north-america-greenhouse-and-controlled-environment-grow-lights-for-agricultural-crops-market