Minimalinvasive Chirurgie umfasst den chirurgischen Eingriff, der mit winzigen Einschnitten am Körper durchgeführt wird. Die Operationen umfassen unter anderem Gelenkersatz, arthroskopische Reparaturen von Sportverletzungen und mikroskopische Behandlungen komplexer Erkrankungen des Bewegungsapparats. Zu den Vorteilen der minimalinvasiven Chirurgie gehören eine kurze Genesungszeit, ein geringes Infektionsrisiko, weniger Blutungen, kleine Narben und kürzere Krankenhausaufenthalte.

Minimalinvasive Techniken bieten viele Vorteile, darunter kürzere Krankenhausaufenthalte, schnellere Genesungsphasen, weniger Beschwerden nach der Operation und ein geringeres Risiko für Komplikationen. Patienten und medizinisches Fachpersonal in diesem Bereich bevorzugen diese Technik als Alternative zu offenen chirurgischen Eingriffen. Die Nachfrage nach orthopädischen Implantaten, die mit minimalinvasiven Methoden funktionieren – wie kleinere Implantate, spezielle chirurgische Techniken und Instrumente – wird durch diesen Wechsel hin zu MIS-Verfahren vorangetrieben. Daher wird erwartet, dass der Fokus auf die Einführung minimalinvasiver Chirurgie als Treiber für das Marktwachstum wirken wird.

Zugriff auf den vollständigen Bericht @https://www.databridgemarketresearch.com/reports/mena-orthopedic-implants-market

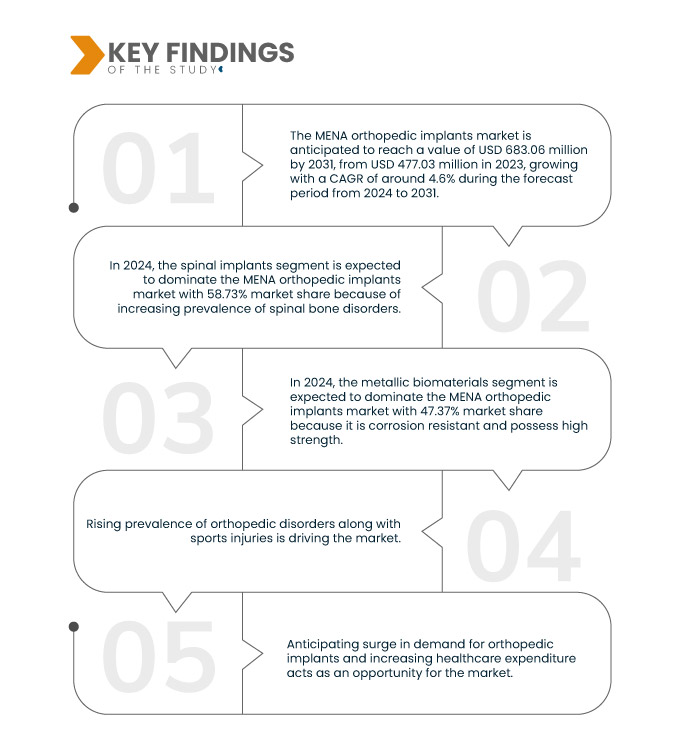

Data Bridge Market Research analysiert, dass die MENA-Markt für orthopädische Implantate soll von 477,03 Millionen USD im Jahr 2023 auf 683,06 Millionen USD im Jahr 2031 ansteigen und im Prognosezeitraum von 2024 bis 2031 eine durchschnittliche jährliche Wachstumsrate von 4,6 % aufweisen.

Wichtigste Ergebnisse der Studie

Steigende Prävalenz orthopädischer Erkrankungen und Sportverletzungen

Es besteht ein steigender Bedarf an orthopädischen Implantaten zur Behandlung von Muskel-Skelett-Problemen wie Muskel-Skelett-Erkrankungen (MSD), Muskelschmerzen und anderen. Denn die alternde Bevölkerung, sitzende Lebensweise und vermehrtes Sporttreiben tragen zu einer höheren Inzidenz von orthopädischen Erkrankungen bei. Der Bedarf an orthopädischen Therapien wird durch schwere Verletzungen wie Frakturen und Bänderrisse durch sportliche Aktivitäten sowie chronische Erkrankungen wie Osteoarthritis und Osteoporose getrieben. Sportbedingte Verletzungen treten immer häufiger auf. Für diese Verletzungen sind häufig orthopädische Implantate und chirurgische Eingriffe erforderlich, um Gelenke zu stabilisieren, Bänder zu reparieren und Frakturen zu behandeln. Infolgedessen wird erwartet, dass der Bedarf an orthopädischen Implantaten, die mit sportmedizinischen Operationen kompatibel sind, erheblich steigen wird.

Der dringende Bedarf an orthopädischen Therapien wird durch die steigende Prävalenz von Krankheiten wie Osteoarthritis, Osteoporose und Muskel-Skelett-Verletzungen unterstrichen, die durch Veränderungen in der Demografie und im Lebensstil noch verschärft werden. Darüber hinaus hat die zunehmende Beteiligung der Region an Sport und körperlichen Aktivitäten zu einem Anstieg der sportbedingten Verletzungen geführt, was den Einsatz von orthopädischen Implantaten und chirurgischen Eingriffen für erforderlich macht. Fraktur Reparatur, Bänderwiederherstellung und Gelenkstabilisierung. Daher wird erwartet, dass die steigende Prävalenz orthopädischer Erkrankungen zusammen mit Sportverletzungen das Marktwachstum ankurbelt.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik

|

Einzelheiten

|

|

Prognosezeitraum

|

2024 bis 2031

|

|

Basisjahr

|

2023

|

|

Historische Jahre

|

2022 (anpassbar auf 2016–2021)

|

|

Quantitative Einheiten

|

Umsatz in Mio. USD

|

|

Abgedeckte Segmente

|

Produkte (Wirbelsäulenimplantate und Traumaimplantate), Biomaterialien (Metallische Biomaterialien, Polymere Biomaterialien, Keramik Biomaterialien, natürliche Biomaterialien und andere), Modus (offene Chirurgie und minimalinvasive Chirurgie (MIS)), Gerätetyp (Geräte zur internen Fixierung und Geräte zur externen Fixierung), Anwendung (Wirbelsäulenfraktur, Hüftersatz, Knieersatz, Schulterersatz, Halsfraktur und andere), Endbenutzer (Krankenhäuser, ambulante Versorgungszentren, Fachkliniken, orthopädische Zentren und andere), Vertriebskanal (direkte Ausschreibung, Einzelhandelsverkauf und andere)

|

|

Abgedeckte Länder

|

Saudi-Arabien, Vereinigte Arabische Emirate, Ägypten, Katar, Kuwait, Oman und Bahrain

|

|

Abgedeckte Marktteilnehmer

|

Stryker (USA), Arthrex Inc. (Deutschland), CONMED Corporation (USA), B. Braun SE (Deutschland), Globus Medical (USA), Auxein (USA), Matrix Meditec (Indien), Medtronic (USA), Norm Medical (Türkei) und Orthomed (Ägypten) unter anderem

|

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse

Der Markt für orthopädische Implantate in der MENA-Region ist in sieben wichtige Segmente unterteilt, die auf Produkten, Biomaterial, Modus, Gerätetyp, Anwendung, Endbenutzer und Vertriebskanal basieren.

- Auf der Grundlage der Produkte ist der Markt in Wirbelsäulenimplantate und Traumaimplantate segmentiert

Im Jahr 2024 wird das Segment der Wirbelsäulenimplantate voraussichtlich den Markt für orthopädische Implantate in der MENA-Region dominieren.

Im Jahr 2024 wird das Segment der Wirbelsäulenimplantate aufgrund der zunehmenden Verbreitung orthopädischer Erkrankungen voraussichtlich mit einem Marktanteil von 58,73 % den Markt dominieren.

- Auf der Grundlage von BiomaterialDer Markt ist segmentiert in metallische Biomaterialien, polymere Biomaterialien, keramische Biomaterialien, natürliche Biomaterialien, andere

Im Jahr 2024 wird das Segment der metallischen Biomaterialien voraussichtlich den Markt für orthopädische Implantate in der MENA-Region dominieren.

Im Jahr 2024 wird das Segment der metallischen Biomaterialien aufgrund der zunehmenden Fokussierung auf minimalinvasive Chirurgie voraussichtlich mit einem Marktanteil von 47,37 % den Markt dominieren.

- Auf der Grundlage der Methode ist der Markt in offene Chirurgie und minimalinvasive Chirurgie (MIS) segmentiert. Im Jahr 2024 wird das Segment der offenen Chirurgie voraussichtlich den Markt mit einem Marktanteil von 67,01 % dominieren

- Auf der Grundlage des Gerätetyps ist der Markt in Geräte zur internen Fixierung und Geräte zur externen Fixierung segmentiert. Im Jahr 2024 wird das Segment der Geräte zur internen Fixierung voraussichtlich den Markt mit einem Marktanteil von 62,82 % dominieren.

- Auf der Grundlage der Anwendung ist der Markt in Wirbelsäulenfrakturen, Hüftersatz, Knieersatz, Schulterersatz, Nackenfrakturen und andere unterteilt. Im Jahr 2024 wird das Segment Wirbelsäulenfrakturen voraussichtlich den Markt mit einem Marktanteil von 30,74 % dominieren

- Auf der Grundlage des Endverbrauchers ist der Markt in Krankenhäuser, ambulante chirurgische Zentren, Fachkliniken, orthopädische Zentren und andere unterteilt. Im Jahr 2024 wird das Krankenhaussegment voraussichtlich den Markt mit einem Marktanteil von 47,60 % dominieren

- Auf der Grundlage des Vertriebskanals ist der Markt in Direktausschreibungen, Einzelhandelsverkäufe und andere unterteilt. Im Jahr 2024 wird das Segment der Direktausschreibungen voraussichtlich den Markt mit einem Marktanteil von 64,28 % dominieren

Hauptakteure

Data Bridge Market Research analysiert Stryker (USA), Arthrex Inc. (Deutschland), CONMED Corporation (USA), B. Braun SE (Deutschland) und Globus Medical (USA) als die wichtigsten Unternehmen auf dem MENA-Markt für orthopädische Implantate.

Marktentwicklungen

- Im Februar 2024 präsentiert Auxein Medical, ein Hersteller und Exporteur von orthopädischen Implantaten, seine neuesten Innovationen in der Medizintechnik auf der Arab Health, die vom 29. Januar bis 1. Februar im World Trade Center stattfindet. Das Unternehmen stellt am Stand CC99 in der Halle neue Produkte in den Kategorien Trauma und Arthroskopie sowie ein umfassendes Sortiment fortschrittlicher orthopädischer Implantate vor. Die Teilnahme an der Arab Health und die Präsentation neuer Produkte wird die Markenbekanntheit von Auxein Medical steigern und potenzielle Kunden anziehen, was zu höheren Umsätzen und einer Marktexpansion führt.

- Im Januar 2024 startete Arthrex, Inc. ein neues patientenorientiertes Portal namens TheNanoExperience.com, das die Wissenschaft und Vorteile der Nanoarthroskopie beleuchtet, einer innovativen, minimalinvasiven orthopädischen Technik, die eine schnelle Erholung von Aktivitäten und weniger Beschwerden ermöglichen kann. Chirurgen können orthopädische Verletzungen in einer Vielzahl von Gelenkspalten diagnostizieren und behandeln, insbesondere in kleineren Gelenken wie Ellbogen, Handgelenk und Knöchel. Sie können die Nanoarthroskopie auch bei verletzten oder arthritischen Knien und Schultern anwenden. Diese Verfahren werden durch eine winzige, hochwertige Kamera an der Spitze eines nadelähnlichen Geräts sowie andere miniaturisierte arthroskopische Instrumente ermöglicht.

- Im Dezember 2023 gab Stryker bekannt, dass es ein rechtsverbindliches Angebot an Menix zur Übernahme von SERF SAS abgegeben hat. SERF SAS ist unter Medizinern auf der ganzen Welt für seine Fortschritte bei Hüftimplantaten bekannt, zu denen auch die Entwicklung des ersten Dual Mobility Cup gehört. Durch diese Übernahme könnte Stryker einem größeren Patientenstamm einen verbesserten Service bieten und sein globales Portfolio für Gelenkersatz erweitern.

- Im Dezember 2023 hat B. Braun SE das CARESITE Micro Luer Access Device eingeführt, das die Exposition gegenüber gefährlichen Chemikalien minimieren und das Infektionsrisiko senken soll. Diese Innovation soll die Sicherheit des IV-Zugangs sowohl für Patienten als auch für medizinisches Personal erhöhen. Dies wird die Marktposition von B. Braun stärken, indem es eine sicherere IV-Zugangslösung anbietet, neue Kunden gewinnt und seinen Ruf für Innovation und Sicherheit stärkt.

- Im September 2023 hat Globus Medical, Inc., ein führendes Unternehmen für muskuloskelettale Lösungen, sein Engagement für EUROSPINE bekannt gegeben, indem es sein Silber-Sponsoring verlängert und seine Teilnahme an EUROSPINE 2023 bestätigt hat. Diese fortgesetzte Partnerschaft und das Sponsoring mit EUROSPINE werden die Sichtbarkeit und den Ruf von Globus Medical, Inc. innerhalb der Wirbelsäulenchirurgie-Community verbessern und möglicherweise zu einer erhöhten Markenbekanntheit und Geschäftsmöglichkeiten führen.

Geografische Analyse

Geografisch gesehen sind die im MENA-Marktbericht für orthopädische Implantate abgedeckten Länder Saudi-Arabien, die Vereinigten Arabischen Emirate, Ägypten, Katar, Kuwait, Oman und Bahrain.

Laut Marktforschungsanalyse von Data Bridge:

Saudi-Arabien wird voraussichtlich das dominierende und am schnellsten wachsende Land in der MENA-Markt für orthopädische Implantate

Aufgrund der steigenden Gesundheitsausgaben wird Saudi-Arabien voraussichtlich den Markt für orthopädische Implantate dominieren. Außerdem wird das Land voraussichtlich das am schnellsten wachsende sein, da die Regierung in forschungsbasierte Aktivitäten und die zunehmende Verbreitung orthopädischer Erkrankungen investiert.

Für detailliertere Informationen zum MENA-Marktbericht für orthopädische Implantate klicken Sie hier –https://www.databridgemarketresearch.com/reports/mena-orthopedic-implants-market